Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Deliverance & a New Dawn

“Deliverance” is an important concept in Society & Humanity. It usually signifies “liberation” and /or “rescue”, either physically or for moral salvation. Often it is used to signify a huge event that wipes out the envelope of evil and that enables a new Dawn to light up the physical & moral existence of society.

That is what we have been waiting for most of 2024. We were aware of the mammoth collection of forces determined to extend the semi-evil that had been draped over America for the past 4 years. We were hopeful & we did NOT want to jinx what we hoped would happen. That is why, for the first time, we did NOT wish readers Happy Deepavali, the celebration of Light over Darkness.

Then the Deliverance came well into the night of Tuesday, November 5 & early morning of Wednesday November 6. And the Deliverance was FULL & not partial. President Trump won big with 312 electoral votes & secured the Senate with 53 seats. The elections for the House are still being counted but the prospects for Complete Trumplican control seem good. It is not an old-fashioned Republican control because the evil NeoCons within the old Republican party are NOT welcome in the Trump Administration.

The victory is of the good people of America, people of all races, religions & languages. And we feel blessed to have been a part of it. Look back in history & notice that most great victories are comebacks of people, races, religions & languages. That is what this Victory was, as was summarized by the VP-elect J.D. Vance:

- Bespoke@bespokeinvest – Quote of the Day – “I think we just witnessed the greatest political comeback in the history of the United States of America.” – @JDVance

And, as the below points out, “God works in mysterious ways“.

- Cynical Publius@CynicalPublius – God works in mysterious ways.

- It’s quite possible that the best thing that has happened to America in decades was Biden stealing the 2020 election.

- Had Donald Trump won in 2020, he would have suffered an ineffective, COVID-plagued second term full of impeachments and “resistance,” and America would not have fully seen the lies, perfidy and treachery of the Democrat/Media Complex.

- Instead we had four years of a Biden administration where all of the evil in The Blob was laid bare for all to see. We learned how to stop the election cheating that Democrats have engaged in at least since the 1960 election. Over those four years Trump was able to put together a plan for a renewed Presidency, this time with the right people like JD, Vivek, Tulsi, Elon and RFK instead of the Deep State stooges he trusted last time.

- We are about to embark on an American revival that literally could not have happened had Trump won in 2020.

If our cup was already full, then now it is running over. Because every General needs a Chief of Staff who is highly respected & intensely feared. And who knew that President Trump would stun us in this area as well. Listen to Tudor Dixon, Former Michigan GOP gubernatorial candidate, describe why Susie Wiles will help President Trump build the most historic administration in the history of the country.

2. First Reprehensible Rejection of the People’s Vote:

What happened under President Reagan has begun again. Amazing isn’t it? An appointed bureaucrat who shamelessly followed the path laid by Treasury Secretary Janet Yellen stood up in rebellion a mere two days after the historic election of President Trump & essentially said “President who?

Amazing! And we thought the Chief Justice of the US Supreme Court was the ONLY chief of a US Agency who is guaranteed a permanent seat. Listen to the first 32 seconds of the clip below:

Look, we don’t care whether Powell likes President-elect Trump or hates him. But it is absolutely imperative for us that an appointed Bureaucrat follows norms of public protocol of respect. Powell has shown that he absolutely holds both institution of the Presidency & the current President-elect in personal contempt.

What is even more weird is that, as Bloomberg’s Tom Keene & Mike McKee, said on Bloomberg Surveillance on November 8, that the question to Powell was a set-up that Powell was already aware of & ready for it (minute 1:58):

- Mike McKee – “we were all waiting for the question to come; As soon as it did, he (Powell) swatted it away; he was prepared for it; he was ready for it; he wanted to make a definitive statement without going into much detail; so one word did the trick for him” ….

Seriously, watch the triumvirate at Bloomberg Surveillance laugh loudly & contemptuously with Keene saying “Powell went mental“. Seriously watch the few minutes from minute 1:58:30 when Tom Keene, Mike McKee & the 3rd guy start laughing & mocking about how Powell went “mental” on Trump.

Tom Keene is, for us, beyond redemption. His hate for President elect Trump & most non-Brits is public. The only weird question for us is why Mr. Mike Bloomberg tolerates Keene’s vitriol on the network that bears Mr. Bloomberg’s name.

The real question for us is why Powell, knowing that the question was coming, didn’t prepare a sensible, diplomatic answer that essentially conveyed the same legal answer. And Powell himself has done that before in his Pressers at FOMC calling some questions “speculative” & refusing to answer them. There has been no public statement from President-elect Trump about his desire for the resignation by Powell. So the only reason “Powell went mental” to use Tom Keene’s phrase is that Powell wanted to express his utter contempt for President-Elect Trump. Powell did not even wait for a full week to the joy of the great Trump victory to subside. Clearly, he wanted the prick the bubble as he saw it.

We fervently hope that Powell now resigns soon & without much public damage to the Fed. Think about it. The Fed reports to the Congress of the United States & not the President. Usually the Congress allows the Fed Chair to essentially say whatever the Fed chair wants in the hearings.

But Powell has unilaterally changed the rules & the standards of decorum. We think President Trump should not engage in any public dialog with Powell. How simple might it be for the Senate & the House finance committees to censure Powell for his breach of protocol either in person before them or simply via a resolution. Powell can laugh off a direct command from the President elect BUT can he laugh off a contempt resolution passed by both the Senate & the House?

Let us not forget that the Senate & possibly the House went Republican because of President-elect Trump’s massive success. Do we think that the same House & Senate Republicans will support the reprehensibly rude & politically harmful comments from Powell? We don’t think so, especially now when Ms. Susie Wiles is now the Chief of Staff.

Also given the sweep of all the swing states by President Trump, would it be possible for Chief of Staff Wiles to convince the Regional Fed Presidents to first quietly & then publicly criticize Powell’s reprehensible comments made this past week. The Regional Fed Presidents have to make their own judgements about whom they back – Powell the guy who publicly tried to humiliate the President despite or perhaps because of his huge triumph or the President-elect voted in by the majority of people of the regions/districts they represent.

And that is also a decision that Mike Bloomberg has to make. Is he a patriotic American who respects the decision of the American people or does he show that he has retained people like Tom Keene & Mike McKee to express feelings of contempt about Mr. Trump? Perhaps he might want to check which network has a bigger mike with a broader reach – Fox or his own Bloomberg?

3. Markets Last Week

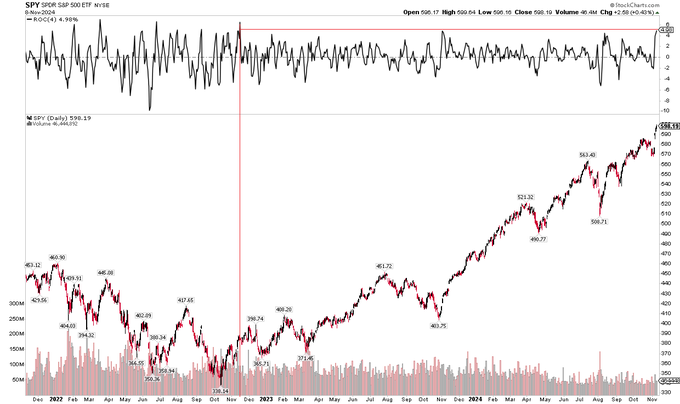

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – $SPY best 4-day rally in two years

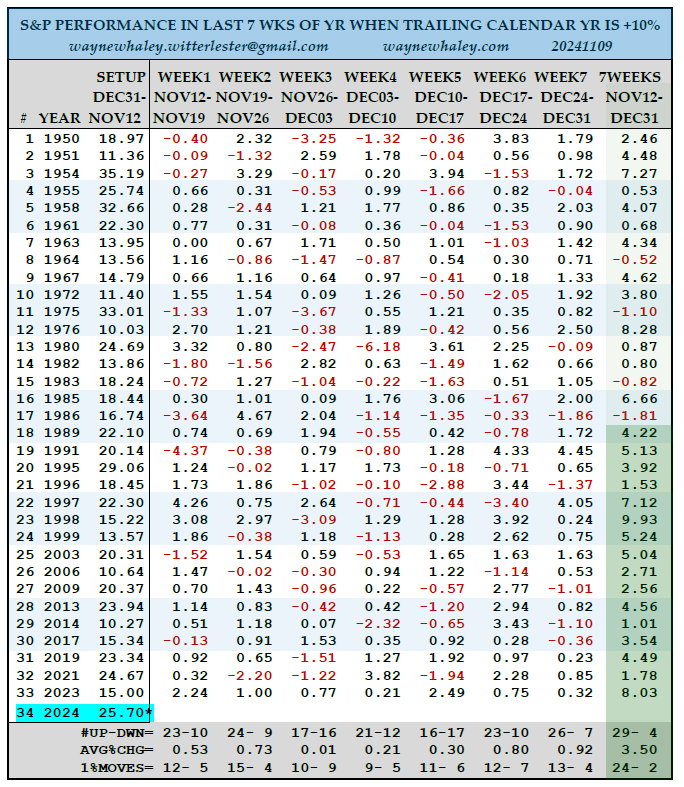

- Wayne Whaley@WayneWhaley1136 – THE S&P IN THE LAST 7 WEEKS OF THE YEAR (NOV12-DEC31) When preceded by a +10% Calendar Year –

As of Nov 10th, the S&P is up 25.7% for the 2024 calendar year.

Below are the results for each of the last 7 weeks of those 33 prior years in which the S&P was up at least 10% going into the last seven weeks (Nov12-Dec31) of the year.

The S&P has been positive from Nov12-Dec31 (the last 7 weeks of the year) in each of the last 16 years in which the trailing calendar year was up at least 10%.

And going back 74 years, there has never been a 2% loss in that seven week period in the aforementioned setup, while 22 two percent gains were experienced.

One of 22 studies on 14 markets shared with commentary subscribers this am.

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – US stocks’ best week vs ex-US since October 2008 $VTI $VEU +5.1ppt

US Indices:

- VIX down 31.6%; Dow up 4.6%; SPX up 4.7%; RSP up 4.5%; NDX up 5.4%; SMH up 6%; RUT up 8.6%; MDY up 6.4%; XLU up 1.3%;

Key Stocks & Sectors:

- AAPL up 1.9%; AMZN up 5.3%; GOOGL up 4.3%; META up 3.8%; MSFT up 2.9%; NFLX up 4.8%; NVDA up 8.9%; MU up 11.8%; BAC up 8.11%; C up 7.6%; GS up 12.7%; JPM up 6.3%; KRE up 10.7%; EUFN down 3.3%; SCHW up 4.3%;

Dollar was up 68 bps on UUP & up 55 bps on DXY:

- Gold down 1.7%; GDX down 1.81%; Silver down 3.2%; Copper down 76 bps; CLF down 3.6%; FCX up 1.5%; MOS up 4.2%; Oil up 1.4%; Brent up 1.3%; OIH up 9.6%; XLE up 6.75% ;

International Stocks:

- EEM up 40 bps; FXI down 44bps; KWEB down 62 bps; EWZ up 3%; EWY down 2.2%; EWG down 1.4%; INDA down 98 bps; INDY up 34 bps; EPI up 89 bps; SMIN down 1.8%;

Rates along the Treasury Curve fell this week:

- 30-year Treasury yield down 11.4 bps on the week; 20-yr yield down 12.3 bps; 10-yr down 8 bps; 7-yr down 6 bps; 5-yr down 3.3 bps; 3-yr up 1.5 bps; 2-yr up 4.6 bps; 1-yr up 3.5 bps;

- TLT up 1.7%; EDV up 2.8%; ZROZ up 2.6%; HYG up 1.3%; JNK up 1.4%; EMB up 1.8%;

Send your feedback to editor.macroviewpoints@Gmail.com Or @MacroViewpoints on X.