Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. Back to what we saw back then?

Frankly, we feel stupid about how we began our article last week. Yes, the tweets & charts about TLT were accurate & consistent with what we had pointed out on February 18. But we omitted to mention that this bullish message potentially had a short life until the 3rd week of March consistent with the pattern in 2008.

Look at the charts below from January 1, 2008 to July 1, 2008.

TLT TNX (10-yr yld)

TLT TNX (10-yr yld)

USO FCX

USO FCX

The first 2 charts show that the buy in TLT & fall in 10-yr yld began in late February this year just as in 2008. Now this week showed that this rally reversed hard this past week as it did in 3rd week of March 2008.

Look at the bottom two charts above to see that Oil & Copper bottomed in 3rd week of March 2008 just as 10-yr yield bottomed. This week, Oil, Copper & commodities broke out in the 3rd week of March 2024.

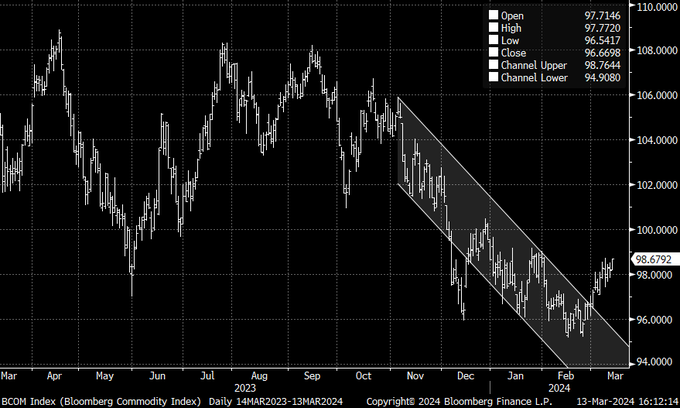

- Andreas Steno Larsen@AndreasSteno – Mar 13 – We have probably entered the part of the cycle where commodities start to thrive. BCOM breaking out of range. Silver, Copper and Oil look technically compelling here

Another was stronger in emphasis:

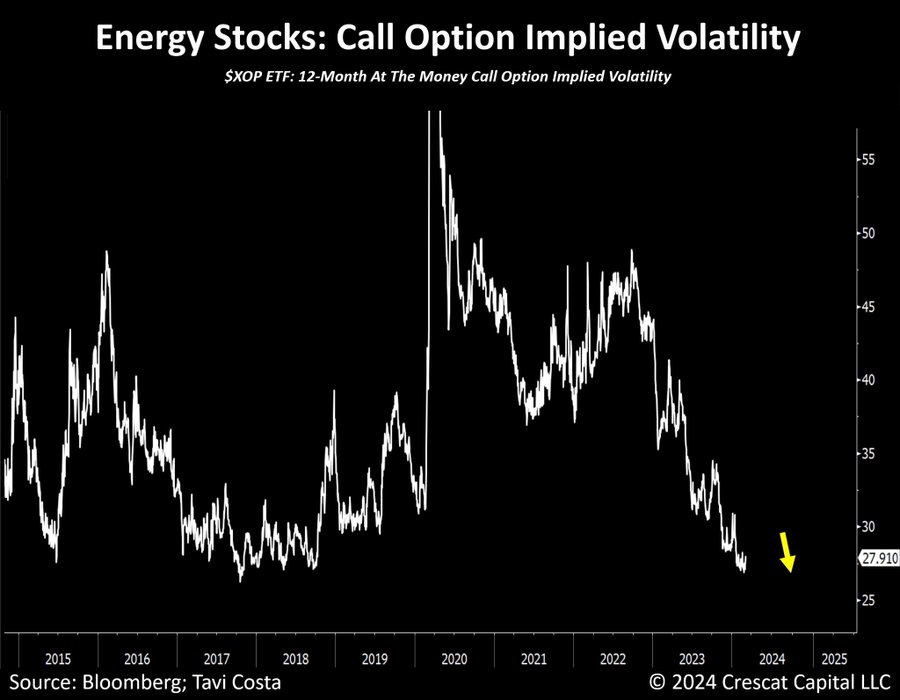

- Otavio (Tavi) Costa@TaviCosta – Today’s oil setup reminds me of gold a few months ago.

Energy has shifted from a prominent narrative to one that’s been largely neglected.

Consequently, notice that the implied volatility in call options for oil and gas stocks is now near historical lows. The $85/bbl is an important technical level, and a breakout above it could signal a substantial shift in the energy industry, potentially driving prices toward previous highs at $130/bbl.

Nothing speaks to the above as the move in Southern Copper (SCCO):

You know what this is saying:

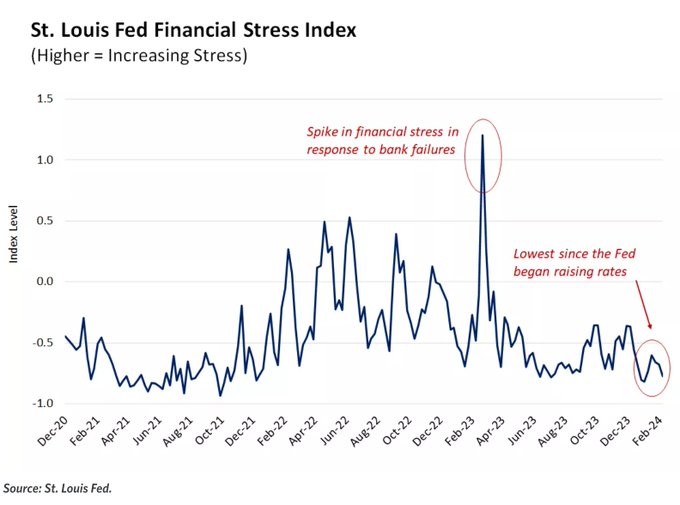

- Markets & Mayhem@Mayhem4Markets – March 17 – Financial stress is the lowest since the Fed began raising rates, which begs the question — why cut this year? 🤔

We will let the man paid to answer the above question do so in his presser on the coming Wednesday. But look at how his potential listeners reacted this past Wednesday:

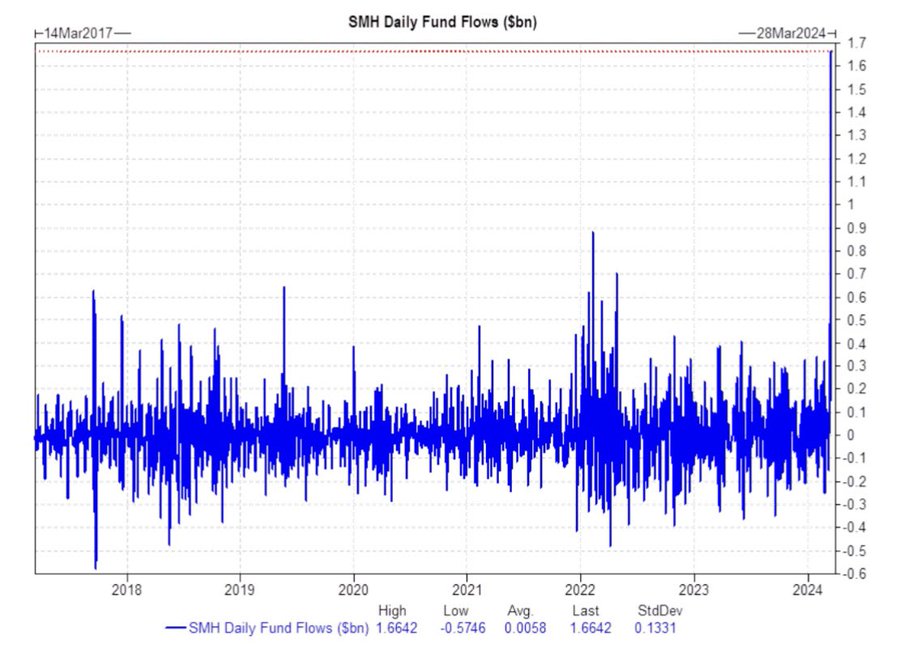

- David Marlin@Marlin_Capital – Mar 14 – $SMH, the top Semiconductor ETF, just saw its biggest daily inflow EVER yesterday. $NVDA $AMD $AVGO $SMCI

Inflows into S&P and QQQ were big as well. But what about those who feel nervous about jumping into stocks?

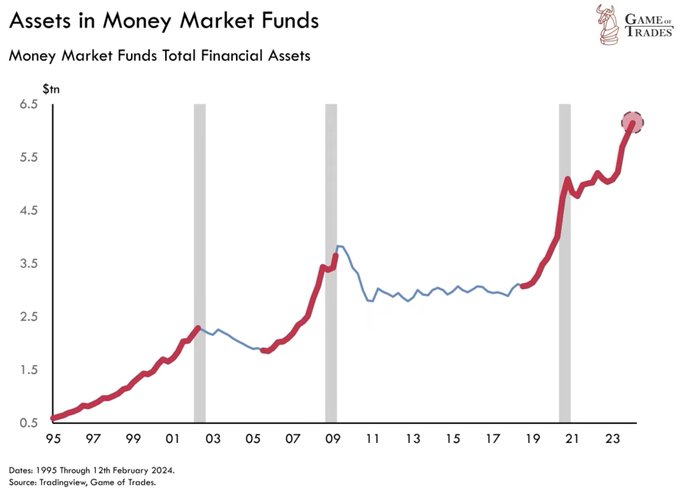

- Game of Trades@GameofTrades_ Mar 16 – Money Market Funds have crossed a shocking $6 TRILLION. Such sharp run-ups have only been seen 3 times since 1995: – Dot Com Bubble – Financial Crisis – Pandemic

2. The other side of 2008 first half

On Friday morning, Max Layton of Citi spoke with CNBC’s Mike Santoli to disagree with above Uber-bullish view of oil. He said:

- “… generally speaking, our house view is for a recession across the DM economies over the next 6-12 months which would be a headwind for demand growth; certainly as we look into 2025, the balances look really tough for the oil market … “

The views in Section 1 above were based on typical markets view- meaning viewing the economy from the action in financial markets. That is important because the Fed usually responds to what the markets are pricing. But just for the heck of it, why not look at what the non-markets part of America is going thru:

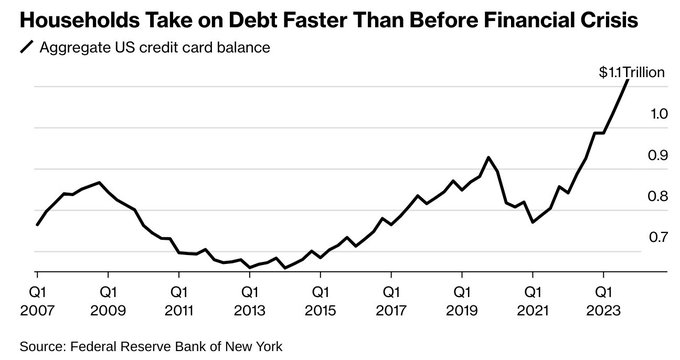

- Markets & Mayhem@Mayhem4Markets – Mar 15 – Some consumers have been binging on credit card debt, pushing it above $1.1T for the first time ever as many struggle to make ends meet, tapping into these revolving lines of credit to pay bills and buy necessities.

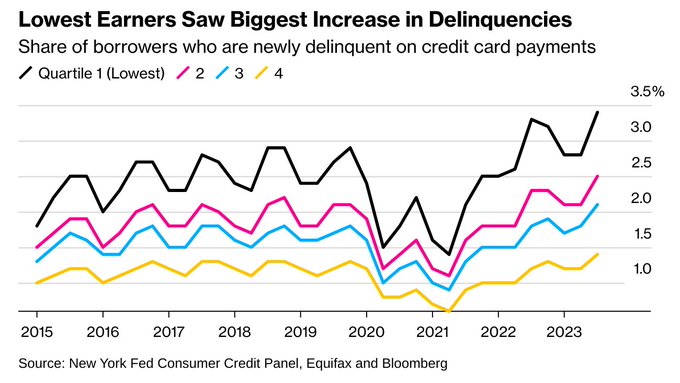

- Markets & Mayhem@Mayhem4Markets – Mar 15 – Lower earners are seeing the largest rise in delinquencies as high interest rates on credit cards add to budget pressure.

Some smart folks tell us that this is to be expected when Real Rates in the economy are so high. And Real Rates are high because the Fed has NOT cut interest rates. Therein lies the dilemma for the Fed – either lower Real Rates by cutting interest rates to benefit the majority OR avoid cutting rates until they feel compelled to for fear of markets going euphoric.

If you believe that the PRIMARY MISSION of the Fed is keep up its reputation, then you know they will do what the markets say they should. They remember, as all should, that Ben Bernanke did NOT suffer even a bit of blame for delaying easing until markets blew up in 2008. In fact, he got a Nobel Prize for rescuing the world economy in 2009 by pumping in massive amounts of money via TARP & QE.

Now let us expand our first half of 2008 view into full-year 2008 view below and observe that the huge rallies in Oil, Copper (FCX) in first half of 2008 were wiped out in the 2nd half of 2008 AND the plunge in interest rates led to a big rally in TLT .

TLT TNX – 10-yr yld

USO FCX

So many smart people have compared 2024 to 1995. They might well be proven right. Why don’t we agree? Just look below at how TNX (10-yr yield) behaved during 1995 & then compare it to how it is behaving now above (closer to 2008).

On the other hand, we will change our view IF the Fed launches a fast & deep rate cutting campaign & TNX starts behaving like it did in 1995. Sadly, our bet is that by the time Fed starts to cut gently, it will prove to be too late & too little.

Hopefully we will be proven very wrong.

3. Markets last week

Broad US indices were weak:

- VIX down 2.1%; Dow down 15 bps; SPX down 14 bps ; RSP down 52 bps; COMPX down 70 bps; NDX down 1.2%; SMH down 2.2%; RUT down 2.1%; IWC down 2.3%; DJT down 1.4%;

Key US Stocks:

- AAPL up 1%; AMZN down 27 bps; GOOGL up 4.2%; META down 3.2%; MSFT up 2.4%; NFLX up 34 bps; NVDA up 2.6%; BAC down 39 bps; C up 17 bps; GS up 5 bps; JPM up 1.1%; SCHW down 10 bps; KRE down 3.3%;

US Dollar rallied by about 70 bps:

International Indices:

- ACWX down 36 bps; EEM down 22 bps; FXI up 2.7%; KWEB up 8.8%; INDA down 3.2%; INDY down 3%; EPI down 5.3%; SMIN down 4.5%; EWZ down 90 bps; EWY down 71 bps; EWG up 52 bps;

Commodities:

- Gold down 1.1%; GDX up 44 bps; Silver up 3.8%; SLV up 3.6%; Copper up 5.9%; CLF down 5.7%; FCX up 11.8%; Oil up 4%; Brent up 4.1%; Nat Gas down 7.3%; USO up 4.1%; OIH up 4.5%; XLE up 3.8%;

Now for the real move – Interest Rates:

- 30-yr yld up 17.8 bps; 20-yr yld up 19.9 bps; 10-yr up 23.9 bps; 7-yr yld up 25.9 bps; 5-yr yld up 27.5 bps; 3-yr yld up 25.9 bps; 2-yr yld up 24.8 bps; 1-yr yld up 14.6 bps;

- TLT down 2.9%; EDV down 4.8%; ZROZ down 2.1%; HYG down 49 bps; JNK down 48 bps; DPG down 3.2%: UTG down 2.1%; PFF down 53 bps; EMB down 1%;

4. India – China – what happened in the Military meeting in late February 24?

Remember what we wrote last week:

- The timing of the 2-weeks old overture by Wang Yi & the same old rejection of withdrawal to pre-2020 line of control by Chinese Military is interesting to us. PM Modi’s re-election is coming up soon & China might be tempted to engage in a new encroachment & tussle with the India at the Line of Control to embarrass PM Modi. The new re-deployment of 10,000 troops & the creation of a new self-sustained Armored Corps might be a signal to China that this time India might not be content to play defense.

We were kind of naively foolish when we described the Chinese posture at the military meeting two weeks ago as being “interesting to us”. This week, the picture looks starkly different. Because 4 different major events took place this week which when taken together suggests heightened preparation to send bold, overt & unmistakable signals to China.

4.1 – At the other end of LoC across Bhutan to Tawang

Tawang is located adjacent to Bhutan at the extreme left corner of Arunachal Pradesh, the large area of strategic importance. China has always claimed Tawang (actually all of Arunachal Pradesh) partly because China claims everything & mainly because right out of Tawang, a force can be launched at Lhasa, capital of Chinese-occupied Tibet; Tawang where the last attempt of China was stopped & reversed thanks to intelligence input from America.

Tawang is located about 200 miles from Tezpur, the closest major Indian military base. Both were places that saw military action in the India-China war in 1962. The only way to get to Tawang was the Sela Pass (named after Sela, a young woman who was killed by the Chinese in 1962). The pass is closed in the winter & not ideal even in normal wet weather.

Guess where PM Modi was on Saturday, March 9? He was in Arunachal Pradesh to inaugurate the world’s longest bi-lane tunnel at 13,000 ft, constructed 499 meters below the Sela Pass. This delivers an all-weather year-long motorable access from the military base at Tezpur directly to Tawang.

This makes Tawang a forward base for the Indian Army that can be supported defensively or offensively both by armored infantry & air force. The inauguration of the Sela Tunnel was on the eve of the 4th anniversary of the border conflict with China in Ladakh, per the 3-minute clip below.

Last week, it was the new offensive corps & deployment of 10,000 troops to Ladakh at western end of the Line of Control & this week, the inauguration of the strategic all-weather tunnel at Tawang at the Eastern end.

But that’s all land. What about the Indian Ocean, another long & critical area of Indian & Chinese interaction. And isn’t that the right area for US-India cooperation?

4.2. These “Romeos” don’t die; They Spot & Destroy

Guess what happened last weekend. Six MH-60R Seahawk helicopters were commissioned by the Indian Navy to be based at the Kochi naval base in southeastern India. Another 18 will be delivered by Lockheed at the agreed upon schedule.

Think about the greatest military challenge China poses to America which is above all a naval-air power. No one thinks America is going to land a large army in mainland China. So the battle will be naval-air. What makes naval battles difficult is that oceans are large & it is difficult to find enemy ships. Recall how the biggest battle of WWII was won by US Navy because their carrier based planes spotted the 4 Japanese aircraft carriers way before the Japanese spotted the US carriers. That ended offensive capability of that Japanese Navy in WWII.

Now look at the South China Sea & the Taiwan Straits. Much much smaller than the Pacific Ocean near Midway. So Chinese ships, especially submarines, would find it difficult to hide in that small body of water. So where are they likely to go? Not north to Japan & US naval assets. The quickest exit to cause damage is thru the Malacca straits across Sri Lanka into the western Indian Ocean or Arabian sea.

Until now the Indian Navy did not have the high-level capability to find, track & handle Chinese submarines. That began changing last weekend on March 9 with the commissioning of Lockheed Romeos. Now you can check Lockheed’s prosaic description of these Romeos or you can listen to veteran anti-submarine pilot Capt. Rajkumar (minute 7:03 to min 10:23) describe the Romeos in passionate terms – “this aircraft can create magic, trust me … the most advanced ASW helicopter in the world“:

Last week, the Indian Navy conducted an exercise with 2 aircraft carriers. And where could you read about it? In a Newsweek article dated March 11 & titled America’s New Partner Against China Shows Off Aircraft Carriers. Being partners in Naval strategy, armaments & operations is probably the most critical of US-India joint operations.

The “Romeos” are fine & terrific for close surveillance & interception of submarines but being helicopter-based they can’t go too far from a ship or a helipad. What long endurance surveillance of an entire part of the Indian Ocean? That was solved last week on March 11, the same day as India tested the MIRV-ed Agni-5 missile.

The US formally sent an acceptance letter to India’s Defense Ministry for the deal for India to buy 31 MQ-9B long endurance drones that can operate at 27,000 feet & are equipped with latest surveillance suites & state-of-art missiles. This substantially increases Indian Navy’s long-range surveillance capability of Chinese ships & submarines since half of the 31 drones are for the Indian Navy.

With the MH-60R Seahawk helicopters & with the MQ9B drones, the sharing of intelligence & tracking of Chinese naval assets in the Indian Ocean will be substantially enhanced for the new “friend” against China, as Newsweek put it.

4.3. From Naval Ships to ALL of China

Remember how the world was stunned last year when India landed a lunar module on the South Pole of the Moon, something no one else had been able to do. That launched India into a higher orbit of respect for Indian science. Recently almost every one knows that India is the fastest growing economy in the world. Despite all of this, India was just not taken seriously especially when it counted. Every one knows China is a major power but no one thinks India is.

We think that changed on Monday, March 11 when the world woke up to hear & see India’s test of MIRV-ed Agni 5 missile. Yes, India successfully tested an MIRV-ed ICBM of range 5,000 – 8,000 km that can be fired not just from a fixed launcher but from the back of a truck. So the Agni-5 can literally be fired from any place in India to land at any chosen part of China. And that launch could be of up to 10 warheads on targets in different places.

In investing terminology, everything else we have described is a micro military weapon while MIRV-ed Agni 5 is a macro weapon that creates an existential risk for China. Whereas BrahMos has an accuracy of 1 meter, Agni-V has accuracy of less than 10m, not bad given the distance it travels to impact. Instead of us describing why this Astra, created almost exclusively for China, is a “terrifying prospect” for China, we urge you to watch the 9-minute technical clip below :

The MIRV-ed weapons are not new to students of real India. For those who may not understand this, we urge reading of the first several paragraphs of the Karna-Arjun battle in the Mahaa-Bhaarat war in which 3.15 million warriors died. The Mahaa-Bhaarat text describes in detail how each could launch multiple independently targeted missiles. And it gives a reasonably technical case of how that was possible then. Note that the Mahaa-Bhaarat war was the last such in India’s history & it was the culmination of weapons & missiles commonly used by Celestial warriors & few mortals like Arjun & Karna.

When you know this, you will understand why PM Modi described the MIRV-ed Agni-V as a Divine (Divya) Astra or the compound Divyaastra (Divine Missile). It is NOT a shastra as many describe it. Sanskrut is clear in that a Shastra is a weapon like sword, mace & others used in near-to-near combat while Astra is a missile type weapon that is used to strike way beyond physical reach.

That leaves demonstration of Indian army’s prowess. So on Tuesday March 12, PM Modi flew to Pokhran near the border with NaPakistan.

4.4. Self-Reliance, Self-Confidence & Self-Celebration – at Pokhran

For those who don’t know, Pokhran is a large flat area near the desert that borders NaPakistan. It now has a deep place in the hearts of Indians because Pokhran was where India exploded its first nuclear device in 1998 by thwarting the endeavor of CIA to prevent it. President Clinton did impose sanctions on the Indian Military in response. But, as Strobe Talbot has written, the Indian nuclear test is what made President Clinton decide to take India seriously.

Below is a celebration of India-made weaponry to be used in war:

4.5. What’s going on?

We cannot recall another week or another two weeks that were filled with so much military-preparedness moves between India & China. Wasn’t it just 4 weeks ago when China’s Minister Wang Yi approached India’s Minister JaiShankar at Munich, an overture that led to a high-level military-to-military meeting at the Line of Control in Ladakh. What happened at that meeting that seems to have launched the above series of military moves this week & the addition of 10,000 combat troops to the India-China line of control last week?

We don’t have clue but our uninformed & severely uneducated guess would be that, while the Indian military entered that meeting expecting a deal of sorts, they received the standard Chinese treatment of threats & acquiesce-or-else type demands by the Chinese military on Indians. If our guess is even somewhat accurate, then we can understand India’s responses in this week:

- last week’s addition of 10,000 combat-ready forces to a specific small section of the line of control within 50 minutes of Tibet’s Ngari Prefecture, occupied by China,

- activation of the Sela Tunnel to enable Indian forces to move combat troops to Tawang at the Arunachal border,

- the public commissioning of the Seahawk choppers & the naval exercise with 2 aircraft carriers near Chinese-friendly assets in the Indian Ocean,

- the public test of MIRV-ed Agni-5 missile, that has been tested already without fanfare, and which can reach every part of China,

- the 3-services military exercise near the NaPakistan border.

We see this as a clear message to China that India is militarily ready for any misadventure by China & any such response is potentially likely to expand to multiple regions of the India-China land, air & naval theater.

It might well be a threat by China to create an event just as the nationwide elections in India begin on April 19, just a month away. And China reportedly conducted a surface-air missile exercise with live ammunition on the Karakorum plateau yesterday on March 15.

A military conflict between China & India, either in the Himalayan borders or at sea, is likely to prove important & disruptive to the economies & markets of both countries as well as global markets. That is why we have been writing about these events in such detail. After all, as the Annual Threat Assessment of the U.S. Intelligence Community put it, these moves “risk miscalculation and escalation into armed conflict“.

Send your feedback to editor.macroviewpoints@gmail.com Or @MacroViewpoints on X