Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Does the President speak for his organization?

Or is there a difference between Presidents? There clearly seems to be as we all saw this week. John Williams is the President & CEO of the NY Federal Reserve. And he is the Vice Chairman of the Federal Open Markets Committee (FOMC) that sets monetary policy. So when President Williams speaks, markets listen. Boy, did they listen? The 5-2 year yield curve dropped by 13 bps from Wednesday, July 17 to Thursday, July 18.

- Lawrence McDonald@Convertbond – Shock and Awe? “Monetary policy can mitigate the effects of the ZLB (Zero Lower Bound) in several ways: First: don’t keep your powder dry—that is, move more quickly to add monetary stimulus than you otherwise might.” John Williams Implications here (link: https://www.

thebeartrapsreport.com/blog/ 2019/07/17/precious-metals- not-taking-a-breather/) thebeartrapsreport.com/blog/ 2019/07/1…

Then, on Friday, the NY Fed repudiated its own President & CEO and the FOMC repudiated its own Vice Chairman by dismissing the comments of Williams as merely “academic”.

John Williams was not alone in creating the meltdown in rates on Wednesday & Thursday. The Vice Chairman of the Fed, Clarida, contributed bigly as well:

- Lawrence McDonald@Convertbond – Clarida –Outlook uncertainties have Increased -Global Data Have Been Disappointing to the Downside -Inflation Data Has Been on Soft Side –You Don’t Want to Wait Until Data Turns Decisively if You Can Afford To Translation: Global risks trump US economic outlook

That was sweet music to our ears. Our fear has been that the Fed will wait & proceed slowly to minimize “risk” to its own credibility & thereby be too late in preventing the slowdown spreading through the economy.

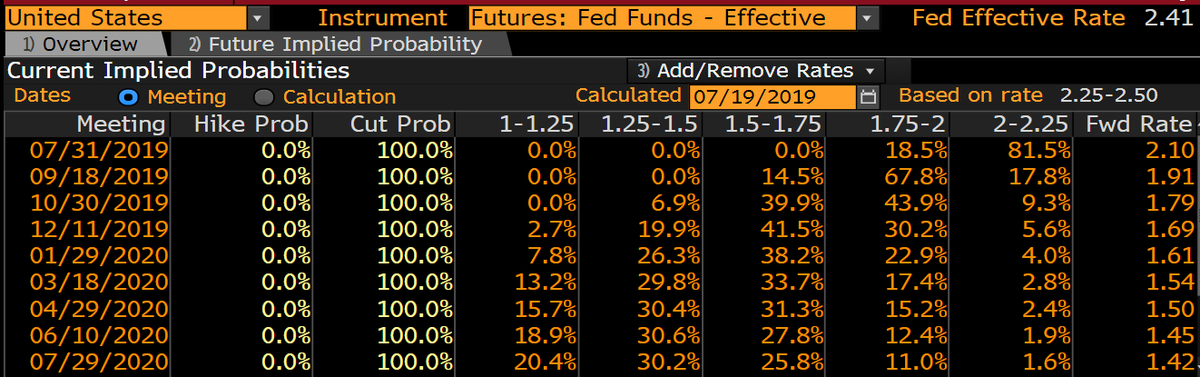

But, as we well know, the Fed is an entirely self-interested institution. And their cover of Ph.D. filled reverence from the Congress has served them well. So the Fed, meaning Chairman Powell, signaled on Friday that the market should only expect a 25 bps cut on July 31.

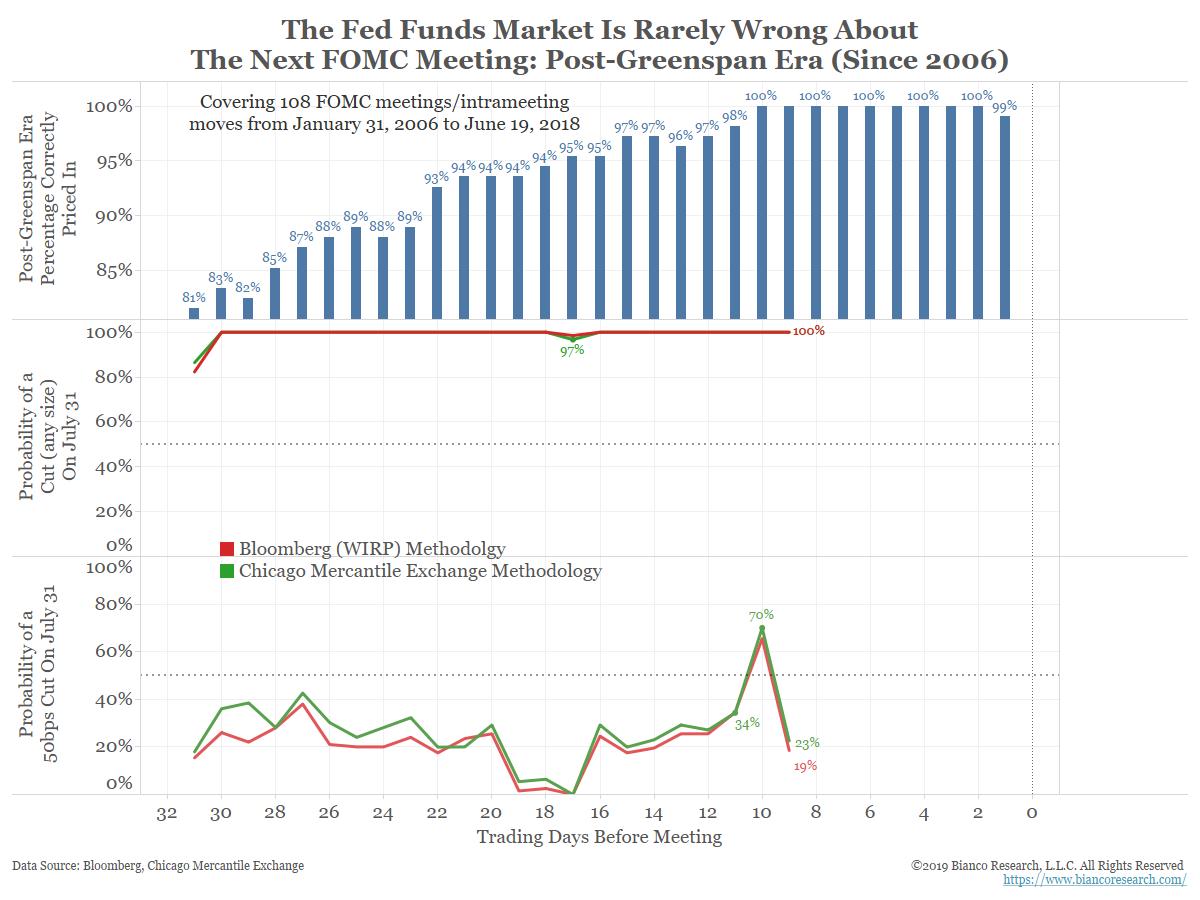

- Jim Bianco @biancoresearch 18 hours ago – Today is the last day Fed officials can talk before the July 31 FOMC meeting. So call the WSJ and essentially told him the decision has been made and they are cutting 25 basis point. This morning “50” was trading 40% and 24 hours ago it was trading 70%. Now it around 20%. https://twitter.com/biancoresearch/status/1152302259524505606 …

Not uncoincidentally, the opening rally in the broad US stock indices turned negative after Fed’s clear signal on Friday. And the broad indices closed down about 1% -1.4% on the week. But as Rick Santelli said “there was damage done” to interest rates. So despite the small rise in interest rates on Friday, the week was a stellar one for Treasuries.

Not uncoincidentally, the opening rally in the broad US stock indices turned negative after Fed’s clear signal on Friday. And the broad indices closed down about 1% -1.4% on the week. But as Rick Santelli said “there was damage done” to interest rates. So despite the small rise in interest rates on Friday, the week was a stellar one for Treasuries.

The 30-year & 10-year yields closed down 6.5 bps on the week. In fact, the entire 30-3 year curve fell by 6 bps on the week. And their high-beta counterparts, German bund yields, fell by 12 bps on the 30-year and 7.5 bps on the 10-year.

2. “hasn’t even begun yet”?

Who & what you ask? The Who is Bob Michele, the chief investment officer and head of global fixed income at JPMorgan Asset Management. And what hasn’t even begun yet? “The rally in bonds”, Michele said this week.

Seriously folks, David Rosenberg is increasingly looking like a piker with his US 10-year yield will fall to the level of UK 10-year yield (74 bps) call. Because Bob Michele , who was bullish on credit until June, said on Thursday that he expects the US 10-year yield to fall to ZERO.

- “The only thing they have left to do is cut rates as far as they can and probably expand balance sheets.”

Michele’s colleagues on the advisory side said, per Bloomberg, that

- the global pile of negative-yielding debt is becoming a tar pit that will eventually suck in the U.S. government bond market.

One such is Jan Loeys, a senior strategist at JPMorgan, who wrote this week:

- “The steady fall in US Treasury yields, despite a strong economy and a large deficit, raises the prospect that the US could join the zero bond yield world of Japan and Europe in the next few years,”

JPMorgan was not alone in the 10-year yield going to Zero call. Kyle Bass said the same to Financial Times this week. Actually Bass is not just saying, he is betting on it:

- “He is betting that the current US economic slowdown worsens into a recession by mid-2020, which will force the central bank to move monetary policy back to its financial crisis setting — and stay there for the foreseeable future. “As we have all learned, once an economy falls into the tractor beam of zero rates, it’s almost impossible to escape them,”

What has this week’s fall in yields done to those who sold during the last couple of weeks?

- Raoul Pal@RaoulGMI – Jeez… I spend a week running around NYC for Real Vision and I took my eye off Eurodollars for one day and they start exploding higher again! Need to add more… much more

Not to worry though. If the 10-year rate is going to zero, then so is every rate from overnight to 10-years. So lot’s of room to buy. Look the German 2-year rate closed the week at minus 80 bps. As the old tenet says & as everyone found out in 2008 – Fading the Rate Cycle Never Works on the Way Down : Or as Juckes says, buy the 2-year Treasury until before the last rate cut.

The big message is that the ECB is almost completely out of ammunition and is crying for a fiscal stimulus from Germany & so will the Fed soon. Of course, we are much more likely to get a fiscal stimulus from President Trump than from the ostriches in Germany.

Perhaps not a fiscal stimulus like an infrastructure program given the suicidally stupid behavior of the Pelmer gang. But a coordinated Treasury-Fed action to take the Dollar down is likely.

Perhaps we were wrong in describing this week’s performance of Treasuries as “stellar”. Because if that is stellar, what adjective could we give to the performance of Gold miners? GDX was up 7% & GDXJ, junior miners, was up 10% this week. And Silver was up 6.5%.

Does the “Fading the Rate Cycle on Way Down never works” dictum also apply to the Gold on the upside? If the 10-year yield is going down to zero & there is non-trivial probability of a Dollar intervention by the US Treasury & the Fed, then is fading this gold rally for a few percentage points wise? Of course, now that we are scoffing at the Candles-etc stuff we see, Gold will throw egg in our face by falling hard, especially if the Fed only eases, hawkishly eases, by 25 bps.

3. US Stocks

As we saw on Friday, the action in stocks seems tied to the expectations of easing on July 31. Beyond that we don’t claim to have a clue.

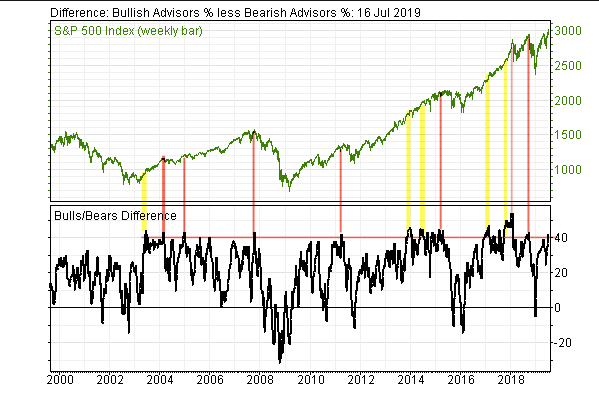

- Urban Carmel@ukarlewitz – Investor Intelligence bulls-bears now >40%. Fund flows telling a different tale, but it’s definitely time to pay close attention to sentiment w/ $SPX up 20% ytd, at 3000 and w/ less favorable seasonality until autumn

A similar message from technician Carley Garner was communicated this past Tuesday by Jim Cramer:

A similar message from technician Carley Garner was communicated this past Tuesday by Jim Cramer:

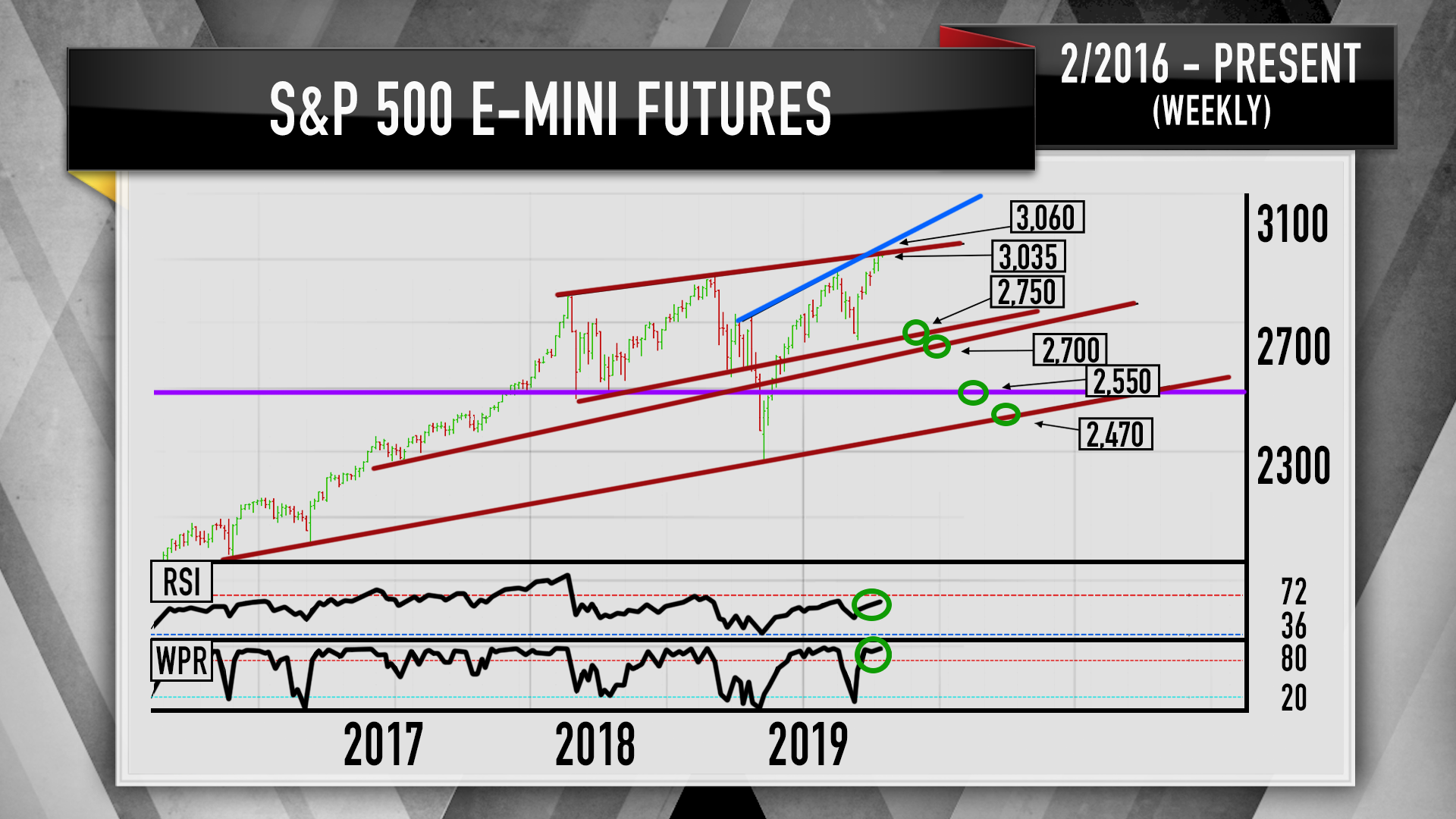

- “Ever since the meltdown late last year … Garner’s been bullish on the stock market — that’s one of the reasons why I like her — she’s been dead right, but all along she has been using 3,000 as her target for the S&P,”

- Furthermore, the relative strength index (RSI), a momentum measurement, is nearing the overbought threshold of 70 and the Williams %R oscillator, another momentum indicator, is already in extreme overbought territory at 99, Cramer said.

- “This suggests the S&P has come up too far, too fast. When both of these oscillators are at extreme highs, you often see the same pattern: the buying starts to dry up and a correction, there’s the keyword, begins,” he said.

- If Garner’s predictions prove true, she says the S&P 500 could drop to the low 2,700s and, in the worse case, as far as 2,470, Cramer said.

Watch the clip below:

But what about after the correction?

- Tony Dwyer@dwyerstrategy – Looking forward to our near-term correction call followed by move toward our 2020 target of 3350. “Slop then pop”

What about EM? Kit Juckes of SocGen puts it simply in his clip above – if the Fed manages to avoid a recession, then emerging markets are cheap; Otherwise, their cheapness is illusory.

Send your feedback to [email protected] Or @macroviewpoints on Twitter