Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. A New “Spike Peak” Buy?

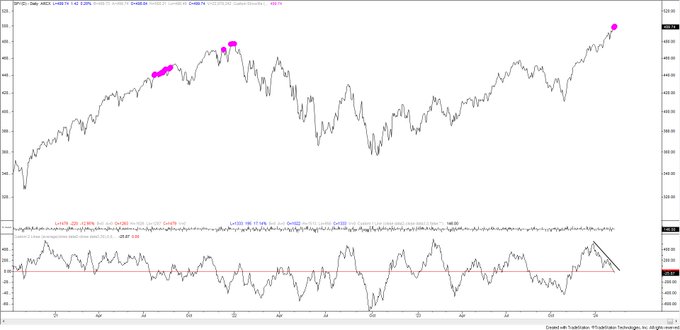

The market event of the past week was the swift fall in the stock market, sparked by the stronger than expected CPI. And that catapulted the VIX to an intra-day high of 17.94. The VIX closed on Tuesday at 15.85 above its 200-day moving average. But the next day, as often in the past, the VIX fell all the way down & closed at 14.38. Ergo, as Options Strategist pointed out on Friday, that a a new “spike peak” buy signal was generated.

This did fit what Jeff DeGraff had said on CNBC on Monday:

- “I think we are good; we had escape velocity that was really the genesis of that call which we made in November 2023 & was still in play in December. It should, for all intents & purposes, last at least the till the end of the quarter – that’s a minimum. And if we have a continuation of the 20-day highs & some of the internals we look at, then you can extend beyond that; but we should be money good between now & the end of the quarter”.

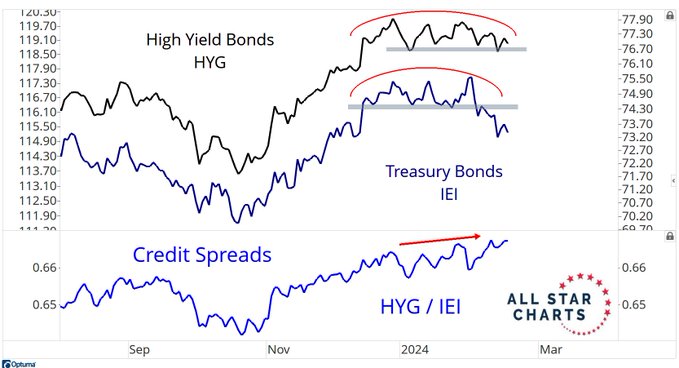

DeGraff then spoke of the message of credit markets:

- “I think the importance of this is the difference between what’s happening to cap structure; … when we go to look at the credit-default swaps, … they just couldn’t care less; credit spreads relative to the market are the lowest in a year; … so there is mismatch here …. ”

Remember Jeff Gundlach told CNBC viewers not to buy any Bond expect U.S. Treasuries because, in his opinion, corporate credit has reached levels that don’t deserve a buy. Also look at what J.C. Parets tweeted on Friday:

- J.C. Parets@allstarcharts – If those Junk Bonds break down and complete that top, your credit spreads are gonna blow out. If you’re long stocks in that environment, my suspicion is you’ll regret that decision. I guess we’ll see... ¯\_(ツ)_/¯

DeGraff’s thesis is that markets have been giving a positive message that is very consistent with the 1995 playbook. He points to the Bloomberg Commodity index making a a new low. He says “Copper hasn’t broken yet but it looks vulnerable“.

When asked whether the Russell is a buy or the S&P, DeGraff replied – “I am a momentum guy & I still like the S&P; I don’t think the Russell is bad; it is relatively under-performing; so you just go with the superstar“.

Look at the tweet DeGraff posted on Saturday about Tuesday’s “weakness” & the level of momentum in the market:

- “I don’t look at this market at 79% as dangerous momentum market … what we saw this week was a snap-back from the Tuesday weakness … we are at 79% percentile; we will alert clients when we get to the 90% percentile“

2. “tapestry of perfection“ from “cashflow generators“

Being Macro Viewers, we don’t generally spend a lot of time & space on individual stocks. But ask yourselves what is the biggest macro decision that needs to be made right now in the equity market – to reduce, hold or buy these few Magnificent stocks (note dictionary meaning of few is less than or equal to 8). Hence the detailed coverage of the two clips below:

The terms above are from Rich Saperstein, a well-known advisor who spoke on CNBC about why long-term investors are holding large-cap tech stocks:

- “right now the market is priced for a tapestry of perfection meaning declining inflation, accommodative Fed making cuts, low unemployment, continued fiscal stimulus as well as achieving $245 in S&P earnings this year“;

Speaking about Mags (Magnificent stocks) and non-Mags (rest), Saperstein pointed out,

- “S&P, over the last 2 years is only up 5.5%; Mags are up 17%; non-Mags are up 2.5%; …. we like the large technology names; if you take GOOG & Microsoft & look at their cash-flows in 2019, they generated $55 billion in operating cash flow; last year it was $104 billion; so the cash flow has increased by 90%; And over the last 4 years, MSFT is up 150%; GOOG is up 115%;”

- “so the multiple of the cash-flow has gone up a little more than we like ; but these cashflows are growing tremendously; they are over-extended, not cheap; … but if you look at the PE-to-Growth ratio (PEG) – the Mags are expected to grow at 20% this yeas & the PEs are 30 – so its a 1.5 time PEG; if you look at non-Mags, they are selling at 3 times PEG – their expected growth is 6 & their PEs are 16-18; “

And he added,

- ” I am a long term holder of large-cap tech that generate copious amounts of cash flow; Keep in mind that these companies have moved from cyclical to secular meaning they used to be “I want this technology” to now “I must have this technology“. So there is less volatility in the demand for services they are providing; they are also buying back their stocks; their is an AI-push that will occur overtime; so there are tremendous long-term reasons to own the large-cap stocks that are generating cash-flows…

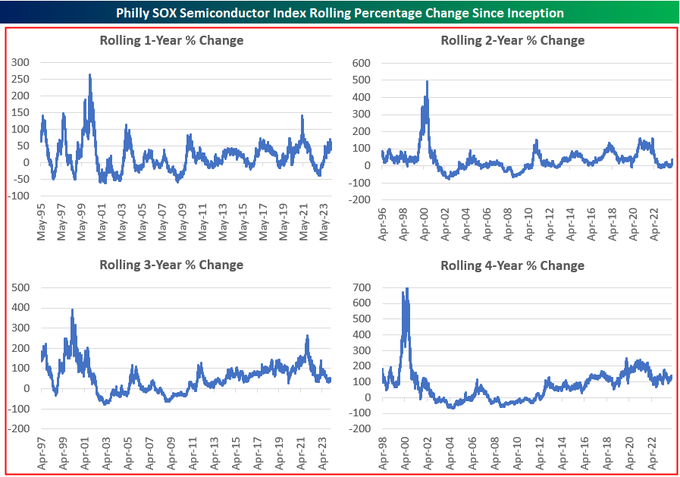

Before we go to the next micro fundamental view of a semiconductor company, let us look at the cacophony about 2024 being another 2000:

- Bespoke@bespokeinvest – Fri – The Philadelphia SOX semis index is up 27% over the last two years. In August 2000, the 2-year rolling % change hit +491%.

And hot off AMAT earnings:

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Sat – New all-time highs on Friday for 3 major Semiconductor Equipment & Materials leaders: $AMAT $KLAC $LRCX. Tech remains our top ranked sector and semis are a top ranked industry group. A key component of the AI buildout, which remains still very early innings.

We all know that the release of NVDIA earnings this coming week is going to be a macro event. But how does an equity investor look at the company & the stock? Read what Ankur Crawford of Alger said on CNBC this week:

- “In Jan 23, the 2024 estimates for NVDA were $4; today they are $21-$22 with whispers UBS just out $28 for NVDA; that’s a 7-fold increase in earnings for NVDA; that’s what happens when you are so early in a cycle which drives not only the performance of a stock; not just earnings but also the multiple; this AI world is burgeoning; we are just starting; in baseball terminology, we are in the locker room still; we haven’t even started the game; we are so early on AI that its unclear as to where it tops; Lisa Sue has $400 TAM (total addressable market) estimate for all accelerated compute in 2027; … that might be $300 billion but its 3-fold what it is today; …”

When asked about the future deflation in the price of compute, Ankur said:

- “history of compute is that you get more in terms of price-performance ; you get more compute capability & you pay less for it on a per-compute basis – that’s what we are going to see; I don’t expect to see a lot of deflation in price because, for example the B100 which is the next version of the NVDA chip (coming sometime in 2nd half of this year) will be priced at 50% increase of the H100 chip (current generation) in part because it is offering 2X performance ; so you know long term, its not going to be a market in which the winner takes all, but it could be a market in which winner takes a majority “…

If you liked what Ms. Crawford said about NVDA, prepare to get mad at CNBC. Because that incredibly “smart” business network cut off her discussion of GOOGL. So based on our recollection & some scribbled notes, below is what we think she said:

- “very underweight GOOGL; in a different spot than they were 10 yrs ago; …”search” is a saturated market; most AI tools have a built-in search capability … so this is an existential risk for GOOGL … “

So why own it? “GOOGL is a cash-flow machine & by cutting costs, they could increase the multiple a lot” was we recall Ms. Crawford said. Why would CNBC webmasters delete this discussion from the clip they posted?

Personally, hearing Ms. Crawford was a big positive for us. For once, we were listening to someone whose name is NOT of Hindu “religious” significance in any way. So even if they mispronounce it (which they did NOT), its not a big deal. “Ankur” is a gender-neutral (Sorkin had a guest named Ankur Jain with an interesting startup) poetic-type name that means a sapling. Ankur is what you get first when you plant; then the “Ankur” grows into its full-fledged form. In this case, Ms. Crawford is already way past the “ankur” stage of a money manager. Kudos to her.

3. Economy & Rate Cuts

After years of watching, we finally had a clip in which the final 2-sentence summary by Joe Kernen was better & more important than the entire clip. We were going to congratulate him but, alas, it was not to be. CNBC Webmasters deleted his final summary from the clip of Duke Professor Campbell Harvey, he with the model with a 8 for 8 record for calling a recession.

So we begin with Joe’s opening line:

- “FED’s wait, wait, wait then drip, drip, drip strategy on rates greatly increases the chances of a recession“.

Mark Zandi is even more upset than Prof. Harvey & Signor Kernen. Look what he said on CNBC:

- “growth feels like it is slowing particularly in the labor market; hiring is down; hours are down; temp jobs are down; … only thing keeping it moving forward is layoff rate; … we are starting to see signs of overall economic growth slowing; … So Why? Why take the risk? Just declare victory; we are there“

So let us see what a true big shot said about what the Fed will do. Rick Rieder of BlackRock said on CNBC on Thursday – “the Fed is going to start in May; they are getting 75 bps off of the Fed Funds rate this year“.

That means the current Fed funds rate of 5.25%-5.50% will fall by 75 bps to 4.5%-4.75% by end of the year?? That will be still higher the entire belly of the curve which has – 2-yr at 4.65%; 3-yr at 4.42%; 5-yr at 4.28%; 7-yr at 4.30%; 10-yr at 4.28%; 30-yr at 4.44%!!!!

Whattttt? Or will they be much lower by factoring another 100 bps cut in 2025? But does that mean all those strategists who kept telling simple folks to buy 2-7 yr bonds for the past several months were fooling us?

Rieder gave another “you are wrong” shout to all those fixed income managers like JPM’s Priya Misra & Kelsey Berro who have been saying that the hedging role of Treasuries is back! You won’t find it in the CNBC clip below, but our notes have an explicit Rieder statement saying “forget owing long bonds for hedging; just own stocks .“

More explicitly, his thesis is “Outbreak of Normalcy and his Trade for 2024 is NOT to bet on long-term interest rates (10 yrs & out) rallying that much“.

But what about funding the massive deficits? Ryder said “when the Fed is lowering rates, there is receptivity to $4-5 trillion of US Treasuries coming in next 2-3 years“

Rieder’s basic point is, as we understand it:

- “the US economy is in really a closed economy & Service economies don’t normally go into recession; US stocks are delivering 12-15% cashflow growth; so Treasury bonds yielding 4% can’t provide hedging of equity portfolios; so forget about them & just own equities (& presumably all the fancy mortgages & stuff he owns in his ETF).”

What we would love to know is which types of stocks should we own to hedge equity positions? The Magnificent 7 or the Non-mags? We would also love to know which stocks, ETFs or indices he owns to hedge the $2.8 trillion he manages at BlackRock?

Signor Ryder may have a good point though. Look what what the 10-yr yield had done in the last two weeks – up 26 bps with the 30-yr yield up 22 bps. Of course, the belly of the curve has risen more with both 5-yr & 7-yr yields up 29 bps.

It is interesting to see how 10-yr yield action so far in 2024 is similar to its 2008 action:

(2024 ytd) (Jan 1 – Feb 17, 2008)

(2024 ytd) (Jan 1 – Feb 17, 2008)

Look below to see that the TLT or the 10-yr yield did NOT serve as a hedge for stocks till way late in 2008:

(10-yr yield Jan-Dec 2008)

(10-yr yield Jan-Dec 2008)

Now look at the late February 2008 action followed by the March 2008 action – the 10-yr yld reached its short term peak in late February & then went down hard until mid-March, stabilized & started rising in mid-April.

Will that repeat in 2024? Below you will see smart observers point to mid-February to mid-late March period being a problem for stocks. If that happens, might that lead to a fall in the 10-yr yield?

The big message from 2008 is that the 10-yr treasury yield did NOT start falling hard until end of October 2008 despite the Lehman Bankruptcy in September 2008. The chart clearly shows that the 10-yr yield on October 31, 2008 was nearly the same as it was on January 1, 2008.

The 10-yr yield began falling hard & fast in November 2008 AFTER the damage to the economy was evident and the stock market began falling hard. So the 10-yr yield did ACT as a great hedge for equities in November & December 2008.

That in a nutshell was the summary of the Duke professor’s point that Joe Kernen summarized in 2 sentences (see Section 1 above). That the Fed wakes up way late & by that time, the damage to the economy might be already done. It might take a month or two to see it in the data. But once the market sees it, whoosh goes down the 10-yr yield.

And those are the two Kernen sentences CNBC webmasters shut out? On the other hand, many (some even within CNBC) might be happy to see that CNBC webmasters have the power & gumption to delete what Kernen has said on air! The same many would wish they exercise it more!

Now back to our usual guys who help us using X:

4. On the other hand,

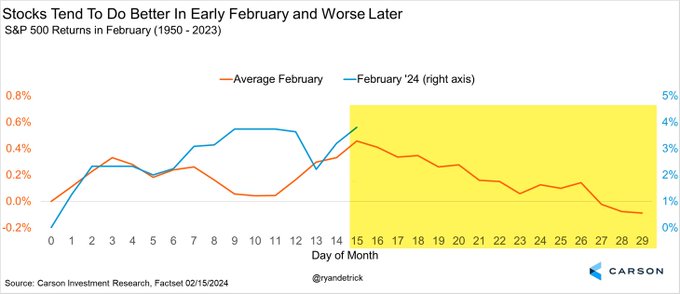

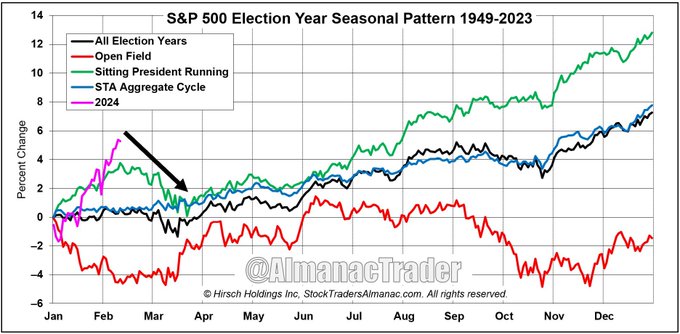

- J.C. Parets@allstarcharts – Sat – The S&P500 just entered what is historically the worst 2 week period of the entire year. I’m sure everything will be fine.

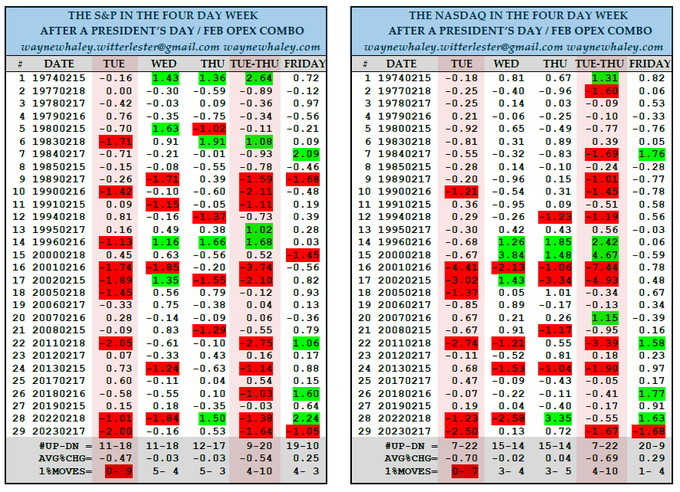

- Wayne Whaley@WayneWhaley1136 – Sat – Last 50 yrs, there have been 29 in which Feb Opex and Pres Day coincided. The Nasd was 7-22 in the 3 days after for avg 3 day loss of 0.69%. If prior wk was neg, Nasd 1-11 on that Tuesday, avg -1.04%. 1% moves for S&P and Nasd, combined 0-16 on Tuesday.

