Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Kuroda/Draghi back away?

Perhaps both were taken aback by last week’s breakout in risk assets triggered mainly, in our opinion, by the tantalizing prospect of helicopter-type stimulus from Abe-Kuroda under the tutelage of Bernanke. Is that why Draghi backed away from any additional action this Thursday and Kuroda said to BBC that the time for helicopter-money is not now.

Not only did Kuroda back away but talk surfaced this week that the Bernanke visit was a ruse. Read what Daisuke Karakama, chief market economist in Tokyo for Mizuho Bank Ltd., said (via Bloomberg.com):

- “Helicopter money, which has been debated in public without anybody clarifying the definition, was used merely as an excuse to unwind speculative yen buying,”

If that is the case, what should have happened this week? Yen should have fallen & the 10-2 year yield curve should have flattened. The Yen did fall by 1.3% vs. the Dollar and the 10-2 curve did flatten by 3 bps. Small moves but consistent with the hypothesis.

But no one really believes that Kuroda & Draghi are done. Perhaps they did not want to intrude on next week’s FOMC meeting. But the U.S. Dollar rallied 1% anyway, perhaps in expectations of some hint of a September rate hike. Actually, the Dollar rallied right into resistance:

- J.C. Parets

@allstarcharts – here is the short-term issue that the U.S. Dollar Index needs to deal with next week$DX_F$UUP

Will the rally in the Dollar stay the Fed’s hand or will they use this opportunity to send a free signal to regain some credibility? There is very little to constrain them – global crisis have proved to be non-crisis, US data is coming in somewhat stronger & the US stock market is at all time high. So why not take this free shot? Perhaps to prevent a breakout in the U.S. Dollar?

2. Credit Cycle

The big question is whether this is July 2012 type factored-in situation waiting to rebound or a 2007 type downtrend possibility. One fundamental factor seems positive:

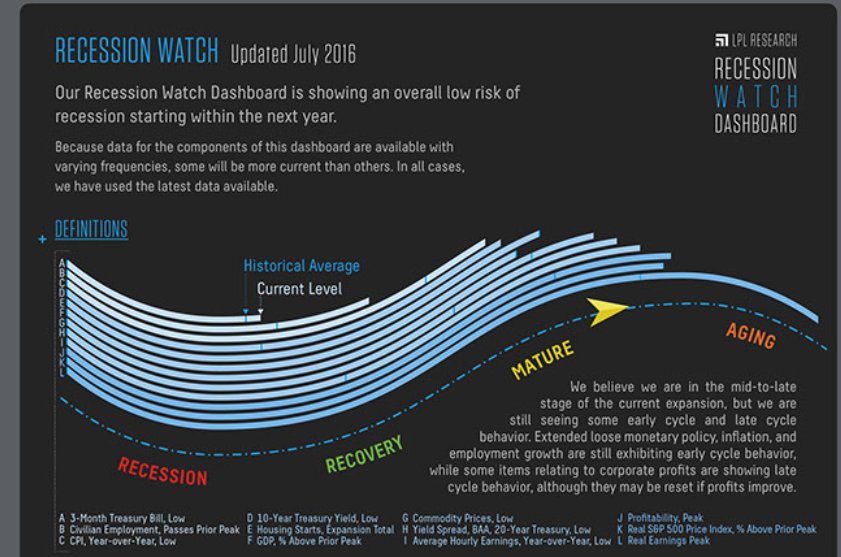

- LPL Research

@LPLResearch – Our Recession Watch Dashboard shows overall low recession risk ahead#ChartOfTheWeek http://oak.ctx.ly/r/4vvvd@LPL

And the behavior of credit markets supports this:

- Charlie Bilello, CMT

@MktOutperform US High Yield credit spreads continue to tighten, new 11-month low: 540 bps.$HYG$JNK

and,

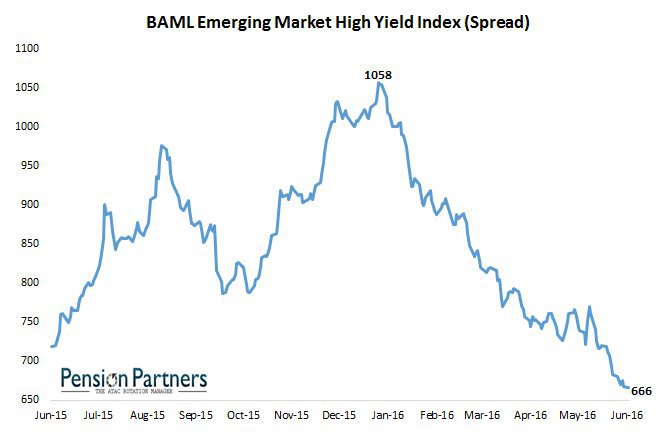

- Charlie Bilello, CMT

@MktOutperform EM High Yield credit spreads at new 1-year lows, have tightened 392 bps since Feb 11.$EMHY

The big question is whether the Fed is willing to create some risk in these complacent, levitating markets.

3. Treasuries

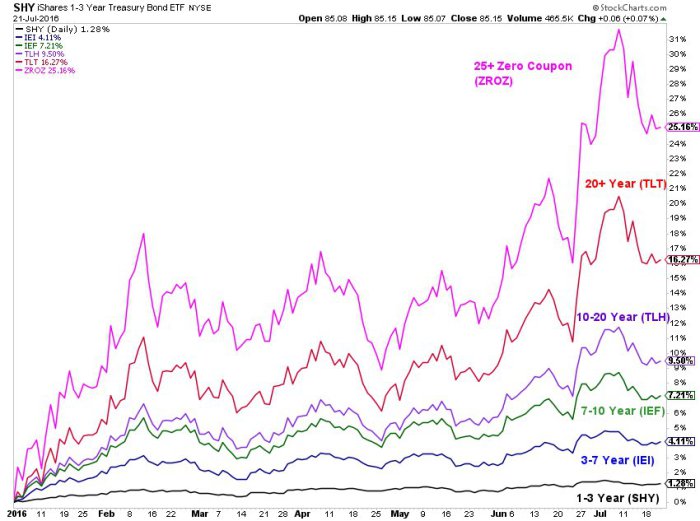

The performance has been simply superb this year:

- Charlie Bilello, CMT

@MktOutperform – Treasury ETF Returns YTD 1-3 Yr: +1.3% 3-7 Yr: +4.1% 7-10 Yr: +7.2% 10-20 Yr: +9.5% 20+ Yr: +16.3% 25+ Zeros: +25.2%

So, if this is like July 2012, it would be time to scale out or even get out, right? A technician seems to concur:

- Mark Arbeter, CMT

@MarkArbeter – My new seeitmarket post: Many Signs of a Top in Treasuries http://www.seeitmarket.com/higher-u-s-treasury-yields-good-possibility-tlt-15887/ …$TLT,$TNX,$TBT

But what if this is not July 2012 or what if the Fed refuses to send a September rate hike hint? Then this week’s action might simply be a consolidation.

4. Stocks

The same question for US stocks. Is this a good overbought condition that may be resolved with a short consolidation or is this a top of some kind? Tony Dwyer argued the former this week on CNBC FM and suggested buyers wait for a roll back to buy. He got cautious, he said, because the market has come too far too fast; reached his 2175 year-end target and exhibited a VIX signal that usually results in a 20% jump in volatility. But he added “this is a fantastic set up unless we are going into a recession“.

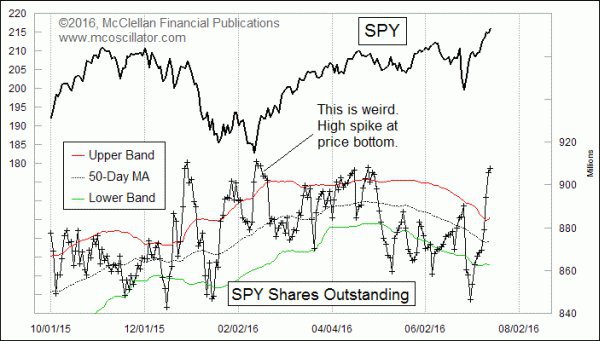

But Tom McClellan sees a topping condition based on the “SPY shares outstanding” indicator:

- The current reading is way up above the upper band. In fact, it is 3 standard deviations above that moving average right now. It is reminiscent of the sudden surge we saw back in December 2015, just before the sharp drop in early January 2016. This big rush into SPY says investors have suddenly become exceedingly interested in being invested in SPY lately, and whenever the crowd rushes in like this, it is a sign of excessive bullish sentiment.

That brings us to what seems sensible at this moment from Lawrence McMillan:

- “In summary, the indicators remain on buy signals, and so we expect $SPX to add to its gains over the short term. Overbought conditions and negative divergences may eventually spell some trouble for the market, but those things are not sell signals. They are only supportive of sell signals when and if the indicators roll over to sell signals. So, we will remain bullish until actual sell signals appear“

5. Gold, Silver & Miners

They were hit hard this week & that was just a week or so after breakouts in GDXJ/GDX ratio & Gold/Silver ratio. GDXJ was down 9% this week and GDX was down 4.5%. Silver was down 3% while Gold fell by 1%.

What happens this week? We will simply wait for the FOMC to show us.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter