Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Markets last week

Who can say it better?

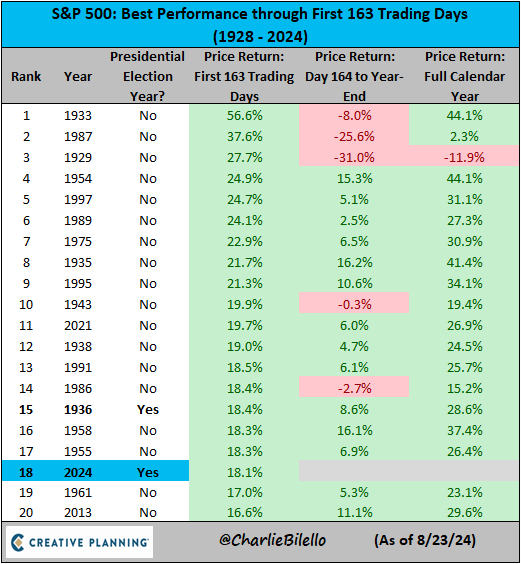

- Charlie Bilello@charliebilello – The S&P 500 is up 18.1% in the first 163 trading days of 2024, the 18th best start to a year going back to 1928 and 2nd best start to a presidential election year ever. $SPX Video: https://youtube.com/watch?v=SiUzKinXpfQ&t=198s

And once again, the Dollar was down hard with Treasury yields down with short duration yields down harder than long duration yields, both thanks to Chair Powell.

US Indices:

- VIX up 7.2%; Dow up 1.3%; SPX up 1.5%; RSP up 2.2%; NDX up 1.1%; SMH up 73 bps; MDY up 2.8%; IWC up 9%; XLU up 1.3%;

Key Stocks & Sectors:

- AAPL up 38 bps; AMZN down 11 bps; GOOGL up 1.5%; META up 22 bps; MSFT down 38 bps; NFLX up 1.8%; NVDA up 3.9%; MU down 4.6%; BAC up 97 bps; C up 6.7%; GS up 94 bps; JPM up 1.9%; KRE up 5.3%; EUFN up 3.6%; SCHW down 1.8%;

Dollar was down 1.5% on UUP & down 1.7% on DXY:

- Gold flat; GDX up 2.3%; Silver up 3%; SLV up 3%; Copper up 1.2%; CLF up 5.7%; FCX up 2.7%; MOS up 2.5%; Oil down 2.2%; Brent down 72 bps; OIH up 58 bps; XLE down 29 bps;

International Stocks:

- EEM up 1%; FXI up 49 bps; KWEB down 2.2%; EWZ up 73 bps; EWY up 2.9%; EWG up 3.2%; INDA up 1.2%; INDY up 2.6%; EPI up 1.1%; SMIN down 4 bps;

Thanks to Chair Powell, Treasury yields were down with larger declines in the short end.

- 30-year Treasury yield down 4 bps on the week; 20-yr yield down 4.4 bps; 10-yr down 6.1 bps; 7-yr down 7.1 bps; 5-yr down 8 bps; 3-yr down 9.3 bps; 2-yr down 9.7 bps; 1-yr down 6.3 bps;

- TLT up 96 bps; EDV up 66 bps; ZROZ up 1.5%; HYG up 51 bps; JNK up 24 bps; EMB up 1.5% ;

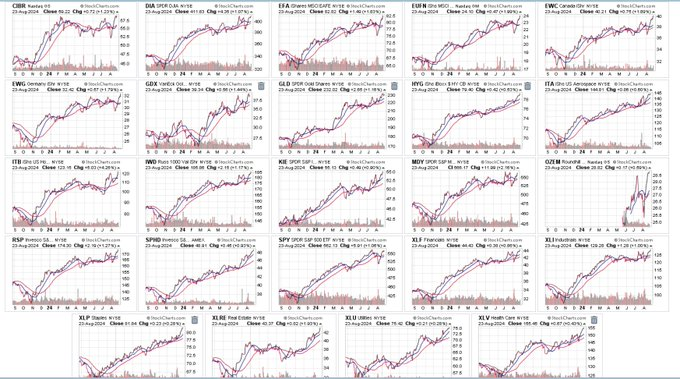

So much looks good:

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – 24 tracking ETFs that I follow made new 52-week or all-time weekly closing highs yesterday, including $SPY $DIA, 6 of 11 $SPX sectors, gold, miners, international, high yields bonds + NYSE. Broad based breakouts going into a Fed rate cut cycle.

And,

- Seth Golden@SethCL – Confluence of Bullish Breadth not seen since… NYSE Common Stock Only A/D Line ATH; Mid-cap S&P 400 A/D Line ATH; S&P 500 A/D Line ATH; Small-cap S&P 600 A/D Line ATH – I don’t know what it’s gonna take to make a bear turn bull, but… man-a-live $SPX $NYA $SPY $IWM $MID $QQQ

So the future?

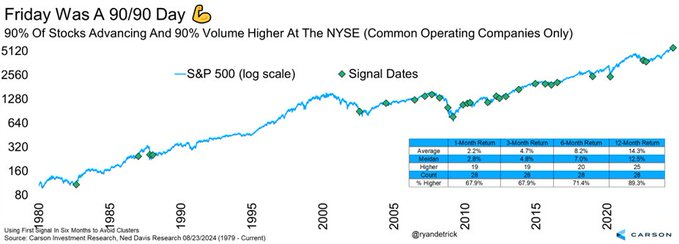

- Ryan Detrick, CMT@RyanDetrick – Friday was a 90/90 day at the NYSE. 90% of stocks up and 90% of volume higher, first since end of bear Oct ’22. @NDR_Research has data back to 1980 for common operating companies only, so no bond stuff. Bullish returns going out, up 89% of time a yr later and up 14.3% on avg.

What did Mr. Clissold of NDR tweet himself?

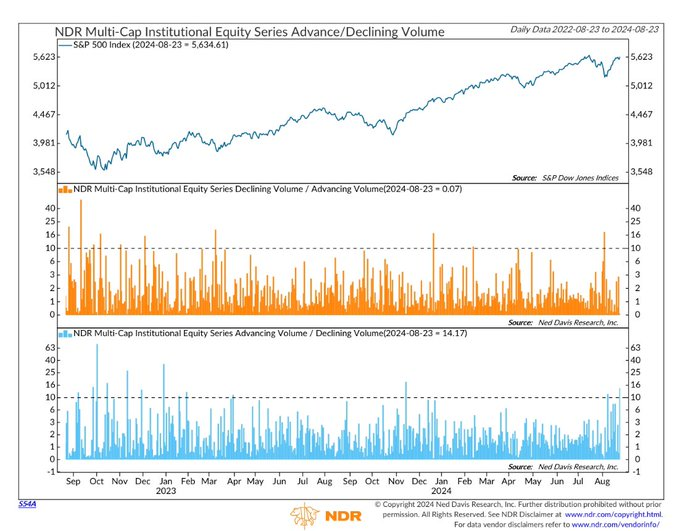

- Ed Clissold@edclissold – Aug 24 – Friday was a 14:1 up day (volume of advancing stocks 14x volume of declining stocks) using the @NDR_Research common stock data. It’s the 2nd 10:1 up day w/o a 10:1 down day. Remarkable considering the relatively minor pullback. Not stuff one normally sees in a bear market.

Now to a critical sector:

- Seth Golden@SethCL – The key to the bull market cycle has been Semis. As they go (outperform) the market has followed. Trend line performance ratio is… for a lack of better word… perfect. Above and ride along, below and let go! $SPX $SPY $SMH $QQQ $SOXX $NVDA

Now the most important Semi stock, NVIDA is on deck. So next week will be the most important week of the year said Dan Ives of Wedbush on Friday. We all feel we know what happens if NVDA disappoints next week. But what if NVDA surprises to the upside & the stock & semis roar up?

That brings us to:

2. On the other hand,

Notice that VIX was up 7.2% during the week which impressed so many with the market’s breadth. In fact, VIX was up on Tuesday, Wednesday & Thursday. It fell 9.63% on Friday probably relieved by the dovishness of Chair Powell’s speech. John Kolovos of Macro Risk Advisors touched on this on Thursday on CNBC in discussing his call for “a long & winding road to S&P 6,000“:

- “still a bull market … continue to push up higher with a lot of volatility: .. the volatility part has a lot to do with macro uncertainty so even though VIX has retraced a lot of its pop, fixed-income vol hasn’t moved; currency vol hasn’t moved; commodity vol hasn’t moved and when most of the cross-asset vols are still elevated, the market is still exposed to a oh-oh moment; it could be another swoosh lower or we continue to move sideways; so there is still a lot of volatility; … the cumulative A-D line is actually leading the S&P to new highs; the S&P 500 A-D line is breaking out; the 1500 line is also breaking out; … that’s actually interesting, very bullish on the surface; in the last 2 times it happened, 2018 with the after the volmogeddon & the previous time was in 2020 as we were coming out of the COVID bottom, the first consolidation phase there; so the breadth broke out of those moments but the S&P stayed sideways … that would open the door for a stealth bull; … the market for stocks is stronger than the stock market in those times; … not my base case scenario but its important; … in election years, volatility tends to rise ; that’s why I like VIX calls right now; there should be hiccups along the way; its very rare to see the market rip from this point until election day; … there is huge risk coming to the market right now … “

Back on Tuesday of this past week, Jim Cramer spoke about the call by the veteran Larry Williams about his Short-Term (ST) & Long-Term (LT) pointing down. Based on our hastily scribbled lines, Cramer said:

- “this rally is kaput; …. rally will run out of steam by August end; … there will be a rally in September but it will be sold; the real rally will begin 2 months from now … “

Cramer followed it up on Thursday (from minute 3:48) after the horrid reversal in stocks, especially Semis:

- ” … I am most concerned about is the prediction we got this week from Larry Williams, the incredible market prognosticator & historian; I trust Larry & I don’t like going against him. Larry sent us his thoughts on Monday & he used a term that made me concerned – he said that the rally was Kaput! … the word kaput has some ominous connotations, right! we didn’t take out the highs of the averages despite the 8-day win streak; worst, Larry’s charts showed tough sledding for the S&P 500 next week led by the most important stock in the entire market … NVDIA; Given that the market is overbought plus the short range oscillator …, the idea that the rally is kaput has some resonance; …”

Wasn’t it only two weeks ago when Tom McClellan said his the Fosback Absolute Breadth Indicator had risen high enough to “mark a good price bottom“? That led to one of the best 2-week rallies in the S&P. That should persuade many to read his opposite call on Thursday in his article Annual Seasonal Pattern’s Late Summer Dip.

- “If the DJIA traces out the steps of the ASP perfectly, then we should see a decline from here to a preliminary bottom due in late September, followed by a retest bottom in early October. But the stock market does not always follow such average patterns exactly. The situation is further complicated by this being a presidential election year, so the normal seasonal up move that happens in late October may not happen this time. In election years, investors often continue holding their collective breath until the votes are tallied in November.“

That brings us to a more near-term analysis:

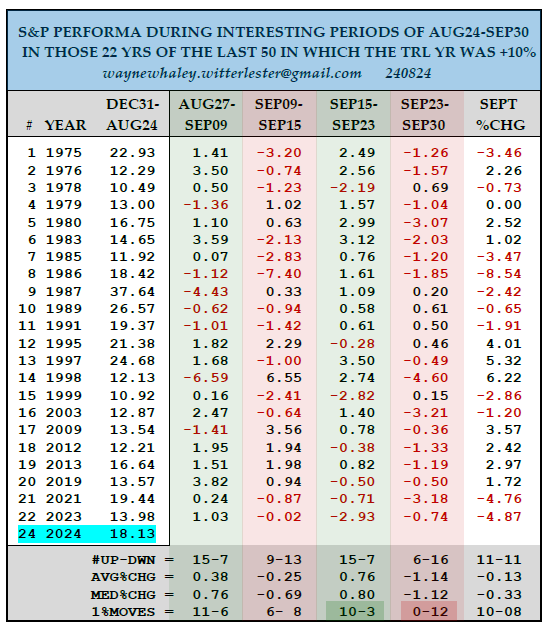

- Wayne Whaley@WayneWhaley1136 – SEPTEMBER’S IN +10% YEARS – One of 28 studies on 14 markets shared with commentary subscribers this am – waynewhaley.witterlester@gmail.com – As of August 24th, the S&P is up 18.13% for the 2024 calendar year. In the last 50 yrs, I see 22 yrs in which the S&P was similarly up at least 10% on Aug 24 for that calendar yr. Below is the performance for four different time frames in the Aug24-Sept30 time frame of those 22 years which exhibit enough aberration to be of interest. The stat that jumps out at you is the 1% moves are 0-12 in the last week of September which catches much of the post Third Quarter Options Expiration Week weakness that the world has come to expect. But also worthy of notice is that given a strong tail wind, the Labor Day wraparound weeks, which are dead ahead, are usually respectable as is the Pre Qtr 3 Opex week.

3. Treasury Yields

Four months ago on Friday April 26, the yield on the 5-year Treasury closed at 4.69%. This Friday the 5-year Treasury yield closed at 3.65% – a drop of 105 bps in 4 months. That is what Bob Michele of JPM Fixed Income said on Bloomberg Surveillance on Tuesday:

- “… I think of every single conversation I have every day. It doesn’t matter if it’s institutional, or it is in wealth management, it doesn’t matter if it is domestic or international, everyone is looking to get into the bond market and frustrated beyond belief that they never got to buy at yields 5%-6%. And once rates start coming down and money market funds start to drift lower, that money will come in. … the market is thinking put me in an aggregate bond fund, put me in a general muni bond fund; you have an income fund, OK put me in there; Do you have a core plus ETF? Put me in there and the money comes into the market in a big way; … So I worry yields could get down to 3% or even lower; “

When asked has that started? Michele said:

- “It’s just started in the tiniest of drip of ways which I have always turned to and said “Look where yields are and everyone is telling you ah, we don’t like them here … Look how far through Fed funds rates are; look how cozy it is in 5 & half percent in cash; Then who the heck is buying to take the entire yield curve down below 4%; There is a lot of buying of money that is leaking in but its not come in in earnest; the process hasn’t started …”

Could it start if the September payrolls come in negative & a 50-bps cut is priced in for the September FOMC meeting?

In any case, Tracie McMillion of Wells Fargo disagrees & recommends cashing out of a portion of short-term fixed income to get into stocks. That is what she said on Bloomberg Surveillance on this past Tuesday (from minute 1:44:00) despite her call that the Fed will lower rates by 100 bps in 2024:

- “… now is the time to take some [bonds] out & broaden exposure to equities – lower rates we see & we also see a recovery in growth in 2025 & that combination we think is going to help smaller companies; we are also adding to large caps … within a diversified portfolio we are under-weighting bonds slightly & over-weighting stocks slightly …we think the 10-yr is going to be closer to 4% … any volatility in markets is an opportunity to buy large cap stocks & small cap stocks “

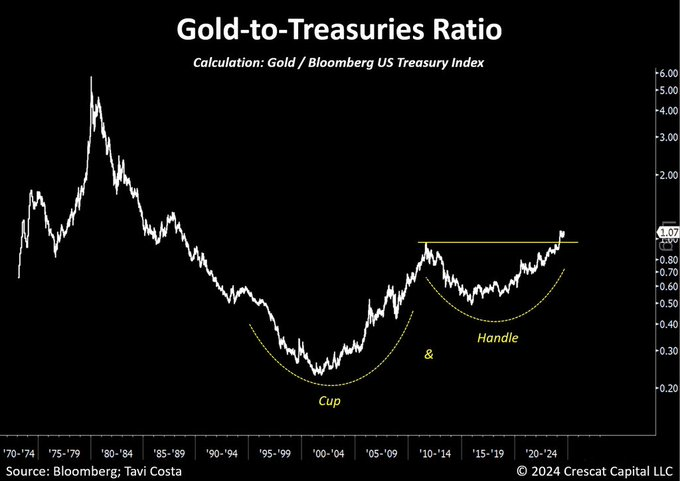

Are Stocks the only competition to Treasuries? Not for the world’s most powerful investors!

- Otavio (Tavi) Costa@TaviCosta – Ask yourself: What would a central bank rather own?

Now to events in the world that impact business & conflicts:

4. Nations & Their Relationships:

First & foremost is the relationship between our Country to whom we swear allegiance & the country from which we came to America. This year is an amazing year in which a first generation American born to an immigrant from India is running for the Presidency of the United States & she has publicly stated that the heritage she received from her mother is extremely important to her. On the other side is the wife of the Vice Presidential Candidate who is a first generation immigrant from India. How fast things change & for the better?

4.1 USA & India

While we have been writing about the stunning growth in Indian Defense exports, we confess we did not know that the USA is already the biggest importer of India-made defense subsystems. As the clip below explains, this will be substantially benefited from the SOSA (Security of Supplies Arrangement) agreement signed by & between USA & India. In itself, SOSA is not a weapons or defense deal but it is an enabler of confident relationships between US & Indian Defense companies (see clip below):

The smallest & weakest part of the Indian Navy is its submarine force. In contrast, China has a huge submarine force. So effective anti-sub capability is important to the Indian Navy. That explains the significance of Secretary Blinken’s approval for sale of anti-submarine warfare sonobuoys worth $52.8 million to India for its MH-60R Seahawk helicopters.

4.2 India & Central Europe

It was just over a month ago when PM Modi visited Austria & became the first Indian Prime Minister to do so in 41 years. This week, he became the first Indian Prime Minister to visit Poland in 45 years. We did not know that there is a square in Warsaw named after an Indian King who helped Polish children during the extremely bad period for Poland & Europe. We also did not know that Yog has a 100+ year history in Poland with over 300,000 practitioners, 1000 Yog centers & 8,000 teachers.

Perhaps more importantly, Poland is India’s largest trading partner in Central & Eastern Europe and over 30 Polish companies in the defense sector have joint ventures in India. To build on this sector, India has now posted a Defense Attache in its Warsaw embassy.

Poland is also important because Poland will be the next President of the Council of EU. And Poland wants to be build a genuine relationship with India given its new profile as a trusted leader of the Global south. A summary can be found in a rational business clip from WION Gravitas.

Poland is also crucially critical because where it is located – between Russia & Germany. and they have suffered enormously for it. Now its neighbor is NOT Russia but Ukraine, the hosting ground of the most destructive war in the world.

Ergo, the next quick trip to Ukraine by PM Modi to meet the invitation by Pres. Zalensky. It was probably the most physically dangerous trip (in an armored train journey) but also diplomatically challenging. His highly publicized & successful to Russia after his June election & his interaction with President Putin had made it clear that if there is anyone who could speak candidly with President Putin, it is PM Modi.

We also believe that the entire World, except the combatants & their allies, is utterly sick of this destructive Russia-Ukraine war. And that also put some pressure on PM Modi to meet with Ukraine’s leader. But very few realized how strategically important is Ukraine for India.

Most might have forgotten that Ukraine was not only a food basket to the world but it was also the physical seat of major defense companies that manufactured & serviced Russian equipment. For example, the engines that run Indian Navy’s Talwar class of frigates were made in Ukraine and so were engines for over 100 Antonov defense transport planes. India wants joint venture agreements with companies like Zorya-Mashproekt gas turbines. Ukraine has also been a supplier of nuclear fuel.

Assuming the war in Ukraine ends in the next 2-3 years, this is a good time for India to discuss such mutually beneficial business interests & position Indian companies to benefit from Ukraine’s rebuilding. Watch the 15 minute clip below that examines the visit’s implications with Air Commodore Ashutosh Lal, former Indian defense attaché to Ukraine.

Now from Ukraine towards the one country that has supplied drones for use against Ukraine. Not to the Israel-facing side of Iran but to the southern-eastern side of Iran, its most vulnerable side.

4.3 Fighting over a tempting asset?

Back on December 26, 2022, we had written in our article Two Macro Events Leading to a Turbulent World:

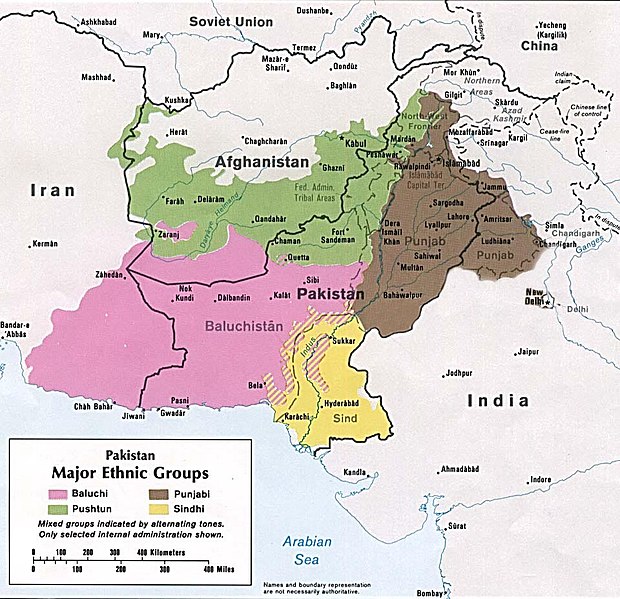

- “Just look what a geo-strategic prize the united Balochistan would be? No wonder the Balochi nationalists are fighting the NaPakis for Balochi independence! Frankly, there isn’t much for anyone to fight over Afghanistan. But fighting over a juicy asset like Balochistan is so tempting, isn’t it?”

Actually forget united Balochistan. It would be not be juicy but an ulcer. So let’s focus on the achievable Balochistan:

By now, everyone knows about the Pushtun (green) area of NaPakistan, the area contiguous to Afghanistan. As we read, about 1/3rd of this Pushtun area inside NaPakistan is already in the actual hands of the Talibani Afghanistan and there is nothing NaPakistan can do about it.

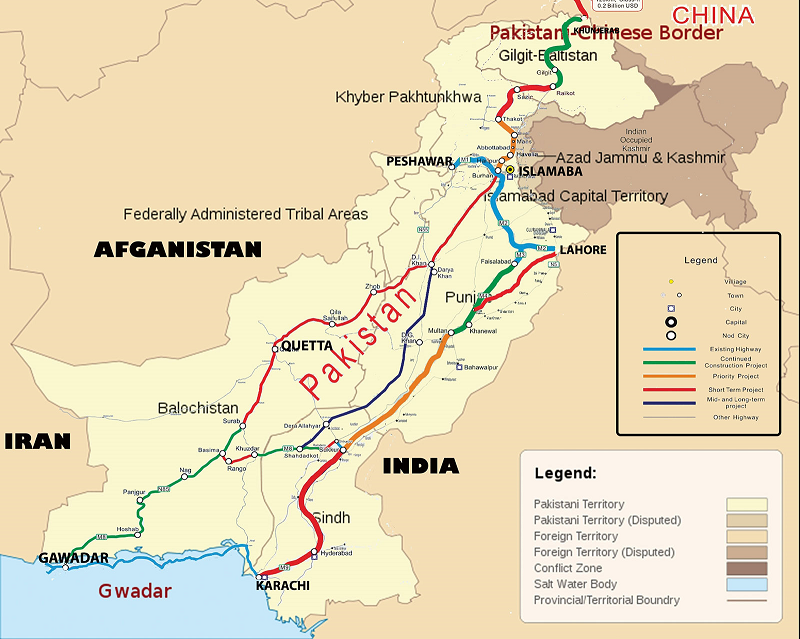

Now focus on the sparsely populated pink area labeled Balochistan, the province of the Baloch people. The NaPakistani have contempt for the Baloch & didn’t care how many Baloch people they killed or made to disappear. Then China came in and pitched the China-Pakistan-Economic-Corridor that was supposed to connect Xinjiang in China all the way down NaPakistan to the port of Gwadar located at the southwestern corner of Balochistan.

And China leased the strategic port of Gwadar from NaPakistan & exulted in having finally secured a deep-water port near the entrance of the Persian Gulf. And they built a rail-road connection to the China-Pakistan border as you can see below:

But China jumped in without considering how the Baloch people would react to Chinese coming in with their own labor & their fishermen monopolizing the fishing in Gwadar. So now this strategic port sits EMPTY & as Chinafile.com reported in March 2024 – “There Is No CPEC in Gwadar, Except Security Check Posts”. This is true all across NaPakistan in all the projects built by China. So the entire CPEC has become an ulcer for China.

So we ask again – “But fighting over a juicy asset like Balochistan is so tempting, isn’t it?” And that seems to have begun with guess who? Greta Thunberg of the Climate Change fame. Google “Greta Thunberg re Baloch” and see how many articles, instagram posts, X messages Greta has posted about Napaki treatment of the Baloch people. And their charismatic young woman leader Mahrang Baloch is now a media celebrity:

And look what happened today (on Monday 8/26 local time) – the UN finally took a stand about the disappeared Baloch:

- Mahrang Baloch@MahrangBaloch_ Finally, the @UN takes a stand for the disappeared in #Pakistan. Urging Pakistan to ratify the Convention against Enforced Disappearances. The @UN ‘s call for Pakistan to address enforced disappearances is a crucial step towards justice. We, the people of Balochistan, have waited too long for the world to see our plight. We are looking forward to more adequate pressure to meet the magnitude of the issue. #EndEnforcedDisappearances #StopBalochGenocide dawn.com/news/1854284

Why is this relevant now? Because NaPakistan is asking the IMF for a $6 billion emergency loan given the state of its Treasury. And IMF has not responded so far.

Now you look at the above map & look at Gwadar, its position virtually so close to Iran’s weakly defended border and ask who in the world can afford to step in & pay Pakistan enough money & assistance to buy rights to the Gwadar port? And who has the power in global media & at UN to try to compel NaPakistan to sell rights to Gwadar to that entity?

The answer is simple – USA. Gwadar is a perfect fit for America’s dominant Navy. And Gwadar, as a US base, can pressure Iran as nothing else in the American asset base can. Now think adventurously. With the Gwadar port, wouldn’t America be able to make a deal with the Afghani Taleban whose desired lands are immediately north of Balochistan? And wouldn’t America be able to fund the Baloch & other groups fighting Iran for liberation of the Balochi territory occupied by Iran – the pink area in pre-Britain Balochistan below:

The problem is that China still owns the rights to Gwadar & would be highly unwilling to give up Gwadar to America. It would be extremely humiliating to the Chinese to exhibit their failure & also such a give-up would forever doom their chances to getting access to the Persian Gulf.

We discussed this today because today the UN took a formal stand today and, as we all know, the UN does not do so unless & until some one powerful forces their hand.

Now let us move across the Indian subcontinent to the real trouble spot of today:

4.4 BanglaDesh

The best news for BanglaDesh this week was:

- The International Monetary Fund (IMF) said on Wednesday that it has agreed to provide Bangladesh with $1.15 billion as the third installment of its multi-billion-dollar loan program.

Just as they could feel happy about the loan, monsoon rains struck BanglaDesh & the Indian state of Tripura causing thousands of people to leave their homes. The only positive is that these floods were not as destructive as the floods on the western states of India last year.

Surrounded on 2.80 sides by India (except for a tiny border with Myanmar), there is very little capability for others like China to help. Actually Myanmar has made the situation far worse by sending in 1 million Rohingya refugees & they are suffering the most because the BanglaDesh authorities don’t care about them.

Instead of working together to provide a solution, now the two sides of the coup-makers – leftists & islamists – are trying to outdo each other in heaping hate on India & attacking innocent Hindus within BanglaDesh. If you look at previous such coup successes, you find that the Leftists & the Islamists start fighting each other & most of the time the Islamists end up killing the Leftists whether in Afghanistan in 1990s, in Iraq in mid 2000s, in Iran in early 1990s & so on.

This last week began with Bloomberg reporting that Adani Power, the company that sends electricity to capital Dhaka & other areas of BanglaDesh, had unpaid bills of $800,000. Now the company, if it chooses, can stop supplying BanglaDesh & start supplying electricity within India.

We hear that agricultural inflation is now in double-digits in Dhaka & other areas. Simple products like Chillies have risen from Rs. 400/- to Rs. 1,000/-. The worse news for BanglaDesh is that order books in Indian states of Bihar & Tamil Nadu are bulging with business coming in from companies that used to order from BanglaDesh.

Hopefully the new “leaders” of the coup have not learned from NaPakistan which had developed the habit of attacking India militarily in the hope that the international powers would step in to stop the hostilities & give help to NaPakistan to preserve peace. Hopefully, this new “leadership” in BanglaDesh does not copy their failed methods.

The real tragedy of BanglaDesh is that their massive troubles don’t affect any other country. Islamic nations like Malaysia & Indonesia are more concerned about such regime-change riots within their own societies. And Myanmar is in the throes of far worse racial-religious violence. The coup leaders in BanglaDesh probably wish they had nuclear weapons as NaPakistan, their fellow Muslim breakaway from India has. But they don’t & the World is thankful for that.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.