Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.Dow above 5,000

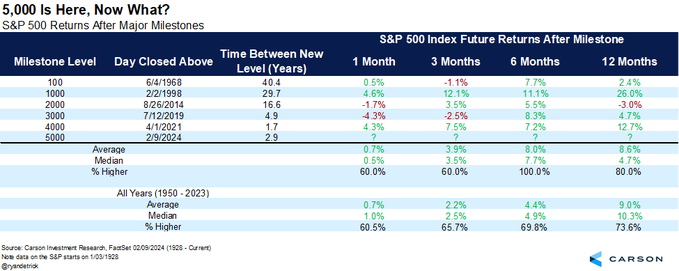

What does history tell us about previous peaks?

- Ryan Detrick, CMT@RyanDetrick – Fri Feb 9 – It took close to three years to go from 4k to 5k, but it is finally here. Now what? Looking at previous milestones (100, 1k, 2k, 3k, 4k) showed these levels did little to slow things down. Higher 6 months later each time and up 8.0% on avg vs avg 6 month return of 4.4%.

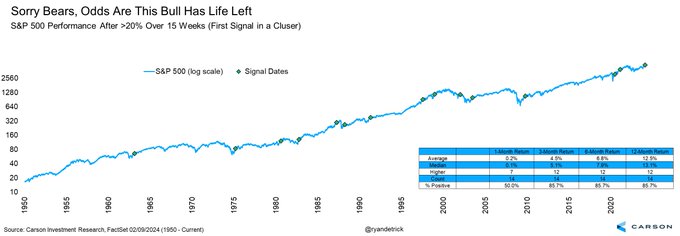

What about after 20% returns in the first quarter?

- Ryan Detrick, CMT@RyanDetrick – Fri Feb 9 – S&P 500 up more than 20% the past 15 weeks. After previous huge 15 week gains it was higher a year later 86% of the time and up 12.5% on avg and 13.1% median. I almost feel sorry for the 🐻, almost.

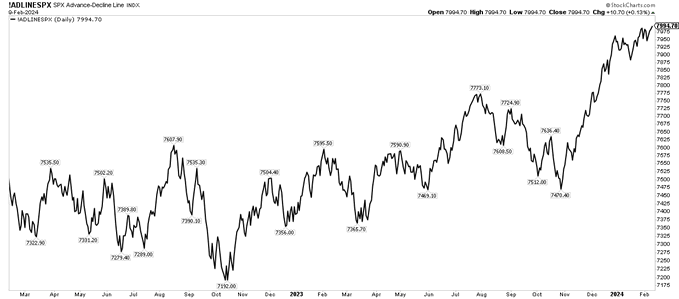

And breadth?

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – $SPX Advance-Decline Line closed at a new record high. For those who focus on stock market breadth…

We have been told that large institutions buy in the afternoon while smaller players jump in at the opening.

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – “In 28 sessions this year, 71% have seen the benchmark ($SPX) close above the midpoint of its daily range”. <strong closes are a sign of a strong market>. Relentless S&P 500 Momentum Leaves Dip Buyers Without a Playbook https://bloomberg.com/news/articles/2024-02-09/relentless-s-p-500-momentum-leaves-dip-buyers-without-a-playbook

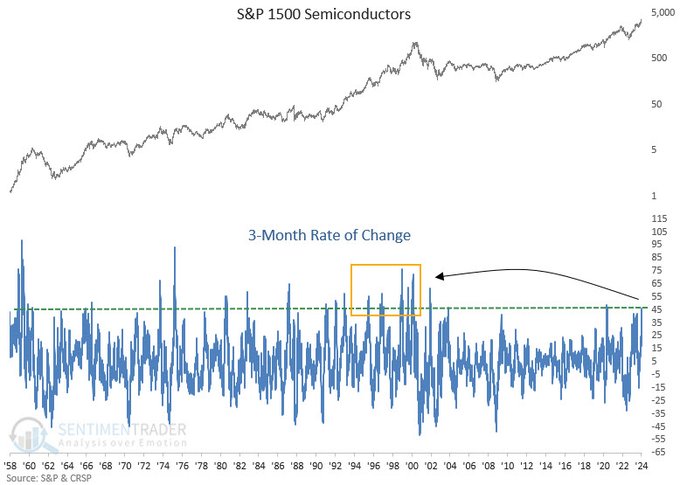

What about similarities with the Dot.com era?

- Dean Christians, CMT@DeanChristians – Food for thought if AI is a bubble and semiconductors are the poster child: The current price momentum falls far short of the extremes witnessed during the Dotcom era. Remember, nobody knows anything until after the fact.

Is there another visible difference?

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Massive post earnings breakouts in $ARM $META and $PLTR says a lot about current market tone, and demand for tech/AI. Unlike 95-2000, which had a lot of promise, but often not a lot of EPS in the dot coms, these are big beats and/or raises coming in.

Tom McClellan has written about the High-Yield Advance-Decline line before. He points to the

- “divergence which unfolded back in July 2023. The SP500 then was making higher highs, but this High Yield Bond A-D Line was making divergent lower highs, signaling that there was trouble in the liquidity stream which feeds both the stock market and the high yield bond market. That trouble then got resolved in mid-July 2023, when this A-D Line moved to a locally higher high, thus rehabilitating the small divergence highlighted by the dashed divergence line”.

That is relevant now because,

- In early January 2024, this A-D Line stopped confirming the higher highs that we were seeing in the SP500 Index. That was a concern for a while, but the resurgent market strength in late January 2024 pushed this A-D Line up to make a higher high, so there was no longer a divergence versus prices.

So? He writes:

- “The current higher high we are seeing in the HY Bond A-D Line is bullish news for the stock market for now. If we are going to end up seeing weakness in stock prices later this year (and I see strong indications of that in my long term models), then I would expect to see hints of those problems show up in advance in this HY Bond A-D Line. But those problems are not evident yet.”

A similar message about the near-term being OK & a possible rally to 5,200 by May came from Warren Pies on CNBC on Friday:

- “… we are overbought; … evidence that earnings are now taking the baton; … overbought conditions will most likely resolve with consolidation & advance further …. if yields retrace some of the 2024 rise (he says 4.40% will be peak for 10-yr in current rally), market can go higher & hit 5,200 by May …”

Finally, a “wow” of an observation:

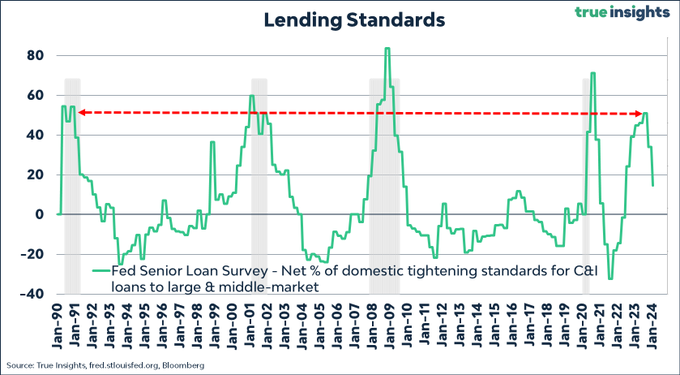

- jeroen blokland@jsblokland – Mon Feb 5 – Another chart showing that the #recession is already behind us. The only thing is that #NBER didn’t call one. The tightening of US lending standards is easing.

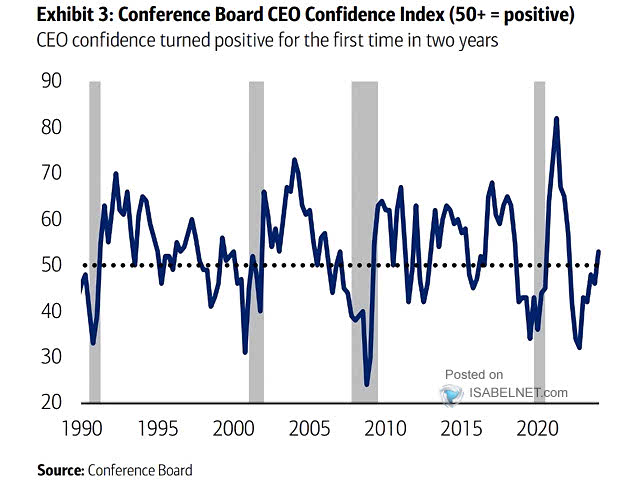

Wouldn’t this raise CEO confidence?

- ISABELNET@ISABELNET_SA – Sat Feb 10 – CEO confidence is back in positive territory, signaling a renewed sense of optimism among business leaders. This is a significant development that can have far-reaching effects on the US economy and business landscape

👉 https://isabelnet.com/blog/ @BofAML #ceo #confidence

2. On the other hand

- SentimenTrader@sentimentrader – On Monday, a new signal from a voting member in the Risk-Off Composite Model issued a warning.

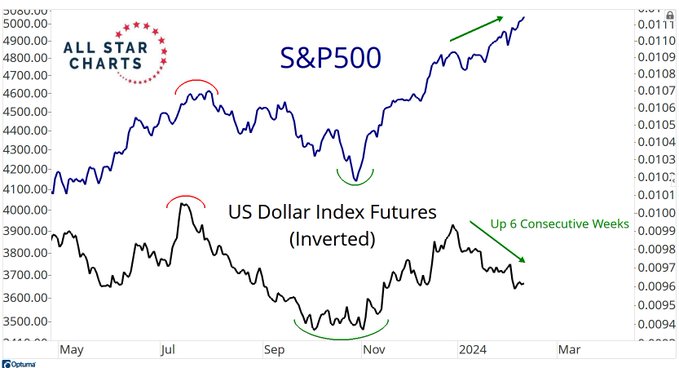

Has something changed in macro?

- J.C. Parets@allstarcharts – The negative correlation between the US Dollar with stocks (and other risk assets) has been strong for quite some time. Meanwhile, US Dollar Index Futures are up every single week this year. Has this relationship now changed, or is the unwind about to come?

And,

- J.C. Parets@allstarcharts – It wasn’t just the majority of U.S. stocks that couldn’t advance this week, the German DAX put in back to back weekly doji. Momentum in DAX is rolling over and European Financials went out for the week at new multi-month lows. Here’s what that looks like.

Coming back to the U.S.,

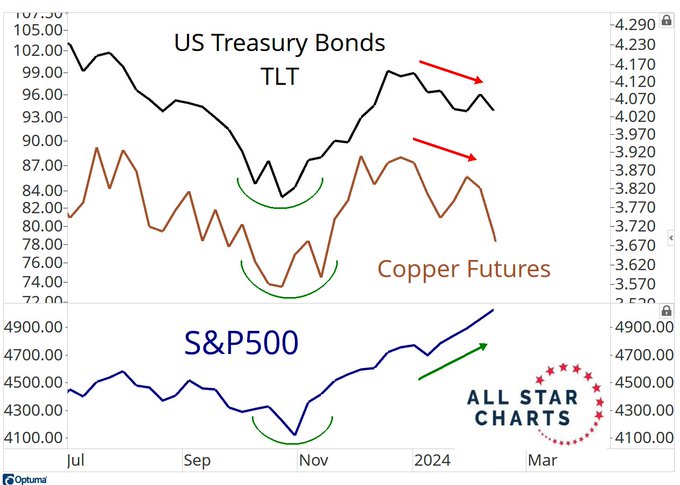

- J.C. Parets@allstarcharts – – Do you guys think Bonds and Copper can keep falling while the S&P500 moves on to new highs? Or does something gotta give? allstarcharts.com/update-on-our-

3. Week that was

- VIX down 7.3%; Dow up 4 bps; SPX up 1.4%; NDX up 1.8%; SMH up 6.9%; RUT up 2.4%; IWC up 2.6%; DJT up 2.6%;

Dollar was up with UUP up 21 bps & DXY up 15 bps

- Gold down 73 bps; GDX down 3.9%; Silver down 44 bps; SLV down 39 bps; Copper down 3.5%; CLF down 2.2%; FCX down 6.7%; MOS down 3%; Oil up 6%; Brent up 6.1%; OIH up 1%; XLE down 14 bps

- Global Markets didn’t react much – EEM up 2.4%; FXI up 4.3%; KWEB up 5%; EWZ up 67 bps; EWY up 2.2%; EWG up 14 bps; INDA up 69 bps; EPI up 69 bps; SMIN down 38 bps

Sectors reversed to the pre-last-week relationship;

- BAC down 1.3%; C down 2.7%; JPM up 15 bps; KRE down 1.1%; GS down 71 bps; AAPL up 1.8%; AMZN up 2%; GOOGL up 5.3%; META down 1.3%; NFLX down 1.3%; NVDA up 9.4%

This week reversed the previous week’s fall in Treasury yields:

- TLT down 2.3%; EDV down 3.2%; ZROZ down 3.6%; 30-yr yield up 15.2 bps; 20-yr up 14.8 bps; 10-yr up 15.1 bps; 7-yr up 16.2 bps; 5-yr up 15.2 bps; 3-yr up 12.7 bps; 2-yr up 11.4 bps; 1-yr up 5.4 bps;

- HYG up 26 bps; JNK up 36 bps; DPG down 2%; UTG down 3.1%; EMB down 17 bps;

4. Super Bowl

Remember what Mahomes said early in the season when people questioned their offense? First he praised the Kansas City Defense & then he said “don’t worry about the offense“. He proved that against the Bills & in the first half against the Ravens.

We are going to watch the highlights of the most enjoyable Super Bowl for us – Brady Bucs vs. the Chiefs. Brady destroyed the Chiefs defense & the Bucs front seven tore down the Chiefs offensive line. The Chiefs were the big favorites & Mahomes had said just before that kickoff “we will dominate“. Coach Andy Reid kept getting stunned again & again during the game and his face after the decisive Fournette 30+ yds touchdown showed that he knew it was over.

But now, three Super Bowls later, you see that Coach Andy Reid totally learnt the lessons of that Super Bowl – Kansas City offensive line is now big & strong & they can RUN the ball the way Brady Bucs did in LV AND the Chiefs Defense is now big, fast & dominant.

Make no mistake – We don’t want Mahomes to repeat & get a bit closer to Brady. But we are strong disbelievers of the Kyle Shanahan thinking. He built his defense to chase opposing QBs assuming his offense will give them a lead. What if his offense falls behind & his defense needs to shut down the Chiefs running & Kelce game? Remember that Mike Shanahan, Kyle’s father & OC for Steve Young’s 49ers, finally won his first Super Bowl as Head Coach only when his offensive line was really dominant and Terrell Davis ran like the game’s MVP.

Our problem is that we don’t want Mahomes to repeat a la Brady and we don’t want the Kyle Shanahan brand & strategy to win. What do we do? Hope for a tie and, before today’s game, watch our favorite Super Bowl LV to see how 43-year old Brady again stunned the world with the perfect antidote to the Spagnuolo defense.

Fortunately, the Houthis have not shut the supply line for single malts or chocolate cakes.

Send your feedback to [email protected] Or @MacroViewpoints on X.