Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TACs is our acronym for Tweets, Articles, & Clips –our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Taper Tantrum II?

Look at:

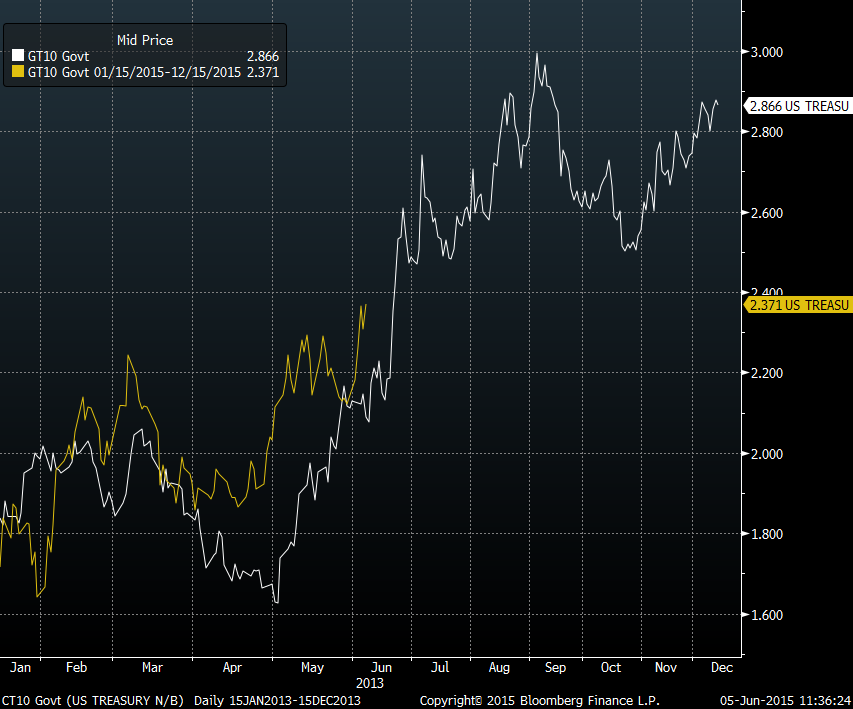

- Friday – Two And Twenty @deuxetvingt – If I had told you 2015 would be a virtual repeat of 2013….

The chart illustrates the damage that can be done to interest rates in the next few months if Chair Yellen keeps up this will-they-won’t-they game. Remember the various Bernanke comments in 2013? Remember the incessant attempts to not surprise the bond markets, the incessant attempts to manage the reaction of the bond market? Remember how it made the bond selloff much worse than what it would have otherwise been?

The Yellen Fed is going along the same path, signaling sometimes that a rate hike this year is virtually certain and signaling sometimes that rate hikes may not happen in 2015. All this is confusing bond markets and they are getting fed up. And this week, they took the chances they got to spike interest rates with a velocity that must have scared the Fed.

Doesn’t Chair Yellen recall that interest rates stabilized and went down when she finally announced the Taper in 2013? Was that because the bond market got certainty or was that because the insane babbling of the Bernanke Fed had taken long rates much higher than they would have otherwise gone?

Dr. Yellen, you got a gift this Friday. Use it. Raise rates by 25 bps on June 17 and state clearly that only one additional rate hike will be considered if necessary in 2015. That will cool down the bond market and limit the damage to the economy.

2. Will They or Won’t They?

Jeff Gundlach, Jim Bianco & Rick Santelli all said “No” when asked whether they thought the Fed would raise interest rates in 2015. But that was Thursday, a day before the stunning 280,000 jobs number on Friday. But would that number move the Fed to tighten in September? The Fed-Whisperer Jon Hilsenrath wrote no in his article on Friday.

One reason might be the precedent of March, 2015. The payroll number on Friday, March 6, 2015 was a stunning 295,000 print. The 2-year yield jumped to 72.74 bps & the 3-year yield to 1.14%. These yields kept coming down slowly in March and then came the shocking 126,000 jobs number on Friday, April 3, 2015. The 2-yr & 3-yr yields closed on that Good Friday at 48.41 bps & 78.95 bps resp. That raises the question:

- Friday – Charlie Bilello, CMT @MktOutperform – US 2-yr yield testing highest levels since 2011 for 3rd time. Last 2x Fed doves smacked it back down. Same here?

The catalyst for the downdraft in yield in March 2015 was the dovish FOMC statement on Wednesday, March 16. Will that pattern repeat on Wednesday, June 17th or will the Yellen Fed affirm a tightening in 2015? We ask because we can virtually guarantee they will not raise the Fed Funds rate on June 17.

The will-they-won’t-they drama got more interesting with the IMF head Lagarde publicly asking the Fed to not raise rates until mid-2016. Their excuse was their downgrade of the 2015 U.S. GDP growth to 2.5% from 3%. This stupidity virtually guaranteed a statement from the Fed to the contrary. Was the Fed going to accept that the IMF knows more about the U.S. economy than the Fed? Was the Fed going to allow another body, a non-American body, to tell the Fed what to do with US monetary policy? Of course, not. No wonder Bill Dudley took Friday’s payroll number to state almost categorically “Fed still likely to start raising rates this year“. Take that, Ms. Lagarde.

That enabled Mohamed El-Erian to take a victory lap on Friday on BTV and restate that “most likely outcome is a September hike“. That is if the data keeps coming in strong and the next payroll number doesn’t nosedive as the number in April 2015 did.

Another reason for the Fed to hike on Wednesday, June 17.

3. U.S. Economy

- Friday – David Rosenberg – It was one excellent U.S. employment report and many of the Yellen dashboard indicators are now returning to pre-great-recession levels

Is the problem with ADP then?

- Wed – Jamie McGeever @ReutersJamie – ADP jobs growth has slowed for 5 months in a row, something not seen since 2008. HT @alaidi

Raoul Pal of The Global Macro Investor went so far away from David Rosenberg as to use the “R” word on Thursday on CNBC FM:

- “all of the economic indicators including regional Fed surveys are all in recession territory, many of the forward looking indicators including such as retail sales, durable goods, are all kinda in recession territory; the ISM is the only one that hasn’t confirmed it; generally the business cycle lasts 7-10 yrs trough to trough; so it would be reasonable to expect a trough in business cycle in 2015-2016; … if I take all of the data together, the probability is very high of recession coming or in a recession now”

And a couple of Fed heads including Dr. Brainard & Dr. Tarullo spoke of a weaker economy this week. And, as we quoted last week, Jim Cramer said the Fed should be cutting interest rates not talking about hiking them.

These are all smart people but, frankly, the weight of the evidence goes to the strength camp thanks to the NFP number on Friday, unless or until that is revised downwards next month. In fact, James Paulsen of Wells Capital went further on Friday on CNBC and said:

- “We are getting closer and closer to the realization that it was a head fake and that we are rapidly running towards 5% unemployment and wages are already starting to pick up and I just think we are going to head towards getting more concerned about overheat than underheat for the first time in this recovery and the real arbiter in this won’t even be the Fed; it’s going to be the bond market.”

4. Treasuries & Bunds

But which bond market? Yes, yields spiked by 25-28 bps across the 5-30 year Treasury curve this week. But that was put to shame by the 35-41 bps spike in German 10-30 yr curve. . .

- Thursday – Ashraf Laidi @alaidi – 4-mth high in German-US yield spread http://ashraflaidi.com/forex-news/german-us-spread-breakout … #forex #bund #bonds

This spread fell viciously on Friday with a 10-bps spike in the Us 10-yr yield. So will we now see a race between which yield rises faster – the 10-yr Bund or UST? In one way, Draghi does seem to be ahead in his race with Yellen:

- Tuesday – Holger Zschaepitz @Schuldensuehner – Draghi seems to win #QE battle. Inflation expectations, measured by 5y5y swap, rise in tandem w/ #ECB balance sheet

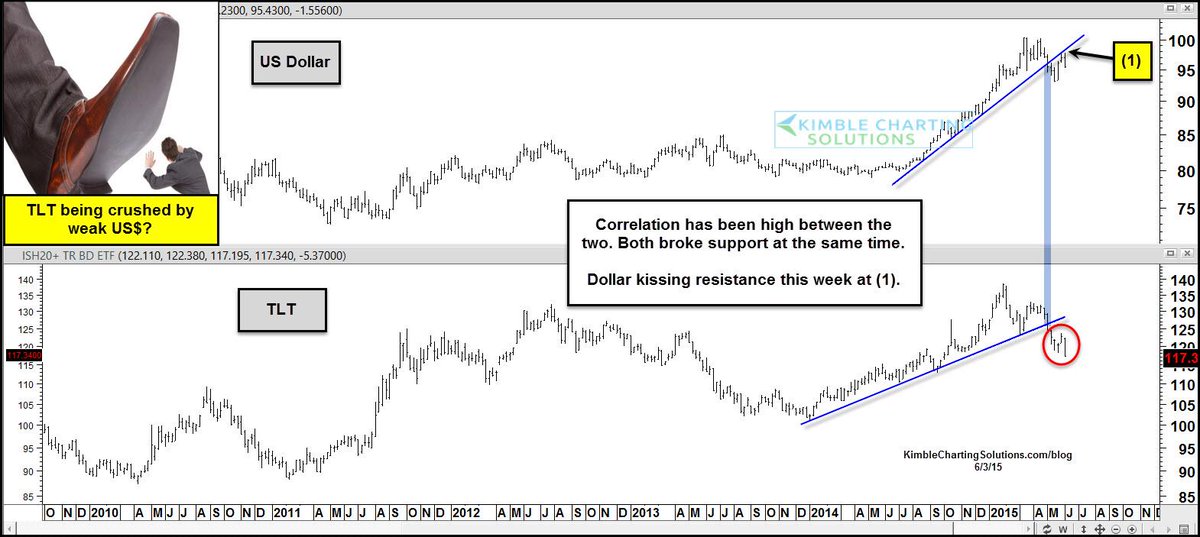

Is there a linkage with the Dollar?

- Wednesday – Chris Kimble @KimbleCharting – Is TLT being crushed by concerns over a weak US Dollar and strong Euro? $TLT $USDJPY $EURUSD $FXE $UUP

The rise in Treasury yields may be one of those rare times when positioning is not the major factor;

- Andrew Thrasher, CMT @AndrewThrasher – Not squeezed yet but interesting if/when they do RT @jessefelder Most net shorts in U.S. Treasuries since 2006 http://www.reuters.com/article/2015/06/02/treasuries-jpmorgan-survey-idUSL1N0YO0OE20150602 …

And they got mighty squeezed in mid-June in 2006. Will Chair Yellen be the catalyst on June 17th?

5. US Equities

Jeremy Siegel seems sort of in our camp with this comment on CNBC Squawk Box – “anticipation of rates rise is worse than the actual act of raising rates“. Assuming the Fed raises rates in September, Siegel stated – “If they go in September, I think the fourth Quarter might be the very best quarter for stocks this entire year“.

David Rosenberg wrote on Friday:

- “For the first time in a long time, U.S. earnings revisions are on the rise – incredible what can happen when the oil price stops plunging and the dollar stops surging”

This sentiment was also expressed on Monday by Savita Subramanian of BAC-Merill Lynch on CNBC FM 1/2:

- “valuation has always been a lousy market indicator – it has very little predictive power; I still think US large cap stocks offer quality at a decent or appropriate multiple – The Alpha is getting scarce, the dispersion is low, but companies are continuing to post positive surprises; we are looking for 2200 on the S&P this year”

The first week of June is seasonally a strong week. That did not hold this year. But what about the month? A detailed treatment was featured in Ryan Detrick’s article on Tuesday:

Detrick asks the question:

- “So is something wrong with 2015? This is usually a very bullish year based on the Presidential cycle and it can’t seem to get anything going in 2015. Does this mean the usually ‘weak’ summer months could be even worse? I don’t know, but I do think about this constantly.”

Well, this 3rd year is all about the Fed raising interest rates? Which was the last 3rd year of the Presidential Cycle in which the Fed raised interest rates? – 1987.

What about the near-term?

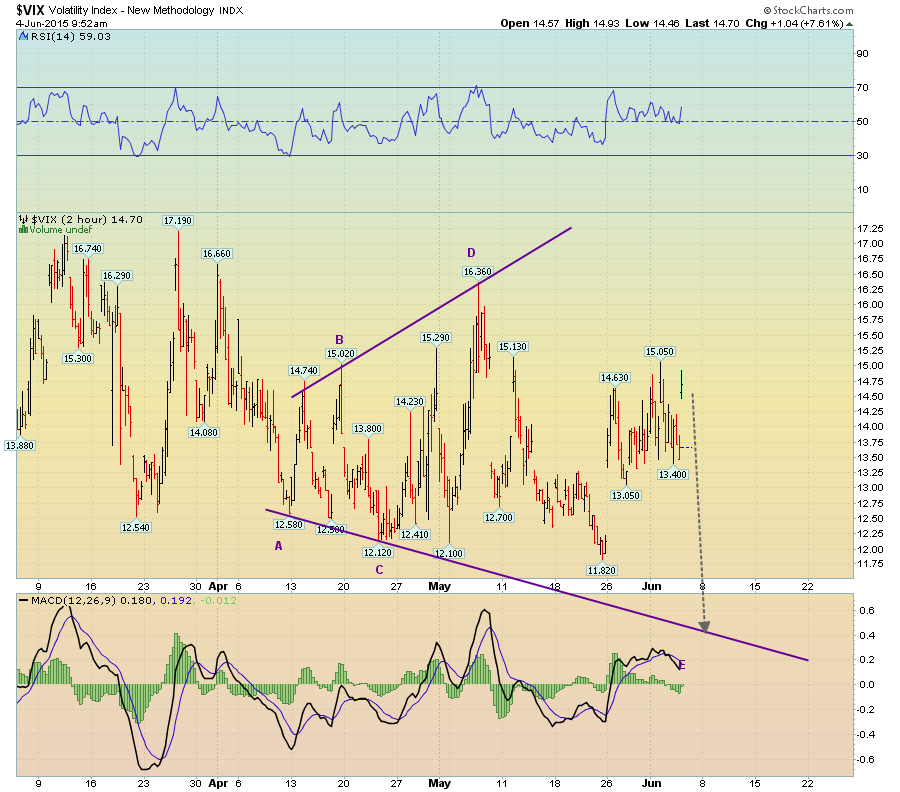

- Friday – Anthony Allyn – 3@traders – Here’s an easier chart to understand. Simple bottoming pattern on the $VIX

On the other hand,

- adam warner @agwarner – If I had a dime for every time TV told me we were about to get more volatile…I’d have money to buy tons of $VIX calls #deepthoughts

tile…#deepthoughtsAnthony Allyn @3Xtraders 14m14 minutes ago

Here’s an easier chart to understand. Simple bottoming pattern on the $VIX

The US stock market has lagged behind many overseas markets. Will the S&P catch up in the second half? That depends on, as Andrew Thrasher writes, whether traders are leaving international markets in favor of the U.S.?

- “Focusing on momentum, a bearish divergence began taking hold in the Relative Strength Index (RSI) in early May as the indicator made a lower high while the ratio between EFA and SPY headed higher. This ultimately led to the RSI breaking through prior support of 47 and the negative divergence acted ultimately as a warning that the trend in performance would rotate back to the S&P 500.”

6. Oil

The Rig count fell on Friday afternoon. Was that what led to Oil rallying on Friday afternoon? Because Oil, which was supposed to fall when OPEC refused to cut production, actually rallied. Or was it because, as T. Boone Pickens said on CNBC Squawk Box on Thursday, that Saudis are bluffing on oil production.

- “OPEC is all in at 31 million barrels a day. That’s about all they can do, … They talk a lot about it, what they can do, and the Saudis say 12 and half. Well show me. I’m ready to see 12 and a half.They’re making 10.3, and they struggle at 10, I think. I think 10 is about all the Saudis can do.” .

That is why Pickens says Oil will rise to $70 by the end of the year. On the other hand, Goldman’s Jeff Currie stated his target on CNBC FM as $45 by October and $50 by year-end.

Speaking of Saudis:

- AEI @AEI 54s54 – Saudis’ drive to kill US #shale has backfired. Welcome to Shale 2.0: http://ow.ly/NVisY

- “But rather than kill the U.S. shale revolution, the Saudis have only made it more resilient, sped up its rate of technological innovation and capped oil prices for at least a half-decade or more. … The U.S. shale industry is by necessity becoming more efficient than ever. … The result is a rapid decline in the break-even price across shale plays. Already, analysts believe it is now $60 per barrel and before long will fall to $50. … Shale efficiency and innovation have created a new ceiling for the price of oil. This certainly was not the Saudis’ aim.”

7. Kudos

As we recall, CNBC’s Joe Kernen was upset when we began using TACs instead of Videoclips in the title to these articles. Our basic point was that expert commentary on Twitter was becoming more useful than long FinTV segments with “expert” guests. He seemed to take it personally and expressed his displeasure on Squawk Box. This week Joe Kernen reversed himself and, on air, displayed a chart that he saw on Twitter and acknowledged that Twitter adds value. Kudos, Joe.

Actually, it is today’s Fed-ECB-created market environment that is the trigger for brevity. There is really no scope for broad macro analysis if everything comes down to what Fed-ECB do and when. So we either have to be like those 1970s Kremlinologists whose work consisted to watching tiny signs of behavior or focus on technical charts in the hope that they might reveal something. That is not where FinTV excels.

But not to worry. Sooner or later, Fed-ECB will act to tighten and then FinTV will have something to discuss at length.

8. What is this?

We know bears, lions, wolves & dogs. But we had never seen anything like the Himalayan dog below:

Send your feedback to editor@macroviewpoints.com OR @MacroViewpoints on Twitter

Anthony Allyn @3Xtraders

Anthony Allyn @3Xtraders