Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1. META & Magnificent

What else could be a better headline?

- Markets & Mayhem@Mayhem4Markets – $META added $205.3B of market cap on Friday, the largest one-day addition in history

That makes us recall what BofA’s Savita Subramaniam wrote as 2024 began:

- “a rout in big tech plus a broadening of market leadership is becoming consensus. January pain trade = higher TMT/Mega-caps”

How perfect was this call? But how realistic as well?

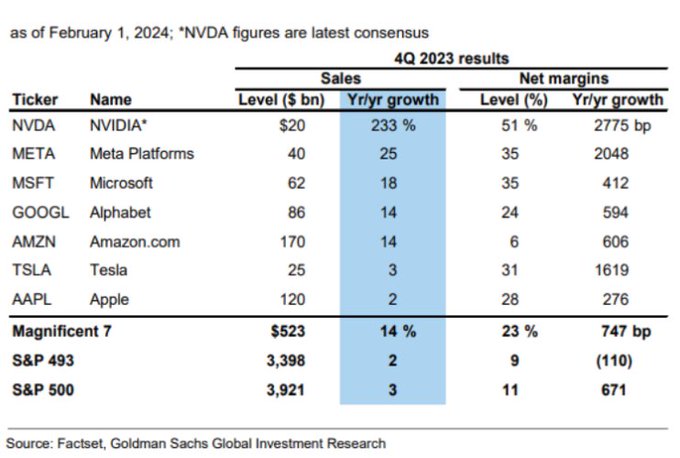

- Holger Zschaepitz@Schuldensuehner – Feb 3 – To put things into perspective: Assuming Nvidia meets estimates, the Mag 7 generated $523bn in sales during 4Q, +14%YoY. Revenue growth for remaining 493 S&P 500 stocks was a comparatively paltry 2%. Margins for the mag 7 expanded by ~750 bp YoY to 23% vs. a 110 bp contraction to 9% for remaining 493 stocks in the S&P 500, Goldman has calculated

But the above is a backward look. What about a forward estimate?

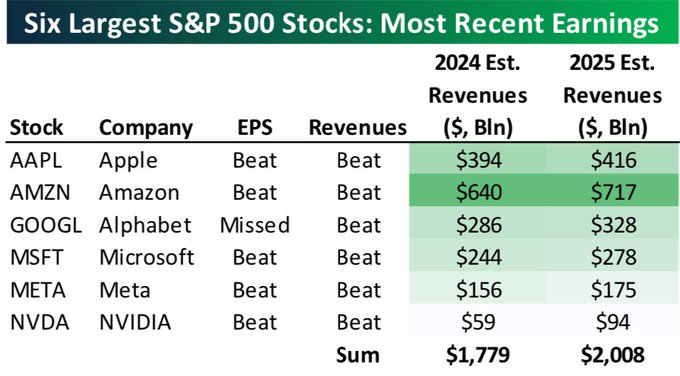

- Bespoke@bespokeinvest – 7h – The six members of the “trillion dollar market cap” club are projected to do $1.78 trillion in revenues in 2024 and more than $2 trillion in 2025. Just massive numbers. #megas $AAPL $AMZN $GOOGL $META $MSFT $NVDA

That behooves a quick look at the near future, up to say February Options Expiration:

