Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Panic first or Panic last?

The old dictum says if you want to panic in a selloff, panic first. Those who panic first can watch the full selloff with equanimity & then buy back what they sold & more at far lower prices. Then you have the other kind, the “rational” kind, the kind that pride themselves on not panicking. The trouble is that they get increasingly frightened as the sell off accelerates & then they panic.

This Fed is of the latter kind – full of logical, rational economists trained to be contemptuous of markets & the lay people that populate them. We all saw this Fed scoff at markets in October 2018 & remain poised in their convictions as markets began to panic. Their ultimate in contemptuous “let them eat cake” attitude was seen by all during Chairman Powell’s presser in December 2018. That was the esteemed Chairman showing he is not the kind who panics because of markets.

Then a couple of weeks later, Powell completely & totally panicked. The man could barely speak in his January public addresses except to say what was written for & memorized by him. And that sheer, unadulterated panic of Powell ended the selloff in stocks & bonds after causing immense harm to the US economy and millions & millions of Americans.

Now Powell & his board of governors are doing it again. That is much worse because, as most saw in the July 31 presser, Powell is now virtually powerless in his own committee. The committee’s smug, contemptuously arrogant disdain for bond markets & the lay people that populate them came across loud & clear this week from James Bullard, the St. Louis Fed head.

We all are like to look back at that July 31 presser, with only one “reluctant” rate cut as a mere “mid-cycle adjustment”, as one of the biggest mistakes in monetary policy. That afternoon launched the 30-year, & more generally the 30-10 year curves, into the stratosphere. The resulting Tsunami of falling yields took the 30-year Treasury yield this week to within inches of 2.10%, the previous low. The German 10-year yield fell concurrently to almost minus 60 bps and the 30-year Bund yield went negative.

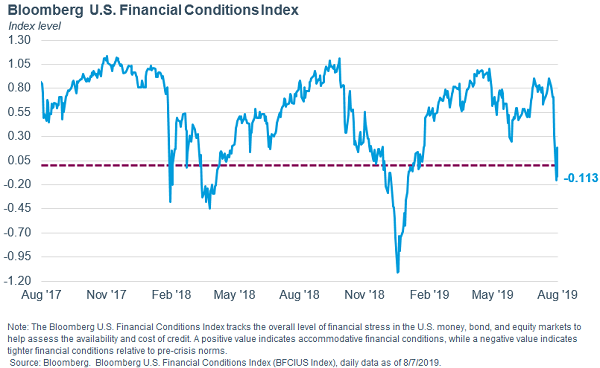

Why? One answer is simple. That so-called “rate cut” actually tightened financial conditions for Americans.

- Kathy JonesVerified account @KathyJones – Falling stock market, inverted

#yield curve and widening credit spreads cause#financial conditions to tighten

This so-called rate cut that was effectively a rate increase created a yield-suck vortex to quote Chirag Mirani, head of rates for UBS. The fury of the bond markets stunned even the earliest proponent of “Buy Bonds” conviction:

- Raoul PalVerified account @RaoulGMI – I knew the Fed had made a policy error by cutting 25bps only…but wow, the rapid and violent inverting of the entire yield curve was not something I expected… the bond market is SCREAMING that recession is now baked in the cake but the steepening is always the final signal…

Even Rick Santelli admitted to getting worried about the flattening of the 2-10 yield curve on Friday.

But the above is all markets stuff. What about the American consumer?

- David Rosenberg @EconguyRosie – Q2 ended off with American consumers cutting back on their credit card balance by $80 million, and started Q3 by reducing their usage of motor fuel. When households in the USA cut back on their plastic and driving simultaneously, you know we have moved into the Twilight Zone.

A dark night follows the physical twilight. So what dark night does Rosenberg see ahead? – “Deflationary Recession” and “when not if” .

There is an obvious resemblance to the current action in global sovereign yields & the corresponding action in 2016 when the 10-year fell to 1.38%. We use “obvious” as a synonym for “visible” hinting at “superficial”. Some smart minds were more direct:

- Lawrence McDonaldVerified account @Convertbond – We are lectured about the strength of the 2012-2016 recovery relative to the 2017-19 period. BUT this colossal difference in accommodation vs. tightening is pure historical math, NOT politics. It points to two far different periods of growth and a Fed eviscerating the tax cuts.

The other big difference is that China in 2016 was an economic partner of US. Today the two largest economies in the world, with two completely opposite political systems, and, with two inimical global objectives, are locked into economic combat. As Pavilion Global Markets reportedly said this past Wednesday,

- “The relentless fall in inflation expectations is crowding out other data, and the Fed has little choice but to return to the slippery slope of accommodation,”

Sadly, this smug & arrogantly “rational” Fed will realize this way late & then panic big time. When? Hopefully on September 9.

* Those who pride themselves on being “rational” & market “reason” & “logic” as always positive should read what Kurt Godel did in his 1931 Ph.D. thesis at Princeton. He proved, yes mathematically proved, that logic is ALWAYS Incomplete no matter how detailed, complex logical system you build. This is one of the most important & truly seminal works in human thinking. This is why at critical junctures in a society, truly intelligent societies choose a leader who doesn’t think or act logically, the way the majority is taught to view logic. In this case, the Fed needed a chairman who understood the critical juncture where we sit & who would reacted massively on July 31. Another way to think about it is to realize that no one has been able to build market models for Poisson Jumps, the crazy outlier jumps in otherwise continuous distributions. So no algorithm can be constructed (yet) to take advantage of Poisson Jumps. Therefore market turmoil is always the result. That is why we need a non-linear, non-rational human Fed Chairman who can react massively & early.

2. 1930s & the Vortex

We have long considered this current period to be a re-rhyme of 1930 if not a repeat with China replacing 1930s Japan in a US-China-Germany conflict. The United States of 1930s had powerful allies against that Germany, but fought the war against that Japan alone. Today, the US is single-handedly fighting the economic war against a mercantile China. This is a long drawn fight in which deflation is the greatest risk. Very little has been written on this “big” picture. So the following tweet was refreshing:

- David Rosenberg @EconguyRosie – It seems to me that the only difference between today and the 1930s is that we had a dust bowl back then and a flooding crisis now. That’s mother nature. Human nature is even more unstable.

Looking back at 1930s, you will notice that President Trump is being as determined & as smart as FDR was against 1930s Japan. FDR squeezed that Japan continuously to get Japan to change its ways structurally. He could do so because he knew Japan could not survive against America in a war to the finish. Those Japanese leaders reacted wrongly at almost every juncture both because they disrespected FDR and because they could not afford to lose face in Japan.

Xi Jin Ping’s China is virtually making the same mistake against Trump’s America. President Trump has already converted China into an adversary & a potential enemy in the eyes of the American people. So he is on strong moral, political ground when he takes on China. And contrary to popular “talk”, Trump is being both smart & determined. Partly because he knows that in a long economic fight, China simply cannot win against America.

And look how stupid Xi’s China was last week. How can the largest importer of food afford to stop buying food & ags from the largest seller? How hard is it to radically re-orient that supply chain? You can ramp up world’s industrial production with money & labor, but you can’t ramp up the world’s food supply. We saw this week what is happening to food prices inside China – high food inflation. And this is happening when the supply of domestic “pigs” is virtually shut down and when industrial jobs are being lost due to tariffs & supply chain reorganizations.

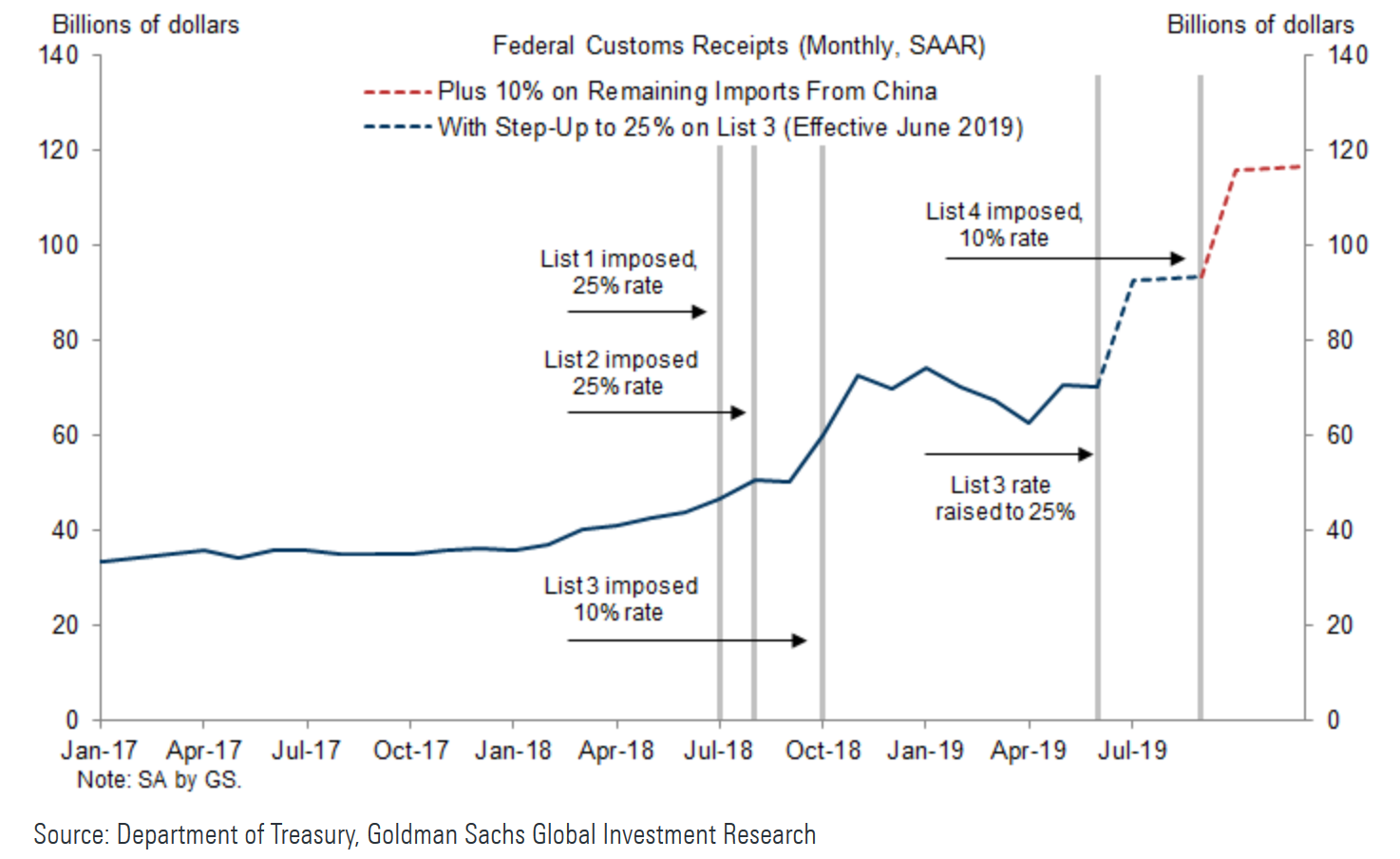

The idea that cutting off food imports from America will seriously damage President Trump’s chances in Iowa & the rest of the Midwest is stupid despite its appeal in political meetings in Beijing. Not only will American farmers stand with their President against an adversary like China but they also understand that they will be big victors if President Trump wins his battle with China. And as The Market Ear wrote on Friday:

- “Tariff Revenues Are Likely to Grow by Over $80bn Relative to the Pre-Trade War Trend”

We wonder why President Trump doesn’t launch a Agriculture program like Europe’s. We all know that EU will negotiate about everything except their “subsidies” to EU’s farmers. The same works in much poorer India. Before every election, farmers get financial relief and they also get higher prices for the foods they grow. Because no one in India can win if the farmers vote against them.

So why not take the tariff revenues collected from China and use them to buy soybeens & other products from US farmers that China was going to buy? Why not build a strategic Ag reserve the way we built the strategic petroleum reserve? Such a food reserve can then be used within the US to hold down food prices if necessary as well as help US farmers. Sales from such a reserve can be used to help US workers that have been laid off when US companies cut jobs or move overseas. Only a new FDR could get such a program implemented or a President Trump who wants to take care of Americans hurt by China & other trade partners.

Frankly, we think China is less important to the US economy today than Germany. Adjectives pale into irrelevancy when we try to describe the destructive policies of Germany. All of Europe & actually the entire world is screaming for Germany to launch a fiscal stimulus program. And they have keep their heads buried deep in the sand.

The combination of German refusal to launch fiscal spending and the reluctance of the US Fed to cut rates hard & fast is creating the specter of a global deflationary recession.

- Raoul PalVerified account @RaoulGMI – You get the picture. Sadly, we are at one of the BIGGEST junctures for markets in history. You may disagree with my assessment of the odds. It doesn’t matter. But you simply CANNOT ignore the risk. Bonds. Dollars. Bitcoin and Gold. Thanks for paying attention.

3. A double bottom in Treasury rates?

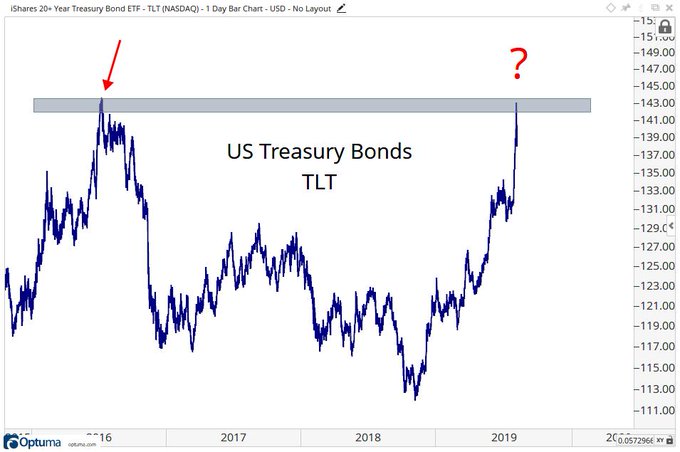

But when fear reaches a crescendo, when strategists start using sadly accurate phrases like “yield-such vortex”, isn’t reversal a more likely outcome? After all, human beings can’t sustain extremes of emotion. And this past Wednesday seems to have signaled a reversal to many. And that reversal came at a key level:

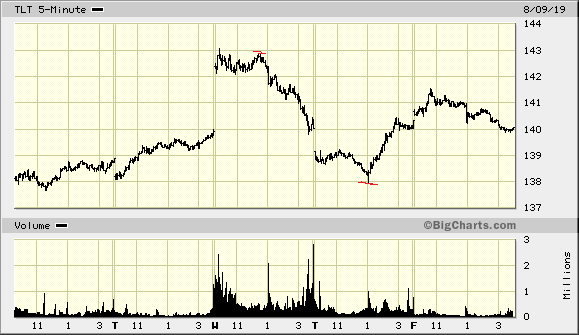

- J.C. Parets@allstarcharts – now what? $TLT

Another doesn’t think the above is a question:

- Thomas Thornton@TommyThornton – US Treasury Cash Balance is low. It was a little lower right before the big drop that started in January 2018. The Treasury can’t help and liquidity is thin. If the market crashes remember this chart

Interest rates collapsed on Wednesday morning – the 10-year yield dropped to 1.616% & the 30-year yield dropped to 2.11%, a hairbreadth away from the all-time low yield of 2.10%. As you can see in the Parets chart above, TLT, the Treasury ETF, came close to breaching the all-time high.

Then they reversed with the 10-year yield closing Wednesday at 1.721% & the 30-year at 2.242%, about 10 bps & 13 bps higher resp. This looks like a text book double-bottom in yields & a text-book double-top in TLT. The sell-off is Treasuries accelerated on Thursday morning as stocks rallied up.

Remember Priya Misra of TD Securities who said the Friday before – “go long maximum duration risk here“. Did she change her mind with Wednesday’s reversal? Note that the 10-year yield at 1.616% on Wednesday was 23 bps below that Friday’s close. So she could have backtracked claiming victory.

Instead she told BTV’s Jonathan Ferro on Thursday morning – “Stay long duration, Buy any backups“. She said US is not an island & that global weakness will be seen in US in about 3 months & the Fed Chairman will convince others to ease. And she said US Treasuries are “pretty cheap” with S&P where it is and all the stock of negative yielding bonds out there make Treasuries attractive . She said “structural issues of demographics will far outweigh small fiscal easings“.

Rick Santelli stepped up on Thursday morning and said Wednesday was “A” Treasury rates bottom, but he didn’t think it was “The” Treasury rates bottom. That was brave.

Look what happened a couple of hours later:

The high of TLT & the low in rates was just before 1 pm on Wednesday. Then rates rose up fast & TLT fell almost off a cliff. What happened at 1 pm on Wednesday? The 10-year Treasury auction. How many would load up on the 10-year at the lows in yield? The reversal in rates began with this bad 10-year auction on Wednesday and continued on Thursday morning. The 10-year yield was up another 10 bps from Wednesday’s close just prior to 1 pm on Thursday.

The high of TLT & the low in rates was just before 1 pm on Wednesday. Then rates rose up fast & TLT fell almost off a cliff. What happened at 1 pm on Wednesday? The 10-year Treasury auction. How many would load up on the 10-year at the lows in yield? The reversal in rates began with this bad 10-year auction on Wednesday and continued on Thursday morning. The 10-year yield was up another 10 bps from Wednesday’s close just prior to 1 pm on Thursday.

Now look at the rally in TLT from 1 pm on Thursday. Rates fell hard on Thursday afternoon into Friday morning. What happened at 1 pm on Thursday? The 30-year Treasury auction. Simple minds like us think the bad 10-year auction created fear about continuing demand for Treasuries. Hence the short & fast selloff. The decent 30-year auction dissipated at least some of the fear and hence the fast rally in Treasuries & fall in rates. And this rally in Treasuries happened concurrently with a 370 point up day in US stocks.

This might go to show that Treasuries Will rally when stocks fall hard but Treasuries could also rally when stocks rally. That might support what Priya Misra said to BTV’s Jonathan Ferro that long duration Treasuries are the best hedge against risk assets and that is another reason to own them. Russ Koesterich of BlackRock agreed in his article:

- “Back in June, I discussed three potential hedges: yen, gold and U.S. Treasuries. Gold and long-duration U.S. bonds have done particularly well since then, up 8.5% and 4% respectively. Going forward, however, I would lean more into Treasuries as a hedge against equity risk. The main reason: the dollar. ”

- “With inflation subdued and central banks generally turning dovish, the biggest risk for most investors is growth and the risks to the expansion. Not helping matters are the President’s latest tweets. An escalation in trade frictions has the potential to further undermine business confidence and investment. If events move in this direction, bonds are likely to prove the more effective hedge.”

That doesn’t mean the bottom in rates of last week is not a short term bottom. It will become a serious bottom if rates don’t close below that level soon.

4. Stocks

US stocks, we think, are more influenced by China-US turmoil than Treasuries given the exposure to China of the largest market-cap stocks in the S&P. That almost makes stocks a binary decision. So we turn to smart opinionators.

- Lawrence McMillan of Option Strategist – In summary, a mixed picture has emerged. The breakdown through support on the $SPX chart turned that negative, and that is very important as is the fact that put-call ratios remain negative and $VIX is still above 17. But the ferocity of the decline spawned oversold buy signals. Hence, we are maintaining “core” bearish positions, but also trading some of the oversold condition buy signals.

How far has sentiment gone?

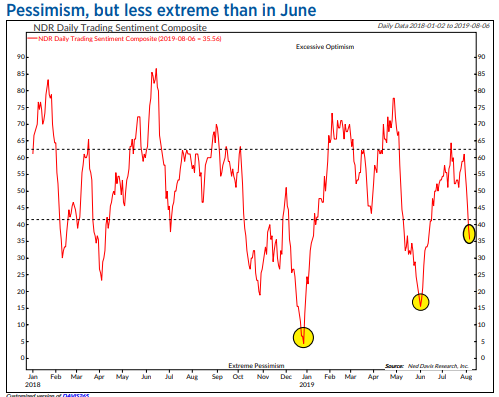

- Babak @TN – Short term chart of NDR’s Daily Trading

#Sentiment (it is still at 35.6% – far from the Jan 2019 low and still a ways off from even the shallow late May, early June correction low

Frankly, we don’t know how to interpret the above higher lows sequence. Are the higher lows bullish by definition or bearish because it is not low enough yet to serve as a powerful a contrary signal? Or should these pessimism levels be normalized with 10-year rate levels?

Frankly, we don’t know how to interpret the above higher lows sequence. Are the higher lows bullish by definition or bearish because it is not low enough yet to serve as a powerful a contrary signal? Or should these pessimism levels be normalized with 10-year rate levels?

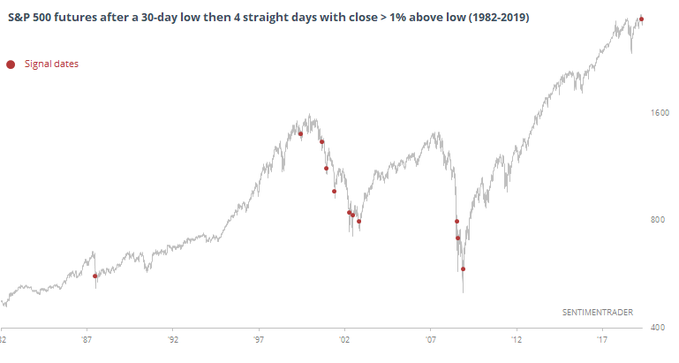

While the week was negative for stocks, the S&P never closed on its lows this week. Looking at this closely,

- SentimenTraderVerified account @sentimentrader – S&P 500 futures hit a 30-day low, then rallied more than 1% off its intraday low for 4 straight sessions. The other market environments when this happened were…interesting.

- Babak @TN – Morgan Stanley’s prime brokerage unit: aggregate hedge funds’ long/short positions (net leverage) at lowest level since Feb 2016

#contrarian – http://bloomberg.com/news/articles/2019-08-07/hedge-funds-turn-most-bearish-since-2016-hone-long-stock-bets

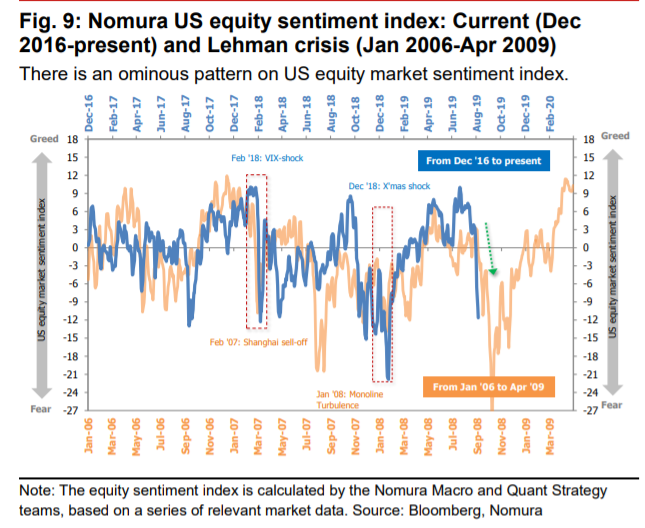

How often is the most bearish on stocks article found on CNBC? This week for sure. The article that used the L-word is titled – Nomura: A second market sell-off could be ‘Lehman-like’.

- “At this point, we think it would be a mistake to dismiss the possibility of a Lehman-like shock as a mere tail risk,” Nomura macro and quant strategist Masanari Takada said in a note Tuesday. “The pattern in US stock market sentiment has come to even more closely resemble the picture of sentiment on the eve of the 2008 Lehman Brothers collapse that marked the onset of the global financial crisis.”

So what should investors do with a near-term rally if they get one?

So what should investors do with a near-term rally if they get one?

- “We would expect any near-term rally to be no more than a head fake, and think that any such rally would be best treated as an opportunity to sell in preparation for the second wave of volatility that we expect will arrive in late August or early September,” Takada said. “We would add here that the second wave may well hit harder than the first, like an aftershock that eclipses the initial earthquake.”

If that happens, then we will know that this week’s bottom in Treasury rates was NOT the real bottom.

5. Dollar

Is it a breakout or a failed breakout? The answer could be momentous. But smarter minds than ours are asking the same question:

- J.C. Parets@allstarcharts – we saw no evidence this week that it’s NOT like this $DXY

The above may prove to be the most important signal in the world. But is there anything that is acting despite of it & signaling something about it?

- Raoul PalVerified account @RaoulGMI – Gold is rightly doing its job, sniffing out a BIG problem and is exploding higher, outperforming even the super strong dollar as gold begins to price in an end game of an eventual MASSIVE readjustment of the dollar (in 12 months? 18 months?)

#GOLD$GLD

Gold was up another 1% on the week & closed above $1,500. Silver was also up over 1%. And then you have,

- Raoul PalVerified account @RaoulGMI – And

$BTC#Bitcoin is doing its job of suggesting an alternative system is gaining in probability (it trades like call option on a new system, in my mind). The price moves are so ENORMOUS (and thus the increase in probabilities are so FAST) that you have to use log charts…

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter