Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”China has unabashed momentum and it’s very, very bullish“

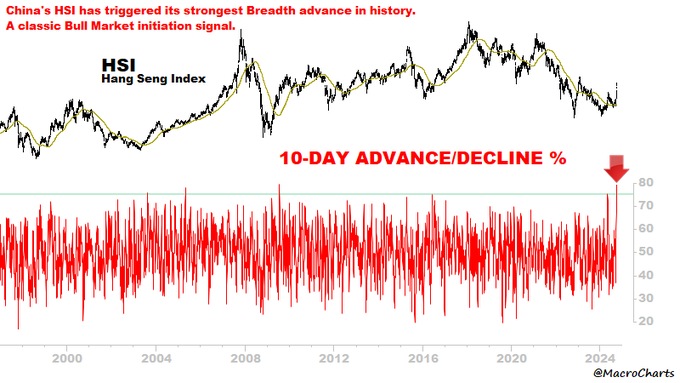

Last week, Jeff DeGraff of Renaissance Macro pointed out that 20-day highs in the Chinese market were running at 80%. Did these scale back a bit this week? No, he said on Friday afternoon on CNBC:

- “some internal statistics – 97% of the constituents of the CSI 300 are making 20-day highs; 100% of constituents are above their 20-day moving average; this is unabashed momentum; its very bullish & its coming on the back of extraordinarily negative readings we have had in alpha-generation over the last 3-5 years; this is where bottoms are made; …. then we get this hot spark thru momentum- … these are very rare occurrences; crazy but I think this market can get 6,000 in 18 months, even as short as 12 months … so I really think it is a very important call coming out of China; you have actually valuation & now you have got momentum; so it looks really, really good to us technically; ”

But what about a step back or a correction? DeGraff said:

- “… Sure we can pullback, consolidate, have a 10% may be consolidation; I think its a gift if you get that; we are going to be very very aggressive not only adding to positions but probably putting some leverage onto that …. I just think the upside is multiples better than the risk to the downside; so that’s how we think about it & how we play it”

And,

- Macro Charts@MacroCharts – China’s HSI has triggered its strongest Breadth advance in history. A classic Bull Market initiation signal.

US indices also rallied in to the close on Friday enabling the S&P and NDX to close marginally higher on the week. And Tom Lee of FundsStrat quoted his Technical Analyst Mark Newton as saying that we may see new highs next week. And Tom said he expects a rally to 6,000 on S&P by year-end.

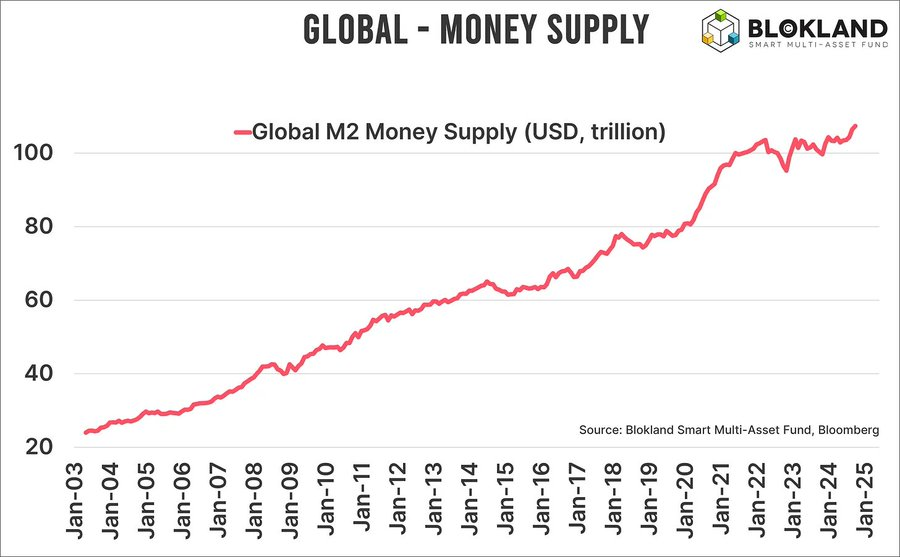

And the macro story globally looks good & comforting:

- jeroen blokland@jsblokland – Geopolitics aside, things look pretty solid – Central Bank easing

– Global Money Supply increasing – Yen Carry Trade safe – Inflation dropping below targets

– High Yield spreads stable and low – Earnings indicators flashing ‘green.‘ The state of markets: https://jeroenblokland.substack.com/p/geopolitics-aside-things-look-pretty

On the other hand, Roger Altman said on Friday – “its going to be hard for equities to move up between now to end of the year in any material way because they are already so high; in a lot of cases, multiples are abnormally high“. And he pointed out that “10-year has risen by about 40 bps since its lows; not trivial“.

2. Powell’s confidence an inverse indicator? Treasury rates

Going back to October & December 2018, whenever Chair Powell has basked in the glory of his own confidence, he has proved to be quite wrong. The last time was the September 18, 2024 FOMC meeting & his presser. Recall how comfortable he was in his conviction that lowering rates hard & large was the absolutely correct route to take.

But the Treasury market reacted adversely to his message as Roger Altman pointed out above.

The yield curve also steepened as short rates fell hard while longer duration rates rose. That changed dramatically on Jobs Friday, October 4, 2024. The message of the happy Jobs report was that the Fed would not cut with the abandon they had exhibited during Powell’s presser. Look at the action on Friday:

- 30-yr yield up 8 bps; 20-yr up 8.4 bps; 10-yr up 12 bps; 7-yr up 15 bps; 5-yr up 17 bps; 3-yr up 20 bps; 2-yr up 20 bps; 1-yr up 19 bps.

Will this emerge as a trend as prospects for a fast & hard rate cut campaign diminishes? On Friday Jim Cramer relayed the views of his techni-pal Carley Graner suggesting 10-year Treasury & longer duration treasuries have been shorted massively. We recall, subject to our often imperfect memory, Cramer saying the short position against 10-yr UST was 750K in late 2018 & now it is over a million. And Garner-Cramer wondered if we could potentially see a bonfire of the shorts.

Coincidentally we saw the following on post-Friday:

- Jason@3PeaksTrading – $TLT Bonds lots of potential to find support in this 95 region with the 200 day MA and near 50% retracement of the 2024 rally. Personally think there are better plays out there but don’t hate nibbling here

And its companion message:

- Jason@3PeaksTrading – $TLT now a large buyer for 4200 April $105 calls at $1.45 offer in a single block

Also is there any one who hasn’t heard of Druckenmiller’s 10-15% short position in long duration Treasury bonds? And as we hear, his short position is based on utter abandon of fiscal discipline post the election. But that’s a month away, right?

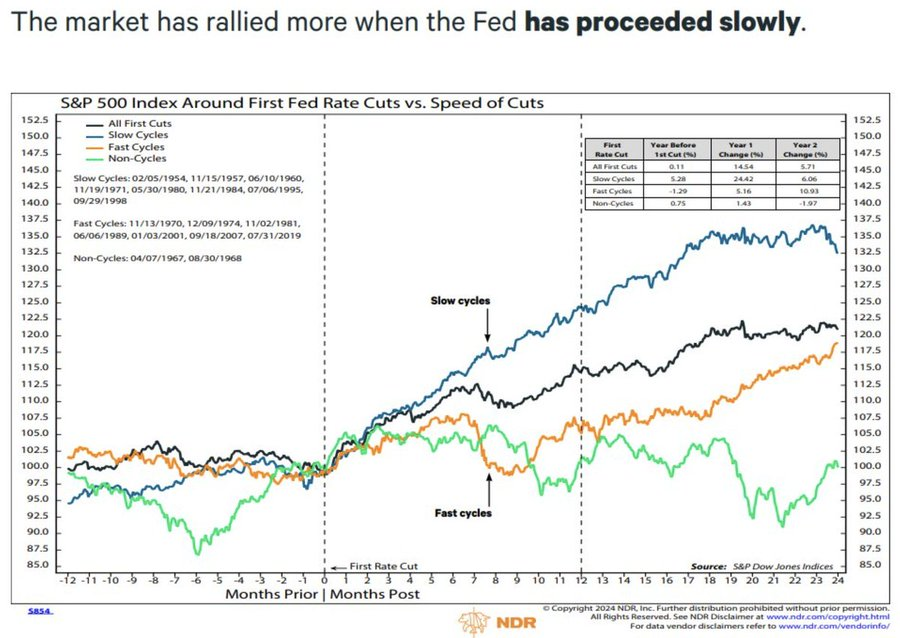

Speaking of the Fed, does it make any difference whether the Fed’s described rate cutting cycle decelerates from fast to slow?

- Seth Golden@SethCL – Fed fund futures have been repricing November rate cut from 50bps to 25bps probability. Soft and no-landing scenarios accompany slow rate cutting cycles and more often than not higher equity markets. The difference between fast and slow rate cutting cycles is vast. You want that 25bps in November, so says history! – $SPX $SPY $QQQ $DIA $ES_F $IWM $TLT h/t @NDR_Research

3. China – Other thoughts

First about the economy from CEO of China Beige Book:

The above is sort of conventional wisdom which might be accurate but it might be missing the crucial “why” component of why,

- “last Tuesday, People’s Bank of China Gov. Pan Gongsheng introduced a new package of large-scale support measures, including cuts to the mortgage rate for existing loans and its reserve requirement ratio, as well as new tools to prop up the stock market. These measures were followed by an unexpected announcement that the government planned to give one-time cash handouts to people living in poverty – a welfare scheme that not even a year ago was deemed ineffective“.

As Victoria Herczegh of Geopolitical Futures wrote in China Charts a New Path on Friday, October 4:

- “Put simply, this means that Beijing has determined that steadily declining housing prices, defaulting property developers, weak consumer confidence, dependence on foreign markets for its manufacturing surplus and high levels of youth unemployment cannot be slowly or gently nudged away. It means that Beijing realizes it must count on itself, not Western FDI, to solve its economic problems.”

So,

- “if Beijing has begun to abandon the hope that it could prop up its economy with Western foreign direct investment, then it no longer has to “behave” in the South China Sea“.

How has China’s behavior begun to change?

- Last weekend, the South China Sea was unprecedentedly busy with military activities. For the very first time, the Chinese navy deployed three aircraft carriers at the same time and in the same place. The United States, Australia, Japan and the Philippines, meanwhile, were joined by New Zealand for the first time for naval drills in the Philippines’ exclusive economic zone. Indeed, there has been a considerable uptick in China’s military exercises and associated activities over the past few months – sometimes on its own, sometimes in concert with Russia. During Ocean 2024, a joint naval exercise in the Pacific and Arctic oceans, as well as the Mediterranean, Caspian and Baltic seas, Russian aircraft were tracked entering the Alaska Air Defense Identification Zone, bringing home the risk that a Sino-Russian alliance poses.

Our understanding of the thinking of China’s leadership is almost zero. So we can only report using the Geopolitical Futures article & leave it for readers to examine.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.