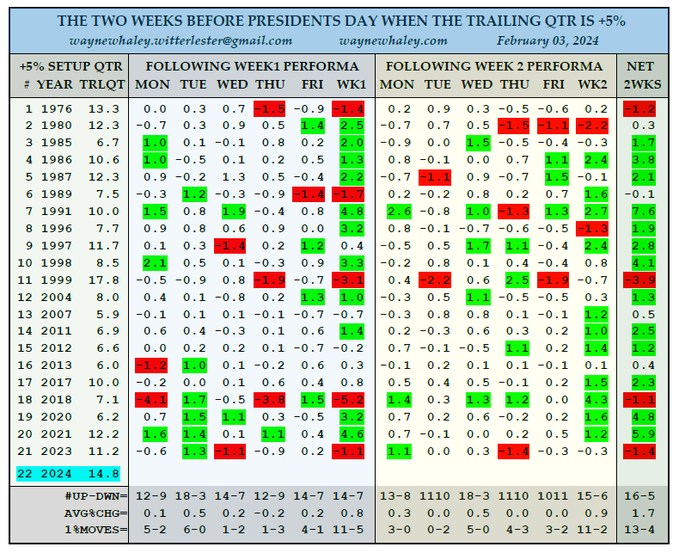

- Wayne Whaley@WayneWhaley1136 – Feb 3 – Feb is historically a coin toss mt but my conditional seasonal studies suggest a tailwind normally pushes the rally into mid Feb. Below is the performance for the 2 wks prior to the 3 day, Presidents Day weekend in those 21 yrs of the last 50 preceded by a +5% Qtr. PDay is Feb19.

Is there a look into 2023, an indicator that might suggest a positive move ahead before a summer pullback?

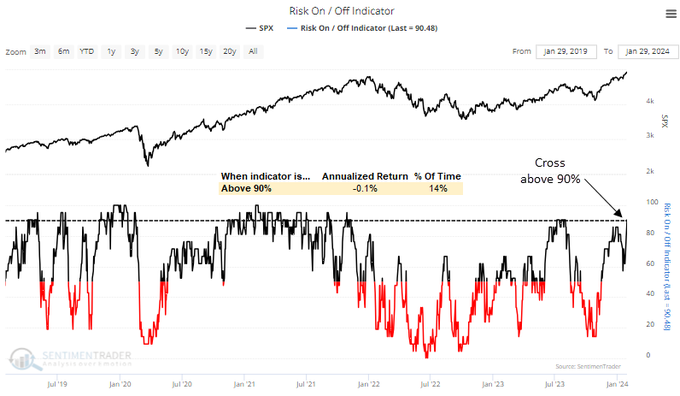

- SentimenTrader@sentimentrader – Feb 2 – The Risk-On/Off Indicator, a composite encompassing 21 diverse sentiment and breadth-based measures, increased to the highest level since July 2023, with 90% of its components in a bullish status.

2. On the other hand,

Caution is advised when the hitherto consistently bullish begin sounding not so bullish comments:

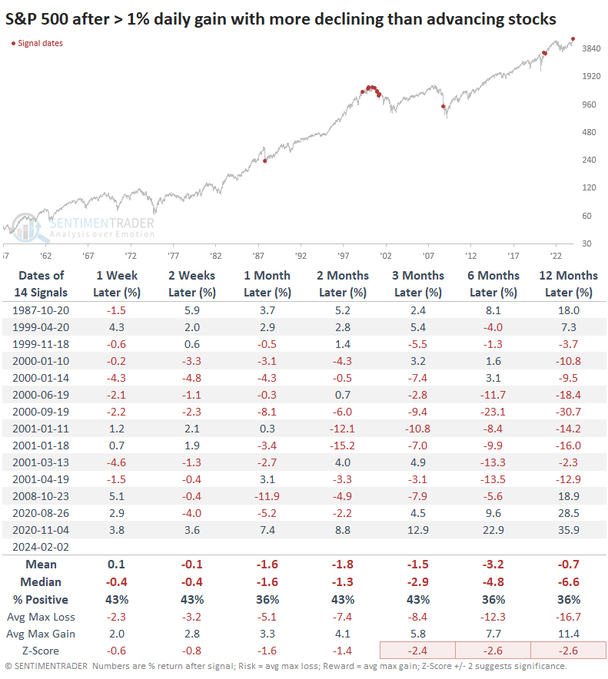

- Jason Goepfert@jasongoepfert – Feb 2 – Well, that was weird. Thanks $META. This seems like it’s going down as one of the very few times since the S&P 500 became a 500-stock index that it jumped more than 1% on a day when more of its stocks declined than advanced. Forward returns weren’t great.

Also,

- Jay Kaeppel@jaykaeppel – Not one to put too much emphasis on any one day BUT $NDX up +1.72% with putrid internals may be a ST warning sign. More declines than advances and lots of “churning” (lots of NH AND NL). Not a “sell everything.” But the ride could get a little “rougher.” @sentimentrader

And a more direct comment:

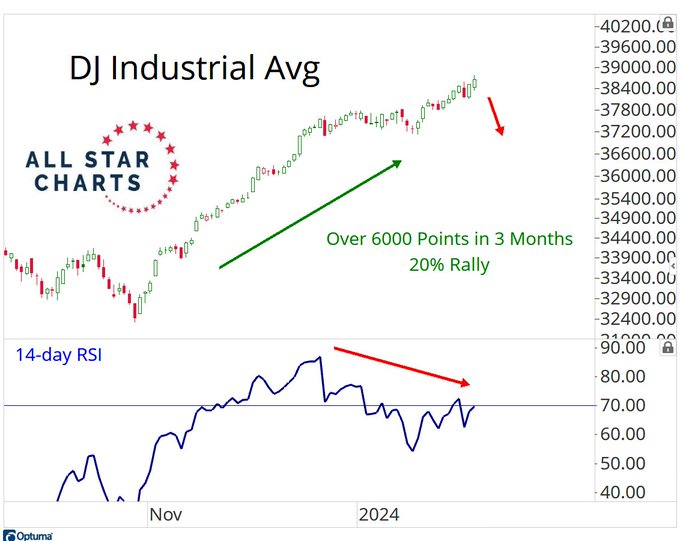

- J.C. Parets@allstarcharts – These are the types of divergences we love to see before a good rug pull

And one rug is being pulled at this moment:

- J.C. Parets@allstarcharts – After a historic rally in stocks, permabears got blown up. Now that they’re all broke (and some even retired), it’s time for stocks to correct. I’m here for it. https://allstarcharts.com/rug-pull-2024/

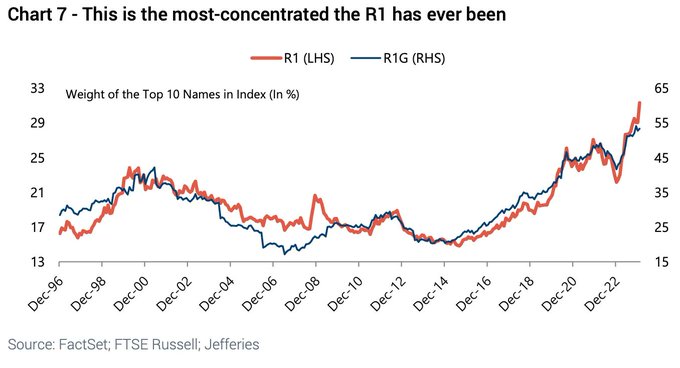

For those who think the concentration of performance in SPX is a risk relative to small caps,

- Jesse Felder@jessefelder – Feb 3 – “The top 10 names in the Russell 1000 now make up 31.3% of the index and this is the most concentrated they have ever been.” https://dailychartbook.com/p/daily-chartbook-374?utm_source=post-email-title&publication_id=1009050&post_id=141320765&utm_campaign=email-post-title&isFreemail=false&r=m7j5t&utm_medium=email via @dailychartbook

3. The Week that was

Once in a while, VIX acts parallel to the S&P as it did this week:

- VIX up 4.6%; Dow up 1.4%; SPX up 1.4%; RSP up 58 bps; NDX up 1.3%; SMH up 1.4%; RUT down 76 bps; IWC (micro caps) down 1.2%; DJT down 64 bps ;

Dollar was up with both UUP & DXY both up 54 bps & 43 bps:

- EEM down 59 bps; EWZ down 2.2%; EWG down 71 bps; ASHR down 6.4%; FXI down 5.3%; KWEB down 5.5%; INDA up 2.4%; EPI up 3.8%; SMIN up 1.6%; INDY down 8 bps;

With the Dollar up, commodities were mostly down:

- Gold up 1.8%; GDX down 8 bps; Silver down 57 bps; SLV down 43 bps; Copper down 88 bps; CLF up 10.5% (on earnings); FCX up 1.3%; Oil down 7.7%; Brent down 1.3%; UNG down 3.7%; OIH down 6.7%; XLE down 82 bps ; MOS down 4%;

Sectors that had moved conversely until now moved together this past week:

- AMZN up 7.8%; AAPL down 3.6%; GOOGL down 6.3%; NFLX down 1.4%; META up 20.5%; MSFT up 1.8%; BAC flat; C up 3.4%; GS up 2.5%; JPM up 1.5%; KRE down 7.2%; SCHW down 1.9%;

Despite the violent up move on Friday, Treasury rates went lower last week:

- 30-yr yield down 16 bps; 20-yr down 16.4 bps; 10-yr down 12 bps; 7-yr down 10 bps; 5-yr down 6 bps; 3-yr down 1.4 bps; 2-yr up 0.5 bps; 1-yr up 3.7 bps; TLT up 2.3%; EDV up 4.1%; ZROZ up 4.3%;

4. Interest Rates & Economy

On Wednesday afternoon, Chair Powell tanked the stock market by saying categorically in his presser that they are NOT thinking of cutting rates at the March meeting. The stock market reversed happily the next day and the Treasury market kept pushing down yields until they rose violently on Friday on “strong” payrolls data.

As after the payroll report release in January, there were many comments about the disparity in the different segments of employment. One simple one we found is below:

- The Mad King@TheKingCourt – Feb 2 – Total Payrolls (pink) vs Composite (black); Composite =((Full time jobs + Part time jobs) – Multi-Job Holders); Feel like 2000! Reach your own conclusion 🫡

Much more interesting than Powell was Jeffrey Gundlach who was on CNBC Closing Bell for almost 30 minutes. Since we can’t find a video clip of his comments, we use his slightly older clip with Charles Payne of Fox Business below. Gundlach’s message is the same that the markets (bond markets) are in a “euphoria type of period“. He applied the phrase “grabby nature” to the bond markets. And his specific message on CNBC after Powell’s presser was that he would only suggest owning Treasury Bonds. He also pointed out on both FBN & CNBC that 88% of States are reporting lower employment while the national employment is showing strong growth.

Earlier in the week, Dominic Konstam of Mizuho spoke extensively on Bloomberg Surveillance on January 28 (minute 39:50 to minute 48:51) about the hard landing he sees ahead for the US economy. A short clip of his conclusions was posted on YouTube by Bloomberg in which he says “a soft landing looks soft until its hard; … hard landing is a sharp increase in unemployment; … inflation is a a leading indictor & its decline will hurt profits & that will lead to shredding of labor“. He expects “unemployment to rise to 6.5% – 7%” and semi-casually points out that we “will NOT going to get more than 20% – 30% decline in stocks“.

This, as we all realize, is way off from the soft landing priced in Stocks & non-Treasury Bonds.

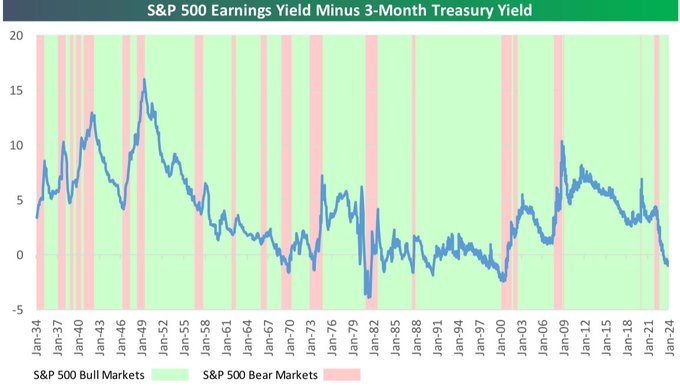

That brings up today’s level of the 3-month Treasury yield relative to the S&P earnings yield:

- Bespoke@bespokeinvest – Here’s S&P 500’s earnings yield a look at the minus the 3-month Treasury yield in the context of historical bull and bear markets for equities…

5. Gundlach, India, Houthis-Red-Sea-Saudi-IMEC

Shree Gundlach has said for awhile that investors should invest in India for the long term & that would make their grandchildren happy. He did something different this past Fed-day in his conversation with CNBC’s Scott Wapner. He said his #1 recommendation for 2024 was INDA, the iShares MSCI India ETF. He said Service PMIs for the Indian economy were above 60 & that the Indian economy was the strongest in the world.

The next day, trader on CNBC Half Time Report, Josh Brown seconded Gundlach’s recommendation on India but said buy EPI, the WisdomTree India ETF and his colleague Steve Weiss spoke of his ownership of INDA with SMIN (small caps India ETF) and INDY.

Trade Tracker: Steve Weiss buys $INDA $SMIN $INDY

He breaks down his bet on India. Josh Brown weighs in on why he thinks "Weiss is going to make some money here." pic.twitter.com/SHTHyOWduJ

— CNBC Halftime Report (@HalftimeReport) February 1, 2024

We support long term ownership of Indian equities, without any question or hesitation. But our personal style has been to buy when India is disliked or when international investors are exiting India. The toughest example of this belief was asking if Indian Stock Market – Is It Time To Get In? on April 25, 2021 when India was in the throes of a COVID-related wave. We fondly recall Josh Brown pointing out about 4-5 weeks later that “the Indian Stock Market is on fire“.

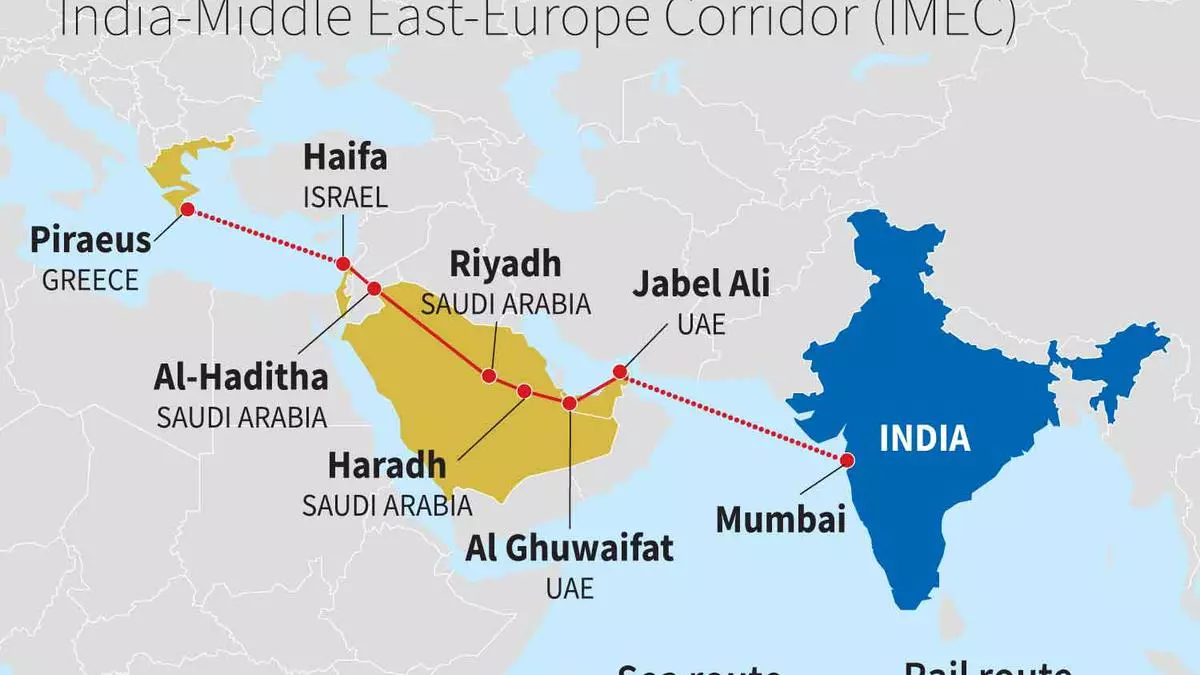

But the CNBC folks didn’t notice that their buys on India were on an important 1-year anniversary of January 31 & February 1, 2023. Those were the days when Prime Minister Netanyahu & Mr. Adani signed the acquisition of the Haifa Port in Israel. What a gutsy decision that was because the Adani group was caught in a hurricane of negative financial media storm, a condition we termed as Adani Washout. Being naturally rash & impetuous, we argued that the corridor implicit in the Haifa Port deal (now termed as IMEC – India-Middle East-Europe-corridor) was a phenomenal idea.

In any case, buying shares of Adani Enterprises, Adani Ports at that time turned out to be a fantastic move for Rajiv Jain, the well known emerging markets investor. His purchase of Adani Enterprises (at around 1,450/-) is worth Rs. 3,155/- and shares of Adani Ports (then around Rs. 500/-) are worth Rs. 1,250/-.

(Adani Enterprises) (Adani Ports)

At that time, the big boy in container routes was the traditional one via the Red Sea into the Suez Canal. How is that doing now?

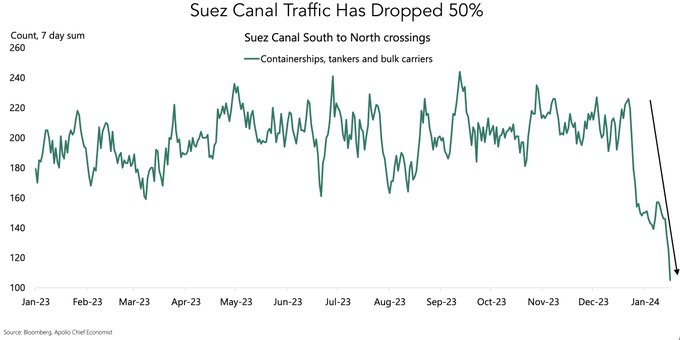

- Game of Trades@GameofTrades_ – Feb 3 – Suez Canal is responsible for 12-15% of global trade; But amid geopolitical tensions, traffic has dropped by 50%; To make things worse, freight rates have been rising aggressively; This is a major risk to the disinflation narrative

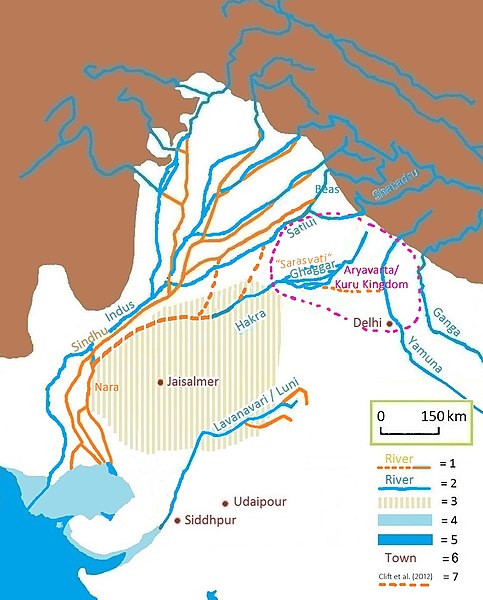

Ask how long this mess will be allowed to continue; ask if there will be a concerted effort to create an alternate route between the Indian Ocean & Europe via the Middle East. Actually you don’t need to ask. Just look at the map below:

Look again at the channel via the Red Sea. It is lined with unstable states that have disputes with their neighbors – Ethiopia-Somalia, Egypt-Eritrea and, of course, Houthis in Yemen.

In contrast, the ONLY country that has to come thru for the IMEC is Saudi Arabia. And it is THE country that stands to benefit the most from the IMEC corridor. And the Saudi-India relationship is the second largest beneficiary. In this context, look at what began this week & is continuing this week – the first ever military-military exercise between Saudi Arabia & India.

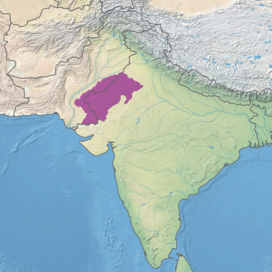

Few know that the Thar Desert or the Great Indian Desert spans 77,000 sq miles of the border states of India & NaPakistan.

The scope of this week’s Armored Exercise is small but it suggests a growing training & support relationship between India & Saudi Arabia, a supporter of NaPakistan until a few years ago. Note also that this armored exercise is taking place in close proximity of the border between India & NaPakistan, a border that historically seen intense military engagements between their militaries.

Think from the Saudi point of view. The past large presence of US military led to Bin Laden pronouncing Jihad against Saudi Arabia & launching Al Qaeda. Today if US were to place its armored units inside Saudi Arabia, it would provoke the Houthis mightily & Iran as well. And after Gaza, it would be nearly impossible for Israel to enter Saudi Arabia even to help.

That makes India a natural choice for a military training & support relationship. India has friendly relations with Iran & India is a virtual military ally of Israel. Further the military relationship between India & France just rose to a different level last week.

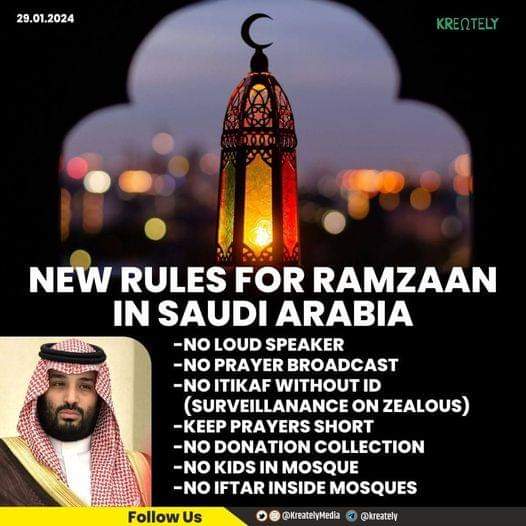

All this is also facilitated due to a real drive for modernization inside Saudi Arabia that has been launched & backed by Crown Prince Mohammed Bin Salman. Just look at his recent proclamation:

What makes India an easier relationship is the deep familiarity of Saudi people, especially Saudi youth, with Bollywood & India. That makes us prone to believe what we heard – that Yog, the Indian discipline of breath-based exercise, is now required learning in schools in Medina, one of the two most sacred Muslim cities in Saudi Arabia.

As an important aside, at the end of this article is a NaPakistani clip of a TV anchorwoman speaking with Napaki Muslims in the street about Yog being mandated in schools in Medina. Just their facials & body language point to a big discussion inside NaPakistan about why Saudi Arabia is jettisoning them despite their intense obedience to traditional Saudi religious dictats and now allowing the hated Indian disciplines inside Saudi Arabia.

The point of the above is to show the trajectory of Saudi-India relationship that will soon be a part of the India story, especially after the focus on IMEC returns. By the way, just this week, Indian Finance Minister reiterated PM Modi’s belief that the IMEC corridor will be a big factor for “hundred years” and change the near Middle East (UAE already being a deep friend & ally of India).

Speaking of another benefit to the Indian economy, read this week’s article from NBC news titled Facing dire labor shortage, Israel recruits migrant workers from India. – “About 6,000 workers have already been selected, some of whom will be arriving in Israel as early as mid-February.” is the caption beneath the photo to the right below.

Not sure how many know that Italy is intensely interested in a similar program to import workers from India. These are programs supported by the Indian Government with Israel & Italy. If successful, these programs would link up a large Indian sector which historically has had high unemployment with Europe that needs large numbers of non-religious peaceful workers.

In a similar vein but at a different educational level, during his visit to India last week, President Macron announced a target of 30,000 Indian students in French institutions by 2030. On social media platform X, the French president said France will do this by launching new pathways to learn French; developing the Alliances Francaises network; creating international classes for non-French speakers; and easing the visa process for those who have studied in France.

At the other end of the geographical spectrum, India’s successful lunar landing last year has raised the hopes of LUPEX – or Lunar Polar Exploration — a joint mission with Japan to study lunar water resources. The project seeks to send a probe to the south pole region at latitudes over 80 degrees south in fiscal 2025.

We did not mean this to be an elaborate article. We simply wanted to bring many facets of how India is working with Middle East, Europe & Far East & how these ventures are likely to raise incomes for Indians, bring in revenues into India. All of these, despite being longer term in nature, should throw some light on why smart investors like Shree Gundlach want to be long-term investors in India.

Note none of the above has anything to do with Apple or other US companies leaving China to enter India. That we think is a small part of the India story. The real reason to invest in India is the expectation of Indian Bank CEOs that India will be a $7 trillion economy by 2030 (double in 7 years).

Having said that, we don’t understand & we can’t get any analyst to explain why the Indian Reserve Bank is curtailing Bank liquidity in India, except a deep desire to keep inflation controlled before the big election in India. It would be great if someone could help us understand this.

Finally, the promised street clip from NaPakistan:

Send your feedback to [email protected] Or @MacroViewpoints on Twitter