Summary – A top-down review of interesting calls and comments made last week about monetary policy, economics, stocks, bonds & commodities. TACs is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance

1. Is Fed back in play?

Go back to Thursday, September 18 and recall what the economic cognoscenti said in response to the Fed statement & Yellen’s press conference. They virtually promised us that Fed was determined to raise rates. Then came the big rally in Treasuries on Friday, September 19th. From September 18th to the lows this Wednesday, yields on the 30-year, 10-year & 5-year treasuries fell by 26, 23 & 16 bps reps. With this rally, the talk of Fed’s determination quieted down.

Then came the 248,000 NFP number on Friday morning. Not great by any means but a good number. And the Fed came into play again. Read what Paul Richards of UBS said on CNBC FM 1/2 on Friday:

- “I actually believe Yellen is going to take out “considerable period” on October 29; if she doesn’t, she has to wait until December & they wouldnt want to upset year-end markets- so the window is now”

On the other hand, Steve Liesman articulated the real fear of the Yellen Fed:

- “these guys are very concerned about having to go back”

Why would they have that concern? Zero wage growth in Friday’s number as ECRI’s Lakshman Achuthan pointed out on Friday. This means negative real wage growth which Chair Yellen is focused on. Achuthan also pointed out that median family income has fallen by 1/8 over the past 10 years and that is also true in all major economies in the world. These are not conditions that are ideal for becoming hawkish, Chair Yellen might say.

If she does, she would be in sync with the Treasury market which flattened by 5 bps on the 30-5 yr curve. And the 30-year yield actually closed down on Friday. To simple folks like us, the Treasury market is sending a clear signal that raising short rates will slow down growth & lower inflation. The frustration of Chair Yellen at this action was voiced by Jim Cramer’s colleague Stephanie Link who cried in sheer anguish on Monday on CNBC FM 1/2 – “darned yield will not steepen“

And remember what Jeff Gundlach said back on Friday, August 15,

- “Fed follows long end of the bond market; Fed doesn’t tighten while long rates are falling”

Of course, Richards is talking about removing “considerable period” from the Fed statement and not raising rates. What would the treasury market do if Chair Yellen gave them this signal? – Front-run the actual hike right away, we think. And catapult the U.S. Dollar to a higher moon.

2. U.S. Dollar

The chart of the U.S. Dollar looks like it is Netflix or what Tesla used to be. Fundamentals say the Dollar rally continues. Europe is “in serious trouble” now and “Draghi is running out of bullets” as Paul Richards said on Friday and Japan will keep printing money. On the other hand,

- Friday afternoon – Blake Morrow @PipCzar – USD Index on Weekly chart most overbought (RSI) in over 30 years

- “The U.S. Dollar Index has recently been in one of the biggest blowoff moves we have seen in years. The lesson of the past blowoffs is that the downward slope out of the eventual top tends to symmetrically match the slope of the advance up into it.”

- “The current reading is the highest in the history of this indicator (see his article). That is another way of saying that the “smart money” commercial traders are making a huge bet that this uptrend in the dollar is going to reverse itself.” .

- “Commodities prices should rise, commensurate with the percentage amount of the dollar’s fall. Small caps should reverse their recent trend of underperformance which is correlated to the dollar’s outperformance; And oh, by the way, a big dollar downturn should be a huge tailwind for gold prices finally starting to rise”

What if Chair Yellen disappoints Richards & his cohort by keeping “considerable period” in the Fed statement on October 29? Remember that FOMC meeting does not come with a press conference. So the Fed statement will be the only window into their thinking. And what if Draghi continues to disappoint on QE? Will these twin disappointments weaken the US Dollar? Or will it take bad US data?

3. The other extreme of the week

In their piece titled Extreme Protection Buying, Deutsche Bank wrote “Several indicators point to extreme protection buying in equities“:

- “The put/call volume ratio in US equity options spiked to extremes (98th percentile since 1995). The ratio now looks to be declining and previous turnarounds after spikes were associated with strong market rebounds; … S&P 500 option vol skew rose rapidly, close to 2 year highs; … Implied correlation amongst S&P 500 stocks also spiked close to 2 year highs as investors positioned for a selloff. Similar spikes around previous selloffs saw the market bottom and rebound strongly.”

This dovetails with the tweet below of Ryan Detrick:

- Friday – Ryan Detrick, CMT @RyanDetrick CBOE equity put/call ratio getting up near past major peaks. A turn lower would be bullish. $SPY http://stks.co/p0qu6

The article of Ryan Detrick relies on 8 charts including the one above to argue for a lasting bounce in equities. His charts are interesting & we urge interested readers to read his article. His bottom line is:

- “My only concern is the first half of October is historically bearish, then it rallies hard late. I don’t think we’re quite out of the woods and the next few weeks could be frustrating to both bulls and bears alike. The best thing would be sometime next week we make new lows and really get fear spiking.”

The amazing stat from his article is the following:

- ” … the SPX is up an incredible seven quarters in a row. This is definitely a lot, but here’s what gets me thinking we have more to go. Since 1950, the previous three times the SPX gained at least seven quarters in a row, it went up at least another three quarters in a row each time. Amazing, but it has happened before and I sure won’t bet against it this time.”

The last and the longest was the streak of 14 quarters from Q1 1995 to Q3 1998. That was the prior period of strong disinflationary growth in America. Only Japan was going through its deflationary crisis then. Today, Europe has joined Japan & China looks like it might follow. Will this global weakness come through in S&P earnings? No is the bet on which Detrick’s confidence is based.

4. U.S. Equities

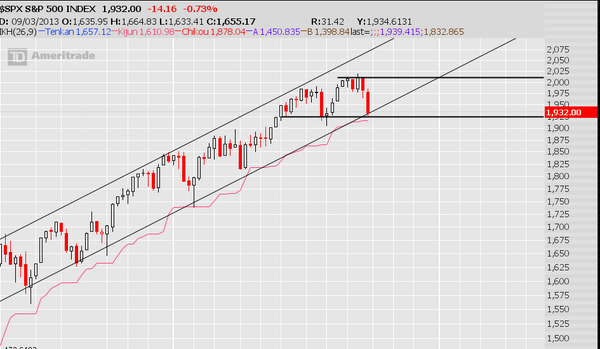

The most helpful call of this week came on Thursday just after 12:00 pm from the tweet below:

- Joe Kunkle @OptionsHawk – S&P w. Weekly Kijun

There were others tweets that were similar and made the case for a bounce. Such tweets & charts are why we focus on tweets these days rather than on strategist opinions. We recall Mark Haines was so furious once that he banned his guests from using the term “cautiously optimistic“.

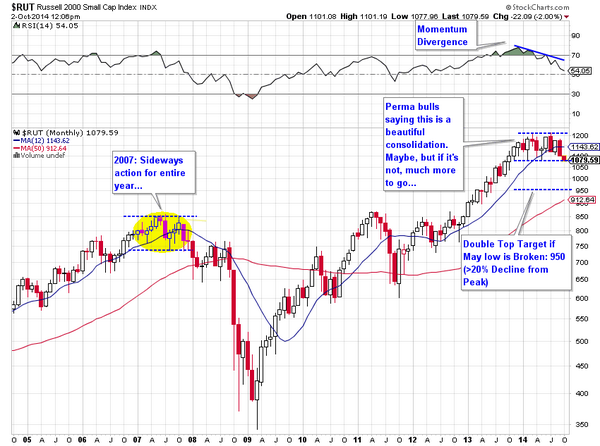

The biggest divergence in the stock market is the relative performance of small caps to large caps. Dana Lyons writes that this quarterly divergence was “Last Seen in 3Q 2007. He adds:

- “In our database of the Russell 2000 (back to 1991), this is the 8th such quarterly divergence between the two indexes. … While this is a pretty small sample size, returns going forward were actually fairly positive. This should come as no surprise, however, as most of the examples occurred during the blowoff phase of the secular bull market in the mid to late-1990’s.”

- “Despite these positive average returns, there were a few inauspicious dates within the sample that present a concern regarding the present situation. The two troublesome occurrences were the 2nd quarter of 1998 and the 3rd quarter of 2007“

- “Sure the market can continue higher for some time, extending such divergences. However, eventually these conditions tend to get corrected. And the more egregious the divergence, the more corrective the action tends to be”.

One way to correct this divergence would be for small caps to outperform large caps in Q4 & beyond. That is the argument Adam Parker of Morgan Stanley made to Scarlett Fu of BTV on Thursday:

- “I actually tell people to buy small caps right now. I view 3-4 positives. First of all, small caps have lower margins than larger caps. Large caps are at all time high. You have got more margin expansion potential for small caps. Second, they grow faster. Then you have M&A – a lot of people think M&A is really picked up but it is almost all inversion in large cap space. If you look, the fraction of small cap companies that receive tender offers so far in 12 months is far closer to a trough than a peak.”

But what if small cap bulls like Parker are wrong?

- Thursday – Charlie Bilello, CMT @MktOutperform – Perma bulls saying this is a beautiful consolidation in the Russell. Maybe, but what if they’re wrong…

If small caps are bad, mid-caps are worse according to what Lori Calvasina of Credit Suisse told CNBC FM on Thursday:

- “we are very very worried about midcaps; they have the worst valuation story; midcaps look as expensive vs small caps as in 2000“

Richard Ross of Auerbach Grayson a similar view of mid-caps as he said on CNBC Talking Numbers on Wednesday:

- “Ross is particularly concerned the ETF that tracks the S&P 400 mid-cap index (trading under the ticker symbol MDY) began to form the beginning of a bearish double top pattern over the summer. … When that comes at the tail end of a multiyear move like we’ve seen here in the mid-caps, that spells trouble.” … But what also is problematic for the MDY, according to Ross, is that it broke below its 200-day moving average this week, the first time since November 2012. … Should the mid-cap ETF remain below that long-term moving average for a matter of days – or a week perhaps – that’s going to tell you that the bigger trend may have reversed to the downside”

Larry McDonald has made good calls this year using his capitulation model, the last one being “I think the 10-year is a screaming buy here” on Friday, September 12. Since then, the 10-year yield has fallen by 16 bps & TLT has rallied by 3.8%. This week, he recommended EWZ, the Brazil ETF, in his proprietary Bear Traps newsletter:

- “EWZ YTD has recently sold off but as we mentioned the risk vs. reward is very good. We aren’t suggesting that Silva needs to win; the EWZ can turn around very quickly with just a small sentiment change. EWZ is scoring well in our capitulation model and we see the near term downside as very limited.”

5. Gold looks like it is dying

That is what John LaForge from Ned Davis Research told Amanda Drury of CNBC Street Signs on Thursday:

- “Gold goes to $660 based on 65% peak-to-trough decline analysis from $1900 top & fact that commodities move in super cycles; they all end the same way; they all end pretty badly;gold looks like it is dying”

Normally such calls suggest capitulation but this is gold in a vertical rally of the U.S. Dollar. On the other hand, you have the possibility of a bounce as suggested by:

- Friday – Brian Kelly @BrianKellyBK – $gld at massive support level…will it hold?

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter