Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.What a fall was that?

- Charlie Bilello@charliebilello – The S&P 500 closed below its 50-day moving average last week for the first time since last November, ending the 10th longest uptrend in the index since 1950.

Was the size of the fall the problem or was it the speed of the fall?

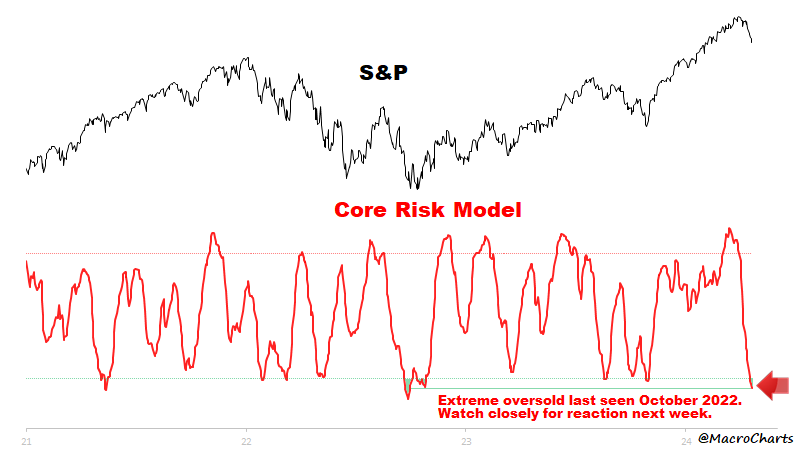

- Macro Charts@MacroCharts – 4-20 – Core Systems extremely oversold: • Plunged since triggering Sell mid/late March; • One of the fastest drops in history; • Watching closely for turn UP; • IF confirmed, look for “A” bottom and potential *sharp* retracement bounce lasting 1-2 weeks – watch key supports for reaction; • Intermediate-term trend still looks to be down; • My broader Rates & USD view remains the same. Good luck next week.

Does the fall, or at least the speed of the fall, have anything to do with positioning?

- Markets & Mayhem@Mayhem4Markets – Sat – Hedge fund gross leverage is at 270%, according to Goldman’s Prime Desk. That’s awfully high, and could add to potential volatility. Leading to highly shorted stocks and macro products having pops if the market drops, and exaggerating downside in crowded areas like Mag 7.

- Markets & Mayhem@Mayhem4Markets – Net long, but both sides of the book are irresponsibly big

What about sentiment, you ask? Hark back to what the usually sober & staid Rick Rieder said after the Non Farm Payroll report on April 5 – “when you step back, there is something really impressive going on here“. We had watched & heard him several times before. But we had never seen him so exultant on TV before as others can watch at https://www.youtube.com/watch?v=Wc9jERKD7n4&t=2319s. To us “his sheer delight” seemed a sentiment signal that only the mucho big shots can deliver. Just look what happened from Monday, April 7.

That was then & this is now, as one describes it below:

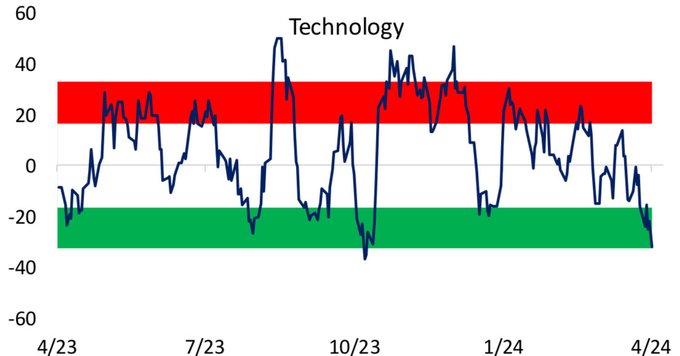

- Bespoke@bespokeinvest – The Tech sector’s 10-day advance/decline line now sits at one of its most extreme oversold readings of the last year…

The above chart shows that the October 23 selloff was worse. Is there any other factor that is similar to October 2023?

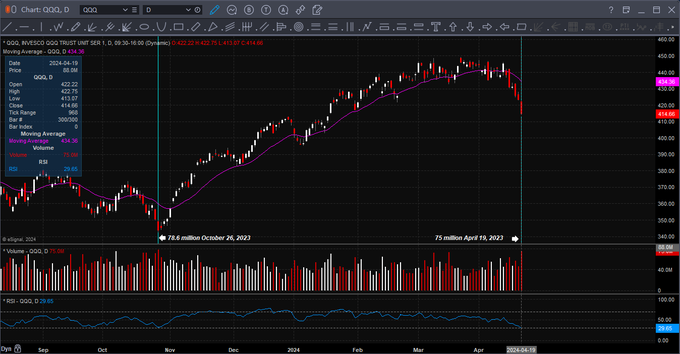

- Trader Z@1TraderZ – Apr 19 – $QQQ traded 75 million shares today. The last time it traded higher volume was October 26, 2023 at 78.6 million shares.

A “fleeting opportunity” as one described it:

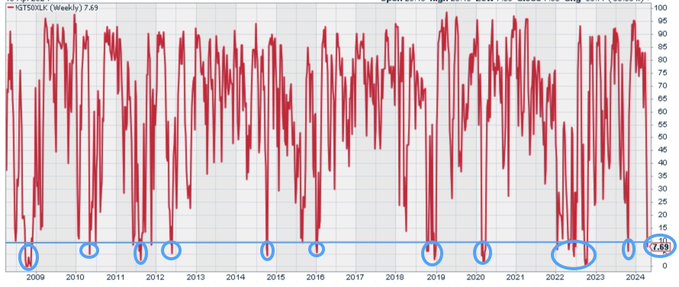

- Seth Golden@SethCL – The Red, White & Blue land of opportunity! Only 7% of Tech stocks were trading above their 50-DMA to end the week. In bull markets, this is a fleeting opportunity as a bounce has proven imminently profitable. $SPX $QQQ $SPY $XLK $AAPL $NDX

Some didn’t wait till Monday:

- Jason@3PeaksTrading – Apr 19 – $NVDA into the selloff seeing large unusual buys now for over 14,000 June $1100 calls at $8.00 to $10 in size lots … Things that make you go hmmmm

- Jason@3PeaksTrading – Apr 19 – Microsoft $MSFT holding up decent in this mess today and sees a massive buyer of 7000 Dec 2026 $360 calls at $110.55 adjusting the $380 calls

But what about next week, you ask? In turn, we ask our tried & true practitioner:

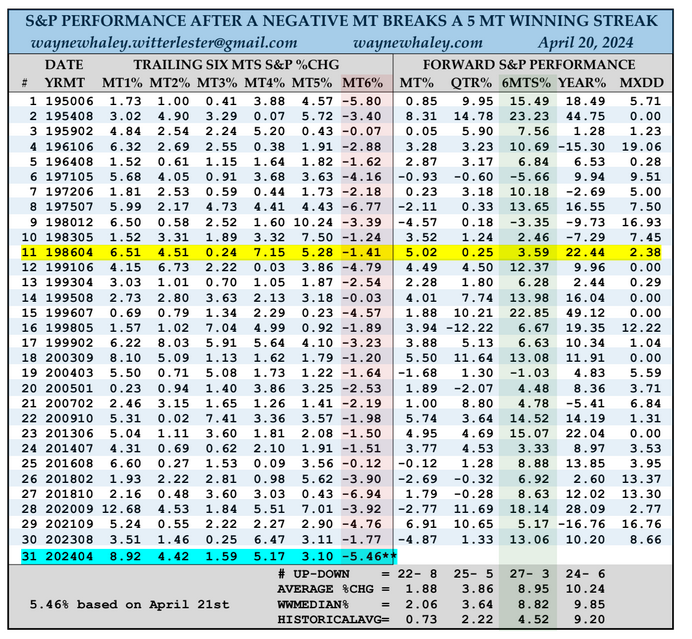

- Wayne Whaley@WayneWhaley1136 – WHEN A FIVE MONTH S&P WINNING STREAK IS BROKEN – With seven trading days remaining in the month of April, the S&P is currently down 5.46% for the month & likely facing the end of a five month winning streak with the rally that began on Oct 27 topping out at 27.6% on March 28. Since 1950, I see 30 prior occasions of a losing month breaking a five month winning streak with the forward performance, on average, exceeding the norms at all the usual suspect levels with the forward six month performance showing out at 27-3 with an average six month gain of 8.95%. The 10% moves, six months later were 13-0, supporting the thesis that a Bear Market, at least from this study’s perspective, is currently likely not in the making. A handful of the cases did run into problems in the second six months. I highlighted 1986 because it is an analog we have been following since January and now, similar to 2024, posted five consecutive positive months November through March before a negative April.

Having begun this discussion with the venerable Rick Rieder, we feel we should end it with him on CNBC on Thursday, April 18:

- ” … I still think the Fed would like to get 1-2 rate cuts done this year; we need the data though; …. service inflation is still too high; … I think the Fed should get rates down 100 bps; they would like to get it there; …. much of the US economy today is not rate-sensitive – we have a digital economy, a service economy … what is interest rate sensitive is low income, small banks, small business, real estate – so what happens is you create a pernicious impact on parts of the economy … “

True that!

2. Market this past week

Most sectors & markets were down this week, except the U.S. Dollar, Gold-Silver, Copper and a few sectors like Banks. Bonds were down – Treasuries, credit & international. Oil was down as well. Interest rates went higher as well. This raises interesting questions as are posed below:

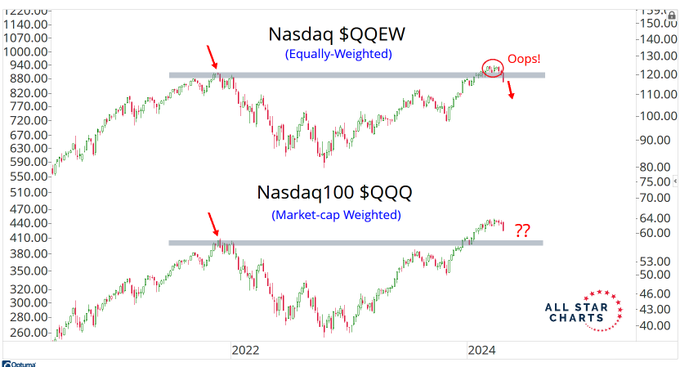

- J.C. Parets@allstarcharts – Now that the equally-weighted Nasdaq100 failed and is officially back below those 2021 highs, is the market-cap weighted version vulnerable to do the same?

We all know what happened to the Mags who populate QQQ – AAPL down 6.4%; AMZN down 5.9%; META down 5.3%; MSFT down 5.6%; NFLX down 10.9%; NVDA down 12.6%.

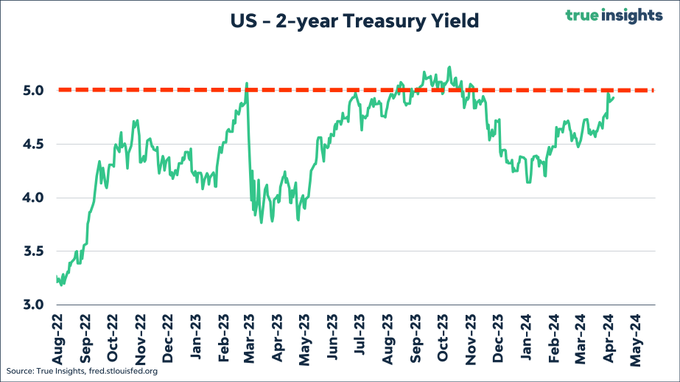

All these stocks are scheduled to report earnings in the next two weeks. That will answer the question posed above. Also it would help QQQ if Treasury rates, especially long duration rates, stabilize & inch downwards. That, according to one, depends on the number 5:

- jeroen blokland@jsblokland – 5% #yield has proved a catalyst for things starting to fall apart on several occasions in recent years. Will this time be different?

3. India & Indian Energy

India’s mammoth election has begun & will take until early June to conclude. Currently, that market has priced in a big win by PM Narendra Modi. Obviously, if that fails to materialize, we will see a big correction. Even with Modi’s expected victory, there is a question of how Indian growth will maintain its expensive multiple.

We have focused on identifying new sectors that are not priced in today’s market structure for India. One we have discussed at some length is India’s emerging defense sector in which previously laid back companies are now focused on new arms development & selling those to friendly nations.

Solar & Wind

Today we focus on a mega clean energy project that is being built on a spectacular scale. In a barren land about 4 km from the international line of control with NaPakistan, Adani Green Energy is launching a solar & wind project with an area that is about 5 times the size of Paris with the ability to meet all the energy needs of a country like Belgium, Switzerland. “With the second best solar radiation in the country after Ladakh and wind speeds five times of plains“, this barren land is an ideal location for a renewable energy park.

CNN titled its story as A coal billionaire is building the world’s biggest clean energy plant and it’s five times the size of Paris.

Nuclear – PFBR has begun fuel loading

The above solar & wind project is impressive indeed. But does it really match the amazing delivery of power for the next 10,000 years & perhaps for next 60,000 years? Nuclear power elsewhere has always been associated with availability of Uranium in plenty. Not any more. We direct you to an article in World Nuclear News (WNN) on March 4, 2024 titled Fuel loading begins at Indian fast breeder reactor.

- A fast breeder reactor is one that generates more Uranium as output than what was fed as input. And the above PFBR, with closed fuel cycle as the energy resource, is capable of generating a large amount of U-233 (a fissile isotope) from the abundant available thorium-232 within the country, to launch the third stage nuclear energy program based on U-233 fuel cycle.[5]

- India has the capability to use thorium cycle based processes to extract nuclear fuel. This is of special significance to the Indian nuclear power generation strategy as India has one of the world’s largest reserves of thorium, which could provide power for more than 10,000 years,[6] and perhaps as long as 60,000 years.

India has 930 million tonnes of Thorium deposits followed by USA with 630 million & Australia with 300 million tonnes. When the Indian nuclear program began in mid 1960s, the dream always was to develop a fast breeder technology to use India’s thorium deposits. Now India has become the 2nd country (after Russia) in the world to build & operate a fast breeder reactor. Once this technology is used in size, it can commercialized & exported to nations who are not blessed with oil. Watch & listen to a simple explanation of the PFBR Reactor:

Alexander the ordinary – India’s Mental Independence

Anyone who knows even the barest outline of Indian history knows that India has been a continuous civilization since antiquity and antiquity to Indians is not Greece but a couple of millennia before Greece. And those pre-Greece years have been documented by story telling texts that go back way before Greece.

But, as India’s National Security Advisor, pointed out in a speech that every Western study or description of India & its society begins with Alexander in India while NO text in India has even mentioned Alexander at all. Because his border venture with India was so minuscule & ended so quickly & disastrously that it was insignificant. And Alexander’s army rebelled, after one battle with a minor boundary king, and forced Alexander to retreat via the Indus River to today’s Arabian sea & then walk to today’s Balochistan. This has been well documented by Greek authors who accompanied Alexander.

- And so many know it. We have heard that Field Marshal Zhukov, the victor of Moscow & Stalingrad and the man who drove German army from Russia into Berlin & won Berlin, mentioned this history of Alexander in his lecture at Dehradun War College in 1957. He said his strategy in fighting Hitler was based on the strategy used by Marshal Kuznetov against Napoleon and that Kuznetov had studied it from how Alexander’s army was driven from Indus Valley to escape in tatters to Iran. It is noteworthy that Napoleon won a couple of victories after returning from Russia & Hitler fought a few in Normandy until Zhukov took Berlin. Not only did Alexander win any battles after his flight to Iran but he never went back to Macedonia. Instead he chose to stay in Iran.

NSA Doval brings this to the attention of his listeners as he teaches them how fake history is created & thrust upon others as a mental invasion.

This is a fundamental change & an adherence to mental independence that characterizes the Modi administration.

Send your feedback to [email protected] Or @MacroViewpoints on X.