Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Powell’s Presser – its market impact & its significance

Wednesday was a major day with VIX shooting up 69%-75% depending on what minute you looked at it before the close. Dow fell 1123 points by Wednesday’s close; SPX fell 178; NDX fell 792; SOX down 199 & RUT down 103.

Friday was quite different – Dow rose 498 points; SPX up 64 pts; NDX up 179; SOX up 71; & RUT up 21 bps.

Relief to be sure with perhaps more relief to come in the traditional holiday rally, but what then? The simplest message we saw was a repost a tweet Thursday morning, as we recall:

- SpotGamma@spotgamma – This feels like Dec ’21 to me. The market was up a ton and things were so frothy before the Fed decided to shift policy. The $SPX tanked ~4%, caught the obligatory end-of-year bounce, and then met its maker in January. Backing a recovery bounce: You can also see today that traders want to reflexively sell big percentage moves in the VIX, and probably are emboldened due to “holiday theta“. Additionally there are a lot of 1DTE puts that were worthless yesterday AM, that are now worth something to sell today. But overall we think that yesterday was more of a spasm and warm-up vs the full move.

We also saw another repost focusing on $VIX on Thursday:

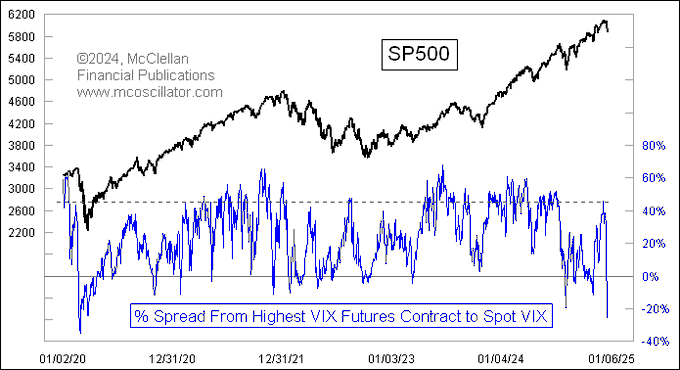

- Tom McClellan@McClellanOsc – The post-FOMC reaction sent the VIX Index up way above its futures, resulting in a deep negative reading in this chart. It did get lower than this during the 2020 Covid Crash, and that one took a few days to end the carnage. Otherwise it is a great bottoming indication.

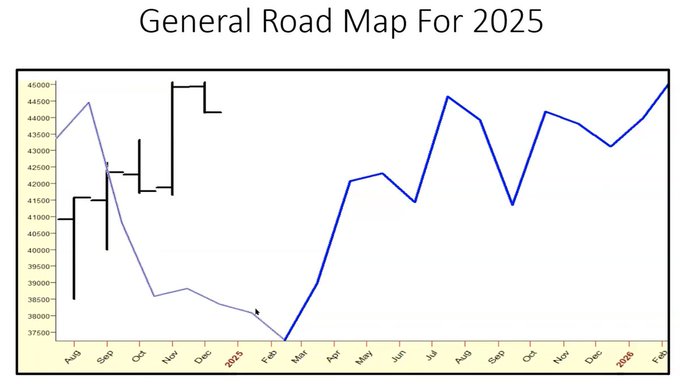

Later that day, he discussed this week’s fall to the December 1980 fall in his article The December Dip That Was A Week Late:

- [Powell’s presser] started a big wave of sell programs on Dec. 18, the day of the FOMC’s announcement. The stock market tried to get up but made a slightly lower low on Dec. 19, 2024.

- This dip matches one that the stock market suffered in December 1980. The difference is that the prior dip bottomed on Dec. 11, 1980. So the dip which the Fed’s announcement ushered in this week matches the dance steps of that Dec. 1980 dip, just not precisely to the day.

- If the 1980 script continues to get followed by the stock market, then we have a robust rally coming toward a top due just after New Years Day. Then the trouble starts.

That sort of fits in with the chart of Larry Williams that was highlighted below with a concise view:

- Seth Golden@SethCL – Dec 21 – Larry Williams 2025 Outlook – Cycle forecast: Begin the year with some selling pressure in Q1, from higher base at prior year’s end. Back half of year strong, gains for the year as a whole.

How much of a near term rally? No one wanted to say:

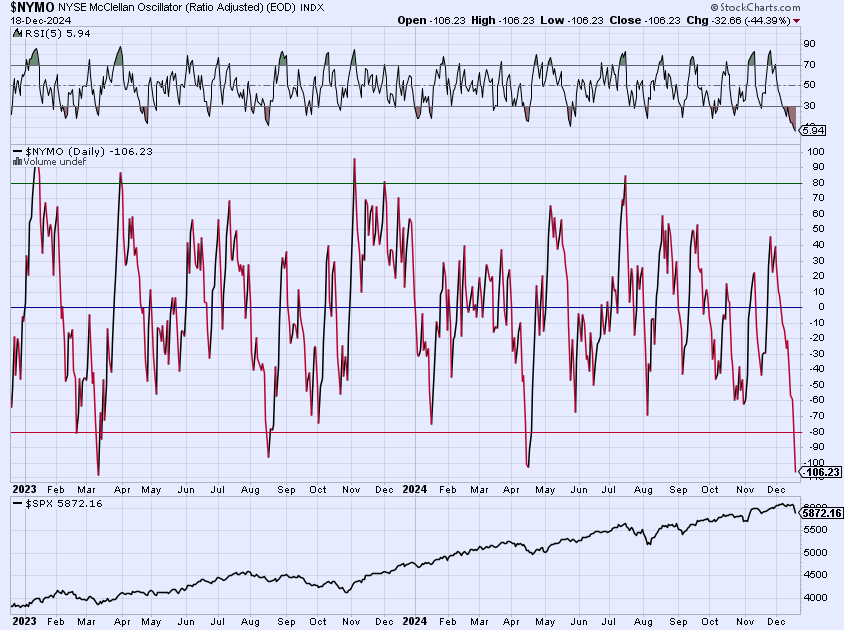

- Jason@3PeaksTrading – $NYMO oscillator already under -100 and extreme oversold short term. Every time that has happened over the years during a bull market stocks have had huge rebound rallies. The breadth correction has been going on for a few weeks based on NYMO, yesterday was more likely closer to a short term low.

The real question is what Treasury rates do in the near future. Warren Pies told CNBC’s Scott Wapner on Thursday that “they [Fed] are too optimistic on the economy & too optimistic on labor market“. But does this view change in January or does it take February-March to get noticed, if it actually happens?

In our simplistic way, we would like to remind people that whenever Chair Powell has been positive & determined in his presser, he has turned out to be wrong. Just look at his September 24 presser when he was absolutely sure about easing multiple times. The Treasury market laughed at him & promptly began selling off. Smart folks like Andy Constant of Damped Spring began shorting Treasury bonds (10-yr, TLT we guess) the next day in the face of Powell’s dovishness.

What did Mr. Constant do after this past Wednesday’s Powell presser? He came on CNBC Fast Money & said, as we recall, he had covered most of his equity shorts and he had covered all of his bond shorts. Given his record, does that suggest Treasury rates will fall from here?

2. Bloomberg TV’s Finest Hour

Unlike CNBC, Bloomberg TV brings on their most “macro” anchor team for the Fed meetings & the Presser. That is always helpful. But this week it was fantastic. We urge ALL to watch the clip below from minute 1:52:13 onwards. After Powell was done with his presser,

- Jonathan Ferro began with … “arguably not the Federal Reserve’s Finest Hour …… is it about the data or is it about Donald Trump?“.

- Lisa Abramowicz said “I want to go here … this is going to be viewed thru a political lens inevitably; already it was threatening to do so‘ …. now there are some people who are incorporating highly conditional estimates that I wish we had learned more about what these estimates look like – whether they were inflationary or some of them were slower growth“..

Then just before Jeff Rosenberg began speaking, Lisa Abramowicz read out some reviews of the Powell presser:

- “Steve Schiveron – worst Powell performance since 21; first reacting to labor market data in September, now they are over-reacting to inflation data;

- Krishna Memani – probably the worst presser so far in his tenure“

Then Jonathan Ferro quoted Neil Dutta of RenMac by saying “he believes there is a real Trump effect in the forecast“. Then he asked Sarah House (of Wells Fargo) as he welcomed her on the show – “Sarah, is it the data or is it the incoming President?“. She replied “I think it is a little bit of both”

We really think that the market fell so hard & so steeply because of this big concern about the Fed trying artificially to fight President-elect Trump instead of focusing on their own mandate.

Ferro pointed out the previous headfakes by Powell – “this year so far, Q1 inflation headfake; Q3 labor-market headfake, Q4 this Fed looking a little bit lost“. Lisa added “honestly, the market is responding to being this little bit lost by selling off in a dramatic fashion“.

Again, we can’t remember a time when we have been so impressed & so thankful to Fin TV hosts as we are to BTV’s Jonathan Ferro & Lisa Abramowicz.

So far everything we heard from the Fed or the Fedosphere was above board. But then we heard the extent of the true feelings in the Fedosphere about President-elect Trump & that too in the China Show on Bloomberg Asia. Watch & listen to Alan Blinder from minute 7:34 to minute 9:39 on Bloomberg: The China Show 12/19/024. (recall that Blinder was a Vice-Chair of the Fed years ago and he is now a Professor at Princeton).

- “… the 3rd thing which may be on people’s mind at the Fed, but they would never say out loud, is President-elect Trump’s promised policies … are clearly inflationary …. That’s at the back of Fed’s head. It’s something the central bank is not going to talk about …. “

- “… nobody knows what Trump will actually do. He has a lot of authority over tariffs. That’s a bit of a disgrace. But the Congress has ceded the President that authority over tariffs …. so there is no question about violating the law … “

Interesting – ceding executional authority to the President of USA is “a bit of a disgrace“??? Then Blinder went on to exhibit his true feelings about President-elect Trump:

- “what will he do? …. he will have a call with Chinese and they will say some nice things about how good he looks on TV & he will decide not to go …. Or they will do something that makes him angry & he will go much more heavily on bigger tariffs? I have no idea. It’s anybody’s guess… “

This is the most abominable insult we have heard about the President-elect on open TV & that too not from an MSNBC/CNN type host but from a respected professor at Princeton & a previous Vice-Chair of the Fed!!!

That is our reaction. We leave it to readers to decide on the level of disdain we sensed from Alan Blinder about a man who has mounted the most successful political comeback in US history. That speaks to the utter disdain not merely of Mr. Trump but about the American people. What must Blinder & his Fedosphere say about the American people in their private intra-Fed conversations? To think we let these arrogant people run our economy & our financial future!!!

Whatever religion Alan Blinder or the Fed staff practice, we urge them to read up words of Jesus Christ this coming week as the United States celebrates Christmas, especially a very slightly modified version of Luke 6:31 (the original “do to” changed to “Speak Of” & changed original “do so to” to “Speak so of”):

- “And as you wish that others would speak of you, do speak so of them.”

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.