Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Two-year anniversary with a goal

The stock market rally celebrated its 2-year anniversary this weekend & even a usually circumspect writer could not avoid placing a target to match his exuberance. So many quoted strategist Hartnett of BofA-Merrill saying:

- “A bull market that began at 666 in March ’09 ending with a blow off top to 6666 as Fed slashes yields of $6.5tn in money market funds…just feels so right“.

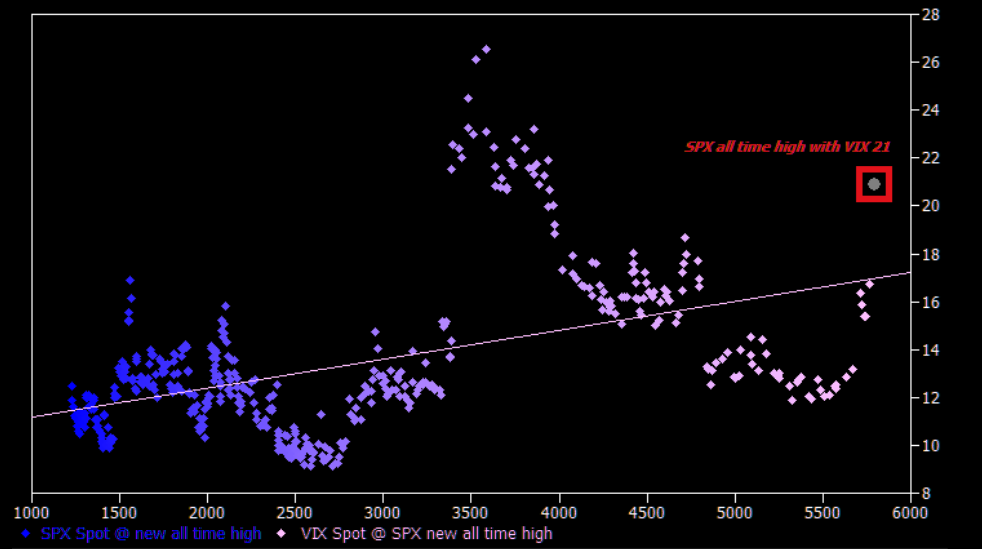

Of course, Ed Yardeni might disagree because his target is 8,000 to cap off the nouveau Roaring 20s. The VIX seems to disagree with the bullish fever:

- The Market Ear – Rarity – VIX at these levels when SPX is printing ATHs is very rare. Goldman’s derivatives guru Garret writes: ” …excluding 2020-2021 pandemic+stimulus induced rally, new highs in SPX have never been met with this level of anxiety … in fact the avg level of VIX when SPX makes all time highs is about 50% below current (~13.4)“.

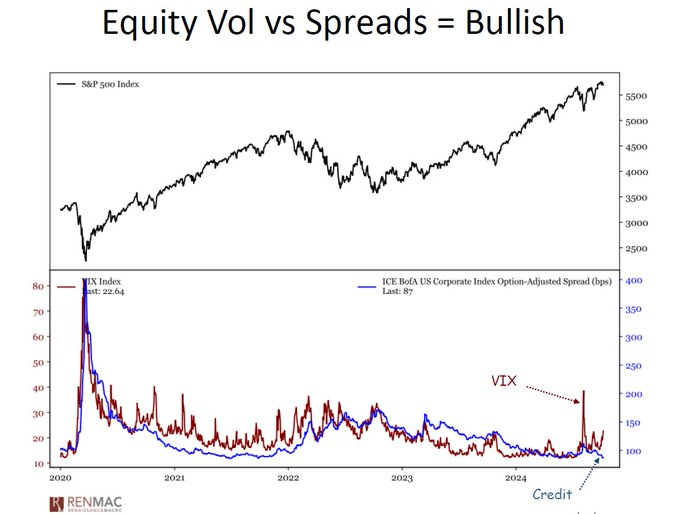

Perhaps VIX is pricing the worry that usually credit spreads price. And that might be bullish:

- RenMac: Renaissance Macro Research@RenMacLLC – Oct 10 – $VIX vs Credit is set-up bullishly for $SPX. Basically, equities are pricing in risk (vol) that the credit markets are not bothered about. There’s more math to it than what you see here, but it’s extreme enough to provide a bullish back-drop for Q4. #CPI or not

