Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Markets last week

Kudos to Dan Niles who said last Friday afternoon that:

- “we covered some of the AI-related shorts at the end of the day because some of them were getting oversold – its never a straight line down … you are going to get some rallies; so I took some of those positions off

How timely & brave was that call?

US Indices:

- VIX down 25.5%; Dow up 2.6%; SPX up 4%; RSP up 2.6%; NDX up 5.9%; SMH up 10.2%; RUT up 4.4%; MDY up 3.2%; XLU up 3.6%;

Key Stocks & Sectors:

- AAPL up 99 bps; AMZN up 9.1%; GOOGL up 4.5%; META up 4.8%; MSFT up 7.5%; NFLX up 4.8%; NVDA up 15.9%; MU up 5.8%; BAC down 26 bps; C down 2.3%; GS flat; JPM down 3.6%; KRE up 1.6%; EUFN up 3.9%; SCHW down 80 bps;

Dollar was flat on UUP & down 6 bps on DXY:

- Gold up 3.4%; GDX up 10.5%; Silver up 9.8%; Copper up 3.8%; CLF up 4.2%; FCX up 7.1%; MOS up 2.5%; Oil up 1.5%; Brent up 80 bps; OIH down 8.9%; XLE down 38 bps;

International Stocks:

- EEM up 2.5%; FXI up 1.3%; KWEB up 55 bps; EWZ up 1.2%; EWY up 4.6%; EWG up 2.3%; INDA up 2.4%; INDY down 22 bps; EPI up 2.3%; SMIN up 3%;

Rates along the Treasury Curve fell hard despite a small uptick in inflation;

- 30-year Treasury yield down 4.3 bps on the week; 20-yr yield down 4.5 bps; 10-yr down 6.2 bps; 7-yr down 6.6 bps; 5-yr down 6.6 bps; 3-yr down 10 bps; 2-yr down 8.1 bps; 1-yr down 8.8 bps;

- TLT up 84 bps; EDV up 1.5%; ZROZ up 90 bps; HYG up 56 bps; JNK up 58 bps; EMB up 1.2%;

How did Treasuries behave on Wednesday? Just up 1-2 bps at the long end but up 4-6 bps at short end. Some saw a message in that action:

- RenMac: Renaissance Macro Research@RenMacLLC – Sep 11 – Bonds rallying after an upside inflation surprise is a massive tell. This is about the Fed waiting too long and downside risk to growth. It’s something the 2s vs Fed Funds has been telling us for weeks. $TLT $SPX

And how does the 2yr vs FF chart look?

- Steve Place@stevenplace – Sep 13 – Your driveby macro chart to end the week. Spread between UST 2 year yield and the current Fed funds rate. spooky

Might this spook the Fed into a 50 bps cut?

2. “I am so excited“

Football fans show their excitement differently than do Goldman bigshots, don’t they?

Ashish Shah, Chief Investment officer of Public Investing at Goldman, said the following on CNBC Squawk Box:

- “.. I gotta tell you I am so excited because it is very rare to see an easing cycle begin & we are about to do this. Next week we are going to start the easing cycle; its gonna continue for awhile; we don’t know the total cuts we are going to get; the Fed’s gonna have to feel that out; but what’s important is … its really setting up the playbook for this entire cutting cycle …. lots of opportunity to cut there …. let’s start with the equity market – that’s where the big returns are going to come … small caps …. are going to be primary beneficiaries of Fed cuts … you have to invest in small caps & focus on quality … January is the best month for small caps “

IWM is ok but Shah admits there is a lot of poor quality in that. So he prefers their own ETF GSC. Some in the trading community agree with the Small Caps message:

- Seth Golden@SethCL – Small-caps do NOT want to trade lower. Have only traded back in the box ONCE since markets peaked in July. Series of higher-lows as year progressed. Likely on the verge of another significant move toward 2024 highs. $SPX $IWM $RUT $RTY $SPY $QQQ

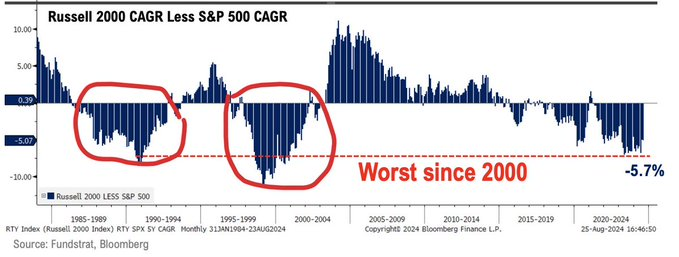

Tom Lee has been speaking out for a big move from Small Caps. Below is a chart from him with comments:

- Seth Golden@SethCL – The current regime has been the worst from Small-caps relative to Large-caps since 2000. But after that was a long runway of Small-cap outperformance. (chart via Fundstrat’s Tom Lee) $SPX $RUT $IWM $RTY $ES_F $QQQ $SPY $QQQ

3. Never forget 9/11/01 and now don’t forget 9/11/24 at least not until 2028

Last week, we highlighted NVDA’s bottom at just below $101 just after noon on Friday, September 6 – chart below.

This week, NVDA didn’t touch back to that bottom. Not even on awful days like Wednesday morning. Actually NVDA made a higher bottom Wednesday morning – this time after NVDA CEO made a clear cut statement about demand & sales. Almost everybody had known about 2025 revenue but that morning statement was made about 2026 revenue as well. That put in the bottom on Wednesday morning around 10:50 am some 15-20 minutes after the CEO presentation began. Look at Wednesday September 11, 2024 chart:

If you check the charts of all other indices on Wednesday 9/11, you would notice that all those rallies began AFTER NVDA began its rally from below $108.

The NDX chart of Wednesday show the NDX rally beginning just about a couple of minutes later.

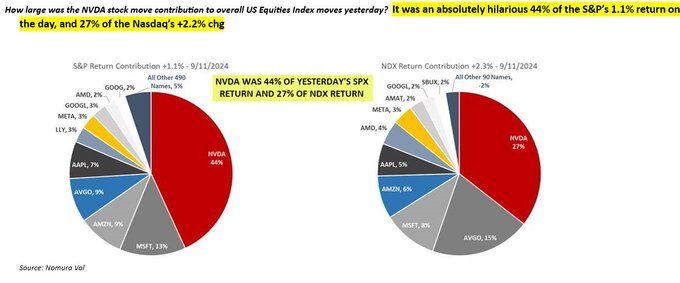

The above is about timing. That doesn’t tell us about NVDA’s contribution to the gains in the indices:

- Thomas Thornton@TommyThornton – Thu – From Charlie at Nomura regarding $NVDA contribution to yesterday’s index gains

But how long might this continue? How about thru 2025, thru 2026, thru 2027 & even possibly 2028? Watch & listen to what Ankur Crawford said to Mike Santoli on Friday afternoon:

First her comments about why NVDA bottomed during the GS conference:

- ” … at the earnings call, the numbers did not go up & it was the first time in 7 quarters the numbers have not gone up for NVDIA; stock comes in as people say 2025 is the peak ; at the GS conference, Jensen gets on the stage & talks about how capacity has to go up in 2025 but it also has to grow in 2026; that marked the bottom for the stock and the stock went to 120 where it is today; “

Then in more fundamental detail:

- “so it is very sensitive to the growth trajectory of 2026 & whether 2026 will be a growth year; now in our opinion, given how much capex needs to be spent, 25 is not peak capex; we think 25-26-27 & potentially 28 are going to be big capex years; … the opportunity is 50-fold; .. when you put in that context, the big picture on AI is a complete transformation of the technology& how we use it; I think that is the part that sometimes get lost because the end-point is very very different from what the market thinks …”

What about the semiconductor sector at large? Anastasia Amoroso addressed that on Bloomberg on Thursday:

- ” I do look very closely at the semiconductor space … .the valuations got very extended relative to the S&P; … the ratio was 1.4 times; … they have come back to earth; they are still expensive relative to the 10-yr averages; But if you look at the multiple adjusted for growth on semis, its actually below the long term averages. …. NVDIA talked about how much additional rental revenue the HYPERSCALERS can generate if they invest in NVDIA chips. And that’s why I think ROI is so huge for the industry right now. So despite the weakness, investors should be looking at the space & adding to it”

4. Other Sectors

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Sep 13 – $EQR new 52-week high in a strong real estate sector. Many upper right-hand corner charts in that group.

And,

- J.C. Parets@allstarcharts – Sep 14 – “Real Estate is going to bring down this entire economy. You’ll see JC!” Meanwhile, Real Estate... https://allstarcharts.com/all-star-charts-premium/2024-09-13/every-sector-uptrend

Aren’t regional banks loaded up with loans to the real estate sector?

- Seth Golden@SethCL – Biggest drop between Regional and Large banks occurred as you would expect during the SVIB bank crisis in 2023. Regional banks have underperformed Large banks ever since, but… That is the largest, bullish divergence I’ve seen in most any chart, as RSI fails to make lower-lows with relative performance making lower-lows. And… The bottom for Regional banks vs. Large banks may very well have formed as rate cut CERTAINTY developed in June. Regional banks are likely gearing up for Q4 Outperformance. $SPX $KRE $JPM $KBE $BAC $SPY $XLF

Moving to a different sector:

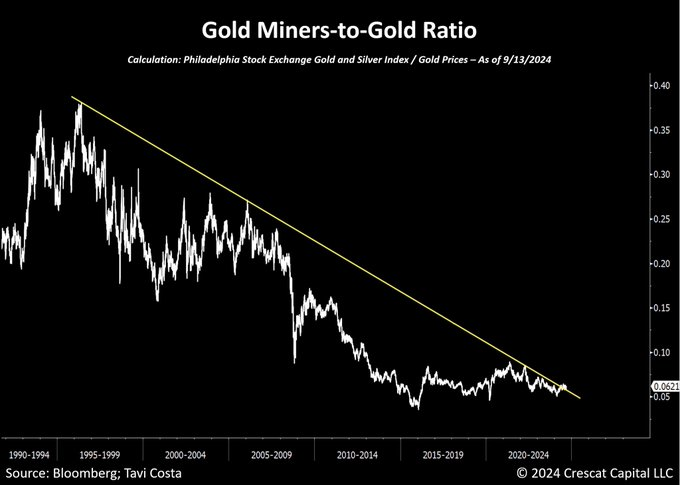

- Otavio (Tavi) Costa@TaviCosta – 57m – Generally speaking, there are two types of investors who will interpret the chart below: Some will look at it and see a disaster, while others will immediately spot the potential for a major opportunity. I’m in the latter camp..

And,

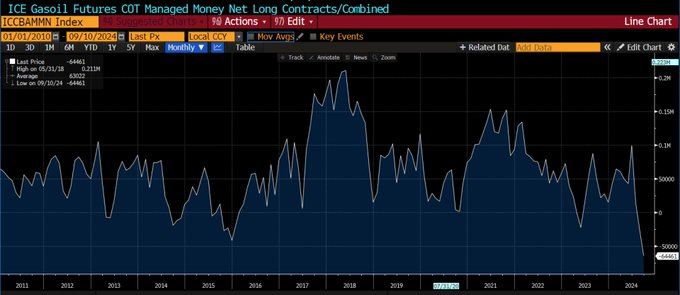

- Warren Pies@WarrenPies – Sep 13 – OIL Hedge funds have now built a record net short gasoil position. Looking at crude and refined products, we are now, basically, at max pessimistic speculative positioning.

5. China-India – Cramer inspired II

First re Cramer’s point that he doesn’t understand how India is growing so much. We discussed some broad points in Section 3. China-India Section of our last week’s article. Today we will take a narrower view.

Our own perspective has been that India needs to build new secular sources of high growth. Last year & earlier this year, we concentrated on the Defense Sector as one of those. A few years ago, India was the largest importer of weapons in the World. Today the imports remain but at a very high level. At the same time, PM Modi has been able to make the Indian Defense sector into a major builder & exporter of sophisticated weapons like ballistic & intercontinental missiles.

This month PM Modi launched his drive to make India a global leader in Semiconductor design, manufacture & technology development with the banner – You Can Bet on India When CHIPS Are down. Already,

- India makes a contribution of 20% of the talent & that number keeps increasing secularly;

- India is building a workforce of 85,000 technicians, engineers, R&D experts in the chip industry.

Below is a 4-minute clip that highlights the Semicon 2024 conference that was attended by major Semi companies worldwide. What makes Modi special was highlighted by Kurt Sievers, CEO of NXP as – “I have to say that after speaking to many political leaders in the western world, I haven’t met a single one with such deep expertise in our specific industry; very impressive“

India’s success in software is now 25 years old or older. With this determined entry into Semiconductor Design, Development and R&D, we do think Semis will emerge as a secular source of high growth in India.

PM Modi has also built a top-tier team in critical areas like External Relations & Intelligence. Minister JaiShankar is now openly described by western media as a Star. His fluency & ability to express India’s strategy & actions is now a huge asset for India. Witness his response in Geneva to a question about BRICS in a 3-minute clip:

Now India is demanding a permanent seat in the UN Security Council with a Veto power pari passu with the current 5 members. And this has the support of the Global South. Actually it is the GCC (Gulf countries) that proposed this formally to the UN and JaiShankar is driving it.

JaiShankar is now so successful that China has now taken direct aim at him with a hard, nasty article in China’s Global Times.

The other stellar member of the Modi Team is Ajit Doval, National Security Advisor for India. His international stature was highlighted when President Putin met him one-on-one in Russia during the BRICS meeting, contrary to Mr. Putin’s determined practice of not meeting any one other than Heads of State one-on-one. Interestingly, after his meeting with Mr. Putin, Mr. Doval held a detailed meeting with Chinese Foreign Minister Wang Yi in Russia.

Somehow after this meeting, the China has announced a withdrawal back to the Line of Control in 4 disputed areas including Galwan Valley, the place where the hostilities first started.

This is not a big victory for India as the clip announces. More important is a statement that China is reportedly willing to withdraw from Demchok, the southern most point of contention in Ladakh. But China is unwilling to do so at the northern extremity Depsong where the PLA has dug in positions. India is clear that China must also withdraw from Depsong before any normalization can begin.

The real story here is that Foreign Minister Wang Yi has taken this decision. We had quoted what we had heard/read a couple of weeks ago that President Xi Jin Ping has been reportedly Bidenized in that he remains the ceremonial president but real work is done by the “Gang of 4” that includes Wang Yi & Xi’s wife, who is one of the top officers in China’s military.

On one hand, China is now looking to resume trade growth with India given Chinese economy’s troubles & India’s growth. That requires normalization of the Line of Control between China & India.

On the other hand, China cannot countenance losing the Gwadar port in Balochistan & that is becoming a real possibility. Balochistan has apparently declared itself independent of NaPakistan & NaPaki flags have been pulled down. This in itself may not matter but the key is Napaki military forces are now loath to venture out of their army camps into Balochistan. China is visibly livid about this mess.

But the big headache for China is TTP (Tehreek-e-Pakistan) that now has virtually declared a revolt against Napaki military in the Khyber-PakhtunKhawa (KP) province that borders Afghanistan ruled by the Afghani Taliban. And this week, the Police in KP went on strike against the NaPaki Army & its ISI . This is the first step towards Self-Government in KP outside the purview of the Napaki State or whatever is left of it.

The situation is very fluid & every day it seems to get worse for China & its investments inside Khyber-Pakhtunkhawa. We have no doubt that the hawkish faction in China’s military is arguing for a quick military action against Indian military in Ladakh & on the eastern India-Bhutan-China line of control in Doklam.

The situation is made worse by a section of the new Coup-created BanglaDesh leadership demanding a joint BanglaDesh-China attack on India’s territory in that area. And the same Islamic faction is threatening to get Nuclear Weapons from NaPakistan in a joint war against India.

Getting back to China,

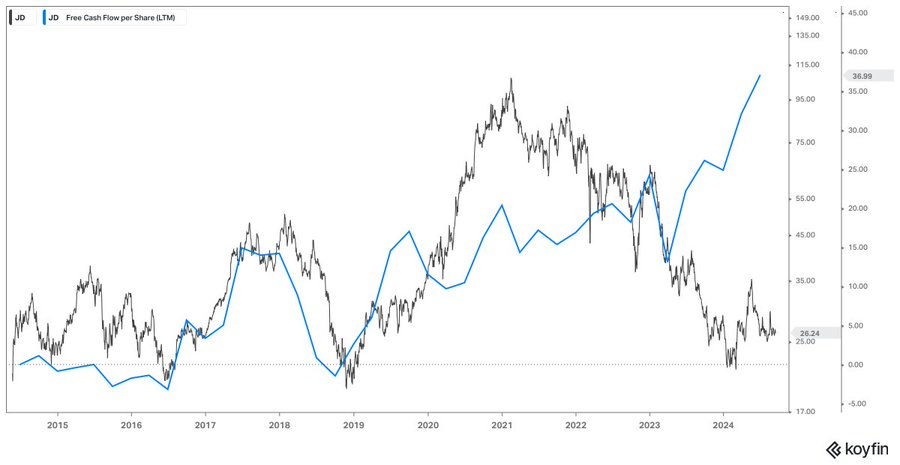

- Tiho Brkan@TihoBrkan – Unless there is a year-end rally, the Chinese stock market is on track for the fourth down year in a row. This is exceptionally rare for any global market. Several key names — Alibaba, JD, Tencent, etc — show just how much corporate value creation fundamentals (FCF per share in blue) have completely disconnected from sentiment-driven, market expectations (share price in black). In many cases, FCF per share is at or near record highs while the share price is near multi-year lows (in some cases decade lows). See the $JD chart below.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints