Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Rally on Friday

Kudos go to Barry Bannister of Stifel who said on Thursday after the close that “at 5501 at 1:48 pm today, we made a tradable low …. we will get a bounce“. The next day the Dow rallied by 675 points (up 1.7%), the S&P by 117 points (up 2.1%), NDX by 479 (up 2.5%), SOX by 146 points (up 3.3%) & RUT by 50 points (up 2.5%).

Despite his almost to-the-minute call on the bounce, Bannister maintains his year-end target of 5500 on the S&P. That is because he sees a slowdown to which the market is going to react with another move down. But he doesn’t “see imminent recession“.

In contrast, the eminent Larry Williams posted a clip on Friday saying “I think it is Rally Time“. He gives 3 reasons for the rally – “Market is now undervalued; Smart money has been buying; Cycles say: now is the time“. And Mr. Williams explains his reasons with charts and discusses chart patterns of his “Stocks to consider” – TSLA, XLP, NVDA, ASML, AAPL. He ends his 25-minute clip with:

- “if we look at my cycle forecast … remember they are all saying we should rally right now. …. To wrap this all up, I think it’s Rally Time; I think its Rally Time for fundamental reasons, for technical reasons, for cyclical and seasonal reasons.”

2. Are you Tariffied?

What about Tariffs, you ask? Mr. Williams touches on that at minute 6:07 of the clip in the section “Wall Street is Tariffied” and gives a brief but important history lesson:

- “…. in part Tariffs began in St. Croix, beautiful Virgin Islands. Alexander Hamilton came from this little island, went to DC & was our 1st Secretary of Treasury and liked big tariffs. His idea was that if we can make it in America, big tariffs on it; if we couldn’t make it in America, then no tariffs on it & he used tariffs to fund the Government; until 1913 there was no income-tax. All the government revenue came in from tariffs“.

His view is that while tariffs may increase prices but they will increase jobs. And more jobs is very bullish. And “Drill baby drill” will lower inflation.

Speaking of tariffs, we think it might be important to listen to what President Trump has alluded to and what Treasury Secretary Bessent has said – their goal is to drive interest rates lower, goad the U.S. Dollar lower & get oil prices lower. And their target dates seem to be late 3rd quarter or 4th quarter of 2025. If they can achieve that, then they can argue that they have cured the mistakes of the Biden years and made America stronger by their pro-America economic policies and geopolitical leadership including an end to the Ukraine war.

If you look at the cycle chart of Larry Williams above, you will notice a sell-off in the S&P in September-October 2025 followed by a strong rally into year-end. Not a bad way to begin the 2026 Mid Term campaign.

Those whose confidence in America has been shaken should watch the entire clip of CNBC’s Sara Eisen’s conversation with Secretary Bessent this past week.

Speaking of being unshaken in his conviction of American Exceptionalism, watch BTV’s Haslinda Amin discuss it with the sound & balanced Dr. Ed Yardeni below:

- “I’m not giving up on American exceptionalism. I think what’s happening is a lot of the technological innovations that have driven the Magnificent Seven are now actually benefiting the productivity of the S&P 493. …. They were selling at a forward PE of 30 a few weeks ago, and now they’re down to 26, may be 25. So we’ve had a significant correction in the valuation multiple. But these are still great companies. A lot of these are cloud companies there’s demand for cloud & that’s only going to increase with artificial intelligence . And so this idea that they’re spending all this money on data centers and it’s not necessary, I think that flies in the face of the fact that they’ve got tremendous demand from customers to do more computing and on the cloud and more storage on the cloud. “

It is important to point out that Yardeni Research cuts its forecast of the S&P to 6400 from previous 7000 based on the risk of stagflation while keeping their 2025 & 2026 earnings estimates at $285/share & $320/share. The difference between the new targets & the earlier seems to be the Fed. Clearly if stagflation seems to be a serious possibility then Fed won’t cut rates & S&P won’t go to 7,000. On the other hand, as we believe, if inflation stays mild at worst and if Treasury rates stay down, then the Fed will cut rates & then the optimism about 2026 could lead to a lovely year-end rally.

But our main reason for featuring the above Yardeni clip is not their forecasts or targets for the S&P 500. It goes to the charts below:

If you plot the above comparison charts for a 6-month history, you would see very pronounced & juicy moves in ACWX (World ex-US) and FXI (Euro Stoxx 600), while the 1-year charts below simply point out that the excess returns of the S&P have closed to parity with ACWX & Euro Stoxx 600. The question remains whether having achieved parity with the S&P 500, does the recent outperformance continue or does the spread between S&P & the rest of the world remain small?

We don’t have a clue but it is the recent outperformance of non-US over US has raised the question of the end of American Exceptionalism. What did Dr. Yardeni say in the clip above?

- Look, in my opinion, the jury’s still out on whether these stimulus programs that the Chinese government has put together to boost consumption or whether the German program to improve German industry, are going to be successful. I mean, I think we know that given the American attitude towards defending Europe, that a lot of spending is going to go on to defense. And I guess that can be stimulative. But it’s not really going to make Europe suddenly an economic powerhouse. Europe really lacks a capital market that is as vibrant as the American capital market, that’s constantly providing financing for new ventures, for new technologies. And China has a rapidly aging demographic profile. And I don’t think they’re going to be able to stimulate their consumers. So I think, yeah, the stock markets in Germany and China have had a nice run here but I think they are going to kind of fizzle out once these realities come into better focus. And, I think, meanwhile, the US economy is going to turn out to be remarkably resilient in the face of what we’re seeing as a lot of chaos and confusion coming out of Trump 2.0. But I think the economy handled the tightening of monetary policy in the U.S. remarkably well over the past three years. And I think that’s going to be continue to be the case. So I think, there’s tremendous value here in the Magnificent Seven and a lot of technology names and semiconductor names. I think those names are going to turn out to be good values. I think this is a buying opportunity, not a reason to panic out of US stocks or to greatly change asset allocation away from the US towards either China or India or Germany or France.

That brings us to China and to the explosive rally in Chinese Stocks:

- “But look, China has been a frustrating market for a long, long time. It has been a tremendous underperformer for a long, long time. And I don’t see that there’s anything radically changing in that regard. And, you know, the Europeans just really, totally botched up the transition, the transition from fossil fuels to clean energy. The clean energy doesn’t work. It’s not reliable. They are going to be extremely dependent on natural gas from the United States. And they also have a geriatric population. And on top of all that, there’s a lot of social tension between immigrants that just aren’t melting into the societies over there. So I’m not that impressed by what’s going on over there. And, you know, sure they’re going to spend more money, but I don’t know that its going to work.”

Of course, as we all know, the huge rally in Chinese market is based on the promise of massive fiscal easing in China. And it has the blessing of Signor David Tepper. Any one when went in on his call has done very well indeed. We don’t see Chinese easing up on their fiscal injection at least until the Presidents Summit between Trump & Xi.

But notice that the huge outperformance of Chinese market has been only a 2025 story. If you look to a 2-year chart, you see that the two markets are now at par.

All this stuff is fine but you know what we really want? Inputs from Mr. David Tepper about what he thinks of China, USA & stocks vs bonds. Would Joe Kernen & Steve Weiss, two friends of Mr. Tepper, help US-based investors in this regard?

4. China & India

US SPX is still a few percent ahead of FXI China on a 2-year basis. In contrast, FXI has gone ahead of INDA on a 2-year basis this month.

You need to go back 4 years to see sizable outperformance of INDA over FXI.

Notice that the outperformance of China over India began in October 2024, when China announced its fiscal drive to increase its money supply & India, due to its currency fall, launched a fiscal contraction program.

The more interesting chart is the 1-month chart between INDA & SPX. It shows INDA chart rising above above the SPX chart in March thanks to the violent sell-off in SPX in the US market.

Is that because the International Investors are at their minimal portfolio allocation in India? There is no sign yet of equity portfolio flows returning to India. On the other hand, Indian Government released its annual budget in February 2025 that was described as investor & middle-class friendly with tax cuts. Is that why we are seeing an outperformance in INDA over SPX? We should know soon since we expect a rally in the S&P going forward.

To get into a bit of minutiae, read what the Morgan Stanley strategist said this past week:

- “RBI (Reserve Bank of India) has put a 3-pronged correction – cutting interest rates; committing itself to liquidity & starting to lift regulatory burden on Banks; the Government’s fiscal contraction continues but the pace of fiscal consolidation is going to be a lot slower in the subsequent 12 months… at the same time, the government’s capex budget is going up; they are achieving this by cutting subsidy spending which has now hit all-time lows … “

Then he makes a bold point:

- “India’s policy environment today is far more certain than the rest of the world’s, whether it is US, Europe or China; …. our retail investors get it; I suspect February might have seen record inflows; …. this is a shift in the balance sheet allocation that got underway in 2015; “

Then Desai moved on to Bond investors:

- ” look what bond investors are doing; 900 million dollars of inflows two weeks ago; last week 2 billion; Foreign debt flows have turned vertical (via gesture) ; they are suggesting that Rupee has now reached a level where they don’t expect much more in terms of downdraft; that has been a very important change that has happened“

And take a look at what happens next week in a 59 second clip:

5. Back to Tweets & Charts

We began the article with a terrific investor; we begin this segment with kudos to one of the absolute best;

- J.C. Parets@allstarcharts – Mar 14 – Berkshire Hathaway just closed the week out at the highest levels in history. Now over $1.1 Trillion in market-cap. Shout out Uncle Warren

Perfect?

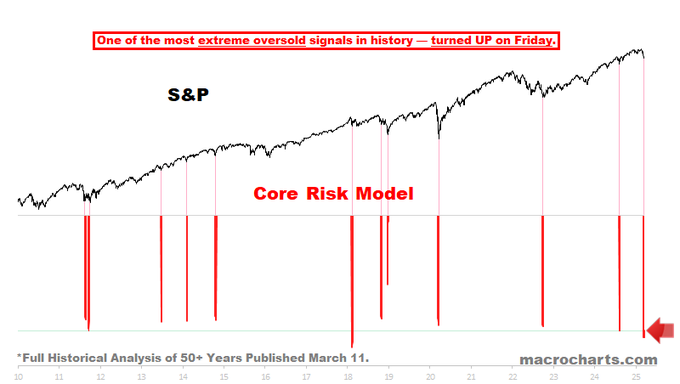

- Macro Charts@MacroCharts – Mar 15 – Perfect setups are very rare. But this could be it.

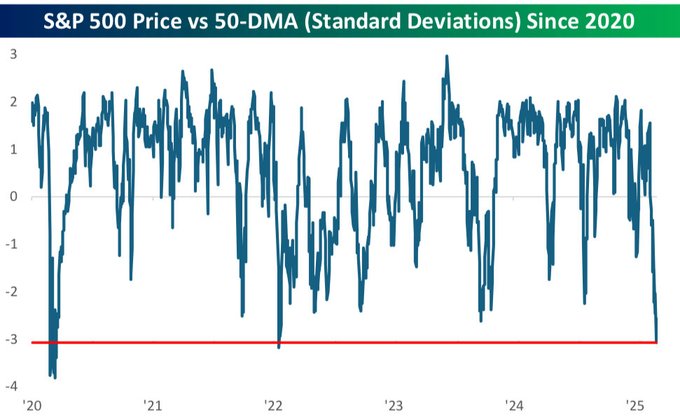

Oversold?

- Bespoke@bespokeinvest – Mar 15 – Here’s a look at just how oversold the S&P got this week. Doesn’t usually stay that way long even in market downtrends.

Looking at it from view of Advancers:

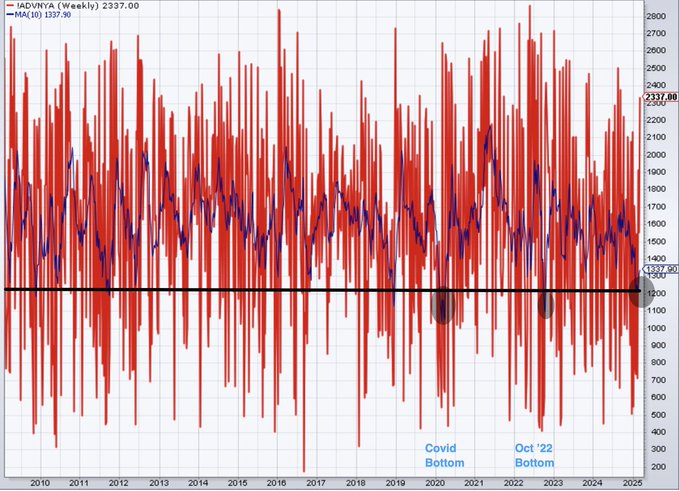

- Seth Golden@SethCL – Bottom is in🎤 Only 3 other times has 10-week moving average of NYSE Advancers been lower 1) Covid bottom 2) October 2022 bottom 3) 2018 bear market bottom. Something tells me we are witnessing the bottom of correction. $SPX $SPY $NYA $ES_F $QQQ $NVDA $IWM $NDX h/t @ChrisDMacro

Speaking of tech stocks,

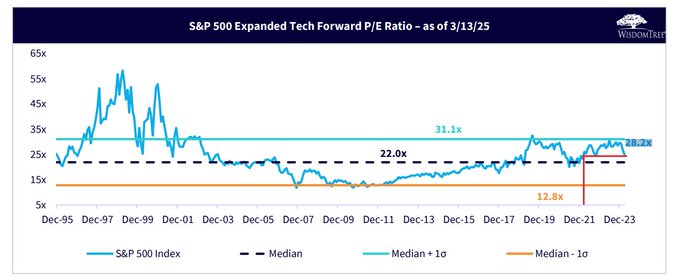

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – SPX Expanded Tech P/E 28.2x P/E – Nearly the cheapest in two years

Shouldn’t the always WRONG be noticed, condemned but thanked? Thanked because their grave errors can make money for sensible folks!

- Ryan Detrick, CMT@RyanDetrick – We came into this year with most turning quite bullish and optimistic about the economy. A flush was needed. Now we have this cover. Do covers over the top like this happen closer to tops or bottoms?

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.