Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.God’s Grace

Rarely we think about words like these, but Saturday we did.

From what we heard on TV, Former President Trump turned his head to point at a screen on that side & in that instant the bullet passed by him nicking his ear. Whether that was God’s Grace or sheer luck, we leave to others to decide. But that led to the following iconic gesture of courage under literal fire:

We received a WhatsApp message from an investment banker in Mumbai saying:

- “This is going to become an all-time iconic photo! Ab isko jitne se koi nahin rok sakta! (now no one can prevent him from winning)“

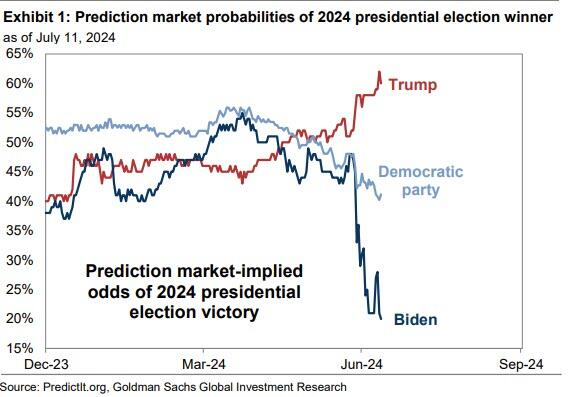

Ian Bremmer said something similar in his appearance on Zakaria’s show on Sunday morning. Odds in financial markets seemed to suggest a similar outcome:

- Markets & Mayhem 🤖@Mayhem4Markets – Sun – Odds of Trump sweeping the 2024 election race surge after last night’s attempt at the former president’s life. This is likely to be perceived as constructive for stocks, particularly within the old economy where de-regulation would be a key theme. Crypto is another beneficiary.

and,

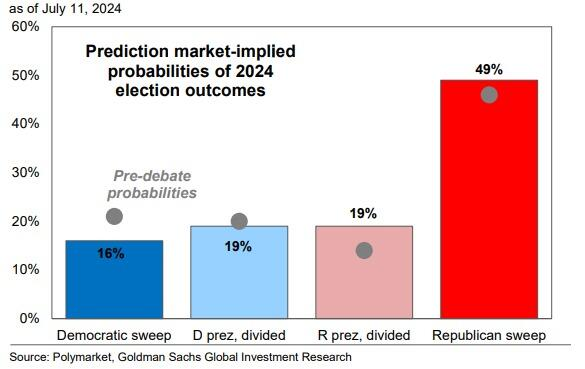

- Markets & Mayhem 🤖@Mayhem4Markets – Sun – A republican sweep of the White House and legislature is now calculated with odds of approximately 49%, per Polymarket

The big question is how does American society & the American economy react to this event and what happens at the Republican National Convention this week? We have no clue. So we will wait for the markets to signal this coming week.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.