Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”huge Dow rally; … it’s a different world now“

Look what Bob Lang, a Cramer colleague on his Real Money, tweeted on Friday afternoon:

- Bob Lang@aztecs99 – We are looking for a good run into year end, let’s add some call exposure here. BOUGHT SPY JAN 350 CALL AT 16.85 BOUGHT QQQ JAN 290 CALL AT 13

Apparently Mark Sebastian, another Cramer colleague, agrees with the “good run” call but might disagree with choice of indices above. As Jim Cramer reported on his Mad Money show on Friday evening, Sebastian expects a “huge rally” in the Dow Jones Industrial average but not so much in SPY. Further he expects “Nasdaq to meander“. The message from Sebastian, as conveyed by Cramer, is simple – “it’s a different world now; stop being afraid, VIX in backwardation …”

Makes sense after this past week, right? Dow rallied 5.4% this week while NDX fell 1.3%.

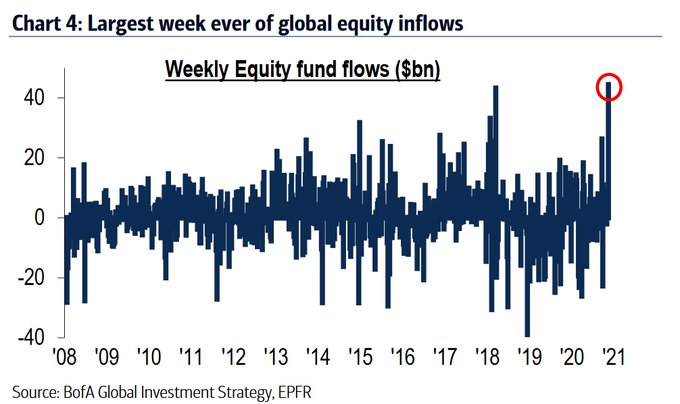

Goldman raised their price targets substantially this week and JPMorgan raised their equity overweight to 10% from 8%. What is necessary for a buying spree? Big inflows of funds into stocks.

- Comped Capital@CapitalComped – Replying to @hmeisler – To add to the bullish sentiment, BAML is showing the largest ever weekly equity fund inflows.

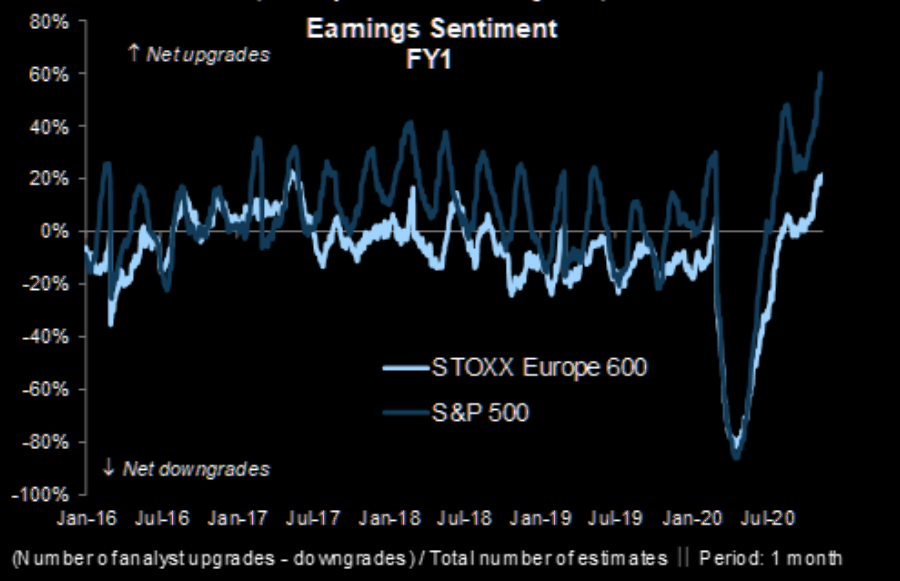

And what is necessary to support rallies from fund flows? Earnings growth, right!

- Market Ear – Earnings sentiment upgraded from V to Rocket; Earnings sentiment both in Europe and US behaving more like a rocket ship now. So many upgrades that the chart soon will have to be expanded.

No wonder Marko Kolanovic raised his S&P target to 4,000 next year & his potential target to 4,500 by end of next year. His 7 points via Market Ear:

- The equity market is facing one of the best backdrops for sustained gains in years.

- Biden victory with a likely legislative gridlock as a goldilocks outcome for equities, a “market nirvana” scenario.

- Global central bank policy remains very supportive (rates to remain at zero with ongoing QE).

- The prospect for another round of fiscal stimulus has improved as well, though scope and size should be narrower.

- Corporate earnings (i.e. 3Q) and labor market recovery (i.e. October jobs) continue to come in ahead of expectations.

- Equity positioning remains at below-average levels with ample room for mechanical re-leveraging as volatility levels subside

- We see the S&P 500 reaching 4,000 by early next year, with a good potential for the market to move even higher (~4,500) by the end of next year.

And the right stocks have shifted into up trends:

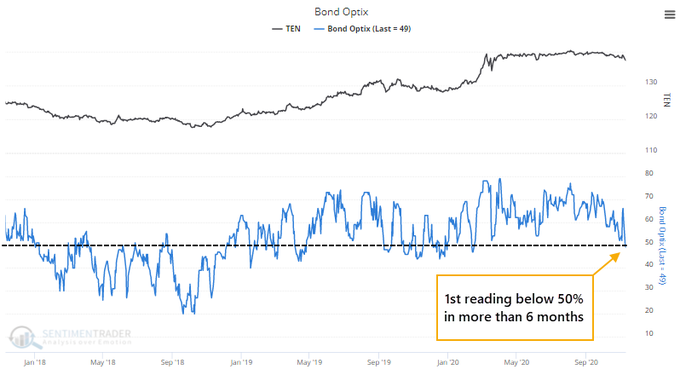

- SentimenTrader@sentimentrader – Just as traders go risk-off in bonds, more than 90% of small-cap stocks have shifted into uptrends.

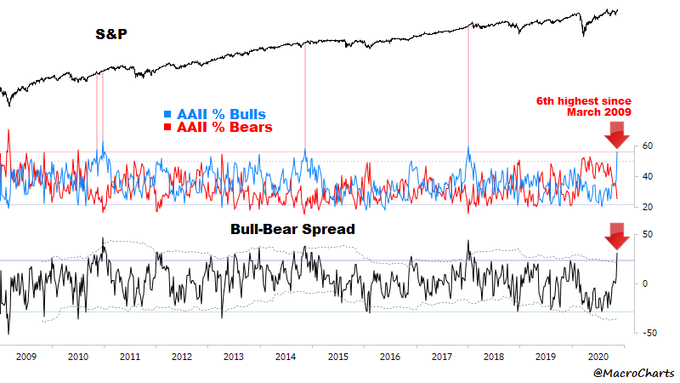

A small sour note to all the above – reportedly BAML’s Michael Hartnett points out that their Global Breadth Rule has triggered a “sell” signal with “91% of MSCI equity country indices above 50 day & 200 day moving averages“. This they say is an “early warning signal that topping process has begun“.

- Macro Charts@MacroCharts – Nov 12 – Big change in Stock market sentiment this week… AAII BULLS spiking to 56% – top decile in history (33 years), *Top 6* since MAR 2009 and largest weekly increase in 10 years. BULL-BEAR Spread at 31% – top 5% in history. Both series are now at the highest since JAN 2018.

Given that all indices reached new all-time highs on Friday and BAML’s sell signal is just an “early warning”, perhaps the above series might also make important new highs into year-end.

And why shouldn’t they? Hasn’t BlackRock’s Rick Rieder said nominal GDP in 2021 will hit 5% growth?

2. On the other hand

Jim Cramer said on his show on Friday that the market has no memory. We dare to differ and say the market showed its memory on Thursday & Friday. We feel that irresponsible comments from Biden’s Covid-head about the necessity of a 4-6 week national lockdown was a catalyst for Thursday’s sell off & the 10-bps fall in Treasury yields. Friday’s rally was a given when Biden’s political advisors said no “lockdown” was being planned.

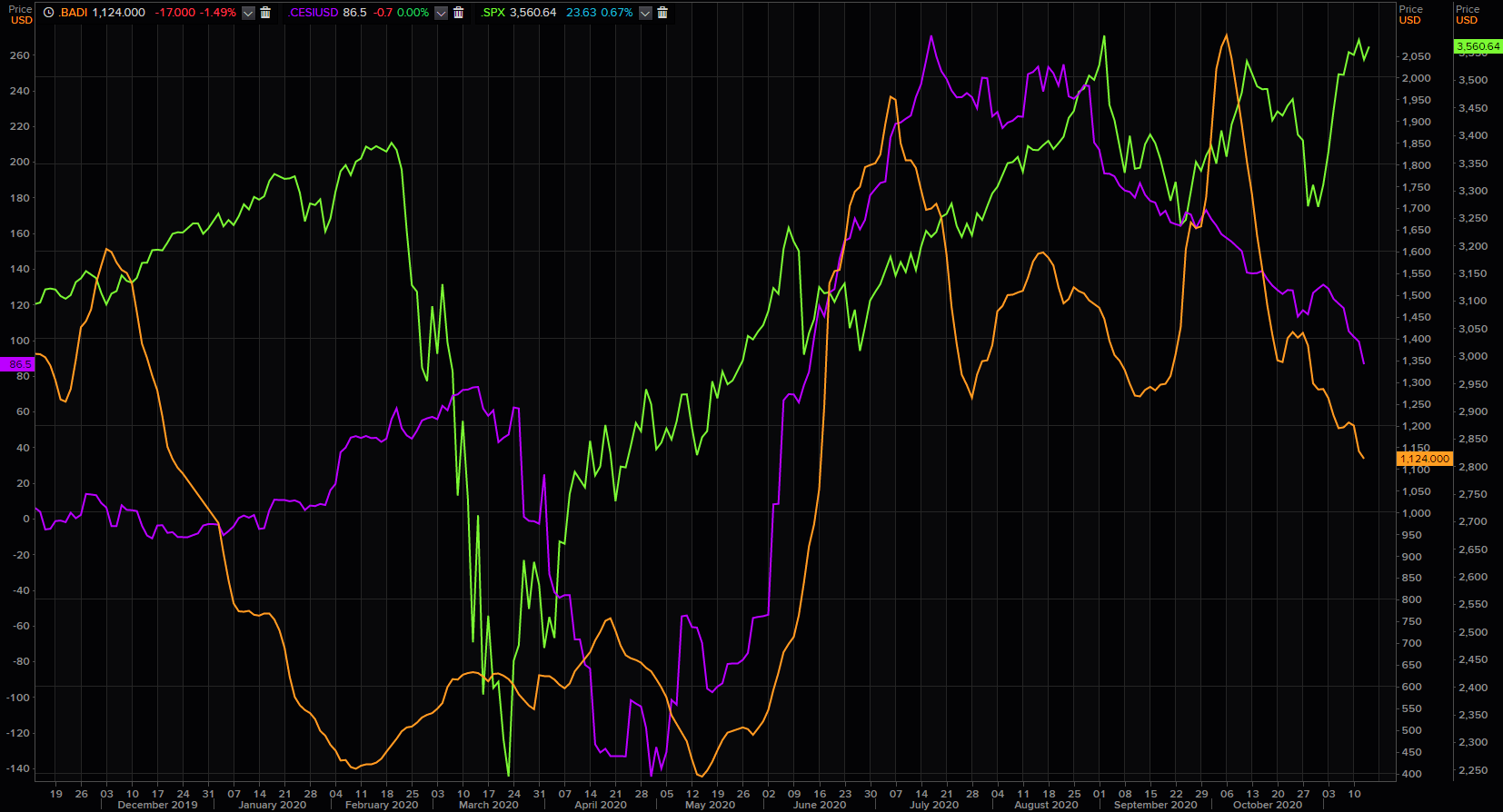

But the economy is exhibiting some signs of a slowdown in its rate of growth. Per the chart below from Market Ear,

- “Citi’s economic surprise index continues surprising to the downside, and Baltic dry is no better. Will the gap vs Spuz “come in”?”

And,

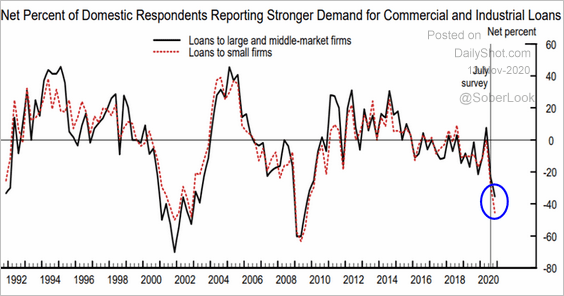

- Jesse Felder@jessefelder – ‘Corporate loan demand is now at its weakest since the financial crisis. Small business demand is particularly soft.’ thedailyshot.com/2020/11/12/us-

And Biden’s Covid guy wants a national lockdown into this and into the most important Senate election in recent years? Kolanovic’s 2nd bullish point calls for a “legislative gridlock” and his 4th point says “prospect for another round of fiscal stimulus has improved“. This is not an “and” but an “or” in our opinion. If Democrats take the Senate then we expect a massive fiscal stimulus. But if Republicans keep the Senate, then forget about a fiscal stimulus.

How important is a stimulus? We were surprised to hear CNBC’s Mike Santoli say on Friday after the close that the stimulus doesn’t matter to the market. That may be only true for the year-end run. Who thinks Small Businesses will do ok without a reasonably sized stimulus – a stimulus to protect tenants from eviction risk & to renew mortgage forbearance for landlords; a stimulus to protect employees from layoffs & termination?

Our view on October 31, was:

- “What if Biden is elected President but GOP keeps the Senate? Then we think the GOP will revert back to its preferred economic policy and oppose all attempts to further economic stimulus that increases the debt. And a President Biden will try everything he can to raise taxes. The two together will take us back to the Obama days and create near-deflationary conditions. “

The GOP may go along with a $500B sized stimulus that contains lower taxes for middle class but they are unlikely to spend the way Democrats want them to. This may be why even Jeff Gundlach said we could get a deflationary environment in the short run. And David Rosenberg said in their joint call that he is “in the global deflation camp; it is a high conviction call” . His blunt statement is:

- “if vaccine is not coming quickly & if we are not getting enough stimulus; that’s a recipe for something called a double-dip recession … in that case, the stock market is going down at least 20%.”

Gundlach was also blunt:

- “… Rosie is right; without the stimulus, economy is already in tatters, it would be a disaster ..”. But if Democrats take the Senate & Biden follows through, the stimulus is going to be absolutely huge “.

His longer term suggestion is owning 25% stocks for growth & inflation hedge, 25% gold, 25% long maturity Treasuries as a deflation hedge and 25% in cash.

And both agree that this will begin playing out in the credit market & “how the credit market behaves without stimulus is going to be a very good litmus test“. That brings us to the guy who made a huge bet against credit in February 2020 and closed it in mid-late March to go long stocks around March 19-20. If you don’t remember, look at the clip below just for 60 seconds beginning at minute 3:06:

What did Bill Ackman do this week? He put on a similar short bet on in credit saying:

- ” … we are in a treacherous time generally & what’s fascinating is that the same bet we put on, call it 8 months ago, is available on the same terms” .

Ackman clarified this in his interview with FT:

- ” … so this is different from the hedge we put on last February; we thought that was a near certainty that it would get really ugly … now it offers the same asymmetry & for people 100% long equities, it is a nice insurance policy ”

Of course, simple folks can also buy an insurance policy via long duration Treasuries, as both Gundlach & Rosenberg pointed out.

Ackman does seem to mean it when it says it is different now than it was in March:

- “… there is a reasonably high expectation we are going to have a distributable vaccine; widely distributed by sometime in the first half of next year; … that number of people dying is going to start declining at some pint relatively soon; businesses are going to recover; we are going back to our normal lives”

That may be why he is long stocks while buying an insurance policy in investment grade credit.

What Ackman does not address is what happens to the economy without a stimulus to tide over small businesses, landlords & tenants until we get to the El Dorado in Q2 2021? Hopefully nothing or perhaps nothing worse than a slowdown!

So what about trades or investments? Gundlach says look for closed end funds that get sold off for tax loss selling. He says the U.S. Dollar will be declining for a multi-year period & U.S. stock market may be the worst performer. He says the Eurozone is highly vulnerable & has horrible demographics. He is looking at Asia principally & thinks India over a very long term. Rosenberg also says Asia & while he says India screens very well, he is looking at China.

3. Happy Diwali

We wish all a very Happy & Prosperous Diwali. In that spirit, we hope that all the negative stuff above is next year’s business and we have a wonderful continuation into year-end. And speaking of stocks, below is a lovely greeting from NSDL e-governance in India, the sister company of NDSL, the stock custody company.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter