Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Big “wholesale” Change

Perhaps people have already forgotten their horror when previously great US Universities were engulfed in horrific racist protests in favor of violence against helpless civilians. A few people stood up, protested & took action against the Boards & leadership of these Universities. One of them spoke out not only about people of his own religion but also about what Asian students went through.

- Bill Ackman@BillAckman – Friday – Nov 15 – How can Democrats challenge the bona fides of any of

@realDonaldTrump’s appointees when they enthusiastically supported a cognitively impaired POTUS for a second term and Tim Walz for Vice President of the United States?

The second was Apollo’s Marc Rowan who explained why he is “extremely optimistic” about the “wholesale” change he expects from President Trump & his Administration.

We know what Elon Musk has done & his track record. So when he says that we can cut $1 trillion from waste in our huge budget, we are inclined to believe him. We hope President Trump is able to implement the changes that will bring immediate relief to the workers. Eliminating income taxes on “overtime” & on “social security benefits” will deliver much needed relief to the people who built this country.

2. US economy, Fiscal & Monetary policy at this time

Guess what we heard from the normally placid Lori Calvasina of RBC on CNBC just before 5 pm on Friday:

- “I think we just had a problem with positioning & valuation coming into today … the market was largely looking thru a lackluster earnings season; the consumer’s woes have been well-known for quite some time …. but there was just sort of a chill that came through in company commentary on the overall macro backdrop; little bit worse than what we have been seeing coming in … somehow the market just ignored that focused on the election; it feels like that kind of dour commentary is finally coming home to roost in here; …. now we are dialing down Fed expectations again; …. as long as we are more skittish on the Fed, that’s very tricky“.

Lori Calvasina is not suggesting that a recession near-miss is on her horizon but she does seem to suggest that a 5%-10% drop in the equity market might help in pulling some froth out. Interestingly David Rosenberg is not making a recession call either in his clip below:

- “… in my 40 years in this business, I don’t recall seeing such massive divergences among all the economic indicators; … when we run our AI model premised on all the various surveys, the ISMs, Consumer Confidence polls …. it’s spitting out growth in the economy closer to 1.5%;“

- “the Fed’s Beige Book … heading into September, even in the context of 3% real GDP growth, was telling us that 3/4 of the country was either in stagnation or contraction mode; … the tone was the same as it was heading into the 2008 recession, 2001 recession & the 1990-91 recession …”

- “what has kept the ball rolling is the influence of Government; …. for the 2nd year in a row, Deficit to GDP is exceeding 6%… that’s a $1.8 trillion deficit’ … rest of OECD is running deficit/gdp of 3% less than half of that of US;”

- ” … on a diffusion basis, US economy has been deteriorating at a fairly rapid rate; you are seeing more decay than meets the eye; manufacturing is flat as a pancake; no Capex cycle; housing market that can’t get out of its way; … there is no country that is running as profligate a fiscal policy as the United States is … “

But how didn’t this profligacy create bond market volatility in 2024? Larry McDonald answers & points to a major shift by the Fed in 2025:

- “what Yellen did last year was a very clever thing but a dangerous thing; … they wanted to take a lot of bond volatility & put it in 2025; so they issued a ton & ton of T-bills (that mature within a year); the US team quite irresponsibly & recklessly issued two standard deviations higher of T-Bills than any other Treasury Secretary in the history of United States; that kept bond volatility out of the market which is very important in an election year; …”

- “… we have never seen anything ,like this …. essentially the USA has $15 Trillion of bonds (1/2 of our debt) that mature in 2024, 2025 & 2026. …. the Biden team spent $2 trillion into the election on top of a 75 bps rate cut, Chinese stimulus that is going to keep rates up; …. force the Fed to step in to protect the bond market via QE; “

- “… you don’t see a real bottom in bonds till the first quarter of 2025; it is going to be a hall of fame bottom to step in & buy duration “

3. Powell speech in Dallas on Thursday November 14

When Treasury Secretary Yellen was running a profligate fiscal policy in 2024 &, in addition, issuing massive amounts of T-Bills that no other Treasury Secretary had done before (per Larry McDonald), why didn’t Fed Chair Powell warn her or alert the people about the consequences?

Surely the vaunted independence of the Fed should have made Powell speak up. Or has the long association at the Fed between Yellen & Powell made Powell unwilling to challenge her non-traditional issuance of T-Bills to minimize bond market volatility in 2024?

Watch & listen to the complete speech of Fed Chair Powell in Dallas last Thursday:

We are not smart enough to opine on such an esteemed speaker or on his long address. So we thought we would share immediate feedback we saw from two luminaries of monetary policy:

- Mohamed A. El-Erian@elerianm – I doubt Fed Chair Powell will do another interview like this anytime soon. He struggled with some of the smart questions, often deflecting with historical explanations, and he confused the economics of different possible scenarios.

His response to the question on a new monetary framework will likely leave many perplexed.

#economy #fedralreserve #markets

Another one in a bit more detail:

- Jim Bianco@biancoresearch – I have to disagree here. @crampell questioning was not good.

- She started very political, pushing her own political /worldview before she rushed at the end with the “good questions.”

- She began with Fed independence (will Trump destroy the world by firing you). Also, Trump is not firing Powell; these questions make Powell look like a victim.

- Then, she pivoted to a bunch of things outside of monetary policy.

- The Deficit (will Trump’s deficit destroy the world?)

- Tariff (will Trump’s tariffs destroy the world?)

- Trade wars (will Trump start a trade world that will destroy the world?)

- And Immigration (will Trump deporting nice grandmas destroy the world?)

- Again, none of this has anything to do with monetary policy. She was spewing her political agenda, and even Bloomberg TV got tired and bailed halfway through for an interview with the CSX chairman.

- After Bloomberg left, and she was running out of time, she got to “good questions” about the policy framework and the strong economy and asked why they were even cutting rates at all. These should have been the first three questions!

- She rushed Powell by warning him, “They were running out of time.” (I’m assuming a 30-minute limit) So, his answers might have been due to haste rather than thinking them through.

- I agree that Powell should not do another interview with

@crampell again; he should find someone who wants to ask him about his primary job … monetary policy and not their personal political agenda.

How do they choose interviewers like Rampbell who acted more like a political hack?

Speaking of inflation, Powell proved again that he is a backward-looking driver. Back in September, he was 100% sure about his plans to ease. Smart observers like Yardeni & El Erian questioned his 50 bps cut at that time. What we don’t know is whether his 50 bps cut & then another 25 bps cut were because of his desire to be loyal to Secretary Yellen & help the machine that appointed him to win the 2024 election. And now when the bloom is receding off the US Economy & his allies are on their way out, he is getting tough & unwilling to ease to displease the new regime?

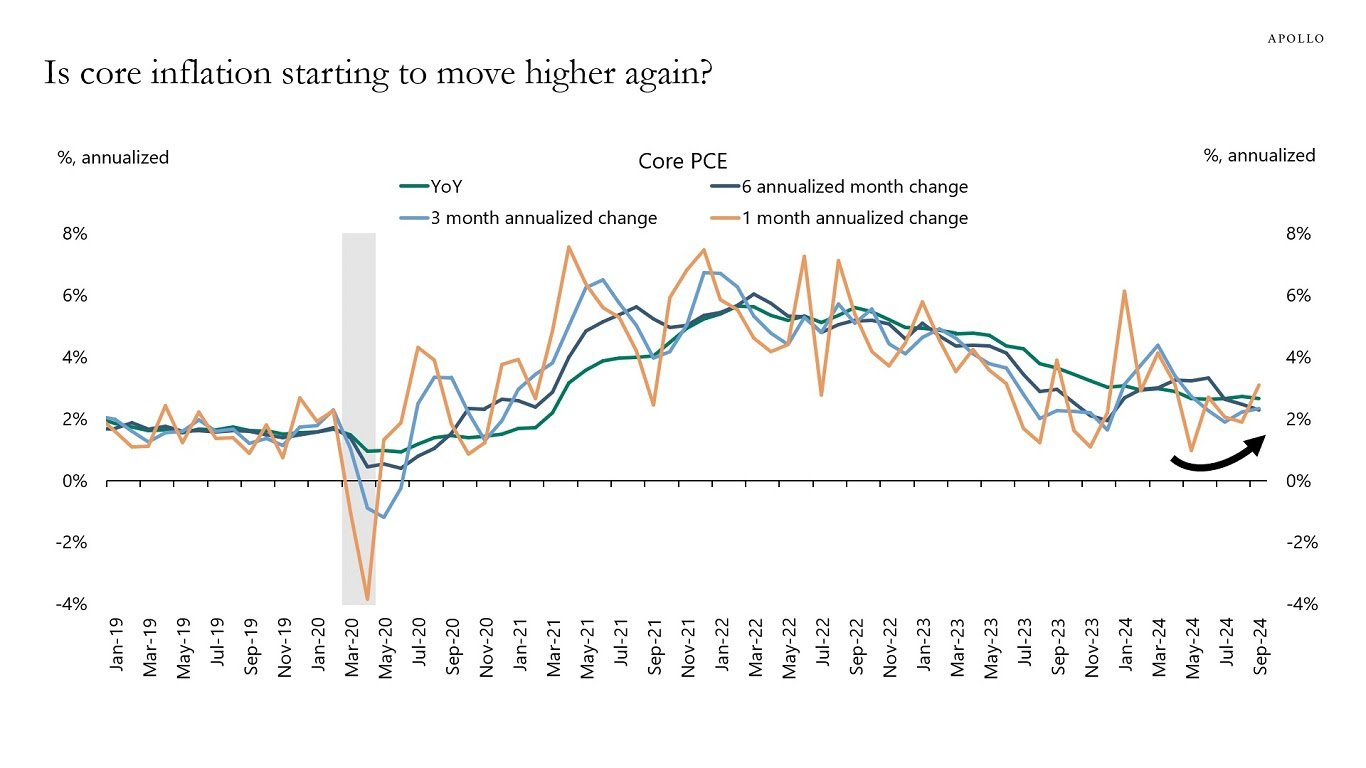

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – Torsten: Is Inflation Coming Back? “This week, we got higher CPI, PPI, and retail sales, and the incoming data continues to be strong. Combined with the observed acceleration in average hourly earnings in recent months, the risks are rising that inflation could begin to move higher again“

https://go2.apollo.com/e/1047283/campaign-GWM-24-TOR-DailySpark/21wby/137414845/h/1ACKwBBhu2Rz_hgn9GRaqR1se2MNMu8hLeZRHfVutTM

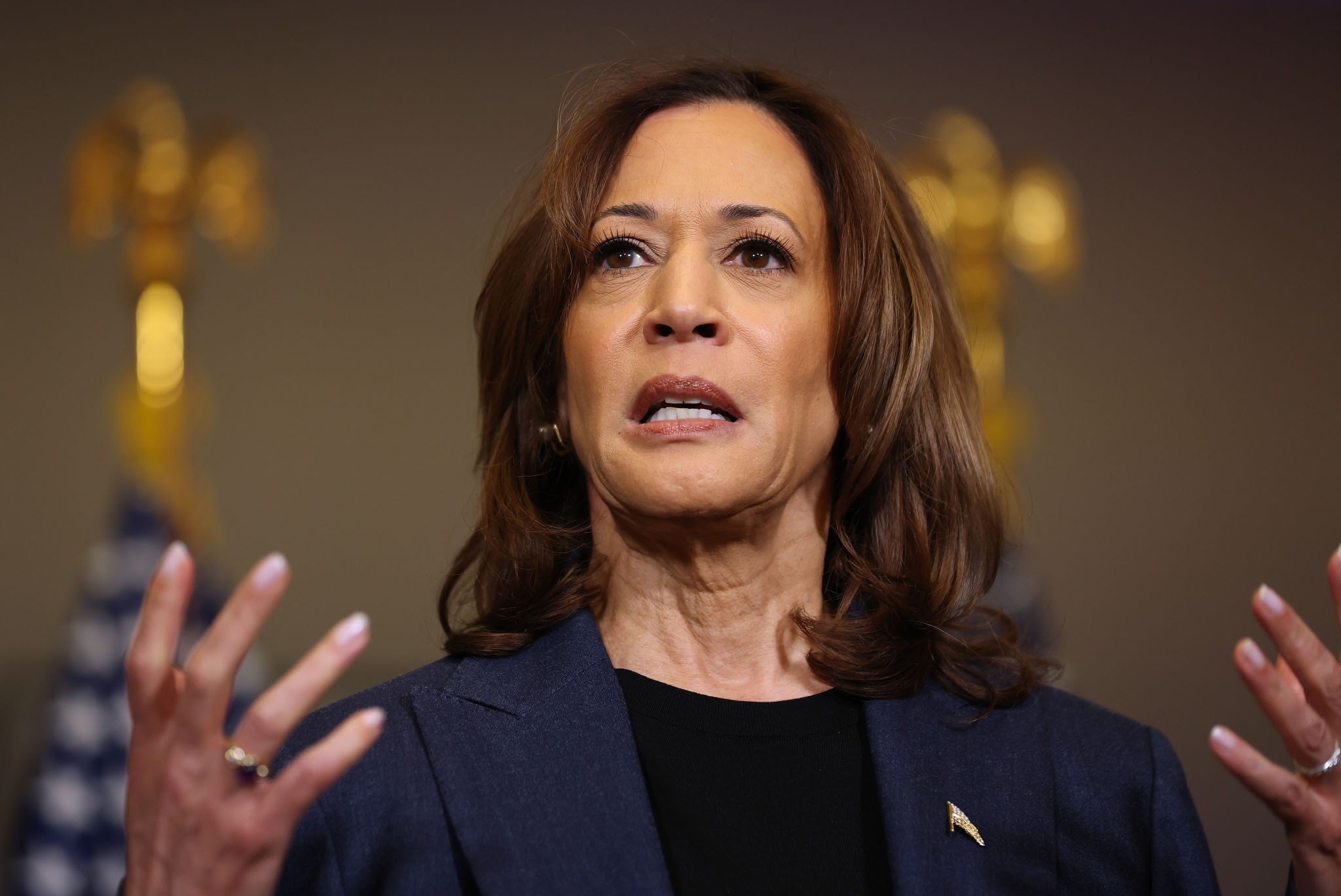

4. Appalling Insults to VP Harris from CNBC et al?

Indian Americans as a group have traditionally been pro-Democrats. In 2020, a determined effort by Indian Americans in Georgia ensured the Senate Democrat victory in Georgia. Just four years later, based on what we have heard, 2.5 mm – 3mm Indian Americans voted for Candidate Trump. As one voter said on TV – “I have been a Democrat for 30 years. No longer. I have had it“.

Generally speaking, Indian Americans live in the bluest of blue states, concentrated on the two coasts. And they seem to have voting power when they vote together because of a common theme.

Nothing makes Indian Americans, especially this one, more angry when Indian names of import are casually & routinely butchered on US TV, even US Fin TV. Now watch a CNBC Squawk Box clip dated July 30, 2024 from Paris (from minute 5:29 onwards) with Barry Sternlicht as guest.

At about minute 5:29, Sternlicht pronounces the first name of VP Harris as Ka-maa-la. CNBC’s Joe Kernen & Becky Quick jumped on Sternlicht immediately:

- Joe Kernen – Kaamala

- Sternlicht – Kamaala

- Joe & Becky – Kaamala

- Joe – Kaama pause la; you will get yelled at if you don’t get that;

- Becky – emphasis on Kaama; its “Kaama & la”

- Joe – Trump on purpose says Kamaala & people don’t like that ….

We have said for awhile that Anti-Hindu bigotry is rampant within CNBC &, historically, Joe Kernen has led it. But what we heard above stunned us in its utter stupidity & contempt of Hindu culture. It was as if Becky & Joe didn’t even know VP Harris was of Indian-Hindu descent. In contrast, every African American woman we spoke with in NY in the past 3-4 months knew VP Harris was the daughter of an Indian-Hindu mother & that mother was the most important woman in the life of VP Harris.

Also most Americans (of all races) we know have heard of Kaama-Sutra, the text described by Wikipedia as:

- The Kama Sutra (/ˈkɑːmə ˈsuːtrə/; Sanskrit: कामसूत्र, , Kāma-sūtra; lit. ‘Principles of Love‘) is an ancient Indian Hindu Sanskrit text[1][2] on sexuality, eroticism and emotional fulfillment.

Heck, even Wikipedia tells you to pronounce the subject as Kāma or Kaama. So, as everyone can see, the pronunciation Kaama & then la means Sex-Erotic lady . So ask yourselves, WHAT IS WRONG with Becky & Joe that they demanded Sternlicht publicly call Ms. Harris as Sex-Erotic-la?

By the way, the Ka-maa-la pronunciation used by Sternlicht is also wrong but not in the Sex-Erotic label way. Ka-maa-la is mostly used in Muslim lands and Bollywood uses it too, In fact, a male Actor named Ram Avtar, “known for his big stomach and mirthful demeanor” played the role named Ka-maa-la in a famous film.

We are sure that both Becky Quick and Joe Kernen have heard of Google & it is likely they have searched for something using Google! Why didn’t they simply search for “meaning of Kamala” on Google? Then they would have known that the name is KAMALA & not Kaama-la or Ka-maa-la and they would have known the name Kamala signifies Lotus, the symbol of purity. This is as radically different than Becky-Joe pronouncing the name as Sex-Erotic woman!!!

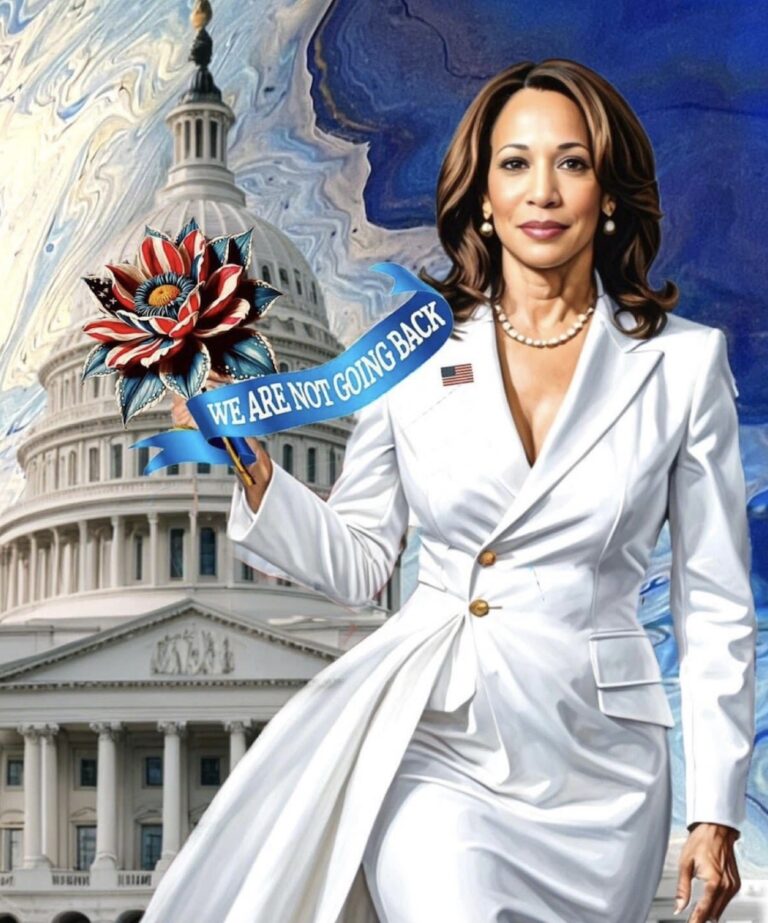

Speaking of Google, look what we found out in a couple of minutes using Google – “Kamala Harris’ Name Is Inspired by the Lotus Flower” written by Jill Brooke, a former CNN correspondent, Post columnist and editor-in-chief of Avenue and Travel Savvy magazine. The artwork below is from this article which attributes the quotes below to VP Harris:

- “The first female Vice President in U.S. history explains that her name means “lotus flower” in Sanskrit .. “It’s a symbol of significance in Indian culture,” says Harris. “A lotus grows underwater, it’s flowers rising above the surface while the roots are planted firmly in the river bottom.”

Now look at the election graphics that were prepared for her Kamala name & Hindu identity!

We never saw these images in any Democrat sponsored commercial about the Harris campaign. Why? Was it because her Hindu identity was “cancelled” out completely to make her more appealing to African Black voters?

Now imagine how Indian Americans & Asian Americans in general felt when people like Becky Quick & Joe Kernen kept referring to VP Harris in a Sex-Erotic-woman manner!! The Lotus flower as a symbol of PURITY is used all over Asia & it is the national flower of Vietnam. The Middle East also recognizes the Lotus Flower as a symbol of purity. So is CNBC this off the charts contemptuous of Indian-Asian- Americans or is there another racial factor at play?

5. Color vs. Race in the Democrat Party

We know & have documented CNBC Squawk Box as Anti-Hindu but we don’t think Becky & Joe went out to deliberately call VP Harris by that vile sex-erotic-lady name. They were coerced into that disgusting name that essentially “canceled” the Hindu-ancestry & Hindu-Culture of VP Harris, her mother & her entire family. Why? Because as Joe Kernen says in the clip above “Kaama pause la; you will get yelled at if you don’t get that“;

So who would have yelled at him and why is he so afraid of getting yelled at by them? Watch the clip below & listen carefully to Prof. Michael Eric Dyson, African American Studies, Vanderbilt University say to White congresswoman Nancy Mace (R-SC) that “mispronouncing is misjudging“. Remember that Joe Kernen when you mispronounce the next Hindu name on CNBC!

Listen to this professor & the other African American guy get upset at Rep. Nancy Mace for pronouncing name of VP Harris as “ka-maa-la” while they themselves deliberately pronounced the name of VP Harris as the sexist-erotic label “Kaaam-la”!!!! Nowhere does this professor or the African American strategist ever acknowledge that VP Harris has a HINDU name that has ZERO connection with African American culture or history.

This is the height of racial arrogance & prejudice of some African American Blacks that allows them to cancel all the heritage, religion & culture of VP Harris, her mother & family for the gift to her of running as a “Black”.

And CNBC’s brave Joe Kernen & Becky Quick are so afraid of being “yelled at” by presumably African American “Black” purists like this Vanderbilt Professor that they bowed down & yelled at Barry Sternlicht for not following the Sex-Erotic label Kaama-la hoisted on VP Harris against her own will.

Now perhaps you might understand why Indian-Americans &, presumably, Asian Americans moved as a group towards President-elect Trump, VP-elect Vance & Vivek Ramaswamy.

Ms. Vance, soon to be Second Lady of USA, & Mr. Ramaswamy are as “Black” as VP Harris. But they are NOT forced to change their names to suit “Black African” sensibilities in the Republican Party while VP Harris was compelled to accept being labelled Sex-Erotic (Kaama-la) in the Democrat Party & while their members scared CNBC’s Joe Kernen & Becky Quick with their yelling.

Perhaps now you understand why Indian-Americans & Asian-Americans joined Hispanic & Latin Americans & European Americans to move towards President Trump.

It seems the Democrat Party has made “Black Complexion” as the sole & defining property of Democrat leaning African-American Black-complexioned people. And professors like Michael Eric Dyson above see no racial hegemony or prejudice in compelling all Black-complexioned people of all cultures & racial backgrounds to be “subordinate” to Democrat African-American cause. This is in stark contrast to the reality that Black People live & are born in racial households that have Nothing to do with African Blacks. As most know & everybody can guess that long exposure to intense sun makes skin blacker & that process over generations & centuries makes then Black. That does not give a small number of African-origin Blacks the right & power to be the Black supremacists of all global blacks.

The transition from Democrat to Republican has been on since a life-long Democrat named Michael Bloomberg switched to being Republican simply to run for Mayor of New York City. And in 2016, a life long Democrat named Donald Trump switched to being Republican to run for the Presidency of America.

The only “Black” Democrat who successfully ran as an American first was Barak Obama. To him & his campaign, attributes like “skin color” were but an aspect of his values in 2008. Sadly the values on which he ran in 2008 are hardly visible at this time in 2024.

So unless something changes within the Democrat party, Indian-Americans & presumably Asian-Americans will keep moving towards the Republican Party simply to avoid their religion & culture being “canceled” by African-American Black bigots that dominate the Democrat party.

6. Markets Last Week

US Indices:

- VIX flat 14.97; Dow down 1.2%; SPX down 2.1%; RSP down 1.4%; NDX down 3.4%; SMH down 7.3%; RUT down 4%; MDY down 2.9%; XLU up 32 bps;

Key Stocks & Sectors:

- AAPL down 90 bps; AMZN down 2.8%; GOOGL down 3.3%; META down 6%; MSFT down 1.8%; NFLX up 4%; NVDA down 3.6%; MU down 13.8%; BAC up 3.5%; C up 51 bps; GS up 73 bps; JPM up 3.6%; KRE minus 2.1%; EUFN down 76 bps;

Dollar was up 1.9% on UUP & up 1.8% on DXY:

- Gold down 4.7%; GDX down 9.3%; Silver down 3.5%; Copper down 5.5%; CLF down 13.8%; FCX down 7.6%; MOS down 4.8%; Oil down 4.8%; Brent down 3.8%; OIH down 2%; XLE up 98 bps ;

International Stocks:

- EEM down 3.9%; FXI down 4.6%; KWEB down 5.7%; EWZ down 1.1%; EWY down 4.6%; EWG down 1.6%; INDA down 2.5%; INDY down 3.6%; EPI down 5.2%; SMIN down 2.5%;

Rates along the Treasury Curve fell this week:

- 30-year Treasury yield up 15.8 bps on the week; 20-yr yield up 15.2 bps; 10-yr up 14.1 bps; 7-yr up 13.1 bps; 5-yr up 11.7 bps; 3-yr up 7 bps; 2-yr up 2 bps; 1-yr up 3.5 bps;

- TLT down 2.4%; EDV down 4.1%; ZROZ down 4.2%; HYG down 63 bps; JNK down 63 bps; EMB down 1.7%;

What about next week & beyond?

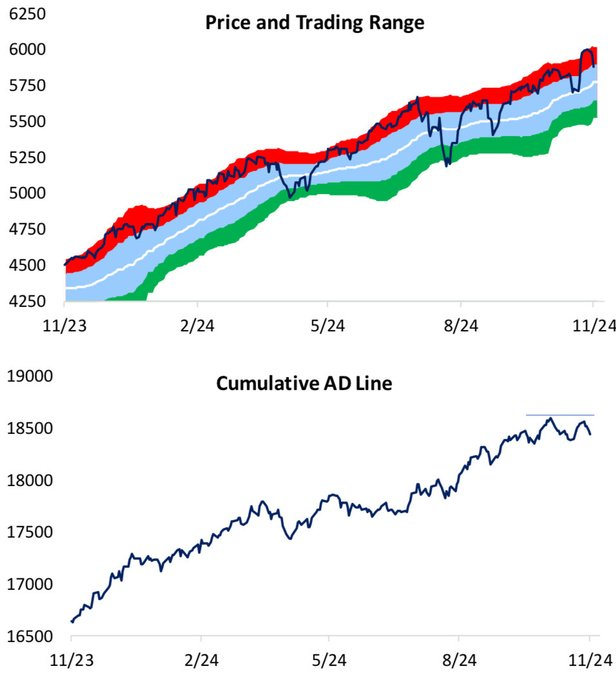

- Bespoke@bespokeinvest – Sun 11-17 – The S&P recently made a new all-time high without its cumulative advance/decline like also making a new high. Cause for concern?

A key factor for next week?

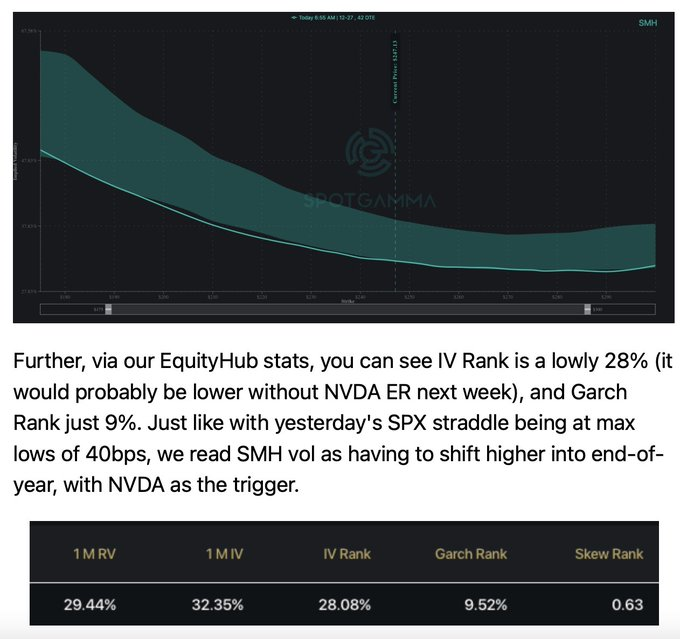

- Seth Golden@SethCL – Nov 16 – SpotGamma: “…we remain of the view that $NVDA earnings will be the catalyst into the end of the year. We remain in the “Santa Rally” camp, and the beauty of this volatility landscape is that it’s very cheap to express bullish views.” $SOXX $SMH $QQQ $SPY $SPX $MU $AMD $NDX

Getting a bit broader:

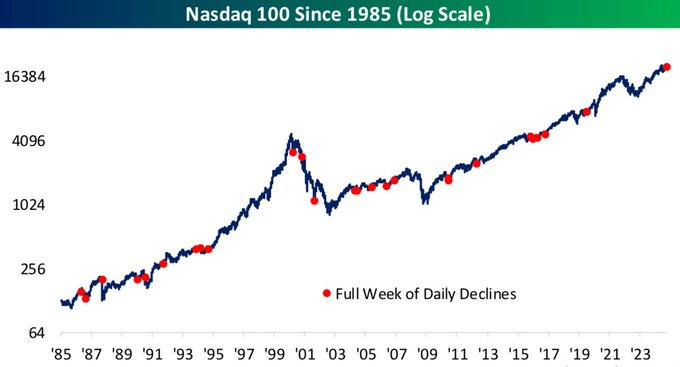

- Bespoke@bespokeinvest – The Nasdaq 100 fell all five trading days this past week. Here’s all the times that has happened in the index’s history since 1985.

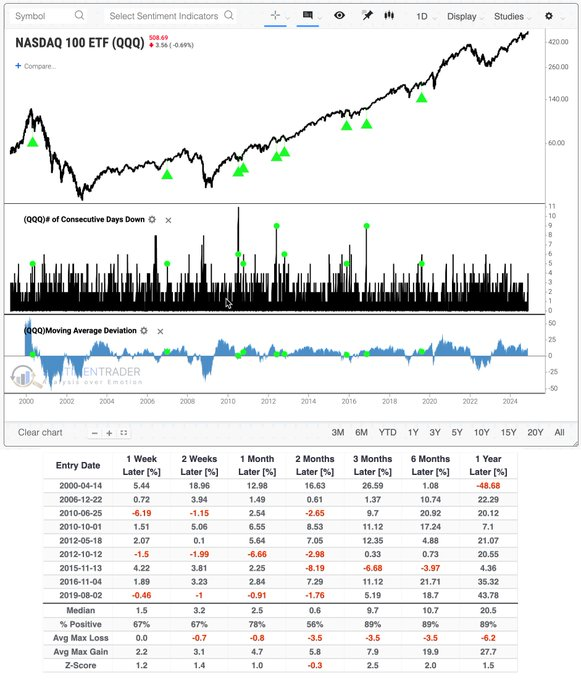

Another way to look at the same fact:

- Jason Goepfert@jasongoepfert – When $QQQ drops every day during a calendar week while trading above its 200-day average…. Once, it preceded a bear market, but not before a vicious rally.

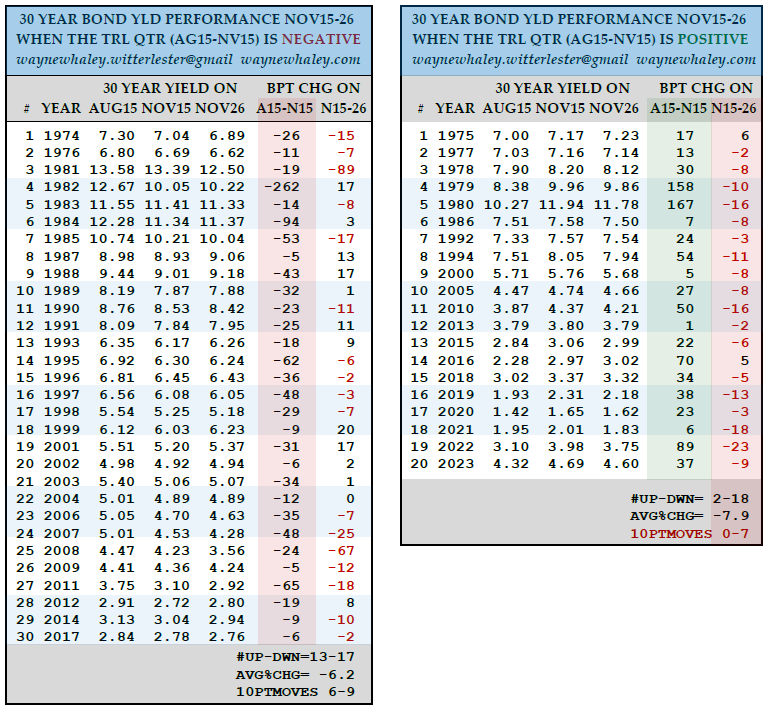

Finally, our favorite short term guru, this time on Bonds:

- Wayne Whaley@WayneWhaley1136 – A 2-18 Thirty Year Bond Yield Setup for Nov15-26 – compliments of a positive trailing Qtr (Aug15-Nov15)

- Over the last Quarter, Yields have rose from 4.18% on Aug15, to 4.60% today, Nov15th, a 42 basis point gain.

- Thirty Year Bond Yields have declined in the upcoming Nov15-26 in 35 of the last 50 years.

- Similar to 2024, in those 20 years of the last 50 in which Yields advanced in the Aug15-Nov15 Qtr, Yields subsequently declined in 18 of those 20 following Nov15-26 time frames.

- One of 18 studies shared with commentary subscribers today.

Finally, given the past 2 days following Powell speech & interview:

7. One more gift from 2024

No question that Patrick Mahomes is the best quarterback in the game today, both physically & mentally. No question for us that Andy Reed is the best offensive Coach in the game today and that Reed-Spagnuolo is the best coach duo we have seen, better than Bill Belichick.

All that pales before our Tom Brady is the greatest conviction. We have been nervous that Patrick Mahomes would go unbeaten this year & win the Superbowl. That would let him do something that Brady could not do. Guess what? Today on Sunday November 17, 24 evening, Mahomes lost to a gritty performance by Josh Allen by Buffalo Bills. So half of our fear is laid to rest.

But our joy pales before the joy of someone we listen to whenever we can & whom we admire. So we feel good today for Jeffrey Gundlach who has been fervently & patiently waiting for Josh Allen & Buffalo to beat Mahomes & Kansas City.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.