Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Happy!

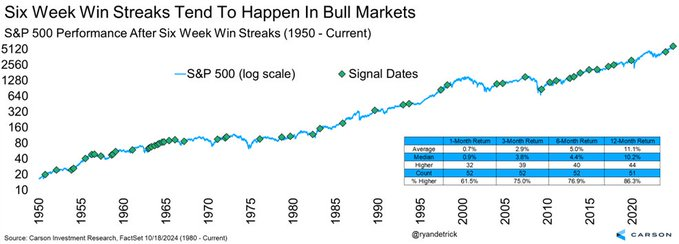

What else can you say about a market that is up 6 weeks in a row?

- Ryan Detrick, CMT@RyanDetrick – The S&P 500 is up 6 weeks in a row for the first time this year. I found 51 other times it did this and stocks were higher a year later 86.3% of the time and up 11.1% on avg. Both are better than the any-time returns. Yet another clue this is a bull market. Plan accordingly.

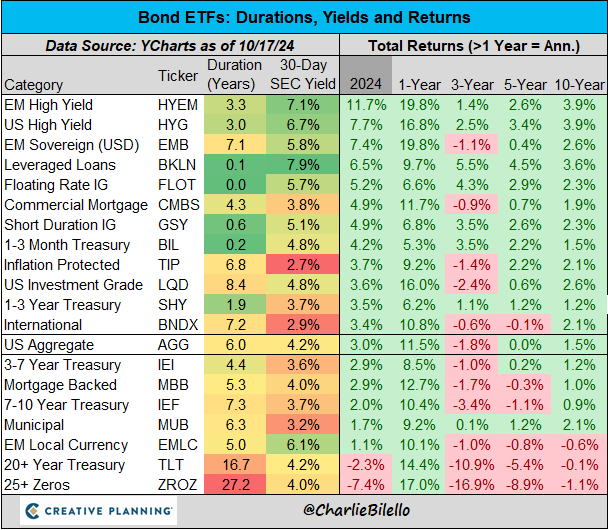

Not just in equities but also in bonds that speak a language similar to stocks.

- Charlie Bilello@charliebilello – Junk bonds have been the best performing sector in the bond market this year as credit spreads have tightened to their lowest levels since 2007. Video: https://youtube.com/watch?v=9MUdukEZsBY&t=557s

What about the one big index that is not yet at a new all-time high:

- Seth Golden@SethCL – Oct 18 – Nasdaq 100 $NDX is within 3% of a new all-time high. Historically, the Growth-heavy index has NEVER been within 4% of an all-time high in the Q4 period without making another new all-time high. Signal date 10/4/2024 $SPX $SPY $QQQ $IWM $DIA $COMPQ

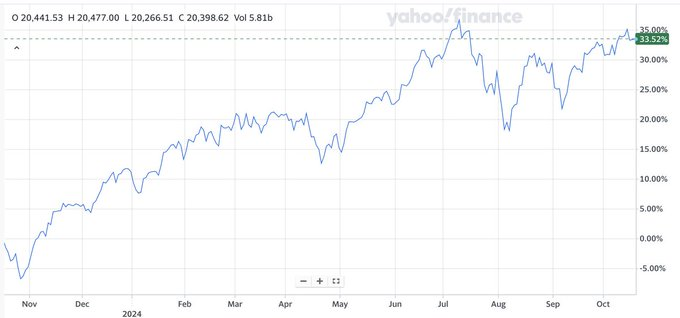

How about a broader index?

- RenMac: Renaissance Macro Research@RenMacLLC – While we were out visiting clients, R3000 breadth made a new cycle high on Wednesday. We struggle to see the “breadth problem” bears have been plagued with for the last 2-years.

And target prices keep being raised:

- Taylor Riggs, CFA@RiggsReport – S&P 500 PTs keep getting raise, with latest from UBS. “Historically, when the Fed is cutting rates in the context of a soft landing, equities rise 18% on average in the 12 months after the first Fed rate cut.” Raising June 2025 PT to 6300 from 6200. December 2025 PT at 6,600

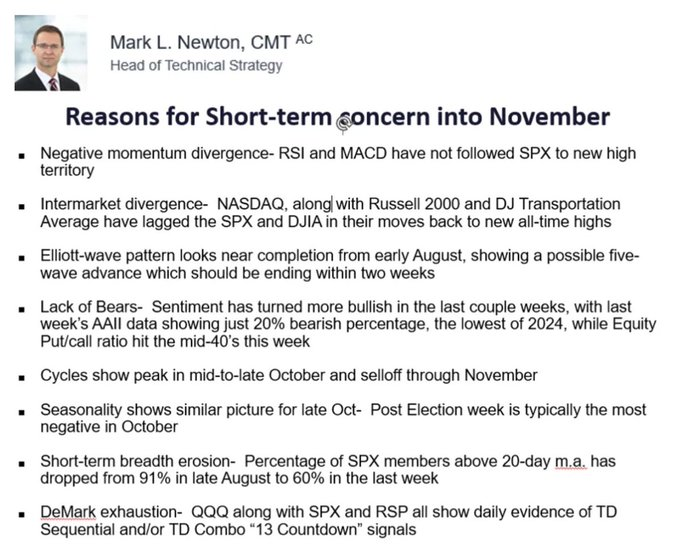

On the other & nearer sight:

- Seth Golden@SethCL – Oct 17 – Fundstrat’s Mark Newton CMT calling for a -5% to -7% pullback in the market through mid-November. “Late October to post-Election week is typically most negative.” A “buy-the-dip” opportunity for savvy investors/traders. $SPX $SPY $ES_F $NYA $QQQ $IWM

And an important class of investors seem disinterested:

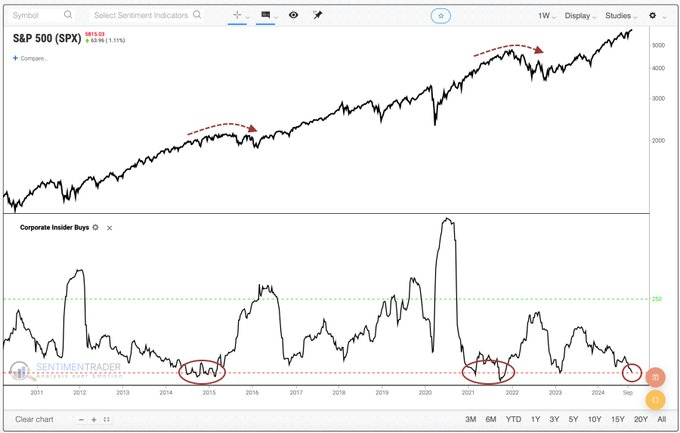

- Jason Goepfert@jasongoepfert – You know who’s not chasing stocks here? Insiders. Corporate executives among S&P 500 firms have some of the least open market purchases in 13 years.

That brings us to one videoclip that articulates why the “stock market still has legs“. Look what Dan Suzuki of Richard Bernstein advisors said on Wednesday, October 16:

- “2 months left in the year; anything can happen but the 2 things that matter the most to the markets are … profits & liquidity; … profits are accelerating & broadening out & liquidity is really strong & the Fed’s cutting interest rates; with these 2 levers, the market still has legs … “

- “… people forget that huge proportions of the S&P 500 are in a profits recession but they are exiting their profits recession; that’s the opportunity … “

- “.. on top of that you have the China stimulus story that’s also playing into the growth recovery …. when you out all that together, we are looking at a world which is growing pretty decently with upside relative to beaten down expectations.. its just fundamentals“

When asked what he sees as the big risk, Suzuki replied:

- “… the biggest risk is that the slowdown people are worried about actually comes through; … you are seeing credit stress among the low-income consumers; look at retail earnings; they are all negative numbers these companies are posting; when you put all that together, if China stimulus doesn’t come thru; US economy is consumption driven; drivers of that consumer are slowing gradually; they are not falling of a cliff; but if that continues that’s the worst-case scenario – that this broadening out in temporary & a head-fake; that’s the risk“

That brings us first to China:

2. China Stimulus & Chinese stocks

Mid-week we saw a tepid buy comment on Chinese stocks from technician Jonathan Krinsky.

On one hand, Krinsky said “This creates a great secondary entry point if you missed the initial breakout“. But he said at the same time “But don’t let a winner turn into a loser, Krinsky cautioned — saying he would use stop-loss sell orders at around $30 on FXI and $31 on KWEB.”

In contrast, Jeff DeGraff unequivocally said “we think the turn in China is real, legit & probably has some duration to it that is unappreciated in the broader market place“.

An even more explicit statement was the one below:

- Thomas Thornton@TommyThornton – Added back some $BABA and $KWEB long exposure after taking profits on most of our longs higher 40%-50% gain. I will add more if the bounce continues

Below is a more explicit negative commentary on China’s Problems with charts posted on X by Jeffrey P. Snider@JeffSnider_EDU

- There is this idea that Beijing’s “bazooka” resets everything in the economy and banks (since they’re doing a “recapitalization” of the Big Six). Markets aren’t buying it and even the bazooka was something it still matters just how big of a hole China would have to climb out of.

- Latest alarming bank data shows it’s huge – and that’s why they’re really talking about injecting new capital into some of them. Balance sheet constraints must be enormous; the real question is why. Authorities are claiming it’s lack of profit but we know this is about hidden losses tied to real estate.

- It isn’t just RE, though, as there is likely to be a fair amount of bad debt from pure macro.

- China’s local currency loans rose 8.1% year-over-year in September, hitting a record low and showing a significant drop from the previous month. Household loans rebounded but remained below last year’s levels.

- Bank lending has been slowing throughout the year, with domestic loan growth decreasing sharply each month. Beijing considers bank “recapitalization” due to increasing troubles and reduced lending activities.

- There has been a reluctance to lower loan prime rates despite the PBOC’s MLF reduction, indicating challenges in the banking sector.

- It’s the accelerated decline in lending which raises concerns about hidden balance sheet issues within the banking system. I’ve done a few videos on China’s banks for obvious reasons. Here’s the last two: youtu.be/EcA-4KbaTe4 youtu.be/KhtNBLeldgE There’s always more in-depth and detail at the Deep Dive Analysis here: eurodollar.university/money-macro-pro

Of course, both views could prove correct. We could see a further rise in Chinese stocks in this market move and we could also see the problems in China get worse in a few months.

3. Dollar, Gold, Silver

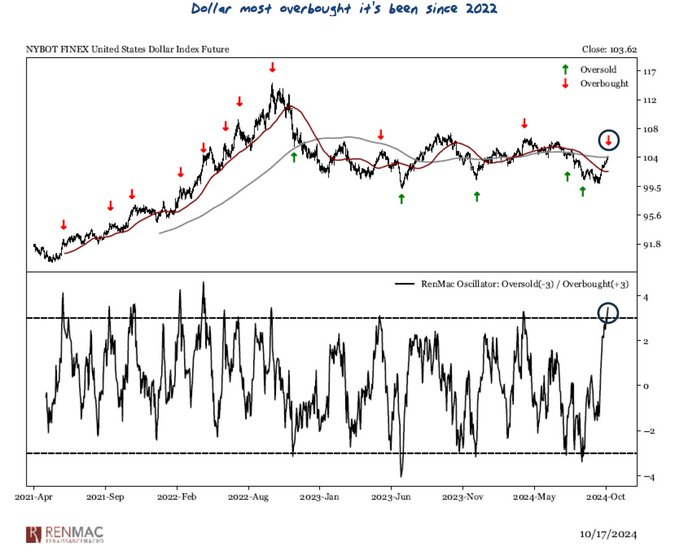

- RenMac: Renaissance Macro Research@RenMacLLC – $DXY most overbought since 2022

Is there anything RenMac likes in particular?

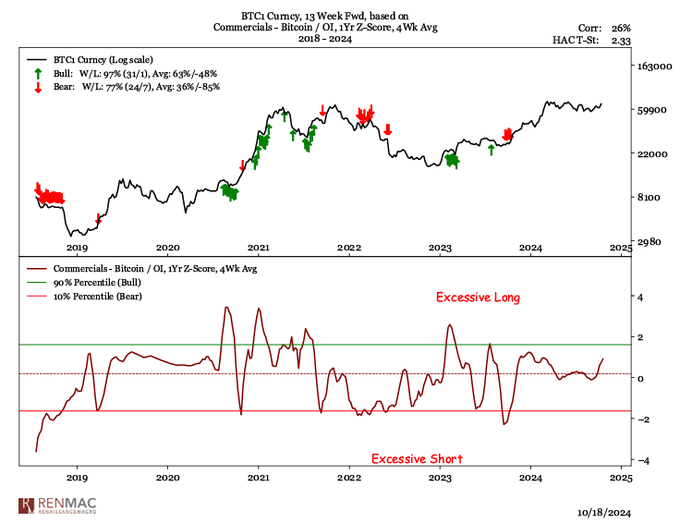

- RenMac: Renaissance Macro Research@RenMacLLC – Oct 19 – Commercial hedgers continue to buy into #Bitcoin strength….It could be stronger, but historically this has proved bullish to forward returns.

Now to a more mainstream instrument:

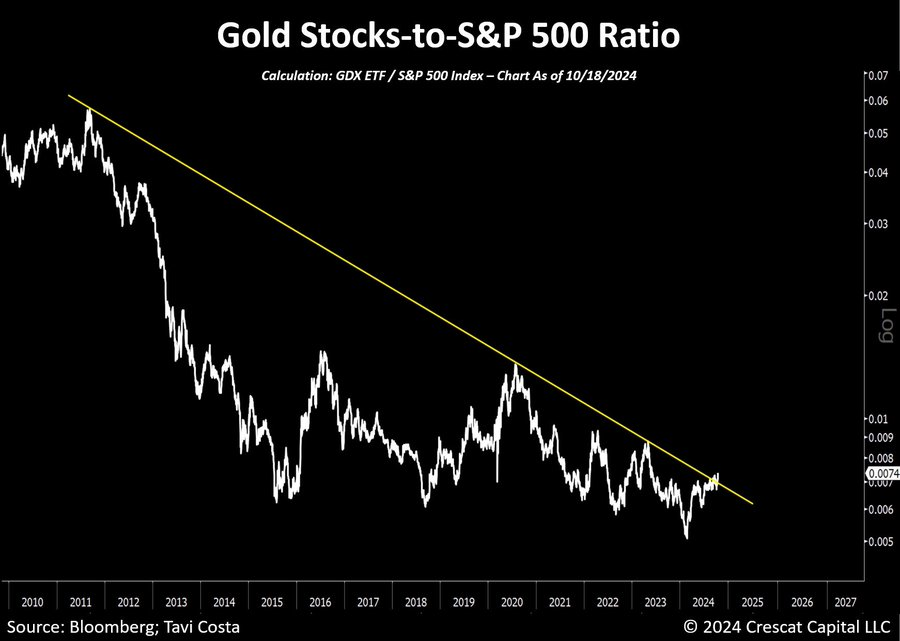

- Otavio (Tavi) Costa@TaviCosta – This is very intriguing. Gold stocks are starting to gain traction, particularly compared to the broader market. More importantly, the gold equities-to-S&P 500 ratio is breaking out from a key support level that has been in place since 2011. When there’s a shift from one end of the spectrum of views and positioning to the opposite side, that’s often where significant opportunities arise, in my view.

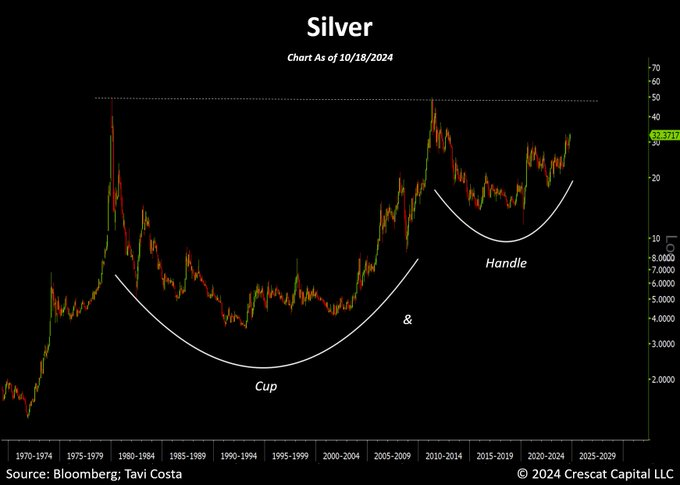

And to Gold’s poorer cousin:

- Otavio (Tavi) Costa@TaviCosta – It’s remarkable to think that silver is at a 12-year high, yet remains one of the most undervalued metals in history compared to gold—the gold-to-silver ratio is still at 83! This suggests that the rally has momentum and is just getting started in my view. Game on.

4. Interest Rates

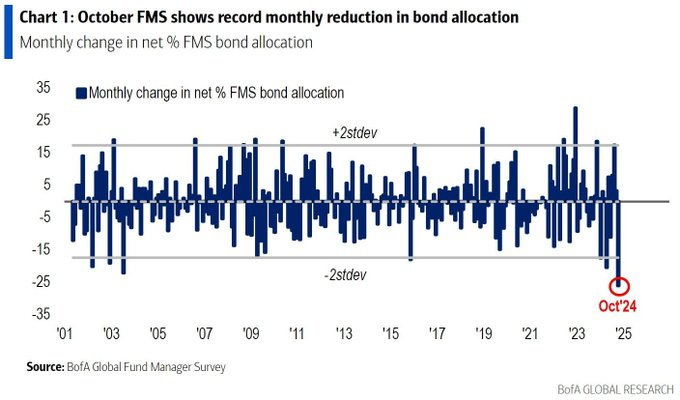

Druckenmiller said on Bloomberg TV that he shorted long duration Treasury bonds when the Fed cut rates by 50 bps. He has lots of company it seems:

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – Investors wanted out of bonds huge in the last month

Are such extreme short positions sustainable? Not that one week means anything but Treasury rates did dip a tiny level this past week with TLT up 25 bps.

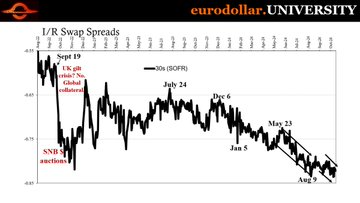

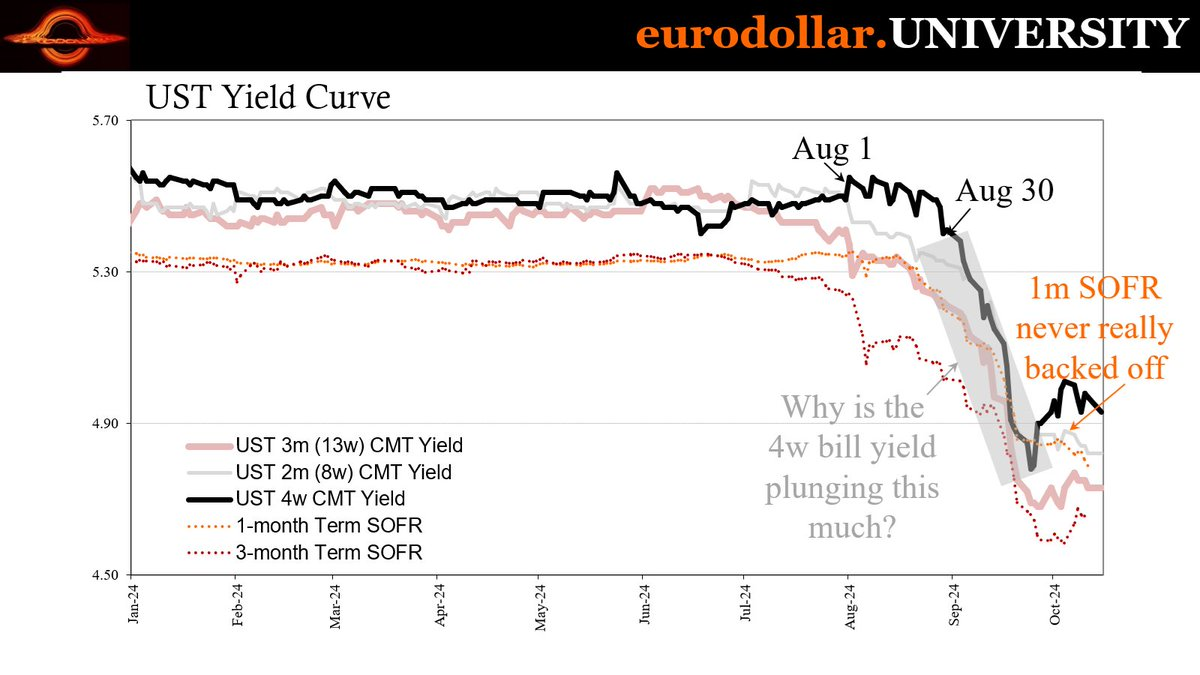

Revisit the Dan Suzuki clip in Section 1 above & recall the risk highlighted was that the economic slowdown might actually come thru. On that note, look at the charts posted in his tweet by Jeffrey P. Snider@JeffSnider_EDU

The text of the tweet is below:

- Bill yields falling, swap spreads hit more record lows, then ASML spooks everyone with an “unexpected” 50% drop in future sales during the quarter before LVMH’s “unexpected” revenue decline. Both of those further confirm the same thing driving interest rates lower (and eventually central banks do follow).

- The bond market’s behavior, particularly interest rates and derivatives, reflects deteriorating global economic fundamentals. Despite rate cuts by central banks and stimulus efforts, markets remain pessimistic not buying the official actions and instead anticipating a continued downturn.

- Companies like ASML and LVMH are bellwethers reflecting the underlying condition of so many industries in so many places around the world, each coming from very different angles. The declining performance of these key players is more powerful evidence for the bond/rate view.

- Despite optimistic views on rate cuts and stimulus, historical evidence suggests their limited effectiveness in halting economic downturns. And that gets us to interest rate swaps whose spreads keep going lower and more negative. ASML plus LVMH, faster central bank cutting and drop in bill yields, all of it consistent with a world moving in the direction swaps have already gone and are still going.

- They’ve said rates are going to go down…and stay there. Today’s big news certainly fits on the road to all that. More here: youtu.be/yVKT5lvy134 There’s a lot more about all this in our subscriptions, including EDU memberships which include The Basics, a series of videos going over, well, the basics. Our current mini-series focus just happens to be interest rate swaps. With Fall Sale going on, best prices available on everything. eurodollar.university

- Jeffrey P. Snider@JeffSnider_EDU – – US retail sales were down in September, not up. It goes along with why 8 in 10 US voters say the US economy is their top worry. The seasonal adjustment for retail sales was up big time, yet the unadjusted data was lower compared to last year. Another source from the National Show more

- “The American economy has left other rich countries in the dust. Expect that to continue” – The Economist”

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.