Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Markets Last Week

US Indices:

- VIX down 1.1%; Dow up 75 bps; SPX down 84 bps; RSP up 84 bps; NDX down 2.6%; SMH down 3.1%; RUT up 3.5%; IWC up 5.2%; MDY up 2%; XLU up 1.7%;

Key Stocks & Sectors:

- AAPL down 2.9%; AMZN down 6.5%; GOOGL down 6%; META down 2.3%; MSFT down 1.7%; NFLX down 29 bps; NVDA down 4.3%; MU down 4.4%; BAC down 2.2%; C up 12 bps; GS up 2.9%; JPM up 1.3%; KRE up 6.2%; EUFN up 1.1%; SCHW up 7.4%;

Dollar was flat on UUP & down 8 bps on DXY:

- Gold down 71 bps; GDX down 2.4%; Silver down 4.8%; Copper down 3.1%; CLF up 1.6%; FCX down 1.6%; MOS down 24 bps; Oil down 4.5%; Brent down 2.5%; OIH down 3.2%; XLE down 32 bps;

International Stocks:

- EEM down 94 bps; FXI down 1.2%; KWEB up 2.3%; EWZ down 54 bps; EWY down 28 bps; EWG up 1.4%; INDA up 1.2%; INDY up 17 bps; EPI up 2.6%; SMIN up 1.4%;

And interest rates went down across the curve except for the 30-year, setting up a softer Fed?

- 30-year Treasury yield up 0.3 bps on the week; 20-yr yield down 2 bps; 10-yr down 4.5 bps; 7-yr down 6.3 bps; 5-yr down 8.6 bps; 3-yr down 8 bps; 2-yr down 12 bps; 1-yr down 7 bps;

- TLT down 2.9%; EDV down 28 bps; ZROZ down 44 bps; HYG up 40 bps; JNK up 32 bps; EMB up 38 bps;

2. Powell on Deck

Everything seems loaded up for Fed Chair Powell to talk about the upcoming rate cut in September. He could also deliver a rate cut this week given the message of the short-end of the Treasury curve. Add to that Bill Dudley’s Mea Culpa blessing for a rate cut this week. And what better way for Jay to signal his loyalty to the cause than by cutting rates as a welcome to VP Harris?

But the naysayers just won’t go away:

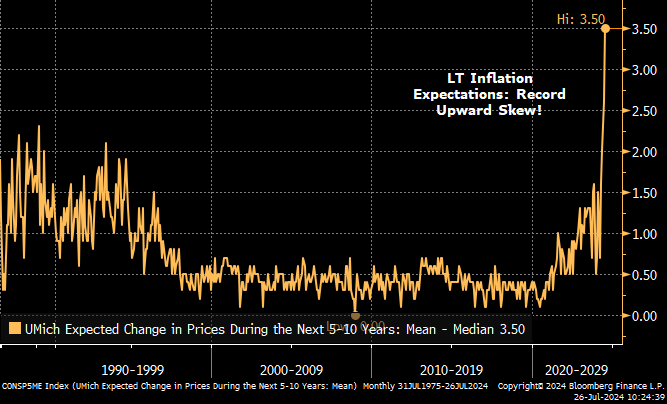

- Richard Bernstein Advisors@RBAdvisors – #Economists celebrating the conquering of PCE #inflation but LT inflation expectations are skewing upward by a record amount.

And,

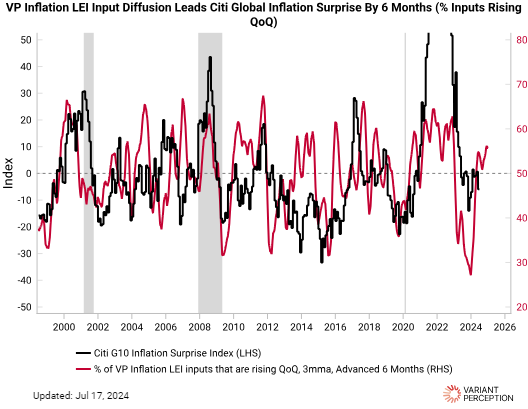

- Variant Perception@VrntPerception – Our global #inflation input diffusion remains fairly elevated (i.e. what % of the inputs into our country inflation models are rising QoQ). This implies that the “hawkish” cut will remain the default for most major central banks in 2H24, as the inflation data will likely not improve enough to allow aggressive cuts.

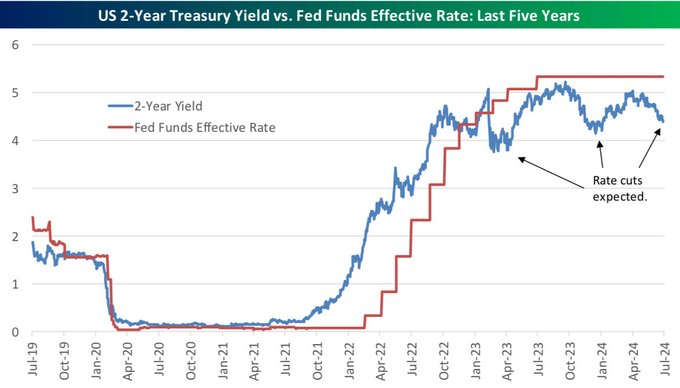

As Bespoke said, what do you notice from the chart below?

- Bespoke@bespokeinvest – Follow the path of the 2-year Treasury yield to see where markets expect the Fed Funds rate to trend. What do you notice about this chart?

3. Small is Big, right?

That is what Tom Lee said on CNBC this past Monday predicting a 40% rally in small caps by end of summer, because “small caps are very sensitive to probability of Fed rate cut“. He pointed out that the Oct-Dec 2023 small cap rally delivered 30%. And he added “this one should be bigger because of the short positioning & the amount of oversold in the Russell“.

What about technicals?

- Trader Z@angrybear168 – $IWM weekly ratio chart up against resistance, RSI broke out, let’s see if price follows.

What about the concept of relativity?

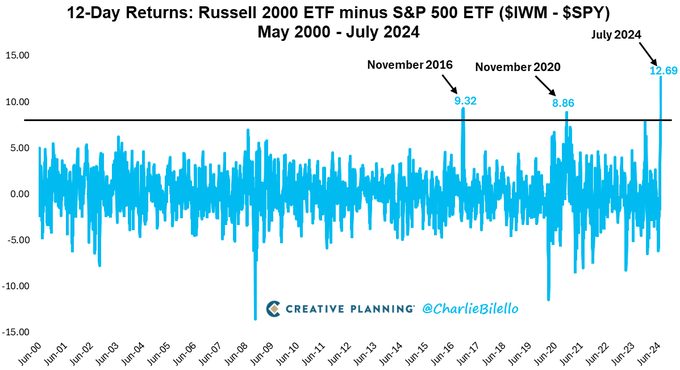

- Charlie Bilello@charliebilello – US Small Caps are up 10% over the last 12 trading days while US Large Caps are down 3%. The 13% spread is the largest 12-day Small Cap outperformance ever. $IWM $SPY

What about Options Gurus?

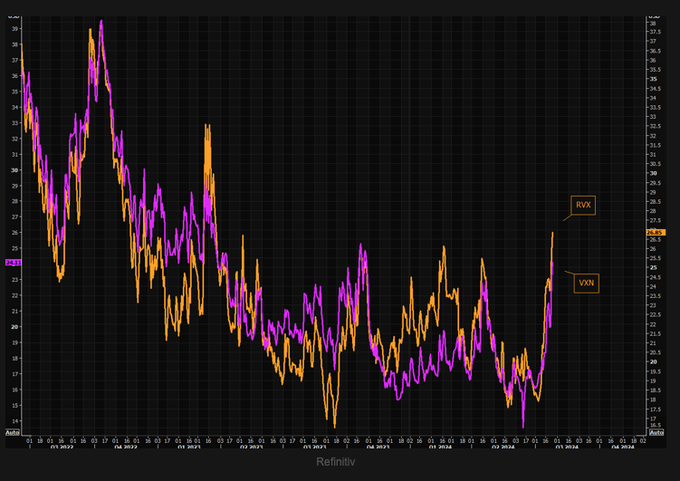

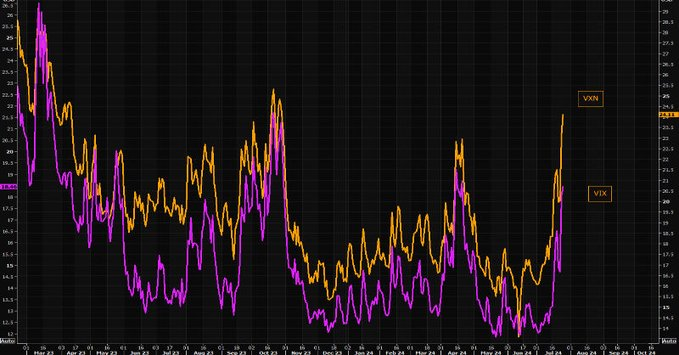

- Imran Lakha | Options Insight@options_insight – Both $NDX and $RTY vol exploding higher during this risk unwind. Mean reversion traders with the stomach for it may want to look at put selling on NDX vs call selling on RTY… Personally I would use spreads to stay safe!

Ben Laidler of Bradesco likes small caps too but AFTER Europe & EM. He told Bloomberg Surveillance (min 4:25 to 12:55) on Friday that “Europe-EM has either bottomed or started to recover … this quarter will be the end of earnings recession in Europe & by the end of the year we might be seeing 20-30% earnings growth in Europe given the cyclicality of earnings… same goes for parts of EM“.

4. Semis & Tech

First,

- The Market Ear@themarketear – Tech stress is at levels last seen in late October 2023.

Narrowing to Semis:

- The Market Ear@themarketear – Oversold semis – SOX has been more oversold once since last October. We are below the 100 day, but longer term trend line is coming in around these levels.

How about specific names?

- RenMac: Renaissance Macro Research@RenMacLLC – $NVDA We are now in similar territory to previous outside reversal day correction back in the Spring. Recall excessive optimism preceded both events in our buyers frenzy model:

And,

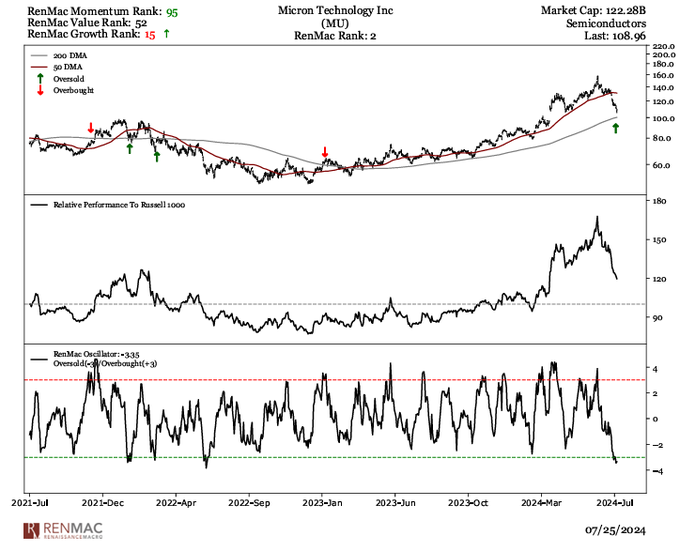

- RenMac: Renaissance Macro Research@RenMacLLC – Jul 26 – This aged well, now $MU oversold in our work.

5. SPX

Is there a message from the VIX stuff?

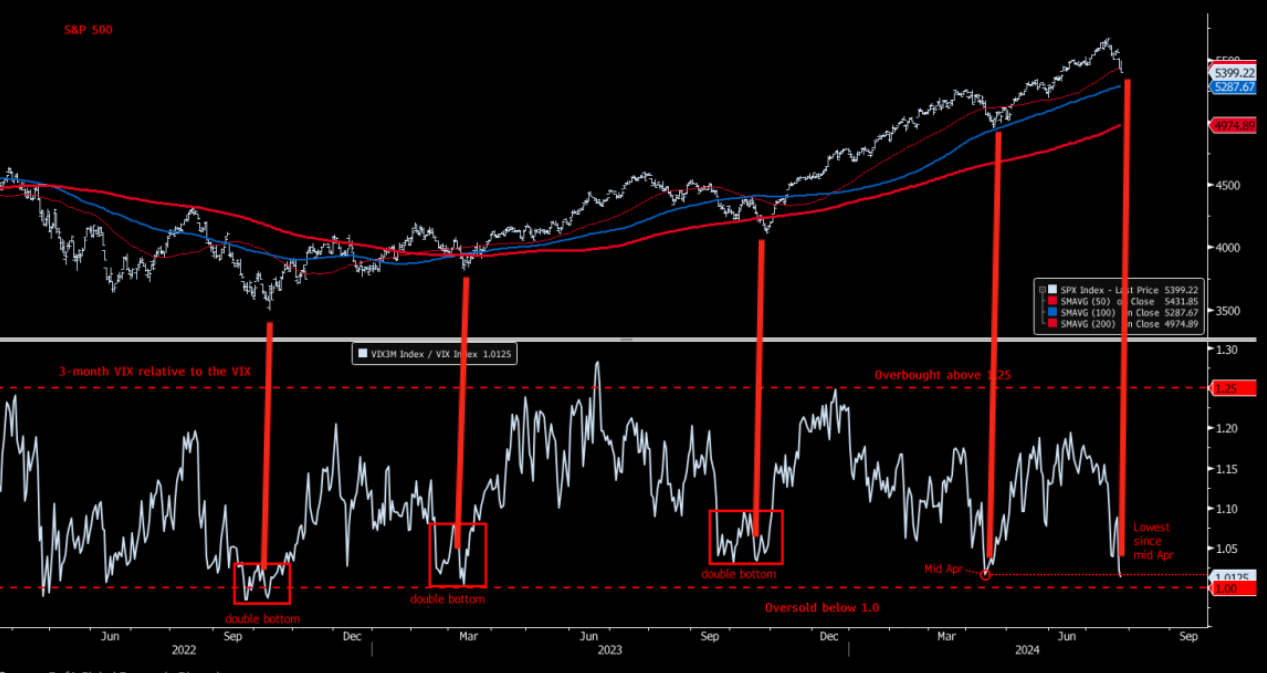

- The Market Ear@themarketear – SPX and 3M VIX vs VIX – For bottom pickers. BofA points out: “The VIX3M vs VIX has moved to its lowest level since mid-April to reflect souring tactical sentiment. While the April reading just above the oversold tactical panic threshold of 1.0 preceded a 14% rally into mid-July, we would not rule out a panic dip in the VIX3M vs VIX below 1.0 prior to set-up a better tradeable low for the US equity market.“

In the above context, a “juicy” situation:

- RenMac: Renaissance Macro Research@RenMacLLC – #copper is oversold, still in an uptrend and at the ascending 200-day moving average. #juicy

On the other hand,

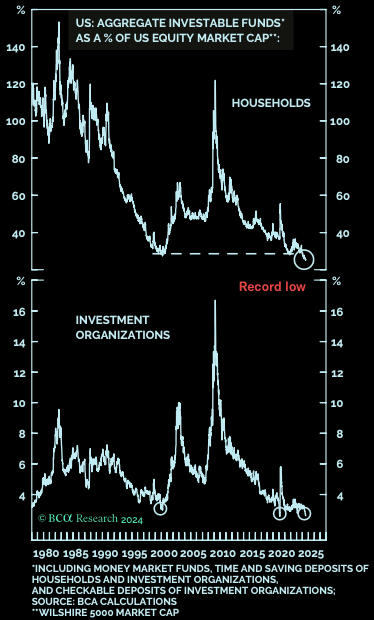

- The Market Ear@themarketear – Wait a second – That huge pile of cash on the sidelines looks rather tiny. As a percentage of US equity market cap the cash on the sidelines has slid to record lows. BCA also writes: “The odds are that US stocks will soon peak, and a bear market will commence“.

6. India – CNBC’s Aversion vs. Reality

Most readers recognize what we have been pointing out for awhile – CNBC’s aversion to India, to use a somewhat muted & semi-respectable word. You saw that this week. On Friday, Kelly Evans was speaking with an EM investor & when that guest started talking about India, Ms. Evans stopped him saying something like everyone talks about India, so give me another idea. Does Ms. Evans know how few of her viewers own Indian ETFs? But she didn’t care. Enough about India was her derisive instruction to her guest.

In contrast, Jon Fortt, anchor of the 4 pm show, is smarter & couched his aversion lightly saying he always speaks about “demographics”. But what about 5 years from now, he asked. As if demographics change every 5 years! Guess Mr. Fortt doesn’t understand that demographics is a double-edged sword with the lethal edge being much more dangerous. NaPakistan has better demographics. Does Fortt want to invest there?

Bangladesh, India’s neighbor, has even stronger demographics and a democratic society. Look what happened in that country very recently (courtesy of Getty Images):

The big reason is Jobs. Very few people know that India also has a 40% youth unemployment rate. So why doesn’t India have these massive riots? The BIG REASON is PM Modi & his team. But CNBC & their community despises Modi for his “Hindu” beliefs and so can’t stop denigrating him & his policies.

This is why they piled on when the initial reaction to his election was negative on Tuesday June 3. Sadly, CNBC’s viewers missed on a massive rally from June 4 onwards. The pattern repeated this past week, when the Indian stock market dropped hard on the new populist budget introduced by Modi’s Finance Minister. Once again, that drop was a buying opportunity as usual;

- Tejasvi Surya@Tejasvi_Surya – The Employment-Linked Incentives envisaged in the Union Budget 2024 triggers long-term job creation. Modi 3.0 is driving 3 major schemes in this regard: – A one-month wage (up to Rs 15,000) for youngsters entering formal workforce for the 1st time, – boosting savings with EPF contribution for 4 years of employment – & supporting employers by reimbursing Rs 3,000 rupee per month for 2 years towards EPF contribution for each additional employee. These initiatives are expected to facilitate employment & skilling for 4.1 crore (41 million) youth over the next 5 years. I explain. #SansadDhvani

Something that Jon Fortt does not know & does not care to know is that PM Modi has made it his absolute priority since his first election win in 2014 to maintain Macro Stability. For the past 11 years, India has avoided the classically detrimental foreign exchange crisis so endemic to EM markets like Turkey.

This is why foreign investors have been pouring money into India, this year into the newly opened Bond Markets in India. And now earlier investors are reaping the rewards of their success in India, like Hyundai Motors of South Korea as the Japanese Nikkei newspaper wrote:

- Indeed, Hyundai has succeeded at leveraging India as an export platform more effectively than most multinationals. Over the past 20 years, the South Korean automaker has shipped out 3.6 million locally produced passenger vehicles — more than any other carmaker in India — to over 150 countries, primarily other emerging markets.

- At the same time, Hyundai has overcome issues that have driven rivals like General Motors, Ford and Fiat to withdraw from India, the world’s largest auto market after China and the U.S. This has enabled the South Korean company to narrowly emerge as the biggest rival to local sales champion Maruti Suzuki. As a result, India is now Hyundai’s second-largest market, behind North America but ahead of the company’s home market.

- Hyundai, which has so far invested 297.41 billion rupees ($3.55 billion) into India, has promised the state government of Tamil Nadu to invest a further 200 billion rupees through 2032. It is also investing 70 billion rupees to upgrade a former General Motors factory in Maharashtra state in time to begin production by March 2026. The two production hubs would have a combined annual capacity of 1.82 million vehicles.

And Hyundai is now raising $3 billion via an IPO of Hyundai in India. So now Hyundai can finance its expansion in Indian markets without bringing in Korean capital.

Watch & Listen to Mark Mobius express his opinion to Anchor Fortt who couldn’t ask even a basic question! What a choice between CNBC anchors re India – Kelly Evans who simply told her guest to not bother her about India and Jon Fortt who threw out same old 1-word putdown?

By the way this week Senator Marco Rubio introduced a Bill proposing that India be treated similarly to allies like Japan, Israel, Korea, and NATO partners in terms of technology transfers. Moreover, the bill aims to support India in addressing threats to its territorial integrity and seeks to block security assistance to Pakistan if it is found to sponsor terrorism against India.

We urge all to read this article just to see how some smart lawmakers are thinking about India. Or simply watch the 3 minute clip below:

7. Is America about to change & drastically so?

We have to begin with a nod to Steve Eisman who called it in his clip (minute 1:59 to 2:52) in which he addressed both his prediction about what might happen during the Democratic convention & what happened this week in Washington DC.

We assume most of our readership is aware of what happened outside Union Station in Washington DC during PM Netanyahu’s speech. In case that is not true, below is a short clip from the Times & Sunday Times:

We are fairly inured to such scenes & images though the above represents a highly unusual occurrence in America.

In stark contrast, we were totally unprepared for the comments made on the record by VP Kamala Harris: The speech below is a radical departure from the prevailing US policy re Israel that has been in effect for decades. Listen to the speech from minute 1:59 onwards to see how radically different she sounded. And this is now the Acting President of the United States who could well be the elected 47th President of USA in less than 4 months.

The “I will not be silent” vow of VP Harris represents a unilateral pledge from her on behalf of the United States. And, predictably, the Middle East blew up overnight. The best example of the far-reaching impact is seen from the declaration from Pakistan labelling the Prime Minister of Israel as a “Terrorist”. (India has reacted to this declaration with anger & condemnation).

And the devastating impact of her words is seen in the rocket attack from Lebanon, by Hezbollah as stated by Israel, that resulted in death of 12 young boys & men in a playing field. It is possible that the “I will not be silent” vow of VP Harris has been interpreted as a leash on Israel that might embolden a range of terrorist organizations to kill Jews inside Israel.

As everyone can see & hear, VP Harris sounded totally different than how President Biden has for the past several months. Israel was given substantial supplies of ammunition & weapons from the Biden Administration which also sent US Navy to deter Iran from launching attacks against Israel. Does the “I will not be silent” vow of VP Harris mean that Israel will not keep getting weapons from USA when they need them to fight the terrorism machines that stretches from Lebanon to Iran & to Yemen once she becomes the President of USA?

Our sincere hope is that this “vow” of VP Harris will be ignored & relegated to a misunderstanding without a lot of debate & discussion. A degree of retaliation from Israel against Hezbollah is to be expected but, hopefully, that also can be kept in previously acceptable measures. For a detailed & previous discussion of Israel vs. Hezbollah, we refer readers to the article on July 9 titled Israel’s Graduated Escalation Against Hezbollah on Geopolitical Futures.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.