Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Tale of Two NFP Numbers

Remember the release of the ultra-hawkish Fed minutes on Wednesday, May 18? About two weeks later came the shockingly weak NFP number of 38,000 on June 3, 2016. That market reaction was consistent with that shock:

- Minor reaction in Stocks – Dow down 30 bps; SPX down 30 bps to 2099; NDX down 48 bps; RUT down 55 bps;

- Big Move in Yields; Curve Bull-Steepened – TLT up 1.42% EDV up 1.73%; 30-yr down 7.7 bps; 10-yr down 11.1 bps; 5-yr down 13.3 bps 3-yr down 11.9 bps 2-yr down 11.5bps;

- Small move in High Yield – HYG up 18 bps; JNK up 17 bps

- Huge Move in Gold & Miners – GLD up 2.75%; GDX up 11.20%; GDXJ up 12.01%; SLV up 2.56%

Fast forward to this week & to the Fed minutes that were described as:

- David Rosenberg – From my lens, the minutes from the June meeting of the Federal Open Markets Committee were very dovish

The stunningly high NFP number of 287,000 on this Friday, July 8, 2016 was in stark contrast to the dovish Fed minutes & to the positioning of markets. Add to that Fed-whisperer Hilsenrath’s warning of a possible rate hike in September. How should the markets have behaved? Rates should have catapulted higher & Gold/Miners should have been shot. In fact, for a very brief period, that’s what happened. Then, as if via a magic wand, the pain disappeared & everything was wonderful again:

- Big Rally in Stocks to almost new highs of – Dow 1.4% up 251 to 18147; SPX up 1.53%; 32 to 2130; NDX 68.78 up 1.54% RUT up 27.60 to 1,177 up 2.40%

- Minor move in yields – Bull Flattening – TLT up 74 bps; EDV up 1.03%; 30-yr yield down 4 bps; 10-yr yld down 2.6 bps; 5-yr down 0.7 bps; 3-yr yld up 2.4 bps; 2-yr yld up 2.8 bps;

- Nice rally in High Yield – HYG up 1.33%; JNK up 1.35%

- Sizable Rally in Gold/Miners – GLD up 60 bps; GDX up 3.14%; GDXJ up 4.86%; SLV up 2.73%;

What’s going on? A major signal? Remember the old dictum – when a market rallies on bad news instead of going down, get bullish on that market! So did Friday provide a bullish signal on both Gold/Silver/Miners and Long duration Treasuries? That almost means we should be disregarding the strength implicit in the 287,000 jobs number, right?

- David Rosenberg – June Job Jump – Fade it! – What if I told you that employment actually declined by 119,000 in June?

His reasons were technical about the Household survey. What about historical patterns?

- Urban Carmel

@ukarlewitz – Monthly NFP: prints near 300k followed by ones under 100k, and vice versa. Last two months nothing unusual

What about seasonality?

- Raoul Pal

@RaoulGMI – I expect US growth to slow from here. See cyclicality of AtlantaFed GDPNow. Will be more of an issue later in summer

Given all of the above, what do we know? Forget about any possibility of a Fed hike at least until the July 27th Fed meeting. So OK for treasury yields to fall & for Gold/Miners to rally?

But what about the small down move in stocks on June 3 vs. big rally in stocks on July 8? Is that correlated to the small move in high yield on June 3 vs. the nice rally in high yield on July 8? HYG & JNK made a new year-to-date high on Friday and both closed above their upper Bollinger bands.

- Charlie Bilello, CMT

@MktOutperform – Leveraged Loans and High Yield Bonds at new all-time highs. Strength in credit continues.$BKLN$HYG

Just like Michael Contopoulos of BAML last week, Anastasia Amoroso of JPM said buy high yield on Friday after the NFP number. And strength in credit is our real determinant for low treasury rates being beneficial for stocks. So does that explain the contrast between the big rally in stocks this Friday vs. small decline in stocks on NFP Friday June 3?

But isn’t high yield correlated to oil? And didn’t oil go down 8% this week and did nothing on Friday? Does that support our conjecture that high yield is now more correlated to health of European banks? How did European banks act on Friday? EUFN was up 3%; BCS up 3.7%, RBS up 5.8% & even DB was up 3%.

But someone has to add a sour note, right?

- J.C. Parets

@allstarcharts – I expect new lows in Junk Bonds relative to US Treasury Bonds in the near future$HYG /$TLT – next target under 0.5

Frankly, we ourselves are worried about a downturn in credit in August & later. We don’t claim to know much but this period does remind us of the rally into July 2007. That would mean a rally in stocks to a new high of sorts in July and then a reversal. What might be a cause of such a reversal in credit optimism & stocks?

- Dana Lyons

@JLyonsFundMgmt – ICYMI>ChOTD-7/7/16 Euro-PIIGS Are Squealing Again$GREK$PGAL$EWP$EWI$EIRL Post: http://jlfmi.tumblr.com/post/147081575385/euro-piigs-are-squealing-again …

And of course,

- Holger Zschaepitz

@Schuldensuehner – SG’s Edwards:#Brexit is a symptom, not the cause of our problems and#Italy is next! https://doc.sgmarkets.com/en/1/0/149526/183601.html?

2. Treasuries

Once again, Treasuries had a good week and once again the 30-year was the star. The yield curve again flattened this week.

- 30-year yield fell 14 bps to 2.1003%; 10-yr fell 9.5 bps to 1.3612%; 5-yr fell 5.2 bps to 95.24 bps; 3-yr yield rose 0.4 bps to 70.76 bps; 2-yr yield rose 2 bps to 61.73 bps;

Isn’t this a proven signal for “0 before 50 bps” as we have maintained? That depends on whether the fall in the 30-year yield is a signal for slowdown or merely the result of inflows in search of 2-handle yields? But isn’t 2% a big number? Wouldn’t you expect some resistance at 2%? Or what would it suggest if the 30-yr yield cuts down through 2% like hot knife through butter?

Some would call the above questions & conjectures as comedy:

- Lawrence McDonald

@Convertbond – Similar clowns selling oil in February are buying bonds today, pure comedy#Capitulation

- Bob Byrne @ByrneRWS – still getting bogged down around 143 $TLT

Some merely point out what a freight train the 30-year has been for 34 years:

- Ed Bradford

@Fullcarry – Take a moment

We would prefer to wait until TLT & the 30-year T-bond decline hard on good economic news or until we see a Euro-TARP for European, especially Italian, banks.

3. New Highs of sorts in S&P

As simple folks we only knew all-time closing highs. That would mean the S&P has not made a new high as of yet. But we found out about different sorts of new highs on Friday:

- Urban Carmel

@ukarlewitz – All time high weekly close for the S&P 500.

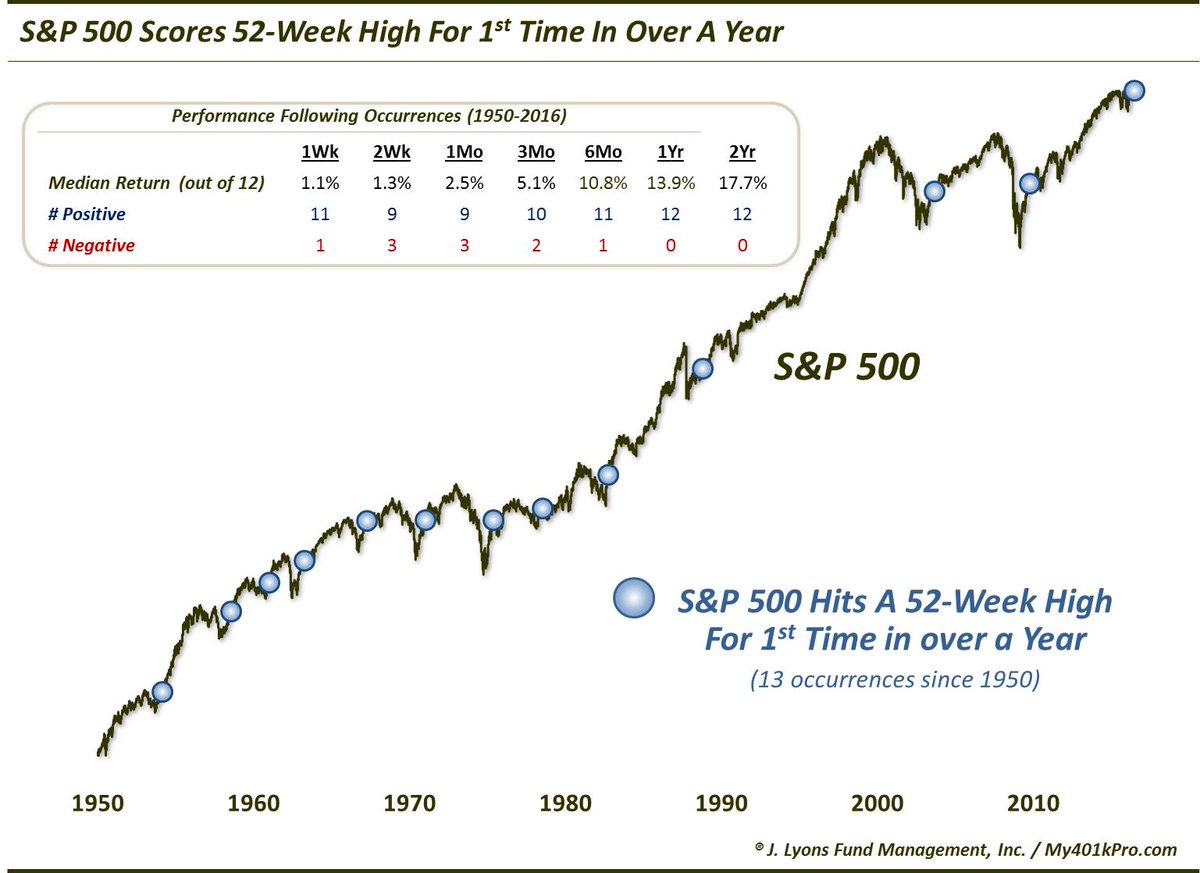

- Dana Lyons

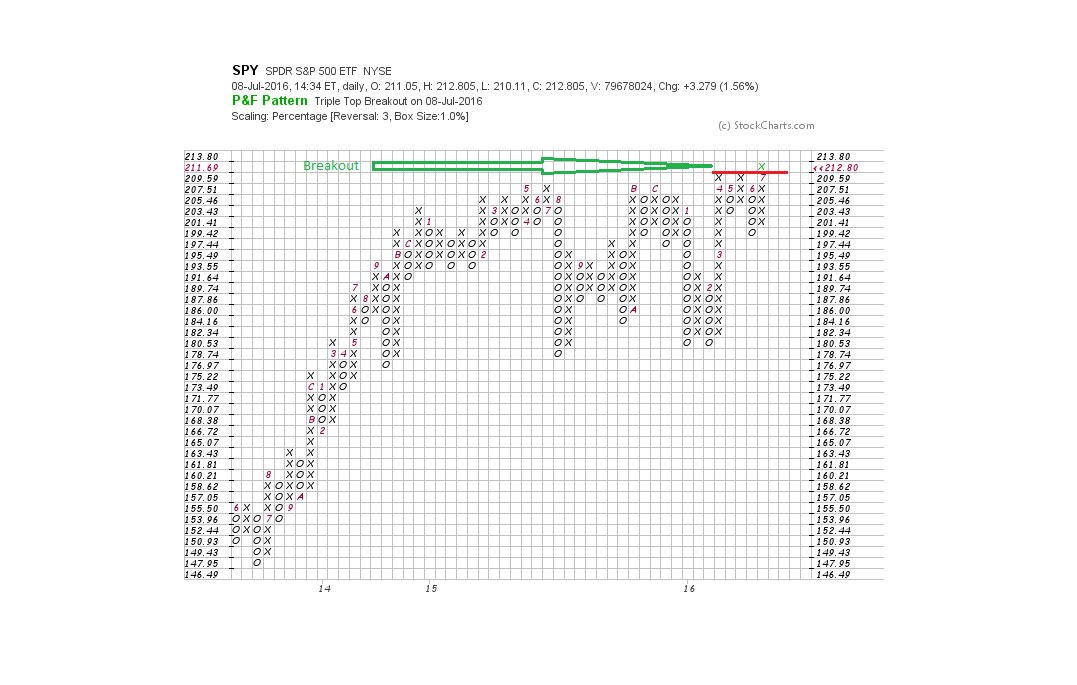

@JLyonsFundMgmt – ChOTD-7/8/16 S&P 500 Scores 52-Week High For 1st Time In Over A Year$SPY$SPX

- Karl Snyder, CMT

@snyder_karl –$SPY Breakout

These seem perfectly fine as steps to a new all-time high but are they worth much without a new all-time high, especially given how close S&P came to a new all-time high on Friday? In our simplicity, we would argue no. Because what message would the S&P send if it came so close but failed?

We do expect to get a new all-time high soon but what if that new high is not confirmed by S&P remaining above the old high for a few trading days at least? What is the statistical track record for next week?

- SentimenTrader

@sentimentrader – There have been 8 times when$SPY,$TLT,$GLD all up when payrolls beat estimates. A week later, SPY down 7 times, avg -1.9%.

But does that preclude a new all-time high in the first couple of days of next week & then a giveback? We will found out.

4. Buy the June swoon, Sell the July high?

The affirmative original of this title was a tweet by Urban Carmel @ukarlewitz and a succinct summary of the LPL Research article titled Welcome to the Strongest Month for Equities Since 1928. Based on the chart below, the article states “July is consistently positive, while June and August are usually weak“. It adds “In case you are wondering, August is usually when big drops can happen, as that month is lower by 4.8%, on average, when it is red“.

- Willie Delwiche, CMT @WillieDelwiche – % of $SPX making new highs (less new lows) has surpassed the March peak & is at highest since 2014. #2016isnot2015

- Forex Analytix @forexanalytix – SPX quickly approaching resistance, RSI is getting overbought, so breakout may be faded next week (if breaks)

5. Gold vs. Stocks

Not only did Gold not decline in the face of 287,000 NFP number & a 250 point rally in stocks, but it also seems to have given a major signal to some technicians.

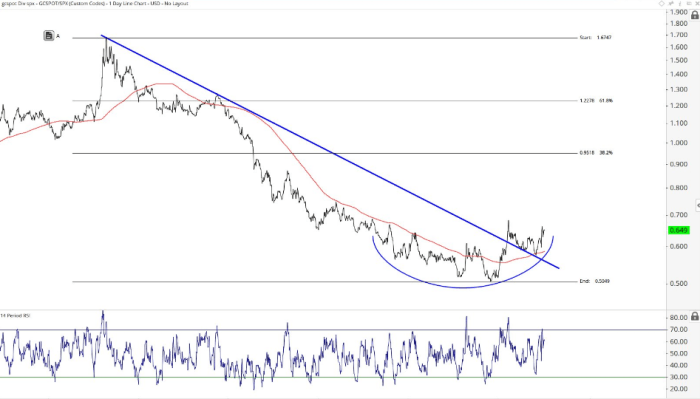

- J.C. Parets

@allstarcharts – Gold Technical Update: Major Bottom in Gold/S&P 500 Ratio http://energyandgold.com/2016/07/08/gold-technical-update-major-bottom-in-goldsp-500-ratio/ …$GC_F$GLD$SPY via@CEOTechnician

- “Gold was in a downtrend vs the S&P 500 since the highs in 2011 until February when the ratio broke out above the downtrend line from those 2011 highs. At this point with momentum in a bullish range, we want to be long the Gold/S&P500 spread if we’re above that downtrend line with a target up near 0.95 which is the 38.2% retracement of the entire 2011-2015 decline.”

- This looks like one of the most compelling trade setups available to investors right now. In addition, the risk/reward is attractive and more importantly the risk is clearly defined. To put this into perspective for the gold/S&P 500 ratio to rise to .95 will mean that gold is about to rise significantly (~$2000) or the S&P is about to drop precipitously. Or, some combination of the two will occur. I like this trade not only from a technical perspective but it also makes a lot of fundamental sense to me. The fact that it is grounded in a clear long-term chart setup makes it compelling.

That brings us to pure gold.

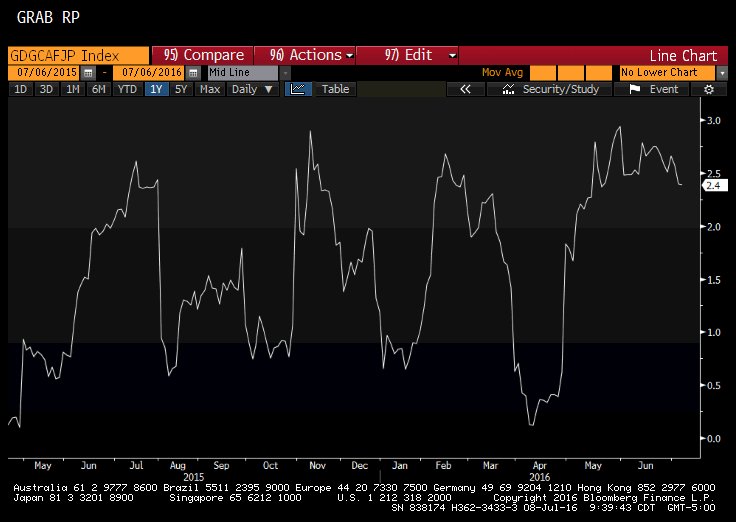

6. Gold, Silver & Miners

Gold, Silver & Miners were again absolute stars of the week, much of it driven by Friday’s rally. Silver again beat gold by 2.5% over 1.6%. And GDXJ beat GDX by 8.9% to 5.2%. Both of these represent signals to a well-known technician. But with all the accolades about gold, we have to begin with a negative:

- Kora Reddy @paststat – 100k NFP beat is very bearish for gld , down 8/8 times five days later at an avg of 110 bps ..

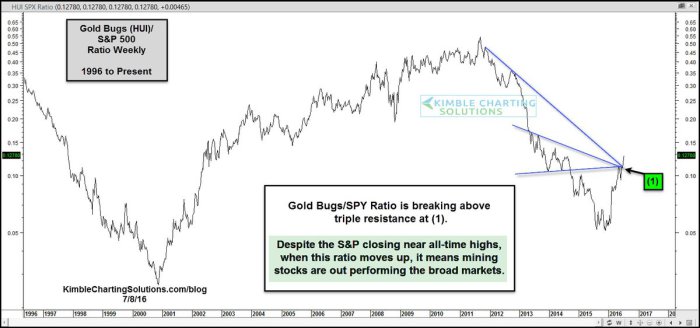

- Chris Kimble

@KimbleCharting – Miners key ratio breaks out above dual resistance, historically a positive message for mining stocks.$GDX$GDXJ

- Chris Kimble

@KimbleCharting – Silver breaks free from this 5-year slide.$SLV$GLD$GDXhttp://blog.kimblechartingsolutions.com/2016/07/silver-breaks-free-from-this-5-year-slide/ …

And a fundamental case by:

- Steen Jakobsen @Steen_Jakobsen – Is Gold on the Cusp of Its Next Bull Run? http://bloom.bg/29yuhnX via @business