Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”Everything” …. “incredible stuff”

Pure Teppersims delivered in unique Tepperistic style. He said he bought ETFs, Futures, Chinese stocks, everything, “EVERYTHING“. This is “incredible stuff for that place“, he said. … and “if we get a pullback,”, he would “buy more” if he sees these implemented. He pointed out that the “big Chinese tech stocks had Single PE multiples with Double-Digit Growth & some of these stocks have 50% cash” When asked how is he hedging this exposure, Tepper said “My counter bet – I don’t care“

OK, but how does it look to a technical analyst?

Jeff DeGraff told CNBC’s Mike Santoli “… I am very excited about what we are seeing; … from a sentiment standpoint, from a historical returns standpoint & the idea that policymakers are kinda throwing anything at it to see if it sticks“. Regarding the upside & downside risks, DeGraff said “if we are wrong, I think the risk is very well managed; may be 10% downside but if we are right, there may be 50% upside“. By the way CNBC Webmasters were back to their stupidity & deleted from the above clip the two big points below that DeGraff pointed out:

- “this rally in China is NOT led by tech but by discretionary & finance sectors“

- “the 20-day highs (DeGraff’s key indicator) are running at 80%“

Getting back to Signor Tepper, he pointed out that while the Chinese steps are “incredibly good for very undervalued Chinese Equities, Europe is 2nd followed by Asia (Japan, Korea). In contrast, US is not a cheap market at 21-22 PE while Europe is at 14 PE….”

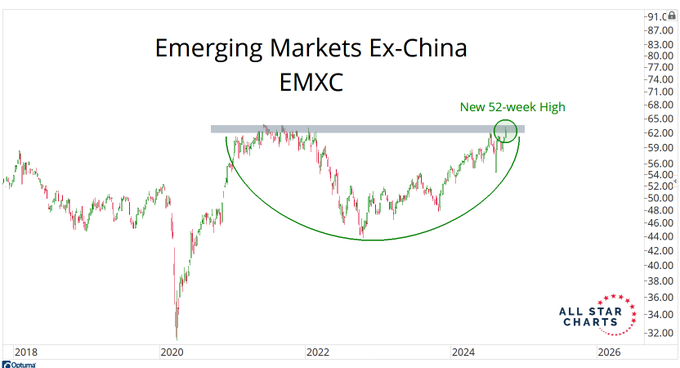

This is also the message of the chart below:

- J.C. Parets@allstarcharts – China has been the talk of the town after having its best week in history. But notice how Emerging Markets Ex-China are already hitting new multi-year highs, and have been leading the way, even before China got going.

But the same China looks different to Marathon’s Bruce Richards, a Credit specialist and he said so on Bloomberg:

- “… lot of news about how equities have flown & how KWEB, Alibaba & all big cap tech companies are up; … The other side is, because it is a tale of two cities. The Banks are deficient; they don’t have capital. Its being improperly marked in their loan book ; the real estate market has collapsed. These real estate projects, both commercial & residential, are so far underwater that there is very little to resolve in many of those loans. And so, the whole construction cycle of building buildings & building railroads has come to an end. And so even the steel mills are filing for bankruptcy …. everyone is missing out on this because there is very little capital is allocated to it.”

- “The other side of this equation is … China is in a very tough position because of geopolitics, because of increased tariffs coming this way despite who is going to be in the White House. So I wouldn’t want to be long China. I want to be long some of the undervalued tech, if you are going to be long China. …. But, as relates to sovereigns, the Sovereigns are fine credit. Its the 2nd biggest economy in the World. It has no problem servicing its debt. So the banks & asset managers, I am a huge fan of that.”

2. “what’s coming is prolific” … “Super Bullish “Risk on across the Board“

Who is saying this about Credit? The same Bruce Richards of Marathon. who made the above un-enthusiastic comments about China, is so bullish & thrilled about the opportunities in US Credit.

Before we go there, kinda interesting dichotomy here, right? Signor Tepper who is so Bullish on China stocks is un-enthusiastic about US stocks while Mr. Richards who is so un-enthusiastic about China is so Bullish about US Credit. But the two agree on a key point. As Richards said,

- “Fed didn’t make its easing move because the economy is getting weaker (3.0% Q2 GDP & 2.9% GDP in Q3). Its looking really strong from the economic standpoint; corporate earnings are also very strong; they are cutting into strength & that’s going to accelerate markets & its risk on across the board“

He expects the Fed Funds rate to settle around 3%; 2-yr notes around 3.25%; the 10-year probably settle around 4%. So,

- “the Real Trade is $6.5 trillion sitting in money market funds that can see rates fall; … That money belongs everywhere in terms of Risk on. I think the number one place it goes is into Fixed Income like securities & credit …. high yield loans, private credit, especially leveraged equities where if rates come down, these equities fly; high yield companies are suffering from higher rates & if they see lower rates that all of a sudden generate cash flow to the bottom line. … all kinds of opportunities in the marketplace.”

Buy All Credit generally is a big theme:

- Within private credit … within private credit, because all those LBOs deals at zero rates that still need to work out ; there is going to be tremendous opportunity there.

- Direct lending with rates coming down; .. the LBO machine is going to start up big because earnings are strong, economy strong & now you are putting into the formula lower interest rates; we are going to see enormous boom in leverage buyouts.

- Finally asset backed lending is a big business that is getting bigger; And there is no stopping that train because it has already left the station and we are going to see more & more of these deals. There’s not a week that goes by without us not doing these transactions of private credit in our asset-backed lending business. Remember for every billion dollar you could spend on a buyout, $500 million is financed with debt. The net cost if that debt is a lower level which means it helps accelerate transactions. So we are Super Bullish. Our direct lending team has never been busier; its in the pipeline today, its deals closing recently but what’s coming is prolific“. “

All the above rests on the new confidence that Central Banks around the world are cutting rates. So while the US GDP might come next year at 2% or higher, Global GDP will be 3% which is terrific for EM & for all risk assets, Richards said.

3. Tweets & Charts

Fed & Global Central Banks are easing into this:

- Otavio (Tavi) Costa@TaviCosta – Global money supply is rising once again, having increased by $7.3 trillion over the past year. That is the highest growth rate in two years.

For another look:

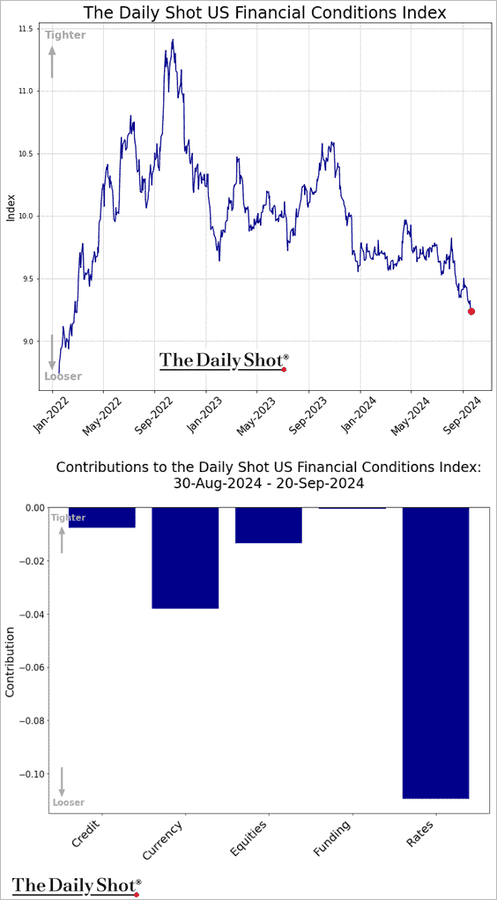

- (((The Daily Shot)))@SoberLook – US financial conditions have eased sharply in recent weeks, with much of the September easing attributed to lower rates.

Hmm; a non-positive tweet from Mr. Detrick:

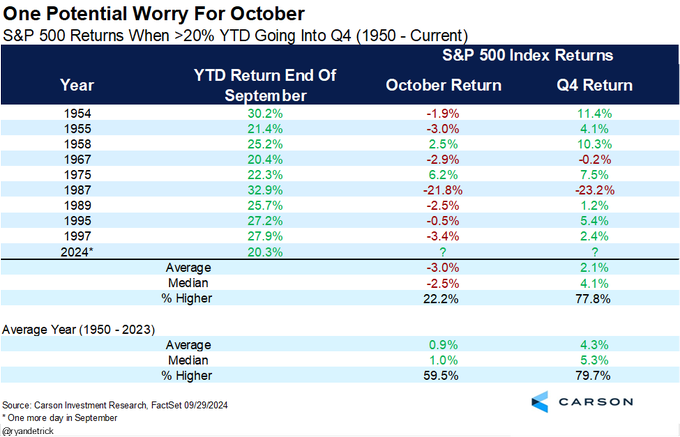

- Ryan Detrick, CMT@RyanDetrick – S&P 500 with a shot at being up 20% YTD heading into October for the first time since 1997. That’s the good news. The bad news? Oct lower 7 of 9 times that’s happened. Still, Q4 with a solid median return of 4.1% when all is said and done says don’t lose faith now.

In a similar vein:

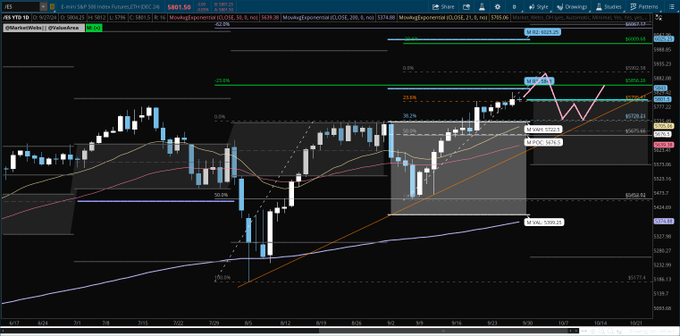

- Trader Z@angrybear168 – $ES_F one more pump then back into value for a corrective october ? price overdue to test the 21 daily ema.

Another way of looking at it:

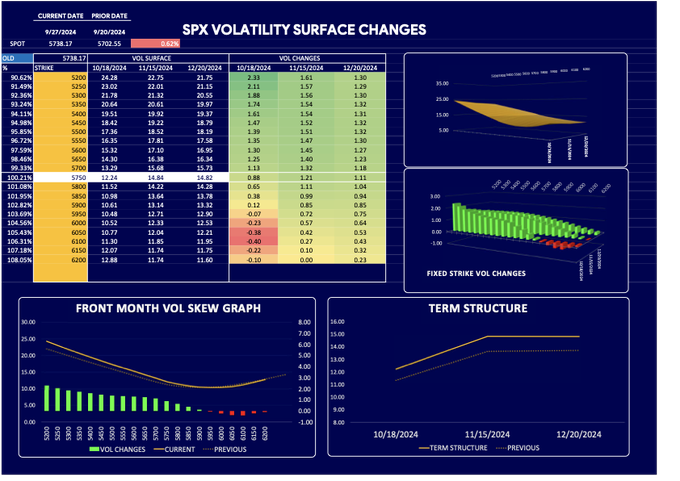

- Imran Lakha | Options Insight@options_insight – SPX up 0.62% on the week on a realised vol of less than 5%. But look what fixed strike vol did. This does not make me bullish FYI!

On the other hand,

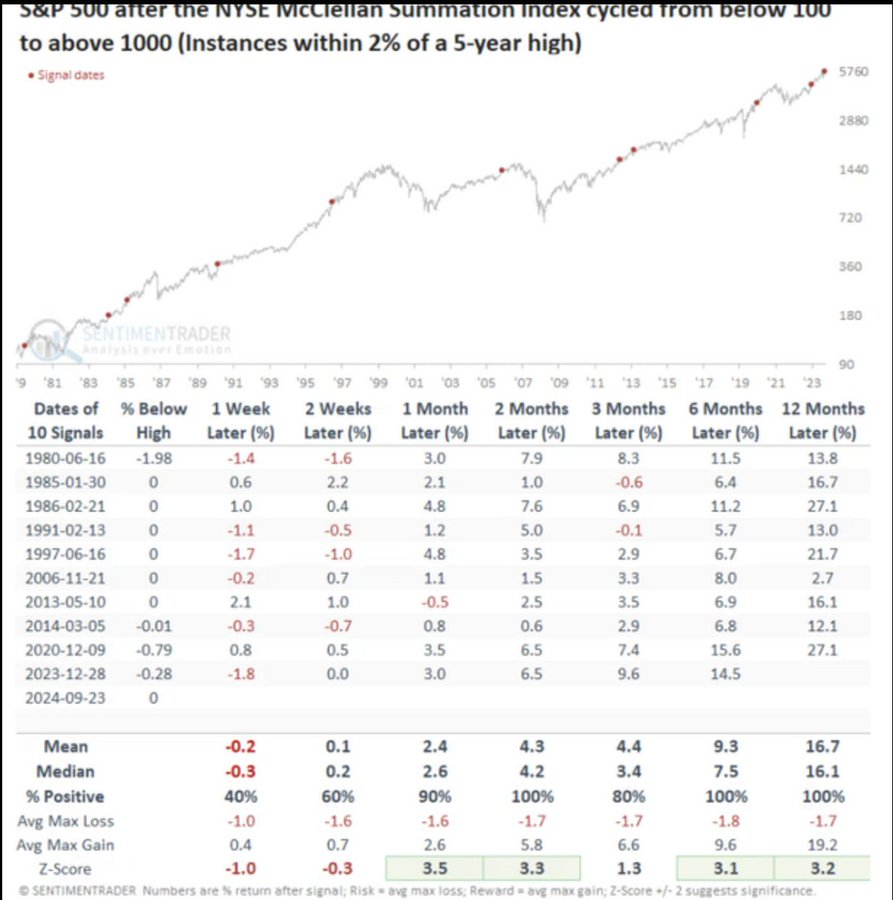

- Seth Golden@SethCL – 🤯 Boom… that just happened 🤯 – NYSE Summation Index has round tripped from below 100 to above 1000, offering a powerful and bullish signal across most-time frames. 2, 6, and 12 months later S&P 500 has been higher EVERY. SINGLE. TIME‼️ $SPX $SPY $QQQ $DIA $ES_F $NYSI $NYSE $IWM h/t @sentimentrader via @HedgeFundTips

Hmm, previous leadership returning?

- J.C. Parets@allstarcharts – oops!

What might the above suggest?

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – $QQQ with a higher high and higher low from the 8/5 reversal. If semis fully turn up, new highs aren’t far off.

4. From Least-expensive EM market to Most-Expensive EM market

Chinese equities have been ferociously oversold & China might be the cheapest market in the world in terms of PE. Indian equities have been bought continuously & India might be the most expensive market in the world in terms of PE. But when global investing luminaries like Mark Mobius talk about India, they dismiss the high PE because they say they care far more about growth.

Isn’t Market Cap to GDP a favorite long term valuation indicator for Mr. Buffet? The peak of this indicator for India was 150% in 2007, the peak of that market cycle. As Rajiv Batra of JPMorgan pointed out this past week – today this indicator, despite all the rallies, is still around 120-125%. In contrast the same indicator for US stands at 225% & at 300% for Taiwan. This is due to India’s growth rate which is the highest in the world.

But how can this growth rate continue at current high rate or accelerate? Besides basic known factors like demographics, shouldn’t we focus on newer & secular business areas that can drive this growth rate higher?

One such area is new areas of high growth in technology that can propel India into newer high growth area in contrast to India lagging in earlier technology advances. And who better to comment on the newest & hottest growth sector in India than Jensen Huang, the NVDIA man. This week, he called this an extraordinary time for India because of the reset of the whole computing stack. What he said was new to us:

- “NVDIA has been in India for almost 25 years; almost 10,000 NVDIA engineers are in India; they do every single aspect of our engineering; … NVDIA builds the full stack of AI infrastructure ; we build everything from chips to systems networking to CPUs, GPUs, Switches; we write an enormous amount of software from algorithms all the way to applications of Artificial Intelligence; India is also the home of some of the world’s greatest computer scientists; so this is a great opportunity…

- ” I am looking forward to partnering with India in a very deep way; to make that possible we have many partnerships with India; we are helping India gain access to our most advanced technologies; we are partnering with internet companies like Yoda & end-to-end networks to create the latest generation of AI supercomputers in India for all the startups; India is the home of the 3rd largest startup economy; so this new generation of startups are all based on AI; every IIT (Indian Institute of Technology) has a NVDIA center of excellence where teaching professionals teaching students how to upscale into this new world of AI;”“

Not many people know that both the Indian men’s team & women’s team won the global chess Olympiad this last week. A few years ago, Chess wasn’t even a mainstream conversation point. Now, as a report stated, India is growing Chess Grand Masters like a crop & this week the Indian teams won the global Olympiad. This is the new India, one in which the people, especially young people, are driven to reach & succeed at the highest level.

Now think how many of the large number of technology students in Indian institutes get startups going in all sectors of AI? And if they do, it would create a secular growth area for India, wouldn’t it?

NVDIA only has 10,000 employees in India. Now hear someone whose company has grown from 6,000 to 60,000 employees in India & how this company, that everyone knows, is opening new offices in mid-range cities like Pune to serve 850 multinational companies coming into India:

This theme was discussed in detail by Filippo Gori, Co-Head of Global Banking for JP Morgan with Bloomberg’s Haslinda Amin (from minute 28:10 to 36:31).

- “we have been growing our presence in the country (India) enormously over the last decade or so. India is currently the location outside US with the largest number of employees which is almost 60,000. We have kept investing now … in the last decade in a very positive way because we see the benefit of being invested in India; … India is a super-exciting place where to have a large team on the ground to serve global clients coming into India; local clients playing in the country & local clients who have ambition abroad; … We are definitely looking to invest because the pure quality of talent that we find in India to support the firm globally is absolutely outstanding“.

How many US investors even know that the 2nd largest physical employee pool of JPM is in India & not in Europe or in other places?

Now we come to a new secular growth sector in India – Defense. If you google “biggest importer of Indian produced defense goods“, guess what you get:

- “The United States has emerged as the largest importer of Indian defense products, accounting for nearly 50% of India’s total defense exports – Aug 22, 2024“

Two of the larger importers are Boeing & Lockheed. From turning from importer to exporter, India’s defense exports have jumped 30-fold, wrote the Economic Times. Watch the 4-minute clip below:

If the above can add to India’s already impressive growth rate & given how relatively inexpensive India is on the Market-Cap/GDP ratio, then those like Mobius who focus on growth rate over PEs might be correct.

5. A Pure All-American Agony & Ecstasy

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.