Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips –our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Insanity or Obedience?

Lunacy is the word that comes to mind when Bank of Japan Governor Kuroda reverses himself within a week and causes a havoc in world markets. But what do you say when Kuroda does so twice in 3 months & gets the same awful result? Insanity per Einstein’s definition?

The first time was on Friday January 29, 2016 when Kuroda delivered negative interest rates after explicitly squelching any such possibility a week earlier in Davos. The Yen exploded higher, Gold shot up and stock markets went into a swoon.

Kuroda did just the opposite this Thursday. Contrary to what he had said several days earlier & contrary to what the markets were expecting, Kuroda stayed pat. The Yen-Dollar rocketed up 3 full points and Nikkei fell 1,000 points to close down 661 points. The US stock market got hit hard and Gold rocketed higher.

- ForexLive

@ForexLive – USD/JPY: In like a lamb, out like a dead lamb...

So two totally opposite monetary actions of Kuroda had the same fast & furious result – havoc in macro markets. Why? Is surprising the markets the main reason? But surprises can be positive & negative and markets react differently to the two kinds of surprises. They did not on Thursday. So are markets reacting to a belief that Kuroda has lost his mind or, worse, that he has lost control? In either case, the primary reaction would be risk aversion:

- Holger Zschaepitz

@Schuldensuehner – Risk aversion seeping in:#Gold has broken to a high of 1,287.70, the highest level since Feb2015.

Or is there another logically sound reason for Kuroda’s action? The first stunner from Kuroda was wrong because it was negative for China. Look at the chart we referred to on January 30:

- Simon RabinovitchVerified account @S_Rabinovitch January 29, 2016 – No, not the yen. It’s the yuan. With JPY 15% of CNY basket, Kuroda is testing China’s will to let yuan fall vs USD.

Kuroda’s stunner on Friday, January 29 caused a massive problem for China by making the Yen weaker relative to the Chinese Yuan. Remember the pain that inflicted on global markets in early February? That was totally unacceptable especially in this US Presidential election year. That may have been the principal reason for the US Treasury & the Fed to put in place the Shanghai accord – an accord designed specifically to remove the devaluation pressure off of China by the Fed going dovish and by forcing the Yen & Euro up relative to Dollar & the Yuan.

Unlike the Plaza accord of 1985, this was a secret deal not to be acknowledged or commented upon. How has that accord delivered? Just look at the humongous rally in risk markets from early February. The world looks so much better, doesn’t it?

How dumb were we to even think that the Fed could hint at hawkishness at the April 29 FOMC meeting? Chair Yellen showed us how dumb we were. She delivered what she was supposed to – the Dollar weakened more & markets rallied. Kuroda was on deck the next morning in Tokyo. He had to deliver what Japan had committed to and he did.

So what’s the difference between Yellen & Kuroda? Yellen behaved in the manner that markets expect from the dovish Yellen. So the reaction was as expected. In stark contrast, Kuroda had to behave as anti-Kuroda. The man who delivered the stunner of negative interest rates on January 29, the man who had built his image as a champion of easier & easier monetary policy was forced to deliver a stunningly unexpected hawkish decision. That’s why he rocked the markets while Yellen soothed them.

So was Kuroda incompetent or insane? Or was he simply obeying the Shanghai accord? We don’t know of course. But the markets should tell us. If the markets think BoJ has lost its power and/or mind, then the risk markets could lose their poise next week. On the other hand, if the markets think the latter over the weekend, then the risk assets could regain their balance & the EM outperformance could resume.

By the way, what do we look at when we want to understand whether good things are happening to or in China?

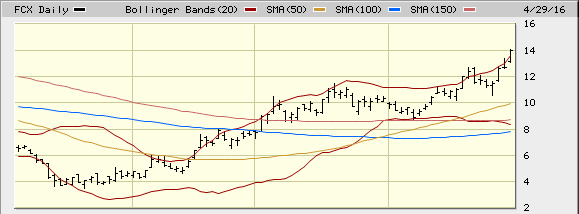

(FCX chart – year to date – up 20% this week)

Is China saying Domo Arrigato to Kuroda-san? We will find out next week.

2. China

Is there is anything more credible regarding Government-to-Government monetary agreements than the voice of Larry Fink? We haven’t forgotten how he soothed the concerns of global investors in 2012 about the promise by Draghi to do “whatever it takes“. Mr. Fink was just as soothing about China’s massive stimulus in his appearance on BTV on Wednesday. George Soros might have sounded the alarm on China last week but Larry Fink was serenely ebullient. Any thoughts of a bubble could be a 2017 or 2018 event but the Chinese market would be fine this year, he said.

We think Mr. Fink is right, as long as China is not forced to devalue its currency. Stratfor explained why this week:

- “An overvalued yuan helps to achieve several strategic imperatives. Devaluation would sink many firms loaded up on dollar debt, risking a systemic debt crisis. And with China trying to transition away from an export-oriented economic model to one geared toward consumption, currency strength guards the purchasing power of tens of millions of newly minted middle-class households. Beijing needs to keep this upwardly mobile, asset-owning constituency politically in its corner. While maintaining an overvalued yuan creates real estate and equity deflation risk, a credit crisis sparked by devaluation could create a complete collapse in household net worth.”

Just as keeping Yuan weak was critically important to China in the growth phase, keeping the Yuan strong is critically important to China today. So, in political parlance, China is just as committed a currency manipulator today only in the reverse direction.

How do you say “Pangloss” in Chinese? And what do you own in a Chinese Panglossian world?

- J.C. Parets

@allstarcharts – I think the main point is that the place to be in April was not in stocks, but in commodities. First Metals, then energy, now ags….

3. Gold & Silver

Can you fall in love with Gold? King Dhan of the Nand dynasty of the Gangetic Plain, a contemporary of Alexander of Macedonia, loved gold so much that his personal treasury owned 99 koti or 990 million gold coins ( 1 koti or crore = 10 million). Of course he had usurped this collection from the treasury of the state. He was deposed & replaced by a 20-year old young man who went on the build the greatest empire of those times (his grandson Ashok is made Buddhism the global religion it is and Ashok’s chakra adorns the center of the Indian flag).

And who can’t love Gold in 2016? Gold rallied like crazy when risk assets were getting trashed in the first 6-8 weeks of the year and Gold has rallied as risk assets exploded higher. Gold rocketed higher when Kuroda stunned markets on January 29 and Gold rocketed higher when Kuroda reverse-stunned markets this Thursday. So Gold has been the asset class for all seasons so far this year.

What a week this was a week with Gold Miners up 14% on the week with ABX up 20% on the week. As if that weren’t enough,

- Joe Kunkle @OptionsHawk – $ABX day highs and now 5,500 next week $20 calls bought, crazy call flow all day in this one

How many ways can we describe the action?

- Michele Schneider @marketminute – Here’s that channel in $GLD on the weekly chart

And Silver is now catching up:

- Day Trade Alerts @AlertTrade – Silver jumps 15% for the month as gold logs highest settlement in over a year http://dlvr.it/LBJ01H → via @AlertTrade

Silver now has more fans than Gold, it seems:

- Carlos Ledezma @Charlie_Ledezma – Say what you will about how or why, but $SLV is breaking out, no real resistance till $18.

And why not? Dollar is being kept weak, interest rates are held low in America, interest rates are being held negative in most European markets, inflation expectations are going up. Isn’t this the pure Panglossian for Gold? And if Gold is in a fundamental, technical & flow bull market, shouldn’t gold miners dance in abandon?

On the other hand, is this sense of abandon the right time to sell? That’s what Larry McDonald & his Bear Traps Report said on Friday:

- Lawrence McDonald @Convertbond – Gold Bears on milk cartons, it’s a Sell Signal Once cluelessly giddy, now crickets#MIA $GDX $GLD

He was seconded by Carter Worth of CNBC Options Action. His message – GDX has seen the steepest 3-month move on record. Sell GDX. Unlike his succinct message, his chart work is best seen and not read:

The message of Carter Worth is tactical and not strategic because he does say Gold can go much much higher if this “debt disaster” works out as he thinks it will.

4. Treasuries & Bunds

Something interesting happened in the last couple of days. Apart from Yellen & Kuroda or perhaps because of them, German Bund 30-yr & 10-year rates went up by about 3 & 6 bps this week while Treasury 30-yr & 10-yr yields fell by about 6 bps. If this continues next week, that would be really interesting. In fact, yields along the 10-3 year Treasury curve fell by about 6-7 bps with the 30-year yield a laggard by falling only 3 bps. Was it the Fed or was it the economic data or both?

Once again Gundlach proved right.The big question is whether his growth scare materializes in the summer. Next week is the payroll report. Will that catch up to the weakness in other data? We say catch up because Larry McDonald tweeted its description as “the lagging of all lagging indicators“. And we heard Alyce Andres-Frantz, Chief of the MNI Chicago Bureau, tell Rick Santelli that the employment component of Chicago PMI saw this week its “10th contraction in the last 12 months“.

And technically speaking,

- Carolyn Boroden

@Fibonacciqueen –$TLT did trigger against the timing work and the retest of old support yesterday…max risk below 4/26 low

5. Stocks

They manufactured a decent bounce on Friday afternoon to let S&P close in the green for the month. But that’s the best we can say for the last two days of the week. All the major indices closed down 1-3% on the week. Will the bounce on Friday afternoon carry into early next week?

- Kate’s Dad

@KASDad – Seasonal strength first 2 days of next wk. That could provide impetus for attempt to close today’s gap & avoid island reversal.$SPX$QQQ

And indices are close to levels they could bounce from:

-

Steve Burns @SJosephBurns – $QQQ near the 30 RSI.

- Steve Burns @SJosephBurns – $IWM near the 200 day.

-

Andrew Thrasher, CMT @AndrewThrasher – Momentum for the $SPX is now at its prior short-term April dip level.

On the other hand, earnings have been lackluster despite the big beats by Facebook & Amazon.

- Not Jim Cramer @Not_Jim_Cramer – Large Divergence in EPS vs. Price is Unlikely to Persist

And aren’t the next 6 months a seasonally negative period for the stock market?

- Ryan Detrick, CMT

@RyanDetrick – When the usually bullish Nov-Apr timeframe is negative (like it just was), next 6 mos see a big spike in volatility. Will it happen again?

And what about the Sell in May & Go Away dictum?

- LPL Research @LPLResearch – Is It Time to Sell in May? http://lplresearch.com/2016/

04/29/is-it-time-to-sell-in- may …

In this preliminary article, they point out:

- “When looking at the past 10 years, what’s particularly interesting is that the S&P 500 virtually peaks right at the start of May, before the usual volatility and consolidation during the summer months. In fact, as of April 30, the S&P 500 is up 4.2% year to date, on average, over the past 10 years; by the end of October, it is up to 5.2%”

What about volatility?

- J.C. Parets

@allstarcharts – dude look at speculators net short Volatility & adding to positions…..this has monster squeeze written all over it

So how bad can a decline from here get?

- Chris Kimble @KimbleCharting – Triple Top spanning 18-years taking place? Not a place bulls would want weakness to start taking place. $SPY

6. Oil

Oil ETFs had a great week with USO & BNO both up 5%. That should be par for the course if, like metals, Oil is more about China strength & US Dollar weakness. How can you say in technicalese?

- Mark Arbeter, CMT

@MarkArbeter Updated$USO chart: Nice breakout, and not yet overbought. Room to stretch its legs.$WTIC,$UWTI,$OIL

If you think Oil is more about physical,

- Lawrence McDonald

@Convertbond – Record numbers of tankers floating on the high seas, stuffed with oil, physical supply SELL signal

And,

- ValueWalk

@valuewalk – Oil Rally Won’t Persist Despite Extreme Long Bets shttp://www.valuewalk.com/2016/04/oil-rally/ …$OIL - “Analysts at Morgan Stanley disagree with the rising bullish sentiment and believe that this false rally will fizzle out soon. They predict a severe unwind of this bullish positioning in the later half of this year as large speculators scale back their long bets”

What seemed interesting to us was that Oil equities severely underperformed Oil this week.

7. Trump

While so many Trump related comments can be quoted, the most interesting, from a macro markets view, is:

- Boris Schlossberg

@Fxflow – Does the strength of Trump support suggest that market is underpricing the risk of#Brexit? GBPUSD

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter