Summary – A top-down review of interesting calls and comments made last week in Treasuries, monetary policy, economics, stocks, bonds & commodities. TAC is our acronym for Tweets, Articles, & Clips – our basic inputs for this article.

Editor’s Note: In this series of articles, we include important or interesting Tweets, Articles, Video Clips with our comments. This is an article that expresses our personal opinions about comments made on Television, Tweeter, and in Print. It is NOT intended to provide any investment advice of any type whatsoever. No one should base any investing decisions or conclusions based on anything written in or inferred from this article. Macro Viewpoints & its affiliates expressly disclaim all liability in respect to actions taken based on any or all of the information in this article. Investing is a serious matter and all investment decisions should only be taken after a detailed discussion with your investment advisor and should be subject to your objectives, suitability requirements and risk tolerance.

1.”global sigh of relief” & a New All-Time High in SPX

A “relief” is much more welcome after an unexpected blow. The latter hit when Palo Alto Networks surprised markets on Thursday with a 100-point drop. NVDIA stock got hit hard on Thursday & markets held their collective breath until NVDIA reported at about 4:30 pm on Thursday afternoon. Then a collective global sigh of relief:

- Jesse Felder@jessefelder – ‘Stock indices on three continents hit all-time highs on Thursday after a bumper earnings report from Nvidia sparked a powerful market rally and boosted shares of other technology companies.‘

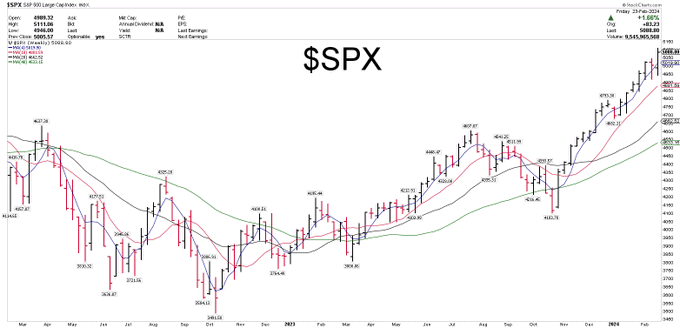

How did our own SPX do on Friday?

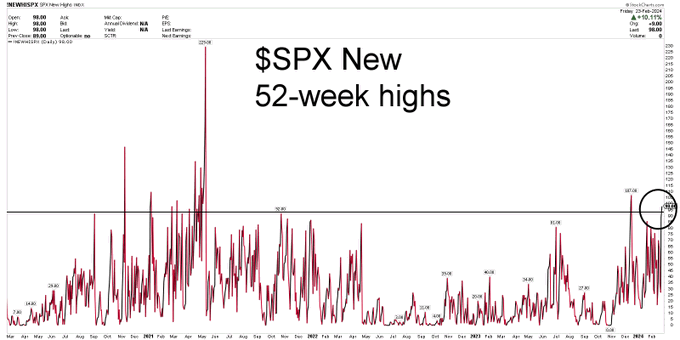

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Sun – $SPX New 52-week highs on Friday, 98. The second best day since April 2021, continued strong market breadth. (SPX A/D Line new AT highs, as well).

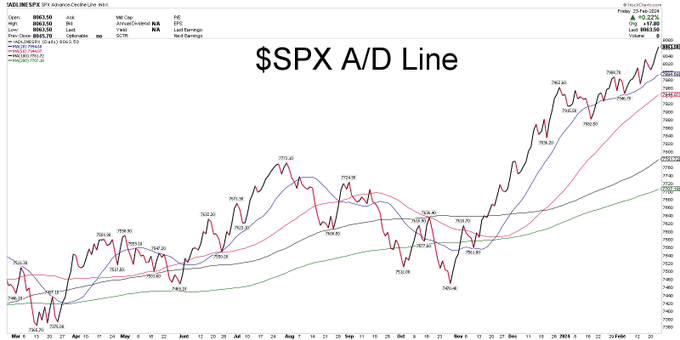

What about a chart of the Adv-Decl line?

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Sun – $SPX Advance/Decline line, new all-time high. A very bullish breadth signal.

Ok, but what about the 2000 comparisons between NVDA now & leading techs in 2000?

$NVDA net income for the last 12 months = $29.7B. That's 11x what $CSCO netted, $2.6B, in 2000, their best year.

The full $NVDA 2024 vs $CSCO 2000 video is in the second post below. pic.twitter.com/qrSrCmuQDP

— Larry Tentarelli, Blue Chip Daily (@bluechipdaily) February 24, 2024

But the S&P has 500 stocks, right?

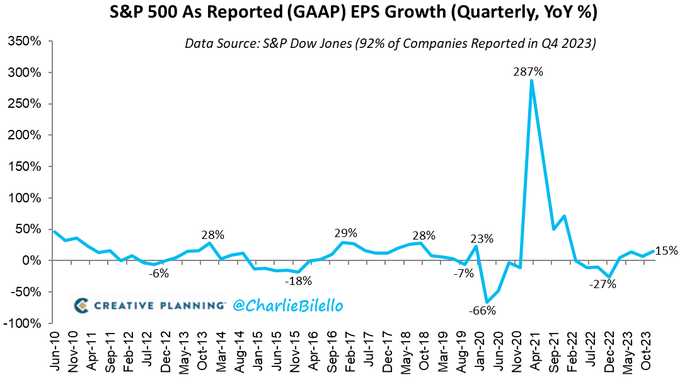

- Charlie Bilello@charliebilello – With 92% of companies reported, S&P 500 Q4 GAAP earnings per share are up 15% over the prior year, the 4th straight quarter of positive YoY growth and highest growth rate since Q4 2021. $SPX

Broadening this to NYSE,

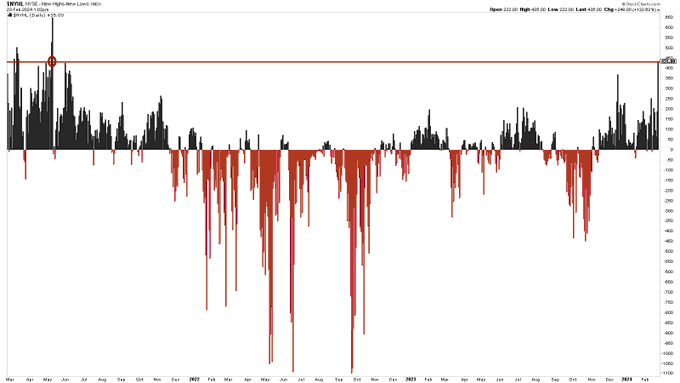

- Markets & Mayhem@Mayhem4Markets – Sat – 433 NYSE-listed companies made new highs in excess of new lows yesterday, which is the largest reading we’ve seen since May of 2021 👀

To summarize the trend,

- Larry Tentarelli, Blue Chip Daily@bluechipdaily – Feb 24 – $SPX weekly remains in a clean uptrend, higher highs, higher lows, over rising MAs. New record highs this week and today.

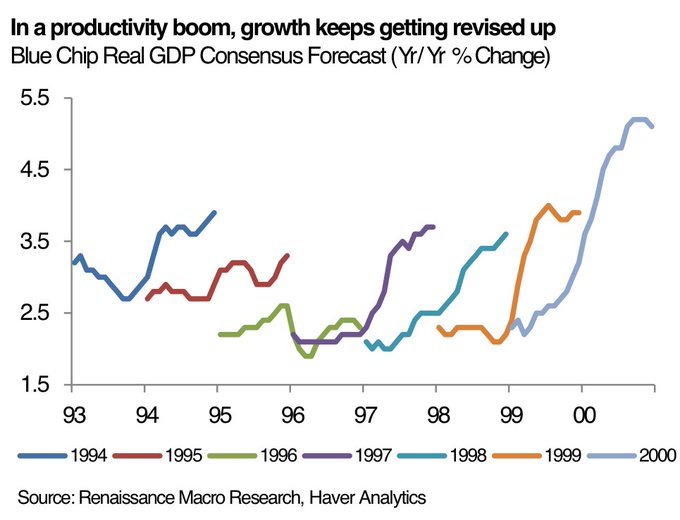

What might be a quasi-magical elixir that forecasters don’t seem to get? It is the P-word, first transmitted to us simple folks by Signor Yardeni (if memory serves us correctly) and now highlighted by RenMac below, presumably by the Blue Dutt(a) (Neel meaning blue & Dutt the label for so many elites from India – We urge those with Wikipedia-clout to add the name Neel Dutta to the list)

- RenMac: Renaissance Macro Research@RenMacLLC – – Productivity growth is notoriously difficult to forecast. If we are in a productivity boom, something we’ll keep seeing: continued upward revisions to consensus growth estimates. In the 90s, GDP expected to always be around 2% to start the year but ended up be 4!

Does all this fit with our look-forward seer?

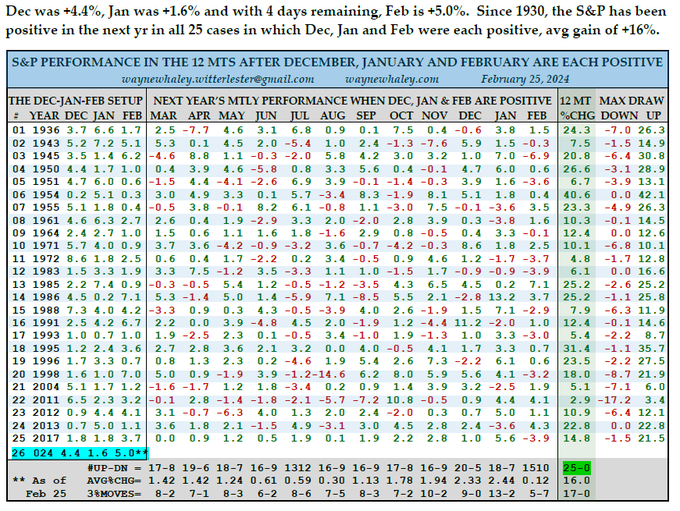

- Wayne Whaley@WayneWhaley1136 – A 25-0 NEXT YEAR (MARCH-FEBRUARY) – WHEN DECEMBER, JANUARY AND FEBRUARY ARE EACH POSITIVE

From his mind & pen to the market’s ears, right?

2. One hurdle in the march to higher levels for Mega-techs?

We all know they have said so for decades but perhaps that is not so impactful now at least for the mega-techs, as the following suggests:

- Gina Martin Adams@GinaMartinAdams – Feb 23 – Higher for longer rates may be less problematic for tech stocks than is commonly believed. The S&P 500 tech sector has above-average cash flow duration relative to the rest of the market, but also carries relatively little debt and has a higher interest-rate coverage ratio.

That’s somewhat comforting. But is a potential turn ahead at least for the short term?

- GP@gpaisa7 – Feb 24 – $TLT continues to show constructive price action on the weekly as the rising weekly 20SMA is finding support back to back weeks.

Also, Treasury yields fell hard despite the snorting bull market in stocks on Friday.

- 30-yr yld down 8.7 bps on Friday; 20-yr down 6.4 bps; 10-yr down 7.3 bps; 7-yr down 6.5 bps; 5-yr down 4.9 bps; 3-yr down 3.3 bps; 2-yr down 2.2 bps; 1-yr down 0.9 bps;

In fact, Treasury yields fell on 3 of 4 days last week with Wednesday being the only up day. And both Treasury & credit ETFs rallied last week:

- TLT up 1.3%; EDV up 1.8%; ZROZ up 2.1%; HYG up 53 bps; JNK up 53 bps; DPG up 1.7%; UTG up 1.7%; PFF up 1.2%; EMB up 1.1%;

So the following worked & the trendline held, at least for last week:

- Heisenberg@Mr_Derivatives – Feb 17 – $TLT some argue TLT is not really chartable. Also too low beta for some. But I think we have a potential bounce play off this very notable loooong trendline here. Basically 20yr bond yields down, TLT up and vice versa. Lets see if this trendline holds near term.

And we saw this on Thursday:

- Jason@3PeaksTrading – Feb 23 – $TLT also a stock replacement buys 2500 December $95 calls at $4.85, over $1.25M. Would be interesting to see bonds move up and stocks lower to surprise people, feels like the correlation has been decoupling of late

Frankly, we would rather be surprised by Bonds moving UP and Stocks moving Up as things are supposed to be at least for Tech & EM stocks.

3. The EM Big 2 – traditional & perhaps a nouveau view

The traditional view is simple & now built-in:

- Michael A. Arouet@MichaelAArouet – Feb 25 – India replacing China as the favorite for foreign direct investments in one chart

This China vs. India stuff is, to us, just like the FinTV bonds vs. stocks stuff. Just like when stocks go up, bonds go down stuff. Why can’t both go up? Now that is NOT true about one huge economic factor. China cannot grow its population to, forget matching India’s population, but even to support its own economy & infrastructure. After all, to the best of our knowledge, it still takes about 18-20 years to grow a new adult or even near-adult kids.

The real source of Chinese problems are highlighted below:

- jeroen blokland@jsblokland A🧵from the latest @true_insights_ Feb 25 – Weekly Market Monitor: #China – ‘Oh, boy’ 1/5 Due to the Chinese New Year, there were no macro figures from China. But to ensure that markets don’t sink further in the face of limited liquidity, policymakers have devised additional rules. New quant funds will be required to report their investment strategies to regulators before beginning trading. And China has banned major institutional investors from reducing equity holdings at the start and end of each trading day.

We see & hear more & more smart people taking at least initial steps to get long Chinese ETFs like FXI, KWEB & big ADRs. The allure is really awesome & the risks, while large, may be getting somewhat smaller. The real problem is that very few trust Chinese leadership & actually don’t even trust the misunderstanding of the Chinese leadership about their own warped perspectives.

One especially warped perspective has been this China being the new Middle Kingdom & the need for all neighbors to “tremblingly obey“. No Chinese emperor ever worried about their economy & stuff while exercising this right to punish those who don’t obey. Neither did Xi Jin Ping. And his only direct physical action against a neighbor was against India in Ladakh that led to the death of 20 Indian soldiers & an estimated 40-45 Chinese soldiers. This was the first clash since mid-1980s & came as a surprise to the Modi government.

Well, you can only do that once. India very quickly mobilized & virtually stopped all economic traffic across their 2,100 mile long border with India. Even now, both countries have about 60,000 heavily armed soldiers facing each other backed by armor, fighters & missiles. This has created serious problems for cheap Chinese goods that were exported by China across this long boundary into India.

Now China has lost serious ground in just about every theater. China’s best friend & recipient NaPakistan has virtually been seized back by the US & China has washed its hands off of the Balochistan area that was the rich prize China wanted – the port of Gwadar at the opening of the Straits of Hormuz. America has put in strong new positions directed at a potential Chinese attack on the Philippines. Now even North Korea seems to have moved away from China as 38north.org wrote last month:

- “There are few signs that relations with China have moved very far, and, in fact, signs of real cooling in China-DPRK relations. However, ties with Russia developed steadily, especially in the military area, as underscored by the visit of the Russian Defense Minister in July and the Putin–Kim summit in the Russian Far East last September“.

It seems that even Russia is sending signals to Chinese leadership that Russia remains a major strategic partner of India. Very recently, Putin both diplomatically & publicly invited India to participate in the development of Russia’s new SU-75 air-superiority fighter. Pointedly Putin has NOT invited China to participate in the SU-75 project.

So we have been waiting for China to realize how isolated China is in its own neighborhood & how rapidly India is moving into a desired-partner role in ASEAN.

China needs to send a signal or two to let other Governments & Investors know that Chinese are getting more realistic. Where could China signal such a a softer geo-political approach? In our opinion, the easiest relationship to stabilize would be the China-India relationship. And the first stage of that relationship would be a retreat back to pre-Galwan boundaries by China. Apparently the Chinese have disengaged from 5 out of 7 disputed sectors & only 2 are remaining. So a dovish signal in a diplomatic setting might be smart, we have thought.

Now look what happened about 7 days ago on February 18, 2024 at the Munich Security Conference. Watch the first 20 seconds of the clip below to see Chinese Foreign Minister Wang Yi walk down the few steps to have a “mysterious chat” with India’s Foreign Minister for a few minutes. Neither government has revealed any details about this conversation Seriously, watch the 3-minute clip below & notice this was an important step by China:

Now we read & watch that, within 2 days of the mysterious chat at Munich, the two militaries held direct talks in Ladakh to discuss “Full Disengagement along the Line of Control” that has been India’s demand since the 2020 clash.

Now for a more global disagreement between China & India. As is well-known, India has been making a strong case for inclusion in the UN Security Council as a Permanent Member. Now it seems India is getting fed up of the delays. So, according to the Eurasian Times,

- “In the interim budget for 2024-25 presented to parliament, India’s Finance Minister Nirmala Sitharaman slashed the funding for international bodies, including the UN, by 35.16 percent compared to the revised estimates for 2023-24.”

Welcoming this step, Sridhar Vembu, Chief Executive Officer of the global Software as a Service (SaaS) giant Zoho Corporation, tweeted on February 15 that

- “India’s move to reduce its funding of the UN was “a welcome move” and called for India to stop being part of the UN-mandated peace-keeping missions. He also noted that Indians should not “waste our time and money” with this body when the UN powers do not recognize the world’s most populous nation“.

Is this another way to pressure China? From what we have read, it appears that USA, UK, France & Russia have no problems with adding India to the Security Council and only China has not yet consented to adding India.

Part of India’s case is also its current standing as “Vishva-Mitra” or literally “a Friend to the World“. In just about every single crisis that is currently facing the UN, India is friendly to both sides of the crises, whether it be Arab States vs. Israel re HAMAS, Russia vs. EU & USA re Ukraine, Iran vs, USA re Houthis.

Remember the IMEC or the new corridor between India-UAE-Saudi Arabia-Jordan-Israel that we have been discussing since the Adani Washout on February 2, 2023? Surely that is kaput given the break between Israel & Saudi Arabia, right? Think again or actually just watch-hear Ms. Miri Regev, Israel’s Minister of Transport & Road Safety say “Goods are shipped from India’s Mundra Port to the UAE and transported to Israel through Saudi Arabia and Jordan via trucks.”

Israeli Minister of Transport reveals the new supply route that bypasses Yemen's Red Sea Blockade.

Goods are shipped from India's Mundra Port to the UAE and transported to Israel through Saudi Arabia and Jordan via trucks. pic.twitter.com/43dncPO1sd

— Ravi Nair (@t_d_h_nair) February 20, 2024

Getting back to China, remember our discussion last week about delivery by India to Philippines of BrahMos supersonic missiles. Watch the instructive video below from Defense Updates that shows how, with BrahMos, Philippines will have a potent deterrence. In summary, they say:

- “BrahMos is a deadly weapon and, as demonstrated multiple times in tests, a single hit from this weapon is enough to sink or cripple a large warship and bust even fortified bunkers“.

From about minute 4:14 to minute 7:30 of the clip below, Defense Updates lists 8 features of BrahMos which we will summarize below:

- Supersonic speed of Mach 3 or 1 km per second; 660 lbs or 300 kg warhead; since Kinetic Energy is directly proportional to square of speed, BrahMos has about 9 times the Kinetic Energy of conventional subsonic missiles like Tomahawk. The combines destructive force of a massive warhead and Kinetic Energy is lethal for even the biggest surface warships & bunkers. The accuracy of around 1 square meter makes it apt for precision strike on high value targets.

Now imagine China being surrounded on 2-3 sides by BrahMos equipped Philippines, Thailand, Indonesia & potentially Vietnam. Use of BrahMos by these countries to ward off Chinese advances will NOT involve US participation. Hence the massive US capabilities now arrayed against China can wait to counter China’s retaliatory actions.

3. A nouveau view of India

Any one who has invested in India knows of Chris Woods, now at Jeffries. As the clip below states, Woods wrote the following 21 years ago:

- “The bottom up appeal of India has always been severely diluted by the lack of compelling top down story. In a sense, India has been the inverse of China which is the ultimate macro story but without compelling micro options“.

His clip below lays out 3 big programs that have now been demonstrated to be a “compelling top down story“. Watch it and you will see a very different India from what an earlier generation knew.

But how can one invest in this “nouveau” India? As every Fin TV network tells viewers, buy INDA, the BlackRock ETF that gives you exposure to MSCI India. The clip below from CNBC-TV18 (yes, CNBC but in India) shows how pathetic MSCI India has done vs. say the Jeffries Greed & Fear India – latter up 75.5% since March 2023 vs. MSCI India up 39.2%, both in Dollar terms.

We especially urge CNBC’s Bon Pisani to watch the CNBC-18 clip below. Hopefully it energizes him to use his ETF network to launch an ETF using Jeffries Greed & Fear index.

Send your feedback to [email protected] Or @MacroViewpoints on X.