Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”.. best reflection … a barometer for every politician … every central banker ..“

Apart from showing the real issues facing the economy & Fed this year, watch the two clips below for understanding the main goals of CNBC & Bloomberg in portraying the same conversation at Davos. The first clip is from CNBC of CNBC’s Sara Eisen essentially labelling views of Larry Fink in a manner that Larry Fink himself refutes in the first sentence of his response:

- Sara Eisen – “Larry Finks warns on inflation; we are not done with inflation; Larry Fink is very worried about inflation. Why?“

- Larry Fink – “I am not terribly worried.”

This is an example why the credibility of Sara Eisen is quite low in our estimation. She is far more interested in scoring points & emphasizing her not-entirely-educated views. To his credit, Larry Fink explicitly yet politely rejected her false characterization of his views. And Mr. Fink went on ignoring another imposed view by Eisen:

- “… I think the bond market is the best reflection of what’s going on in the world! It is a barometer for every politician, for evert central banker; it really informs us every day where the mood of the global economy is; … I believe the bond market is indicating that inflation may be higher than we think; the genie may be coming out of the bottle …”

Sara Eisen again interrupted Mr. Fink in mid-sentence asking “do you think the Fed is done cutting rates this year?” Again Mr. Fink shot her down:

- “No, I think they still have room to cut that will create more steepening of the yield curve; so I think the next few months of data & information will identify it … I would say to you the economy is very strong; it was very strong in the first quarter“

The minute 1:07 long clip stops here abruptly on Fink in his mid-sentence suggesting to us that the purpose of the above clip was merely to show the “power” of Sara Eisen & her ability to shut down a man of the eminence of Larry Fink. See why we wonder whether CNBC even has a managing editor responsible for content or anchor behavior.

We were also upset because we did want to hear the opinions of Larry Fink. Fortunately for us & readers we found a more detailed clip (2:50 minutes) from Bloomberg that gave more time & space to Larry Fink’s opinions:

- ” …. what we are seeing now is a normalizing of the yield curve. But I believe we are going to have a much more steeper yield curve. And that’s a function of forward inflation expectations. And one of my fears is because of this complacency & I have not even said the most ugly word that’s called the deficits & the debt, the debt of so many countries. …. When you think about the amount of capital we are going to need to be financing all these amazing transformations, we face growing deficits worldwide & the cost of financing these deficits are going to go up. I think the yield curve is showing you that. As .. I have said repeatedly in Davos, I could see a scenario, I’m not calling for it, where we have a 5.5% 10-year“.

This is where CNBC’s Sara Eisen cut in with her question about the room for the Fed to cut rates to which Mr. Fink responded (as quoted above) “No; they still have room to cut” and he added a bit later that Bloomberg featured as saying

- “they may pause for another period of time and they may ease a little bit. I am not worried about the short term moves but over the next year, all this materializes, .. could they revert & go back up possibly; … rate hikes? I am not calling for that but all I am saying I see probabilities of that; that’s not my core prognostication“

Watch, hear this clip & wonder why CNBC chose Sara Eisen to be the anchor of the top panel. They have other far more capable people, Mike Santoli, Becky Quick, Andrew Ross Sorkin merely to name a couple. We wonder if the answer is that Sara Eisen is the choice of the powerful lady in the green jacket in the middle.

We have noticed that whenever Kristalina Georgieva (head of the IMF) has public inputs to deliver, she selects Sara Eisen. Why? Because she can rely on Sara Eisen to ask, say & do what Ms. Georgieva wants? This may be farfetched but the question remains with so many qualified & smart anchors available to chair a panel like the above, why was Sara Eisen the only one chosen?

Now compare with the above with the Davos clip of Becky Quick & Sorkin with Larry Fink below. He also told then that the 10yr could get to 5%-5.5% but added that would shock the equity market; that would not be a good scenario. Watch this clip and wonder why the IMF & the other powers on the panel above would choose Sara Eisen to the anchor instead of Becky Quick or Sorkin!

And the Quick-Sorkin clip below is the most clear cut clip of what Larry Fink believes. Notice also that Mr. Fink smiles as he is speaking with Quick-Sorkin which he did not do while speaking with Sara Eisen.

Sadly, the above is not the only or the most arrogant display of ego & contempt (this time of President Trump) by a star CNBC anchor this past week. Melissa Lee, the star host of CNBC Fast Money interrupted a line about rates by saying, as we recall, “and he knows a lot about interest rates!!!“. Melissa Lee is a Harvard product and her flag-bearers on Fast Money never miss a moment to trumpet her supposed “intelligence” on her show.

That confuses us somewhat. We have never seen any special intelligence in Melissa Lee or in her advisory comments on Fast Money. She runs a good & funny show that, thanks to the panel, is often fun to watch due to her panelists.

We have noticed that many Ivy League graduates, especially Asian Americans, do seem to mock President Trump’s intellect. And we think the comment by Melissa Lee was in that spirit. Amazing isn’t it given the amazing political comeback of President Trump and the utter lack of any Asian American coming even close to it in any sphere? Racism is not a uni-directional arrow, is it?

We might also add, as we see it, the arrogance of Ms. Melissa Lee extends within CNBC as well. We were taken by surprise when, as we recall, she asked on air what the name of CNBC’s lunch-time show was. Seriously, we wondered, is it possible that a CNBC anchor of an CNBC show (for over 16 years) did not remember the name of CNBC’s lunch time show? Then we heard, as we recall, her most loyal show member ask aloud if the name of the other show wasn’t “Power Lunch”?

Hmm, did this Melissa-obedient guy not know that CNBC Power Lunch is a 2 pm show & isn’t the name of that the name of the CNBC lunch show “Half Time Report”? As we recall, the original name of the half-time show was indeed Fast Money. It was subsequently changed to Half Time Report &, as we guess, the show was separated from the 5 pm Fast Money Show. So do hard feelings remain & did that prompt the on-air put down by Melissa Lee & her loyal verbal henchman? That again makes us wonder what political battels are raging inside CNBC & whether there is any one in charge.

Just to complete the discussion, these two shows & their anchors are really different in what they force their shows to be – Fast Money is a 5 pm fun-oriented show with games & their primary purpose seems to be to entertain in search of ratings. In contrast, Half Time Report seems to be a serious show dedicated to delivering investment ideas & advice to its viewers.

We like both & we know that both shows have a sense of contempt for us & our Indian heritage. So, while we do not have a favorite in this dogfight between these two shows, we hope this fight extends a bit with CNBC Half Time throwing its own punch next week. This reminds us of a much older fight between two star women ex-anchors at CNBC, a fight in which Larry Fink of BlackRock chose one side to appear as guest and PIMCO founder Bill Gross chose the other side.

That, in a round about way, brings us back to Larry Fink & his views on interest rates. The Treasury market stayed neutral this past week:

- 30-year Treasury yield down 0.3 on the week; 20-yr yield down 0.7 bps; 10-yr up 0.4 bps; 7-yr up 0.2 bps; 5-yr up 0.3 bps; 3-yr down 1.4 bps; 2-yr down 1 bps; 1-yr down 4.1bps;

- TLT up 17 bps; EDV up 12 bps; ZROZ down 4 bps;

And the U.S. Dollar fell 1.8% last week both on UUP & DXY basis.

So at least for one week, the tweet below was correct:

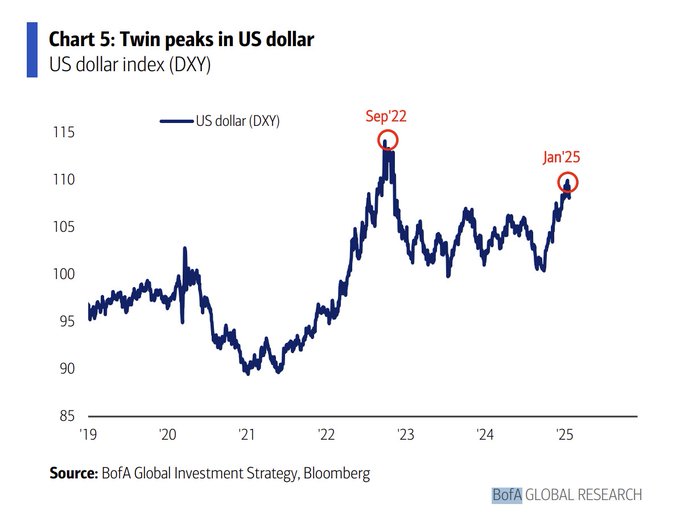

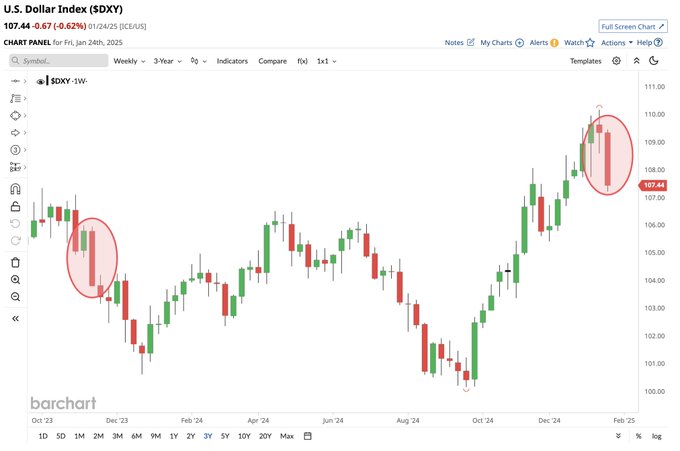

- Neil Sethi@neilksethi – Friday, 24 January – BoA’s Hartnett sees potential “twin peaks” in the dollar and #UST yields.

And focusing on just the Dollar:

Fed Chair Powell is on deck this coming week. Will he back the twin peaks theory or will he get those peaks re-conquered?

2. Markets Last Week

US Indices:

- VIX down 6.9%; Dow up 2.2%; SPX up 1.7%; RSP up 1.2%; NDX up 1.6%; SMH up 1.3%; RUT up 1.4%; MDY up 1.1%; XLU up 81 bps;

Key Stocks & Sectors:

- AAPL down 3.1%; AMZN up 3.9%; GOOGL up 2.1%; META up 5.5%; MSFT up 3.4%; NFLX up 13.5%; NVDA up 3.3%; MU down 5 bps; BAC down 11 bps; C up 1.8%; GS up 2.4%; JPM up 2.2%; KRE up 48 bps; EUFN up 3.7%; SCHW up 6.8%;

Dollar was down 1.8% on UUP & down 1.8% on DXY:

- Gold up 1.5%; GDX up 3%; Silver up 35 bps; Copper down 1%; CLF down 3%; FCX down 6.6%; MOS up 4.6%; Oil down 4.4%; Brent down 2.8%; OIH down 3%; XLE down 2.9%;

International Stocks:

- EEM up 1.9%; FXI up 3%; KWEB up 3.6%; EWZ up 3.6%; EWY up 1.7%; EWG up 4.3%; INDA down 1%; INDY down 38 bps; EPI down 1.1%; SMIN down 2.8%;

3. Interesting Tweets:

Since we generally like to begin on a positive note,

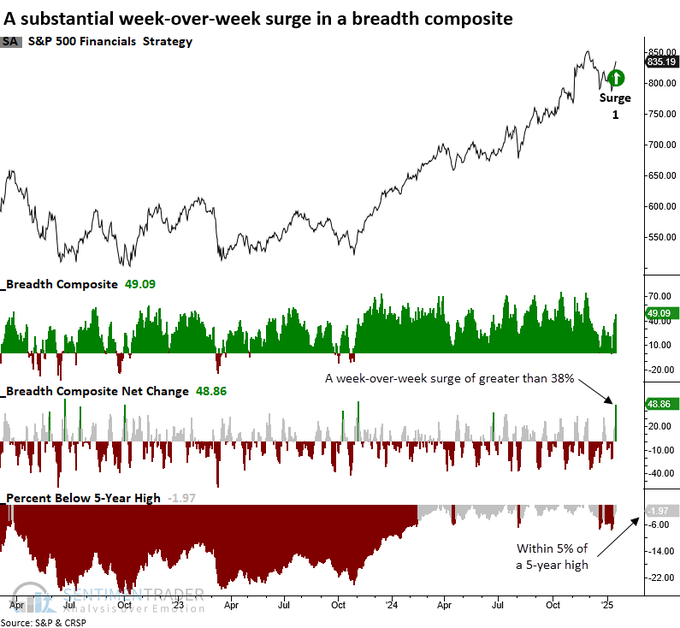

- SentimenTrader@sentimentrader – Jan 24 – For only the 27th time since 1952, the S&P 500 Financials sector triggered a breadth composite buy signal. Comparable thrusts saw the sector rise 81% of the time over the subsequent month and exhibit significance relative to random returns.

And on a 9-month & 12-month forward basis,

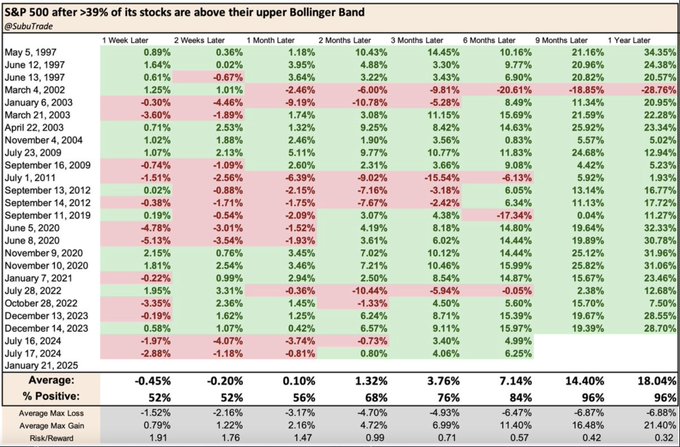

- Seth Golden@SethCL – Aweeee suki suki now !! When greater than 39% of $SPX stocks trade above their Upper Bollinger Band the 9 and 12-month forward positivity rate is 96%, since 1997. (only one failed occurrence from 2002) $ES_F $SPY $QQQ $NYA $DIA $IWM $VIX via @SubuTrade

On the other hand & on a short term basis,

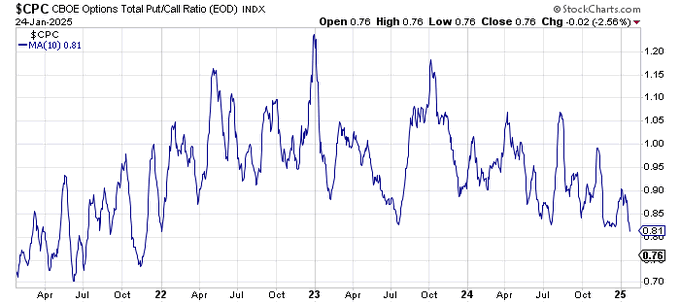

- Chartfest@Chartfest1 – Jan 25 – 10 dma of put/call ratio is now lowest since Jan. 2022

Now we wait for Wednesday & Powell’s presser.

4. How simple is it?

Once again, Josh Allen had the ball in his hands with the chance to win the championship game or lose. Once again, Josh Allen lost the game in his final drive. Once again, Patrick Mahomes showed that he is in that rarefied league of Tom Brady, Joe Montana & Terry Bradshaw. And Andy Reed has again shown that he can call plays that bring out the best in Mahomes while Buffalo keeps putting Allen in situations in which the defenses can converge on him.

Now the re-match between Patrick Mahomes & Jalen Hurts in two weeks.

Send your feedback to editor.macroviewpoints@gmail.com Or @Macroviewpoints on X.