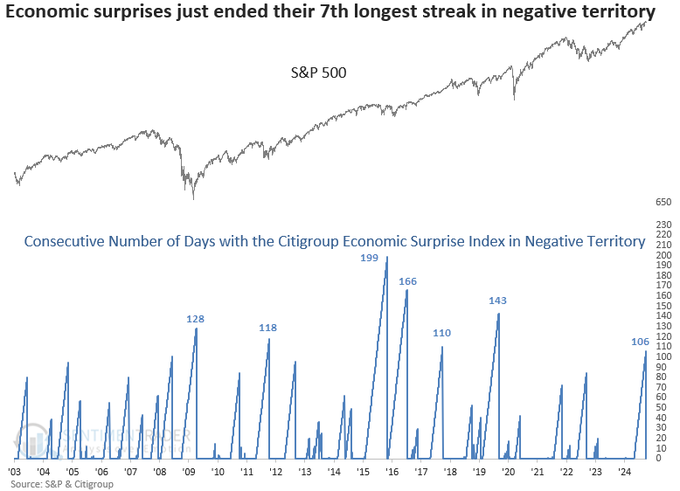

All this fancy stuff is fine but what surprises will the economy provide – positive or negative?

- SentimenTrader@sentimentrader – Tue – Following the 7th longest streak in history in negative territory, the Citigroup Economic Surprise Index turned positive. Similar precedents saw the S&P 500 rise in all but one case over the subsequent year.

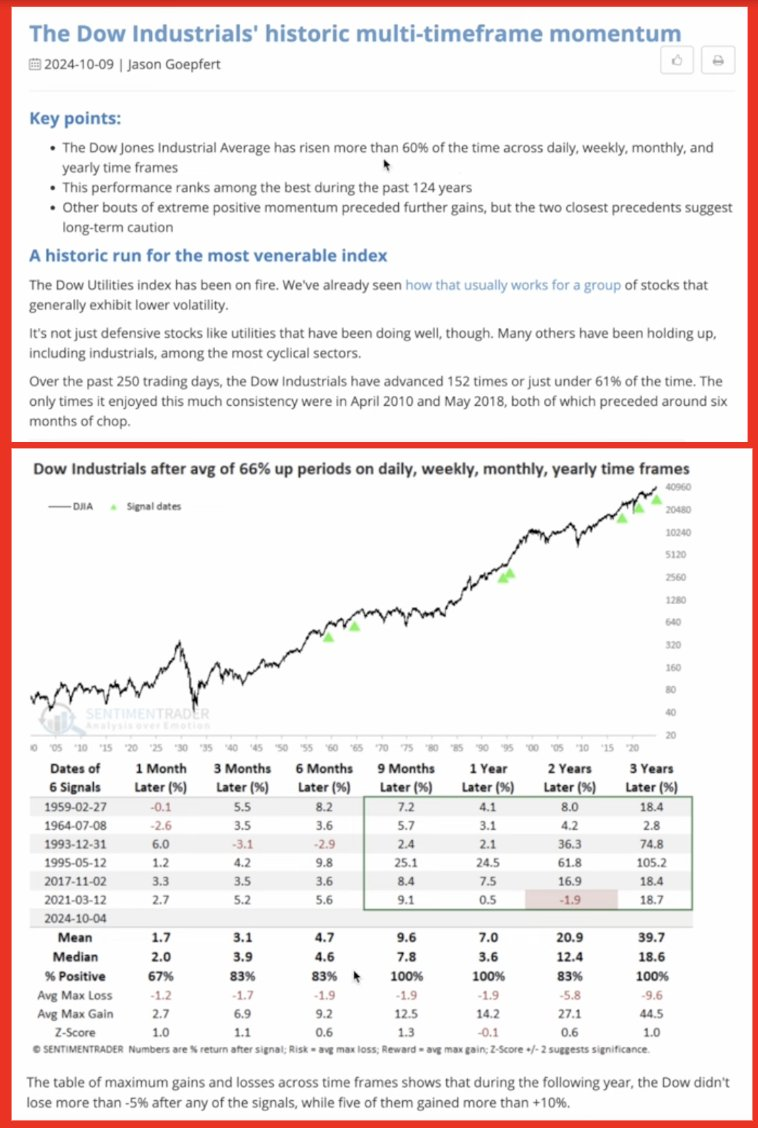

What do the market indicators say?

- Seth Golden@SethCL – 🚨Boom, that just happened, and it’s a rare occurrence – The Dow has advanced roughly 60% of the last 250 trading days. Historically, this proves a perfect foreshadowing of future returns. The index has never been lower 9 and 12 months later when the uptrend has been this strong! Something tells me, the S&P 500 holds a likely outcome. $SPX $SPY $DIA $QQQ $NYA $ES_F h/t @sentimentrader

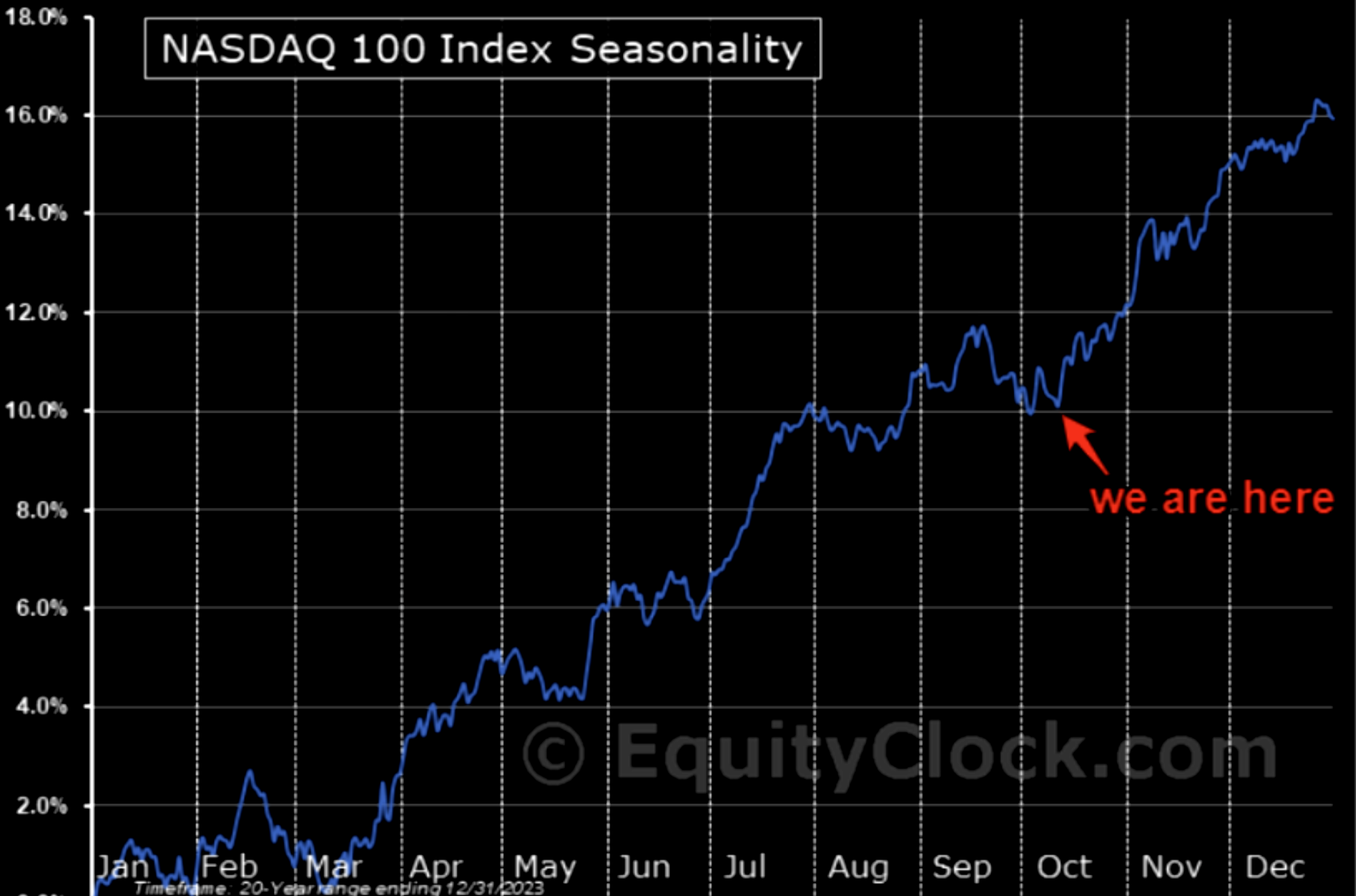

What does seasonality favor at this juncture?

- The Market Ear – NDX seasonality – Is upside the real pain trade? NDX seasonality is very strong from here.

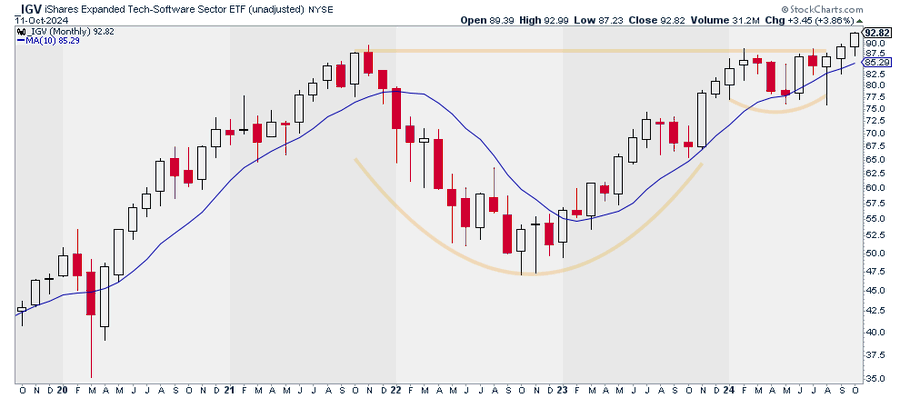

Anything specific within NDX?

- Justin Spittler@JSpitTrades – Software stocks are leading. And by the looks of it, this move could still be in the early innings. Software ETF $IGV is just starting to break out of a multi-year, cup and handle pattern. Breakouts like this typically have long legs. Group Leaders: $PLTR $ORCL $MSTR $ZETA $APP

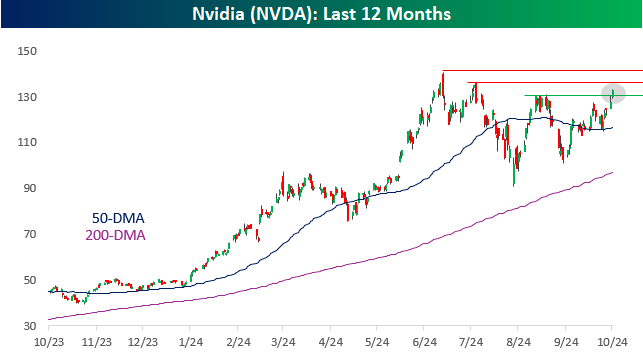

What about the most celebrated tech stock of 2024?

- Bespoke@bespokeinvest – Shares of Nvidia made their first higher high since June. $NVDA

And,

- Jason@3PeaksTrading – The best part about this big +30% rally the past month in $NVDA since the Sept 6th low is that call skews in its options are still quite low compared to past rallies this year. Shows a lack of belief from traders (since many missed it). This almost surely points to new highs by earnings

Below is a detailed message from Dan Niles about $NVDA:

Dan Niles@DanielTNiles – I said on @CNBCOvertime yesterday that “I think with

@Nvidia , it’s not going to surprise me to see that hit new all-time record highs before the end of the year.” Today, the Chairman of Hon Hai, partner of Nvidia, said that demand for Blackwell was “crazy.” This echoes the comments by Nvidia’s CEO on 10/2 that demand was “insane.”

AI buildout compared to the internet in the late 1990s:

1. During the internet infrastructure buildout, $CSCO revs increased ~15.5x over 6 years from the end of 1994, when Netscape Navigator (the first mass internet browser) was introduced, to its peak and Cisco’s stock rose ~4000%.

2. Nvidia, since the end of 2022 when OpenAI’s ChatGPT was introduced, has seen revenues go up “only” 5x over the past 7 quarters with the stock up “only” ~800%. While I see a digestion phase of customer capex in the first half of 2025 versus consensus expectations of 7-11 sequential growth for the next 6 quarters, I believe revs and the stock will ultimately double over the next several years.

But I still believe there will be an AI capex digestion phase in early 2025. As the CEOs of Google, Microsoft and Meta have all said that they view the greater risk to be underspending on AI versus overspending. What this means to me, is that when they decide to digest their historical spend now that supply is catching up with demand, much like following Covid, there may be a sharp correction at some point in 2025.

When these same hyperscaler customers digested their Covid spend as their own revenue growth slowed, Nvidia revenues went from up 53% year-over-year in CQ4:2021 to down 21% by CQ4:2022. Nvidia’s stock declined 66% from peak to trough during this slowdown. Prior to Covid, Nvidia revs on a full calendar year basis were down 11% in 2019 before growing 51% in 2020 and 62% in 2021 as everyone had to get online during Covid. As the world became unlocked following Covid, hyperscaler revenue growth slowed and Nvidia revenue growth slowed to 6% in 2022. Then the Generative AI spending wave hit and Nvidia revenue growth accelerated to 102% in 2023 and an estimated 118% in 2024.

Forward revenue estimates went down for Nvidia’s hyperscaler customers $MSFT, $GOOGL and $AMZN after they reported their June quarter results. In addition, investors want to see that all of this capex spending is having some return on investment. Soon to be released September quarter results and the outlook for the December quaerter will help determine what happens to hyperscaler AI investments in 2025. It would not surprise me to see hyperscaler spending growth slow from over 50% this year towards 10% next year.

In summary, through year-end, I am very bullish on Nvidia but in the first half of 2025, once initial shipments of Blackwell have been received by customers, I still expect an AI digestion phase to occur.

How we wish more experts on Fin TV would publish such detailed messages? Thank you Mr. Niles.

2. Rates & Treasuries

More are alluding to what Cramer-Garner said last week:

- “On Friday Jim Cramer relayed the views of his techni-pal Carley Graner suggesting 10-year Treasury & longer duration treasuries have been shorted massively. We recall, subject to our often imperfect memory, Cramer saying the short position against 10-yr UST was 750K in late 2018 & now it is over a million. And Garner-Cramer wondered if we could potentially see a bonfire of the shorts. “

On Wednesday, we saw:

- The Market Ear – Wed – Rates mania – The 10 year continues moving even higher, hitting the 100 day moving average and the big negative trend line. Note just how stressed the VXTLT remains.

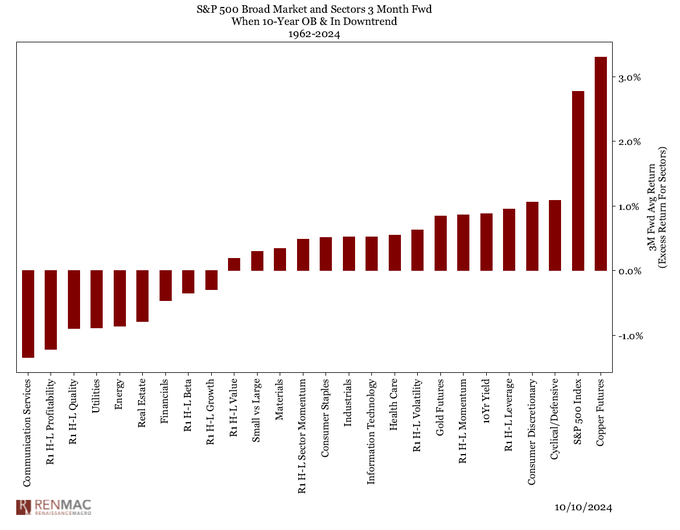

Renaissance Macro called 10-yr rates “overbought”:

- “10-year yields are overbought for the first time since April of this year. Here’s what happens historically when overbought in a downtrend back to 1962. Not bad for $SPX and one of the reasons we’re tilting back toward cyclicals here $TLT.”

3. Gold

The first sign we saw was on Tuesday:

- The Market Ear – Gold technicals – Gold is putting in the biggest down candle in a while. Nothing huge, but worth watching, especially as gold is such a darling these days. The short term trend channel remains in place. Note we are touching the 21 day as of writing, but the bigger support is at $2600. 50 day is down at $2533. The negative divergence in RSI should not be dismissed.

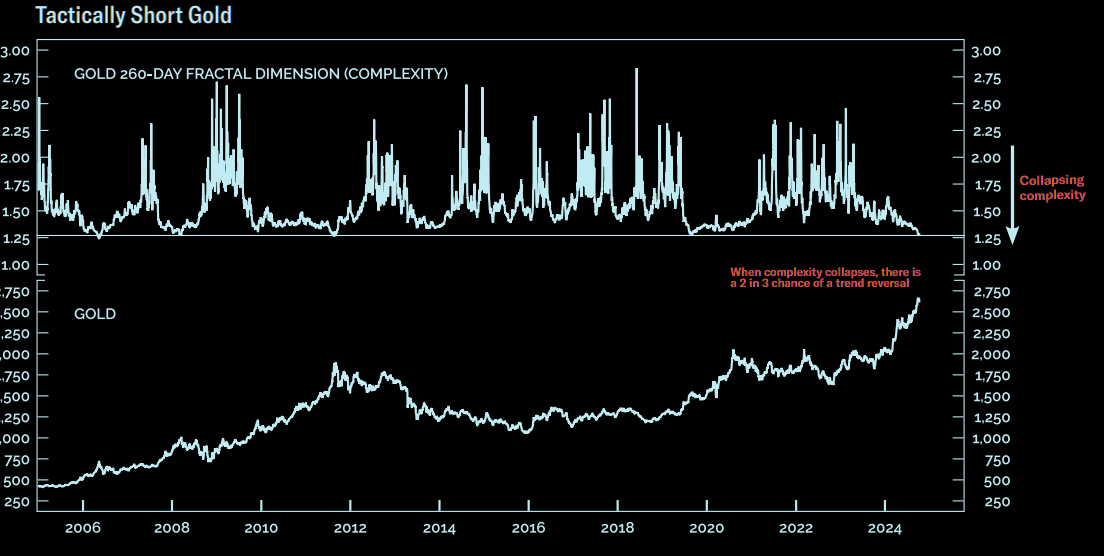

Then we saw a short Gold for 6 months call from BCA:

- The Market Ear – The counterintuitive gold short – BCA: “On the face of it, a Fed that is behind the curve to stabilise prices should be good for the inflation hedge, gold. Yet if Fed reacts by cutting rates much less than is priced, as I strongly believe, then it will boost the dollar. Which is bad for gold.” When BCA’s model sees collapsing complexity, you watch closely. Chief strategist Dhaval Joshi recommends shorting gold on a 6 months horizon.”

4. China

We recall the smart call made by Stefanie Holtze-Jen of Deutsche Bank Private Bank before the elections in India. This week Ms. Holtze_Jen said “China will over-deliver on fiscal stimulus expectations as it faces ‘Whatever It Takes’ moment“. She remains constructive on China assets over the medium to long term, as sentiment and positioning are now primed for a pick-up.

Mark Mobius was much more bullish on China this past week. He said “China is going to be in a win-win situation. They have stimulated the property market & other markets with lower interest rates & lower mortgage rates in particular …. this will encourage more foreign investors to come in.”

In contrast, Anna Rathbun of CBIZ Investment Advisory Services said:

- “Don’t think anything out of China will be able to satisfy the markets, … until the structural issues facing China’s economy are solved, the market will not rally in a sustainable manner.….there are structural problems that these stimuli don’t actually solve … stimuli don’t really change the Chinese economic trajectory …. we have a balance sheet recession type of slow growth with a lot of debt on the books“

Mobius said that “most significant was the statement by Xi Jin Ping that he wanted to encourage enterprise. That’s very very significant because before there was a feeling that he was down on private enterprise. ”

In stark contrast, John Rutledge, a commentator & investor in China said explicitly that “investors shouldn’t touch China stocks …. as long as Xi Jin Ping is in power, he will do same” as he has done before.

What about the stimulus announced by China a day ago on Saturday?

- Holger Zschaepitz@Schuldensuehner – #China stocks face a volatile start Monday as the FinMin’s weekend briefing lacked firepower expected by markets. Officials promised more aid for slumping property sector & indebted local govts, but refrained to put a price tag on fiscal stimulus. China’s deflationary problems became more entrenched in Sep, w/Core CPI slowed to 0.1% in Sep, lowest since 2021. (BBG)

5. On the other hand,

We see Jamie Dimon again speak of his deep concern about geopolitics. You can hear Nassim Taleb say on BTV that markets are more fragile now that at any time in the last 20 years.

Putting that in the context of China, read the opinion below:

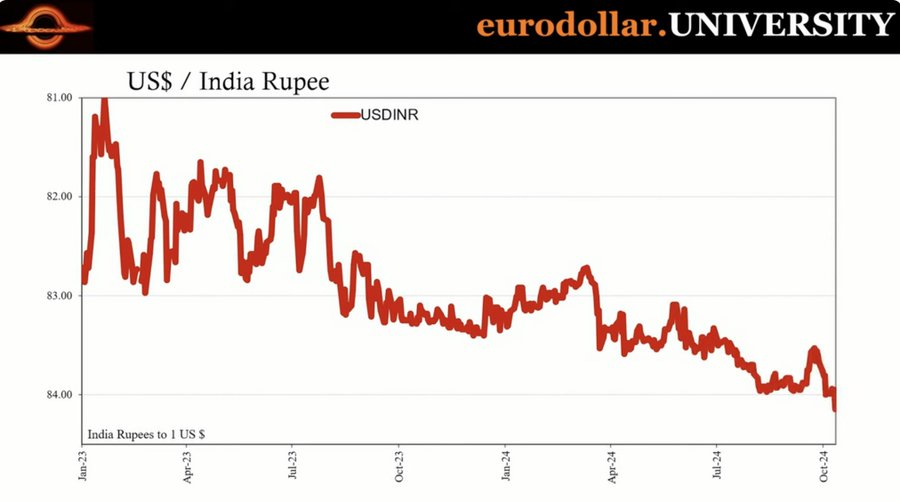

- “… count India and the Indian Rupee as another market that is neither buying the China stimulus story nor is it buying that the slowdown is nothing more but tapering off from a high rate of growth; the currency direction , esp. since it is globally synchronized, tells us downside of the supply shock“

Ok, so why should we care? Read the statement near the end of a 18 minute clip:

- “… it confirms the entire global system, if India cannot stand up to all this, what are the chances of US soft-landing or Europe, Japan , China & everywhere else recovering? … “

Why? Because “The Indian Rupee has been the canary in the coal mine for global crises“, as Jeffrey Snider of the Eurodollar university says:

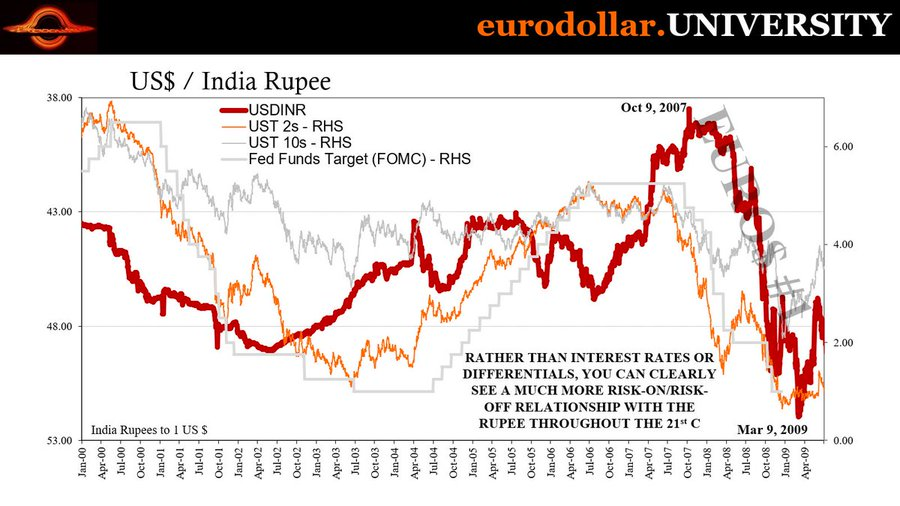

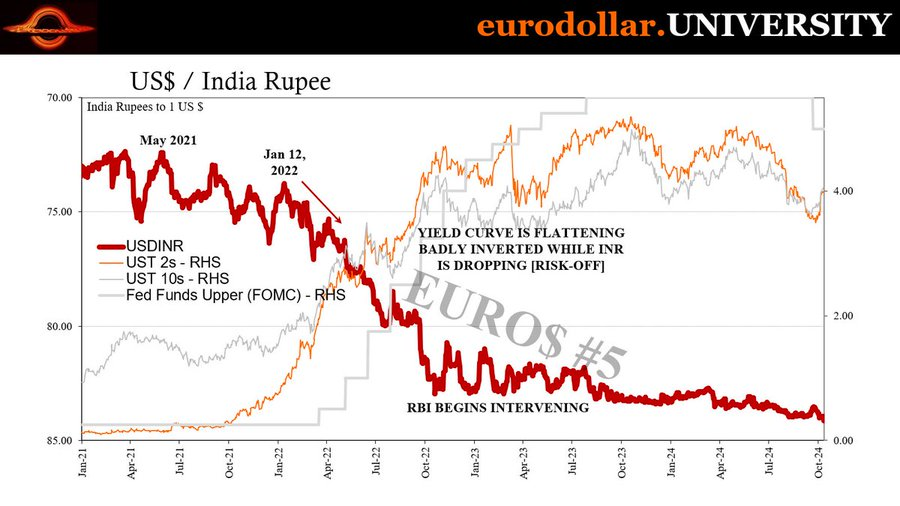

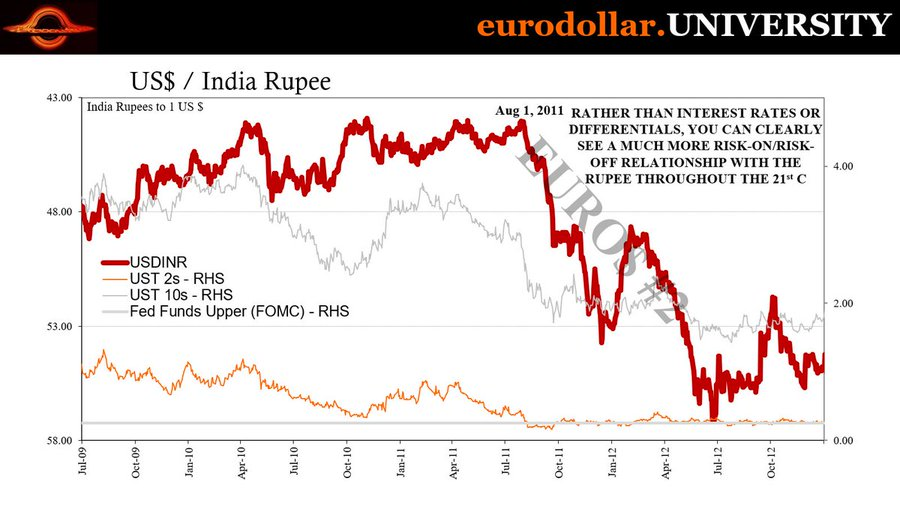

- Jeffrey P. Snider@JeffSnider_EDU – Oct 12 – The Indian Rupee has been the canary in the coal mine for global crises— Here’s what it’s doing now India’s rupee just fell to a record low and it has nothing to do with interest rates. The Indian rupee has been intricately linked to everything Euro$ in the 21st century, coinciding with global dollar shortages including an exact match w/stocks from top to bottom 2007-09.

Below is the detailed message:

- The Indian Rupee has been the canary in the coal mine for global crises— Here’s what it’s doing now India’s rupee just fell to a record low and it has nothing to do with interest rates. The Indian rupee has been intricately linked to everything Euro$ in the 21st century, coinciding with global dollar shortages including an exact match w/stocks from top to bottom 2007-09.

- The rupee is a canary. Despite conventional wisdom attributing currency behavior to interest rate differentials, the rupee’s movements have defied such explanations, showing a pattern of alignment with eurodollar cycles since 2007. This unique relationship has made the rupee a canary in the coalmine, providing early warnings of looming financial challenges. Rupee plunged again in 2011 due to Euro$ #2; Fed rates pinned at zero, INR declined anyway. There was Euro$ #3 when again the current fit. None of that was interest rates. In fact, during Euro$ #4 it was RBI’s Governor at the time, Urjit Patel, who spilled the beans. Patel even went so far as to write an op-ed in FT where he flat-out cited “dollar funding has evaporated” for the rupee’s plunge. Because of this unique relationship where the rupee’s value is closely tied to eurodollar conditions, it has been repeated canary in coalmine for global monetary issues many times including collateral angles.

- Here we are again in 2024 and INR continues to go lower and correspond with other signals. While everyone continues to be absolutely sure (again) the US soft landing is assured after a single payroll number, or following China’s “stimulus” Oprah-fest, India’s currency is yet another critical market betting the opposite way on both. A lot more to this one, too. Check it out at our DDA (Fall Sale) here: eurodollar.university Or my latest video on the current macro background in India: youtu.be/-mGv6StBbOA

Watch the entire 18 minute clip:

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.