Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Memorial Day 2025 – Remember And Honor

2.Markets Last Week

Fixed Income:

- 30-year Treasury yield up 13.1 bps on the week; 20-yr yield up 11.1 bps; 10-yr up 6.6 bps; 7-yr up 3.4 bps; 5-yr up 1 bps; 3-yr down 7 bps; 2-yr flat; 1-yr up 1.6 bps;

- TLT down 2.2%; EDV down 3.5%; ZROZ down 4.2%; HYG down 59 bps; JNK up 13 bps; EMB down 57 bps; leveraged DPG down 1.1%; leveraged UTG down 1.8%;

US Indices:

- VIX up 30%; Dow down 2.5%; SPX down 2.6%; RSP down 3.1%; NDX down 2.4%; SMH down 3.7%; RUT down 3.5%; MDY down 3.6%; XLU down 1.6%;

Mega Caps:

- AAPL down 7.4%; AMZN down 2.2%; GOOGL up 1.8%; META down 2.1%; MSFT down 1%; NFLX down 52 bps; NVDA down 3.2%; MU down 4.4%;

Financials:

- BAC down 3.3%; C down 3.5%; GS down 3.3%; JPM down 2.6%; KRE down 5.1%; EUFN up 3%; SCHW down 1%; APO down 9%; BX down 6.2%; KKR down 5.3%; HDB up 2.4%; IBN up 97 bps;

Dollar was down 1.8% on UUP & down 2% on DXY:

- Gold up 5.2%; GDX up 8.7%; Silver up 3.8%; Copper up 6%; CLF down 14%; FCX up 2%; MOS down 20 bps; Oil down 1.2%; Brent down 58 bps; OIH down 5.3%; XLE down 4%;

International Stocks:

- EEM down 6 bps; FXI up 87 bps; KWEB down 1.5%; EWZ down 1.3%; EWY up 36 bps; EWG up 1.2%; INDA down 20 bps; INDY down 26 bps; EPI down 90 bps; SMIN up 67 bps;

3. Equities & Rates

Last week was not a good week for equities or even for Treasuries. But some were more bullish on both after Friday:

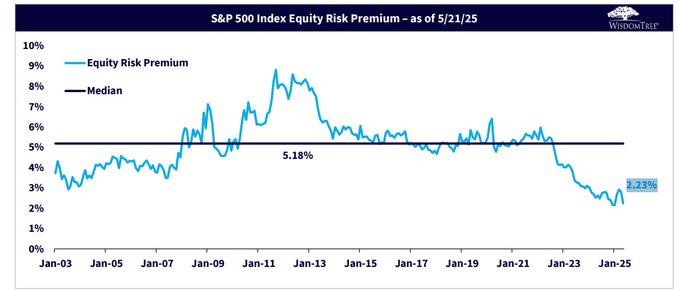

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – S&P 500 equity risk premium sinking toward a fresh 23-year low. Bonds cheap enough here? Still, stocks are expected to return 223bps over bonds in the next decade based on this metric. Plus the dividend.

What about a target?

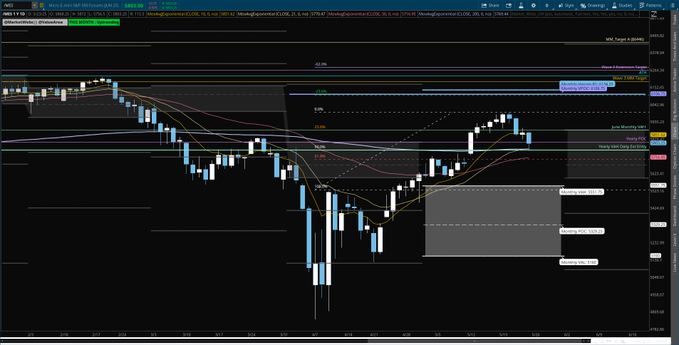

- Trader Z@angrybear168 – $ES_F I think the market will build a nice base here to rally from with 6100 as the next target, 5700 invalidation.

And looking forward to the June expiration:

- Trader Z@angrybear168 – $SPY June puts very active this week, could put in a floor.

Warren Pies gave us a warning around mid-February. After the first move up from that sell-off, he was cautious & again right. Look what he said on Friday 23rd May near the end of the market day:

- “the message of the markets is overwhelmingly bullish, right now“; … the sentiment backdrop is institutions don’t believe in this rally; if you look at vol-targeted funds, CTAs – these systematic investors haven’t got back in this rally; that’s the sentiment side; institutions I talk to share that opinion; then technically we see a lot of participation in this upside – basically a combination of breadth thrust (a technical term for a lot of stocks are going up at the same time); we have really never seen this & NOT had outstanding returns forward over the next year; … institutions are going to get forced back in this market …”

Then he added that “fears in the bond market are over-blown” & said “my honest opinion is if you are going to fade fear, fade fears in the bond market; existential fears like Dollar as a reserve currency fears“

From what we simple folks saw, last week’s peak in interest rate fears was on Wednesday, May 21, when 30-yr yield shot up 11.6 bps; 10-yr shot up 10.8 bps & 5-yr shot up 8.4 bps. That was the afternoon when Max Kettner of HSBC gave the same message about fading fear in the bond market to CNBC’s Mike Santoli. He proved right again. On Thursday & Friday, same rates went down hard with 30-yr yield down 7 bps; 10-yr down 9.8 bps & 5-yr down 8.8 bps.

Then we noticed something interesting on Friday. The session with Max Kettner also had Kate Moore of Citi Wealth & another participant. For some reason, CNBC webmasters removed the footage & message of Max Kettner & ONLY published the clip of Kate Moore. So we asked Mike Santoli on Thursday:

- Editor Viewpoint@MacroViewpoints – – @michaelsantoli – You put the Kate Moore talk wth u on Youtube. Could you also put the Max Kettner portion that show on YouTube as well? Kettner made some key points, we recall.

Kettner had said, as we recall, that fading fear in the rates market works & that not only gets rates down but also results in stocks recovering. Wasn’t that a good & correct message for a day that featured Dow down 817 points, S&P down 96 pts & NDX down 287 points?

Why did CNBC only publish the views of Kate Moore of CitiWealth and remove both Max Kettner of HSBC & his views from the published clip for their broad viewer base? Our first thought was about CNBC’s disdain of the Bond market. Then another thought occurred to us. We have seen many commercials from Citi on CNBC while we can’t say we have noticed any from HSBC. Did that factor in only publishing views of a CitiWealth “expert” as a thanks & reward for the extensive commercials that Citi runs on CNBC?

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.