Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”complete utter disaster” & a breakout to the upside

There hasn’t been a more vocal supporter of Zelenskyy & of military support to Ukraine than Senator Lindsey Graham of South Carolina. What did say just after Zelenskyy & his outfit were “kicked out” of the White House? He called the meeting “complete, utter, disaster” and added:

- “I have never been more proud of the President; very proud of JD Vance, of JD Vance standing up for our country; What I saw in the Oval Office was disrespectful & I don’t know if we can ever do business with Zelenskyy again”

He even used the “Resign” term as a way to move forward. And this has been Zelenskyy’s most ardent supporter! Treasury Secretary Bessent who reportedly had a high decibel meeting with Zelenskyy in Europe wrote:

- Secretary of Treasury Scott Bessent@SecScottBessent – Thank you, President Trump, for standing up for the American people and our nation on the global stage.

The member of the Zelenskyy team one could feel sorry for was the Ukrainian Ambassador to America:

- Sean Davis@seanmdav – The Ukrainian ambassador to the U.S. appears to be the only Ukrainian in the room who understands how much damage Zelensky just did to his own cause.

If you heard the discussion live, you would see that President Trump tolerated ridiculous comments & semi-insulting accusations from Zelenskyy during the meeting. You would also see & hear that President Trump wanted Zelenskyy to agree to a ceasefire. Zelenskyy refused to do so & insulted the President by questioning his word. There was nothing to discuss after that.

We think President Trump was superb & he let Zalenskyy go on insulting him & the USA on air. When VP Vance protested these comments made on TV, President Trump stopped him and said:

- “I think it is good for the American people to see what’s going on; its very important; that’s why I kept this going for so long“

We think and we fervently hope that Zelenskyy is done. Yes, Macron & Starmer put up a brave public front & assured Zelenskyy of their support. What might President Trump think of that professed support? Watch & listen to the one-liner President Trump asked PM Starmer: – “Could you take on Russia by yourselves“? PM Starmer was visibly taken aback & laughed sheepishly without answering thus leaving UK’s image in tatters as the clip headline said.

The reality post Zelenskyy disaster is as simple as Jeffrey Sachs put it in a fiery speech to Europe – “Putin-Trump will end Ukraine war, cut your losses“.

After the initial spasmodic shudder at the Zelenskyy disaster, the markets came to the same & highly bullish conclusion around Friday 2 pm as all can see below:

But isn’t the above conclusion much more bullish for Europe? Markets tended to concur on Friday:

How perfect was the above for what Ryan Detrick had said on CNBC Squawk Box on Friday morning?

- ” …. lot of fear out there; individual investors most fearful they have been in history… there is a lot of outflow from ETFs & Mutual Funds; … we are near that area where we tend to have panic when you are down like 15-20%; actually we are sitting 3-4% off the lows; … pretty close to a low here, we think! …. don’t forget Fridays have been very very weak this year; nobody wants to hold over the weekend; … we need to see some strength on Fridays before we kinda get out of this choppy malaise that we have been seeing …. I think it will happen soon enough .. “

We don’t think Mr. Detrick thought his “soon enough” would be realized on Friday afternoon, just a few hours after he said it. Kudos to him for warnings us two weeks ago & mega kudos for saying look ahead for a rally almost at the perfect time, assuming our own bullish interpretation of Friday afternoon holds. And he added later that Friday’s “1.59% jump for the S&P 500 was the best Friday since May 2023 and the best Friday in February since 2022.

Not just that, but as Seth Golden @SethCL wrote ” Friday’s Advancing Volume in S&P 500 $SPX was the 2nd highest since Covid 2020’s market recovery. ” Double not just that, but he pointed out a weird but positively bullish fact:

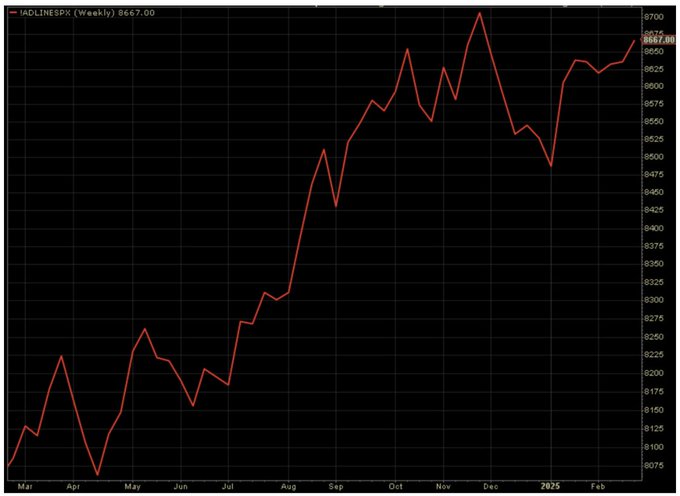

- Seth Golden@SethCL – While $SPX is down 3% from YTD highs, a significant bullish divergence occurred this past week with S&P 500’s A/D Line finishing at a weekly, monthly and year-to-date HIGH (2025)! Who would have guessed after this past week’s price action🤯 $ES_F $SPY $VOO $QQQ $NYA $IWM $DIA

All this fine for the big caps. What about Small-Caps?

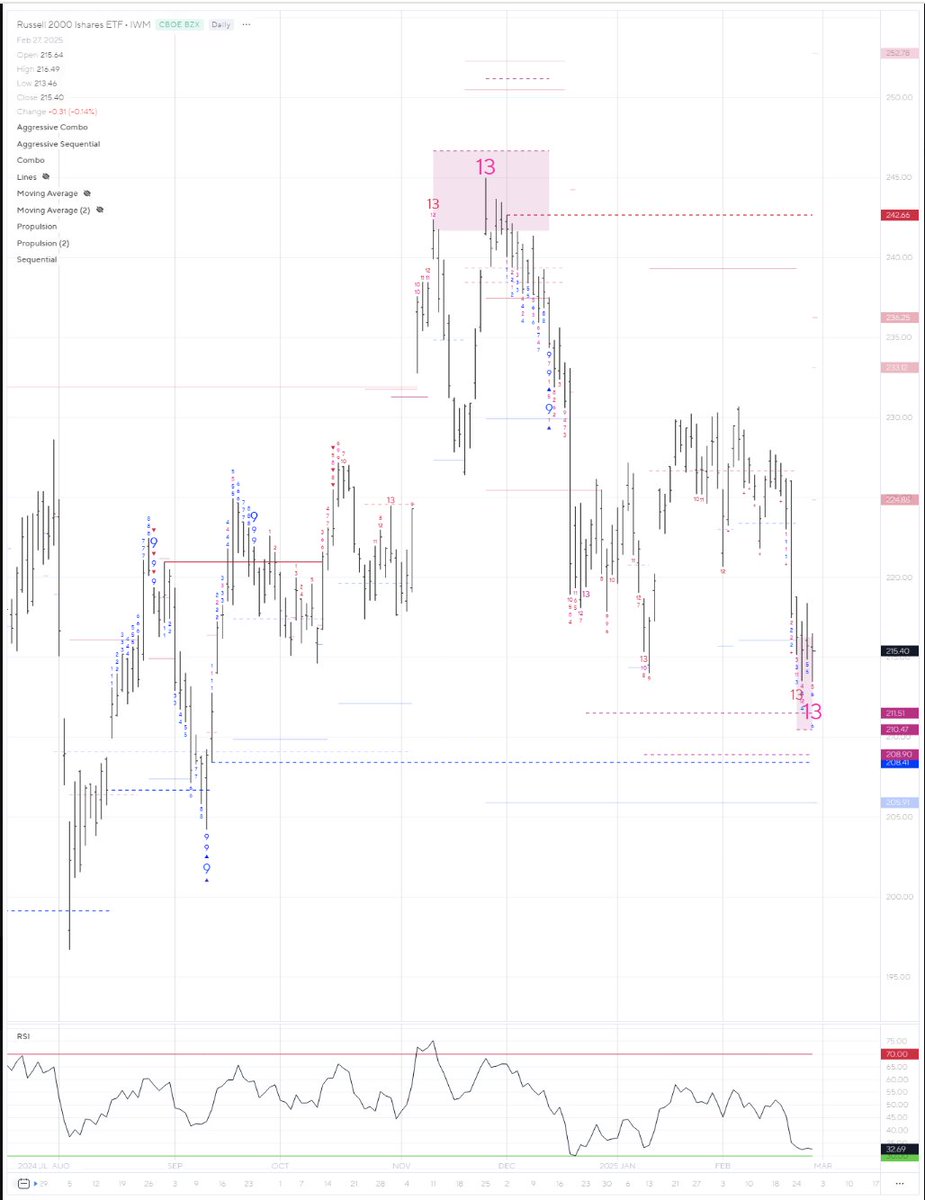

- Seth Golden@SethCL – 🤯 Boom !!… that just happened 🤯!! Small-cap Russell 2000 ETF $IWM ( $RUT ) triggered a DeMark 13 Sequential/Combo, signaling trend exhaustion. Recall, former Demark 13 sell signal marked peak most accurately, current trigger may have marked BOTTOM and renewed uptrend. $SPX $ES_F $SPY $QQQ $RTY $TNA $QQQ $NYA h/t nice capture by @pinkhasov

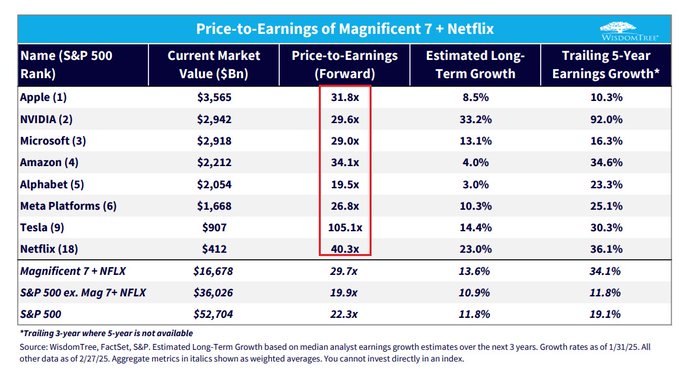

What about the Mag 7? Are they still way overvalued?

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – Mag 7 P/Es: reasonable except for one $TSLA

2. Treasury Yields & Fed

Not only was Ryan Detrick correct two weeks ago about the stock market, he also has been proved correct about adding long-term Treasuries & TIPs at that time. What does he think of Treasuries now?

- “when we look at inflation data…. there are many reasons why inflation is improving; … our take is 2-3 Fed cuts this year while the market is pricing just 1 rate cut; …. “

Warren Pies said “overweight bonds” two weeks ago because he expects the Fed to deliver 3-4 rate cuts this year. The most explicit views came from Mary Ann Bartels two weeks ago, when she said:

- on CNBC on Feb 10, 25 – “in the near term, we just had a break-down on the 10-year that would point to about 4.2%, but our target for the year is to be range-bound between 4% – 5%; … if the economy stays strong, I would not be surprised if at some point we are back up near 5%“

- on BTV on Feb 11, post CPI – “technically, I look at the 10-year; its formed a head & shoulders pattern and broke down; so there is a good chance that, if we get good inflation data this week, that we can actually see the back end of the curve actually drift down

The 10-year Treasury did touch 4.2% this past week. Does it now go to 4%, her lower-end target? Or does it now reverse & head higher? Perhaps Ms. Bartels tell us via Fin TV?

It seems some are now focusing on the work Elon Musk is doing with DOGE to cut waste. The figures of potential layoffs, especially in & near Washington DC, seem very high. No wonder we have begun hearing terms like “deflationary” to describe the economy. Below is one reaction we saw to the 2-year yield falling below 4%.

- James E. Thorne@DrJStrategy – Keep it simple. A chart of the U.S. 2-year Treasury yield showing lower highs and lower lows indicates that the credit market is assessing real-time economic and geopolitical factors and concluding that the economy is slowing, and inflation is not a significant concern. Old rule: the Fed follows the 2yr. Watch Wall St superstars that were calling for no rate cuts change their power point presentation. FFR will be in the 3% range by year end and the Fed will still be too tight.

But before we get too far, we would prefer to wait until the upcoming payrolls figure. That is also what the Fed watches, we hear.

Below is a summary of Treasury movements this past week.

- 30-year Treasury yield down 18 bps on the week; 20-yr yield down 18 bps; 10-yr down 21 bps; 7-yr down 24 bps; 5-yr down 26 bps; 3-yr down 24 bps; 2-yr down 21 bps; 1-yr down 8 bps;

- TLT up 3.4%; EDV up 4.7%; ZROZ up 4.9%; HYG down 15 bps; JNK down 5 bps;

3. China and/or India

Friday was deemed a disaster in the Indian stock market with BSE down 1.9%. On top of that, we saw the clip below titled India’s Dollar Short Position Is EXPLODING (Here’s What You Need To Know). That seems consistent with the fall in the Indian stock market. The clip introduction says:

- The new guy at the RBI said he wasn’t going to interfere with the rupee as much as his predecessor. Apparently, the dollar has left him with little choice. It’s the fundamentals that matter. And even India is showing more signs of forgetting how to grow. That’s why the dollar has been on a rampage again and why RBI can’t let it go.

On the other hand, European Banks are strong & their stocks are performing strongly. Yet, we saw the clip below about European Banks titled Something HUGE Is Happening to European Banks (Should You Be Worried?) The introduction of this clip says:

- European banks are surging into safety, buying the third most on record in January. At the same time, they scaled back activities in the real economy expecting further deterioration. Their behavior also backs up market pricing especially interest rates, while also exposing the fallacy behind them.

Getting back to India, Jonathan Garner of Morgan Stanley said:

- ” we are optimistic that by the June quarter end you will see a quite pronounced cyclical upturn in fact we think we’re seeing the signs of that already valuations have come back a lot for India um it’s below 20 times forward PE now and so if we do see that expansion coming through we think that’s a market that investors will want to take a a look at again; India’s become pretty much a retail market now now well the domestic mutual fund bid is ongoing still very strong about $3 billion a month I don’t think foreign investors actually switched out of India into China I relatively little of that is going on the big drivers of interest in China tend to be more Global pools of capital particularly out of New York interested in things like the internet e-commerce names ; that said of course there was profit taking in India after a spectacular three-year run um but we don’t think we’re looking at a multi-year downturn in India we actually quite confident but by the middle of the year the the bull market will resume there

A clip we liked quite a bit is Investing in China vs. India: Two money managers reveal their favorite; The two managers are Gareth Nicholson, CIO (International Wealth Management) of Nomura, and Florian Weidinger, CIO of Santa Lucia Asset Management. This is not a theoretical discussion but an active discussion about sectors & stocks.

Speaking of India, Bollywood films have always shown heroes talking boldly & responding verbally to people hurting them. Fans love the crazy dialogs even though they are crap & no hero actually fights. That has now come to political favorites. GUESS who is today’s favorite as example to Indian politicians:

- Congress Kerala@INCKerala – Both Rahul Gandhi and Zelenskyy speaks for their country! They don’t surrender their country’s interest in front of anyone. They don’t look at the size of the GDP and prostrate in front of the mighty!

We feel so bad for Zalenskyy!

- Manish RJ@mrjethwani_ – A true leader vs A Jhumlebaaz

This may become a little clearer when you realize that Rahul Gandhi & Congress have reportedly been large beneficiaries of USAID via their connections with NGOs.

Since we began with President Trump in the Oval Office, we should also end with President Trump in the Oval Office but in a clip that is funny from Comedy Central Africa.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.