Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Breakout like 2014?

That became our view as the US Election neared its conclusion. A big tell for us was the Trump event in NY, a phenomenal event by any measure. By sheer coincidence, an old & veteran friend from Mumbai called us to say that the election reminds him of the Indian election in 2014 that virtually became a welcome for Narendra Modi as PM. Actually, the 2024 election was a bigger event than the first Modi election in 2014 and the MSG event was a lovefest bigger & more intense that any we have seen before.

What lies ahead? The parallel to 2014 works only if the US begins a steady & unwavering march higher in every category – economy, markets, international standing, defense strength and so on. Today we will only highlight the first two:

2. $10 trillion opportunity from Reshoring into USA

No. We are NOT crazy to put forth such a “massive” number on our own. Watch & listen to Michelle Weaver, Morgan Stanley US Thematic Equities Strategist make the case at Bloomberg The Open on Monday, November 18. A few excerpts below:

- “.. Reshoring is an exciting theme that is coming back to the forefront …. now the next wave, the next Trump administration will drive that further ….. this could be huge for the US; … ($10 trillion) its a massive number absolutely; that’s why we are so excited so excited about it; … Mfg is a growth market; pie is getting bigger… its also about locating your new incremental companies in USA; …. it is a multi-decade opportunity “

Then Ms. Weaver touched on AI:

- “… its really going to be next year when you are going to see start seeing AI go into production; … results are going to start hitting next year; … ”

When asked about small caps, Ms. Weaver said:

- “.. for the Russell 2000, we are really neutral on large cap vs. small cap; time you want to buy small caps is when you are in a recession; that’s when you get a washout in lower quality names … they are really an early cycle play … so we think its still too early to buy small caps … neutral position seems to work there best …. “

Is there anything exciting about S&P targets ahead?

3. S&P at 10,000 – 13,000 before a market peak?

The eminent & sensible Ed Yardeni has spoken about a parallel ahead to the Roaring 20s. A similar & more elaborate case, based on technicals & fundamentals, was made on the Bloomberg Open on Friday 11-22 by Mary Ann Bartels (staring at minute 26:06):

A few excerpts below from the Bartels clip:

- “S&P at 10,000 – 13,000 before seeing a peak in markets; in a secular bull market that won’t peak out till 2029-2030 till 10,000; next year at 7,200 – 7,400; Why? AI & Block Chain for the global economy; … Similar to 1995-2000 & 1925 – 1929 ; … all that is new is old; strong economy leading to strong corporate … 50-50 blend of technicals & fundamentals ; when technicals & fundamentals match, its a good match; … ROE on Tech is 31%; high valuation supported by earnings; … whole market will come up; optimistic that small caps perk up & play a big role in next 12 months – … industrials KEY; … look at Vistra & Constellation …. “

Any one else waiting for market signals to match their model?

4. Treasuries

We saw the following mid-week:

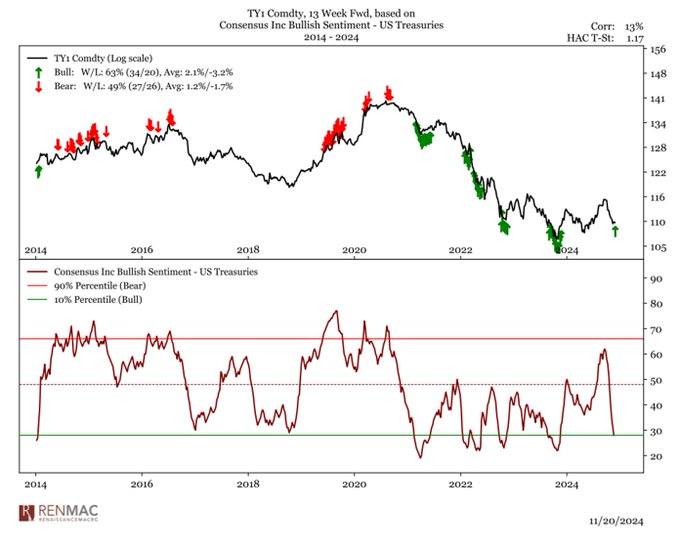

- RenMac: Renaissance Macro Research@RenMacLLC – Nov 21 – Finally consensus bulls on 10-year bonds (prices) have sunk to levels consistent w/ other bottoms. Our models want to buy bonds and increase 15% allocation, but the trend not cooperating. Cash not killing us at 4.3%, but maybe this is the turn that extends our duration?

Then we heard Jeff DeGraff of RenMac say the following on Sunday, November 24:

- “… 10-yr Bulls at 28%; pretty good opportunity in bonds historically; allocation model is 15% in Bonds ; our model wants to be higher but markets aren’t giving us that signal yet; we make biggest bets when the model & markets are in sync giving us that message; …I do like this 10-yr with 28% bulls“

On the other hand,

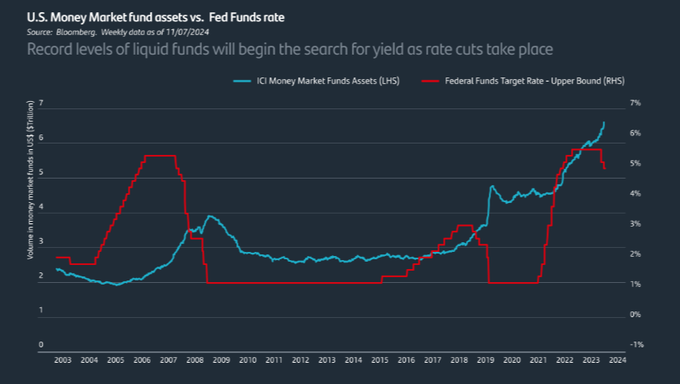

- Mike Zaccardi, CFA, CMT 🍖 @MikeZaccardi – Sun 11-24 – Search for yield hasn’t begun yet…MMF assets rising as the Fed cuts rates

And,

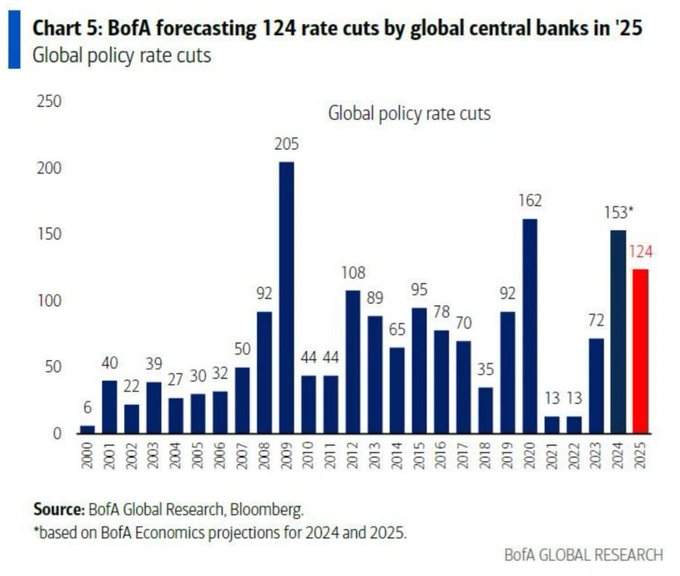

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – Sun – 11-24 – The world is cutting … maybe a higher dollar makes sense (as Fed cuts keep getting taken off the board for 2025)

5. S&P, NVDA & Applovin

The weekly chart shows the big rally in S&P began on Thursday morning as NVDIA bottomed & began moving higher:

Nothing surprising about that. But frankly, NVDA was not the story of this week. It was a stock few have heard of named Applovin ($APP) which rocketed. The most interesting discussion we heard about $APP was CNBC’s Scott Wapner & his favorite guest Josh Brown speaking about $APP as if CNBC had not covered it earlier. Actually $APP was discussed by Ankur Crawford of Alger on CNBC Closing Bell on September 13, 24. Signor Wapner was away & Mike Santoli spoke with Ms. Crawford who said the following about $APP:

- ” … we think those numbers are too low & they generate massive amounts of cash;… we just met with the CEO yesterday & first of all, what a phenomenal CEO with a great command of the business but also the wherewithal to understand that he needs to pivot his business & he is pivoting again … we love it” ….

If you watch the clip of Ms. Crawford we highlighted in our September 15 article, you would notice that $APP was at $111.44 that day. This week, we closed at $333.51 – a TRIPLE in 2.5 months.

Frankly this is the sort of value CNBC adds to simple folks like us. And we would think, CNBC marketing folks would use it & anchors like Scott Wapner would strut around highlighting the value they add to simple folks and ,in this case, to 99% of money managers out there. But they spend so much of their time creating & dabbling in non-monetary issues. What do they want to be? CNN or MSNBC?

The other thing we don’t understand is why Ms. Ankur Crawford was NOT invited again to share her views about $NVDA, $APP & other interesting stocks after adding so much value to CNBC viewers on September 13?

6. Indian Markets

Look what Zerohedge posted on Thursday, November 21:

Go back & look at similar comments about foreigners exiting Indian markets at Bloomberg.com or in this Blog. You are likely to discover that such actions by “foreigners” have signaled a similar opportunity we see in US markets with excessive short positions.

Secondly, last week US office in Brooklyn indicted Adani companies & Mr. Adani for corruption-related activities in India, an action that initially took down shares of Adani companies by 15%-20%. So, as you can imagine, CNBC got its own India-rep to almost gleefully report this. More seriously, Haslinda Amin of Bloomberg Asia did a segment on this with an “expert” from Singapore & Michael Kugelman, a strategist who has covered NaPakistan for years in a “loving” manner.

Thirdly, PM Modi & his party seems to have won a “massive victory” in Maharashtra, the state with Mumbai as its capital, the adjective used by MoneyControl.com, the name of the local unit of CNBC India.

We don’t have the time to do justice to this story this week. And the reality would be clearer by next week anyway.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.