Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Happy New Year & Happy Next Phase

Hopefully, Happy New Year is neither a new phase nor a controversial wish. In contrast, a new phase that is being discussed is controversial & flies in the face of semi-religious dogma. And it says Buy Duration in Treasuries.

Several expert guests alluding to this heresy even on CNBC & even on CNBC Squawk Box. The first is an old guest of CNBC. Look what Jim Paulsen told Becky Quick :

- “… I think the economy is going to slow down fairly significantly in the first half ; there is a lot of tightening force from the Fed …. when money growth is less than GDP growth, real GDP decelerates in the coming year by almost 1%; … the economy is going to slow down to 2% or less; “

That Paulsen said “will re-ignite recession fears … and might give us a correction“. He thinks that might be a 10-15% correction which should not be sold because “we are in a secular bull market for a few years“.

Warren Pies was one of the first ones to worry about growth on CNBC. Pies said the following to Mike Santoli this week:

- ” we are moving into the next phase of the economy – soft landing path; I feel inflation is going to fall pretty hard this year and the number 1 risk to the to the market is growth … the US economy can’t handle a 7% mortgage rate. so is it going to force the Fed to cut? watch housing markets & homebuilders in particular; you are going to see housing starts come down & that’s the 1st domino to fall” in the growth scare

So he sees a 10% correction in the first half of the year and expects 100 bps of cuts from the Fed. He is overweight stocks & bonds and underweight cash & commodities. Meghan Shue of Wilmington Trust went up a step and said they expect 150 bps of rate cuts in 2025.

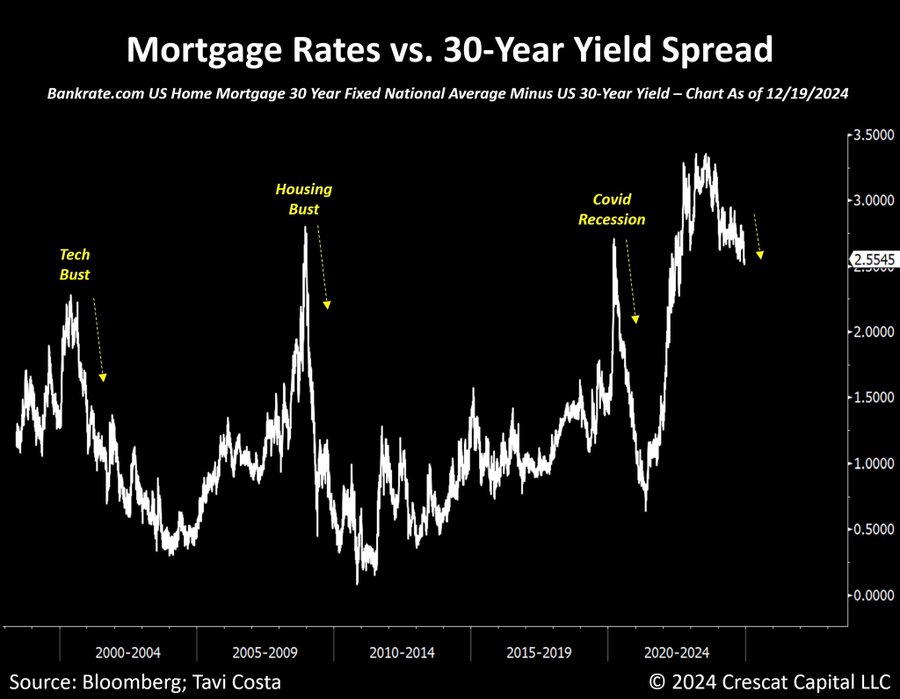

Below is a chart of mortgage rates to 30-year Treasury courtesy pf @TaviCosta:

The above is still within the boundaries of dogma at CNBC. Then we saw Darrell Crock of Wells Fargo cross that sacred line in telling Kelly Evans that “we are starting to extend Duration“. Let’s not get carried away though! He only mentioned 10-yr duration and not the 30-yr duration that anti-believers detest.

At Bloomberg we heard Emily Rolland say on BTV Surveillance that the “stronger Dollar could be a self-limiting dynamic here“. She also pointed to “7%+ mortgage rates; credit card borrowing costs of 20%+”.

A day before on BTV Surveillance Jan 2, 2025 (minute 1:29:30 onwards) , we heard Earl Davis of BMO explain why they have been adding to 10-year Duration.

- “… talk re tariffs has increased the levels to … relatively attractive levels that suggest 10-yrs at 4.5% are adequately rewarding … Q1 is going to be very telling for Treasuries because real-money accounts (insurance, pension plans etc) reallocate in Q1 & we should be seeing significant rotation into fixed-income“. He also pointed out that Treasury issuance in Q1 could surprise to the downside which could be good for risk assets“

He specifically mentioned 10-yr TIPS since they were providing 2.20% above inflation that could prove attractive for international buyers.

Now to the most technical & interesting clip re Treasuries of the week from Strategas & that too with Becky Quick. When was the last time we featured 3 bond-friendly clips from Becky in a week? Doesn’t that alone make it a truly new phase?

A quick summary of this technical but easy to understand & smart clip that says “Bond market getting ahead of itself with headwinds coming:

- “…between 2022 & 2024, Treasury pumped in $2 trillion of excess T-bills into the market; … those are going to be tossed into the 5-10 year portion & that is a bigger concern for the Treasury market than the deficits… deficits next year should probably come down materially vs 2024;… its scooping & tossing those bills is the bigger concern … inflation will come down by Q1 end & then it will get stickier ;”

As we said, we can’t remember a week when there was so much blasphemy on Fin TV, especially on CNBC. We are sympathetic because of our conviction about the P-factor. No sensible listener can deny that Fed Chair Powell is backward-looking in the extreme even for that traditionally backward looking group. Just go back & review his most emphatic Fed Pressers to see that when he is confident, he has been 100% wrong. That gives us some confidence in going along with the Buy Treasuries sentiment discussed above.

But on the other side, the P-man is obdurate & loath to change his views flexibly. As we saw in December 2018, he adamantly sticks to his shtick even though he sees he is damaging the economy. And he could lucky ( the US economy unlucky) if next week’s Payroll number comes in strong. That may be why the gurus above are talking about the US economy slowing visibly by end of Q1.

And we all see that Germany is in trouble, France is getting into trouble and China is in a phase that only Xi Jin Ping understand. So is it not somewhat sensible to expect that the US economy might see some of that slowdown? Any one who wants to see the high downside possible should watch the YouTube clips authored by Eurodollar University.

2. Equities

Rarely do you see a show featuring a luminary like Ed Yardeni a number of times in a TV hour discussing different aspects & regions. We saw BTV’s Haslinda Amin doing so this week. The full clip is below.

We all know Mr. Yardeni’s views about the US market & the US economy. He expects a correction in the first half of 2025 but he in unwavering in his conviction about the great productivity force that will secularly drive growth in the US economy & the stock market. So his target for this cycle is 8,000 on the Dow. And the other factor he pointed out is the absolutely astounding figure of $75 million net worth of the US Baby Boomer generation. Why aren’t the other generations, X, Y, Z or millennials insanely jealous?

The most interesting segment of his interview was about China. Watch & Hear it yourselves:

What about India, as it has become fashionable on Fin Tv to ask while discussing China? We were happy to see that his views mostly resemble ours that the markets in India, like almost all sectors that have US influence, mostly mirror US in their strengths. And his favorite sectors are also our favorite sectors including the Banks & Wealth Management sector.

Quite sensibly, his discussion re India is at the tail end of the 47-minute clip below. Sensibly because there isn’t much to say that is very interesting or new like, for example, his point about how Quantum Computing might pose a big risk to Bitcoin. The clip below begins with the mess in South Korea, FYI.

3. Tweets & Charts

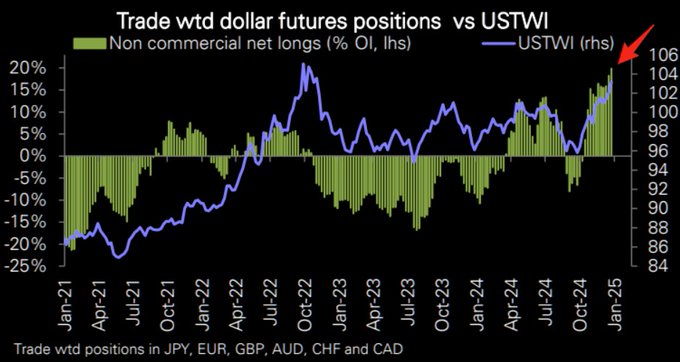

The U.S. Dollar fell about 30 bps on Friday and the US stock market had a great day led by Semis & NDX. A simple but relevant move from the extreme overbought & very oversold?

- Markets & Mayhem@Mayhem4Markets – Dollar long positioning is becoming _very_ extended here. Due for a pullback in the near-term, I’d think. ⚠️ Dollar weakness is often bullish for risk assets, like stocks, and crypto. It can also benefit the pricing of commodities, and in particular gold. Chart: Deutsche Bank

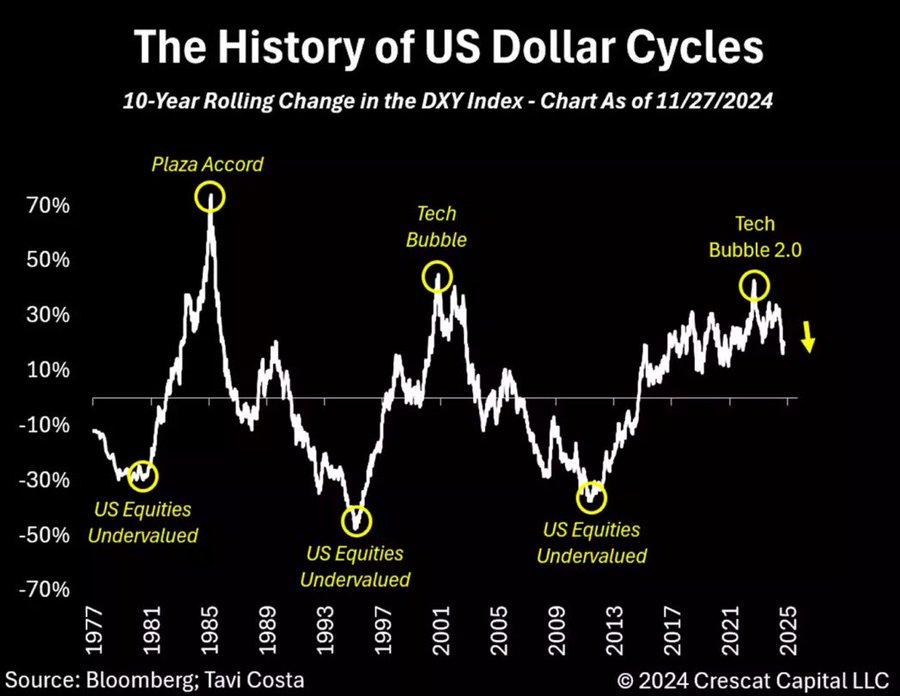

Plaza Accord II anyone?

- Otavio (Tavi) Costa@TaviCosta – The global money supply has contracted to its lowest level in over four years. This is largely due to the strength of the dollar, which is suffocating the global economy. I believe a USD devaluation, whether coordinated or organic against other currencies, is inevitable.

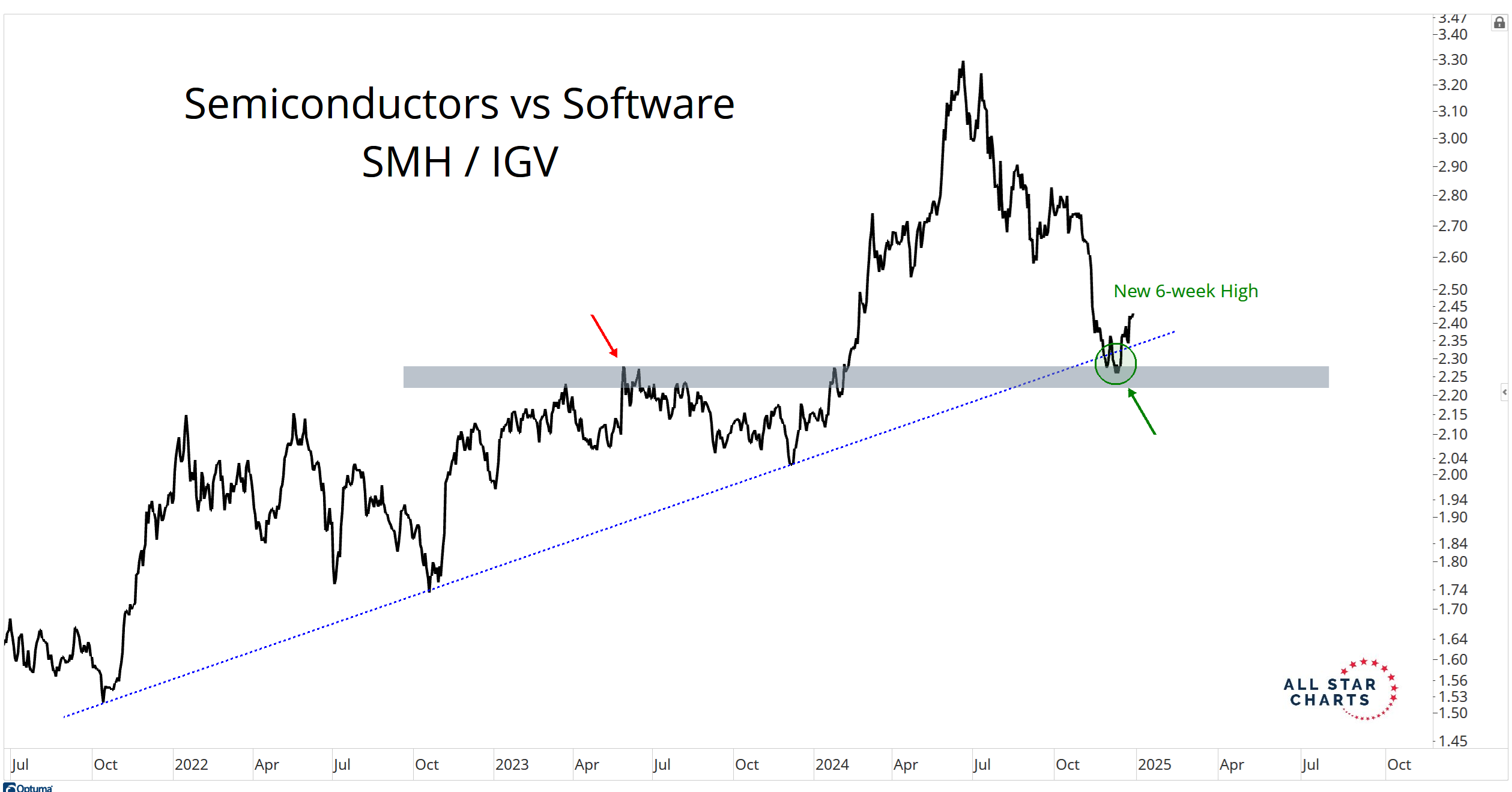

That brings us to Semis vs. Software & an email from J.C. Parets:

- Both Semiconductors and Software represent an unusually large portion of the S&P500, with more than double digit weightings for each of them. But I would still argue that the rotation itself, rather than Semis breaking down on an absolute basis, is very constructive for the overall market. As long as we don’t completely lose Software, the rotation back into Semis is a net positive, in my opinion. Here are Semiconductors as an index still stuck in this range: How long will it take Semis to break out of this base? That I don’t know. But I will tell you that Broadcom exploding higher, with over a $1 Trillion market-cap, is certainly not a bad thing.

- The broadening participation (pun intended) in mega-cap Semiconductors, is a characteristic of healthy market environments. And there is little evidence to suggest that this is not one of those.

What about QQQ?

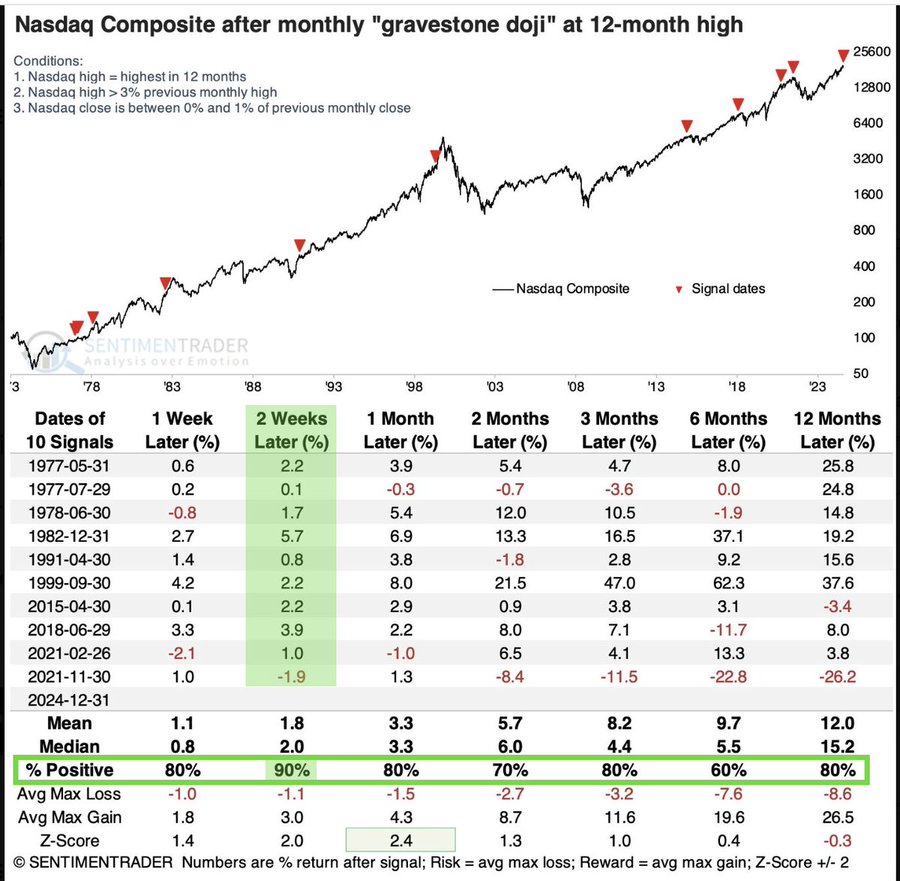

- Seth Golden@SethCL – $QQQ If the bears have a window here, it is not showing favorably in the data. Forward positivity rates across all time horizons are bullish. 2-weeks after past gravestone dojis, Nasdaq 100 was higher 90% of the time, only 1 negative return since 1977. $COMPQ $NDX $SPX $ES_F (via SentimenTrader)

And,

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – $QQQ holding the 50-sma so far. Would like to see this back over 532 soon. $QQQ 90% of stocks higher on the day right now.

And more specifically,

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Jan 4 – $NVDA and $TSM, both higher on the week and look ready to test higher. $TSM new record weekly closing high. $NVDA 2nd highest weekly close on record.

What about S&P?

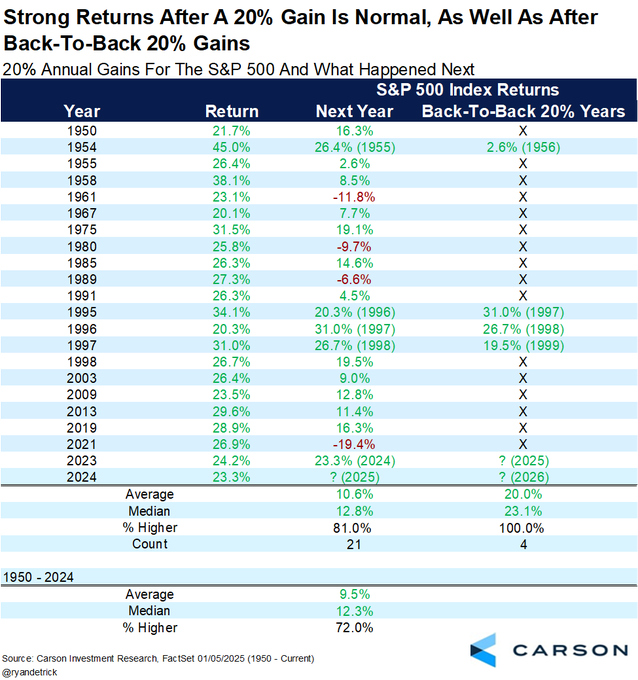

- Ryan Detrick, CMT@RyanDetrick – This had a lot of questions. ❓❔❔❓ Since ’50, 21 times S&P 500 was up 20% (price only, so not total return) and next yr higher 81.0% of time and up 10.6% on avg. After back-to-back 20% yrs? Up 20.0% on avg and higher 4 out of 4. Avg yr up 9.5% and higher 72.0% of time.

This week’s bullishness might have been sparked by the violently bullish action on Friday, January 3 which in turn might have been due to highly oversold conditions & hopes for a weaker Dollar. Just saying!

4. It’s a mentality!

What a coach & what a guy! First time ever, we are Notre Dame fans. And we can’t even write this – we are also fans of this OSU team after their incredible performance against Oregon. What sweet & poetic justice for Chip Kelly to install his old Oregon offense at Ohio State against the new Oregon? Love this playoff system! And for an offense-starved Michigan to defeat a full-strength Alabama without Michigan’s 4 defensive stars including the two dominating defensive tackles!

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.