And,

- Ryan Detrick, CMT@RyanDetrick – Feb 16 – Stocks tend to do well the first part of February

But the second half of the month is usually weak

Is this year different?

- J.C. Parets@allstarcharts – Sat – Historically this is a great time to be shorting stocks. Are you making the bet that this year will be different? h/t @AlmanacTrader

A view contrary to most:

- Quantifiable Edges@QuantifiablEdgs – Feb 16 – The Quantifiable Edges Seasonality Calendar algorithms are showing next week is a weak spot for $SPX $SPY but potentially bullish for $TLT #seasonality

Take care, right now?

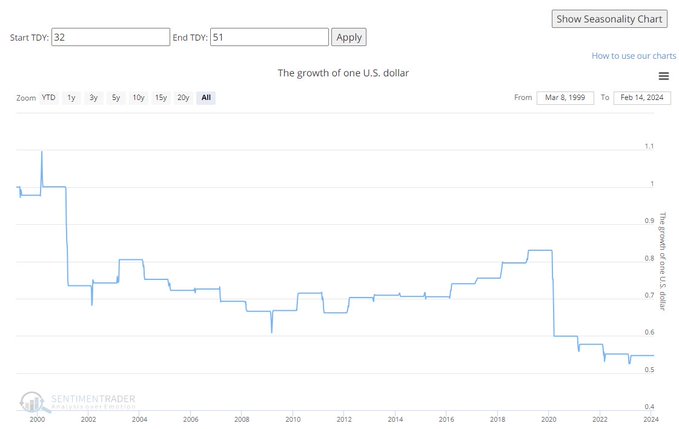

- Jason Goepfert@jasongoepfert – Feb 15 – Traders can get a bit overenthusiastic about seasonality. It can be helpful as a tertiary input; a slight headwind or tailwind at its best. For $QQQ, that headwind starts tomorrow. Since inception, the next ~20 days would have turned $100 into $55.

Now a rare tweet about Tuesday’s fall being bearish:

- Jamie Saettele, CMT@JamieSaettele – Tue Feb 13 – The dots indicate $SPY all-time closing high and 30 day A/D line < 0. Today’s drop is the bearish trigger. This is a rare signal. Also happened at minor peaks in 2013-2014 but also happened in July 2007, May 2006, and March 2000.

5. International

- ur-trading@urtrading – “The rest of the world is currently as cheap as the US market was at the very bottom of the global financial crisis.” @TaviCosta

Speaking of experts whose lines were deleted by CNBC Webmasters, the cap goes to Jeffrey Gundlach this week. Gundlach suggested an allocation of only 30% to global equities which are further segmented as 10% to US Equal-weight S&P 500, 10% to Japan & 10% to India which he termed as “strongest economy on earth with the best demographics“. These comments were deleted by CNBC in the posted clip. Brilliant, aren’t they?

Partly the trouble is that India’s equity valuations are judged as full as those of America. That is why, based on what we saw on Bloomberg, more money is going into India’s credit markets. With the opening of Indian bonds in the JPMorgan Index, $40-$60 billion are expected to flow into Indian credit market this year. That can help India’s mid-cap & small-cap markets get better funding.

Besides the above, there now seems to be increasing interest in importing Indian workers on a govt-govt contractual basis. Last year, Israel & India signed an agreement to import 42,000 Indian workers into Israel. Last week, Taiwan & India signed a “pivotal” pact to import Indian workers into Taiwan, a breakout from Taiwan’s hitherto reliance on South East Asian workers:

- “The quality of Indian labor is stable, they are hard working and well considered,” highlighted Taiwan’s Ministry of Labor, signaling the anticipated positive impact of this workforce integration”

We think this is similar to how the tech outsourcing industry began in India, first in small steps until both sides got comfortable and then a big move to large scale projects. We think these small deals for Indian workers will follow a similar trajectory – small, pivotal arrangements &, if they work, then a move to greater numbers. The reality is India has a huge reservoir of such labor, much bigger than the reservoir of expensively educated tech staff. And the need for hard working, stable labor is large in just about most of the developed world. Recall President Macron signed a deal allowing 30,000 working visas to Indian engineers, especially those who have studied in French universities.

This can be a large & sustainable industry for India that not only adds jobs, revenue for India but also increases incoming remittances from these Indians working in countries like Israel, France & now Taiwan. But the most interesting part of the Taiwan-headline article is the part about Russia’s interest in attracting attract the Indian diaspora a la large populations of Indian immigrants in western nations.

Everyone knows the success of the Indian diaspora in America. But how many know the size & success of the Indian diaspora in the Gulf Countries? Basic facts might astound most readers:

- 9 million Indians live in Gulf Countries.

- They send $35 billion per year in remittances to India.

- 3.5 million Indians live in UAE alone. That is about 35% of UAE’s population.

As the clip above says, Indians are now seen as a bridge to modernization in the Middle East as well as a hub for investment. That, we think, is the principal reason for Saudi Arabia to follow UAE into partnering with India in military & weapons sectors. About 10 days ago, Saudi Arabia signed a $255 million deal with a private Indian company for artillery shells. Now after last week’s world defense show in Saudi Arabia, whispers are that both Saudi Arabia & Emirates are interested in purchasing the supersonic Brahmos missile that has land-air-naval variants.

Remember when Saudi Arabia, the staunch US ally since FDR, began considering other approaches & relationships? Was it after the brand-new Biden administration began its tenure by being nasty & inimical to Crown Prince MBS? It might have been “morally” pleasing to some of the Biden crowd but it wasn’t geopolitically or business-wise smart!

India has announced that the delivery of long-range supersonic Brahmos will be delivered to the Philippines (1st buyer & $350 million deal) in March 2024 and now Thailand has expressed an interest in purchasing Brahmos. Last year, Indonesia had signed a deal to buy BrahMos & that deal is expected to close this year.

Know that BrahMos has been a joint deal between India (Brahmaputra river)& Russia (Moskva river) and it has been extremely successful. This technology is used by every part of Indian military & its success has drawn interest from so many nations in India’s periphery, the larger Indo-Pacific.

India has been pitching this approach to France to manufacture its front-line Rafale fighter-bomber in India along with the entire support infrastructure. Their pitch is that an Indian-made & India-supported Rafale would prove attractive to many nations in the larger Indo-Pacific. It was Lockheed that tried to sell this approach to India but only for the older F16-F21 line. The idea was sound but the product was deemed outdated.

We don’t believe analyst estimates for India’s growth have included these two potentially high growth & high margin business lines, just as no one in mid-late 1990s had included growth of India’s tech services in their growth forecasts.

By the way, all the above doesn’t include the power projection by the Indian Navy & Air Force into the Indian Ocean. Literally just a few weeks after Maldives turned back to China, India decided to firmly extend its naval footprint by establishing naval bases in Agatti and Minicoy Islands along with air bases in order to secure the vital sea lands of communication.

Where are these islands?

- “The Lakshadweep and Minicoy Islands sits on the nine degree channel through which billions of dollars worth of commercial trade passes through while en route to South-East Asia and North Asia. Minicoy Islands is a mere 524 kilometers from Maldives.”

A 15-ship task force will accompany Defense Minister Raj Naath Singh when he inaugurates the INS Jatayu naval base in Minicoy Islands in the first week of March:

All this is extremely positive for America and Robert Kaplan was the first Euro-American to see it in 2012:

- “Rather, it is the very fact that India’s rise, militarily and economically, automatically balances against China because of India’s proximate position on the map. Thus, the rise of India, however uneven and admittedly over-hyped, has been the best piece of strategic good luck the United States has had since the end of the Cold War“.

And think that the above doesn’t even touch on the stunning draw India, Indian Dharma & Indian history is becoming all across the larger Indo-Pacific from the Straits of Hormuz around India thru the Malacca Straits into South-East Asia into Taiwan & into Vietnam. For a glimpse into that, look at our adjacent article: First Shri Ram in Ayodhya & Now Shri Krushn in UAE.

If even 25% of what we see above happens, we will all blame Jeffrey Gundlach for being unduly reserved in his enthusiasm.

Send your feedback to [email protected] Or @MacroViewpoints on Twitter