Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”acute fear is ending“

said gentle & composed Sant* Mike of CNBC in his Friday’s end of day comments. A perfect comment to end a week that tired out most investors. Now, after so much was said on TV, it may be the time to look back to similar market turmoil & see if there are some signs for the next few weeks & months.

- Scott Brown, CMT@scottcharts – Last week, the S&P 500 opened lower by more than 2% but closed up more than 5%. May 1970 was the only other time we’ve seen that. It marked a multi-year low and stocks gained an additional 56%

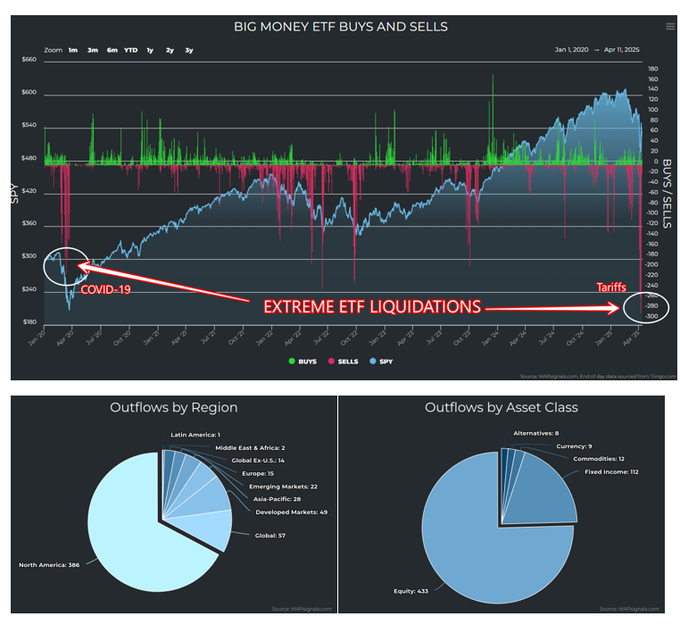

Liquidations seen last week:

- MAPsignals@mapsignals – What a week it was; #ETF liquidations reached COVID-19 magnitude; Bonds = liquidated ; Stocks = liquidated; Currencies = liquidated; Global = liquidated. This only occurs during forced selling events. $SPY $QQQ #stocks

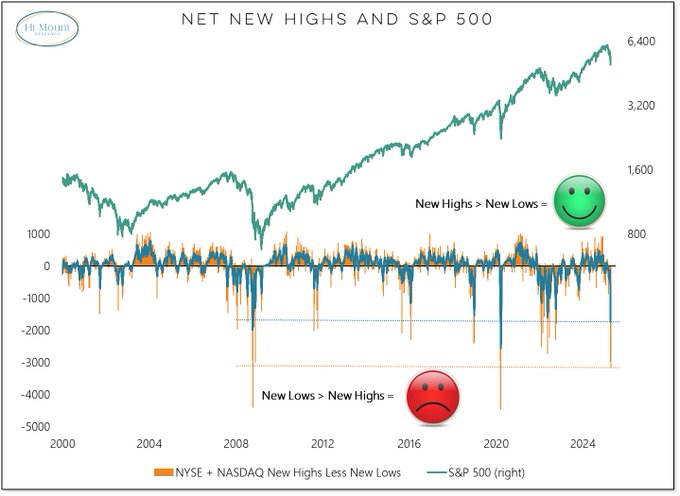

New highs vs New lows:

- Willie Delwiche, CMT, CFA@WillieDelwiche – Net new highs (new highs less new lows) have plummeted to a level that has been exceeded only twice in the past quarter century: October 2008 and March 2020.

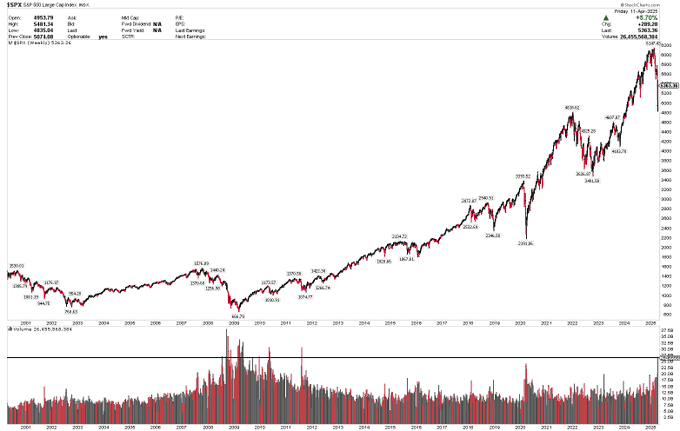

What about volume?

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Apr 11 – $SPX just put in the highest weekly volume in 14 years. Similar volume spikes in 2009, 2010, 2011 and 2020 marked major market lows. On a technical level, this week’s massive volume selling flush and reversal is identical to prior major market lows. Only 2008 broke lower.

Stress & divergence

- Jim Bianco@biancoresearch – April 10 – 1/4 – How stressed are markets? By this metric, the most in 17 years. — SPY = The S&P 500 Index Trust. This was the first ETF created in 1993 and is one of the largest at $575 billion. —- The middle panel is SPY’s Net Asset Value (NAV). The price closed at a 90-basis-point premium to the underlying value of the assets. The last time anything like this happened was 2008. To emphasize, not even in the crazy days of 2020 did its divergence get this big.

Add to this the smart change from President Trump & its embrace from a leading analyst:

- Dan Ives@DivesTech – “This is the dream scenario for tech investors,” Dan Ives, global head of technology research at Wedbush Securities, told CNBC. “Smartphones, chips being excluded is a game changer scenario when it comes to China tariffs.” @CNBC 🏆🐂🔥👇

Going back one more day from above, we saw & heard Jeff DeGraff of Renaissance Macro make bold with their views going forward. Speaking first about the previous Friday April 4, he said:

- “things got fired for us on Friday; started getting negative volatility alerts ; standard deviation moves of over 50%; that to us was scary but pretty consistent with getting max stress“

Speaking of Beta in particular, he said:

- “Beta in our ranking was in the zero-percentile; meaning you hadn’t seen returns as bad for Beta ever in the history of our data; the last time they were even close was in 2020 when we were in the midst of the COVID crisis & then in Summer of 2022 was about a week before the lows… “

He called Beta their best tactical trade:

- “there is a massive, massive convexity to Beta right now ; that’s gonna continue to play itself out on the street & that’s got days & weeks to go…. it could trade at least to the 200-day moving average … “

But for trends that got oversold & didn’t crack with all this stress in the bond market & equities, he said:

- “financials have held their own very very well; so banks, international banks, all these look really really good in long-term bullish uptrends; “

In summary, he said:

- “if your thing is from now till year-end, then financials; if for now to month-end, quarter-end then Beta“

Then DeGraff venture into blasphemy (the CNBC kind) and said “10-year has a lot of resistance at 4.40%; …. long bonds make some sense here; … its a pretty good time to get into long bonds …”

How did financials perform this past week?

- BAC up 5.4%; C up 6.8%; GS up 5.4%; JPM up 13%; KRE up 74 bps; EUFN up 5.4%; SCHW up 12.1%; APO up 15.9%; BX up 6.7% ; KKR up 9.3%; HDB up 4.4%; IBN up 4%;

Mark Newton was not as direct on Friday morning on CNBC Squawk Box when he said “evidence suggests that equities have made a bottom or are in the process of making a bottom … L-shaped market … we go sideways for 1-2 months …. sentiment is turning into almost capitulation … ARMS at 3.43; … 60:1 Advance Decline ratio“.

Then even Newton ventured into blasphemy when he said “basis trade drove the Treasury action …. one of the fastest up moves in bond market in 40 years .. will see rates start to come down in the next months …. “

That “fastest up move in bond market in 40 years” statement has to take us to:

2. Treasury Market

First the actual numbers for last week:

- 30-yr yield up 43 bps on the week; 20-yr up 46 bps; 10-yr up 46 bps; 7-yr up 47 bps; 5-yr up 43 bps; 3-yr up 35 bps; 2-yr up 29 bps; 1-yr up 17.5 bps

- TLT down 6.8% on the week; EDV down 9.4%; ZROZ down 9.7%; HYG down 4 bps; JNK down 6 bps; PFF down 1.1%;

The numbers, though bad, don’t even give a hint of the real story. Usually successful Treasury auctions tend to calm the Treasury market. The 10-yr auction on Wednesday at 1 pm went well. Treasuries rallied for a bit & then began falling hard. The bottom held but drove Mohammed El-Erian to remark at about 3:40 pm that “the Fed got very close to intervening in the Bond market for the wrong reasons“. But the US Dollar was up on Wednesday.

Warren Pies, a smart hedge fund manager, said on CNBC that they were hearing rumors that foreigners were selling Treasuries. Did this selling in Asia result in the 30-yr yield spiking to 5.02% on Wednesday night, as Andy Brenner pointed out below on Thursday?

Thursday was worse but perhaps not in the plumbing sense for the Treasury market. The 30-year Treasury auction, the toughest of them all, was Stellar in the word of Rick Santelli. But soon after the auction, the Treasury market fell hard with TLT down 2.8% on the day and simultaneously the U.S. Dollar stunningly fell 2% on the day.

Right after the Treasuries reversed despite the stellar 30-year auction, Andy Brenner of Nat Alliance, CNBC’s Steve Liesman & Rick Santelli got on CNBC Exchange. Andy Brenner opened the ball with “first of all, the bond volatility really scares me; its above 51; … I see the Dollar selling off; the fact that the long bond spiked to 5.02 the other time really bothers me; I do fear the same thing that Rick fears – that we haven’t seen the worst of Treasuries as of yet;”

He added, in response to a question by CNBC’s Kelly Evans that “the absolute levels are fine but I just don’t think the momentum is there for you. When you look, as Rick just said, the 2-10 spread has gone from 50 bps to over 100 bps;”

CNBC’s Steve Liesman added “ the MOVE index (volatility measure) has gone from 90 to 124; yesterday 2-10 spread in a 2 standard deviation move ; the stock market is over at the kid’s table; bond market is supposed to be at the adult’s table. when you see that kind of volatility ... “

But we noticed that no one talking about Treasuries on air was a specialist in Liquidity solutions for fixed-income investors. Not just a specialist but one who works with a large base of clients on liquidity solutions. Some one like Mike Siegel, Goldman Sachs Global Head of Liquidity Solutions who happened to be on Bloomberg TV with BTV’s Sonali Basak. His annual Global Insurance Survey has 405 companies representing over $14 trillion in balance sheet, assets combined – about half the industry’s base. Below are excerpts of what Siegel said:

- “Right now, it is primarily an equity market event; concerns me that it becomes a bond market event. Rising yields are not that much of a problem. Draining liquidity becomes a problem. …. within our clients they thought the equity markets would be well-behaved, not rip-roaring but well-behaved. That view is changing quite dramatically; they also thought that rates had peaked & would be coming down slowly both at the short end to the long end. And I think that’s still the prevailing view. So this back up in longer term rates is looking like an investment opportunity. … You have elevated the amount of uncertainty which is elevating the amount of risk ; I need to get paid a bigger risk premium to hold any of these instruments. And that’s why we see credit spreads widening out“.

Then on Friday morning, we felt good to listen to a veteran sensible voice – Tony Crescenzi of PIMCO at the end of Bloomberg Surveillance (minute 2:09:50 onwards). The first topic he handled was the talk of China selling US Treasuries:

- “people talk about China selling; that they well start selling. They have been selling since Feb 2022; when Russia invaded Ukraine. At that time they had $1.15 trillion in US Treasuries. Now they have $750 billion , almost $400 billion has been sold so far. So the idea that China selling will have an impact is kinda looking in the rearview mirror; could see more of that for sure for geopolitical reasons but it’s not the determinant of yields right now!”

Then he put the size of US Treasury market in sensible perspective:

- “I was looking this morning, as any one could, on the IMF website, the COFER data; it shows how much of the World’s 12 trillion in reserves is put in the US Dollar. The figure today is 58%; next close set of nations is Europe at 20%; About the Chinese currency, it has fewer reserves in its currency than in the Canadian Dollar.”

- “Next is Liquidity. The US bond market has seen, according to the NY Fed, a $700 billion or so of daily volume, No market comes close to that; this isn’t to say that over time monies held in Dollars can move into Euros, Yen. It’s possible but it will be gradual not immediate“.

Crescenzi’s views about the deficits & the need to deleverage are similar to those expressed by Gundlach this week. But that is an issue that will be evidenced not in a 2-3 day explosion but in steady erosion. His next point might jar those who look at everything via political lens:

- ” the big signal this week from policymakers in Washington & Trump’s team of rivals is the ascension of Scott Bessent, Treasury Secretary, speaking more in a calm fashion in ways we are used to; Rubinesque you could say as we saw in Bill Clinton & Robert Rubin, Treasury Secretary. “

We personally agree totally. In fact, we think Trump-Bessent is likely to far exceed what Clinton-Rubin achieved in that era.

Perhaps the calm, sensible & smart commentary of Tony Crescenzi rubbed off on the Treasury market. Look what TLT did from about 11 am onwards on Friday and look how S&P followed TLT in its up move & then eclipsed it in the afternoon. So if the Crescenzi magic carries over next week, then the TLT-SPX pair can be the twin engines of a rally.

(TLT-SPX on Friday, April 11, 2025)

Then came the sensible declaration from the Fed in the afternoon on Friday.

3. Sensible vs Frantic

On Friday afternoon, we heard David Zervos, Chief Market Strategist at Jeffries speak with Kelly Evans & Steve Liesman on CNBC. His basic posture is that the trade landscape is changing & that has the look of a battle.

About two hours after that, Krishna Guha, Vice Chairman at Evercore & former Mr. Guha, appeared on CNBC to speak about his views of this week’s action in the Treasury market.

We are running out of time to present our views of the two clips. So we will simply let readers decide which of the two opposite views they prefer.

4. Multi-Dimensional Chess

If you listened to the above clip of Tony Crescenzi of Pimco, you might have noticed that he described President Trump’s style as “the multi-dimensional game of Chess Donald Trump plays“. That was made evident this week when Treasury Secretary Bessent said “no one creates leverage for himself as President Trump“. Look how skillfully President Trump isolated China into a corner that neither its neighbors nor its client states have left to work with America.

Secretary Bessent correctly labelled “China as the most imbalanced economy in the history of the modern world & they are the biggest source of the US trade problems and indeed they are a problem for the rest of the world“.

White House Press Secretary Leavitt said to the press:

- “many of you in the media clearly missed the art of the deal ; you failed to see what President Trump is doing here ; you tried to say that the rest of the world would move closer to China ; in fact we have seen the opposite effect; the entire world is calling the United States of America not China because they need our markets, they need our consumers and they need this President in the oval office to talk to them ; this is exactly why over 75 countries have called“

This was perfectly done. Had President Trump first focused on China & then gone to China’s neighbors & other countries to isolate China, it would not have worked. So he launched his plan on all countries & then after initial discussions with them offered them 90 days to negotiate. He knew exactly how China & Xi would react. And he used their escalation to raise tariffs on China to 3-digit levels. None of China’s neighbors or business relationships want to be caught in the 3-digit tariffs box. So they have restricted their relationship with China.

Secretary Bessent made it clear to all by saying “you might even say he goaded China into a bad position ; they have shown themselves to the world to be the bad actors“.

How bad is China’s position? We don’t know for sure. But there are many clips like the on below. We have no idea what or who China Observer is but the clip below states:

- “The most crucial point is Trump can adjust reciprocal tariffs at any time making it difficult for 3rd party countries to assist China in re-labelling country of origin. ”

China is reaching out to EU to become allies in the trade war. So far, there is no sign that EU is interested to any serious degree.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.