Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”ruled out“?

The biggest statement of the week might have been Larry Kudlow saying that a White House meeting “ruled out any currency intervention“. The Dollar immediately rallied. An hour or so later, Treasury Secretary Mnuchin said he is “not going to advocate a week Dollar policy as Treasury Secretary“.

But in the evening after market, President Trump sounded two-handed about the Dollar. On one hand, he said he was happy & proud about the strong Dollar and how that reflected the robust strength of the US Economy relative to others. But he also sounded unhappy at how the strong Dollar was making America uncompetitive.

The unqualified & almost stern statements from Kudlow & Mnuchin & the contrast with President Trump’s “yeah but” statement made us wonder whether a deal had been struck by Kudlow/Mnuchin with Fed Chairman Powell & FOMC. After all, the Fed has already come towards an easing mode with almost 50 bps built in for the next two FOMC meetings. So adding a currency intervention on top of their imminent easing might have been too tall an obstacle for them. Is that why Kudlow & Mnuchin made such unwavering & unqualified statements about ruling out currency intervention? Who else could they have been speaking to? Not the President & not to the stock market because the US stock market would love a weaker Dollar.

The Dollar was already enjoying a 1% up week when Kudlow spoke & that strength impressed Carter Worth of CNBC Options Action to put a buy on UUP, the Dollar ETF. He said UUP has already broken above the trendline, then checked back to the trendline and is now pivoting above. He also saw a wedge breakout & an inverse head & shoulders formation in the UUP chart. All very impressive sounding as you can see & hear below:

On the other hand, The Market Ear noted:

- DXY – before getting too excited about the move in the mighty USD, do recall that the DXY continues trading the 96/98 consolidation range. So far, any momentum break out trade has been wrong, up and down….

Next week may decide whether the Dollar maintains its range by falling back or breaks out of this range with an up move. And that will be determined by what Fed Chairman Powell does & says on Wednesday.

While everyone is focused on whether the Fed cuts by 25 bps or shocks the markets by cutting 50 bps, we think it is much more important to focus on how the Dollar reacts to the FOMC action & Powell’s presser. Why? Read the succinct discussion by Larry McDonald in his interview:

- “The Dollar is like a global wrecking ball: There is about $15 to $16 trillion of US Dollar denominated debt in the world. Everybody has borrowed in Dollars. So in recent years – while the Fed was trying to hike rates and simultaneously reduce its balance sheet – trillions of Dollars were sucked back to the United States. The big loser was the emerging market’s economic engine. Now, there is almost no growth anymore in the world.”

- “The global economy is headed for a recession. The only way out is if the Fed pulls out the fire hose and weakens the Dollar. If they are successful, the global economy is going to stabilize and will have a good run. But if the Dollar stays up where it is then the world goes into a deep recession.””

- “As mentioned, the Fed’s only choice is to soften the Dollar. As they unwind their policy normalization experiment, the Greenback is in big trouble. There are too many Dollars in the United States and that money is going to flee from a weaker exchange rate. That’s going to give a strong bid to commodities, to emerging markets and to other parts of the world.”

We sincerely hope that Chairman Powell gets it. We think statements of Clarida & Williams suggest that they get it. And, of course, President Trump gets it. But we realize that, at least this time, the Fed & Chairman Powell need to get the credit for lowering rates & weakening the Dollar (without saying so, of course). The Fed does not wish to be goaded publicly to weaken the Dollar by lowering rates & that, we hope, was the impetus for that uncharacteristically clear & unwavering statement by Larry Kudlow.

Will the Fed cut by 25 bps or by 50 bps next week? Rick Rieder of BlackRock told CNBC Closing Bell that he would bet that the Fed cuts 25 bps next week and 25 bps in September but sees a 40% chance that they cut by 50 bps next week. He pointed out that ” … when you cut … , you are supposed to shock the system & be faster & more aggressive … “.

Remember Bob Michele, JPM Asset Management Head of Fixed Income, who said last week that the 10-year yield could go to ZERO! What did he say on Friday on BTV Real Yield about what the Fed will do?

- “I think the Fed will do 25 bps; I don’t think Powell, Clarida, Williams have the votes to do 50 bps but I hope they are uber-dovish & message that they are serious & they intend to create inflation expectations. If it were up to Powell, Clarida & Williams, they would absolutely do 50 bps. They know that once disinflation expectations become embedded, they are very hard to root out of markets & actually, I think the markets are in a very perilous position”

2. Friday’s strong data

What did JPM’s Bob Michele say about Friday’s strong data & its impact on the FOMC decision next week?

