Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”Sell America” opening cry on CNBC Fast Money this past week!

Frankly, this message of markets voting to Sell America was voiced by Krishna Guha of Evercore on Friday, April 12 on CNBC. This was followed up a week later on Monday April 21 with Melissa Lee opening the show quoting a “Sell America” message. That prompted us to ask them semi-facetiously via X:

- Editor Viewpoint@MacroViewpoints – – @CNBCFastMoney – – did you guys ever have a SELL CHINA slogan for yr show in that long bear mkt? Yet u guys seem love using Sell America slogan again & again. Interesting!! which country do you pledge allegiance too?

That slogan has been removed, as we guess, from the posted clip of the show but the message of “Sell America” comes thru loud & clear in the group discussion that followed:

Then Melissa Lee summoned her trusted mouth-piece as she does when she needs backup:

- Guy Adami – “stock market is definitely the star of the show, but … it is the weakness in the Dollar which … should be alarming a lot of people… and the bond market is clearly a story; .. they are selling their Treasuries as if yields are going to 5% which by the way I think they are.. “

And, to imagine, these are “fast money” “experts” that tell innocent viewers what to do!

What did the US Dollar, Treasury & Stock Markets do in the face of these “experts”? The Dollar was up on Tuesday, Wednesday & Friday; Treasury rates FELL on Tuesday, Wednesday, Thursday & Friday and the Stock Market roared from Tuesday to Friday to deliver not only the famous Zweig Breadth Thrust Signal but also a Super Zweig Signal. The Nasdaq 100 rallied 2.6% on Tuesday, 2.3% on Wednesday, up 5.6% on Thursday and up 1.1% on Friday. Look at the summary below:

Fixed Income:

- 30-year Treasury yield down 8.4 on the week; 20-yr yield down 9.9 bps; 10-yr down 7.3 bps; 7-yr down 6.4 bps; 5-yr down 6.4 bps; 3-yr down 4.9 bps; 2-yr down 4 bps; 1-yr down 2.1 bps;

- TLT up 1.6%; EDV up 2.6%; ZROZ up 1.1%; HYG up 1.3%; JNK up 88 bps; EMB up 1.8%; leveraged DPG up 50 bps; leveraged UTG up 2.1%;

US Indices:

- VIX down 15.7%; Dow up 2.5%; SPX up 4.6%; RSP up 2.6%; NDX up 6.4%; SMH up 9.9%; RUT up 4.1%; MDY up 3.1%; XLU up 33 bps;

Mega Caps:

- AAPL up 5.8%; AMZN up 9.3%; GOOGL up 7%; META up 9%; MSFT up 6.6%; NFLX up 10.4%; NVDA up 9.4%; MU up 15.8%;

Financials:

- BAC up 5.7%; C up 8%; GS up 6.7%; JPM up 4.9%; KRE up 4.9%; EUFN up 2.6%; SCHW up 4.8%; APO up 7.3%; BX up 9.8%; KKR up 11.6%;

Seriously, we think CNBC should retitle & re-orient their 5 pm “Fast Money” show into a version of Saturday Night Live like funny & crazy show that you watch mainly for its outlandishness.

Double seriously, does CNBC even care about the viewers who either sold on Tuesday morning or refused to buy this past week based on their Sell America slogan on Monday evening? Does CNBC management have any care or even a thought about what Melissa Lee & her crazy band might have wrought on viewers?

Now to the Breadth Thrust signals:

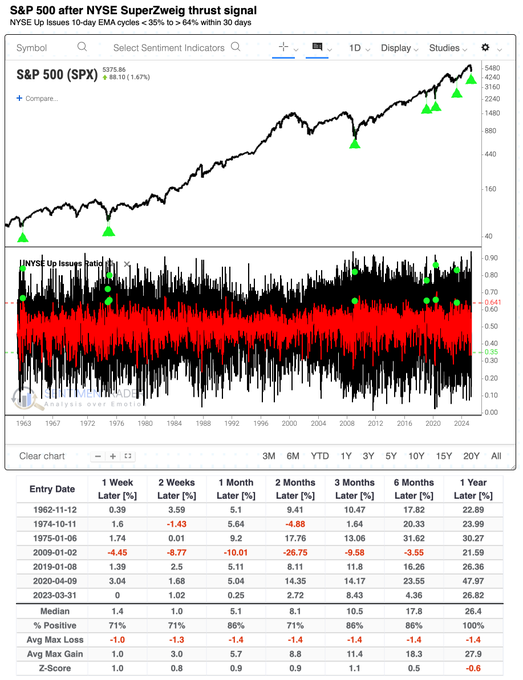

- Jason Goepfert@jasongoepfert – Forget the Zweig breadth thrust – the NYSE just triggered a SuperZweig. Both extremes were significantly further than the thresholds of the original signal. The S&P 500 returned more than +20% the year following every prior thrust. Talk about a bear killer.

And,

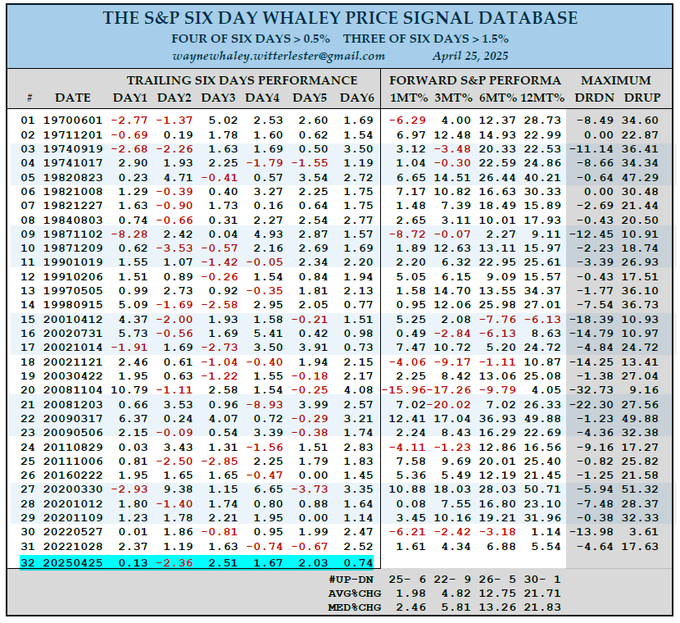

- Jason@3PeaksTrading – Sat 4-26 – Now we have the Whaley Breadth Thrust also confirming this weeks very strong market performance under the hood. I would say Whaley thrust is even more bullish than Zweig signal so its great to see

What about VIX?

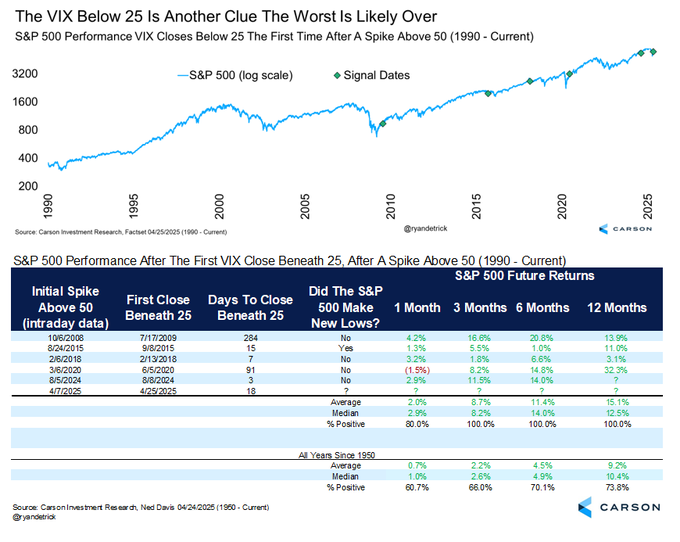

- Ryan Detrick, CMT@RyanDetrick – Apr 26 – The VIX closed beneath 25, after a spike above 50. Option markets are calming down, a good sign. This is yet another clue the worst is likely over. Only once did stocks do this and go on to make new lows after this signal, but higher 6- and 12-months every time.

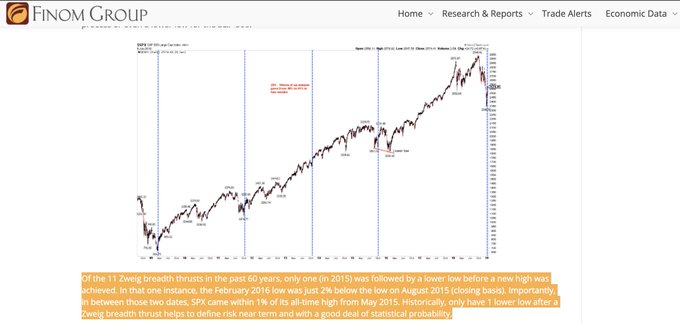

A similar one-time caveat about the Zweig signal that the recent market low may NOT prove to the ultimate low but would still make money over 6 months & 12 months:

- Seth Golden@SethCL – Apr 26 – This was the only Zweig Breadth Thrust that was not the ultimate low in 2015/2016, but still yet recorded 6 and 12 months forward positive returns (annotated chart The Fat Pitch). Inside Finom Group’s research report January 13, 2019. $SPX $ES_F $SPY $QQQ $NYA $NDX $RUT $VOO

Any technical indication how far this rally might go?

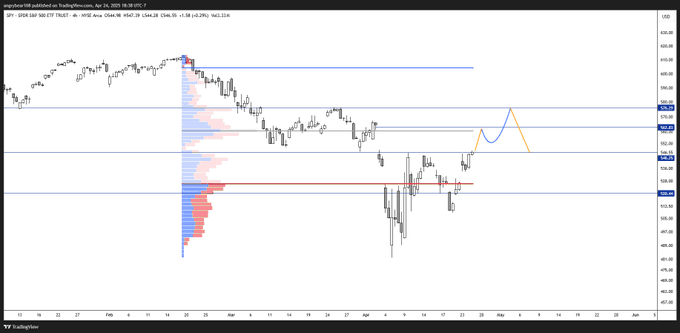

- Trader Z@angrybear168 – 4-24 – $SPY likely to have enough juice to test 576 zone before a bigger reversal.

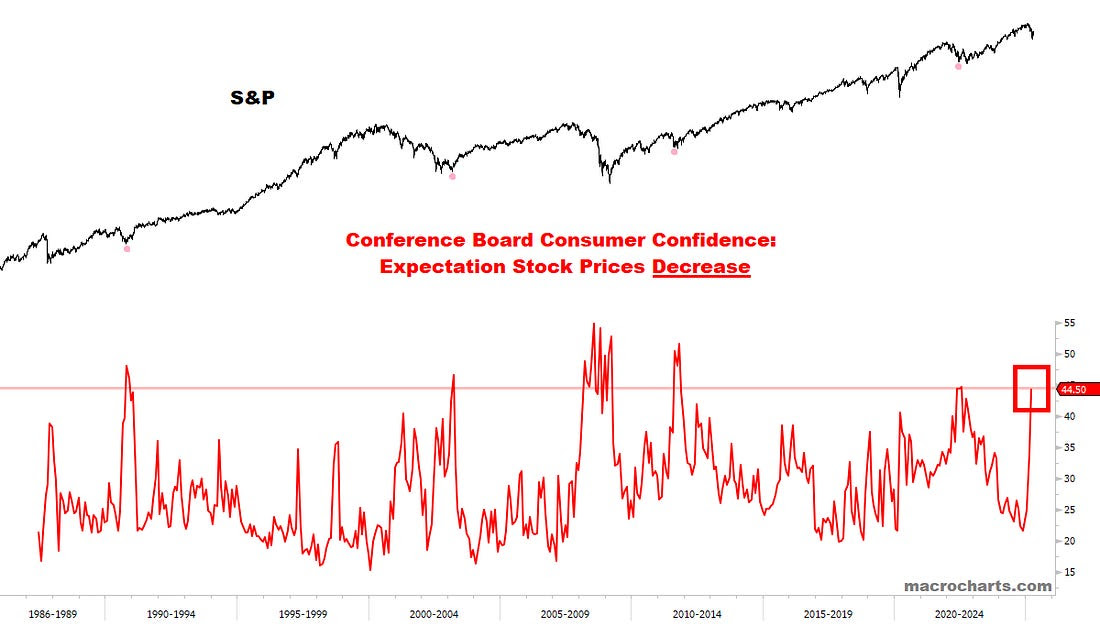

Below from @MacroCharts

- MACRO CHARTS – Nearly half of consumers expect stocks to fall: Similar pessimism led to the market bottoms in 1990, 2003, 2011, and 2020 (sentiment was a contrarian signal). It also happened in the core decline in 2008 (sentiment was right)

2. Treasury rates, Deflationary conditions – MV-ONR re-affirmed at 3.75%

This week was remarkable in the buying seen in Treasuries despite all the cacophony about overseas investors selling Treasuries & refusing to buy Treasuries. Both Tony Cresenzie of Pimco & David Zervos of Jeffries have shown that no other market has the capacity and the volume for Treasuries that the US Treasury market has. And as Bob Michele of JPMorgan said on Bloomberg to Keene & company on Friday,

- “All the false narratives out there were proven to be false. The thought that foreign official institutions were selling Treasuries was just nonsense. When you looked at the Fed’s custody data, they actually increased their position“.

And as the published data from the Treasury International Capital (TIC) system shows, “private foreign buying of US Treasuries was absolutely astronomical” .

The Treasury curve as of Friday was – 30-yr at 4.725%; 20-yr at 4.742%; 10-yr at 4.26%; 7-yr at 4.062%; 5-yr at 3,878%; 3-yr at 3.751%; 2-yr at 3.76%; 1-yr at 3.975%. These levels with the growing prospect of deflationary conditions rising both within US & overseas, we believe that a sensible Over Night Rate (ONR) should be maintained at 3.75% and hence that is the recommended rate by Macro Viewpoints.

Last week, we described the deflationary message radiated by indicators such as Interest Rate Swap spreads, Copper-Gold ratio, Gold-Silver ratio. Today we describe Resale activity , a measure that has a close relationship with nominal Treasury rates. And the data for this measure comes directly from data published in the Treasury International Capital (TIC) system with a rolling two-months delay.

For those who may not have heard it before, the term Resale is the opposite of the more well known term Repo. Resale is when you buy a bond today with cash & agree to Sell it back for same cash plus some interest. So Resale is collateralized lending from the perspective of the lender. And the TIC data shows that

- “private (non-centralbank) foreign buying of US Treasuries was absolutely astronomical in February 2025“.

As the clip titled U.S. Urgent – Banks are preparing for a Rate Collapse? explains:

- “when banks are lending a lot more cash on collateralized basis to offshore counterparts, they are doing this in periods of monetary tightening as lenders of last resort; in other words, they are doing this among deflationary conditions that means 1)demand for collateral overall access to resale drives up demand for Treasuries specifically since demand during these periods of deflationary conditions , junkier collateral is not acceptable & usable; so when we see lender of last resort activity go up, collateral demand for US Treasuries go up & yields go down ;also the deflationary conditions mean drag on economic growth potential; therefore the consequence of lower growth & less inflation may be even deflation; … we see the same in interest rate swap in copper-gold ratios; Resale activity is NOT a perception; its actual activity“

The above shows that there is a “very close relationship with resale activity and the behavior of nominal US Treasury yields“.

3. Time to Re-remember wisdom of Milton Friedman

We specifically mean the wisdom of his comments at Russ Roberts Econ Show on September 4, 2006:

- “The difficulty of having people understand monetary theory is very simple – the central banks are good at press relations. The central banks hire people and the central banks employ a large fraction of all economists so there is a bias to tell the case – the story – in a way that is favorable to the central banks“.

A corollary seems to be that when the Central Bank Head is unable to build respect & trust then the supporting faction, groomed assiduously by the central bank, gets even more aggressive in their support of its benefactor.

One such support is what Austan Goolsbee first expressed, as we recall, and backed emotionally by CNBC Fast Money contributor on Friday, April 25 that removing Jay Powell from the Fed Chair role would instantly drop USA to an equivalent of Turkey. Then he went on to make a point worthy of two other emerging markets – China & Russia.

- “Feels like emerging markets .. we had Steve Liesman on Friday & he kinda stole my metaphor “are we Turkey”? — we don’t want to be seen as having the same economic, political & really a conflicted central bank dynamic & that’s kind of the story – An Independent central bank is one of the tenets of our capital/markets system” … “

First & foremost, a democratic political-monetary system works well when there is agreement between the President, Secretary of Treasury & the Fed regarding the financial well-being of the American people. That’s what we had when we had President Clinton, Treasury Secretary Rubin and Fed Chair Greenspan. And it led to a terrific economy in the 1990s.

Fast forward to the Biden coalition 2021-2025 era. We had no clue who specifically ran the Presidential Office. We do know that Treasury Secretary Yellen followed the White House diktats perfectly & smartly and Fed Chair Powell, who worked for Ms. Yellen at the Fed, followed Secretary’s Yellen’s direction. So it was a unidirectional mandate from the top.

That was the complete opposite of what Tim Seymour & the afore-mentioned Steve Liesman are saying now. It is clear that President Trump & Treasury Secretary Bessent are of one mind & executing on the plan that was endorsed by the American people.

So the odd man out is Fed Chair Powell. And the independence of the Fed was never meant to make the Fed Chair a dictator or an infallible Pope of monetary policy. Nowhere in the US Constitution does it say that the unelected Fed Chair can unilaterally cause serious damage to the US Economy regardless what the President & his Treasury Secretary think.

Finally, you have the ridiculous & false spectacle of US turning instantly into a Turkey if Jay Powell is replaced by say Kevin Warsh. Tim Seymour has been in EM at least for the past 10 years and Mr. Goolsbee should certainly know the history of his colleague at University of Chicago.

Ragu (as he is called on CNBC) Rajan, Goolsbee’s colleague was the Governor of India’s Central Bank, appointed by the previous Prime Minister. When Narendra Modi became the Prime Minister after a landslide victory, his views & Rajan’s views were in conflict. After a suitable period, Rajan resigned & his deputy also stepped down months later having been forced out,

Amazingly and, as Seymour/Goolsbee don’t care to know or remember, Modi’s chosen central bank governor managed a very successful monetary policy that led to the high non-inflationary growth of the Indian Economy for over 10 years.

The key to US in the 1990s and India in the last 10 years has been the same – harmonius, sensible policies between the Reserve Bank, Finance Ministry & the Head of Government. We seriously think that the odd man out today is Chair Powell. It seems Vice Chair Waller is more sensible & less demagogic than Chair Powell.

We believe this current mixup resulted from toxic comments from Chair Powell during a market downtrend on Friday, April 4 and from even stronger comments from Chair Powell two weeks later. We simply failed to understand why Chair Powell made any statements at all on Friday April 4. It seemed there was something personal about those comments on those occasions. Then we heard CEO John Catsimatidies, owner of Gristedes Supermarkets makes stunning remarks on Fox Business last week on April 22:

- (minute 4:18) “That’s Powell’s strategy. He hates Trump; he hates Trump with a passion & he is going to do whatever he can to damage Trump; he should worry about America & not worry about hating Trump; that’s what it comes down to“

We were stunned when we heard this. Then we wondered why Steve Liesman, Eamon Javers or any one else at CNBC haven’t tried to get Mr. Catsimatidies to speak with them to clear the air. Did CNBC even try to get a response? Is their unwillingness to get to the bottom of this story a vivid illustration of what Milton Friedman warned against in his speech on September 4, 2006?

Speaking of Steve Liesman & CNBC, look at the clip below & Liesman’s displayed anger & the calm perspective of Larry Lindsey:

Actually CNBC cut out the next interchange on which Steve Liesman lost his temper & yelled at a much older & senior economics professional Larry Lindsey. That’s sad because it was terrific TV, not the TV CNBC wants to be. As we recall Mr. Lindsey was relaying the tale of President Johnson literally slamming the then Fed Chairman William McChesney Martin into the wall in the Oval Office.

All this stuff brings back the memories of the illustrious Fed governor Bill Dudley publicly advising Fed Chair Powell to oppose President Trump re tariffs. But that was in 2019 when President Trump’s win was narrow.

Today President Trump has won a thumping victory with support from the majority of Americans. And he has a Treasury Secretary that Soros Fund Management Chief Investment Officer Dawn Fitzpatrick & Bloomberg’s Erik Schatzker jointly described as the most savvy Treasury Secretary in history.

And this is the team that CNBC’s Steve Liesman treats with scant respect & almost visible contempt to the point that he was almost abusive to Larry Lindsey on CNBC?

Isn’t it time for Chair Powell to get his adherents on Fin TV to tone down their rhetoric & at least show necessary respect to the victorious President & the Secretary of Treasury? He should worry that the description by the great Milton Friedman might come to mark his entire tenure at the Fed!

That brings us to a more contentious geopolitical & journalistic conflict.

4. America’s Trump vs. China’s Xi

Last week we didn’t know if we were in America or China. We kept hearing people on American TV mock President Trump for making up stories about talking with Chinese when the Chinese Communist party was steadfastly saying no talks were being held. Our friends at CNBC were outspoken in this regard including Eamon Javers who seems to cover the White House. And, if we recall correctly, CNBC invited their China-based Yunice Yoon to discuss this with Melissa Lee. As we said, we heard this while we were busy & could’nt even take notes. So if our recollection is wrong, we apologize.

The reason we were interested in hearing Yunice Yoon was that we had seen the clip on Thursday April 24 titled Xi Jinping Absent, Zhang Youxia Steps In Amid House Arrest Speculation. Look what it says from minute 9:27 to minute 14:10:

- “Xi Jin Ping absent Zhang Youxia steps in Indonesian ministers arrive on a state visit – Xi was absent ; his absence from the high profile meeting raised speculation about Xi’s health, standing & control over the military government …. Xi Jin Ping is known for his prominent role in foreign affairs often meeting foreign dignitaries to assert his authority …. Xi was nowhere to be seen even in the inaugural 2+2 session … official Chinese reports made no mention of his involvement … political commentator Chen Pokong, based in USA, remarked on his program “As long as Xi in good condition and holds power, he meets guests. For him to miss this, something’s up“. The next day Zhang Youxia and … Xi’s absence loomed large … “Xi returned defeated, maybe angry and sick” Chen speculated … a more dramatic theory points to a power shift in the CCP; some analysts argue that XI is retreating from the front line possibly under a form of house arrest ; Chen Pokong highlighted China’s purchase of these allies including military leaders like He weidong, & Mia Hua , reshuffling in the organization dept where Xi has officially begun where Xi’s associate Li Gangiie was sidelined in favor of Hu jin Tao’s ally Shi Taifeng, ; the power in Xi’s faction is shifting to faction representing Hu Jin Tao’s growing influence ; Xi’s role in central military commission makes his absence from military related meetings particularly striking; Commentator Li Dayu noted “As CMC chairman, Xi shouldn’t miss such an important event. This raises questions about whether his role in military diplomacy is being marginalized.” Zheng Youxia‘s prominent role in meeting Indonesian minister suggests he might acting as the de facto decision maker for the CMC. Military analyst shin told overseas media that Dong Jong while defense minister lacks authority ; he is not a CMC member; Zhang Youxia meeting the Indonesian minister alone shows he is calling the shots; … Rumors of Zheng’s dominance gained traction after reports of purges in the 31st army & eastern theatre command leaving Xi as commander without troops; Shen Mingshi, Taiwan’s institute for national defense & security studies , added that with Xi’s allies under investigation Zheng Youxia’s control over military seems clear. ….. foreign trade negotiators loyal to XI were replaced by those loyal to Li Keqiang associates. On line rumors even claimed that power had shifted to elder statesmen like Hu Jin Tao, Wen Jiabao and Hu Deping with Xi’s resignation imminent; “

Two days later, we saw a clip titled Xi’s Misstep: Power Structure Nears Collapse! The contents of this clip are :0:00 Intro 1:01 Tariff War Destroys China’s Food Supply Chain; Prices Soar Across the Board, People Can’t Afford Meat Anymore, and a Domino Collapse Sweeps Across All Industries. 6:38 “Domestic Circulation” Strategy Collapses! China Quietly Removes Some Retaliatory Tariffs Against the U.S., Beijing Urges Washington to Lift Tariffs. 11:04 Xi Faces Criticism for Turning U.S.-China Relations Hostile and Deepening Divisions Within the Party. 14:47 Shocking Rumor Report: Xi Jinping Placed Under House Arrest, Chaos Erupts at Zhongnanhai. 19:03 Forging a United Front with Iran and Iraq Against the U.S.: The CCP’s High-Stakes Diplomatic Gamble. 22:01 A chilling trend grips China: villages vanish, ghost towns rise, and a haunting question remains—where have the people gone?

Look at the line “Beijing urges Washington to Lift Tariffs” – this means someone in Beijing has been talking to President Trump or his team. So he was right & the Fin TV reporters believing Chinese Party saying no talks were wrong. Now hear the portion at minute 14:47 titled Shocking Rumor Report: Xi Jinping Placed Under House Arrest – Most of the details in this sub-clip are the same as in the clip we quoted at the beginning of this section such as Zheng Youxia as the leader of military council & power shift to the elders – Hi Jin Tao, Wen Jiabao & Jiang Zhemin with Li Keqiang.

We have seen multiple clips describing the utter horror of hunger, homelessness & shuttered showrooms. It is clear to most that Xi Jin Ping totally misread President Trump & China is in deep distress. What happens if the above is true & Xi has really been replaced.

We have felt all along that President Trump has been brilliant in his handling of China. Instead of isolating China first, he announced a global tariff & then at a key moment announced 90-day grace period for countries who step forward to negotiate. Everybody did EXCEPT Xi Jin Ping of China & China is almost prostrate. So it makes sense that the elder veteran team will try to oust Xi and revert to a China that acts well with America & others.

Of course, all this could be made up & Xi might return in full force. We don’t know & probably no one does. But common sense would dictate that China will choose to work WITH President Trump & change its aggressive trade policy.

As Secretary Bessent said on the white House lawn, that the entire world has chosen to come to America to discuss & negotiate and that would only isolate China.

Finally if the above is true & accepted, then is it too much to hope that Fed Chair will also see the light? We certainly hope so!

Heck, just one of the two successes might launch a true Breadth Thrust in stocks & if both do, then bababhooom!

Send your feedback to [email protected] Or @MacroViewpoints on X.