Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Markets Last Week

Fixed Income:

- 30-year Treasury yield down 11 bps on the week; 20-yr yield down 11.2 bps; 10-yr down 11.5 bps; 7-yr down 11.2 bps; 5-yr down 12 bps; 3-yr down 10.4 bps; 2-yr down 9.6 bps; 1-yr down 3.1 bps;

- TLT up 2%; EDV up 3.1%; ZROZ up 3.2%; HYG up 76 bps; JNK up 5 bps; EMB up 56 bps; leveraged DPG down 16 bps; leveraged UTG up 1.8%;

US Indices:

- VIX down 16.5%; Dow up 1.6%; SPX up 1.9%; RSP up 1.2%; NDX up 2%; SMH up 1%; RUT up 1.3%; MDY up 79 bps; XLU up 1.2%;

Mega Caps:

- AAPL up 2.7%; AMZN up 2%; GOOGL up 1.7%; META up 3.4%; MSFT up 2.2%; NFLX up 1.8%; NVDA up 3%; MU up 1.3%;

Financials:

- BAC up 2.1%; C up 2.9%; GS flat ; JPM up 1.3%; KRE up 82 bps; EUFN down 1.5%; SCHW up 1.5%; APO down 1.3%; BX up 1.1%; KKR up 3.7%; HDB up 1.9%; IBN down 23 bps;

Dollar was up 29 bps on UUP & up 30 bps on DXY:

- Gold down 2.1%; GDX up 18 bps; Silver down 1.6%; Copper down 3.6%; CLF down 11%; FCX down 59 bps; MOS up 3%; Oil down 1.4%; Brent down 1.5%; OIH up 18 bps; XLE down 71 bps;

International Stocks:

- EEM down 1.5%; FXI down 2.7%; KWEB down 3.1%; EWZ down 1.5%; EWY up 2.8%; EWG up 1.5%; INDA down 50 bps; INDY down 82 bps; EPI down 30 bps; SMIN up 1%;

What a month was May? Kudos to Ryan Detrick who said in late April that they expect a strong May.

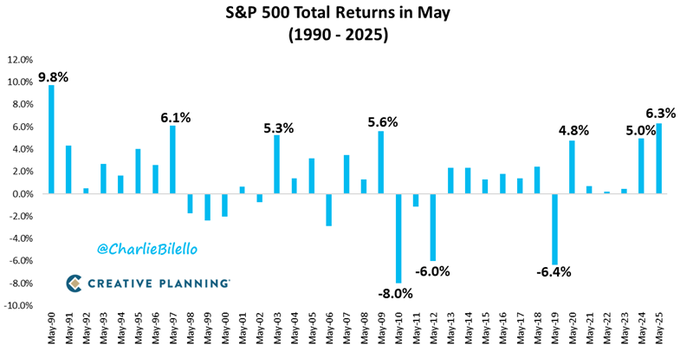

- Charlie Bilello@charliebilello – The S&P 500 gained 6.3% this month, the best May return for the index since 1990. $SPX Video: https://youtube.com/watch?v=spQk29jRLnE&t=90s

And,

- Eric Balchunas@EricBalchunas – $MAGS (Mag 7 ETF) just had its best calendar month ever.. and is up 26% since 4/7 (Cramer’s Black Monday)

And,

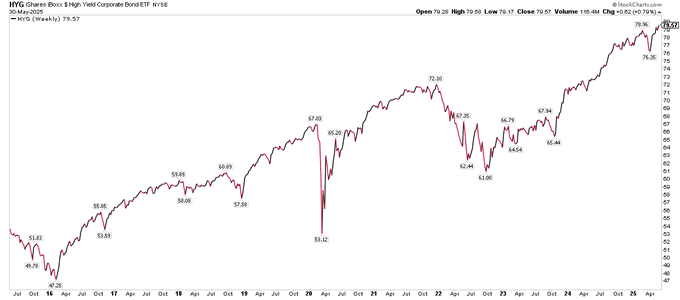

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – $HYG junk bonds ATH tr

And,

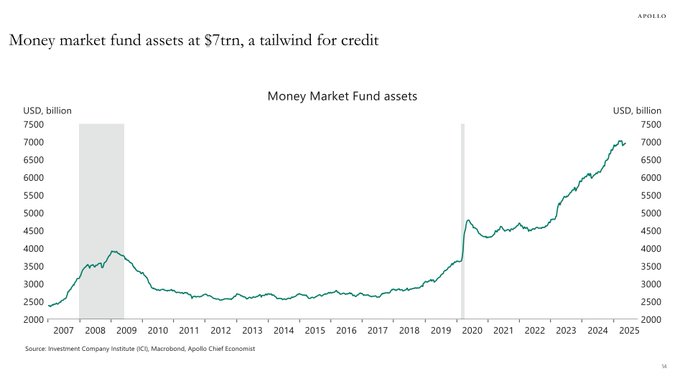

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – $7 trillion in money markets, a tailwind for credit –Torsten at Apollo

On the other hand,

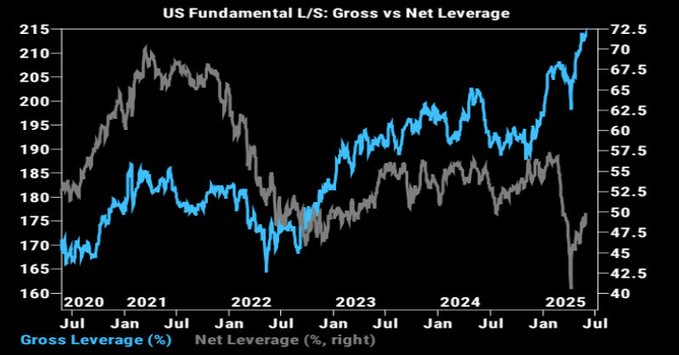

- The Market Ear@themarketear – We gonna need a bigger chart! Gross leverage for US fundamental long/short funds is going exponential. 99th percentile over the past 5 years. Have no fear.

And,

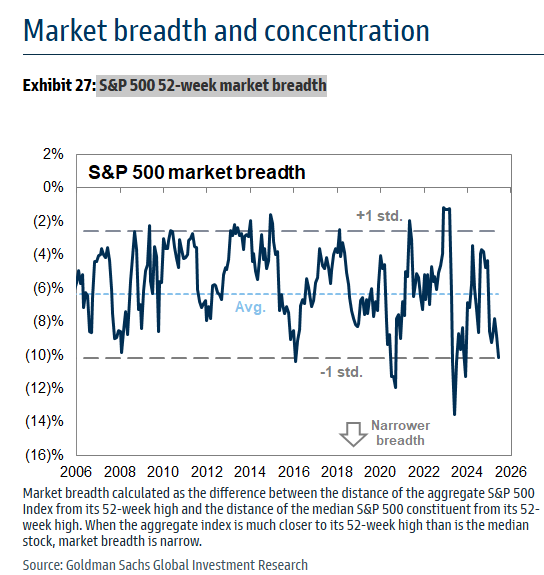

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – SPX breadth has turned south again

And,

- The Market Ear@themarketear – SPX has produced volatility, but no returns since May 12…

2. Equities – Signals, Ideas & opinions

Ryan Detrick of Carson Group shared 2 interesting & bullish patterns on Thursday on CNBC Squawk Box:

- Up 5%+ in May – 10 times in history when May is up 5% or more – S&P is higher one year later to times out of 10 with almost 20% on average; no better month with greater future returns than May;

- 27 days after April 9, the S&P had one of its greatest 27-day rallies ever, up almost 20%; the other times we saw strength like that was off 74 lows; off 82 lows; off 2009 lows; off 2020 lows. … the NYSE advance-decline line hit all-time highs; credit markets are hanging in there & US is catching up with the rest of the world ….

In a similar vein,

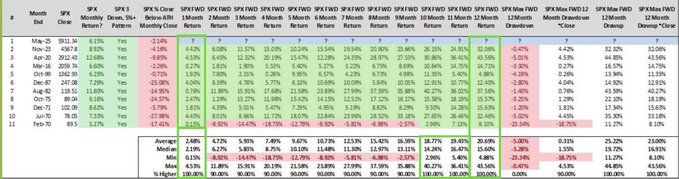

- Seth Golden@SethCL – When $SPX ends a 3-month losing streak by gaining 5%+ in month #4 (May). S&P 500 positive 1-month forward EVERY. SINGLE. TIME. and 100% of the time 10-12months forward. Any intra-month (June) consolidation is a likely buying opportunity. $ES_F $SPY $QQQ $DIA $NYA $RUT $SMH $NVDA h/t @SJD10304

Well-known investor Rich Saperstein said to CNBC’s Scott Wapner:

- look past tariff-turmoil to see de-regulation, more on-shoring, look at the tax-bill for immediate expensing from a tax-basis, greater opportunity for M&A. The environment post-tariffs will be a great environment for investing. Between that & now, we have uncertainty which could cause a slowdown in the next 2 quarters but I would look at the post-tariff environment into 2026 vs. looking at the immediate volatility. If the economy slows in the back half of this year, rates will go down.

- He said they are reducing small-cap exposure & adding to large-cap Tech & added they have been long-term holders of large cap tech.

- Saperstein also scoffed at the talk of “end of American Exceptionalism”, capital outflows, Dollar-crashing, rates going higher, getting tariff-induced inflation. He dismissed the “Sell America” talk at we hear on some TV shows. He pointed out that is you are large investor, you need the American markets for liquidity. And, in terms of exceptionalism, where is the growth? The growth is in America and if you want growth, you have to own US large cap tech.

The speed & magnitude of the rally is undeniable. But is the message absolutely & incontrovertibly positive at all times?

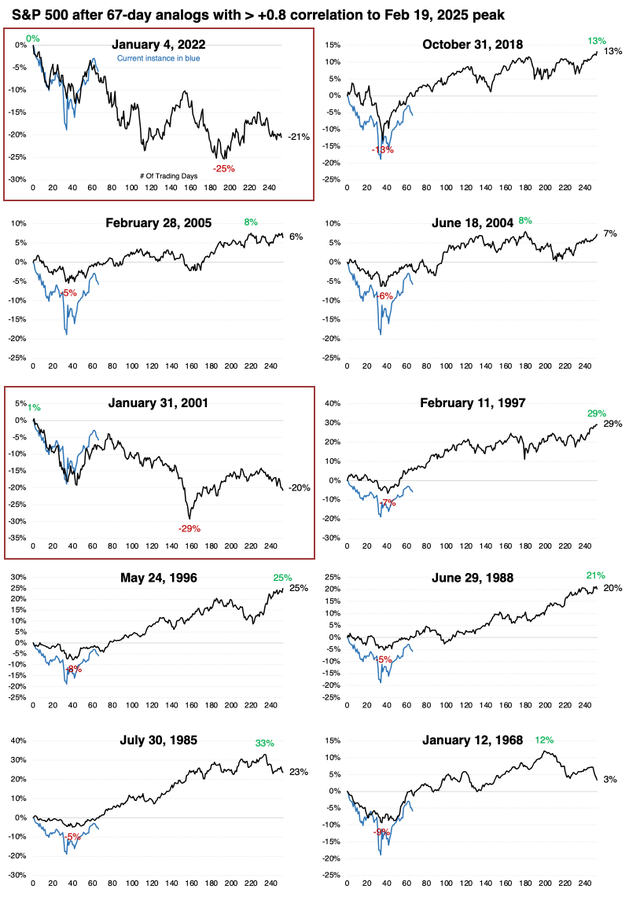

- SentimenTrader@sentimentrader – Tue May 27 – Stocks took a beating, then roared back. Both were of a magnitude and speed rarely seen over nearly 100 years. During the S&P 500’s history, there have been 15 periods closely correlated to this pattern. It’s somewhat troubling that the two closest matches in speed and magnitude of the decline and rally were 2022 and 2001. The S&P’s analog fits both almost perfectly, and both peaked right about now. 🔗 Read

@jasongoepfert ‘s May 27 article “Similar patterns raise the importance of the next couple weeks”:https://users.sentimentrader.com/users/sentimentedge/similar-patterns-raise-the-importance-of-the-next-couple-weeks

And what worked very well in 2022 & 2021 after the peak of those rallies?

3. Treasury Rates

Being long an asset the markets despise is a source of intense pain to believers. Even if the P-L pain may not be debilitatingly high, it is intense. And, as the wise tell us, watch for the long-term & intense believers in being long the pain talk about not wanting to stand in front of the “steam roller” . We will see if that signal works in the case below.

Watch Thursday’s Bloomberg Surveillance from about minute 41: 52 to 47:45 & listen to Bob Michelle of JP Morgan Asset Management, a real bull on Treasuries. Remember that the day before (Wednesday, May 28) was a bad day to own Treasuries with 30-yr yield up 3.bps; 20-yr up 4.9 bps; 10-yr up 4.5 bps; 7-yr up 4.8 bps; 5-yr up 4.2 bps; 3-yr up 3.9 bps & 2-yr up 4.1 bps.

By the way, MV-ONR, the overnight rate of Macro Viewpoints, is & remains at 3.75%. It has remained “anchored around the 2-yr Treasury rate“, to use a phrase of Bob Michelle.

Signor Michelle said above:

- “lets start with the Fed. We looked at the minutes yesterday – there were 13 references to inflation expectations whereas there were 3 a couple of weeks ago at the March meeting; so the Fed is clearly focused on inflation & keeping inflation expectations anchored“

- “I would be happy if the yields held around here; I would have loved to have the 2-year anchored around the Fed Funds rate of 4.375%; I would have loved to have the 10-yr at 5%; that would have been a relatively normal curve; “

- “Priya Misra calls the 10-yr & 30-yr part of the curve as “our risk assets” … I don’t want to be the one to stand in front of the steam roller right now; so I am just going to pack in the intermediate part of the curve; let somebody else help stabilize the long-end;”

- “I am concerned that it’s going to get worse before it gets better.. in my mind where the pain really starts to get felt is a 100-bps shift up from where the steady state was (4.40%) ; Once you break above 5% & get to 5.40%, that path between 5% & 5.40% becomes almost unbearable for bond investors; add another 25 bps on top of that for 30yr“

Guess what happened about 90 minutes later!

- zerohedge@zerohedge – Initial Claims 240K, Exp. 230K; Cont Claims 1919K, Exp. 1893K

- zerohedge@zerohedge – Q1 GDP Revision Reveals Big Deterioration In Personal Spending In “Kitchen Sink” Report

- zerohedge@zerohedge – US Pending Home Sales Plunge Most In 30 Months, Back Near Record Lows

- RenMac: Renaissance Macro Research@RenMacLLC – The latest continuing unemployment claims data tells me that the ranks of the permanently unemployment are climbing.

- David Rosenberg@EconguyRosie – The economy appears more unstable than many realize. I believe that growth is weak and will likely weaken further. Aside from the data center and AI craze, I don’t see any signs of vitality coming to the rescue. With the pending home sales numbers today coming out lower than the worst points we experienced during the Great Recession in 2008-2009 and capex coming to a standstill, we expect negative or near-negative GDP growth between now and the end of the year.

The Treasury market reversed Wednesday’s rise in rates on Thursday by falling 5 bps across the 30-2 yr curve. And the 7-year Treasury auction was a blowout in demand.

But the Fed is focused like a laser on inflation, right? So who cares about the above?

Guess what happened on Friday morning!

- zerohedge@zerohedge – Despite Tariff-flation Fearmongering, Fed’s Favorite Inflation Indicator Tumbles To Four-Year Low

- zerohedge@zerohedge – Supercore PCE turns negative for the first time since covid. Fed now dangerously behind the rate cut curve.

- Sara Eisen@SaraEisen – Today’s inflation report is a big deal and confirms easing inflation: prices up 2.1% April is very close to the Fed’s target. Core services inflation was flat on the month and the tamest in 5 years, so even if goods inflation flares a bit in coming months- between services inflation, housing costs finally breaking and oil declines… doesn’t seem like we have an inflation problem

Holy Whatchamacallit! Folks, this not merely an economist or someone relatively unimportant for the Fed. This is Ms. Eisen, the favorite of Kristalina Georgieva, the Managing Director of the IMF & the one Global Central Bankers request to fly to Europe and Middle East to moderate their media discussions. If the celebrated Ms. Eisen publicly tells the Fed that “doesn’t seem like we have an inflation problem”, then the Fed would listen, right?

We are not at all being sarcastic. We respect Ms. Eisen’s tenacity & suggest that the Fed listen to her. The Treasury market certainly listened with the 2-5 year curve falling by 4 bps and the 7-10 yr curve falling by 3 bps on Friday.

Of course, we don’t know much, at least not remotely anywhere near what the Fed does. So listen to David Zervos, a smart strategist who has been correct & honest all year.

Speaking of the Fed, is it possible that they have already begun to act & act decisively in a non-public manner? Remember their explicit assurances that they would act if the bond markets threaten to unravel. Remember, the Japanese 30-yr going berserk on Wednesday May 21 with long-duration Treasury yields jumping by 11-12 bps. Did that fit the “unraveling” description?

We ask because there is a story that the Fed “secretly bought $43.6B in Bonds” in the week of the above “unraveling”. “They’re not calling it QE, but that’s exactly what it is,” said Michael Gentile, founder partner at Bastion Asset Management on Wednesday, May 28 on YouTube.

Remember the warnings of Jeffrey Gundlach on CNBC’s Closing Bell about the lack of liquidity in Private Credit! We were reminded of that when we saw the chart below in a summary of comments this week in Bear Traps Report. The summary points out that “You have to look far and wide historically to find this kind or divergence across the U.S. financials outside some kind of crisis.” (emphasis ours)

(courtesy of @BearTrapsReport)

What could you view or hear that might assist you in both equity & bond markets over the next few months? Simple – the new clip by Larry Williams appropriately titled What’s Next?

4. Real “TACO” – the key to the China Tariffs Drama?

Frankly, we just can’t believe the nutty stuff that goes around the US media including financial media. But the conventional meaning of TACO as applied to President Trump in Democrat-loyalist media is just insane. Since we like Tacos as they make them in Mexico, we thought we would use our own TACO or “Trump’s Action about Chinese Overhaul“ term. As most should see from below, President Trump’s determination & negotiating style might well deliver a big change in China.

And China is certainly undergoing a massive overhaul of its power structure. It should be clear by now to everybody that President Trump’s tariffs, intensified upon China’s retaliation, dealt a structural blow to the Chinese economy. And that has set off an intense power struggle inside the Chinese Communist Party (CCP). We recommend reading Section 4 of our May 4 article that describes some of the US-China interactions & China’s semi-suicidal responses. Initial Xi’s plan reportedly was to use a protracted war to outlast US in the tariff war. Once that seemed destined to fail, the internal fighting turned into keeping Xi Jin Ping around for blame damage from the tariff war & then replacing him.

Fast forward to this past week to watch the 13:46 minute Bloody purge in the military; Xi’s life-and-death struggle clip dated May 28, 25. Just its introduction states that the 3rd highest ranking Chinese PLA general has died, by “suicide”, and that Xi Jin Ping has been given 60 days. Fast forward to Lei’s hour-long May 31, 25 clip titled Power vacuum in Beijing and the man who might replace Xi Jinping. The introduction itself is fascinating:

- “China’s trade talks with the U.S. have stalled—but not because of tariffs. Behind the scenes, Beijing is in a power vaccum. Xi Jinping has vanished for over 11 days, triggering rumors of a power struggle at the top. With no one clearly in charge, the Party Elders are racing to find a successor. One man has emerged as their pick—but he’s not stepping in without conditions. He’s reportedly demanded three things before agreeing to take the job. “

On the other hand, Decoding China put out two clips one day apart:

- Xi Warns of Chaos if Ousted; Vietnam Booms as China’s Factories Die – 4 days ago

- China’s Political Map Redrawn: Xi’s Last Allies on the Run? – 3 days ago

With this level of intense intrigue & power play, is it hard to imagine at least one or both factions are talking about invading Taiwan & seizing it? The faction/leader who can do this will run China for a long time afterwards. Does that possibility explain the intensely serious warning from Secretary of Defense Peter Hegseth this week:

While attacking Taiwan might be attractive & intensely meaningful, it is far more dangerous in its consequences than another alternative that can be justified in preserving the enormous financial bet made by China – $68 billion invested in the China-Pakistan-Economic-Corridor.

In strategic parlance, this entity named Pakistan is termed as an attractive body that willing aspirants gladly pay to use. It is of huge strategic importance to China in that it “provides” direct access to the Arabian Sea via the Gwadar port leased to China. It is of critical strategic importance to US because it has been used as a corridor to support US troops in Afghanistan & future air-ground sorties against China. Notice the World Bank granted NaPakistan a $40 billion loan yesterday, seemingly out of the blue, while China has warned India that China will participate with Napakistan in its next war against India.

On the other hand, the once highly attractive & welcoming body is getting so old & so fatigued that different body parts are breaking off, especially the most desirous & fulsome body part called Balochistan. The Baloch are now in an intense fight to breakaway from Napakistan. So China has opened a dialog with the Taliban in Afghanistan, the Tehreek-e-Taliban in Napak’s Khyber Pakhtunkhawa province and the Baloch freedom movement. If China can buy their support, then Napak’s ruling province of Panjab becomes not so important.

On the other hand, holding Balochistan is easier said than done as Napakistan again found out yesterday. The Balochistan Liberation Army attacked a central junction town named Surab & seized it.

A much easier alternative for US military access to China & that too the richer parts of China is through the Indian Ocean via Myanmar. It is the shortest missile path to the rich Chinese coast. And Myanmar is now almost destitute & livid with China because the expensive arms supplied by China apparently don’t work as advertised.

Now ask yourselves, what is the best route for China to take? And apparently the Senior CCP leaders are discussing it. Watch the March 23, 25 (11:58 minute) clip below titled China’s future model deliberated within the CCP; Its introduction says:

- “CCP Party elders are quietly deliberating what China’s governance might look like in the post–Xi Jinping era. The models drawing the most interest are Vietnam and Singapore. While both Vietnam and China are nominally communist states, Vietnam has moved ahead in terms of political reform and personal freedom. Singapore, on the other hand, left a lasting impression on Deng Xiaoping during his 1978 visit—he famously ordered Chinese officials to study its political system closely. Now, as China faces mounting internal pressure and global headwinds, the question is back on the table: Could the Vietnamese or Singaporean model guide China’s next chapter?”

Imagine a more liberal leader coming to power in Beijing & turning that great nation towards a focus on peaceful trade & economic growth like Vietnam! What a great gift would that be to the Chinese people & the entire world?

Would that have been even thinkable before President Trump’s tariffs policy?

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.