- “It was a solid number, but the Fed couldn’t care less; that is not their issue; they are concerned about inflation expectations”

But was Friday’s Q2 2.1% number as solid as universally described on Fin TV? You know who would say no.

- David Rosenberg@EconguyRosie – Not to mention another Houdini act. Strip out the effects of the savings rate drawdown and the sharpest government spending run-up since the Great Recession, and real GDP growth was FLAT in Q2!

Savings rate drawdown is not so bad as long as real incomes are going up, right?

- David Rosenberg@EconguyRosie –Jul 25 – My back-of-the envelope calcs have profits at -5% SAAR in Q2 and we know that real avg weekly income came in at -1%. The recession on an “income” basis may have started. As usual, the bond market was early in figuring it out.

So what about the cash buying we used to hear about?

- Liz Ann SondersVerified account@LizAnnSonders – Mortgage financing up, cash buying down

@PantheonMacro@SoberLook

On the other hand, as Rosie pointed out:

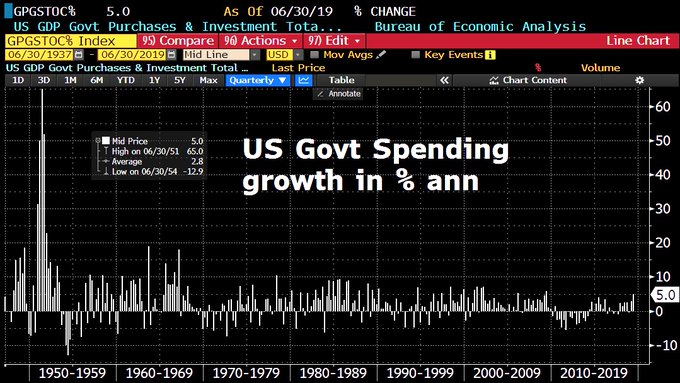

- Holger Zschaepitz@Schuldensuehner – Oops! US govt spending rose by whopping 5.0% annualized in Q2, the fastest growth since GFC.

That brings us to this week’s really really big news.

3. Trump Unbound until 2020

The above Holger chart shows how critical US Government spending was to getting a 2-handle Q2 GDP number. Now you get how big this week’s big news was?

The news that the Trump Administration & the Democrat House shook hands on a two-year resolution about the debt ceiling & higher levels of Government spending & deficits. First & foremost, this confirms our oft-repeated statement that President Trump is, both at heart & in his head, a FDR type of guy & in sync with blue collar Democrats. Who hates this bill? The conservative Republican Debt vigilantes & the Fiscal caucus. They just don’t get it.

Read what Bob Michele, Head of JPMorgan Asset Management, said on BTV Real Yield on Friday about Europe & Draghi of ECB:

- “… fiscal austerity does not work [what Europe practiced in 2012-2013 & what Pres Obama legislated in his 2013 tax raise]; you can’t shrink your way to growth; they [Europe] need to find a sovereign that has both the ability & courage to deficit spend; that’s difficult to come by; I think the ECB is the only game in town for Europe … ”

Well, the US economy does not need to “find” such a sovereign! We elected one in 2016. Thanks to the debt ceiling & spending bill, we might see a sustained jump in Government spending all the way into the 2020 election. And if Pelosi needs another constructive House victory, she & Schumer might work with President & McConnell to deliver an infrastructure bill in early 2020.

Look what PM Modi did in India about a year before his election – increased government spending to benefit the poor & the lower middle class. We expect to see a similar push in middle America. You combine that with a rate-cutting campaign by the Fed, perhaps a somewhat weakened Dollar & we could see a strong stock market in 2020.

4. Draghi’s message to the Fed

German yields fell hard after the text of Draghi’s statement was released. The German 10-year yield fell to a minus 41 bps handle. Then Draghi began speaking & yields backed up in Germany & in the US.

Bob Michele used that back up to get into the German bond market, he said on BTV Real Yield on Friday. Then he added:

- “I think the yields are going a lot lower; I think he [Draghi] set the stage to bring the yields a lot lower; everyone in Europe is scrambling to find positive yields wherever they can get it; I think he was brilliant by the way he laid out what everyone is observing – things are slowing down, there is absolutely no inflation impulse;

- and you know Fed, you started all this, you finish it; you are the guys that raised rates & started the balance sheet runoff; we haven’t raised rates at all; we haven’t run down our balance sheet; by the way, trade problems didn’t start in the Eurozone; so you guys move first & then we are right after you; brilliant;”

5. Treasury Rates – “… nothing but downside to yields”?

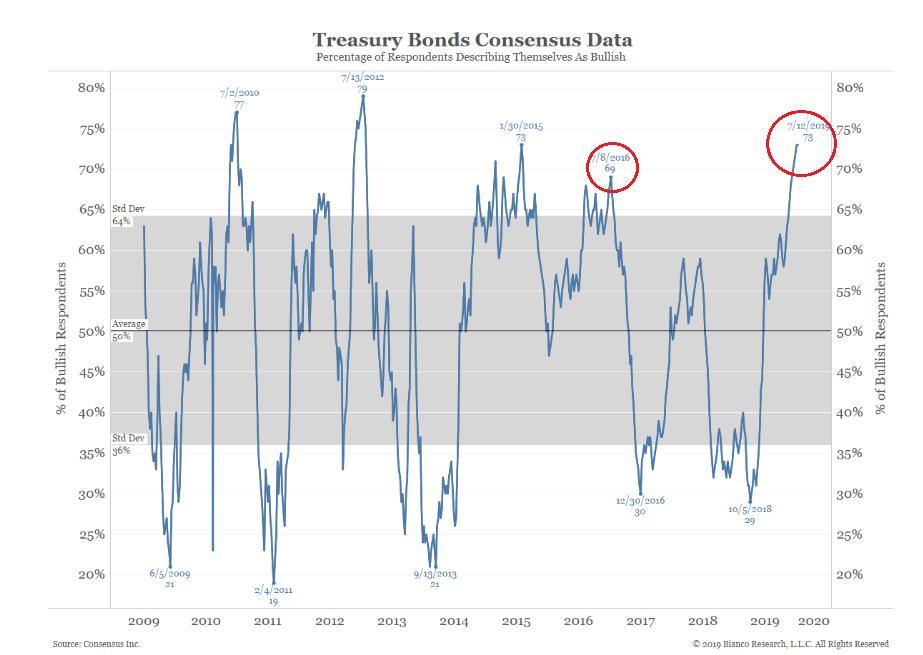

Well, rates did rise this week in a flattening move – 2-5 year yields rose by 4.4 – 4.9 bps on the week while the 10-year & 30-year yields rose by 2.4 bps & 1.6 bps resp. But that did little to change the extreme sentiment for bonds:

- Babak@TN –Jul 24 – Another reason to be cautious re REITs & anything bond related is the current lopsidedness in the bond market. Current #sentiment is running at historic extreme as shown in this chart of treasury bonds consensus h/t

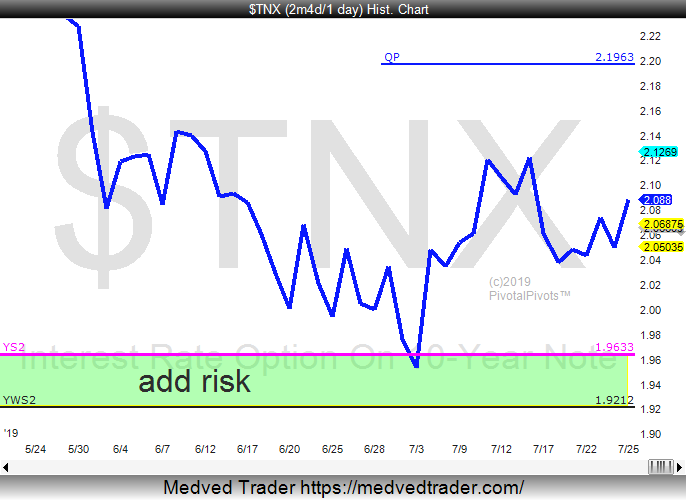

So what is a short term bearish target?

- Jeff York, PPT@Pivotal_Pivots – Jul 25 – My next target on 10 yr. bond yields $TNX is at the Qrtly pivot point(QP) @ 2.20%. $TBT #TradethePivots

Now understand who Bob Michele is. He is not a strategist or even the head of strategy. No, he is the Head of JPMorgan Fixed Income Asset Management. That means he plays with big money, money that probably prevents him from adding to performance by small tactical plays. His real performance has to, we think, come from big bets.

His earlier big bet was, as we recall, in June 2019. That is when he turned from buying dips in credit to selling rallies in credit. Then last week he said he expects the 10-year yield to go to Zero, a stunningly bold statement for the Head of Fixed Income Asset Management.

So what did Bob Michele say on BTV Real Yield on Friday when asked about his forecast? Remember, unlike strategists, he is sitting on the long end of the Treasury curve. So the question is when does he get out or what will make him get out of the long end of the Treasury curve?

- ” … we will see what happens when the Fed begins to cut rates; suddenly near record amount of money, absent a financial crisis, starts to come out of money markets because investors want to lock up some yield; when central banks begin to expand balance sheets again, it pushes bond prices up a lot; and if there is any de-risking … that de-risking goes right into the bond market; I think there is nothing but downside to yields;”

- “… if the central banks are as patient in cutting rates as the Fed was in raising them, then without question we & probably a lot of investors are going to sit on the long end of the curve which will be as flat as a pancake; they need to do something that shocks & awes … they need to get in there & create enough stimulus that inflation expectations do go up a lot “

Are 1-2 rate cuts of 25 bps enough to generate that amount of stimulus? Or will next week be a start of another ride down the slide in rates?

6. Stocks

First the basic & sensible from Lawrence McMillan of Option Strategist:

- “In summary, most of our indicators remain on buy signals, especially the important charts of $SPX and $VIX. As long as $SPX remains above support at 2950, we will remain bullish.”

What is the pain trade? Market Ear says,

- “People have been drawing wedges and pointing out the implosion scenario for some time, but the slow motion melt up has been the trade. The pain trade is still up. Our take remains, use relatively low volatility (especially upside exposure) to play this, especially if it goes into full blown melt up…. Should SPX close here or higher, things could get very dynamic to the upside as so many “smart” guys still talk their bearish book…”

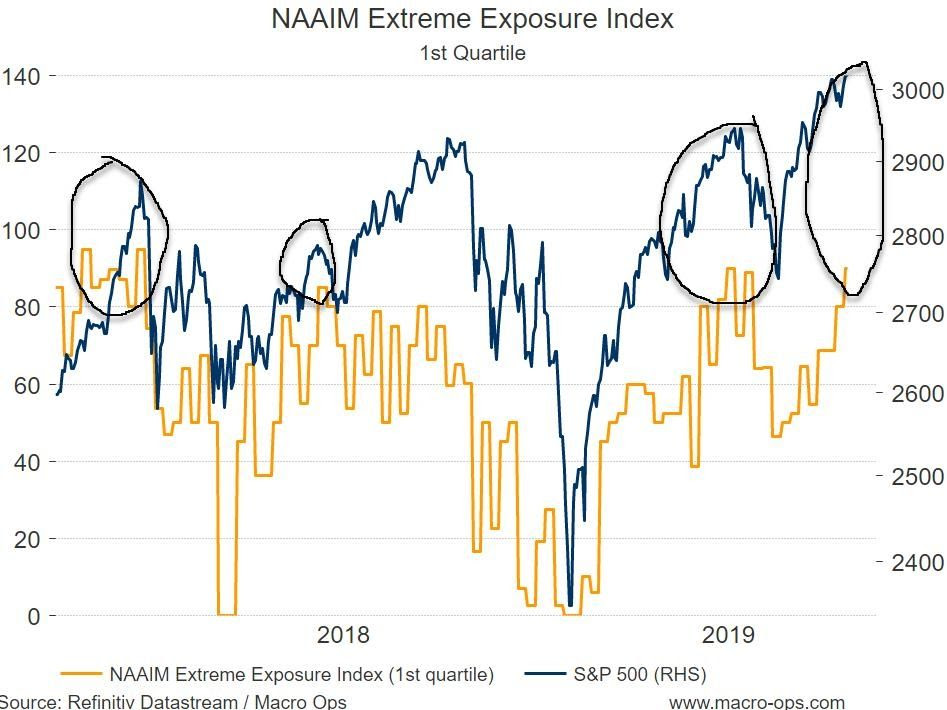

On the other hand, positioning at such extremes (courtesy of macro-ops.com) has led to turmoil:

Of course the real question is what should one do after a 5% turmoil hits? Buy says Tony Dwyer provided credit has not shut down and assuming they are “NOT ALREADY TOO LATE”:

And what if the Fed does manage to weaken the Dollar? Again from The Market Ear:

- “EEM has lagged the SPY rather big recently… Sure, the USD has been a little too strong for the EEM, but given the fact the DXY is approaching the upper part of the trading range and US equities squeezing further, maybe a catch up EEM trade is “rational” here?“

The strength in the Dollar didn’t just hurt EM but it also hurt Gold which fell by 70 bps on the week. The miners, GDX & GDXJ, fell by 2.4% on the week. But Silver rallied about 1% on the week which brings us to views of Larry McDonald:

- “Gold is going to make a run at $2000 per ounce sometime in the next eighteen months. But the best place is silver because the gold to silver ratio is extremely high: Silver is the cheapest to gold in maybe twenty years. That’s why you don’t want to be long just gold. You want to be long gold, silver and other commodities.”

Send your feedback to editor@macroviewpoints.com Or @MacroViewpoints on Twitter