Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips –our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.The more things change, the more they stay the same

How true does this cliché remain? After all the intellectual stuff about China this & China that, about supply-demand in oil and how credit does this or that, what did we find out this week? That markets are Pavlov’s dogs. Who proved that? Today’s Pavlov – Super Mario. On Thursday morning in China, they poured in $60 billion of liquidity and the Shanghai market still went down because they expected more. Then at 8: 30 am on Thursday morning in New York, Draghi said he had more ammunition and he was willing to use it in March. And the dogs went crazy.

- jeroen blokland @jsblokland – And he’s back! #Draghi #ECB

On Friday morning, Nikkei jumped 5.8% on expectations of a BOJ stimulus next week. Kuroda did nothing to quelch this speculation on Friday morning in his interview with BTV in Davos. He laughed his head off in that interview and said there was 2/3rd of the JGB market he had not bought yet. Heck, even Bezos can’t laugh like that.

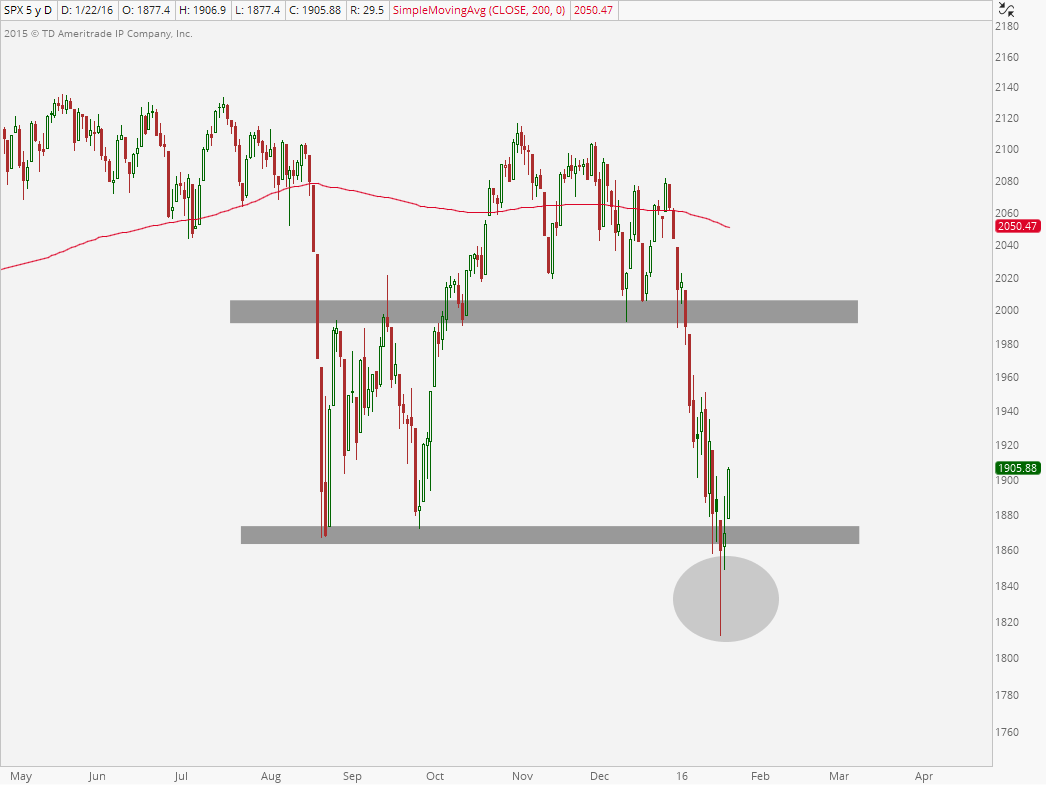

After that, the dogs went really nuts – Oil jumped over 8% on Friday & high yield closed end funds like UTG & DPG jumped over 4% while broad indices in US rallied over 2%. Yes, the move up had begun on Wednesday afternoon after a successful test of 1820. But it would have fizzled out but for Draghi and then Kuroda.

How big was the oil rally?

- Charlie Bilello, CMT @MktOutperform 2h2 hours ago – Crude up over 21% in the past 2 days, one of the largest 2-day gains in history. $CL_F

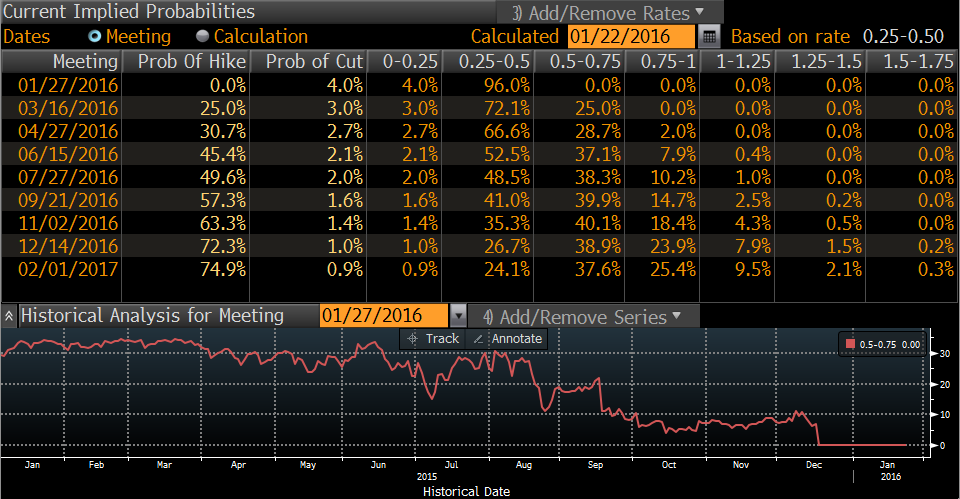

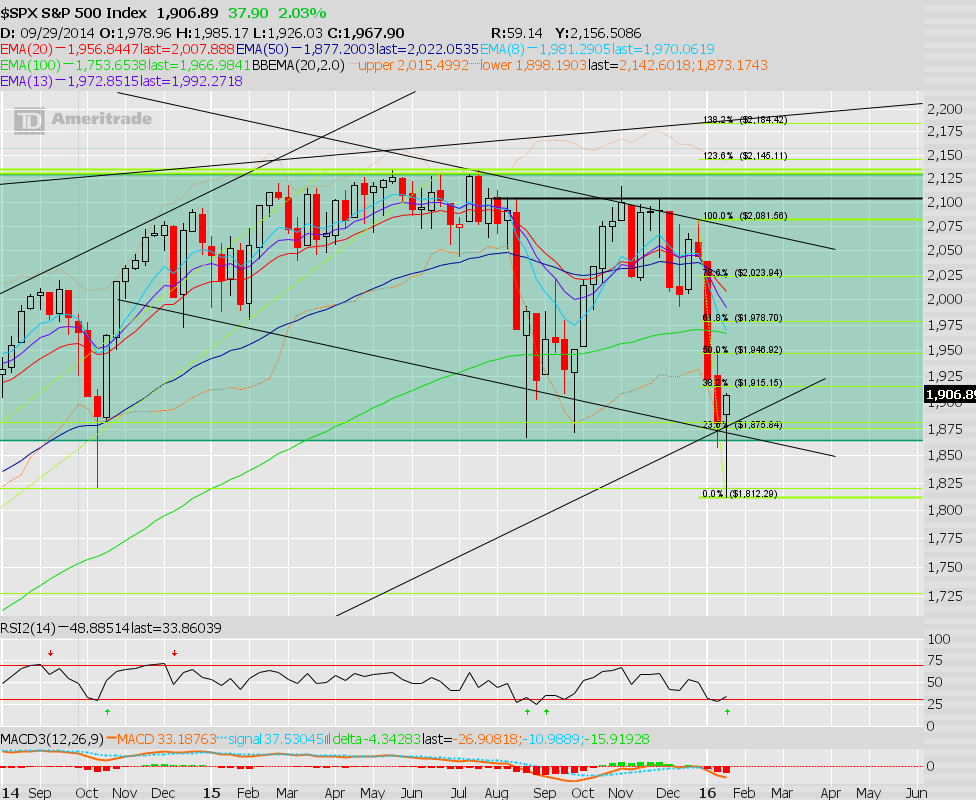

S&P rallied from 1812 on Wednesday afternoon to close at 1907 on Friday. But what did all this do to the expectations about the Fed?

- Charlie Bilello, CMT @MktOutperform – Fed rate hike expectations pushed back to September with market only pricing in one hike in all of 2016.

- ValueWalk @valuewalk – Credit Suisse Expects Soothing Words To Come Out of FOMC Meeting @MarkMelin http://www.valuewalk.com/2016/01/credit-suisse-expects-soothing-words-come-fomc-meeting/ … $FED

But wait. Wasn’t it only two weeks ago when Vice Chairman Fisher reiterated 4 hikes this year commitment? That is what Kate Moore of BAML warned on Friday:

- “rally seems very policy rhetoric driven; can’t expect Yellen to promise not raising rest of the year; changes we get selling“

But isn’t this divergence already built in?

- Charlie Bilello, CMT @MktOutperform Incredible divergence… US 3-month yields at highest level since Oct ’08; German 3-month yields at all-time lows

What are the cognoscenti saying about the US economy?

- Bloomberg TV @BloombergTV – BlackRock’s Rick Rieder: The U.S. economy has seen its best days http://bloom.bg/1Qjc88J #WEF16

And,

- Foreign Policy @ForeignPolicy – At Davos, the IMF sees dark clouds gathering over the global economy @davidcfrancis reports http://atfp.co/1T1Ke3G

2. Deflation, China &Treasuries

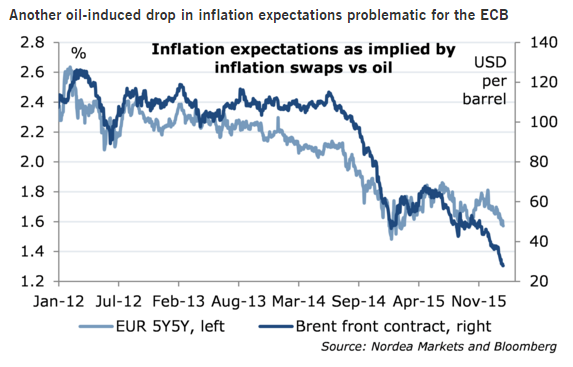

Deflation was the term of the week. Ray Dalio used it to predict new QE from the Fed. George Soros termed deflation as the big thing in explaining his Long 10 year Treasuries vs Short Stocks & Commodities trade on BTV. Where is deflation coming from? A Business Insider article summarized the Soros view:

- “You’ve got basically three major root causes. One is China, the other is oil and raw material prices, and the third is competitive devaluation, … You have all three.”

- “I think the Chinese situation with the currency is very important. Very important. If there is significant currency weakness for the Yuan that will mean more imported deflation and it will make things more difficult“

Gary Cohn of Goldman stated his view of China simply on BTV:

- “I do believe they will end up devaluing their currency“

On the other hand, Larry Fink said on BTV:

- “it would “be horrible” if China devalues its currency because it would have a huge global deflationary impact and would mean the country is moving back to an export-driven economy”

Treasuries are the ideal beneficiaries of deflation fears. And they have been roaring in 2016. But how does a determined Draghi impact Treasuries? Per J.C. Parets:

- with U.S. Treasury Bonds heading into resistance above what is still a downward sloping 200 day moving average. A pull back here coinciding with a market rally also makes sense:

On the other hand, positioning seems supportive of lower yields:

- zerohedge @zerohedge – 10Y futures dealer/intermediary net short biggest since Nov. 2010

The move in yields could be large as Gundlach warned last week and as Bloomberg suggested this week:

- Bloomberg Markets @markets – Treasury volatility jumps to the highest in almost four months http://www.bloomberg.com/news/articles/2016-01-21/u-s-10-year-notes-retreat-following-biggest-rally-in-5-weeks … via @lucy_meakin

As the Bloomberg article notes:

- “The Bank of America Merrill Lynch MOVE Index of Treasury price swings climbed to 81.82, the highest since Sept. 29”

Getting back to deflation, what might be one antidote to deflation fears?

- William Watts @wlwatts – Here’s why the Mario Draghi refuses to ‘look through’ collapsing oil prices http://on.mktw.net/1RW9Hwz

That brings us to:

3. Oil

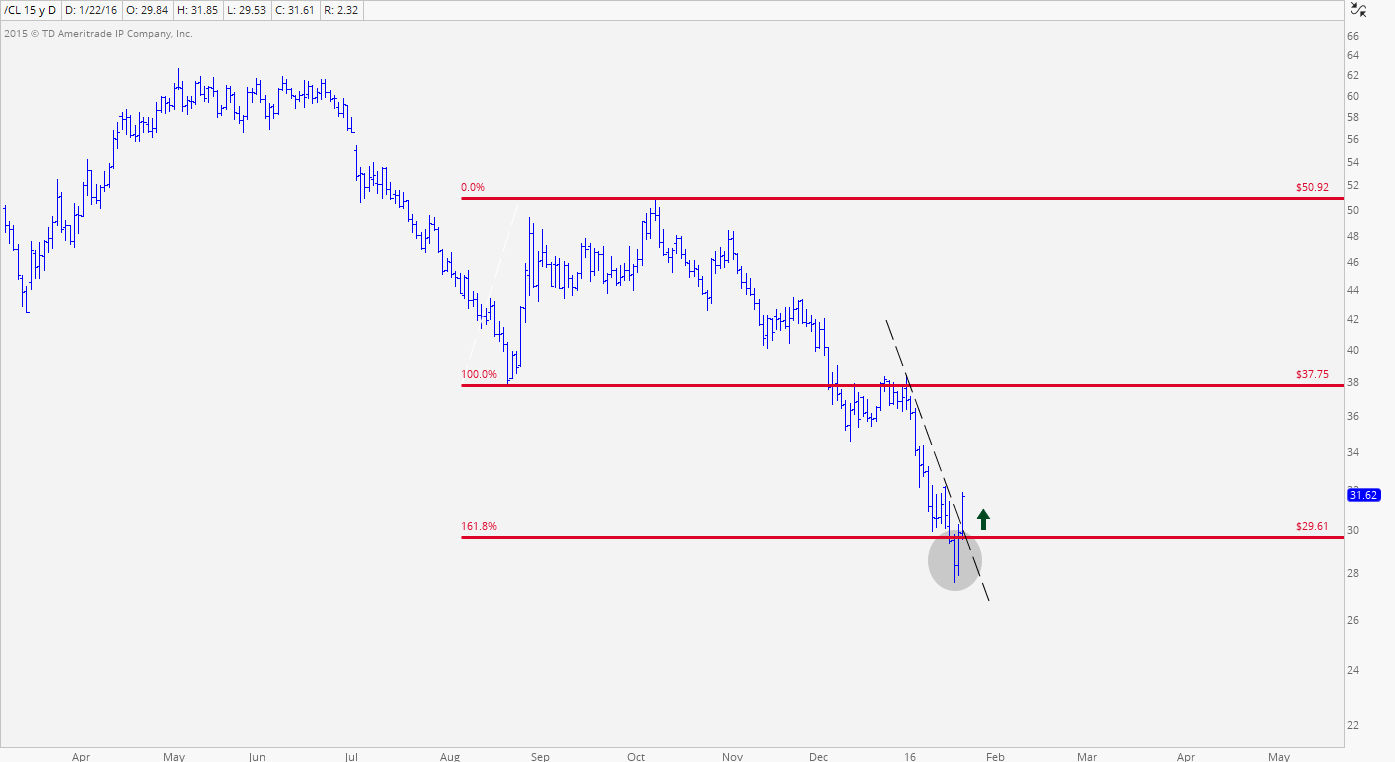

WTI touched 26-handle on Wednesday before bouncing hard. J.C.Parets wrote on Friday:

- “I think it’s worth noting that Crude Oil put in what appears to be a failed breakdown below what was the 161.8% Fibonacci extension of the August-October rally. That could spark a rally … “

The Oil volatility touched 72 on Wednesday, almost at the all-time high noted Pete Najarian of CNBC FM;

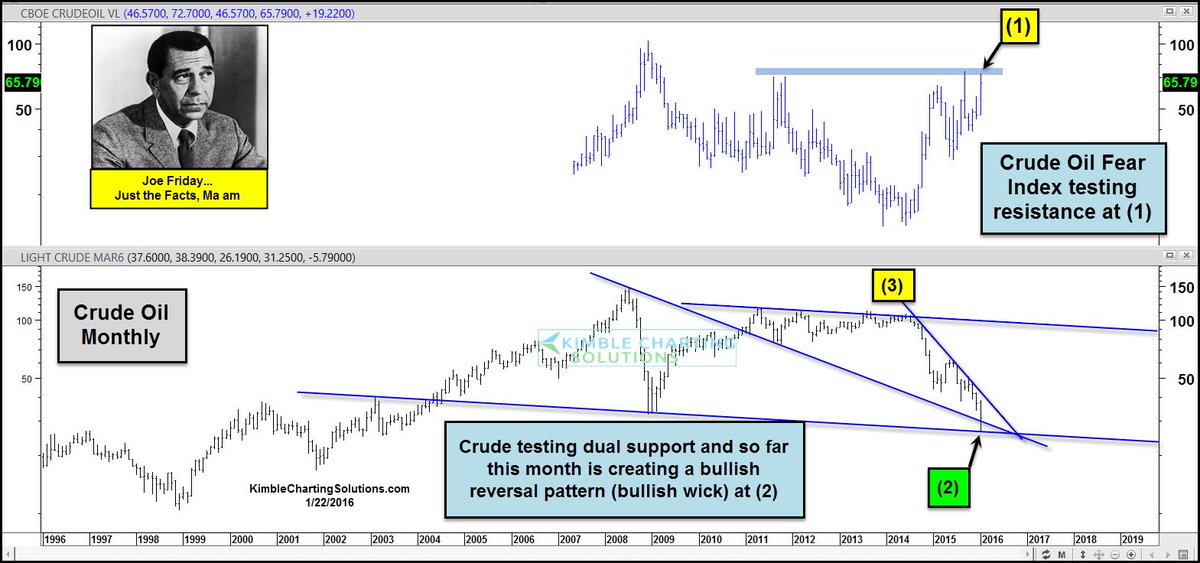

- Chris Kimble @KimbleCharting – Large bullish wick at dual support with fear at triple top? $USO $CL-F http://stks.co/c3B7i

- So far this month, Crude Oil is creating a bullish reversal pattern (bullish wick pattern) at channel support at (2) above. … This is a monthly chart, so where it stands at the end of the month will be critical for this pattern. Crude could also be creating a bullish falling wedge pattern. To prove this pattern read is correct, Crude Oil needs to break above falling resistance line (3), which is still a large percentage above current prices …

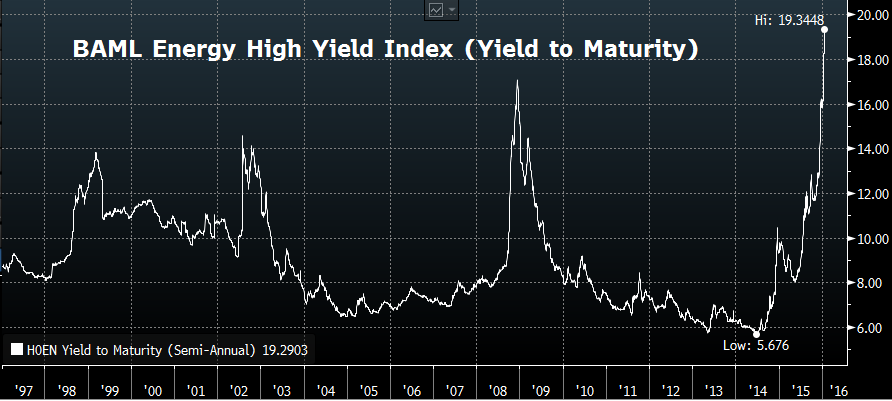

If Oil rallies, can High Yield be far behind?

Energy High Yield, Yield to Maturity

June ’14: 5.7% – All-time low

Today: 19.3% – All-time high

Risk/reward improved

And financials?

- Antony Filippo @Vconomics – Debt Exposure to Oil & Gas: BofA: $21 billion, Citi: $20.5 billion

Wells Fargo: $17 billion, JPM: $13.8 billion

4. Equities

How bad was Wednesday morning?

- Joe Kunkle @OptionsHawk – An awesome amount of destruction today, getting wild

Of course that was precisely the time when a large trade was reportedly put in – $5.5 mm Feb 187/193/197 butterfly for $1.30. This reportedly involved laying out of $5.5 million in pure option premium via buying 42,500 February 187 calls for $2.80, selling 85,000 February 193 calls for $0.92, and buying 42,500 February 197 calls for $0.34. Did this trade turn around the stock market? Or was it simply a ricochet off of 1812 after a momentary break of the 1820 level?

Frankly, it doesn’t matter now. All what matters is how long this rally continues & how high it gets? And how far does the S&P fall back from there?

- Tom DeMark on BTV on Wednesday – today could be an interim low; intensity of this decline is akin to what we say on November of 2008 & August 10, 2011. That deep & that intense has been the current decline; a rally today or tomorrow of 5-8% to anywhere between week & half to three weeks; then we decline again; we should get below 7500 on Hong Kong and 2500-2600 on Shanghai;

- Joe Kunkle @OptionsHawk – Oct. 2014 saw a massive follow-through week, next week busiest of the Q for earnings, same cycle as Oct,

A more elaborate discussion from J.C. Parets in his article- Is This The Squeeze Higher in U.S. Stocks? :

- “I think we can get a squeeze up towards 1980 where I would be selling into, either taking off long positions or looking to initiate shorts. This is still a sell strength market, not a buy dips environment from any kind of intermediate term perspective. We might even see 2000 in the S&P500. That isn’t out of the question at all”.

But Parets is clear about this rally being a squeeze.

- “Remember, I’m still in the camp that this is just a counter-trend rally within a bigger structural decline. Historically, these tend to be the most powerful. A lot of shorts could get squeezed hard here”

But one skeptic from last week remains so:

- Scott Minerd @ScottMinerd – I think the S&P is headed to 1600-1700, but don’t panic–this is not a replay of 2008.

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter