Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Two Views post Powell Presser & Action

Chair Powell & the FOMC statement cut the Federal Funds rate by 50 bps on Wednesday, September 18 and said they are likely to cut another 50 bps by year-end. The stock market did not react positively on Wednesday afternoon. Our view has long been that the most reliable indicator of market’s reaction is the day after the FOMC meeting & presser. That reaction was, as almost everyone knows, was a bullish eruption with Dow up 522 points, S&P up 95 handles, NDX up 495 points, SOX up 207 points & RUT up 46 points.

Jeffrey Gundlach was the first luminary on CNBC to react and his views were mainly about the 2-5 year Treasury sector rallying (rates going down) while the long bond would sell off. We heard him say that we will realize later that “recession started in September 2024“. In stocks, he prefers small caps because “45% of Russell companies have floating rate debt“. The day before Gundlach had said to CNBC’s Scott Wapner that “AI today is same as do.com in 1999; …. you will get a crash & those who survive will become world leaders“.

A different view came from Ed Yardeni who said the following on Friday to Scott Wapner:

- ” …. think a melt up has been initiated by the Fed; … don’t think the 50 bps was really necessary from the point of view of the economy (growing at 3% on yr/yr basis); now it could grow at a faster pace as a result ; …. I think productivity gains are going to be more than we have had of late; … our base case is 5,800; in a melt up scenario for which I raised odds from 20% to 30% – sort of a 1998 deja vu all over again … we could see 6,000 in that scenario setting us up for a correction early next year …. not a bear market because I don’t think we are going to have a recession …. ”

Long Treasury Bonds sold off in 1998 after the Fed cut; so that is one outlook common to both Gundlach & Yardeni scenarios.

What about US financial conditions?

- Kevin Gordon@KevRGordon – GS U.S. Financial Conditions Index is at its loosest and easiest since May 2022 … degree of easing (in year/year terms) has been most accommodative since November 2021

Another way of saying the above:

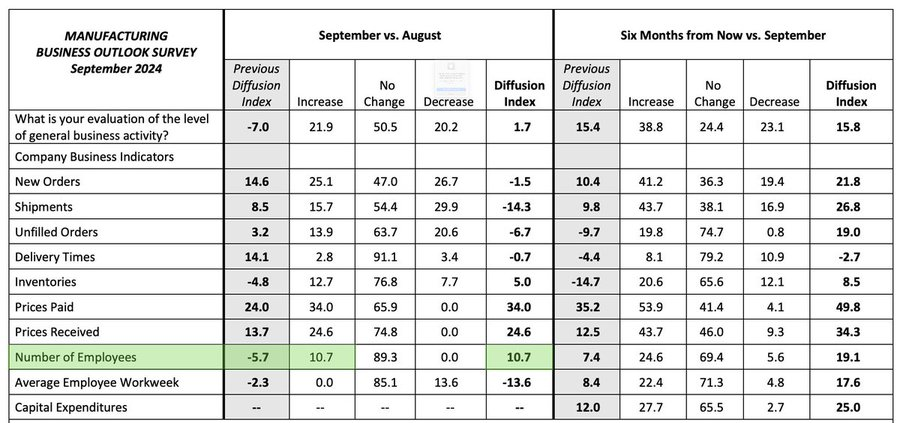

- Seth Golden@SethCL – Just wanted to make sure this got no attention yesterday. We’re just going to overlook this right, that’s how this whole positive data thing works, focus only on the negatives? 😉 Philly Fed Employment Index rises sharply M/M, from -5.7 to +10.7. Also… Empire State Manufacturing Employee Work Week rose 20hrs, yes 20 M/M, biggest 1-month jump since Covid. Either these “surveys” are bullspit, or Fed just poured fuel on an open fire! $SPX $SPY $MACRO #economy #GDP #Jobs #employment

Now a historical view without an economic assumption:

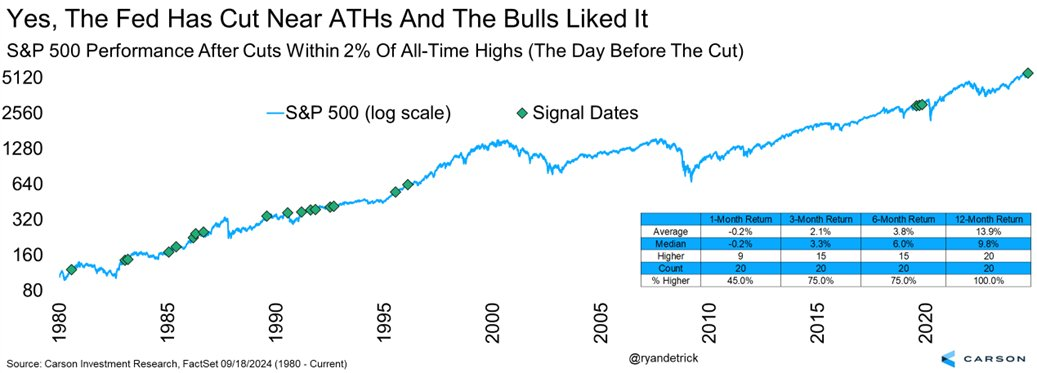

- Ryan Detrick, CMT@RyanDetrick – Thu – Here are the 20 times the Fed cut rates when the S&P 500 was within 2% of an ATH (based on the day before the cut). Higher a yr later all 20 times and up 13.9% on avg. Yesterday was the 21st time.

Assuming Yardeni is right & we don’t get a recession, then this week’s rate cut can described in Detrick’s terms as a “normalization cut”. Other examples of such cuts are ’84, ’89, ’95, and ’19 and “stocks did pretty well after those cuts“, Detrick points out.

Any exhaustion signals after the two week rally?

- Mark Newton CMT@MarkNewtonCMT – Sep 20 – Not just lack of DAILY exhaustion signals, but also weekly, which combined w/ bullish short-term SPX cycles, stronger momentum and breadth, lack of complacency, gives a pretty clear technical message that late September bearish seasonality might not pan out this year

But what about early October?

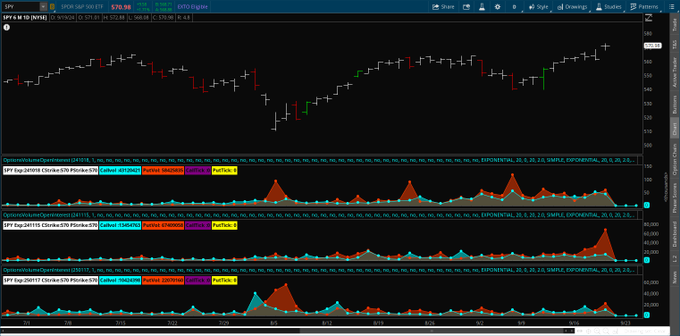

- Trader Z@angrybear168 – $SPY put open interest ramping up as market broke out to new highs showing wall of worry, we are also overdue for a short term shake out, one more week to push sentiment higher then a rugpull?

Finally to our often-quoted short term odds-maker:

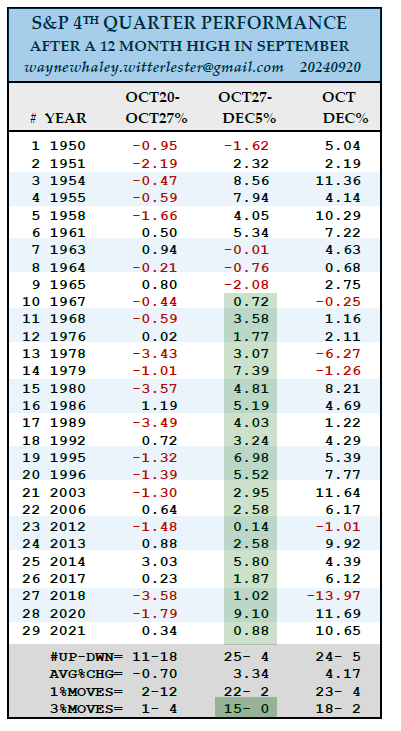

Wayne Whaley@WayneWhaley – Sat – A NEW 12 MONTH HIGH IN SEPTEMBER –

- On Thursday, September 19, the S&P closed at a new 12 Month High as well as an All Time High. Since 1950, there have been 29 years in which a 12 Month High was set in September. In those 29 prior cases, the Fourth Qtr was 24-5 for an average, Quarterly gain of 4.17%. The weakest spot in the Fourth Qtr, on average, was October 20-27 with that week experiencing 12 one percent losses and only two +1% winners. The Sweet Spot was Oct27-Dec5th, which was 25-4 with the 3% moves 15-0. The last twenty, dating back to 1967 have been positive.

2. Commodities & Emerging Markets

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – $GDX weekly breakout > 40. I saw a few bearish Gold/PM posts on Wednesday after the Fed because PM’s weren’t straight up. Big trend moves happen over time, much more important than what happens on a 2-hour timeframe.

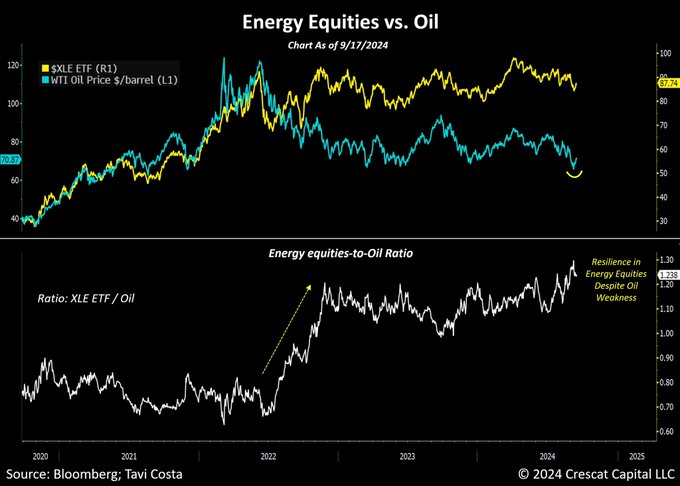

Gold was up 1.5% & GDX was up 90 bps last week. In contrast, Oil was up 3.8%; Brent was up 3.8%.

- Otavio (Tavi) Costa@TaviCosta – Sat – The long-term quarterly chart suggests that oil may be establishing a historical support level after breaking through a major resistance in 2021.

This development is significant and could set the stage for oil prices to find a bottom, despite concerns about elections. Moreover, investors are currently holding one of the lowest long positions in WTI contracts in the past decade. This suggests that positioning is skewed, potentially paving the way for a notable reversal in the recent decline in energy prices. Finally, the Fed’s recent decision to further ease monetary conditions, despite financial conditions already being at two-year lows, could intensify inflationary pressures in my view. As a reminder: It’s worth noting that oil prices and the breakeven rate are closely aligned, which is logical given that energy prices significantly influence inflation expectations over time.

Who better to speak of Emerging Markets than Mark Mobius?

Mr. Mobius was bullish on a range of Emerging Markets from Taiwan to weaker performers like Mexico, Brazil. At about minute 2:50, CNBC’s Jon Fortt asked a smart question saying has the Fed rate cut changed Mark Mobius to bullish from his earlier lukewarm outlook on most emerging markets. Mobius replied:

- “yes definitely; I was leery previously except for India, but now I am much more bullish because of the rate cuts & the general dynamics of how money in America is going to be flowing outside“

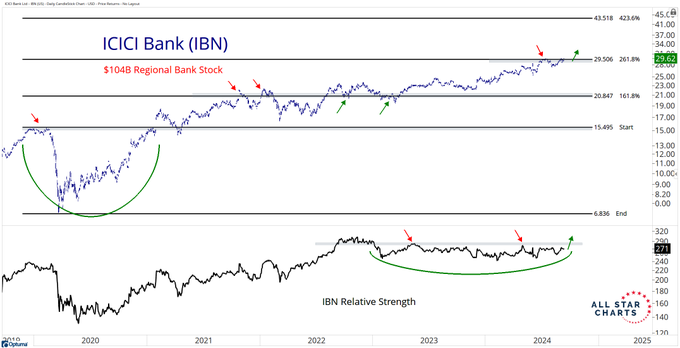

Speaking of India, one of our favorite stocks broke out this week and was highlighted on Monday.

- Sean McLaughlin, NLD 📈 ( formerly @chicagosean)@OptionsSean – Mon – An Indian Bank — ICICI Bank $IBN — is making new all-time highs. Probably not a bad idea to get involved…

A good call because $IBN was up 6.2% this past week and it is breaking out above the India ETFs it is a part of.

As we recall, IBN is owned & liked by Tim Seymour of CNBC Fast Money and has also been owned previously by Stephanie Link of CNBC Half Time Report. Private Banks are one of the major beneficiaries of the secular income growth in India and IBN has been a leader among banks. And it trades on the NYSE.

Last week, we covered Semicon 2024, the conference that focused on attracting the World’s Semiconductor companies to invest in India & build chips from design to production. This week, we begin with an earlier CNBC clip highlighting Qualcomm’s chip design center in Tamil Nadu state that is designing chips end-to-end to meet the AI boom.

If this isn’t enough, wonder what might fill the first Semicon City being developed in Dholera, Gujarat, a Special Investment Zone that is designed to be bigger than Singapore in size:

Below you will see the new Israeli envoy to India, Reuven Azar, talk about a large Semiconductor project, a joint venture between Israel & India, that he said will be announced soon.

In our discussion about new secular sources of growth for India, we have focused on Defense & Semiconductors. Now let us provide a glimpse into a large source of potential growth that stems from the earlier contempt for India’s infrastructure. Here is Israeli envoy Reuven Azar speaking about it:

- ” …. we are going to invest $35 billion in the next 5 years in infrastructure projects in Israel; that means we need to build a new metro for the Tel-Aviv area; we have to build a new airport & many other things; we are interested in diversifying companies from around the world that will build these projects; now India has built already 1,000 kilometers of Metro; India is the 3rd largest country when it comes to build-up capability & we need Indian companies & Indian workers in Israel ….. India is going to be one of the hubs, world hubs, in manufacturing – civilian & military spheres … we want to attract Indian infrastructure companies to come & participate in international tenders in Israel …. “

Given the need to create jobs for the Indian youth, infrastructure projects like the one Mr. Azar mentioned are ideal for India. Previously, Indian workers used to go to the Middle East to serve as industrial labor. Now India’s focus is to actually win infrastructure business outside India & take Indian workers to build them.

Now to what makes today’s India succeed.

3. Extreme ignorance about India in US Financial Sector & Modi’s Visit to US

We saw back in June 2024 how much utter ignorance about PM Modi & India cost investors. The entire coverage on Fin Tv was about how the election results would weaken PM Modi & will lead to a correction. Now as everyone knows, the correction lasted just 1 day & was a phenomenal buying opportunity.

The reality is that most people in US Fin TV essentially think of India as a country that became educated because of the Brit rule for about 150 years. Some others might even be aware of the Mughal rule period before the British & their knowledge ends there. This is the key reason why Fin TV anchors keep butchering important Indian names with nonchalance & their “Indian” guests shamelessly allow it because of their business need to be seen on Fin TV.

That is why US policy has continued to think of & work with PM Modi with the same mental framework. We have tried to portray PM Modi as driving “Mental Independence” of India & Indians. We specifically referred to Vishnu-Gupt Chaanakya in our first article on May 17, 2014 about PM Modi titled ” Vishnu-Gupt Chanakya, Mahatma Gandhi & Narendra Modi“.

How many in US Fin TV have even heard of Vishnu-Gupt Chaanakya or his descriptive title Kautilya? Less than 25 bps, we think. Here is the greatest & the purest of Realists in history, a stone-called Realist who is studied at the US Army War College. His field was StateCraft, the art of using all the instruments of power to achieve the national aims.

After defeating Alexander’s invasion of today’s Pakistan & then helping the young Commander Chandra-Gupt Maurya establish the Great Maurya Empire (340-297 BCE), Vishnu-Gupt retired to compose his magnum opus Artha-Shaastra, a set of 15 books that combine all aspects of StateCraft. That work embodied all the previous knowledge composed by experts that came centuries before him.

Artha-Shaastra was lost in the 12th century & rediscovered in written form in 1904, published in 1909 & translated into English in 1915. Upon reading it, Max Weber wrote that Machiavelli’s The Prince is harmless compared to Artha-Shaastra.

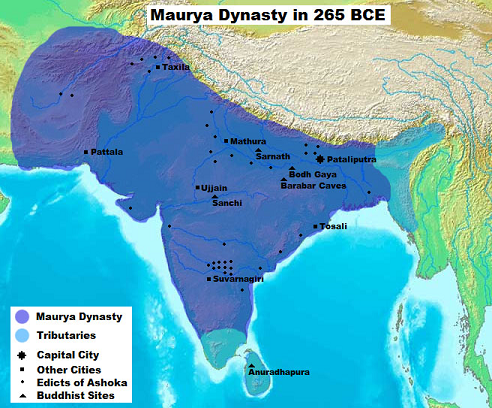

How big & powerful was the Maurya empire Kautilya helped build. As Dr. Larry Johnson of US Army War College states, the empire had 50-60 million people which was about 33%-40% of the world population at that time. It had a standing army of 630,000 which would make the 8th largest army in today’s world. Watch at least the introduction of the clip below.

By the way, Dr. Johnson is not merely an academic. He was in Peshawar (capital of Khyber-PakhtunKhawa province to today’s Pakistan) in late 1980s. Later he worked with the Afghani Mujahideen & attended the Loya Jirga in Afghanistan in 2002 in which US & Afghans chose Hamid Karzai as President of the liberated Afghanistan.

We urge all to watch (or read the transcript) of the above US War College clip. At least watch the first 7-10 slides. It will be a window into a stone-cold treatise on how the King/Ruler should use the resources of the State for the sovereign success. It will also be a window into how PM Modi thinks, a framework that is 100% Indian & totally alien to what Fin TV & western organizations like CFR think.

The US Army War College has not, to our knowledge, covered the actual actions of Kautilya or the enormous impact of his success. His vision was to take India back to its historic approach, a mission that seemed unthinkable & certainly unachievable around 320 BCE.

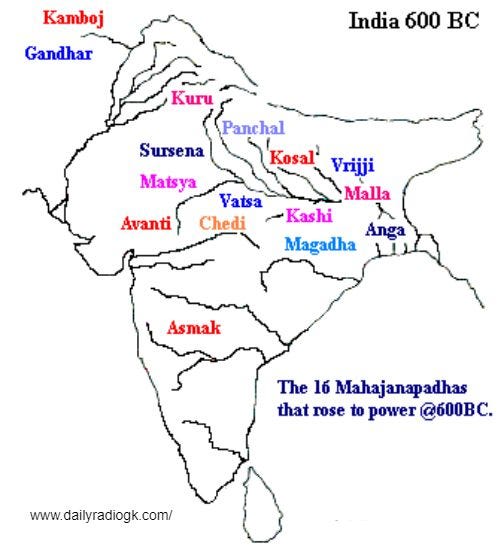

Vishnu-Gupt or Chanakya (son of Chanak) was an Aacharya (Professor of distinction) in the Great University of Taksh-Shila located in the Gandhaar located at the western extremity of the above map (today in NaPakistan, northwest of Islamabad). After Alexander’s successful conquest of Iran, Chanakya was convinced that India was next and that an India divided into 16+ small self-governed provinces was an easy target for Alexander. His vision was to integrate all the provinces into a Federal state run from and protected by the large Army of Magadh located at the eastern & central section of the above map. This was no easy task given the 950 mile distance from Taksha-Shila to Paatali-Putra, the capital of Magadh.

He did reach Magadha & managed to meet the Emperor. The North-western border of India was so foreign to to the Emperor that he didn’t care. Instead, he was so livid that a simple Aacharya had the temerity to come into his royal presence & make demands of him that he asked his guards to physically throw Chanakya out into the streets.

That is when Chaanakya realized that his real mission was to topple the Nanda Dynasty rule in Magadha and install a new Emperor with an all-India vision, a process we term as Regime Change today. Watch the clip below (with English subtitles) to understand the enormity of his mission.

It was an impossible mission and it required first the building of an organization of students across India & warriors fed up & rejected by the various Maha-Jana-Pad.

Amazingly, Chaanakya was successful. But the story of his determined devious machinations to implement the desired Regime Change in Magadha seems very very hard to believe. He managed the regime change & installed his student, Chandra-Gupt Maurya as Emperor. It was Chandra-Gupt who had organized the military effort that forced Alexander to retreat from India by going south using the Sindhu (Indus) river & then escaping via today’s Balochistan.

But Alexander’s defeat was small compared to the emergence of the Maurya Empire that rose under Chandra-Gupt.

By the way, Chandra-Gupt’s asymmetric war against Alexander of Macedon was studied in Russia &, reportedly, this approach was used by Russian Marshal Kuznetov to defeat & maul Napoleon’s attack on Russia. And that was used by General Zhukov to defeat the German Military in the Soviet Union. This chain was mentioned by Gen. Zhukov in his speech at the Indian War College in Dehradun in 1957.

How do we know what Kautilya actually did to topple the Nanda Empire from within? Because of MudraRakshas, the play written by the famous author Vishakhadatta around 4th century CE. Mudra-Rakshas (the signet of Rakshas, previous PM of Magadh) is now available in multiple languages including two English ones below

Many might consider the above too old to be relevant today. They would be totally wrong. It is Chaanakya & his magnificent mission of Regime Change that has been studied by PM Modi & drives his determined work to make India Great again.

As Dr. Johnson points out in the US Army War College clip above, the name of the Diplomatic Enclave in Delhi in which foreign embassies are located in named Chanakya-Puri (city of Chaanakya) a clear message to all that Chaanakya continues to live today as the great teacher of StateCraft.

The easiest way to understand Chaanakya, his strategy, tactics & success, is to watch the TV Series Chaanakya by Dr, Chandra-Prakash Dwivedi. It has 47 superb episodes & bring out the true brilliance of Chaankya. We think these must be required study by every Indian-born professional.

Why was this discussed today? Because PM Modi is visiting USA this week on a state visit. Besides meeting President Biden & VP Kamala Harris, he is going to meet Former President Trump, as Mr. Trump announced in his rally last week. In that context, allow us to say to everyone in Fin TV, in so-called Think Tanks – the next time you think of India, do not even think of Britain. Think first & foremost of Chaanakya. Otherwise not only will you remain ignorant but also fail to make money by investing in India.

To complete the story, Chandra-Gupt’s grandson was the Great Ashok who not only expanded the Maurya Empire but also send his ambassadors all over the known world to introduce Buddhism. As H.G. Wells wrote,

- “Amidst the tens of thousands of names of monarchs that crowd the columns of history, their majesties and graciousnesses and serenities and royal highnesses and the like, the name of Ashoka shines, and shines, almost alone, a star.”

The above story is why the Chakra of Ashok is displayed at the center of the Indian Flag.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X