Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”ludicrous” or reality du jour?

Scott Minerd of Guggenheim used the L-word on his stint on CNBC Fast Money on Thursday. His L-quote?

- “We are either moving into a completely new paradigm, or the speculative energy in the market is incredibly out of control. I think it is the latter. I have said before that we have entered the silly season, but I stand corrected, … We are in the ludicrous season.”

Leaving aside the hyperbole, what did he actually say?

- “In the markets today, yields are low, spreads are tight, and risk assets are priced to perfection, but everywhere you look there are red flags, …. This will eventually end badly. I have never in my career seen anything as crazy as what’s going on right now, .. ”

Any numerical predictions from Minerd?

- “GDP growth in China in the first quarter could be as bad as negative 6%.”

That of course would have big consequences for global growth, especially EM growth. But you know what is really ludicrous? Despite the above predictions of economic doom, Minerd said that he expects the U.S. stock market to be up by 15% in 2020.

How nuts is that? Saying things are incredibly out of control, assets are priced to perfection & this is end badly AND at the same time saying the U.S. stock market will be up 15% by year-end?

Think about it. If Minerd is even somewhat right then the U.S. stock market is behaving perfectly rationally. It sells off when the news gets worse but quickly regains its footing because by year-end, meaning Q4, investors will get a return that is 7.5 times Fed’s inflation bugaboo.

We know we are nowhere as smart as Mr. Minerd but we are also not as starry-eyed as CNBC’s Brian Sullivan who gave his friend Scott Minerd the entire show to discuss “ludicrous”. Because the real actionable message beneath Minerd’s “ludicrous” rhetoric is that people should sell/reduce now & buy in after a steep correction mid-year to benefit from the year-end rally. If we are right in deciphering Minerd’s ludicrous verbiage, then why did it take the Sullivan-Minerd pair an entire show to say that?

Heck, look how a couple of smart guys put it succinctly:

On the other hand, what about here & now, meaning next week? That depends on what you believe moves stocks? Especially during option expiration weeks!

The answer is simple – “Dealer Gamma, that’s what moves the market“. Whose answer is it? Of Charlie McElligott of Nomura, the man who made a perfectly accurate trading call on December 18, 2019 on CNBC Squawk Box. Remember what he said then – Buy Treasuries & Bond equivalents (utilities etc) and Short Energy & Financials in a January reversal of the December consensus.

What did he say this week?

- “… there is a lot of fear story out there w.r.t ongoing slowdown, end of cycle story, coronavirus impact; so dealers are very short downside …. ; during next week’s option expiration this crash protection could start decaying; they have to puke out of that stuff; that could create a slingshot higher … a rates higher, stocks higher move in the next two weeks .… dealer gamma that’s what moves markets …”

Well, one week is already gone of this two-week prediction, a week in which S&P was up 1.3% & NDX was up 2.4%. And next week is Options Expiration.

2. Treasury Rates

What’s up with Treasuries? Yes, the Treasury market absorbed this week’s auctions well; yes Treasury rates, across the entire curve, were flat in an up stock market that called “ludicrous” by some bigshots. But shouldn’t we be seeing declines in Treasury yields with China, the biggest contributor to global growth, virtually grinding to a standstill & with huge inflows into the US bond market?

- Jenna & John@StrategicBond – Incredible flows into bond funds globally YTD annualising at $1 trillion rate versus approximately $500bn last year. A reverse great rotation 😉

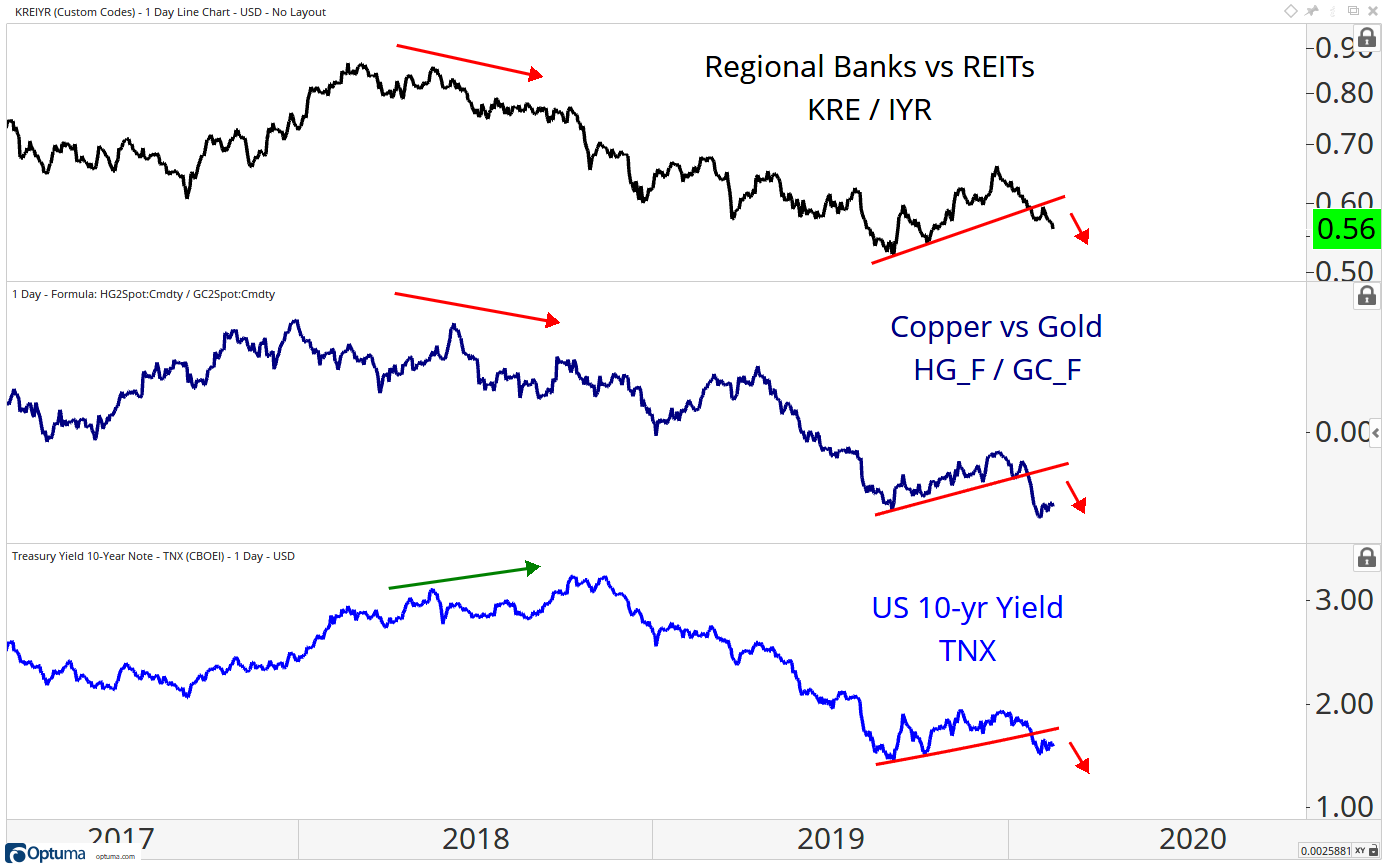

Nomura’s Charlie McElligott said the 10-year could trade between 1.50% & 1.90% to be faded at both levels. But as BlakcRock’s Rick Rieder keeps saying, the short-end of the Treasury market remains boring until we see signs of a Fed rate cut. And the long end is a trading vehicle until we get clear signs of a substantial impact on US, or even Europe.

On the other hand, Jordan Rochestor of Nomura warned on BTV – “whatever happens in China happens in Europe 3 months later“. And he added, “4 out of 5 people are not working in China“.

Does that mean we have to wait for 3 months to see Treasury yields tumble? Or until the 10-year Bund goes below minus 50 bps in yield or the 30-year Bund goes negative in yield? Or do we wait until Credit starts going bad? But can credit go bad in this ocean of liquidity?

Even David Rosenberg voiced his reluctance to be bearish on CNBC Closing Bell,

- “If the Fed cuts interest rates providing ongoing liquidity & we get this ongoing share buyback boom …., even “bears” like me have to reign that in … “

The more important point Rosenberg made was:

- “ … we have a government deficit of almost 5% of GDP & we have government spending up 10% year/year … so government support to the economy is incredible … “

And that might be the reason that bond yields have not tumbled despite the expected global slowdown.

On the other hand, one previous stock-market bull turned bond-market bull thinks Bonds should be bought now:

Parets writes in his Here Come Higher Bond Prices article:

- “When you run the numbers, most stocks in the U.S. are down over the past month, with negative average and median returns for the Russell3000 components. It’s the bonds that are up and I think they’re just getting started. … What does this mean? I think it means we keep buying bonds.“

3. Gold & Energy

Parets likes bonds but he is a seller of Gold & wouldn’t buy gold miners until GDX closes above $31. according to his article. On the other hand,

Yes, no one wants oil now that Chinese demand has collapsed. But,

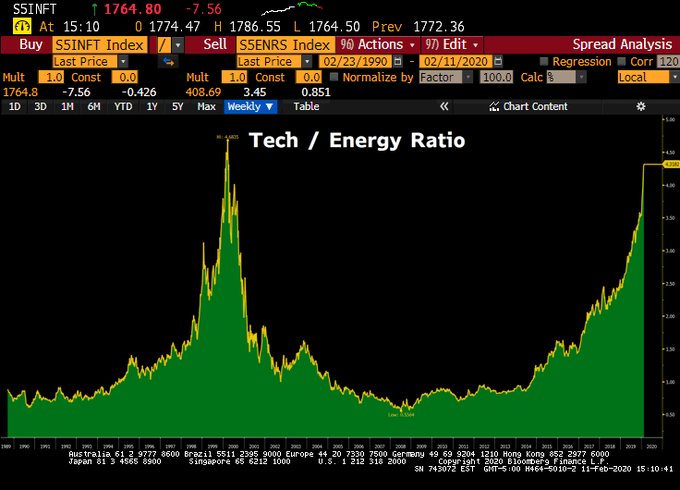

- The Bear Traps Report@BearTrapsReport – – The Tech vs. Energy Ratio is nearing dot-com bubble highs…

Guess what, Oil had the best week of the year this week with USO up 3.7% & BNO up 5.1%. That led to Carter Worth & Mike Khow of CNBC Options Action to recommend buying crude at least for a trade. The charts in the clip below are worth at least a view, we think.

4. US Aerospce Sector & US-India

India’s defense needs are huge but India’s ability to fund what is needed is not adequate. Still the specter of China in the Indian Ocean drives US & India into sensible deals. Below are a couple of tweets from that extremely rare commodity – a rational un-bigoted analyst of US-India defense space:

- Jeff M. Smith@Cold_Peace_ – “The 140-warship force has just about a dozen old Sea King and 10 Kamov-28 [ASW] helicopters as of now.” FMS sale, to be cleared by CCS next week. Follows purchase of 22 Apaches purchased in 2015. New helos will be delivered 2022-2024.

In a bit more detail,

- Jeff M. Smith@Cold_Peace_ – India to purchase six US Apaches ($930m) and 24 Seahawk/Romeo anti-sub warfare helos ($2.6B). Seahawks “considered a ‘critical operational necessity’ for the Indian Navy because its warships are virtually bereft of [ASW] helicopters”

As another article put it,

- “The multirole helicopters from Lockheed will be equipped with Hellfire missiles and torpedoes, and are meant to help the Indian navy track submarines in the Indian Ocean, where China is expanding its presence.”

Besides these limited deals, Lockheed is doing everything it can to persuade India to buy F-21s (upgraded F-16s) for the Indian Air Force. We think this is a worthy but fruitless exercise given that F-16s are old & the Indian Air Force is unlikely to buy US fighters given the old relationship between NaPak Air Force & US. The Indian Air Force is India’s front line defense arm against NaPak and there is virtually zero trust in the Indian Air Force about the sanctions-loving US Congress.

However, the Indian Navy has a very different viewpoint and they now have years of experience via annual Malabar exercises in the Indian Ocean. And the Indian Ocean is where the strategic interests of the US Navy & the Indian Navy are congruent. Here is where Boeing has a good opportunity to win the deal for multi-role 57 fighters operating off of Indian Aircraft carriers especially if the deal also contains the new propulsion technology used on US aircraft carriers for launching fighter aircraft.

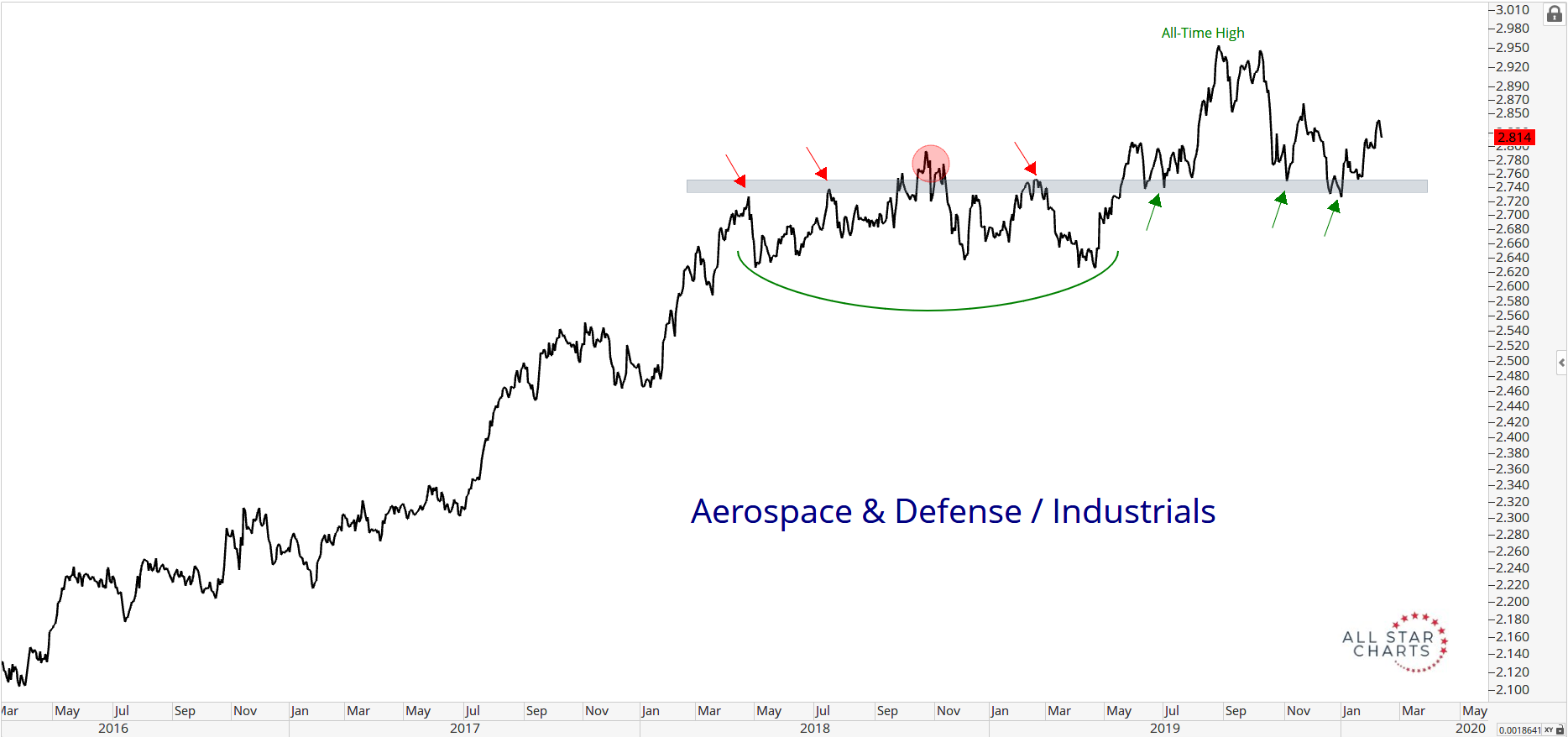

All this goes to show again why the Aerospace & Defense sector may be a long term overweight as well as an outperformer vs. industrials as Steve Strazza of AllStarCharts pointed out this week:

.

Send your feedback to editor@macroviewpoints.com Or @Macroviewpoints on Twitter