Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”Dialing up risk-taking even more” ; “operating leverage machine called S&P 500“!

The sensible Ed Yardeni was quoted by CNBC’s Scott Wapner as describing current situation as “too many charged up bulls“! We don’t know whether that was a “yeah, more the merrier” type of comment or a “we may be on the cusp of that (over-enthusiasm)” DeGraff comment. So we thought we would reproduce the words & tone of the BlackRock strategist who is “dialing up risk-taking even more“. Watch Bloomberg host Lisa Abramowicz expressing her stunned surprise and asking “what it means to be even more bullish“?

Watch & listen to the exchange & focus on the Wei Li asking Lisa “mean revert to what…. if the destination, make-up of destination is changing?” We think this is a very smart way to ask the basic question about investing this year!

- “Right now, we have been bullish on US Equities for all of this year; we are dialing up risk-taking even more because we do believe that earnings can broaden out now; next year we do see the gap (btwn Mag 7 & rest) closing and this broadening out is the reason we believe there is more momentum for US equities to run higher; …. another reason is …. if there are good reasons, mega forces & structural forces that could potentially change longer term trends, mean revert doesn’t quite apply; mean revert to what if the destination, make-up of the destination is changing; we are not over-indexing current valuation levels as we look at investing over a technical horizon of 2025, near term tax cuts, deregulation that drive sentiment which is why we are leaning into it … “

By the way, the quote “operating leverage machine called the S&P 500” comes from Rick Rieder who told Bloomberg’s Sonali Basak (after the payrolls number) “I will take equities all day for duration risk“.

A quick glance at the world shows you South Korea convulsed in political warfare; France convulsing in its unique mess & Germany not being able to figure out where & how it wants to move. And these are the developed ones. China actually could looking better than all these (FXI up 1.9%, KWEB up 1.4%, this week).

Reshoring into US has to be look more & more appealing, right? Especially a USA that will likely refuse to get into any new war & even close down existing ones. What is another way to say this?

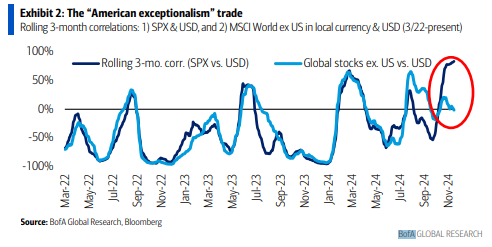

- Neil Sethi@neilksethi – BoA: “The ‘American exceptionalism‘ trade is gaining momentum, driven by the potential return of ‘America First’ policies under Trump 2.0. Post-election, US equities outperformed international stocks by 3ppt, while dollar appreciated by 2.9%. Notably, the 3-mo. correlation between $SPX and $USD has surged to the highest level since 2017, whereas the correlation between international stocks vs USD has declined.”

Perhaps John Kolovos of Macro Risk Advisors is what Signor Yardeni would call a charged-up bull because he said on Bloomberg The Close that his target for S&P is 6,600 at the low-end and 7,700 at the high end. He added that “1990s come to mind … 4 consecutive years of 20% or more … don’t believe the market even touched its 200-day for a couple of years that time… “. An interesting point he made is:

- “… what’s interesting about the Mag 7 index is that it is just breaking out of another consolidation pattern; basically it has been pausing couple of months; when NVDIA peaked, Mag 7 just kind of stalled out & took the back seat …. in leadership; I think they are about ready to push higher & actually look fine; by & large, most of the Mag 7 charts are intact & actually count higher... “

But he also thinks that “there is the 40% of the equity market that’s just getting its sea-legs ready to move higher“. What might be helping this reasoning? While he is structurally bearish on Bonds, he think in the short term we might see a drop to a low of 3.90% on the 10-year.

We all saw Treasury yields fall a bit on Friday after the stronger than expected payrolls number. Perhaps because,

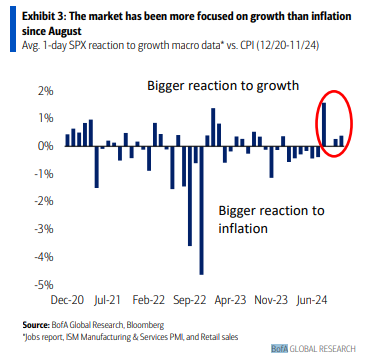

- Neil Sethi@neilksethi reposted by Zaccardi – BoA: “The market has underreacted on #CPI days since Feb and moved just 21bps and 2bps on the last two prints. The market [also has been] more focused on growth than inflation since August.“

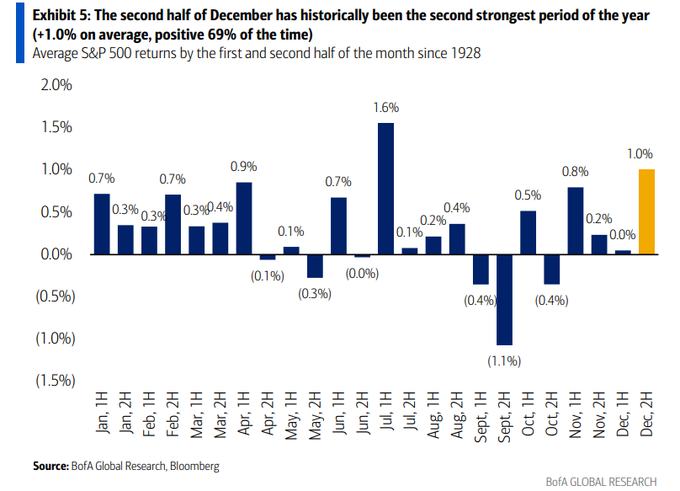

Jim Cramer warned this week that the oscillator he uses is at 5.9% which is overbought. What if he proves right & we get a bit of indigestion in the next week & half leading into the FOMC on December 18? Would that set us for a 69% probability up move?

- Mike Zaccardi, CFA, CMT 🍖@MikeZaccardi – BofA: The second half of December has historically been the second strongest period of the year (+1.0% on average, positive 69% of the time)

2. Treasury yields

The Treasury action on Friday prompted David Rosenberg to write:

- David Rosenberg@EconguyRosie – The 10-year T-note yield at 4.14% just broke below both the 50- and 200-day trendlines. Next stop is the 100-day moving average which resides at 4.03%. The Treasury market is seeing something the macro bulls don’t – perhaps the job market cracks that have emerged in the Household survey.

We keep reading that the Fed is more focused on the job market than on inflation. If next week’s inflation numbers are soft enough, then might the Fed cut in its December 18 meeting?

People can say & write what they wish but we have been looking for real data about what investors are doing. And we got that from Bloomberg Real Yield on Friday:

Look what G. Choudhari of BlackRock said at about 12:16 of the above clip:

- “… I do want to turn just a second to the fact that, as of today, we have had about a trillion dollars in ETF inflows in the US; huge day obviously for us; and a tremendous amount of that has actually com into Fixed-Income ETFs… “

This suggests two things:

- If the economy remains at current level & the Fed remains somewhat sympathetic to rate cuts, then lot more money could come into Fixed-Income ETFs;

- If so, the attractiveness of high earnings, strong growth stocks could only increase with softer interest rates.

CNBC’s Scott Wapner should listen to what Ms. Choudhari said above. He has stated, as virtual Gospel, that investors would move out to cash into stocks when interest rates start falling. The fact is that the money on the sidelines gets first into the belly of the Treasury curve as Ms. Choudhari pointed out with their own inflows on Friday.

In contrast, Ms. Oksana Aronov says in the above clip that the Fed should not cut at all and the lowest Fed Funds can go to is 3.5% and, since the spread between Fed Funds & 10-year yield is 150 bps, the fair value of the 10-year yield is 5%. To her credit, she has been saying this for more than 18 months & she has NOT been wrong. Also her opponents on the 10-year, some within her own Firm, have NOT been right either. Treasury yields have move from pricing in many Fed cuts to not pricing any at all & the two camps move between feeling happy & unhappy as the 10-yr swings from one end to another.

3. Story of the day

President Assad of Syria has already fled to Moscow & the entire country of Syria has been overrun by an ISIS affiliate from a province adjacent to Turkey. The entire Syrian army seems to have vanished in thin air. We all know the story – the original ISIS came out of the same area as this new rebel force – the area between Turkey Syria & some parts of northwestern Iraq. Iranians first came to Assad’s rescue & then came Russians. Recall that the Syrian army didn’t fight much even then. It was Hezbollah forces that took the fight to ISIS with some Iranian forces.

This time Hezbollah is trying to survive Israel’s onslaught & so is Iran. Russia is occupied in Ukraine & did not have land forces in Syria any way. So Assad flew away in 2-3 days & now you have a new force that has won its own country, frankly without having to fight for it.

In one way, Israel should be happy. This new Syria is not really capable of launching any attacks on Israel. On the other hand, these new fighters can be a bigger headache to Israel and this new Syria could quickly become a satellite of Turkey’s ambitions & designs in that area. Spend some time re-watching Lawrence of Arabia because that film was about the Arab fight to push out Turkey from Damascus & today’s Syria. Now Turkey is back in Damascus at least in some way. So, as we read, Israel has already begun bombing key military sites in Damascus.

President Trump destroyed ISIS in his first term. We are relieved to see he has said “this is Not our fight”. On the other hand, does this bring Saudi Arabia & UAE closer to America? We think so.

Send your feedback to [email protected] Or @MacroViewpoints on X.