Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Triggers this past week

The difference one word makes! Look what happened on Friday at noon when we heard on air that Pres. Trump used the word “flexibility” in describing his views on “exceptions” & “exemptions” .

The “Trump word” at noon lifted the S&P vertically & then the closing buy move lifted the S&P to about 51 bps on the week. That prevented what Ryan Detrick warned about at around 2 pm:

- Ryan Detrick, CMT@RyanDetrick – The S&P 500 has been up the past 3 Fridays. Currently down 0.2% with two hours to go. Hasn’t hit 4 in a row since August of last year.

But what about the “tussle” the market was fearful about last week? Well, check out Wednesday’s action:

What was the one issue the market was worried about? The “tussle” between the Fed & President Trump! Notice that the SPX was below last Friday’s low just before 2 pm on Wednesday. And note what Mark Newton of FundStrat had said on CNBC Squawk Box on Wednesday morning:

- “We are starting to see fear turning to capitulation; Not only have we seen inversion in the VIX curve … we saw that the Put-Call ratio is now right close to 1 & registered 0.95 last week.”

The above chart shows you that the market was worried that the Fed would act adamant & lead to another steep fall. But Chair Powell surprised on the upside. Not only he steadfastly adhered to his “dovish pause” in his presser but he did not reduce the impact of the FOMC statement that had delivered a “Mini QE-injection“, as one trader was quoted as saying on CNBC. That was greeted by a “babababoom” vertical move which reached the week’s high (about 5715) before giving back some at Wednesday’s close.

In our humble & uneducated opinion, two major issues were put to rest at least for the next two weeks into April 2. The first was the rapprochement between the Fed & President Trump that should lower the risk of tighter monetary conditions hurting the economy and the second was the almost “joyous” relief at the “flexibility” announced by President Trump. That made the rocket rally of two consecutive 90% up-days seem real & believable. What that means was explained by Ryan Detrick the day before on Tuesday March 18:

- “last 2 days more than 90% of all the stocks in the S&P were higher; that’s extremely rare & that’s usually a sign that sellers have exhausted themselves; every one got all Bear-ed up & then the Bulls take over; … last 11 times this has happened (back to 72) – back-to-back 90% days – six-months later we were higher every time, up well over double digits; a year later once again higher every time ; it is what it is; …. last 2 days could very well be saying that we are trying to make a pretty significant low ….. a few days ago, we saw a huge spike in the put-call ratio; got 55% bears weeks in a row” … last time we saw something like that was March 2009 … as we say “volatility is the toll you pay to invest“

Like Detrick, Warren Pies was one who had warned us of a decline in the stock market before it hit & he had gone under-weight equities. On Monday, he spoke with CNBC’s Mike Santoli:

- ” …. we have had a 10% pullback & I think you need to start having an offensive mindset given the fact that we don’t see a recession at this time“

But why isn’t he going over-weight equities? He said:

- “lows are in for the next 2 weeks in March but I think April is going to be one in which we potentially revisit the lows we saw in March; So you wait until April & play for a fat pitch in the sentiment indicators … “

Instead of generic talk about the economy, Pies pointed out that the recent 10% sell-off has already erased wealth to the tune of 12% of GDP, a 13-th washout of this magnitude. He pointed out that the lower income strata is already in a bit of recession and so if you get the high income consumer pulling back, it would be bad for the economy. That is what could be different in this cycle, he added.

Barry Banister who called last Thursday’s low almost to the minute told Mike Santoli that we are in a reflexive rally that could reach 5850 as soon as next month. Then, he says, we will see a U-shaped inflation rise & no rate cut in the second half of the year.

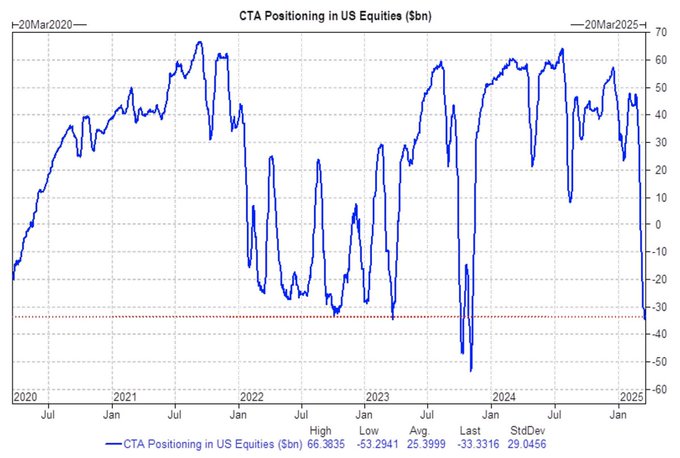

In contrast, CTA positioning seems to suggest a rally after the April 2 tariffs date:

- Seth Golden@SethCL – Mar 21 – Goldman Sachs: “CTAs are net short equities for the 1st time since 2023 and we don’t see them relieving this position until after April 2nd tariffs.” This is the match likely to start the short-covering rally fire🔥 thereafter. $SPX $ES_F $SPY $QQQ $NVDA $IWM $NYA $VOO

But are Pension Plans ready to buy into quarter-end?

- zerohedge@zerohedge – whoa: “Pension Funds and Target Date Funds are poised to Buy into quarter (+$100 bn – largest since March of 2020)” – UBS

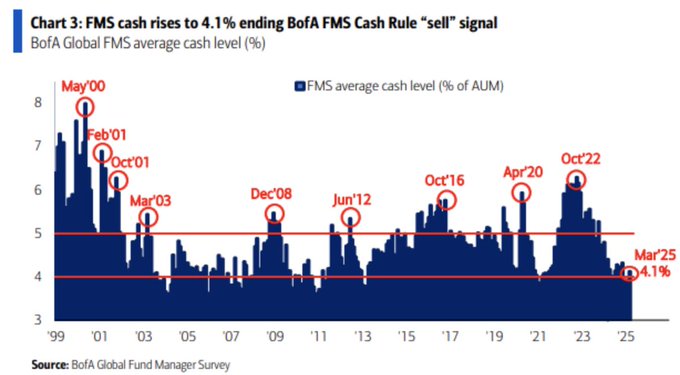

That brings us to BofA:

- Seth Golden@SethCL – BofA: Sell Signal Ends – “Fund Manager Survey cash level rose 62bps (largest 1-month jump since Dec’21) from 3.5% to 4.1%. The rise in cash level to 4.1% ends the former “sell signal“. $SPX $ES_F $SPY $QQQ $IWM $NYA $VOO $NVDA

And,

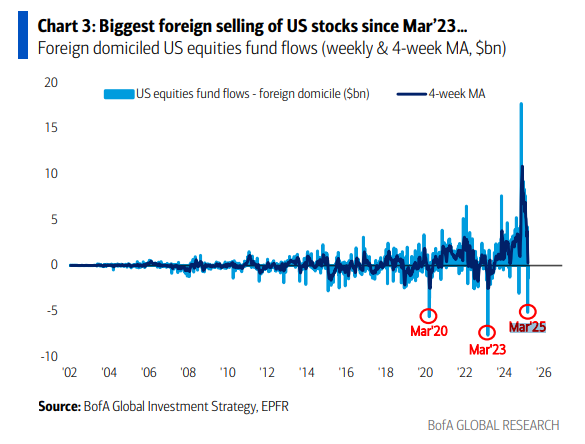

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – BofA EPFR: Biggest foreign selling of US stocks since Mar’23…

2. Markets Last Week

An overview:

US Indices:

- VIX down 11.26%; Dow up 1.2%; SPX up 51 bps; RSP up 65 bps; NDX up 25 bps; SMH down 65 bps; RUT up 64 bps; MDY up 44 bps; XLU up 14 bps;

When will see the red extremes convert to green?

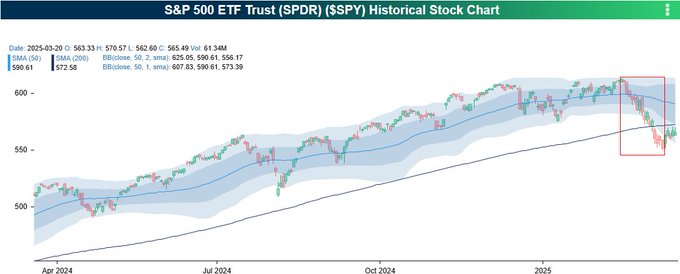

- Bespoke@bespokeinvest – The recent frequency of red candles in the chart of $SPY since its February high has been extreme.

Key Stocks & Sectors:

- AAPL up 2.02%; AMZN down 61 bps; GOOGL down 62 bps; META down 1.67%; MSFT up 78 bps; NFLX up 4.89%; NVDA down 3.2%; MU up 5.37%; BAC up 3.99%; C up 4.58%; GS up 4.43%; JPM up 4.11%; KRE up 1.32%; EUFN up 59 bps; SCHW up 1.66%; HDB up 6.33%; IBN up 6.83%;

Dollar was up 46 bps on UUP & up 42 bps on DXY:

- Gold up 1.1%; GDX up 2.13%; Silver down 2.35%; Copper up 4.53%; CLF down 9.15%; FCX up 3.89%; MOS up 7.49%; Oil up 1.44%; Brent up 2.11%; OIH up 1.92%; XLE up 3.43%;

International Stocks:

- EEM up 4 bps; FXI down 2.7%; KWEB down 3.4%; EWZ up 2.67%; EWY up 1.52%; EWG down 57 bps; INDA up 5.22%; INDY up 5.45%; EPI up 5.24%; SMIN up 7.63%;

Two quick comments:

- zerohedge@zerohedge – JPM trading desk: “we have seen the immense demand for Europe begin to subside“

And in a reverse way:

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – India really coming back to life here.. $INDA relative strength impressive this month

Treasury & Fixed Income:

- 30-year Treasury yield down 3.1 bps on the week; 20-yr yield down 4.2 bps; 10-yr down 6.8 bps; 7-yr down 8.3 bps; 5-yr down 8.8 bps; 3-yr down 8.5 bps; 2-yr down 7.7 bps; 1-yr down 4.5 bps;

- TLT up 67 bps; EDV up 91 bps; ZROZ up 65 bps; HYG up 43 bps; JNK up 1.23%; PFF up 68 bps; EMB up 29 bps;

Actually the action in Treasury yields is mediocre given what the Fed did this week and the conviction expressed by Jeff Gundlach on CNBC that they deem the probability of recession to be 50%-60% and, consequently, they have begun cutting leverage.

And we saw Carter Worth show & discuss a chart of the 10-yr yield on Friday CNBC Fast Money. He said he thinks to the 10-yr will go down further & remain in a 3.5% – 4.5% range. His colleagues on the show, especially Tim Seymour, said it would not be a positive if the 10-year yield fell to 3.5%.

We have to hand it to CNBC Fast Money & the powers that run the show. They will NOT let their viewers be sullied by the possibility that the 10-year yield might go down that hard. What other reason could they have to NOT include this clip by Carter Worth, that borders on sacrilege for them, on their website or on X?

Finally back to US stocks:

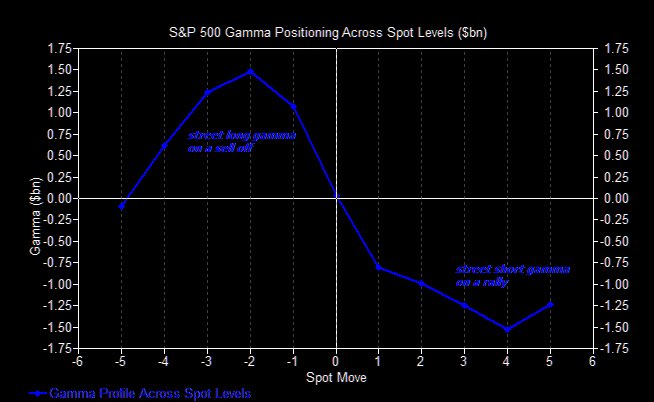

- Menthor Q@MenthorQpro – Goldman Sachs “Dealers get longer gamma to the downside and need to buy deltas should the market fall….they become short gamma in case the market moves higher, and will need to buy deltas to hedge. Dealers are in buy or buy mode”

And a curious timing call:

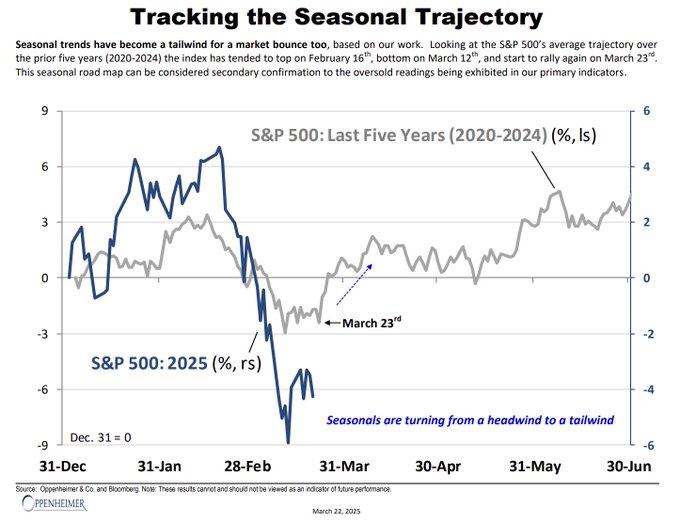

- J.C. Parets@allstarcharts – Great seasonality chart from @AriWald this weekend. “Looking at the S&P 500’s average trajectory over the prior five years (2020-2024) the index has tended to top on February 16th, bottom on March 12th, and start to rally again on March 23rd.“

3. Contd. from last week

Last week we had quoted Ridham Desai of Morgan Stanley India saying:

- ” look what bond investors are doing; 900 million dollars of inflows two weeks ago; last week 2 billion; Foreign debt flows have turned vertical (via gesture) ; they are suggesting that Rupee has now reached a level where they don’t expect much more in terms of downdraft; that has been a very important change that has happened“

Fast forward to Friday, March 21 to read Indian rupee set for best week in 2 years on dollar inflows. No wonder this week large-cap India ETFs were up 5%+ while the BlackRock Small Cal ETF was up 7.6%.

Last week, we had shown INDA rising above the SPX in a 1-month chart. Look at it now:

That is OK but the next chart surprised us. It shows that $INDA has rallied to equal SPX for 2025.

That is nice but it doesn’t correct the big plunge since October 24:

Yes, the $INDA rally has made up much of the difference with the S&P since the plunge in the Rupee & $INDA since October 24. But that has quite a bit to do with the 10% correction in the S&P in the last 5 weeks. It would be interesting to see how the Indian stock market does during the S&P rally so many smart investors expect ahead.

4. Starlink in India while CNBC is out of it?

This is an interesting news with different colors. Starlink has now decided to enter India. Many Indian consumers & businesses already access the internet both via Fiber broadband & wireless 4G/5G internet. So what does Starlink add? Fortunately for simple folks like us, Mint, originally a Wall Street Journal startup, explained it cogently in less than 5 minutes:

The introduction tells us

- “Starlink is expected to bring Satellite Broadband to the nation’s remotest corners. It is designed for regions where laying fiber optic cables is impractical & expensive“.

So it is easy to see why the two largest internet providers are teaming up with Starlink to offer its services thru their platforms. These two have not focused on these remote corners where it is hard to make the money they make in India’s large & medium sized cities. Another angle occurs to us – both Ambani (owner of Jio) and Mittal (owner of Bharati) are billionaires who have learnt to work with powerful Governments. To them the opportunity to partner with Musk is an exciting prospect given Musk’s business successes & his ventures worldwide. And Starlink cannot sell to a 1.4 billion people without country-wide sales-support organization which these two partners can deliver.

We had first heard about Starlink via its presence in Ukraine & its delivery of satellite communications to Ukrainian fighters. Only a Satellite communication company can do so. Despite the density of its population, India has many regions that are sparsely populated either due to border issues with China & NaPakistan or because of heavy forestations & distances. We have no idea what the Indian troops or Indian support organizations in those areas use to connect with their HQ. Clearly Starlink can help a great deal. And with presence of Starlink in India, the Indian Government can work with Starlink to monitor communications by & with these anti-India groups.

In fact, that brings us to the WION clip below that touches on conditions laid down by the Indian Government on Starlink:

That brings up a question that does interest us. Why couldn’t we find any clip or article from the US entity that gloats about being “first in business worldwide“?

Actually we did find a clip to match what we heard on air. Frankly we wish we had not heard it or better that CNBC had ignored this topic.

The introduction by CNBC sets the laughing stage:

- Host Kelly Evans – Starlink’s expansion of its internet service got the green light in India but its success lies in the hands of two billionaires & Seema Mody has that detail in TechCheck:

- Seema Mody – “That’s what sets this deal apart – Elon Musk’s Starlink partnering with India’s two telecom companies Reliance Jio & Bharat Airtel that are run by powerful billionaires“

What did Kelly & Seema think they were discussing – a dating contest between two Indian billionaire for debutante Elon Musk? Host Kelly Evans tells viewers that Seema Mody has “that detail” & Seema Mody says “that’s what sets this deal apart“???? Just look at the face of Kelly Evans as she sets the “who gets the date” question & Seema Mody’s face as she talks about “powerful billionaires“.

Mukesh Ambani already has a big partnership with Larry Fink of BlackRock and an AI partnership with Jensen Huang of NVDIA. Now Kelly Evans & Seema Mody think he is going to “date” Elon Musk. The tone & the signal of their discussion is about which partner will like Elon more.

Neither of these CNBC morons understand that the two Indian billionaires are NOT in competition for Musk & Starlink. Offering Starlink as an option on their platform is additive to both large companies. And the success of Starlink is not dependent on which of these billionaires like Musk more.

Then Seema Mody goes off her own deep end & compares Starlink’s entry in India with that of Walmart, Amazon & Apple. Seriously how stupid is she? Starlink is a service while Walmart, Amazon & Apple had to set up manufacturing factories & a retail network. Walmart & Amazon compete with Indian stores that sell same or similar merchandise.

In contrast, Starlink is introducing a completely new service in India, a service that is not available in India. Selling these services to customers is additive to both Reliance Jio & Bharati Airtel.

Seriously, why didn’t either Kelly or Seema even check out the clips we used above? These clips were published 2-6 days BEFORE CNBC hosted this segment on Friday. Listen to the CNBC clip and you will see that Seema made one call to some research outfit & simply blurted out the crap they told her. And Kelly just swallowed it hook line & sinker. We find this to be utterly unprofessional & insulting to CNBC viewers.

We are used to such nonsense from CNBC’s Seema but we were surprised by Kelly’s stupidity. Then we remembered that Kelly Evans had showered fulsome praise on a young billionaire wife of Indian origin for the unbelievably difficult task of bringing up daughters instead of sons, something that hundreds of millions of Indian mothers do. May be, the word “billionaire” is what entices Kelly Evans to lose her emotional balance!

Now compare the pathetic content above to professional, accurate & well-researched pieces about China by CNBC’s Yunice Yoon or Melissa Lee. Why this massive contrast between well-prepared stories & clips about China on CNBC & the above debutant-type coverage of Starlink’s entry into India on CNBC? The only conclusion we can draw is that CNBC Management has utter contempt for India while they respect China. In the past CNBC-type organizations used to use Cow-props to describe India; does today’s CNBC use billionaire-props to cover who will be a better partner for Starlink???

Neither Bloomberg nor Fox suffer from CNBC’s racist preference for using only an “Indian-origin” on-air face to report Indian stories regardless of her ignorance & her basic lack of news judgement. Perhaps now we get why CNBC India seems to utterly ignore the existence of CNBC USA!

Seriously folks, watch the Mint clip & the CNBC clip above & decide which one of the two is a “business journalism” clip and which one is something way different!

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.