Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”Nasty Signs?“

The Non-Farm Payroll number came in at + 256,000 which Jolted everybody. How strong is the economy said Rick Rieder as usual on Bloomberg Open! And yes, we saw the 30-yr yield jump up above 8 bps in the immediate aftermath of the number’s joy despite some fears expressed about inflation.

Then later stepped in Rick Santelli to be the first to point out the Treasury yield curve had inverted after the jobs number. And it stayed so till the end of the day:

- 30-yr up 3.8 bps on Friday; 20-yr up 5 bps; 10-yr up 8.4 bps; 7-yr up 11.2 bps; 5-yr up 13 bps; 3-yr up 13.5 bps; 2-yr up 11.7 bps & 1-yr up 8.2 bps;

That’s not a strong sign. Or to use a CNBC Fast Money expression, that is “not how Treasury interest rates go up for the right reason“! The CNBC mood & thinking about rates was summed up, perhaps intentionally, by Jon Fortt to David Zervos (at minute 1:14) after the close – “you think rates are still headed lower, why?”. To his credit, Zervos ignored the disrespect embedded Fortt’s question:

- “… this was a strong number; .. no question about it; .. something else is afoot! … the market is struggling a little bit with this idea that the Fed is possibly going to make a mistake in being a little bit too restrictive; the data are going to come in strong … what is baked in is … the policy is going to get more restrictive … & stay too restrictive for too long ; that’s why you got the curve to invert a lot today; the 2-yr was up 11 bps & the long end barely moved; that’s not a sign there is inflation expectations; that’s not a sign about Fed credibility; that’s a sign that they are kinda going to stick around high rates for a little too long & make something a little negative for the economy to happen; I think that is what the market is getting a little bit jittery about & also the politics matter there, Morgan”

Don’t know if it was the message by Zervos or the “p”-word introduced by him, but “Morgan” stopped on a dime without even acknowledging David Zervos or his message & turned to the other guest.

Rick Rieder (of BlackRock, of course) did correctly point out that the “US is a pretty closed economy and …. it operates pretty well …. “. Two was prior, this sentiment was expressed by Alicia Levine on BTV Surveillance (01/08/25). She did add the important distinction that while the US economy is an island, the US equity market is exposed to the rest of the world; the S&P is not an island“.

Neither Ms. Levine nor Mr. Zervos are bearish on risk assets or the US stock market. Ms. Levine said there is a Fed Put & a Trump Put in the markets. And Mr. Zervos is bullish on risk assets.

To get the discussion a bit more balanced, look at the message Credit Just PLUNGED, Here’s What It Means for the Economy on January 9, 2025 from Eurodollar University:

- Consumer Credit in the US absolutely plunged in November credit card users opting to pay back billions just in time for Christmas you want to underscore the challenges facing the incoming Trump Administration this is one of the clearest signals yet …. “

Seriously, look at the graph in the clip at about 00:45 seconds to see the plunge. You will hear next their explanation why long rates are still rising. But what if Friday’s inversion is a signal that long maturity rates will NOT keep rising inexorably? Would that mean the dangers may not be a distance away as we think?

Harking back to the words of Alicia Levine saying “US equity market is exposed to the rest of the world; the S&P is not an island”, let us look at what is still the No. 2 economy in the world & one that US is linked with in important ways.

2. “All Hat & No Cattle“

This famous Texas description was used for Chinese Central Bank & the Chinese Finance Leadership in Friday’s clip titled HOLY SH*T! China’s Currency Crisis Is Worse Than Anyone Expected:

The first 45 seconds ring clear:

- “Fears over a deflationary spiral in China sent its currency to extreme lows this week …. it forced PBOC to scramble, cancelling its primitive bond-buying program, selling a record number of Bills in Hong Kong & generally being made to look like the weak ineffective institution it really is … it’s a signal that China’s plight is now reaching a new phase … ”

The clip then described the big public effort with another Texan expression (originally used as a compliment for Roger Staubach) as “- the govt. took its shot ; it was a Hail Mary & it failed … now what do they do? … the authorities are all Hat & no Cattle” ….

When did the problem with Chinese banks begin? The clip quotes a BNP report saying “China’s monetary transmission has become impaired since the pandemic“. What is scary is that the PBOC will halt purchases of its Sovereign Debt a decision that the clip describes as “Chinese authorities don’t really know what to do” .

To go back to what Alicia Levine said, the clip warns:

” … the consequences will not be left to just the Chinese to deal with; what it boils down to with China impaired in its banking system like this, prospects for China and the rest of the world aren’t good; 2020s are looking for China certainly even worse than the 2010s; CNY is falling because it is pricing that very scenario.. “

We think US investors should watch & read the two quotes of two esteemed Fed Chairs, Bernanke & Greenspan used in the clip above:

- Minute 7:19 – Alan Greenspan in FOMC transcript – March 26, 1991 – “… what we are doing de-facto, is targeting the Funds rate; I’m not sure that any of us believes that that’s the right policy … “

March 1991 turned out to be a great time to buy risk assets, right?

- Minute 6:58 – Ben Bernanke at Brookings – March 30, 2015 – “monetary policy is 98% talk and 2% action. The ability to shape market expectations of future monetary policy through public statements is one of the most powerful tools the Fed has“.

These two have mostly a terrific track record in saying the right things at the right juncture. Sadly, as we have noticed for some time, that the current Fed Chair can be described as emphatically saying wrong things at his most important FOMC Pressers. His public proclamations have been Powerful indeed but in a negative way, like the Treasury market responding to his promise to deliver many rate cuts in September 2024 by relentlessly raising market rates by selling off.

Aren’t we all lucky that we & our Fed chairman live in America in an economy that is still “closed” as both Ms. Levine & Mr. Rieder described it last week. Not only was Friday’s NFP number terrific (up 256,000) but the Household number (up 478,000) was excellent as well. That led Eurodollar University to actually put out a positive clip with a title that is a mirror image of their Chinese clip title above – Labor Market EXPLODES Higher, Are We on the Brink of a New Economic Era?:

3. Good old USA

We begin with equities with a positive message & not a very negative message. The positive message is not couched in a very positive way:

- The Market Ear@themarketear – Jan 11 – S&P500 is not even in correction territory but positioning and sentiment indicators are already approaching levels that would be associated with a buy – which makes our head explode…

The one below doesn’t sound like a buy but it does say buying 77 bps below Friday’s close might work well:

- Jason@3PeaksTrading – $SPX likely going to finally fill that election gap at 5782 which lines up perfectly with the anchored VWAP from the August lows (orange line).. really nice level to look for a rebound after OPEX this week with sentiment now pessimistic

A chance to buy Bonds?

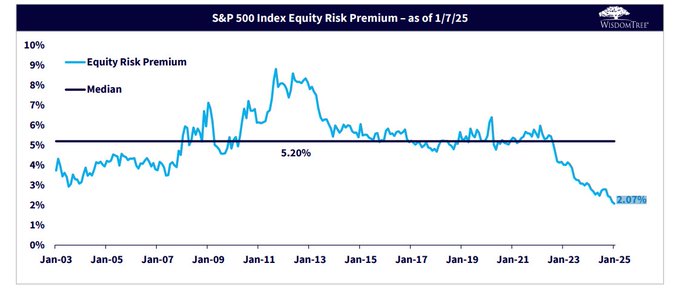

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – Jan 11 – Another 23-year low in the Equity Risk Premium. Just 2.07%. Good time to add some bonds?

And a negative sounding message re Bonds that actually may be a lukewarm positive:

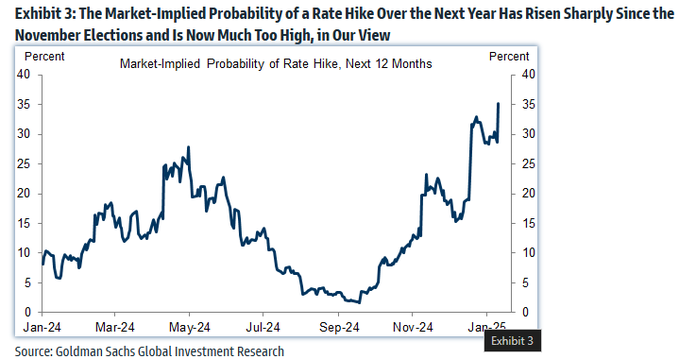

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – Jan 11 – The Market-Implied Probability of a Rate Hike Over the Next Year Has Risen Sharply Since the November Elections

4. Kautilya, Jensen, AI, Reliance & Perfection in Knowledge Representation – is it all coming together?

Back on September 22, 2024, we described a course in State-Craft (political science ++) taught at the US War College. The course is about a practitioner & teacher par excellence named Vishnu-Gupt Chaanakya (son of Chanak), nicknamed Kautilya (the devious one) from about 370 BCE. Those who are interested can read our short introduction to this great Master of Ultimate State-Craft. As the US Army instructor says like so many others scholars, there hasn’t been another one like Kautilya since he retired to write a treatise named Artha-Shaastra (Artha meaning centered on geoeconomics). That is why they chose to develop & teach a course on Kautilya’s Artha-Shaastra.

Then on October 27, 2024, we briefly covered the AI partnership between NVIDA & Reliance announced in Mumbai by Jensen Hwang & Mukesh Ambani in which Ambani made a promise:

- “I can assure you, like we did in data, a few years from now, we will surprise the world with what India & Indians can achieve in the intelligence market“.

Fine – so the first is knowledge coming from old India to new America and the second is knowledge coming from new America to new India. Not that a big deal. Yes, NVDIA has 15,000 experts training Indian students on AI-NVDIA & Reliance can train “hundreds & thousands” of Indians to help implement AI Systems. But the two are 2,400 years apart without any continuous relevance, right?

Hmmm! You may want to rethink a bit or at least watch a 8-minute clip introduced on YouTube on December 16, 2024, less than a month ago.

AI is about Knowledge Representation with clarity, precision & depth of knowledge. The trouble is natural languages are inherently ambiguous teeming with syntactical & semantic complexities that are inconsistent with AI where unambiguous representation of knowledge is paramount.

Some readers who read our pieces may recall that we are 100% dedicated, sometimes semi-violently so, to absolute correct & correctly pronounced Sanskrut words. After all, the language is the purest one we know of – a language that creates (Krut) Sans ( great content). What does Sans-Krut have to do with our topic here?

The answer is a paper by a NASA scientist that has shaken the world, a paper titled Knowledge Representation in Sanskrut & Artificial Intelligence. What follows below is a quick summary of a clip posted on YouTube on December 16, 2024 – a clip titled in such a trivial, almost trashy title. So allow us to begin with the first couple of sentences of the clip:

- “Knowledge Representation in Sanskrut and Artificial Intelligence by Rick Briggs of NASA Ames Research Center, California that shook the entire world. In the paper he suggested that an ancient Indian language called Sans-Krut is the most favored language to develop artificial intelligence. They believe it is the most sophisticated language on our planet. Its complex syntax rules perfectly matches the requirements for knowledge representation and artificial intelligence. And there is a high probability that NASA is already working on it.”

The excerpts below can sound as if they are over-board. But, having learned Sans-Krut from a very early stage & now teaching it to kids beginning with age 3, we can swear that every word copied below from the clip is absolutely valid:

- a marvel of timeless scientific brilliance … with rigid grammatical structures & ability to represent ideas with surgical precision, it stands unparalleled … generative grammar that codifies the essence of Sans-Krut in a series of methodically formulated rules …

- computationally digestible, … ability to represent meaning without syntax … unique fusion of linguistics, science & metaphysics …

- unparalleled structural sophistication making it uniquely suited for scientific & philosophical inquiry …. Sans-Krut can encode knowledge as precisely as the most advanced AI systems.

- Not an exaggeration to say that the structural & logical capabilities prefigure many modern advancements in computational linguistics

The most unique aspect of Sans-Krut is its ability to inspire a different way of thinking, as the clip says.

The clip ends with:

- “After centuries of colonial neglect & the dominance of western linguistics traditions, the language is witnessing a resurgence.. Universities & think Tanks worldwide are exploring how Sans-Krut can inform fields ranging from machine translation to knowledge representation.”

The resurgence is in India as well & the country is already benefiting them. Its explosion into leadership in Chess is at least in some part due to young players who come from a Sans-Krut heritage.

Going back to the Hwang-Ambani partnership, the Indian talent trained by NVDIA in AI may come with an innate advantage given their familiarity with Sans-Krut heritage. And how early does this familiarity begin at least within those with some familiarity with Sans-Krut: (PS; the name is Ved, both singular & plural and NOT the Brit-bootlicking Vedas):

The mantra they recite above is the First Mantra of the Oldest Book extant in the world – Rg-Ved. Personally speaking, we have been successful in teaching this recital to 3-4 yr + kids in Manhattan.

Understand another absolutely unique aspect of Sans-Krut learning – we have NEVER explained the meaning of the couplets these kids recite. The meaning is superb but COMPLETLY INDEPENDENT of the benefits you get from perfect recital – benefits both physically in terms of breathing-inspired brain development AND the understanding that meaning is not that important relative to the structure of the language involved.

By the way, the above is merely one & relatively simple area of Sans-Krut interconnectivity with discovery of modern phenomena. One example is the study of the recently observed phenomenon of Quantum Interconnectedness (connection discovered between subatomic particles even when separated by vast distances) and the description of such connectedness in more profound Sans-Krut texts. The study of this phenomenon became funded when a similar connectedness was discovered between the particles being discovered by Voyage one as it exited its original orbit and those being found by Voyager Two that followed Voyager One.

This study of Sans-Krut following the paper of Rick Briggs shows why the US is still & will always remain the absolute leader in the world. Just as the US welcomed & assimilated the Physics expertise of Oppenheimer, Fermi, Einstein in the 1930s, the US is still welcoming & assimilating the deep expertise & science that is still resident in India.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X