Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Rinse & Repeat

What do we all know about the Yellen Fed?

- “Yellen doesn’t get what Bernanke never got. When they speak and make markets wait, the markets run far ahead of where the Fed wants them to go. And then they reverse after the anticlimax of Fed’s actions”.

Look back to the last three weeks:

- After Yellen speech on March 3 – Reversal of fears built in ahead of the speech – Interest rates fell, Gold rallied and JNUG, the 3X gold miner ETF, jumped by 10%. This reversal lasted only that afternoon.

- After NFP report on March 10 – A bigger Reversal of fears built in ahead of the Payroll number – Interest rates fell; Gold & silver rallied with JNUG up 15% on the day. This reversal lasted that one day.

- After FOMC statement & Yellen presser on March 14 – A much bigger reversal of built in fears – Interest rates fell very hard, Gold & Silver rallied very hard and JUNG exploded up 33% on the day.

So what is the highest beta trade going into a feared Yellen Fed event? Buy JNUG, the 3X Gold junior miner ETF.

What is the difference between this week & the prior two weeks? The first two reversals only lasted for one day. The 3rd reversal, the one post FOMC meeting, did reverse on Thursday but then reasserted itself on Friday. Is that because the first two events had another Yellen event directly ahead while there is no Yellen Fed event directly ahead now?

The last three weeks clearly point out that the most important factor in the markets is measurement of Yellen Fed’s determination to raise rates.The fear in the markets was the possibility of a 1994 type determined rate rise campaign. That fear dissipated with FOMC’s statement & Yellen’s presser. So the markets burst into a rapturous song & everything rallied except of course Volatility & Dollar.

When is the next major Fed rate hike event? Not until the June 14 meeting. So what happens next? A return to the flattening yield curve, lower rates, rallies in Gold & outperformance by utilities & staples until fear of Fed returns?

That is the message we heard from Jeffrey Gundlach, Marko Kolanovich of JP Morgan & David Rosenberg. The one most skeptical of the Fed is Mr. Rosenberg who wrote post-FOMC:

- “Now we have a Fed that has waited and waited and waited so that for the first time ever, the central bank has started its hiking program almost seven years into the expansion. ….. this all tells me we are late cycle, and “bull flatteners” in bonds are the likely the way to go“.

Marko Kolanovich expects a correction in stocks between now & April with a rally in Treasuries. The most explicit was Jeffrey Gundlach who said, about 90 minutes prior to the FOMC statement, that “the bond market is set up for a rally coming up in the weeks ahead; 2.60% in the 10-year yield is a great trade location for a rally; long end of the bond market is a good place to be“.

Gundlach proved right as yields along the entire treasury curve fell hard post Yellen presser. Look at the vertical move in the 10-year Treasury shown in the chart below from Bear Traps Report:

The 30-year yield fell 5 bps on the week while the 5-year yield fell 8 bps on the week with the 30-5 year “bull-steepening” by 3 bps. The 10-year yield closed just below 2.50% on the week and Gold, Silver rallied by 2%. Dow and S&P meandered while Russell 2000 outperformed. The big outperformance came from EM markets with EEM up 4% on the week while big banks closed down 2%.

The 30-year yield fell 5 bps on the week while the 5-year yield fell 8 bps on the week with the 30-5 year “bull-steepening” by 3 bps. The 10-year yield closed just below 2.50% on the week and Gold, Silver rallied by 2%. Dow and S&P meandered while Russell 2000 outperformed. The big outperformance came from EM markets with EEM up 4% on the week while big banks closed down 2%.

The big question is whether Chair Yellen and her merry band of rate-raisers are happy or upset about the reaction in markets. The bigger question is when do they get back to more hawkish signaling if they are unhappy. Their signals will continue to weigh heavily on markets because no one has a clue about what’s really happening in the economy with the Atlanta Fed at sub-1% Q1 GDP & NY Fed at almost 3% Q1 GDP. Since the strength of the economy is in the eye of the beholder, signals from Fed will continue to dominate risk appetite.

Why such a huge chasm between Atlanta Fed & New York Fed? A succinct answer was given by Peter Hooper of Deutsche Bank to Tom Keene of BTV:

- “Atlanta Fed is looking at hard data, what’s happening in consumer & business spending. The NY Fed is looking at the survey data. If you look at ISM, both Mfg & Non-Mfg, it is almost off the charts; its in line with more than 3% growth now“.

The Yellen Fed & Hooper believe in the NY Fed & the survey data. That means Yellen is quite unhappy at the dovish reaction in the markets. So when & how does the Yellen Fed get back to signaling more hawkishness than what they displayed just 2 days ago? And what if the Yellen Fed is shown to be wrong by the upcoming data?

We do think this is the most important factor in the markets going forward until the economy shows its true colors & we get clarity about the timing of President Trump’s legislative actions.

So is it as simple as listening to the tape? Lawrence McMillan said yes on Friday:

- “In summary, we continue to see things pretty much as has been the case since the US election: we remain intermediate-term bullish unless $SPX breaks support and $VIX breaks out over resistance”

That is supported by:

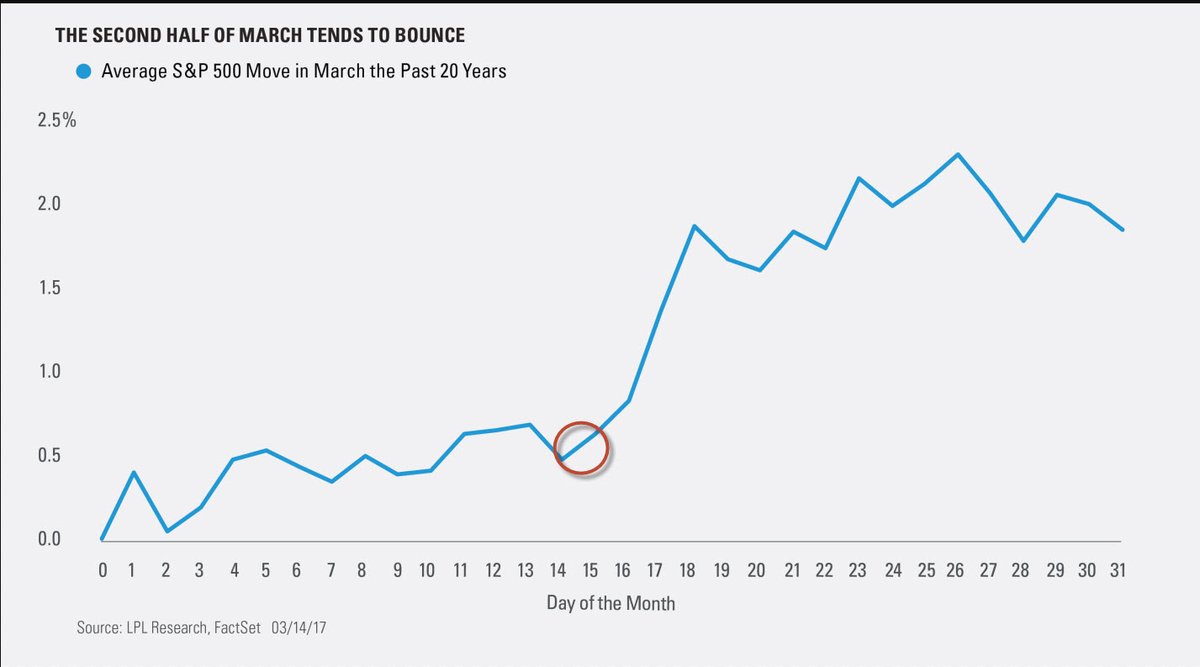

- Ryan Detrick, CMT @RyanDetrick – March 15 – The past 20 years has seen the #SPX bottom now and rally the rest of the month … https://lplresearch.com/2017/0

3/15/can-we-expect-green-for-s aint-patricks-day/ …

- J.C. Parets @allstarcharts – speculators are net short Russell2000 futures with the index less than 2% from an all-time high. Not a characteristic of top imo $IWM $RUT

Whether banks & financials outperform or Staples, Utilities & EM outperform depends on what happens to interest rates. It could get interesting if the large speculators decide to cover their humongous shorts in Treasuries just as it got interesting when they liquidated their humongous longs in oil a few days ago.

As we all have found out, charts & stuff have little relevance when the dominant factor is liquidity from the Fed. Remember what happened after so many smart guys told us three weeks ago that Gold was breaking out. They were right with one caveat – they said break out, markets said break down.

Finally, the Indian market did break out this week after last Saturday’s stunning election victory of Prime Minister Modi.

- Peter Brandt

@PeterLBrandt Attention India followers —#NIFTY$ZIN_F posts all-time highs. Close above 9220 sets new target of 11181

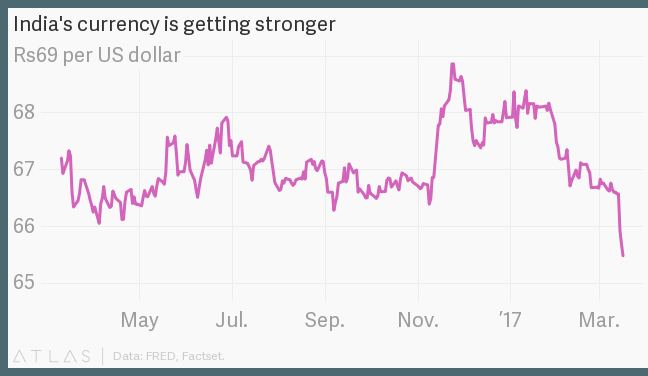

Not just the Nifty index but the currency too:

Not just the Nifty index but the currency too:

- Generalpublic

@genpubliconline – Demonetisation be damned! The Indian rupee is on a tear – http://generalpublic.online/2017/03/17/demonetisation-be-damned-the-indian-rupee-is-on-a-tear/ …

Too much of a good thing? Does the Reserve Bank of India need to sell Dollars to moderate the rise? Actually a strong Rupee is good for Indian consumers, both poor & not so poor.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter