Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Markets Last Week

Fixed Income:

- 30-year Treasury yield up 6 bps on the week; 20-yr yield up 7 bps; 10-yr up 8 bps; 7-yr up 8 bps; 5-yr up 8 bps; 3-yr up 7 bps; 2-yr up 6 bps; 1-yr up 5 bps;

- TLT down 93 bps; EDV down 2.4%; ZROZ down 1.3%; HYG up 1 bps; JNK down 2 bps; EMB up 36 bps; leveraged DPG up 65 bps; leveraged UTG up 1.3%;

US Indices:

- VIX down 3.6%; Dow down 16 bps; SPX down 47 bps; RSP up 80 bps; NDX down 21 bps; SMH up 2%; RUT up 10 bps; MDY up 41 bps; XLU up 49 bps;

Mega Caps:

- AAPL down 3.4%; AMZN up 1.7%; GOOGL down 6.8%; META down 71 bps; MSFT up 74 bps; NFLX down 1.4%; NVDA up 1.9%; MU up 6.4%;

Financials:

- BAC up 1.5%; C up 1.2%; GS up 18 bps; JPM up 15 bps; KRE up 71 bps; EUFN up 2.6%; SCHW up 1.6%; APO down 1.9%; BX up 1.2%; KKR up 98 bps; HDB down 4.2%; IBN down 5.4%;

Dollar was up 47 bps on UUP & up 38 bps on DXY:

- Gold up 2.8%; GDX up 6.9%; Silver up 2.5%; Copper up 28 bps; CLF down 21%; FCX up 69 bps; MOS up 7.5%; Oil up 4.3%; Brent up 3.3%; OIH up 69 bps; XLE up 63 bps;

International Stocks:

- EEM down 18 bps; FXI down 49 bps; KWEB down 2.3%; EWZ up 1.5%; EWY down 3 bps; EWG up 1.1%; INDA down 2.6%; INDY down 2.6%; EPI down 3.1%; SMIN down 2.6%;

Wednesday of last week was the day of the FOMC meeting & the Powell presser. Interestingly, Dollar, VIX & Treasury rates changed their direction on or after the Powell Wednesday.

Dollar, weak on Monday & Tuesday, rallied on Wednesday, Thursday & Friday:

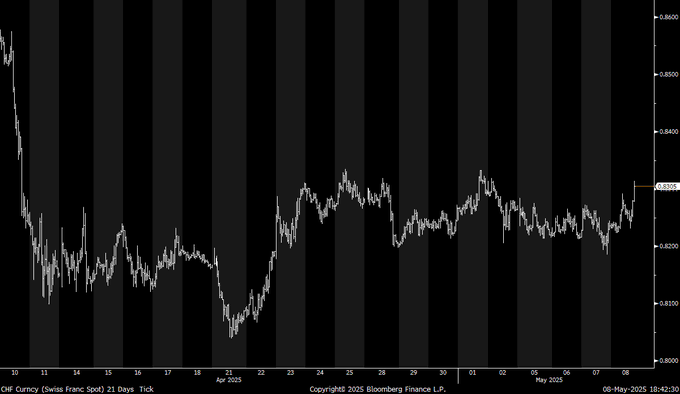

- Macro Charts@MacroCharts – Thu 5-8 – Huge day for the Dollar. Long USDJPY & USDCHF my two biggest potential plays. Tracking these for weeks and got a perfect R/R setup over the last two days. Good market for technical & macro trading, some big swings already and this one may just be getting started.

Then you have the doom-spreaders on America:

- Trader Z@angrybear168 – May 10 – $DXY macro doomers are extremely bearish the dollar at current juncture, seething at the fact that the US dollar has not lost its reserve status, at the same time small non-reportable traders are building a big short position, quarterly chart looks bullish, 128 next stop.

What about Asset Managers, you ask?

- Subu Trade@SubuTrade – May 10 – Asset Managers are short the U.S. Dollar, according to the COT Report. They’ve never been right before.

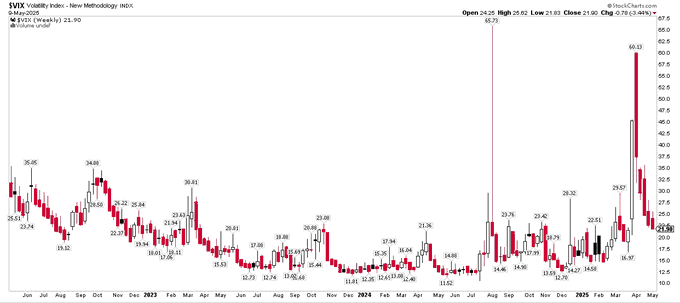

That brings to the $VIX. It was up 4.2% on Monday, up 4.7% on Tuesday. Then it fell 4.8% on Fed Wednesday; fell 4.9% on Thursday and dropped 2.8% on Friday. This, we feel, is entirely due to Chair Powell being non-angry & holding up the “uncertainty” flag unlike the Powell who caused VIX to rally 109% with his combative, arrogant comments on Friday, April 4.

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – $VIX down 5 weeks in a row—first time since March-April 2023

But what about “realized volatility”?

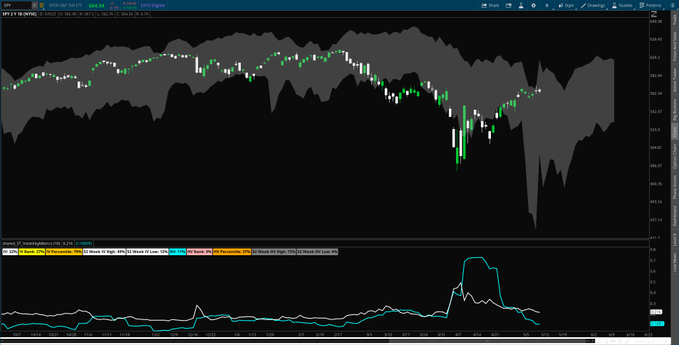

- Trader Z@angrybear168 – Friday – $SPY realized volatility finally coming down to earth.

S&P is fine, but how is Credit risk performing?

- Trader Z@angrybear168 – Friday – Credit risk making lower highs lower lows, RSI confirming, bullish side of the ledger.

The above is really heartening but does it remind you of Pangloss or Mr. Magoo?

2.Pangloss or Mr. Magoo?

Look at Section 1 above & you would say Pangloss – after all isn’t everything all right with the investment world? But one really smart & successful fixed income investor suggests it actually reminds him of Mr. Magoo. Below is the first part of what Jeff Gundlach said to CNBC’s Scott Wapner after the Powell presser:

- ” he said “too early to know; … “don’t think we know” – phrases like that all the time; … I can’t really blame him; we are sort of in uncharted waters; … he did everything but invoke the Hippocratic oath regarding the Federal Funds rate – Above All Do No Harm“; He (Powell) says we are in a good place; wait & see; … It sounds to me that we are back in Mr. Magoo land; we are in car driving around … he says he can’t explain to us what they need to see to get concerned about which side of the mandate we are; So are we just going to wait & see which sort of a tree we bump into? so we are either going to bump into a tariff tree or we are going to bump into a rising unemployment tree? and that will affect what happens to the Fed funds rate down the line?”

Then Gundlach added,

- “that unemployment rate is rising; its above its 36-month moving average & that goes along with recession; the unemployment rate is also above the 12-month moving average; also the 2-10 yield curve which was inverted for so long; now it is dis-inverted which actually puts on watch for economic problems; But the 12-month moving average of the 2-10s is now POSITIVE which has never happened without a recession … back to 1980; “

The Hippocratic Oath comments suggested a different parallel to us. Consider the case of a relative who is consulting a cardiologist about a heart condition. Does the Cardiologist suggest reducing the risk of a negative heart condition with medication even though it is not strictly necessary at this stage Or does the Cardiologist suggest waiting the heart condition to get worse until intervention becomes necessary?

Look at the Disney Mr. Magoo picture & see that the happy shortsighted Mr. Magoo is about to fall off a cliff. That is what Powell is suggesting now? Why? Because the Fed ego does NOT want to be proven wrong or, in Powell’s case, he would risk mostly anything to NOT have to side with President Trump?

It seems to us that the “Above All Do No Harm” oath almost makes it mandatory for the Fed to cut the Federal Funds rate by at least 25 bps right away. That will do NOTHING to add to inflation but it would indeed give a better chance for the economy to heal.

The above is fine & Powell did a decent job on Friday BUT he made it clear that he & his FOMC colleagues have NO CLUE about the grave danger from illiquidity our economy, Banks & markets are facing.

3. Liquidity Crash Iceberg Ahead?

An economic recession by itself is not a crisis. It is kinda a routine risk the economy faces & overcomes. But an economic recession combined with a liquidity driven monetary crisis changes a recession into a potential deflationary crisis, or a depression.

Is there a such a monetary liquidity trauma on the horizon? Gundlach seems worried that it might be. Listen to him yourselves from minute 7:41 of the 34:20 minute clip of his conversation with CNBC’s Scott Wapner titled Gundlach on Fed Uncertainty, Private Credit Pitfalls & Waning Momentum of U.S. Exceptionalism. A summary of his points is below:

- “the thing that’s starting to get talked about that might be significant in the next market problem is this illiquidity issue that is developed & getting some play on the newswires with Harvard & some other elite universities – when they don’t have any money ; they are asset rich but cash poor; Harvard ha $53 Billion endowment & they tapped the bond market twice for basically operating cash — reason is 40% of their assets are in private equity & another big slug in private credit, which has become a booming asset class; we are starting to see stories of some of the faster moving university endowments saying we might want to exit some of our commitments; We know we may have to take a hair-cut but your first loss is your best loss in an illiquid market; “

Gundlach added,

- “I think this is going to be an issue & I believe the probability of this is increasing because of the spread between BB & CCC; that signals to me that a lot of the junky stuff is starting to feel stress and a lot of the really junky stuff went to private credit; we are now seeing the bell being rung almost with some people chomping “let’s raise a fund to buy private credit interest & beyond that, lets make it available to the public; that’s when you have to worry; when you take something that’s viewed to be an esoteric thing only for professionals you say & this is such a great deal that we want to give it to main street investors & we comingle a fund – That’s a real problem when you take illiquid investments & put them into vehicles that require liquidity ”

Wapner stepped in and pointed out:

- “the biggest names in the business since we are on that topic; most of them were just out at the Milken conference in LA & are still defending private credit obviously and almost scoffing at the notion that there is a budding problem; that there is a bubble ; people like XXX & others continue to make that case; … you told me last September that it was a top for private credit”

Gundlach responded:

- “private credit is under-performing public credit since that time period; … when people defend private credit, they use 3 arguments, all 3 of which, I think, have flaws:

- 1. they use a sharp ratio argument saying yes, it is illiquid but it is less volatile than public credit which doesn’t make sense to me at all; what happens is you just don’t mark-to-market it as frequently; … we have clients that have a lot of private credit & some of them have many many managers in it; … one client of ours has 8 managers that actually owned the same position; … they ( client) were kinda shocked at year-end ; they said one of the managers had the position marked at 95 & another manager had marked it at 8; … an extreme example but it gets to the notion we are talking about;

- 2. the next argument that’s used is a true argument but , as past performance may not be indicative of future results, the trailing numbers in private credit are fantastic; they are way better than public credit; that’s what draws all the money in; it hasn’t been lately; … I worry about projecting the path into the future …

- 3. the last argument is the worst of all – at a conference, the person before me was promoting private credit; …. she said the beautiful thing about owning private credit is that it lets you to ride them thru the storm of volatility in your public credit …. this doesn’t really hold up; it reminds me a little bit of “oh, its only sub-prime; its small, contained; its no issue and then, all of a sudden, you realize that there are tremendous knock-on effects in other areas“;

Wapner interjected:

- ” there are some really really smart & successful investors that I am talking about – the XXX, the YYY, the ZZZ”

Gundlach responded:

- “In June 2007, I gave the keynote at Morning Star Investment Conference and I said “Subprime was a total unmitigated disaster that’s going to get worse” and that raised a lot of eyebrows; speakers that followed me were very smart, very accomplished, kind of the category of names you are speaking of; they said I was dead wrong & there is absolutely nothing to worry about & that kinda made my reputation because I was one of the very few people who saw that … I am not saying this has to happen (in private credit); I am saying that it is on my radar screens as something to watch for”

Then Gundlach spoke about his fund’s position:

- “ we have our lowest leverage of all time because we want dry powder …. for another leg down in risk assets“

Subprime became huge because it became a part of almost all mortgage pools at that time that so crisis in subprime rose upwards like a volcano bursting in the economy. We don’t know how big the size of private credit is but we do get that private credit probably is a part of most institutional bond portfolios in America. So a blowup in private credit has to move upwards to cause a down draft in all credit. If true, that may be a serious problem for the Fed.

There is another such period when credit problem fired up in a relatively small portion of credit portfolios. That was in emerging market debt in 1998. Soon enough, it affected a large portion of debt portfolios &, with the huge leverage employed, it because a big crisis that eventually focused on Long Term Credit.

Fortunately, it was the era of Robert Rubin at Treasury Secretary & Alan Greenspan as Fed Chair. They worked together & created a mechanism to rescue Long Term Credit & then Greenspan lowered Fed Funds rates bigly to end that crisis.

Today we have Scott Bessent as Treasury Secretary who might actually be more market savvy than Rubin was. But we also have Jay Powell as Fed Chair who is neither capable of explaining his turn around the way Greenspan could & did nor is Powell capable of looking forward & working with Bessent to prevent the flood before it becomes unmanageable.

That brings us to Powell’s old boss David Rubenstein. Greenspan’s skill was that no one could understand what he was saying. In positive contrast, David Rubenstein’s skill is that he can make his listeners feel that they understand his points & agree with him.

Therefore we would like to suggest Jay Powell request his old boss David Rubenstein to join the Fed as a wise elder with necessary power to fix this private credit problem before it becomes unmanageable. Watch Bloomberg TV to see, hear & appreciate the skill & finesse of David Rubenstein in understanding & discussing solutions to difficult problems.

plus

plus

Imagine Scott Bessent & David Rubenstein working together to address the potential disaster that illiquidity of private credit can create in our already weakening economy. Frankly, Bessent & Rubenstein might make even a better pair than Rubin & Greenspan. We can’t imagine Jay Powell having a personal ego issue with David Rubenstein as he has with President Trump. And Jay Powell would get all the credit for putting the country & his institution above his ego for the next few months.

What if Jay Powell continues to think & act like Mr. Magoo, to use the words of Jeff Gundlach? He might end up destroying the institution of the Federal Reserve as an independent entity.

4. Equities

A quick set below:

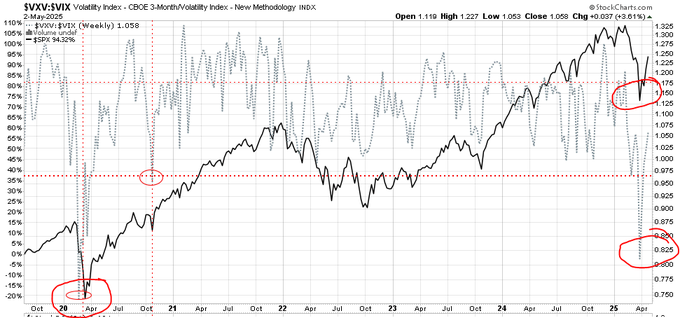

- Mountain Trader@wecoyote13 – May 5 – 6 years of data, $VIX was only this backward twice $SPY $QQQ

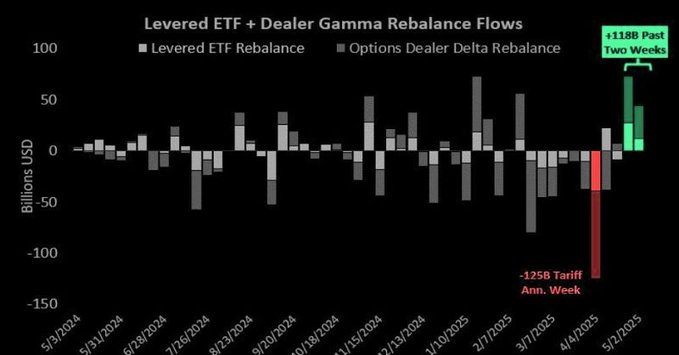

A “buy impulse”?

- The Market Ear@themarketear – “Largest two-week “buy” impulse we have seen in at least the past year.”

Could laggards turn into winners again?

- Seth Golden@SethCL – Semis $SMH looking to close above 50-DMA for 3 consecutive trading days. As suggested in the past, “would not be surprised if by July (1-year anniversary of former top) all-time highs are in reach. (not a forecast or financial advice) $SPX $ES_F $QQQ $SPY $SOXX $NVDA $AMD $MU

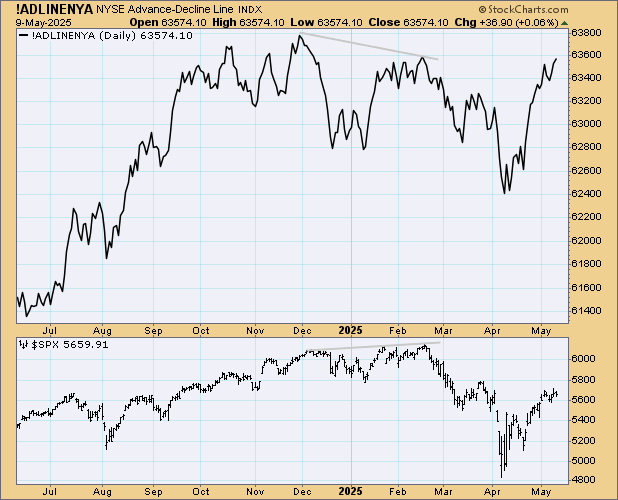

What about the Adv-Decl line?

- Walter Deemer@WalterDeemer – If the Advance-Decline Line is able to push above its February high it would be a significant indication of the rally’s internal strength. Only needs 418 net advances to do so…

What if the S&P is at resistance?

- Seth Golden@SethCL – S&P 500 at resistance; NYSE New Lows non-existent; Either way Win-Win scenario; Down, and Breadth informs to Buy for future gains; Up, and you should already be positioned; Win-Win either way; This is not hard, unless you make it $SPX $ES_F $SPY $QQQ $NYA $IWM $VOO $VIX

Now to the hostilities & war in the Indian Subcontinent.

5. From the “war” to “ceasefire” in 4 days!!!

5.1 How & where did this episode begin? Who are the terrorists?

On April 17, 2025 Asim Munir, the Napaki Army Chief, in an emotional public speech proclaimed that Hindus & Muslims are fundamentally different _ “Our religion is different; our customs are different; our traditions are different; our thoughts are different; our ambitions are different; that was the foundation of the 2-nation theory”

What most people don’t realize that this is NOT even the view of major terrorist organizations like Lashkar-e-Toiba & others. These are driven to capture lands in & of India. That separates them from the Jaish-e-Mohammed, the terrorist organization that sprung from the teachings of the notorious Deobandi Madrassa which taught the above absolute separation of Hindus from Muslims. The main aim of the Jaish terrorists is to kill Hindus.

In a mere 5 days after this violent speech to arms, the Jaish terrorists slipped into the tranquil resort area of Pahalgam & killed 22 Hindu men after making sure they were only killing Hindu men. They told a grieving Hindu widow to go & tell her complaint to Modi.

The Napaki regime expected a single response such as the ones in the prior two terrorist attacks. PM Modi & Indian Armed Forces had a more complete solution in mind. On May 7, 2025, less than 5 days ago, the Indian Air Force attacked 9 separate terrorist camps across the Panjabi border and across the NPak-Kashmir line of control.

The scale of this retaliation was unexpected & families of the founder Hafiz Saeed (Jaish), Maulana Azhar (LeT) were killed in the attack & a little later the brother of Hafiz Saeed was also killed. Guess who turned out to mourn the deaths of these extreme terrorist killers – Senior Officers of the Napak army, the police & the ISI, intelligence operation.

This lent credence to India’s assertion that the so-called terrorists who actually killed were only used to kill & die while killing and the Real Terrorists were senior officers of the Napaki Military including Asim Munir, the Army Chief.

But why did Army Chief Munir launch this heinous attack now? He had Turkey’s support in planning & in supply of arms & drones. It is widely believed that Hamas, the anti-Israeli terrorist organization, planned the retaliation against Indian military via drone swarms they have used against Israel. The timing analysis points to subtle encouragement by China – rationale being China was very concerned about Apple & other US companies moving to India from China because of the US-China trade conflict. And China wanted to create war-like instability in India to dissuade US companies from entering India by leaving China.

This rush by China, it is said, forced Asim Munir to rush the terrorist attack as soon as possible. This may be why Asim Munir gave the orders to his terrorists to launch within a week of his speech WITHOUT conferring with Corps Commanders of Napaki Army. It is now widely believed that these Corps Commanders had neither an idea of the terrorist attack nor had they done any preparations for an Indian counterattack.

5.2. May 7 to May 11, 2025 – The attack, Napaki retaliations & wipeout of Napaki air defense

After launching its retaliation on May 7, 25, India announced that they were done as long as Napakistan did not escalate. And India warned to match & go step above any escalation by Napak. The death of the families of Hafiz Saeed & Maulana Azhar had robbed the Napaki military of common sense. In their anger they launched massive drone-based storm attacks on Indian military & civilian installations. That culminated on Thursday in 500 drones being fired across the 3,500 km line of control from Leh in Ladakh (Himalayan city) way south in Gujarat.

Clearly the idiots in Napaki military had no idea, let alone intelligence, about the hard, intense & integrated architecture developed & installed by the Indian military all across the line of control. These drone swarms a la Hamas, Inc. were totally ineffective and none penetrated Indian Air Defense. Then on Friday, Napaki military fired its Fattah ballistic missiles to hit Delhi. They were shot down too.

Before we go on, it might be interesting for readers to quickly flip thru the 5-stage integrated Air Defense system of India in the clip below beginning at the top with Russian S-400 followed by Barak (8) (Indian manufacture of Israeli design), followed in the middle by India’s Akash (pronounced Aakaash) followed by two other systems for nearby targets.

This was the singular success that guaranteed successful defense of Indian territory enabling Indian military to go to attack mode on Thursday May 8 & finally at a different level on Friday May 9 (US time). On Thursday May 8 night (US time), the Indian Navy task force (26 vessels led by “Vikrant” Aircraft Carrier), opened up with massive shelling & missile attacks of Karachi Harbor, Napak’s only & big harbor) causing serious damage.

Once Napak tried to attack Indian military bases & major cities in North India via Fattah ballistic missile, Indian military went for the jugular. On Friday evening US time, the Indian Air Force hit & destroyed 11 military air bases in Napak & in Napak-occupied Kashmir – Sukkur, Bholari, Skardu, Jacobabad, Sialkot, Rafiqui, Murir, Pasrur, Chakala, Sarghoda, & Nur Khan. India’s mega missile – supersonic & with massive power, was used especially against Sargodha & Nur Khan airbases. That attack absolutely petrified the Napak military & the Army Chief & Prime Minister who had sought shelter in bunkers.

Why the terror? Sargodha airbase is not only the seat of the F-16s that Napak owns but it is also next to one of the sites that store Napak’s nuclear missiles. And Nur Khan is adjacent to Napak’ Air Force National HQ. Attacking & destroying Nur Khan base by a huge Brahmos missile is like destroying an air base located next to the Pentagon, in America.

Within minutes, we saw news go across the TV screens that Secretary of State Rubio had spoken with Army Chief Munir. Even the NYT, as we hear, has “reported” that the hit on Nur Khan prompted US to intervene. A little later, President Trump announced a ceasefire between the two nations.

5.3. What’s Next & other critical events last week

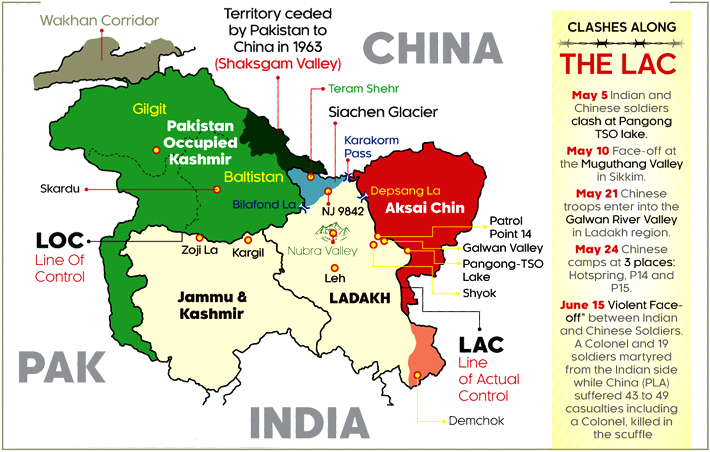

From what we read & hear, the ceasefire is just that and Napakistan has reportedly already broken it. The pronouncements from the Indian Military are clear – this is just a ceasefire & not a peace deal of any kind. India has also declared that the only discussion point with Napak is & will be how & when Napak-occupied Kashmir will be returned to India. There is nothing else to discuss. It is legally Indian territory as was declared in 1948 & so it shall remain.

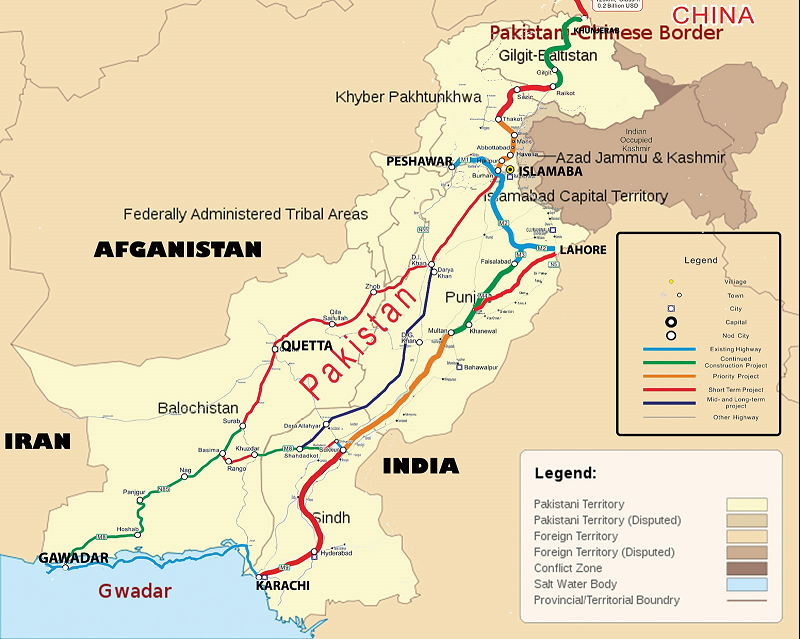

But that is not all for Napakistan. Balochistan has already declared independence from Napak and they seized the important city of Quetta (made famous by Taliban) from Napaki military. And during the conflict last week, the Baloch Liberation Army seized & closed the strategic Quetta-Karachi highway.

Note that Balochistan is the state that would own & control the port of Gawadar that is used by China for its China-Napak-Economic corridor. So an independent Balochistan would rob China of its massive investment. That was deemed impossible until now because the Napak army controlled Balochistan. No more for now, at least.

Look at the new clip published a few hours ago that claims that the BLA (Balochi Liberation Army) has attacked the Napak army in 39 locations already. No idea whether it is true or false but could be true because Napak army has publicly withdrawn the Quetta regiment to help on the Indian border.

Going back to India demanding control & ownership of Napak-Occupied Kashmir, look at what it would mean to China:

Note above we reported that Indian Air force attacked the air base at Skardu, just south of Gilgit in the Napak-occupied Kashmir above. So if India gets full control of the green area of Napak-occupied Kashmir, then Chinese business will have to work with Indian permission & under Indian control. And both ends of the China-Pakistan-Economic-Highway would be under Indian & Balochi-Indian control.

That depends on how much power the remaining state of Napak keeps & maintains. By the way the above map doesn’t show the real military power that is bleeding Napak – Pashtuns in Khyber Pakhtunkhwa inside Napak. Notice that Balochistan has about 44% of the land of the erstwhile Pakistan & Khyber Pakhtunkhawa has at least as much as the main Napaki-Panjab, the heart of the Napaki army. Guess the famous Strategic Depth sought & glorified by Napak has already shrunk to minimal level.

By the way, the port of Karachi attacked & blocked right now by a 26-vessel force of the Indian Navy is the ONLY port that Napak has. If that goes, what will they do?

By the way do read the above very carefully & realize that the last 4-5 days have virtually minimized the threat of Napak nuclear missiles attacking India. The failure of Fattah ballistic missiles fired on Friday by Napak shows India should be able to destroy attacking missiles or as India warned on Friday that if Napak even fired one nuclear missile against India, not only will India destroy that but that Napak will cease to exist.

That threat has credibility & that is why Asim Munir reached out & accepted Secretary Rubio’s ceasefire instruction AFTER the his adjacent Nur Khan air base was destroyed by Indian Brahmos strikes.

We covered this area & its impact in a couple of articles in September 2024 & those might help understand this better, beginning with the article dated September 2, 2024.

At that time, we had also covered the purchase & interest of Phillipines in purchasing more Brahmos missiles & the interest of Vietnam & Armenia as well. Readers might also wish to watch the detailed discussion about Brahmos from the prior Deputy Director of the Brahmos program. It is 23 minutes long but factual. The discussion is on Moneycontrol, a related entity of CNBC India, we believe.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.