Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.What’s Not to Like?

Dollar came down 1% this week, Treasury rates surprised many by not going up despite a strong inflation number, earnings coming in positive wrt expectations and Tariffs postponed again.

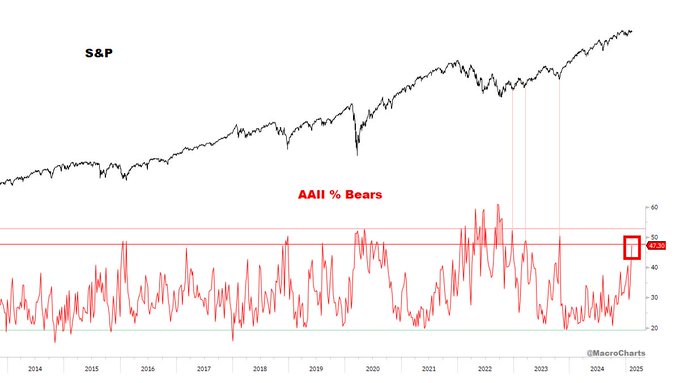

No wonder Stocks of many types rallied – NDX, Semis, AAPL, META, NFLX, NVDA, MU and non-US stocks beat the US stocks – EWZ, EWY, EWG not to mention KWEB, FXI with Materials. And this is despite the S&P remaining range-bound with many still bearish on stocks. So what might happen?

- Macro Charts@MacroCharts – Feb 13 – Nearly HALF of AAII Survey respondents are Bearish on Stocks. In Bear Markets, this typically led to sharp rallies. The last three times they got this Bearish in this Bull Market, Stocks never looked back.

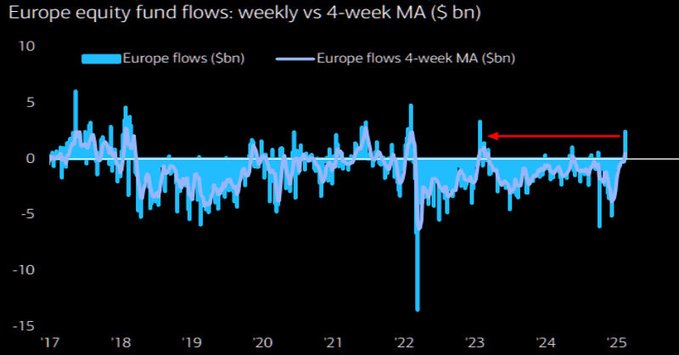

What about non-US markets?

- The Market Ear@themarketear – Feb 14 – Largest inflow to Europe in over 2 years

And,

- Alfonso De Pablos, CMT@AlfCharts – The Euro STOXX 50 is breaking out of a 25-year base to new all-time highs.

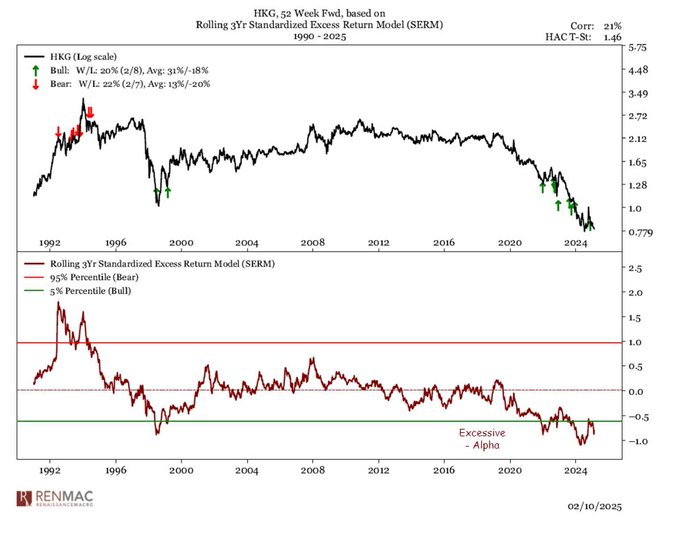

And what about the hottest move in markets?

- The Market Ear@themarketear – Feb 14 – We all remember when Chinese authorities pulled the Ant IPO in late 2020. Is this the inverse set up?

Is that move close to being somewhat over? No, said:

- RenMac: Renaissance Macro Research@RenMacLLC – Feb 12 – Negative alpha generation over the last few years suggests this turn in Hong Kong could be just the beginning. $EWH #HSI #HangSeng

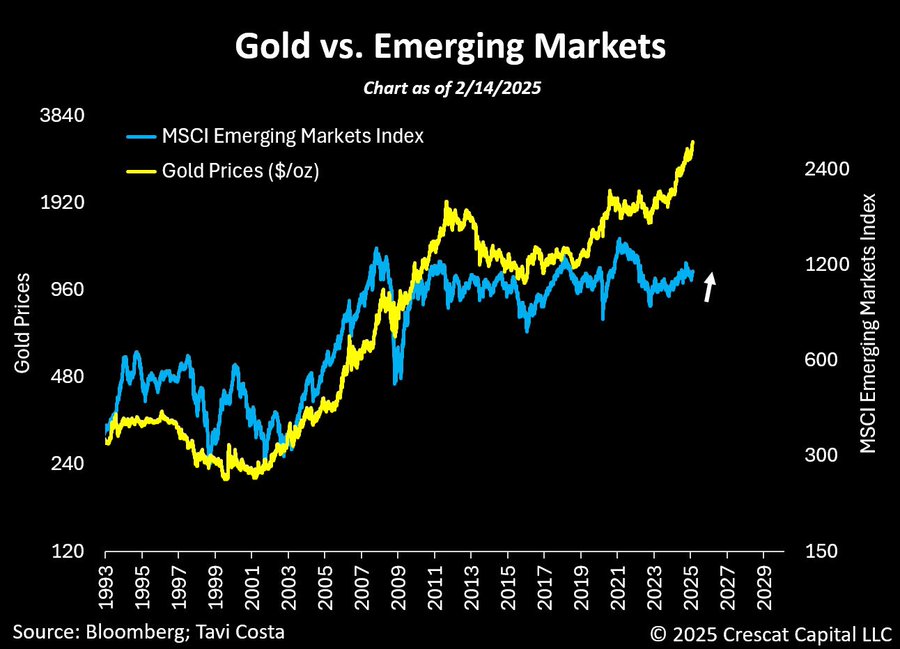

What about Gold?

- Otavio (Tavi) Costa@TaviCosta – Feb 16 – Emerging markets have a deep and often underestimated connection to the metal in my view. Historically, prolonged bull markets in gold have contributed to broader increases in natural resource prices, strengthening economies with substantial exposure to commodity markets. Emerging markets, particularly resource-rich South American nations, tend to fall into this category. Additionally, the structural constraints on further US dollar appreciation, which I firmly believe to be the case, create a highly favorable macro environment for emerging market economies to benefit.

Getting back to S&P:

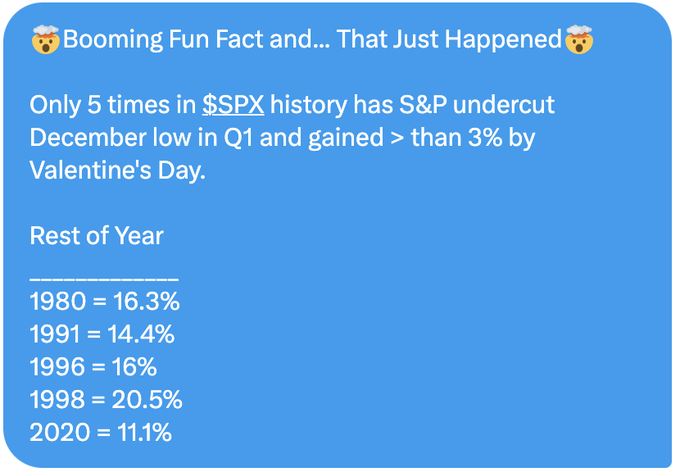

- Seth Golden@SethCL – Feb 16 – This quant takes care of the December Low Indicator and the Valentine’s Day Indicator. Taken separately they cancel each other out, but taken together they produce a PERFECT DOUBLE-DIGIT outcome for $SPX by year-end 2025 $SPY $ES_F $QQQ $NYA $IWM $DIA $VOO

2. Hmm, interesting focus this week from Equity Bulls

To be honest, every one must have seen headlines about job cuts & layoffs from major companies, even companies whose stocks continue to ramp higher. Recall what Don Peebles said two weeks ago:

- And what you’re seeing now in many sectors now are job cuts are beginning to take place now, and more are going to start happening and they’re going to be in banking, ….. and unless we see a change in policy, I think we’re going to we could be dangerously close to a recession.

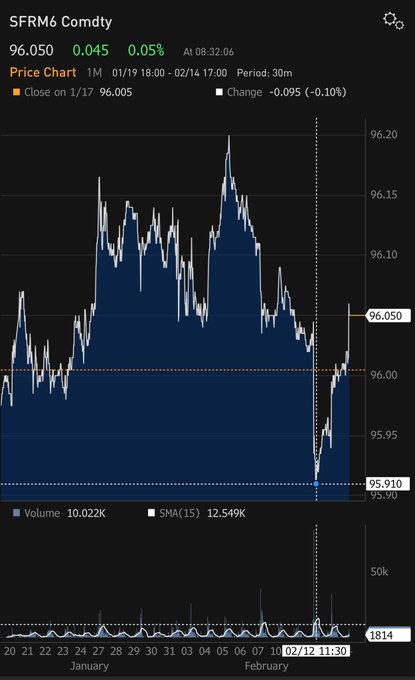

That brings us to Warren Pies who said “we are going to break out to the upside” but he took down his “excess long” position in stocks. He said it is too early to outright worry about the economy because the growth slowdown he expects may not show up until say April. He says the Fed will remain recalcitrant until then. But they will wake up and deliver 3-4 rate cuts this year. So he says “overweight Bonds“. He says he wants interest rate sensitivity in his portfolio and that Semis, NVDA will be the leaders. He says Over-weight Tech, Under-weight resource stocks, miners except Gold.

Sure but he is no Ryan Detrick who has always been correctly bullish, as we recall. But is it possible that Ryan Detrick himself has become more like Warren Pies? Not entirely but like Pies, Detrick, yes Detrick himself, has added long term Treasuries and TIPs. He said he expects 2-3 rate cuts from the Fed & expects inflation to improve. If that isn’t enough, Detrick himself put on his Don Peebles dress and pointed out that “last week we saw hundreds & thousands of Jobs evaporate in essence but GDP was revised higher“. Then, a la Yardeni, Detrick attributed that to productivity & said “during years of strong productivity, you get upside economic surprises and a strong stock market“.

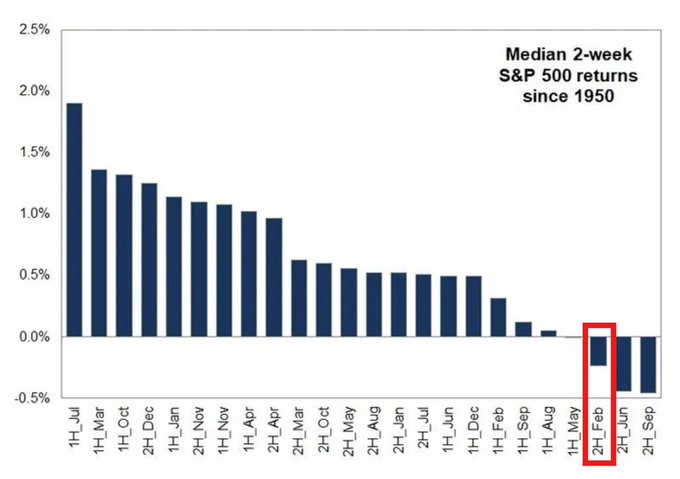

Besides our strictly amateurish attempt at humor, we stress that we have been impressed with & benefited from the consistent & correct bullish posture of Mr. Detrick during this bull market. Now we are really impressed that he has the self-confidence, honesty & the intellectual flexibility to recommend Treasury bonds & warn about the February not being that great a month & that in post-election years, February is the worst month on average.

On that bearish note,

- Neil Sethi@neilksethi – Feb 16 – Goldman: Beware the second half of February.

Now to someone who is even more bullish than Ryan Detrick, not just for this year but until 2030 with her target as 10,000 – 13,000 (& 7,200 – 7,400 by year-end 2025). It was interesting to hear Mary Ann Bartels on CNBC Squawk Box on Monday & again on Bloomberg Open on Tuesday. And what technical signal did this uber-bull point to?

- on CNBC on Monday – “in the near term, we just had a break-down on the 10-year that would point to about 4.2%, but our target for the year is to be range-bound between 4% – 5%; … if the economy stays strong, I would not be surprised if at some point we are back up near 5%“

- on BTV on Tuesday post CPI – “technically, I look at the 10-year; its formed a head & shoulders pattern and broke down; so there is a good chance that, if we get good inflation data this week, that we can actually see the back end of the curve actually drift down and on the opposite end, it is possible I am getting bullish technicals on the equity market; when was the last time we had the equity market going up and the bond market going up; if that happens, that would be what’s unexpected in the market”

The point Ms. Bartels stressed that she is a big believer in leadership and she sees FANG type stocks setting up to take back leadership with the stock market. …. She said broadening can happen but the leadership remains tech & tech-related.

This was an interesting week in which a number of CNBC shows featured bond-bullish comments such as the above including the one below by David Zervos on Friday after the close:

- “Still convinced that we are going to have a good year in stocks & bonds …. they are going to keep pushing 10-yr yields lower, not higher“

Even CNBC Fast Money brought their non-resident Treasury commentator, Andy Constan of Damped Spring, perhaps to be negative on Treasuries. But, he made dovish comments as well:

- “equities don’t have to sell off until there is a negative growth impulse; I think that is heading our way! …. financial conditions have aggressively tightened …. ; bond yields have risen a lot; … the yield curve is flat for 3-4 years … with tightening financial conditions & anti-growth policy… this is an environment of getting a growth slow-down; I think the 10-year responds to disinflationary growth …”

This was something Steve Grasso of the same show spoke about. And even, Karen Finerman, the main player on that show who has been Short TLT, spoke about her trade in a rational & soft manner. And she is the ONLY one on that show that actually has had a short position in TLT.

In contrast, as we recall, Guy Adami, the favorite obedient backer of host Melissa Lee, took a hard & loud position about his personal expectation of yields running higher. That is his view & he is free to express it. But, for some weird reason, Adami never expresses anything except his personal view about Treasuries &, to us, his expression of those views has a harsh tinge as if he personally hates Treasuries.

As we have written for years, CNBC Anchors do have a highly negative view of Treasuries &, way back in the past, they used to voice their emotions. Now that emotional role seems to have shifted solely to Adami. And, in our opinion, he plays that role loudly & tends to overshadow the softer, rational voices on the show. How can such a hostile presentation fail to scare off viewers who may be interested in looking at Treasuries? But CNBC Fast Money doesn’t seem to care because, unlike other CNBC shows, they seem to be much more interested in being a drama-game type show instead of a rational & helpful show for the benefit of individual viewers.

After all that, what did Andy Constan really say about Bonds on CNBC Fast Money that we could not find on CNBC Fast Money? Below are his own words:

- Andy Constan@dampedspring – – I’m a simple guy. I go on @CNBCFastMoney and tell the world to buy bonds over stocks on the day of a hot CPI

3. MAGA + MIGA = MEGA

Any one who even occasionally reads this Blog must know that we think very very highly of Mr. Trump. We thought in 2015 that he would be great as President and, after his election in November 2024, we felt more than 100% certain. We remember a public comment by Mr. Dimon of Chase in his first election that Mr. Trump can be exceptionally charming. He was being sincere & serious, we think.

Watch President Trump show this fantastic side of him in the clip below from 0:22 to 0:44 seconds & from 00:50 to 00:53. The sweet, exceedingly charming & real gesture by President Trump to seat PM Modi by drawing out the chair & waiting behind him to sign & then gently bringing the chair back is something that only a through gentleman with boundless self-confidence would do. Then he shook PM Modi’s hand and said “We missed you; we missed you a lot“.

PM Modi introduced a new term to signify the strong bond between President Trump & him by introducing a new term MIGA or Make India Great Again and he used it to call the America-India partnership as MEGA = MAGA + MIGA.

We think the relationship between USA & India is back to what it was in Pres. Trump’s first term & will actually be much much stronger & mutually beneficial. If you want to see an example of profound change that we expect, look at the two photos below:

(From Donald Lu to Paul Kapur at the State Dept.)

President Trump has nominated Paul Kapur to head the South Asia Bureau at the State Department replacing Donald Lu who is leaving. Mr. Lu was described in the India media as the leading US diplomat that helped the coup in Bangladesh and one who distributed USAID cash to people who would do what he wanted.

In contrast, Mr. Kapur, as associate professor at U.S. War College & a visiting scholar at Stanford, has been has been a fierce critic of Pakistan-based militant groups and argued in his 2016 book that “Jihad or support for Islamist militants has constituted a central pillar of Pakistan’s ‘grand strategy’, and is not just ‘one among many tools of Pakistani statecraft’.”

We think Prof. Kapur is an exceptional choice and he will make America the No. 1 factor in US-India & Asian relations.

Personally speaking, we hope Pres. Trump will be much more direct about India treating US companies & US Citizens better. Americans of Indian-Origin are often treated as captive property & subjected to stricter rules than Indians are treated in America. For example, why can’t we do Indian Banking thru US Banks like Chase? Why are we forced to work with Indian Banks like HDFC/ICICI via cumbersome rules called NRI? The taxation rules in India are horrible for US citizens of Indian origin. And we cannot buy residential property while Indian citizens can buy apartments in NYC & anywhere in America.

But these issues have always paled into insignificance when compared to serious differences between the two countries. And we saw one such when CNBC anchors butchered PM Modi’s last name with glee and under the leadership of the entirely ANTI-Indian correspondent of Indian origin at CNBC. And that is not a mistake or a simple inability. The last such practice we have heard about is White Supremacists calling (including TV Anchors) African-Americans not as Black but with the N-word. That group used to take great joy in showing their contempt of African Americans just as today’s CNBC Anchors seem to take joy in publicly butchering PM Modi’s last name.

The other deliberately negative act we saw was the invitation to an Anti-Modi economics professor to discuss the Trump-Modi meeting. We believe the CNBC Anchor knew this Professor was anti-Modi & yet she chose him to discuss the Trump-Modi meeting. This reminded us of the incident when an anchor of Indian origin at CNBC relayed the opinion of a woman at CFR about Modi’s 2024 election, CFR being an organization believed to be critical of PM Modi. And that CFR opinion proved very quickly to be wrong.

We have felt & written about the visceral Anti-Hindu sentiment prevalent at CNBC since 2008. And we have wondered about where it originates. This past week, we think we got a clue. Read the tweet below from a well-known Indian analyst:

- Abhijit Iyer-Mitra@Iyervval – Have you noticed? Ever since @elonmusk started his crackdown on USAID, not one newspaper NYT, WaPo, Guardian have run a hit piece on India & Modi? Only the BBC ran some pathetic story quoting some irrelevant “hate watchdog”.

Then we saw the following:

- Vijay Patel@vijaygajera – This is very big. 1. Here is the list of so-called Independent journalists funded by USAID-funded Earth Journalism. This list has the names of 86 Indians who write articles on their pay roles. Do you know where their articles are published? To know read this thread now👇

Is this the origin of Anti-Hindu, Anti-Modi hate that we believe we see in some CNBC anchors? The Indian media often describes CFR as a haven for Anti-Hindu, Anti-Modi policies pointing out that Peter Haas (brother of CFR head Richard Haass) was the US Ambassador when the 2024 coup took place & Mohammed Yunus was appointed as US Advisor to the new regime. We have no idea whether this is true or false. But we do wonder why CNBC’s reporter of Indian origin reached out to CFR for her negative opinion about the 2024 election and why another ex-CNBC host now at CFR is often brought on CNBC to comments on issues.

That brings us to President Trump’s smart decision to stop penalizing US Companies against charges of corruption in foreign countries. Of course this was discussed on CNBC Fast Money without any knowledge or quick research. How quickly could such research begin? With a clip like below that describes the fine levied on US Companies for paying bribes to Indian companies or companies in other Asian countries. The clip description says:

- In a major development, several U.S. companies have been accused of paying bribes to Indian officials in exchange for winning lucrative contracts, and to avoid facing serious charges, these companies ended up paying massive fines—three times the amount they allegedly paid in bribes. The companies involved are Moog Inc, Oracle, and Albemarle Corporation, and these cases shed light on the ongoing issue of corruption in international business dealings.

The clip states that Moog paid US regulators a fine of $1.68 million dollars; Oracle paid a fine of $23 million dollars & Albemarle paid a fine of $198 million dollars. The clip posted on Dec 17, 2024 is from TimesXP of India.

Whether the information provided in the above clip is true or not, it shows why it was rational & pro-US of President Trump to cancel this practice of punishing US companies. It seems certain that if US companies are barred, then non-US companies would win the business. Also this shows why the Indian system ignored & brushed aside the action brought by the SEC against an Adani company for paying bribes to Indian officials. Presumably they knew US companies did the same in India.

Getting back to USAID, look at the recent clip we discovered:

And below is a clip from CNN India about USAID in India:

Our key point is that business networks like CNBC USA should perhaps try to avoid acting in a racist-like manner of deliberate mispronunciations and curtail their practice of inviting known opponents of PM Modi. Perhaps that behavior is better left to MSNBC and the like.

We must add that we have been watching Asia coverage of CNBC-Singapore & of Bloomberg Asia. These two networks seem to be free of the bigotry we see in their US counterparts.

4. A sign of Change in Indians – Chhaava

Finally, a great story of enormous personal courage & self-sacrifice told on screen in India. Despite the old efforts of the British & today’s BrIndians who are blamed in India of having sold themselves to USAID, this no holds barred film seems to have ignited Indian viewers. Just as background, in an India ruled by the great & worst Mughal Muhi Ud-Din (self-proclaimed AurangZeb or jewel of throne) and in South by 3 Muslim sultanates, rose the people of Mahaa-Rashtra (of which Mumbai is the capital) led by Shivaji.

King Shivaji has been declared as one of the World’s All-Time Great commanders by people like British Field Marshal Montgomery, military historians like Clausewitz & numerous diplomats in Portugal, Britain, Holland & France, who had become active in India in mid 1660s. He has been included by these authorities in the league of Alexander & Caesar.

After his death, his temperamental son Sambhaji took over & faced a court revolt by diplomats in Shivaji’s regime. He ruthlessly put that down & that created a different image for him. Mughal AurangZeb sensing the opportunity to destroy the Maratha regime came down & stayed with an army of over 200,000 & the boundless Mughal Treasury.

Sambhaji & the Marathas fought him & the Mughal Army for 9 years & Aurangya couldn’t get anywhere. But then one of Sambhaji’s own commanders whispered his location to a Mughal General who overnight attacked & seized King Sambhaji. Sambhaji was given the chance to convert to Islam & surrender his kingdom. Sambhaji refused and then Aurangya made a critical error.

Driven by his anger & Sambhaji’s obvious contempt of him, Aurangya ordered extreme torture to break Sambhaji. His tongue was removed, his eyes burnt out by inserting red hot iron rods & then his skin was slowly roasted & peeled. Eyewitnesses of that era told this story all over Mahaa-Rashtra. On his death, Sambhaji’s body was cut into pieces, fed to wild dogs & paraded all through out the Mughal Army to scare the Maratha warriors & people.

Guess what happened! The entire Marathi people exploded in anger &, as the saying goes, every blade of grass became a spear. The Marathi people adopted the guerilla warfare & began attacking the Mughal Army that was used to open field warfare. For over 18 years, from 1689 to 1707, the Marathi armies essentially wrecked the Mughal Army & the Mughal Treasury. Mughals controlled the large plains but the mountains, hills & passes were Maratha controlled & the Mughal Army became afraid to move out of their camps.

Finally Aurangya died in 1707 & the Mughal reign ended in 1710. With a few years, the Marathi Armies commanded by the Bajirao, a “heaven-sent cavalry general” (read Field Marshal Montgomery) attacked North India and controlled Delhi, the seat of Mughal power.

So, the final words of King Sambhaji to Aurangya have proved correct:

- “when Sambha dies, every Maratha household will give birth to a new Sambha; but when you die, your Mughal regime will also die”

And all this was galvanized by the unbelievable torture of King Sambhaji by Aurangya. The story of Sambhaji is very rough & nearly impossible to read let alone watch. This is why it had NOT yet been presented as a visual film. Until now. The story that was presented decades ago in a play titled “here Death itself was ashamed” was released this weekend as Chaava (young son of the lion).

What has stunned us is the harsh torture & reality shown in this film. Bollywood films have always been soft with song & dance sequences & almost theatrical fights. In contrast, Chaava is a pure film that doesn’t run away from the violence & the inhumane torture inflicted on King Sambhaji by Aurangya. Rightly so because that torture became the war cry, the flame that was lit in Marathi hearts. Unless you see the torture (shown about 20% of what actually was inflicted), you cannot understand how & why the Mughal regime was destroyed in 20 years.

The embrace of the explicit violence in Chhaava, we believe, is of real relevance & shows why PM Modi is winning every single election since the big national election in 2024 that the “experts” & reporters at CNBC described as a loss for PM Modi. We still can’t believe how intensely the normally soft & dovish Indians have accepted this film. As of today, the Indian Press is reporting that in 3 days Chhaava has made 100 Koti Rs. or 1 billion rupees.

This is a major sign in our opinion. Not clear if the BrIndians & paid servants of USAID, CFR and the rest will change but it is absolutely clear that they & their impact is dwindling.

Tomorrow is President’s Day that celebrates both Washington’s Birthday (Feb 23) & Lincoln’s Birthday (Feb 12), two Presidents that made America Great by fighting brutally violent wars. It might be pure accident that Chhaava, a film that celebrates a Great War that wiped out Mughals, was released on the President’s Day weekend.

The US Civil war, the deadliest & most divisive war in US History, was what made America truly great. And one of the most difficult battles of that war made Gen. Ulysses Grant a hero. The campaign to capture Vicksburg is one of the glorious successes of Gen. Grant & sharpened his own convictions about total war. Below is a short clip about the Vicksburg campaign, a must watch for everybody in the world, we think.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.