Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.51-year old Wish of Steve Jobs fulfilled this past week

A truly universal invention was the iPhone. Almost everyone in the world has an iPhone, or a similar competitor product or wishes to own one. As a stock-market based article, how could we not give supreme precedence to the inventor whose invention is now the stock with the largest market value in the world?

A long time ago, some say 51-years ago, Steve Jobs expressed a wish in a letter to his friend Tim Brown. This week, his wife travelled far to fulfill his wish. The event, as you shall see later, also has substantial economic dimensions.

If you think this is relevant to you, watch the 4-minute clip below. The letter by Steve Jobs to to Tim Brown was sold last week for about $500,000/- as the clip says (4,300,00,000/86 dollars)

- PS: A Laakh (not lakh) is 100,000 in Indian languages. And 1 Koti is 100 laakh or 10 million in Americanese.. Everybody can say Koti. But the Brits, in their BrIndianzation quest, termed it Crore. And the sick Indian media still uses the Brit “crore” .

2. Markets Last Week

US Indices:

- VIX down 18%; Dow up 3.7%; SPX up 2.9%; RSP up 3.9%; NDX up 2.8%; SMH up 4.5%; RUT up 4%; MDY up 4.6%; XLU up 4.3%;

Key Stocks & Sectors:

- AAPL down 3.1%; AMZN up 3.3%; GOOGL up 2.1%; META down 41 bps; MSFT up 3.5%; NFLX up 2.8%; NVDA up 1.6%; MU up 6.1%; BAC up 3.4%; C up 12.3%; GS up 11.5%; JPM up 8%; KRE up 8.1%; EUFN up 4%; SCHW up 5.1%;

Dollar was up 1.1% on UUP & up 87 bps on DXY:

- Gold up 3.8%; GDX up 2.4%; Silver up 5.9%; Copper up 8.3%; CLF up 4.3%; FCX up 4.1%; MOS up 9.8%; Oil up 8.7%; Brent up 8%; OIH up 7.3%; XLE up 6.3%;

International Stocks:

- EEM up 1.4%; FXI up 3.7%; KWEB up 17.1%; EWZ up 3.6%; EWY up 2.7%; EWG up 3.5%; INDA down 14 bps; INDY down 88 bps; EPI down 1.5%; SMIN minus 29 bps;

And weird action in long rates with ETFs up in price while long maturity rates were also up; something about a cross-arb opportunity as we read.

- 30-year Treasury yield up 6.3 bps on the week; 20-yr yield up 5.8 bps; 10-yr up 4.2 bps; 7-yr up 4 bps; 5-yr up 4 bps; 3-yr up 6.7 bps; 2-yr up 3.6 bps; 1-yr up 5.5 bps;

- TLT up 1.9%; EDV up 1.7%; ZROZ up 2.5%;

Another way to describe last week:

- Seth Golden@SethCL – Another beautiful test of the weekly uptrend line and support. Nothing to see here folks, you are welcome to unclench 😉 Heading into earnings season for the mega-cap/Tech plays! $SPX $QQQ $NDX $COMPQ $SPY $ES_F $AAPL

3. Rates & US Equities

We recall someone smart saying this past week that the equity market was being driven/influenced by the Treasury market. So why not begin with one of the most important drivers of the Bond market?

Christopher Waller, Federal Reserve governor, qualified all his views with the traditional sounding phrase “data willing”. With that caveat, he said he could see 2 rate cuts. Listen to him yourselves:

Another one gave a more solid reason for his 125 bps rate cut forecast by using the phrase “‘a litany of downside risks” he sees for the economy:

On the other hand, a voice from London on Bloomberg Open was more hawkish describing her views as neutral to hawkish and suggesting an extensive pause or the end to the rate cutting cycle. And Sonal Desai of Franklin Templeton Fixed Income has been more right than wrong in 2024.

Double on the other hand, 2 equity guys were emphatic in saying Buy Bonds at 5% yield. These two are Rick Rieder & Ed Yardeni, two people who tend to speak softly but deliver big returns, at least so we are told. Rieder is not that interested in long maturity rates & he is “moderately long” equities.

Yardeni described “5% as an awfully attractive rate“ & reiterated his price target of 7,000 on S&P by year-end. That is based on his earnings target of $285 on S&P by year-end based on his bullishness on productivity. He says interest rates have normalized – 4.5% with plus/minus 25-50 bps – the range he expects for next two years. He likes financials and terms all stocks as Tech-stocks because they will either make technology or use technology.

4. Interesting Tweets

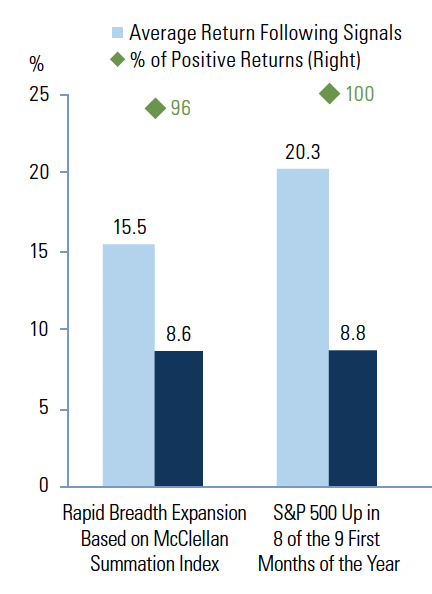

- Seth Golden@SethCL Goldman Sachs With these two criteria achieved in 2024, they provide significant insight into fund flow tails in 2025. McClellan Summation above 1000 and 8 of first 9 months positive returns. When both occur, the forward S&P 500 $SPX 12-month positivity rates are 96% and 100%. $ES_F $SPY $QQQ $IWM $NYA $DIA $VIX $VOO

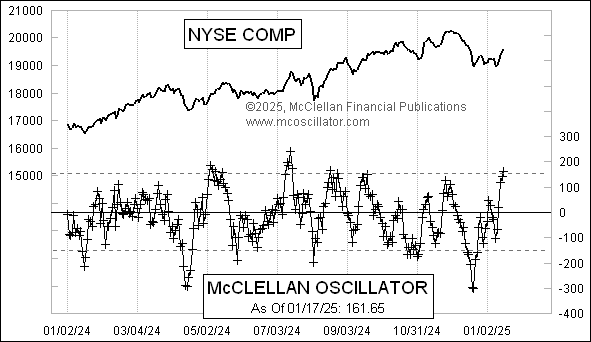

But could the McClellan A-D-Oscillator be flashing a different message?

- Tom McClellan@McClellanOsc – Jan 17 – The NYSE’s McClellan A-D Oscillator is officially “way the heck up there”. Does not mean the up move has to stop, but the rubber band is really stretched. In an uptrend, you usually need a divergence, but countertrend rallies in a downtrend can end with such a condition.

4. India Sell-off

This past Tuesday was a bad day in Indian markets. Not only did the Indian Rupee (INR) fall to a lower all-time low vs. the Dollar but the Indian Sensex also fell by 1,000 points. The same day, our “friends” at Eurodollar University posted their clip about the market turmoil in India.

These guys call the Indian markets & the Indian Rupee as a “canary in the coal mine” for “global health or global sickness” as the case may be! We don’t really understand why India or INR is considered as a “canary” for global growth. But we do understand that Indians are proverbial crybabies, with apologies for any feelings we might hurt! We mean, what stupid society cries “crash” when its Sensex index falls by only 1.3% or so in a day?

Look back to December 1, 2024 & notice that the Sensex is down by 7.5% or so & the Rupee is down by 2.5% or so. That is about 10% on the downside for a stock investor. But listen to the fear in Indian media & you might think it was a 20% fall like October 19, 1987. See why we think of Indians as crybabies!

Actually, it is the rapid fall in the Rupee that is scaring many Indians. They understand stocks fall & rise but they think that the steep fall in the Rupee suggests something is terribly wrong with Indian economy, monetary system etc!

We, on the other hand, are feeling happier especially about the steep fall in the Rupee. Why? Look at the chart below of INR-USD – the oldest we could get was from 2008-2009:

Isn’t this the chart of a perennial long candidate, meaning Long Dollar – Short Rupee. Now for a personal fact. When an elder sibling came to USA for her grad school education decades ago, the exchange rate was 7.5 – meaning 1 Dollar = 7.5 Indian Rs. Today 1 Dollar equals 86.6 Rs. This has been terrible for India, right? WRONG. The Indian economy, the wealth of Indians, the spending capability of Indian citizens is far far far greater today than it was when 7.5 Rs. bought one Dollar.

That is why the average well-to-do Indian family has always bought & stored Gold, 24 carat Gold from the UAE etc., & not the 14 carat Gold. That has been the proven store of value or protection against inflation that weakens the Rupee. Once you remember this, you will see why the Indian Rupee began weakening seriously in December – wealthy Indians in November bought (via imports) large, large amounts of Gold & Gold Jewelry from the Middle East.

The real problem for non-Gold buyers is that India does not manufacture anything that the rest of the world wants to buy. A couple of years ago, Russia was selling oil to India in Rupees & they collected a few billion in Rupees. But they could NOT find any way to get rid of their Indian Rupees. This became a big deal until they found a way to get rid of their Rupees via the UAE.

- PS: India is the opposite of China. Look at your wallets, purses or homes & you will find so many items that were made in China. But you may not find anything that was made in India, except perhaps for some food materials & spices. This reality actually has been very positive for India.

The above is a long-winded explanation why EVERY major correction in trade with India is accompanied by a frantic fall in the Indian Rupee. That looks terrible & feels worse for Indians BUT that has always cleared the markets & trade logjams. The first time we wrote about this was in 2013 in Knowledge@Wharton when we argued that India would be the first EM country to come out of the 2013-2014 EM selloff. That proved true. We also wrote a bullish article on the Indian stock market in 2020 just when fears about the COVID conditions in India seemed frightening. Again we proved to be lucky.

Now we are getting more & more interested in Indian stocks (and consequently in INR) after this week’s frantic fall. Just think, any stock or index you wanted to buy is 10% cheaper due to the joint currency-stock selloff. The fundamentals of India & Indian stocks have not changed at all except getting cheaper. Look at the news this past week – Apollo listed its Tenneco India stake at a valuation of $2 Billion on the Indian stock market & Suzuki has announced a new EV venture in India.

Remember the talk on Bloomberg & CNBC last fall – when anchors kept asking fund managers whether they are still buying India. There was nothing the fund managers could say then because selling stocks at the high is not what they do.

Now ask how foreign institutional investors are currently allocated to Indian stocks? Actually don’t ask us because we are just simple folk. Better listen to what Feroze Azeez, Deputy CEO, of wealth manager Anand Rathi said on CNBC Street Signs Asia 4 days ago:

- ” … FIIs (Foreign institutional investors) have already shorted index futures; they have sold in the Futures markets too; this combination has always resulted in short covering on even a small amount of good news! I am looking for some good news from the earnings side which can create a huge short covering rally in this quarter … “

Now remember or go back & listen to what Ed Yardeni said to Bloomberg’s Haslinda Amin when she asked him about his favorite sector in India. Wealth Management was one of his choices. How smart is Mr. Yardeni in choosing long term winners? Why do we say so? Read what Feroze Azeez said to CNBC Street Signs Asia:

- “India has only 6.7% of the total financial assets in equity … that’s changing rapidly …. we would be at 16% of savings if not the balance sheet of the entire household…. that paradigm shift is a great proxy to play the financialization story of India … “

So many smart traders talk on CNBC USA about buying CME, Nasdaq & other exchanges. That’s fine & dandy. But would any of these smart traders talk on CNBC about buying BSE Limited, the stock exchange in Mumbai? Its all-time high was 2 days ago on Thursday January 16, 2025, a triple from its low on 19 March 2024. But as we have said before & reiterate now – we are simple folk with a simple mind. We warn all to NOT read what we write & assume we know what we are talking about. No one should look to buy or sell anything we write about without serious discussion with investment advisors.

Finally, the fall in Sensex of 1,000 + points & the fall in the Rupee took place on January 13, 2025. What was supremely critical about that day? The Great Mahaa-Kumbh began that day, the most auspicious celebration in 6 years. Is that a signal to step in & buy?

We would say perhaps. See how simple-minded we are? Thinking of buying stocks in India because of the start of Mahaa-Kumbh this past week?

5. The “Kumbh”

The Kumbh Mela that began on January 13 & goes on for 50 days is a perfect illustration of what makes India unique. While ours is going to be coverage focused on the business aspects, we have to illustrate how transformational the original event was.

That event was the determined quest for Amrut or Am-Rut – the liquid when imbibed delivers Immortality. But you can’t order Amrut on Amazon.com. And Am-Rut was deemed far more than an elixir that delivers immortality. It was also deemed to be a transformational weapon for universal domination.

The domination combat between atmospheric Deities (the term Gods is so badly used) and the mainly water & undersea resident Demons was a continuous fight whose results went both ways. Both realized that the constant battles were depleting their strength & numbers. So both wanted to possess the Am-Rut that would make them immortal & hence invincible. They both knew that Am-Rut was located at the bottom of the Indian Ocean. So they decided to unite in their quest.

Bypassing the middle, it suffices to say that they were told to invert a mountain named Mandar with a very steep tip into the ocean to reach the bottom; they also requested the longest snake in the world to serve as a rope to churn the mountain. As the tip of the mountain began churning the ocean bottom, eventually the Kumbh (pot) of Am-Rut rose to the surface. Again, bypassing the how, the atmospheric Deities took control of the Kumbh or Pot & carried it northwards. That essentially decimated the Demons as a race & the Deities took absolute control.

As it is told, while carrying the Kumbh of Am-Rut, a few drops fell into 4 rivers. And the Kumbha Mela is a celebration of this event in the four areas where the drops of Am-Rut fell. The holiest of them all is Prayag-Raj which has the honor to host the Mahaa-Kumbh (every 6 yrs, 12 yrs & 144 yrs), mahaa meaning huge.

And how huge is the 2025 Mahaa-Kumbh? About 400 million (40 Koit) people are going to visit the PrayagRaj Kumbh Mela in these 50 days. Prayag also features the Sangam (meeting) of the two Holy Rivers Ganga & Yamuna with the absolute belief that the 3rd & most sacred river Sarasvati also joins them (Saravsvati was lost to the spread of the desert & is not found above ground).

This Sangam of 3 rivers (Tri-Veni) is what makes Prayag holy all year around but at Mahaa-Kumbh, it becomes a path to eternal salvation.

Now see what a huge economic event the 2025 Mahaa-Kumbh is? It will host about 400 million visitors of all ages & incomes in an area about 2/3rd of Manhattan. For the less fortunate, the event management will provide 100,000 free meals every day of the Mela. At the other end, luxury cottages will host the wealthy at the cost of Rs. 100,000 (US$ 1,150) per night. So you can see the validity of the statement that the Kumbh-Mela touches everyone, from the poor to the ultra-rich.

To get a rough feel for the economic scale, do watch the 4-minute clip below that says “the Mahaa-Kumbh Mela “is not just a spiritual spectacle, it is an economic powerhouse“.

This is an illustration why we think Religious Tourism will be a great economic driver for Uttar Pradesh, the largest state in India.

But these massive events also pose a serious risk as was illustrated by a massive fire that was lit by explosions of gas cylinders in an area. The fire was doused quickly & no casualties have been reported so far, Thank God.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.