Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Big & Correct Decision

In our opinion, President Trump took the correct & decisive action in using the B-2 bombers to destroy the 3 nuclear facilities in Iran. Reportedly, USA had alerted Iran of the operation & Iran used the early warning to move out “materials & people” out of the three sites.

This took out the nightmare scenario from the conflict raging in the Middle East. In our opinion, the Oil States in the Middle East will be comforted with this action without saying so publicly. And hopefully normal life & business can resume in a few days. China is probably heaving of a sigh of silent relief given China’s 80% reliance on Iranian oil & that too without any real capability to militarily intervene in the Middle East. Russia, in our opinion, would probably prefer to take over the Eastern Part of Ukraine rather than intervene in the Persian Gulf.

Those who perceive the above as bullish might be wondering about the positioning in the US equity market.

- The Market Ear@themarketear – Sun 6-22 – From hedge funds to quants, longs are light which should leave less room for an unwind panic.

Below are 3 charts from @themarketear following the above message:

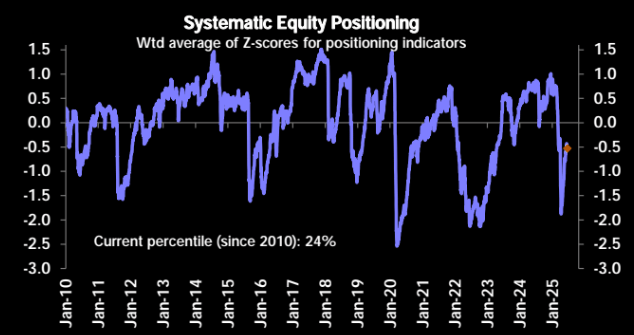

- Systematic strategies positioning is also a touch below zero, at the 24th percentile.

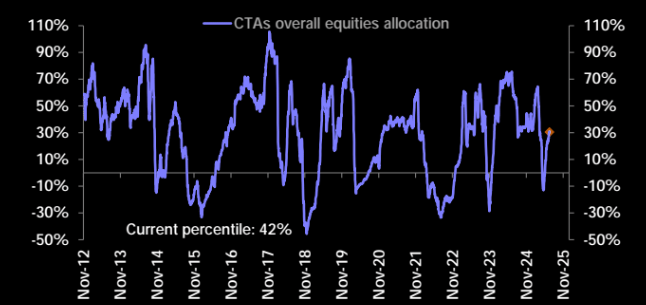

- CTAs (the largest sub-category in systematics) exposure to equities is at 42nd percentile.

- The Risk-Parity guys’ weight in equities is the lowest of the “systematic crowd” at 9th percentile.

This all sounds bullish but, on the other hand, weekend’s Sentiment Trader noted:

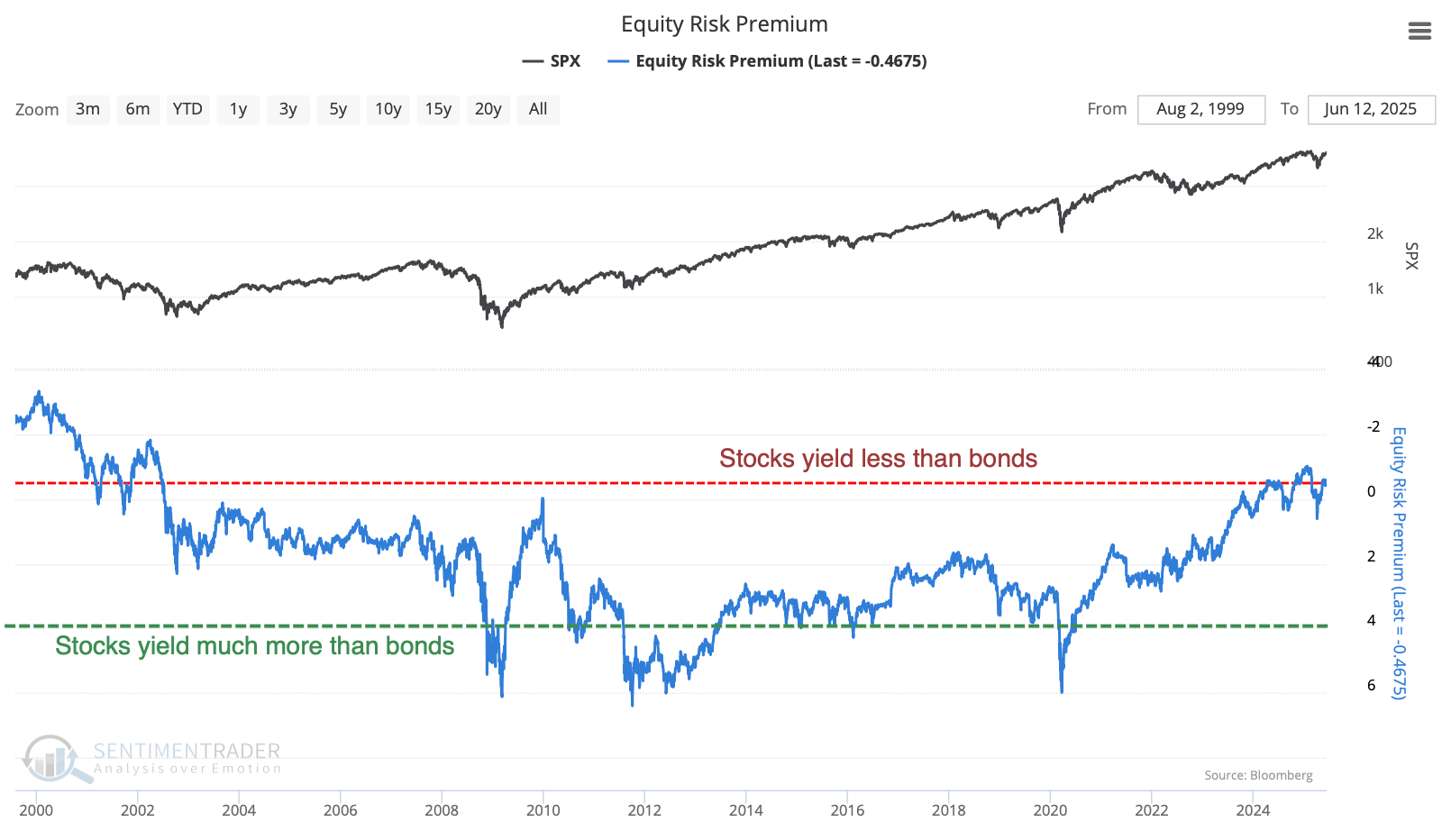

- By two measures, stocks have become overvalued relative to bonds; –Similar extremes have tended to precede poor multi-month returns in stocks, slightly less so in bonds – Value and defensive stocks tended to hold up better under similar conditions

Since $NVDA is neither value nor defensive, the above can’t be ebullient for NVDA. A Demarkian seems to agree:

- “we have seen a massive rally since the April low; almost 70% upside; so … NVDA does look over-extended; we haven’t been worried about the stock until very recently when we saw some signs of short-term, & intermediate term now, exhaustion; that’s best seen on our DeMark indicators; on the daily chart there is a counter-trend signal noted by an arrow & its coming not terribly far from resistance which is pretty strong around $150; then if you zoom out to the weekly chart, you will see also that, as of this week, we have weekly signal of the same kind; we haven’t seen these signals since the peak back in 2024; I do think there is risk here of a retracement; some investors might think about reducing exposure with that in mind; the stock has moved from a cyclical uptrend into a long-term trading range; you can see that in the flat slope of the 200-day moving average which is 11% below current levels; its not a major support level; the major support level is defining the bottom boundary of the range closer to $100; so its a pretty wide range & within that range, traders should welcome the possibility of more volatility because for those who bought in April, they are up nearly 70%; ….. trading range does reflect the loss of long-term upside momentum to suggest that the broader market might be challenged for the balance of the year …”

2. Treasury Rates, Inflation, Growth & Fed

Whom did we hear two days before Powell spoke? What did she say?

The answer to the first question is Emily Rolland of John Hancock with sensible comments from Joe Kernen of CNBC Squawk Box. Answer to the second question is below:

- “there is something going on underneath the surface that the markets aren’t really sniffing out; And that is we are in a period of significant disinflation. You look at the housing dynamics on the supply side; we have the most inventory since 2020; demand is starting to slow; NAHB survey yesterday was the weakest since 2022; home prices fell last month for the 1st time since January 2023. So we think that housing disinflation will feed into the data. … we are also seeing growth decelerating; …. there are more cracks [forming] in the labor market; …. a signal that growth is decelerating more meaningfully than markets are sniffing out right now. So with bond yields elevated still, we would look at this as a gift to lock-in the elevated incomethat is available to investors today; “

At this point, Joe Kernen asked the question:

- “… those brainiacs at the Fed, is it possible they are too late now?‘

Rolland did not equivocate;

- “Absolutely; I mean Yes“

Whom did we hear the day before Powell spoke? What did Barry Knapp of Ironsides Economics say?

His 3 initial statements were –

- Tariffs have become disinflationary rather than inflationary – my school of thought is tariffs are actually impairing demand; so its actually exacerbating the disinflationary effect; it is a tax-hike

- FOMC likely to fall further behind the curve;

- Probability the Fed follows the same July path as 2024 is increasing, starting with a 50 bps rate cut in September;

Regarding the stock market, Knapp thinks the next big hurdle is 2Q25 earnings & he expects a pullback in a month’s time.

Knapp’s view that “Tariffs have become disinflationary rather than inflationary ; …. tariffs are actually impairing demand” is & must be the key topic for the Fed. The Fed & its chairman Powell have based their policies on their CONVICTION that tariffs WILL BE inflationary without giving any academic support for what seems to be their Quasi-Religious Orthodoxy. That orthodoxy has already caused damage to the economy & created a small wave of disinflation as Emily Rolland described above.

Powell is not an economist &, in his current reign, he has not demonstrated any real insight or ability to explain the academic & historical foundations of his orthodoxy. That is something his predecessors like Greenspan, Bernanke & Yellen could have done & probably would have. We don’t blame Powell for his lack of knowledge but we do blame him for not using the several-hundred Ph.D.s at the Fed to put out an academic defense of his orthodoxy.

It is now getting obvious that the trend in employment is downhill. And, instead of focusing on that & what Fed plans to do about it, all we hear from Powell is his single-minded adherence to his core belief. That is why we term his stance as Quasi-Religious orthodoxy. And, as history teaches us, such orthodoxy does create discomfort & even resistance even in Religious institutions. Perhaps, we all saw this on Friday in the sensible comments of Fed Governor Waller:

- “Right now the data in the last few months has been showing that trend inflation is looking pretty good even on a 12-month basis; So I label these good-news rate cuts when inflation comes down to target we can actually bring rates down; … we can do this as early as July.. “

In this context, Karen Finerman of CNBC Fast Money made a simple & highly sensible comment essentially saying why didn’t they cut rates by 25 bps & if that had been proven wrong, they could easily raised rates back up 25 bps. By the way that was our logic in establishing the Macro Viewpoints ONR (over-night-rate) at 3.75% a few weeks ago. Had we been proven wrong, we would have raised it to 4%. No biggie.

So why couldn’t Powell do that? Our thinking is that Powell is over-over-conscious of his lack of academic pedigree in economics & so he simply can’t bring himself to being publicly proven wrong. So much easier to be blamed for being overly-orthodox as most religious heads would prefer.

We don’t have much experience with Religious Dogma & its Orthodox interpretations. But we have seen many backward-intelligent people & a few forward-intelligent people. Powell, as we pointed out a few weeks ago, is most definitely a backward-intelligent thinker and, as such, he demands to see evidence before he gets the confidence at act. This is why he is obdurate & unflinching in his refusal to lower rates until he sees the evidence. He doesn’t seem to realize that, by the time he sees evidence & can show it to people, he might have inflicted real damage on the US Economy.

This is no different than someone driving looking in the rear-view mirror is bound to have an accident with either a bump or a dip in the road ahead. Similarly, the backward-analysis of Powell might have two different consequences:

- The economy or the unemployment picture or both might already be worse than now. And so he would be blamed for being too slow to act. Expecting this, his first cut might be 50 bps with a promise to cut more, a la his promise to cur rates by 100 bps in September 24.

- On the other hand, the inflation picture might be worse than now, something Gundlach suggested this week post Powell-presser. So a combination of weaker employment AND higher inflation might follow his big rate cut. And the longer term Treasury rates might start going higher. This would be a mirror image of how the Treasury market dissed Powell’s promise to cut rates by 100 bps in September 2024.

Good luck to all of us! Why doesn’t Powell simply listen to Fed Governor Waller below:

Watch again and notice the biased interrogation Mr. Waller was subjected to by CNBC’s Steve Liesman. Instead of bringing Waller’s views to CNBC’s viewers, Liesman tried mightily to oppose what Waller was saying. Now open up any interview by Steve Liesman of Fed Chair Powell & notice the contrast.

Google Steve Liesman and you will see him referred to as senior economics reporter for … CNBC. It appears that Liesman considers himself to be a mouthpiece for the current Chair of the Fed. Is that why he came out determined to oppose any thing Waller said that was at odds with the Powell view? More importantly, does CNBC Management want a “economics reporter” or a mouthpiece for the current beliefs of the reigning Fed Chair?

To end on a positive note, if the Powell Fed can get off its quasi-religious orthodoxy & lower rates and if the Senate with the House passes the Big Beautiful Bill to “make permanent expensing equipment, make attractive taxation for factory investment & deliver favorable R&D treatment”, then as Barry Knapp said above “we are on the verge, I think, of a real capital spending boom “.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X.