Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Markets last week

Generally a back to normal 2024 week with Stocks up, Bonds down:

US Indices:

- VIX down 15.06%; Dow up 67 bps; SPX up 2.7%; RSP up 1.7%; NDX up 4%; SMH up 9.2%; RUT up 2.8%; IWC up 2.2%; MDY up 2.3%; XLU up 2.3%; XLI up 1.6%;

Key Stocks & Sectors:

- AAPL up 2.6%; AMZN up 2.9%; GOOGL up 11.7%; META down 7.9%; MSFT up 2.1%; NFLX up 1.2%; NVDA up 14.8%; MU up 7.7%; BAC up 2.4%; C up 5.9%; GS up 5.9%; JPM up 4.3%; KRE up 2.4%;

Dollar was down 7 bps on UUP & down 13 bps on DXY:

- Gold down 2.2%; GDX up 1.3%; NEM up 9.1%; Silver down 5.4%; Copper up 1.6%; CLF down 13.1%; FCX up 1.4%; MOS down 2.6%; Oil up 53 bps; Brent up 2.3%; Nat Gas down 8%; OIH up 72 bps; XLE up 81 bps;

International Stocks:

- ACWX up 2.7%; EEM up 3.6%; FXI up 7.5%; KWEB up 13%; EWZ up 1.9%; EWY up 3.2%; EWG up 2.3%; INDA up 2%; INDY up 1.4%; EPI up 2.7%; SMIN up 4.4%;

And all the above in spite interest rates moving up:

- 30-year Treasury yield up 6.4 bps on the week; 20-yr yield up 4.7 bps; 10-yr up 4.4 bps; 7-yr up 4.4 bps; 5-yr up 3.7 bps; 3-yr up 2.2 bps; 2-yr up 4.3 bps; 1-yr up 4 bps;

- TLT down 1%; EDV down 1.6%; ZROZ down 1.8%; HYG up 84 bps; JNK down 22 bps; EMB up 10 bps;

A couple of sector comments based on the above:

- Bespoke@bespokeinvest – Thu 4-25 – Don’t see the Nasdaq 100 $QQQ down over 1% and the semis $SMH up over 1% on the same day too often. So far today: $QQQ: -1.2%; $SMH: +1.6%

The reason for this unusual action is that the main reason for META’s disappointing earnings was its large investment spending on its AI efforts & AI chips-data centers. And who benefits the most from spending on AI – NVDA which rallied 14.8% this week while META fell almost 8%. So a divergence between Mag gang based on who benefits from whom favors the Semis.

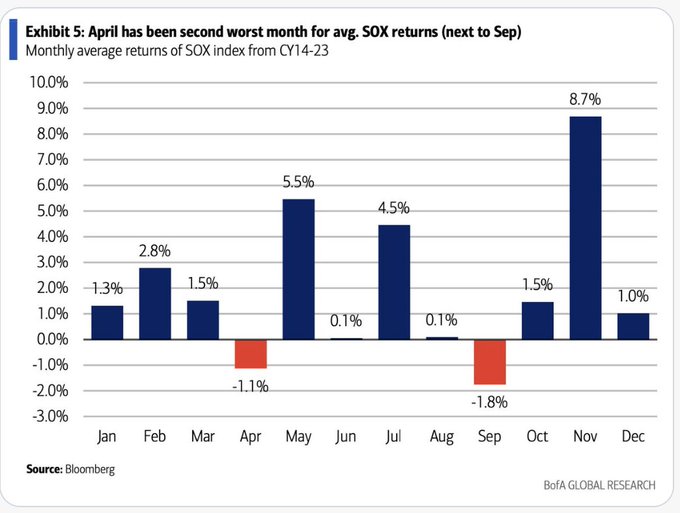

- Seth Golden@SethCL – BofA: Do you own semis? April is 2nd worst month of year for SOX returns but May is the 2nd best for returns. Get you some! $SPX $QQQ $SMH $SOXX $SOXL $NVDA

But how does XLU, the Utilities ETF, go up when interest rates are up across the Treasury curve? Spell AI again:

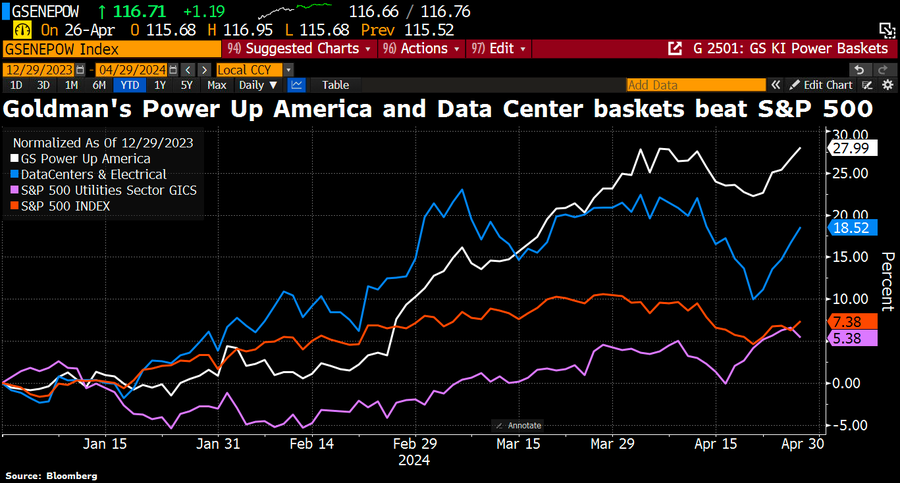

- Holger Zschaepitz@Schuldensuehner – The AI boom is set to drive a rally in what’s traditionally the most boring corner of the stock market: utilities. Utilities to see booming demand as more data centers go online. Power consumption will increase massively. Goldman’s Power Up basket has soared 28% and the Data Center Equipment basket is up more than 18%. https://bloomberg.com/news/articles/

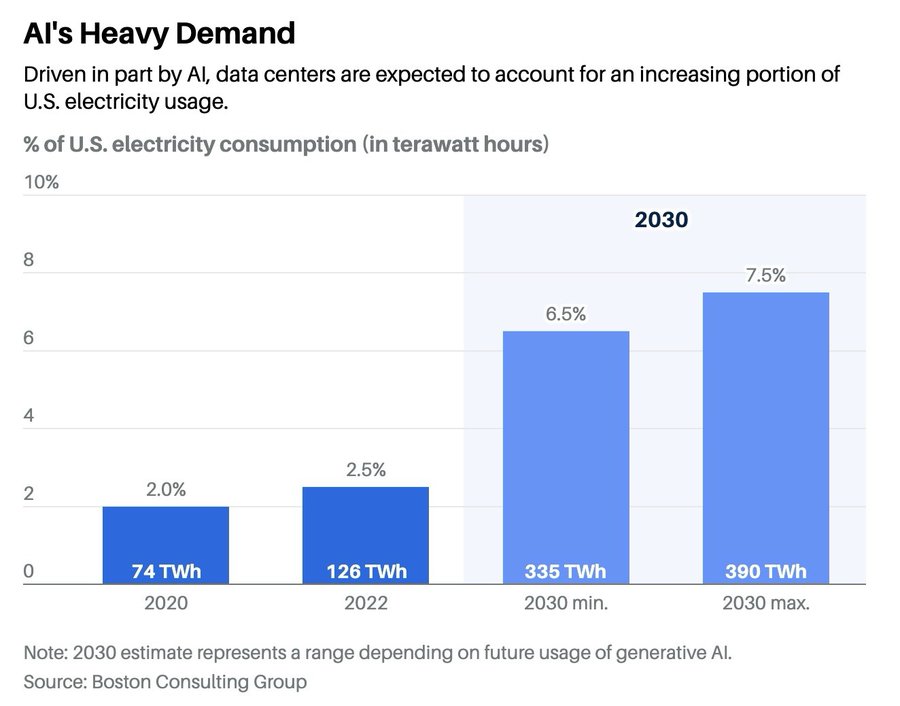

To add a little more detail:

- Nikolay Kolarov, CFA@libertniko – There was some research recently on this topic, showing that that data centers could comprise up to 7.5% of total U.S. electricity consumption by 2030 or 390 terawatt hours, the equivalent of the equivalent usage of 40 million U.S. homes. BCG projects that most AI GPUs will draw 1,000 watts of electricity by 2026, up from the roughly 650 watts on average today

Re another sector:

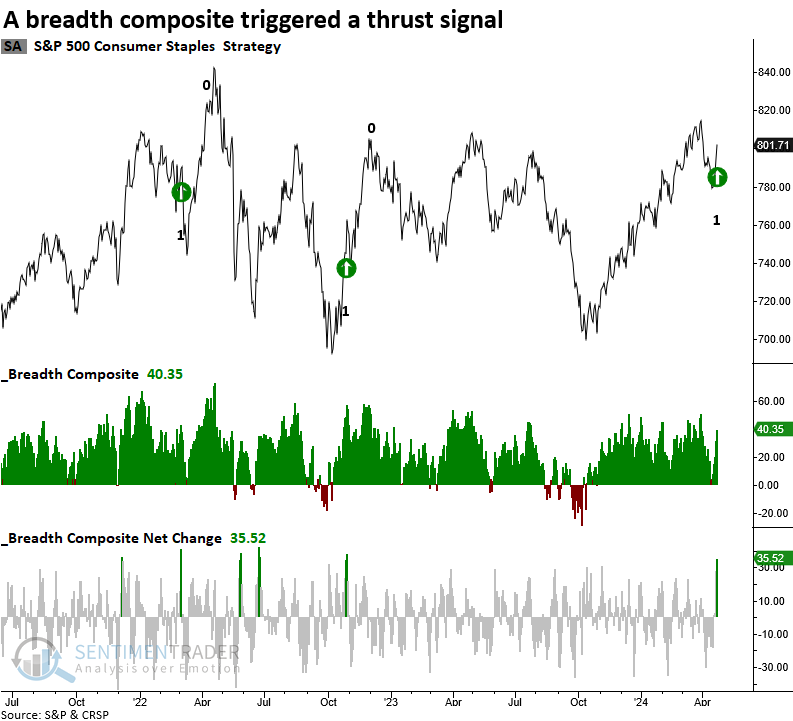

- SentimenTrader@sentimentrader – Consumer Staples triggered a thrust signal when the five-day net change for a breadth composite surged by 35%. I usually avoid highlighting thrust signals for defensive sectors as they rarely provide a compelling outlook on an absolute or relative basis. However, this is one of the exceptions.

2. Treasuries & Credit

Certainly Chair Powell’s presser on Wednesday, May 1 will be the most important factor at least until mid-week. But will the Treasury refunding news create waves before that?

- Markets & Mayhem@Mayhem4Markets – Apr 26 – QRA will likely be bill-heavy again. There’s still enough liquidity to keep that game going for a bit longer. That, in turn, is likely to be well-received by markets.

Wednesday morning comes the ADP number followed by the all-important Non Farm Payrolls Report on Friday. So Chairman Powell’s presser falls right in between.

We have believed that owning Treasuries or TLT in Q2 is not an ideal winning trade until at least June. We have shown parallels to 2008 a few times. So today let us also look at the parallels to 2000, another election year that began strong & ended with an economic slowdown:

(10-yr yld – TNX- 2000) (10-yr yld TNX-2008)

Now notice that the same chart looks angrier & worse in 2024:

We don’t need to repeat it but the 10-year Treasury yield fell hard in both June 2000 & June 2008. And the Treasury yields kept falling until year-end.

Frankly how dare we consider 2000 & 2008 to be even remotely in the ballpark of the so far powerful 2024? Believe it or not, a tweet of Ryan Detrick gives us that courage:

- Ryan Detrick, CMT@RyanDetrick – Mon 4-22 – “Even God himself couldn’t sink this ship.” – Capt. Edward John Smith, Captain of the Titanic ; “The Federal Reserve is currently not forecasting a recession.” Ben Bernanke in Jan ’08, after the worst recession in a generation had already started – Great finds from @bespokeinvest

And this time, there are already some signs that the past might be in our future again:

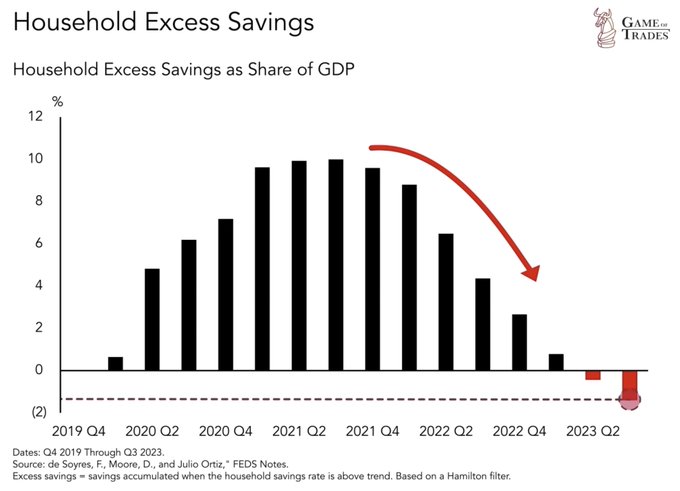

- Game of Trades@GameofTrades_ – 4-23 – CAUTION: Households have officially run out of excess savings; The current levels are the worst they’ve been in the past 5 years

Perhaps leading to:

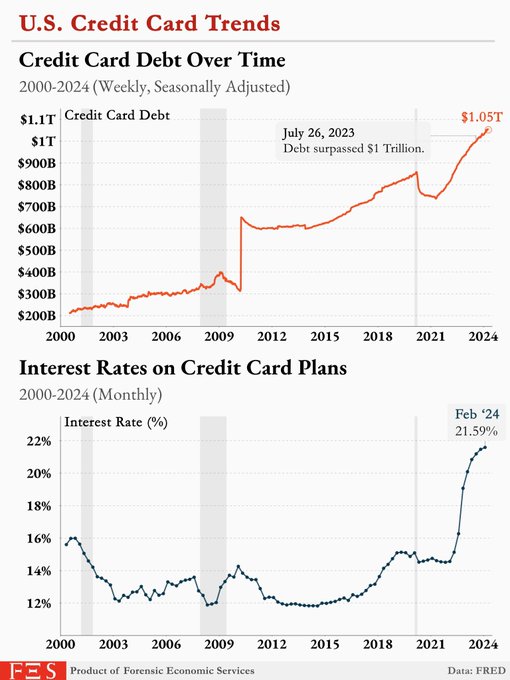

- Markets & Mayhem@Mayhem4Markets – Thu – Credit card debt and interest paid on credit cards are both at all-time highs, as more Americans in the bottom 50% of earners borrow to make ends meet after inflation gutted their budgets.

And we again saw the R-word from the pen of our favorite bear:

- David Rosenberg@EconguyRosie – Has a freight recession resurfaced? The state of the freight industry is looking soft as Old Dominion Freight, Knight-Swift, J.B. Hunt and UPS all had some sort of negatives emerge from earnings/guidance. Beyond that, the Dow Transports are off nearly -10% from the cycle high.

That kinda fits in with the Consumer Staples Thrust signal above, right? And it also does fit with the RenMac view:

- RenMac: Renaissance Macro Research@RenMacLLC – The recent inflation scare and rally in metals coincides with typical seasonality for the materials sector. Both presidential election years and off cycle years see material’s performance peak in the spring historically. $XLB $IYM $VAW

On the other hand, look what we saw near Friday’s close:

- Jason@3PeaksTrading – Apr 26 – Treasury $TLT into the close a large trade buys over 28,000 September $85 puts at $1.95, large lots.. oh boy

And that does fit with:

- Jay Kaeppel@jaykaeppel – Apr 24 – T-bond futures traders are about as bullish as they can be (“But…bonds HAVE TO bounce at some point!”). Historically speaking, that has not been a favorable sign. @sentimentrader

3. Stocks

What if we are twice blessed and we may look long term?

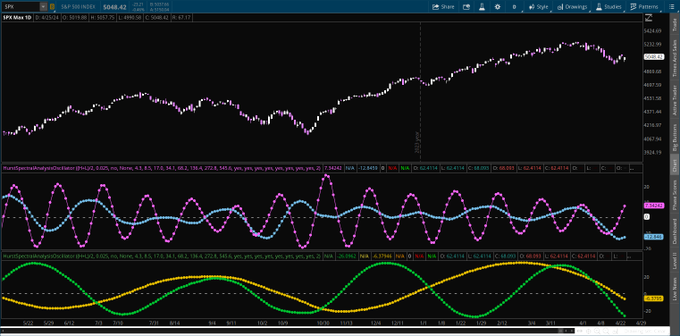

- Trader Z@angrybear168 – Fri 4-26 – $SPY longer term cycles starting to bottom out, we are probably closer to a bottom than a top, maybe more fake outs to trap some bears then resume the uptrend.

But why we did wonder about being “twice blessed”? Everybody now knows the impact that Zweig Breadth Trust can have! And remember, as @RyanDetrick, pointed out, last year had two Zweig Breadth Thrusts! Could we so twice blessed again this year?

- Cam Hui, CFA@HumbleStudent – Apr 27 – 4 of 5 thoughts for the weekend. Zweig Breadth Thrust watch: 10 day window ends May 2, which is the day after the #FOMC meeting. Check us out for more investment & trading insights https://buff.ly/2pl42Wy

Is there any potential omen that might help on Tuesday, April 30?

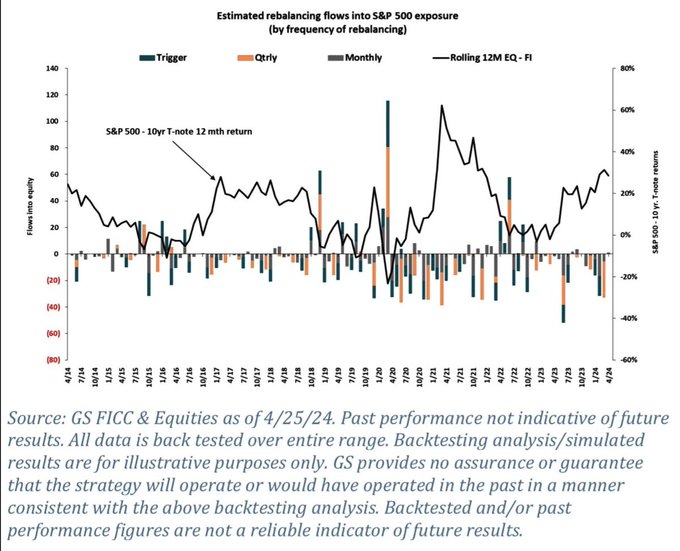

- Seth Golden@SethCL – 4-28 – Goldman Sachs on Month-End Pension Rebalancing: “Heading into month-end, model estimates $1 billion of US equities to buy from pensions given the moves in equities and bonds over the month. $SPX $SPY $QQQ $DIA

What does our tried & true soothsayer say about next month?

- Wayne Whaley@WayneWhaley1136 – S&P PERFORMANCE AFTER THE FIRST NEGATIVE MONTH – FOLLOWING A TOY HAT TRICK – This is one of seven S&P studies shared with my commentary subscribers this weekend, plus a Corn, Oil and Pound Study along with the seasonal history of 14 different markets over each of the next ten trading days. The positive December (4.4%), January (1.6%) and February (5.2%) put 2024 in the rare class of 26 Turn of the Year (Toy) Hat Tricks which have occurred since 1930. With two trading days remaining in the month of April, the S&P is down 2.93% for the month and in all likelihood will book a negative month on Tuesday, thus ending a five month winning streak that extends back to November. Below is the performance after the first negative month following the 25 prior Toy Hat Tricks.

The 21-4 in the next month with 2 of those 4 losses fractional is the first statistic that catches my eye which would be the upcoming May this year. The 1% moves in the following month were 17-2 to the positive. Eighteen of the 25 cases experienced less than a 5%, six month, drawdown as measured from the signal Date

4. Commodities

Got to begin with:

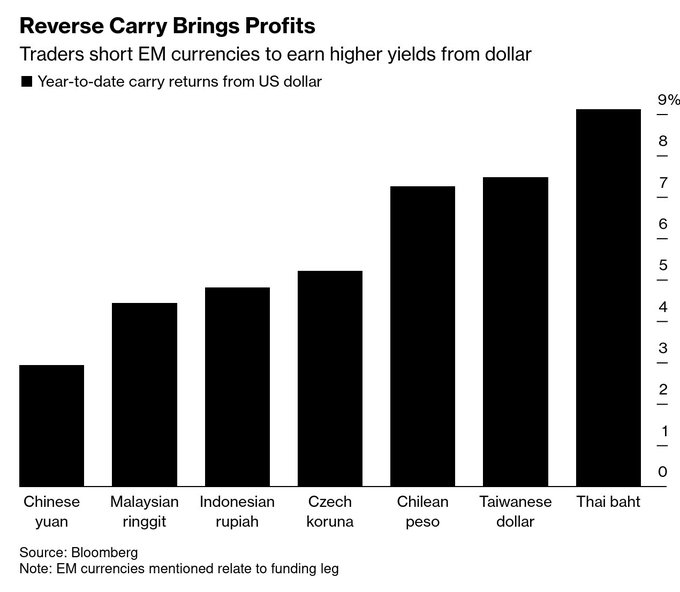

- Markets & Mayhem@Mayhem4Markets – 4-27 – Traders have been shorting EM currencies to earn higher yields from the dollar, bringing in large FX gains this year

No wonder commodity stocks have been hit hard! But what if this trend is also about to stabilize or even reverse a bit? Would that also make the following work well?

- Otavio (Tavi) Costa@TaviCosta – 4-27 – This chart is fascinating. Gold miners, arguably the most hated industry in today’s markets, are also at their most undervalued state in 40 years based on their price-to-net-asset-value ratio. I call this the perfect storm.

Is the below similar?

- Otavio (Tavi) Costa@TaviCosta – Apr 27 – Buy low and sell high. Natural gas is currently re-testing the lows of its prior 7 major bottoms. If you ask me, time to step in.

John Kolovos, Macro Risk Advisors chief technical market strategist addressed all three asset classes on Friday on CNBC. He feels Oil could rise to $100, even to $120. He said the 10-year yield could break above 5% & that would cause the S&P to fall to 4,600. On the other hand, if the 10-year yield does go over 4.72%, the S&P could drop to 4,800. His upper case for this bounce is 5,150. Watch & listen yourselves:

5. A positive Long-Term geopolitical event underway

The election in India could end up having an outsized geopolitical impact either short term or long term. A loss of PM Modi’s majority would be hugely outsized & no one can imagine what that might bring. Some observers believe that it will prompt China to begin a border war with India. They feel China needs to scare off the Asean States & America from risking a war with China. But that requires PM Modi to lose & create significant uncertainty in India.

The real question about the election is the size of PM Modi’s victory. For a true landmark victory, his party has to win some of the southern states. Below is a rare sensible article by a non-Indian publication about what Indian voters want:

- The Diplomat@Diplomat_APAC – The BJP’s vision for India is largely in sync with what most Indians want – an India that is a military and economic power that they can be proud of. https://buff.ly/3Q8MvOm

Below are a few excerpts from the Diplomat article:

- India is a very different place than it was ten years ago, especially for poorer, rural, and less-educated Indians. In sum, most Indians have now entered – and can interact with – the modern world because of improvements in physical infrastructure, internet access, and consistent electricity. This is a step in the direction of national integration: More Indians than ever are aware of and can be mobilized on issues of national, rather than merely local, import.

- Infrastructure has improved dramatically under Modi. Under the present BJP government, more than half the population is connected to the internet, while the size of the national highway network has doubled. India has also built a network of semi-high-speed trains, the Vande Bharat Express.

- the BJP’s view of India as a civilizational entity going back thousands of years, even if it was not always politically united. Which vision is going to resonate more with the average voter?

- According to a Pew survey from 2021, 96 percent of Indians are proud to be Indian. On top of that, 72 percent of Indians believe their culture is superior to others, and 57 percent said that being Hindu was important to being “truly Indian.” Hindu voters also note that the BJP fulfilled its promise to build the Ram Mandir in Ayodhya, a widely popular move. There is a huge divide between [Rahul] Gandhi’s sense of what India is and the beliefs of the average Indian voter.

- Most people, in any country, want their nation, within reason, to become a major military and economic power, and to feel pride in both their history and their future. The BJP, and Modi in particular, have managed to capture these emotions and aspirations much better than the Congress and Rahul Gandhi. This is why Indians want Modi again.

And so does an old civilizational friend of India that is also a true modern geopolitical friend. Yet, the opposition to PM Modi never built on the friendship between the two people &, instead, uttered platitudes about the rights of those who attack, rape & kill. That has changed totally with PM Modi & read what India’s foreign minister said to media:

- Press Trust of India@PTI_News VIDEO | “Think of a country like Israel, people speak today, saying everybody is the same and we should not bring faith into any discussion. Israel became independent in 1948; from 1948 to 1992, we choose not to have an Ambassador and an Embassy in Israel. Why? From 1992, we had an Embassy; from 1992 to 2017, when PM Modi went to Israel, no PM of India ever went to Israel. Think about it, and then tell me that faith has no influence on our policy. What is it? Is it not vote bank?” says External Affairs Minister S Jaishankar (@DrSJaishankar), attending an event in Hyderabad. http://ptivideos.com (“https://twitter.com/i/status/1782771198746591328”)

6. Now to the horror that unfolded on our TVs

First look at the acts of those are now spewing hate on Israel & the same hate they spewed against India & their acts that even normally bad people would shudder to think of:

🇵🇰 Pakistan: Reshma, a 9-year-old Hindu girl in Sindh, was forcibly abducted, taken to a Sufi Dargah, converted, and married to 45-year-old Wazir Hussain. According to Pakistan's court and laws, this marriage is validated, stating she is 19 years old and accepted Islam willingly.… pic.twitter.com/WkDxHdJiDm

— Shunya (@Shunyaa00) April 23, 2024

A 9-year old girl raped by & then forcibly “married” to a 45-year old Napaki Muslim who, perhaps like others, will get rid of her after being done with her. Yet, no one in the US political arena even bothers to think of hundreds of thousands of such girls treated so in NaPakistan. Instead, the US Human Rights groups lecture the Indian government.

But that is & was against Hindus, a people that have suffered so since 1200. What we saw this week was utterly horrifying & completely unimagined. What America has now found that the poison you allow to circulate within you body politic eventually becomes powerful enough to challenge you. For almost 16 years, we have watched as previously noble universities allowed infiltration & semi-dominance of views, practices & demands that would have been totally inadmissible merely two decades ago.

Fortunately, at least in our opinion, the evil has been so outspoken, so scary & so demanding that even previously supine administrations are waking up & arresting those who cross a line. So we do expect the arrests to lead to a cooling down in a couple of weeks or less.

But that is not enough. The United States is unique in having Courts with the power & morality to judge actions of those in power who refused to act the way they should have & thereby violated their own obligations. We are not smart enough to discuss this the way Honorable Bill Ackman did this week. With his courtesy, we insert his tweet below:

- Bill Ackman@BillAckman – – Recent events at @Harvard , @MIT , @Columbia et al couldn’t provide more prima facie supporting evidence for the various Title VI and class action lawsuits against the universities. The complaints just need to be updated to include the new facts. The plaintiffs are going to have a field day in court. The universities’ unwillingness to follow their own stated rules has emboldened the protesters to amplify their anti-Israel, antisemitic, and anti-American messaging and actions. It’s remarkable that even the likely severe economic costs of the litigation doesn’t motivate the administrations and governing boards to address the situation. That’s likely because there are no shareholders and it is therefore other people’s money. Yet another failure of the non-profit model. I am surprised the state attorneys general have not gotten involved as they are supposed to be important ‘regulators’ of non-profits. While it doesn’t happen often, board members of nonprofits can be held personally liable for their failures as fiduciaries. I would not be surprised to see that happen here.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter