Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Markets Last Week

Fixed Income:

- 30-year Treasury yield up 4.3 bps on the week; 20-yr yield up 6.6 bps; 10-yr up 11.4 bps; 7-yr up 14 bps; 5-yr up 16.4 bps; 3-yr up 16.7 bps; 2-yr up 14.4 bps; 1-yr up 3.8 bps;

- TLT down 89 bps; EDV down 1.3%; ZROZ down 74 bps; HYG down 36 bps; JNK down 30 bps; EMB flat; leveraged DPG down 82 bps; leveraged UTG up 81 bps;

US Indices:

- VIX down 10.2%; Dow up 1.2%; SPX up 1.5%; RSP up 1.3%; NDX up 2%; SMH up 5.4%; RUT up 3.2 %; MDY up 1.7%; XLU down 87 bps;

Mega Caps:

- AAPL up 1.6%; AMZN up 4.3%; GOOGL up 1.2%; META up 7.8%; MSFT up 2.4%; NFLX up 2.9%; NVDA up 5%; MU up 14.9%;

Financials:

- BAC up 2%; C up 3.8%; GS up 2.3%; JPM up 54 bps; KRE up 2.2%; EUFN up 1.7%; SCHW down 10 bps; APO up 3.3%; BX up 1%; KKR up 1.6%; HDB up 2.8%; IBN down 18 bps;

Dollar was down 4 bps on UUP & down 20 bps on DXY:

- Gold up 1.3%; GDX up 2%; Silver up 9.2%; Copper up 2.9%; CLF up 30.2%; FCX up 7.8%; MOS down 3.7%; Oil up 6.3%; Brent up 4.1%; OIH up 6.1%; XLE up 2.4%;

International Stocks:

- EEM up 3.1%; FXI up 4.5%; KWEB up 4.8%; MCHI up 4.5%; EWT up 3%; EWY up 8.3%; EWZ up 1.9%; EWG up 1.3%; INDA up 1.1%; INDY up 39 bps; EPI up 93 bps; SMIN up 1.6%;

First, “the biggest in history“, event.

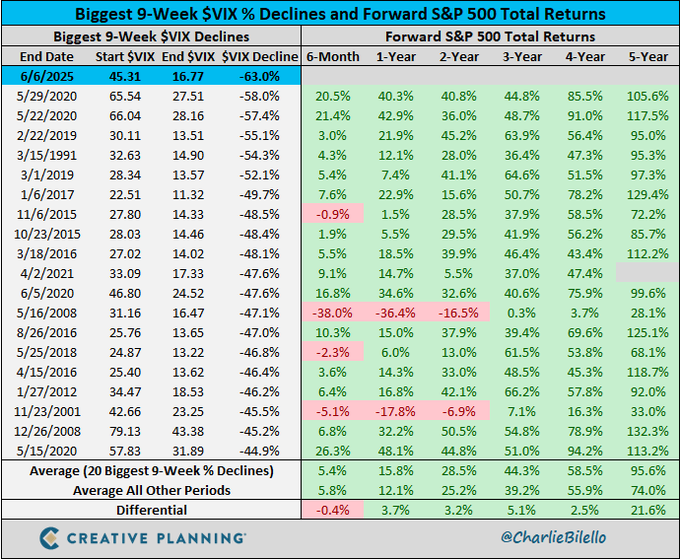

- Charlie Bilello@charliebilello – The 63% decline in the $VIX over the last 9 weeks is the biggest volatility crash in history. https://youtube.com/channel/UCRoWRnXa4ZM85Fw9EN7xICA?sub_confirmation=1

Any indicator signals from the markets this week?

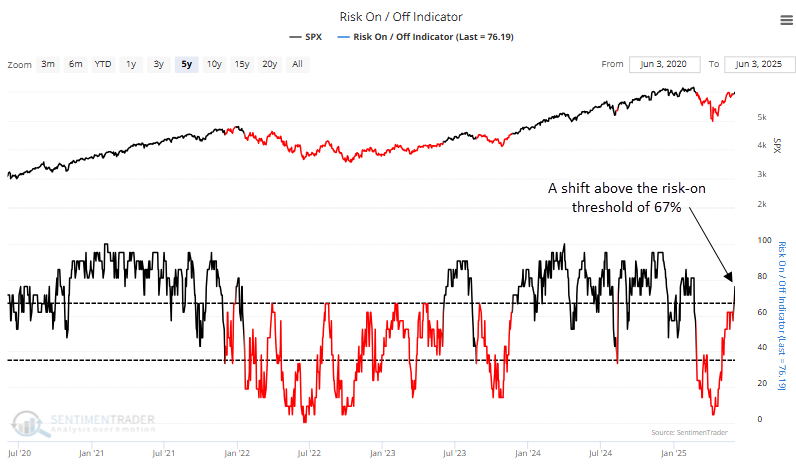

- SentimenTrader@sentimentrader – The Risk-On/Off indicator shifts to risk-on status. Key points: The Sentimentrader Risk On/Off Indicator rose above 67%, shifting the composite to risk-on status; Similar risk-on regimes significantly outperformed risk-off regimes; Cyclical sectors outperformed the S&P 500, and defensive groups

And,

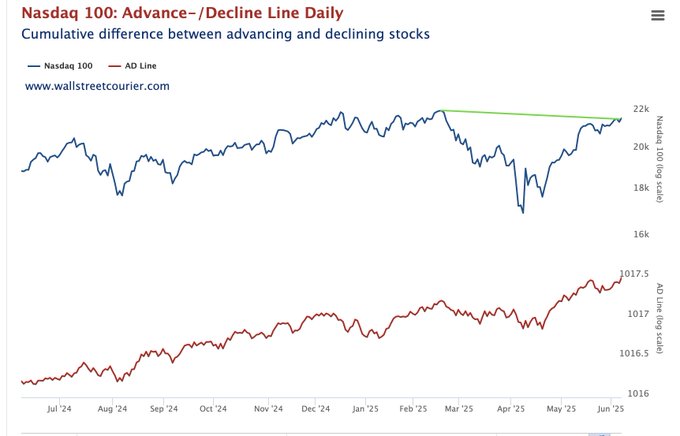

- Seth Golden@SethCL – NOT. BEARISH. 2nd Nasdaq 100 all-time high Advance/Decline Line of the recovery cycle. Last time informed of higher-highs ahead, this time… me thinks much of the same. Breadth leads >> price! $SPX $NDX $QQQ $COMPQ $TQQQ $SPY $NVDA

Kudos to Warren Pies of 3Fourteen Research who simply pointed out on Tuesday, June 3, that there is wisdom in the collective price-action in the market and said:

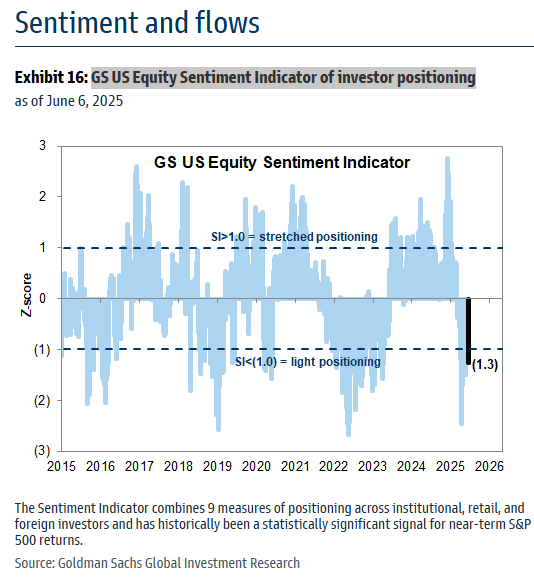

- “… in technicals, you want to look at two broad categories – sentiment & positioning; retail has been buying the dip; if we look at institutional positioning, you can see that institutions are still backing away from the market & underinvested; this v-shaped recovery caught them by surprise, so we see strategists lowering their targets… this is historically a very bullish sign going forward; … they are all short the market still; … that’s very bullish; …. we think the market is going to lead us in the right direction; that the collective wisdom of the market is going to see thru … ”

For example,

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – GS US Equity Sentiment Indicator of investor positioning

while,

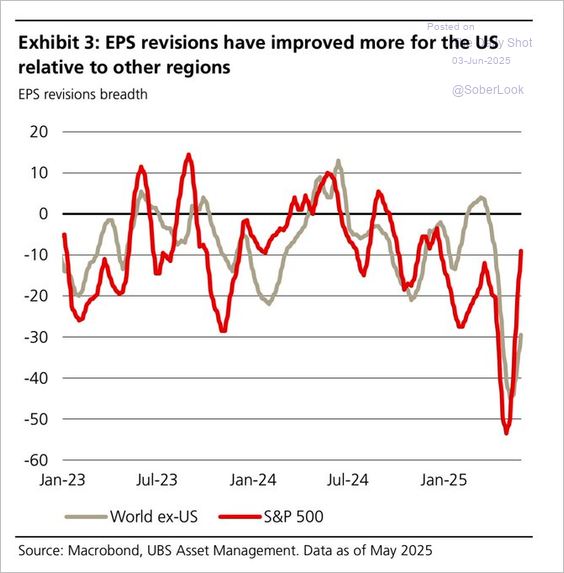

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – S&P 500 forward EPS closing back in on $280.. should reach a new ATH later this month https://yardeni.com/charts/sp-500-forward-revenues-earnings-margins/

If you notice above in our markets recap, RUT was up 3.2% this past week, better than both S&P & NDX. Any reason, any trigger for that outperformance? Any chance the below had anything to do with it?

- The Market Ear@themarketear June 4 – Russell shorty is huge

And SMH was up 5.4% on the week with SOXL (3X-SMH) lighting it up. So kudos to the below for highlighting SOXL in the classic “sales-trader” manner. And SOXL did close the week at $19.18 about 6.5% above the $18 breakout signal.

- Jason Leavitt, LeavittBrothers.com@JasonLeavitt – June 3 – $SOXL – looks good to me

Perhaps the most interesting performance of the day was the Equity Market rallying hard & VIX falling over 9% after the Treasury rates spiked high & Fed easing probabilities went down after the Payrolls number. More on that in Section 3 below.

Or, just look at the first line of international stocks above & notice that Chinese ETFs are up the most followed by Asian markets that would benefit from a deal between USA & China. And which stock comes to mind when you say US, China & Taiwan?

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – $TSM weekly breakout > $200.

This chain of thought leads us to:

2. Commodities

In that vein, notice how commodity stocks rallied led by Copper stocks. Is there a better sector that would do very well with higher growth in China?

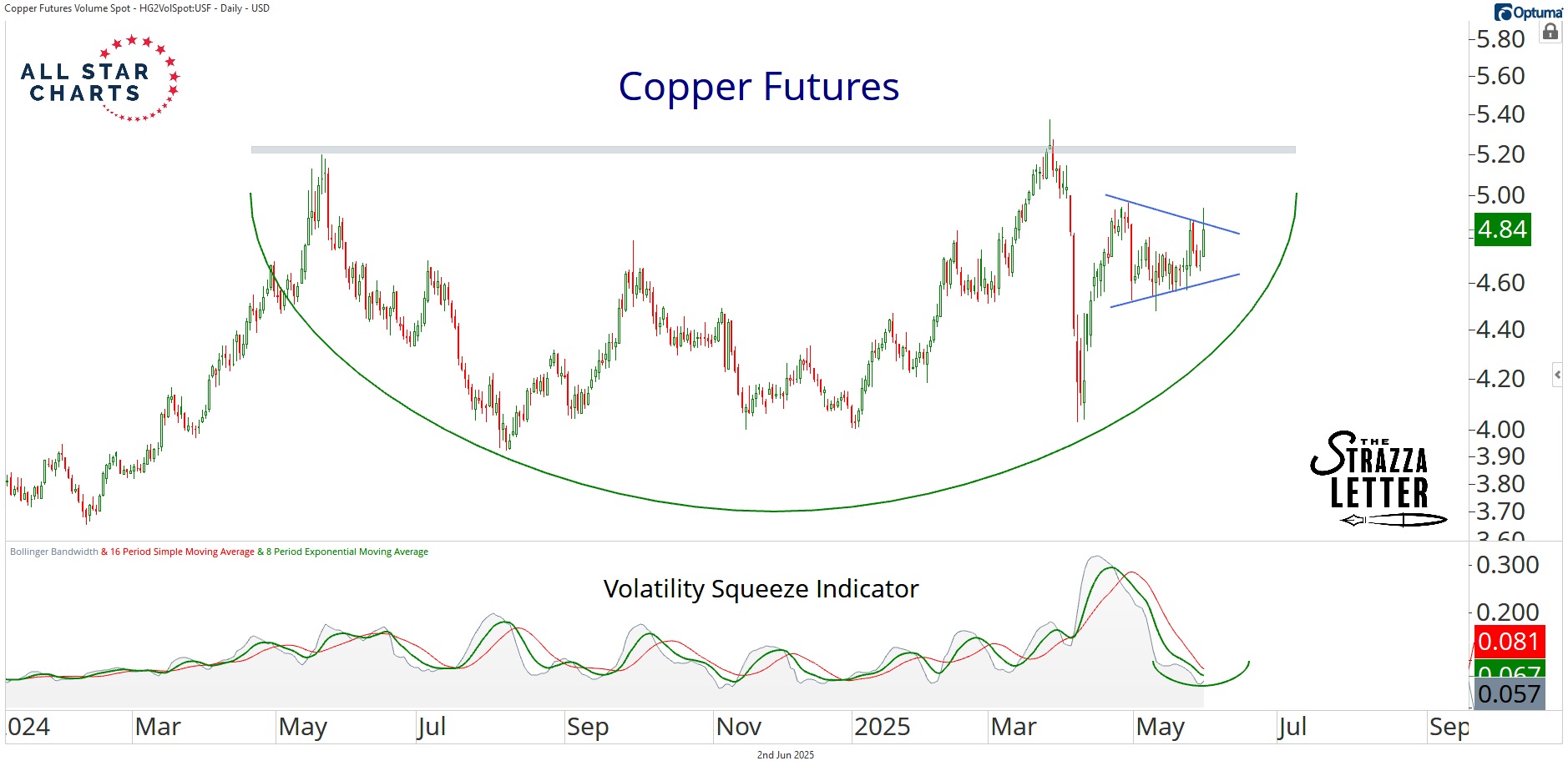

Where would you begin? Probably with what Strazza Letter said mid-week:

- It’s having its best day of the year as it rips higher out of a bull flag. Our volatility squeeze indicator suggests a big move is brewing, and there is plenty of runway considering the pattern hasn’t even broken out yet. I think a major resolution is underway for silver and I’m anticipating a gold-like up-leg to follow. Who knows how high it can go, but there is a lot of catching up to do.

But can you speak of Silver without looking at the Silver/Gold ratio?

“The silver/gold ratio just had one of its best weeks in history and failed this topping pattern with authority“, wrote the Strazza Letter.

They added “Meanwhile, copper is getting antsy with a couple of false starts and short-term volatility spikes recently. There’s a coil that resembles the one in silver, and it could resolve higher any day now“.

The importance of the US-China talks was highlighted by Mark Mobius on CNBC this week. Yes, he did say that it is very very important for the US & China to come to an agreement. And, unlike any other guest on CNBC or Bloomberg, Mobius said:

- “the big problem I think facing the talks is the weakened position of Xi Jin Ping; he is in a weakened position may be because of his problem with the US & the general failure of the Chinese economy; lets see what happens”

The optimistic comments from Senior US officials are encouraging & hopefully the two sides can come to an agreement. Mobius also said that the next important country is Mexico because US companies are so dependent on Mexico for manufacturing.

Then he said after Mexico, its India. Notice that the SPY & INDA, India ETF from BlackRock, are now tied for 2025.

He was as positive about India as he has been recently. This time he actually spoke about 7-8% growth rate figure for India which we thought seemed high. But that’s why he is Mr. Mobius. Because CNBC reported late on Friday, that “India’s economy grew by faster-than-expected 7.4% in the March quarter … That marked the country’s strongest quarterly growth in the fiscal year of 2025“.

Then, in a surprise move, as CNBC reported, India’s Reserve Bank beat “market expectations to deliver outsized rate cut of 50 points. This marks the third straight rate cut since February and is below the median estimates of 5.75%“. And, CNBC added, ” RBI Governor Sanjay Malhotra said in a livestream that the move was taken as inflation had significantly softened, and growth has been “lower than our aspirations amidst a challenging global environment and heightened uncertainty.”

Interesting, isn’t it? Indian stock market is on par with S&P 500 year-to-date, Indian economy just reported the highest growth for this fiscal year. After all that, Indian Reserve Bank delivered an outsized rate cut of 50 bps!

That brings us to our own Fed Reserve that refuses to cut rates despite an obviously slowing economy and an inflation picture that is improving.

3. US Economy & Treasury Rates

Allow us to state, at the outset, MV-ONR, the Macro Viewpoints Overnight Rate is & remains at 3.75%. Despite the volatility in Treasury rates, the 3.75% ONR rate has stood the test of being stable & well positioned just below the 2-yr Treasury rate. For those who might not recall, the MV-ONR is a Treasury rate that takes its inputs from the Treasury market & from expectations on how the Treasury market might react to forthcoming economic data. To use this week’s phrase from Warren Pies, we believe in the “collective wisdom of the fixed income markets” over that of the hundreds of Ph.D. wearing economists employed to come up with a suitable overnight rate.

With weaker labor estimates from ADP & dovish numbers on ISM, the US Treasury Market walked in dovishly into the Non Farm Payrolls number released at 8:30 am on Friday, June 6. Guess what, once again, the released Non-Farm payroll numbers were stronger than what the ADP-ISM fed markets were expecting.

The reactions from the Cognoscenti were as expected. Rick Rieder of BlackRock said what Henry McVey of KKR had said a week or two ago – that US Service economy is doing all right. David Kelly of JPM pointed out that the economy is more threatened by slower growth than higher inflation. Jan Hatzius of Goldman said that the economy is much weaker than the numbers suggest.

The feedback from Renaissance Macro was more detailed than the above one liners expressed on Fin TV. Their title gives away their viewpoint – Friday’s jobs report look fine – until you blinked:

- it’s not the print that matters… it’s the pattern. And the pattern is ugly. Revisions quietly carved 95k jobs off recent reports. That turns this month’s print into something closer to 44k. That’s not soft – that’s soggy.

- The true 2024 average? 124k vs 168k last year. Downhill, in slow motion.

- And it gets worse under the hood. The labor force shrank by 625k. Full-time jobs? Down just under 700k. Unemployment may have “held steady” at 4.2%, but let’s zoom in: Jan: 4.011%; Feb: 4.139%; Mar: 4.152%; Apr: 4.187%; May 4.244% – That’s what a slow-motion deterioration looks like. What’s holding things up? Education and healthcare. That’s not the growth engine you want.

- So while the Fed is squinting at the surface, Neil’s waving a big red flag: this labor market is weakening fast, and that’s the real risk.

That’s where Neil Dutta is wrong. The first question he should ask is “whose risk?“. The answer is neither the economy’s risk nor the risk of the American people. The Real Risk in this interest rates game, the BIG Risk in this game is for the Public Image of the Federal Reserve & of Jay Powell, the current Fed Chairman.

Their defined mandate is Low Inflation Plus Adequate Employment. Understand that the 2nd part, employment, is actual & visible to all. So the Fed does react when employment numbers go negative.

In contrast, the 1st part of the mandate, Low Inflation, is neither actual nor realized inflation. Meaning this mandate is about the Fed’s view of where inflation will go. So the low inflation mandate is a Guess, just a Guess. But a wrong guess by hundreds of Ph.D. economists at the Fed is never deemed wrong. Instead it is the actual US economy that is deemed to be wrong because it is too dumb to understand the guess of the Fed Ph.D. army.

So let us all hope that the economy continues its slow deterioration & allows the Fed to lower rates slowly & gradually AND prevent the US economy from going into a recession. By the way, even a stock bull like Wharton’s Jeremy Siegel publicly expressed his concern on CNBC that by the time this Fed cuts interest rates, it would prove to be too late to avoid a recession.

This is why we had suggested that the Treasury Secretary Bessent introduce his own Treasury market based Over-Night Rate (TOR) and use that rate to price Treasury auctions & any other Treasury functions he sees fit. At the very least, Treasury Secretary would save money for the country by auctioning Treasury Notes at the currently lower Treasury Overnight Rate.

In this context, we are very happy to hear on TV that the well-known sensible economist Joe Lavonia will join the Treasury Secretary as a counselor. We hope this is a beginning of a more active Treasury Department that works for the American people instead of the Fed-support lobby.

4. Private Credit

In our article dated May 11, 2025, we highlighted the dangers of illiquidity in private credit that was discussed by Jeffrey Gundlach with CNBC’s Scott Wapner. For a detailed coverage of what Gundlach said read Section 3 titled Liquidity Crash Iceberg Ahead? of our May 11, 2025 article.

One of Gundlach’s specific points was:

- “we are now seeing the bell being rung almost with some people chomping “let’s raise a fund to buy private credit interest & beyond that, lets make it available to the public;” that’s when you have to worry; when you take something that’s viewed to be an esoteric thing only for professionals you say & this is such a great deal that we want to give it to main street investors & we comingle a fund – That’s a real problem when you take illiquid investments & put them into vehicles that require liquidity ”

The other side meaning “ private credit investing opportunities” was highlighted by Drew McKnight, Co-CEO & Managing Partner at Fortress on CNBC Fast Money this past week.

We heard this segment again before writing about it & we felt a chill go down the spine.

First he says, from what we can tell from his words, that they are getting assets that regional banks (mentioning Silicon Valley Bank, Signature Bank, 1st Republic bank) don’t want to own because of interest-rate risk & because of illiquidity concerns; those assets are now “an area of growth for his firm and for a host of folks“. He added that they have done $7 billion of originations while the opportunity set is $6 Trillion, the “amount of capital that does need to move from the smaller & regional banking system“.

Another area is private wealth that is in traditional 60-40 stock bond portfolios. And at around the 2:53 minute, he said something that we could not believe he said:

- “I think about my Mom’s portfolio & what I would be comfortable with her having; you look at what private credit has delivered over a cycle over interest-rate volatility, over stock-market volatility & you are achieving high single-digit to low double-digits with very low volatility and I would rather my Mom have a portfolio of some of that mixed in with a stock and bond portfolio; ultimately the ability to achieve returns is most important & that’s where I think we feel quite strongly about “the opportunities”

We are amazed that a group of professional investors like Karen Finerman, Tim Seymour, Dan Nathan & Guy Adami sat quietly & let Drew McKnight deliver the above pitch. The two questions we heard were appallingly lame. In contrast, read what a viewer of the above clip wrote in the comments section:

- “@cozyslor 4 days ago – Did he really just say that he thinks Private Credit is appropriate for his (must be 70-80 year old) Mother? Can’t believe he said that on TV. He’ll be meeting with Compliance directly after the show. BTW, he said “frankly” 4 times @1:08, @2:33, @3:20, @4:08. It’s similar to when someone says in conversation, “let me be completely honest with you…”, or “I’m not going to lie…”

Another viewer posted in comments:

That doesn’t mean Mr. McKnight is wrong in expecting the returns he expects. At one point, he even mentions “whether there is a bubble in private credit“. Investing in Subprime mortgage pools & in even CDOs of subprime market pools paid off with decent returns for awhile until 2007-2008. Whether Mr. McKnight’s version of private credit keeps delivering high-single-digit to low-double-digit returns for a long time is his business & that of those who invest with him. Hopefully both are correct & lucky.

Interestingly Jeff Gundlach did address the type of the above pitch in his discussion with CNBC’s Scott Wapner as quoted in our May 11, 2025 article. We doubt if Signor Wapner even remembers what Gundlach said to him. Below is the 34:20 minute clip of the Gundlach-Wapner conversation: Go to the 3rd section of the clip beginning at minute 6:43 titled Illiquidity and Private Credit Risks.

Kudos to Scott Wapner for this clip & other similar clips he does with the very best of investors. Such a contrast between his shows & the CNBC Fast Money Show that mainly hypes themes & stocks in the manner of TV Entertainment shows.

That brings us to Lacy Hunt, a highly regarded economist and Executive Vice President of Hoisington Investment Management Company (HIMCO). He also happened to speak about private credit in the section titled Systemic risks and Minsky moment from minute 48:04 to minute 53:00 in the clip below:

- “… whenever you have a prolonged period of stability in markets and lot of debt creation, & perhaps risky debt creation, there is an increasing risk of what people would call a Minsky moment. Now Minsky moment is very difficult to project; but there are two studies that I would recommend people read; they have recently come out. One is from the Boston Fed on the Systemic Risk to the banking system from their lending to the Private Credit sector and a similar study from the IMF on Systemic Risk that may link banks to Private Credit. Keep in mind that right now the entire increase in bank lending over the last year has been to one sector net & that is to the non-depository financial institutions which is your Private Credit. These folks, right now, have good credit ratings but they are lending to very risky borrowers & they are leveraging those loans. So the Boston Fed is saying there is Systemic Risk; the IMF is saying there is Systemic Risk and there are a lot of instances in the past where we have seen similar types of behavior and, as Minsky said, stability leads to instability. Now you can’t predict that but this pattern of Systemic Risk is something that has me concerned about; its something that cannot be predicted but, in my view, it is in the system“.

Watch the entire clip above if you have the time.

As we have written before, we wonder whether this private credit illiquidity is akin to Emerging Markets illiquidity of 1998 or the far worse Subprime meltdown of 2007-2008. If either comes true, then no one would have to ask to the Fed to cut rates. Powell would cut bigly & direct a flood of money to stop the Financial markets crisis. Of course, investors would have lost a lot money in the meantime.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X