Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

0. Standoff in Korea

The biggest determinant of what happens in markets next week is the standoff between North Korea & America. The fear of what may come might have been the principal reason for this week’s decline in Treasury yields & the rally in Gold. North Korea has apparently decided to postpone its threatened nuclear test. Will that lead to a lessening of fears by Monday? Or will the markets keep pricing in expectations of a bad outcome going forward?

As we show below, almost every asset class is perched on an important trend line and could either bounce or go through. No one can answer or even comment sensibly about which way things turn next week. That caveat should be borne in mind as you read the opinions below.

1.Fink -1 BlackRock-0

Last week, Larry Fink said on CNBC Squawk Box – “51% chance 10-year bond could be below 2%“. He added “my team doesn’t believe that but I do“. The 10-year yield didn’t get below 2% but it took a major step towards that goal. And, as Larry McDonald said, the 10-year yield would have traded near 2% had the Treasury market been open on Friday (ahead of the expected nuclear test in North Korea).

Yields simply collapsed this past week with a bull-steepening of the Treasury curve. The 5-year yield fell by 16 bps while the 30-year yield fell by 12 bps. The 10-year yield fell by 15 bps and closed below 2.25%. The fall in the 5-year could be attributed to Chair Yellen & her speech last Monday. But the fall in the long end was at mainly due to the Korean situation.

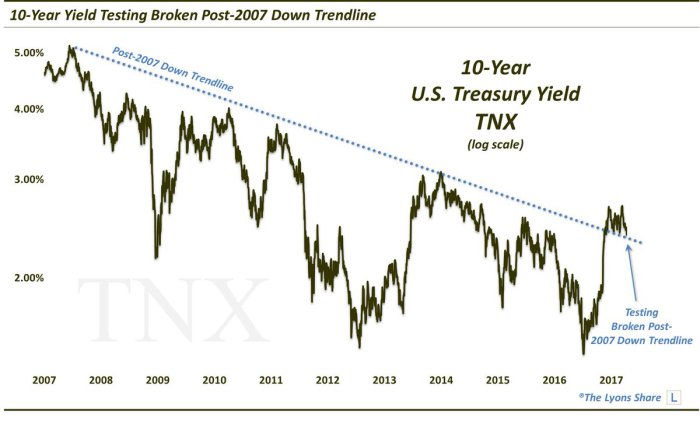

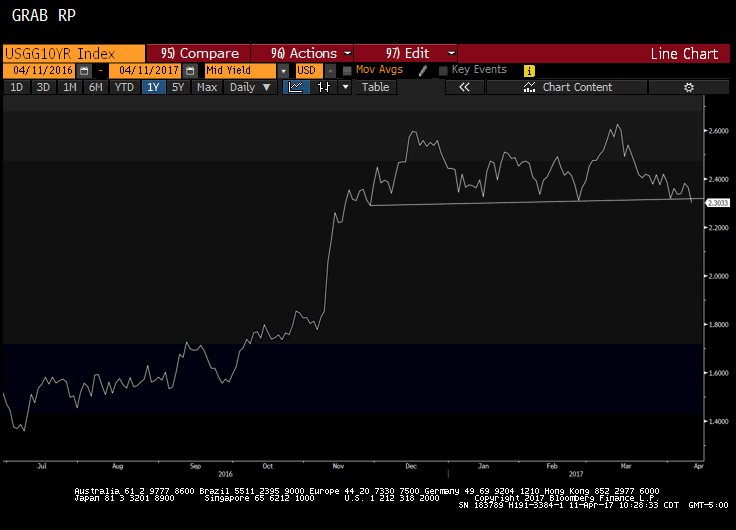

So what’s next? A fast move to 2% or a sharp reversal back above 2.30%? The 10-year yield may have broken Santelli’s levels but it remains perched on an important line per:

- Dana Lyons @JLyonsFundMgmt Year Yield Testing Broken Post-2007 Down Trendline

#TrendlineWednesday$TNX$IEF$TLT$TBT

The prevailing opinion says yields will fall next week.

- Raoul Pal @RaoulGMI US 10 yr bond yields have broken key support. Next stop 1.8%.

If US yields break, can German yields be far behind especially with the French elections coming up?

If US yields break, can German yields be far behind especially with the French elections coming up?

- Raoul Pal @RaoulGMI Morning! German 10-yr Bund yields have broken their key support…

The US 2-year yield fell by 9 bps this week. Could it go lower? Yes, according to:

- Raoul Pal @RaoulGMI 2-year yields looks like they wants to follow the 10 year lower too… lots of informational value here.

Well, what does the economy say?

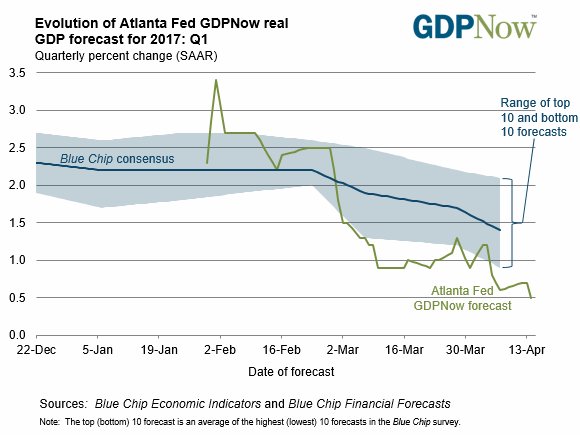

- Atlanta FedVerified account @AtlantaFed – On April 14, the

#GDPNow model forecast for real GDP growth in Q1 2017 is 0.5% https://goo.gl/dy72J5

Is past Q1 prologue or does forward analysis suggest something else?

Is past Q1 prologue or does forward analysis suggest something else?

- Lisa AbramowiczVerified account @lisaabramowicz1 – In an unusual move, a significant number of Wall Street analysts are upgrading their 2017 earnings forecasts. https://www.bloomberg.com/news

/articles/2017-04-12/weird-thi ng-happening-to-global-profit- estimates-they-re-rising …

Shouldn’t that have some bearing on the direction of …

Shouldn’t that have some bearing on the direction of …

2. Stocks

Just like Treasury yields, the momentum seemed all in one direction on Thursday afternoon:

- Charlie BilelloVerified account @charliebilello – Volatility Index ends the week at the highest level since election day (Nov 8): 16.03.

$VIX

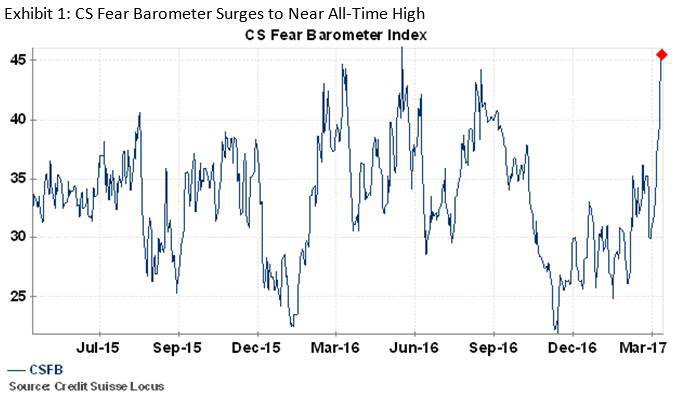

- Dr. Shadow @megadave5000 CS Derivatives team’s note today shows their proprietary Fear Barometer near Brexit level highs

- Igor Schatz @Copernicus2013

$SPY skew trading at 97th percentile.. pretty remarkable given the levels of vol

So has Lawrence McMillan of Option Strategist thrown in the towel? Not quite:

- In summary, we are at what could be a very interesting crossroads. Will the worries of $VIX prevail and send the stock market lower, or will $SPX once again prove itself the “king” of the indicators and not overly react to what might be just a fleeting fear? We should know before the month is out. In either case, a breakout by $SPX from this trading range should be a catalyst for a strong movement in the direction of the breakout.

But what does the history say about the end of April?

- Ryan Detrick, CMT @RyanDetrick Remember, nearly all of the gains in April for the

#SPX the past 20 yrs take place late in the month … https://lplresearch.com/2017/04/12/when-will-the-bullish-april-seasonality-start/ …

Is it time for a rebound in the S&P 500?

- Urban Carmel @ukarlewitz – Probably at/near a capitulation low in

$SPX: extremes in put/call, Trin/breadth, volatility and its term structure, price below BB bottom 1/

3. Gold

Gold had a terrific week with GLD up 2.6% and GDX up 4.6%. So naturally,

- Raoul Pal @RaoulGMI

#GOLD I think its time for action. Gold should break the trend line in next few days but needs to clear the previous recent highs to confirm

But Bear Traps Report chose discretion over valor and said Sell GDX into strength this week. Others also sounded caution about the fervor:

- BloombergVerified account @business – Gold rally gets feverish as trader survey flashes extreme level https://bloom.bg/2ow85ji

Another unusual signal came from the under performance of GDXJ, the popular Junior minor ETF. As the Curse of Success article on Bloomberg.com pointed out:

Another unusual signal came from the under performance of GDXJ, the popular Junior minor ETF. As the Curse of Success article on Bloomberg.com pointed out:

- With investors piling in amid a precious-metals recovery, VanEck Vectors Junior Gold Miners ETF’s assets jumped 60 percent to $5.54 billion this year. That created a dilemma for the fund that tracks the MVIS Junior Gold Miners Index, as its holdings surge above 10 percent of some of the companies it owns.

- On Thursday, MVIS Index Solutions, a VanEck company, announced changes to its equity indexes, widening the criteria for inclusion into the gauge that is tracked by VanEck’s junior gold miner ETF.

4. Oil

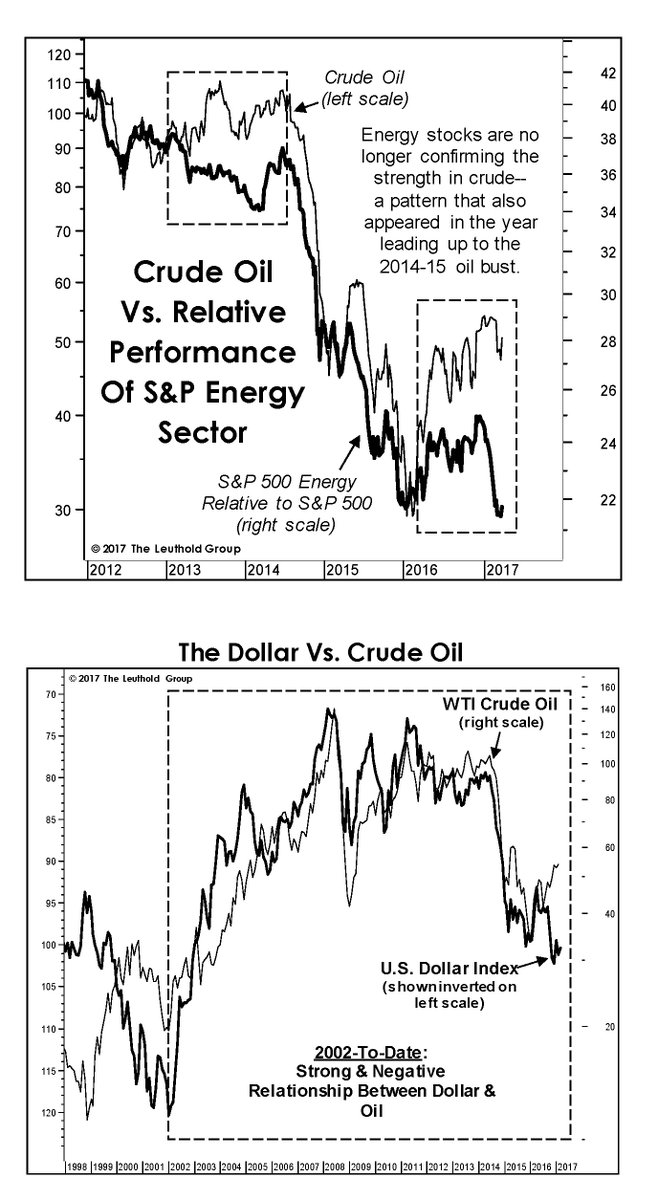

Crude Oil continued its rally this week with both USO & BNO up over 1%. But unlike last week, energy stocks fell hard with OIH down 2.8% & XLE down 1.6%. Does the weakness in energy stocks suggest a decline in Crude?

- The Leuthold Group @LeutholdGroup Performance gap between

#oil &#energy stocks, and#crude being much stronger than predicted by#USD suggest that#oil prices are at risk.

But what if the S&P 500 bounces and Energy stocks rally with it? On the other hand, the supply keeps increasing:

But what if the S&P 500 bounces and Energy stocks rally with it? On the other hand, the supply keeps increasing:

- BloombergVerified account @business – U.S. oil rig count climbs to highest in almost 2 years https://bloom.bg/2ow8JgI

5. Temptation or Elixir

Years ago our Italian-American boss asked us if we celebrated Christmas. Instinctively our answer was we celebrate any festival that involves drinking & eating. In that spirit, we are pleased to share the tweet below from Jon Najarian of CNBC Fast Money:

- Jon NajarianVerified account @jonnajarian –10 Surprising Health Benefits of Drinking Whiskey – http://www.wideopencountry.com

/10-health-benefits-drinking-w hiskey/?utm_campaign=inline&ut m_medium=social&utm_source=twi tter … http://gph.is/1dyU9dV via @GIPHY

For those who don’t know the origin of the name “Whiskey”, the article begins with “Whiskey gets its name from the Gaelic word “uisge beatha,” meaning “water of life,” so raise your glass and toast to these 10 potential health benefits of drinking whiskey“.

- 10.Weight loss aid – If you’re counting your calories, a shot of whiskey is 64. So put down that Michelob & …

- 9. Cancer Prevention – Single malt whiskey is said to contain more antioxidants than red wine.

- 8. Stroke Prevention – Because of its blood-thinning properties, a daily shot of whiskey can lower a person’s risk of ischemic (clot-caused) stroke.

- 7. Whiskey treats the common cold – Whiskey acts as a decongestant by dilating your blood vessels

- 6. It’s a stress destroyer – a shot of whiskey can actually help you relax. The barbiturate affect of the alcohol can reduce stress, and also has sedative properties to help you sleep if you’re experiencing anxiety

- 5. Lowers the risk of dementia – a study published by the National Center for Biotechnology Information concluded that drinking one to six drinks weekly could lower your risk of dementia over and above avoiding alcohol completely.

- 4. Aids digestion – Whiskey has historically been used as a digestif in many cultures throughout the ages

- 3. Helps prevent diabetes – studies have shown that long-term moderate alcohol intake can help the body regulate insulin, which could potentially reduce your risk of contracting type 2 diabetes

- 2. Can soothes a sore throat – The alcohol in the whiskey acts as an antiseptic and numbing agent on aching tonsils and the honey creates a thick coating that will help the healing effects last longer

- 1. Prolong Your Life – A 2010 study released by the Research Society on Alcoholism found that middle-aged and older adult moderate drinkers had a lower overall mortality rate than heavy drinkers or even non-drinkers

Unlike Dr. Najarian, we are simple folk and we don’t need no fancy reasons to enjoy a single malt. But we do appreciate his tweet and reciprocate by showing a clip about a female entrepreneur & her bar. We suspect he might enjoy the clip with or without a glass of whiskey in his hand:

[embedyt] http://www.youtube.com/watch?v=KnvpxAByMyg[/embedyt]

Helen, the star of this clip, may no longer be with us but this clip from 1978 remains immortal.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter