Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Markets Last Week

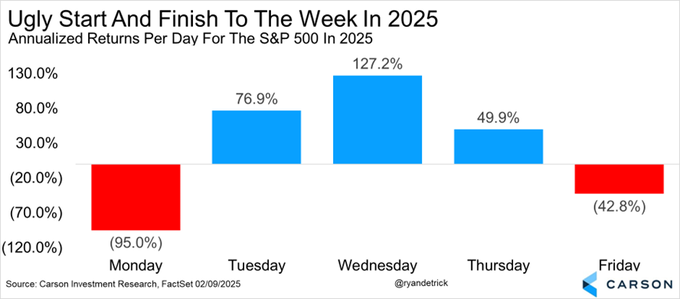

Last Friday we expected markets to get buffeted by President Trump’s decision to impose tariffs. The markets did recover by mid-week but fell hard again on Friday afternoon due to more comments from President Trump. Are Friday’s & Monday’s now the problem days? So far that seems to be true:

- Ryan Detrick, CMT@RyanDetrick – Feb 9 – Monday and Friday have been quite bad for stocks so far in 2025. The other three days have been solid.

It was a somewhat interesting week in that the US Dollar fell, Treasury yields fell somewhat hard & many stock sectors fell, excluding China.

US Indices:

- VIX up 91 bps; Dow down 54 bps; SPX down 25 bps; RSP down 43 bps; NDX up 6 bps; SMH up 70 bps; RUT down 35 bps; MDY down 93 bps; XLU up 48 bps;

Key Stocks & Sectors:

- AAPL down 3.1%; AMZN down 3.3%; GOOGL down 8.9%; META up 4.2%; MSFT down 1.6%; NFLX up 3.9%; NVDA up 8.1%; MU up 1.2%; BAC up 2.7%; C up 50 bps; GS up 3%; JPM up 3.2%; KRE up 97 bps; EUFN up 2.4%; SCHW up 52 bps;

Dollar was down 20 bps on UUP & down 26 bps on DXY:

- Gold up 2%; GDX up 4.8%; Silver up 6 bps; Copper up 7.7%; CLF down 2.4%; FCX up 6.8%; MOS down 3.9%; Oil down 2.4%; Brent down 2.8%; OIH down 55 bps; XLE down 95 bps;

International Stocks:

- EEM down 25 bps; FXI up 3.1%; KWEB up 3.8%; EWZ down 98 bps; EWY up 20 bps; EWG up 6 bps; INDA down 1%; INDY down 1.5%; EPI down 1.2%; SMIN down 1.1%;

Treasury & Fixed Income:

- 30-year Treasury yield down 11.9 bps on the week; 20-yr yield down 11.9 bps; 10-yr down 6.8 bps; 7-yr down 3.5 bps; 5-yr up 0.5 bps; 3-yr up 6.3 bps; 2-yr up 8 bps; 1-yr up 7.3 bps;

- TLT up 1.6%; EDV up 3.3%; ZROZ up 3.6%; HYG down 46 bps; JNK down 61 bps; PFF down 91 bps; EMB down 4 bps;

Despite the fall in Treasury yields over the week, Friday’s data led to yields closing up. Despite that, the 30-year closed below 4.80% & the 10-year closed below 4.50%, both important technical levels per Rick Santelli.

We got lucky in our opinion expressed last week that “We are generally optimists & we hope to remain so on NVDIA, Semis & US dominance in AI.” NVDIA closed up 8.1% to 129.36 & SMH closed up 70 bps. We were happy to hear Ankur Crawford of Alger tell Scott Wapner “re AI, we are in very very early innings; pathway over next 5 years is going to be very fast, very aggressive“. The great 1-liner from her was “when software writes software, innovation becomes exponential“.

In case you haven’t noticed, FXI & KWEB were strong again this past week. We heard CNBC Fast Money do their usual please-Melissa thing & talk about KWEB segment keep doing well. Not that we disagree but we keep getting struck by a complete lack of candor or even real debate about the potential of Chinese equities. In sharp contrast, watch & listen to CNBC Asia Squawk show in which the Asian-background anchor was aggressive about Chinese stocks only to be challenged by the European-background anchor in a discussion about key differences. Having said that, the key point was expressed by the guest, Andrew Swan – Head of Asia Equities at Man Group:

- “For China, now to move into the next stage of development, I think we are going to see a different model emerge; not just some cyclical support for the economy but I do believe we are on the verge of .. a sign of structural changes in how the growth model works. And I think we are potentially going to look back at this time of a turning point for consumptive share of GDP as an example & perhaps led by low income groups … I think that’s where the big picture is here ….. its going to may be change perceptions ”

Kudos to CNBC Squawk Box Asia – why can’t US CNBC Fast Money learn from them?

2. India, AI & positive signs ahead?

China we all get. But what is the India story in AI? Surely Indian entities are also building their own capabilities in AI but is that the story to focus on? Not in our opinion!

Read the story released by Bloomberg on Friday; those like us who cannot afford Bloomberg Subscription Fees either on a financial or moral basis, should look at the reporting on Yahoo! Finance titled BlackRock to add 1,200 jobs in India for AI push :

- “US asset manager BlackRock is looking to hire around 1,200 new employees in India, reported Bloomberg News citing sources. This move is aimed at bolstering the company’s artificial intelligence (AI) capabilities and is set to expand its two support hubs, known as iHubs, located in Mumbai as well as Gurugram. BlackRock’s iHubs focus on value-added offerings such as investment research, risk management, and data analytics, with many areas using AI.”

- “The recruitment drive is expected to increase the current workforce of approximately 3,500 in these cities, by bringing in more engineers and data experts.”

- “Furthermore, BlackRock’s proposed acquisition of data provider Preqin could see the inheritance of a global capabilities center in Bengaluru, stated the news agency.”

Software writing software can make innovation exponential as Alger’s Ankur Crawford told CNBC’s Scott Wapner, but implementation of such innovation might still need people to debug, verify & teach customers. If a global giant with awe-striking capabilities like BlackRock ends up looking to hire thousands in India, is it reasonable to expect we will see hiring of such AI talent in India by other major companies?

There is another interesting angle to this story. Look what the MSN version of this story wrote:

- Moreover, in July 2023, BlackRock entered into a joint venture with Jio Financial, naming it Jio BlackRock, to revolutionize India’s asset management industry.

- In April 2024, both entities entered into a new joint venture to establish a wealth management and broking business in India to tap into the country’s growing wealth business and rising retail investor base. In October 2024, both entities obtained in-principle approval from the Securities and Exchange Board of India to act as co-sponsors and establish a mutual fund business in the country.

Jio is a part of the giant Reliance Industries & BlackRock has a joint venture with Jio. On the other hand, Reliance has established a joint venture with NVDIA to train thousands of AI engineers on implementation of AI. We had discussed this on October 27, 2024 in which Mukesh Ambani said:

- ”.. we are looking forward to be & have a development center where we can take NVDIA tools & train hundreds of thousands of developers in India to use all the enterprise tools, to use all the omniverse tools so that we can really apply in a practical way … this is just the starting of this intelligence age … it is a multi-decade journey”

For convenience, we re-insert the Jensen-Muskesh clip below:

In some ways, this period reminds us of Q4 1999 – 2000. There were hundreds of outsourced Indian programmers working at client offices in California, Boston & other tech centers to implement Year-end 2000 related changes. Then by mid-2000, Congress decided to cancel the visa renewals of these programmers & send them back to India because the job was done. Soon it was realized that you can’t really debug software changes made by some others. And Indian company officers offered US companies to provide them the SAME programmers who had implemented the changes BUT working from India at a 30% discount. It worked & the work was outsourced to India (mainly Bengaluru) & a new industry began in India with service industries growing beside them.

We do see the possibility of a similar or even bigger rerun here. There will be a serious shortage of AI implementation experts here in America, given the scale of demand we see. Combine that with the potential return of many H1-visa people to India because of visa-renewal issues & imagine yourselves.

3. India Sell-off Nearly Over?

We had written in Section 4 titled India Sell-off of our January 19, 25 article:

- “EVERY major correction in trade with India is accompanied by a frantic fall in the Indian Rupee. That looks terrible & feels worse for Indians BUT that has always cleared the markets & trade logjams. …. Now we are getting more & more interested in Indian stocks (and consequently in INR) after this week’s frantic fall. Just think, any stock or index you wanted to buy is 10% cheaper due to the joint currency-stock selloff. The fundamentals of India & Indian stocks have not changed at all except getting cheaper. “

How did the big India ETFs – INDA, INDY do in the past 3 weeks? Just about flat.

And what has been done by the Indian Government & the Reserve Bank of India in the last 2 weeks? The Indian Government announced a ZERO Income Tax slab for those earning less than $15,000 per year.

This is not for the poor in India, the approx. one billion people who earn about $1,000 per year (yes – per year). These have been the darlings of politicians who have showered them with free just about everything. The above tax relief is for the middle class who have been squeezed between the very poor & the well-to-do.

Then on Friday, the RBI announced a 25 bps rate cut. That with the generally liked Budget with tax cuts, the mood in India is now better. So unless the Rupee falls further & hard, thanks to the Dollar, the real damage might be behind us. And the mood seems to be turning as one X-users said:

- Conceptual Investor@DoctorMoneyX – After Jeffries Now morgan Stanley says NIFTY correction done , 19% upside is possible in sensex 1. Fiscal stimulus given as Budget+ Income tax relief 2. Monetary Stimulus package given by RBI as Rate cut 3. Strong Political positive outlook 4. Earning is improving than September & Forex reserves are improving Correction is temporary, Growth is permanent. Avail the opportunity when everyone is in fear, be greedy Govt working on fundamental of economic growth

That brings us to views on investing in India from one of the smart investors in New York, the group that bought Adani shares during the media storm. Listen to Brian Kersmanc speak with Bloomberg’s Haslinda Amin on 2/4/25 in Mumbai about China, India, NVDIA & Brazil (minute 7:50 to minute 21:58).

Haslinda asked him point blank – “India is still looking pretty expensive at 24-25 PE & earnings have yet to catch up with the Indian market“?

Brian replied:

- ” … yes the Indian market is expensive …. there are areas we are seeing with very strong growth, things like infrastructure, utilities along those lines …. yes there is a higher price tag you are paying for some of that growth but the growth is coming thru in a very strong way; and what goes under-appreciated is that there is a durability or visibility to that growth on a longer term basis.. people under appreciate there is a tail that has a lot of value; so structurally that is going to come with a higher price tag .. India could be the main driver of EM earnings over the next cycle …”

- “you are seeing a lot of the infrastructure growth coming from a lot of different areas …. GMR, for example; the 2nd largest airport infrastructure company in the entire world serving 120 million passengers growing at single-digit plus in terms of growth; … the consolidated telecom sector with 3 players, 2 of which lead pricing in a bigger way … mid-teens growth with $7/month for unlimited 5G plan; so there is plenty of runway to continue to grow … “

This was followed by a discussion about NVDIA & banks in Brazil.

By the way, the fresh story is that PM Modi’s party won the Delhi election by the largest number of votes in 27 years. That should also bode well for Indian stock markets.

4. Deportation of illegal migrants from India

The big story in India this week was the deportation of 104 illegal immigrants from USA. This is a weird story that needs to be put in perspective. No one in India, neither the government nor the people, have any issue with deportation. In fact, India has argued for a really strong policy for deportation of illegals living in India. So India cannot complain about America sending Indian illegals back.

It seems the majority of these illegals were from the Panjab area, near the northwestern border. For some weird reason, these people have a DREAM to go live in what was the UK years ago & now it is North America. Their experiences were horrible:

- The cases that were interviewed on Indian TV were not poor. Two workers said they had paid 4.5 million Rs. each (about $51,000 US Dollars) to Agents who promised them straight transportation & assimilation into America. Instead, once the fare was paid & the journey began, the rout was arduous & eventually required walking to jungles in Panama.

- Another lady with 2 daughters had paid 10 million Rs. (USD 115,000) to a similar agent & suffered massive hardship.

This blows our mind. If you have $115,000 in cash, why would you risk so much to travel to USA when you can live in relative comfort on that money in India? What do the Agents promise these people Or is it blind hope? Hardly any other state in India has such people!

We have also heard that much of this grew out of the activities of the left deep state which welcomed such migration & which was based in Panjab province working with Sikh militants & anti-Modi groups. In fact, we recall hearing a CNBC NY TV reporter describing a documented terrorist as an activist in her coverage.

This might actually lead to a positive result out of this – rigorous enforcement by Indian police & army in Panjab with some real support from US intelligence that used to work with these agent groups.

5. Back to Home

First from the famous Signor McElligott of Nomura:

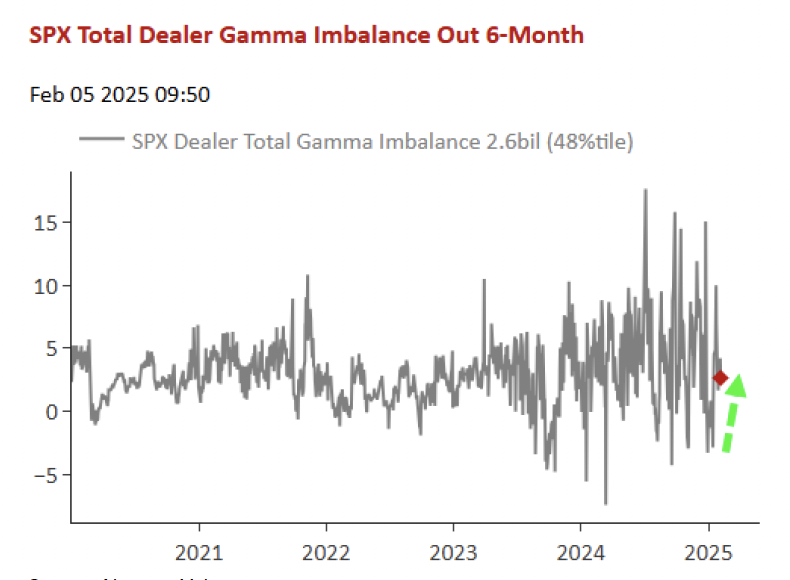

- Seth Golden@SethCL – Dealers/MMs will keep buying Longer Gamma, suppresses rVol daily ranges $SPX …compressed daily ranges/ lower rVol means mechanical reallocation flows to BUY Equities pick back up from the Target Vol/Vol Control funds...upwards of +$21.4B of Futures to BUY over next 2 weeks – $ES_F $SPY $QQQ $VIX $IWM $NYA $UVXY

(Nomura’s Charlie McElligott)

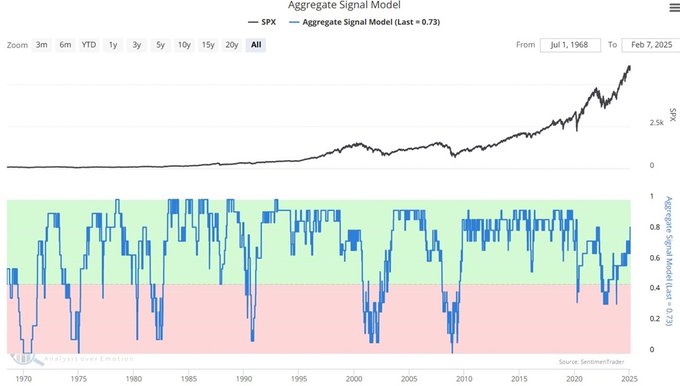

- Jay Kaeppel@jaykaeppel – Feb 8 – The stuff I follow for stocks is still bullish, so I am still bullish. Will the market header higher soon, or throughout 2025? It beats me. But, hey, discipline to follow the plan is discipline to follow the plan, right? @sentimentrader

And,

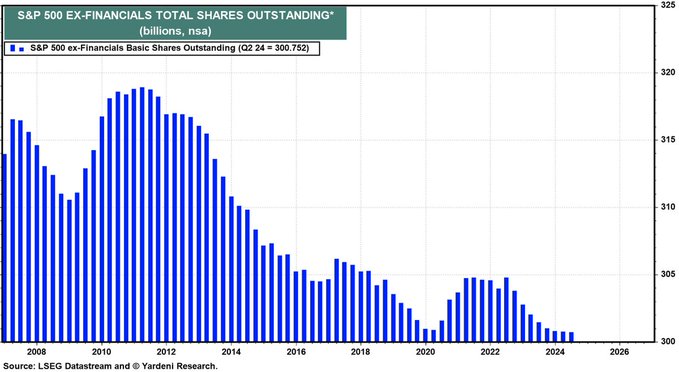

- Seth Golden@SethCL – The last time S&P 500 had so few shares outstanding (2019) $SPX delivered double-digit returns. Be in the business of buying ever-appreciating assets with ever-decreasing supply. $ES_F $SPY $QQQ $IWM $NYA $DIA

5. Just the two of them!

We watched the 2021 Brady-Tampa Bay vs. Mahomes-Chiefs Super Bowl this afternoon before the super bowl. And then we watched a virtual replica of that defensive performance. And Tom Brady himself remarked in the 4th quarter that Chiefs Offensive Line could not pass-protect today just as the Chiefs Offensive Line could not pass-protect against the Bucs defensive line in that Super Bowl. This is surprising because Andy Reed is an ex-offensive lineman. The Eagles played great. Their defensive mangled the Chiefs Offensive Line & hence even Mahomes & his electric offense.

There is no question in our mind that Mahomes-Reed & Chiefs will be back as winners. Mahomes is the best QB we have seen in this era next to Brady. But Brady to us is still No. 1 & therefore we did not want Mahomes to 3-peat.

Nick Sirianni was absolutely correct when he said Football is the ultimate team game. And they played a truly great game that will live in Super Bowl history. Just as College Football gave us its best this year & now NFL gave us its best.

Send your feedback to editor.macroviewpoints@gmail.com or @MacroViewpoints on X.